What is ACY Securities?

ACY Securities is a multi-financial broker regulated by the Commonwealth of Australia Regulatory Authority (AUS) in Australia. Since 2011, the company has relied on its keen insight into the market, effective demand management, client-oriented & advanced technology, and perfect educational resources to help more institutional participants and retail traders integrate into the ever-changing financial derivatives industry.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

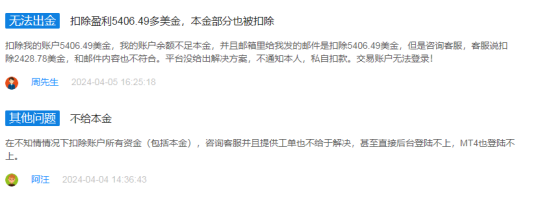

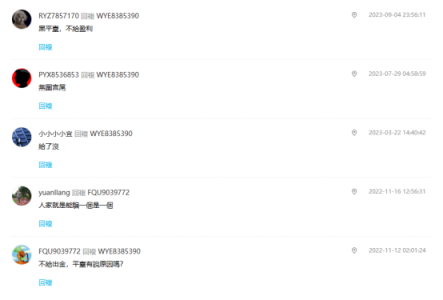

ACY Securities offers a comprehensive trading experience with access to multiple assets through the industry-standard MT4/MT5 platforms. It shines in stringent regulation in Australia, low minimum deposits required, competitive spreads and commissions, trading tools, educational resources, and more. However, some traders have reported issues with severe slippage and withdrawals. While ACY provides demo accounts for practice, it's crucial to evaluate the potential drawbacks alongside the benefits before committing to a live account.

Note: These pros and cons are based on the information provided and may not be exhaustive.

ACY Securities Alternative Brokers

There are many alternative brokers to ACY Securities depending on the specific needs and preferences of the trader. Some popular options include:

RoboForex - A reliable broker with a wide range of trading platforms, but with high fees and a limited product portfolio.

Hantec Markets - A good choice for experienced traders seeking a range of markets and trading platforms, but with limited educational resources and high fees.

Key Way Investments - A decent broker for beginners with a strong focus on education and low fees, but with a limited product range and average customer service.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is ACY Securities Safe?

Currently, ACY Securities has two entities regulated by the Commonwealth of Australia Regulatory Authority (AUS) in Australia. The only difference lies in license type: ACY SECURITIES PTY LTD holds a Maket Making license under license no. 403863 and ACY CAPITAL PTY LTD holds a STP license under license no.474738.

Market Instruments

ACY Securities offers access to over 2200+ trading instruments, covering Forex, Indices, Commodities, Cryptocurrencies, ETFs, Shares as well as Futures. This allows traders to diversify their trading portfolio and take advantage of different market conditions. With so many options, traders can find opportunities in multiple asset classes and take positions based on their trading strategies. The variety of instruments offered by ACY Securities makes it a versatile platform for traders looking for diverse opportunities in the financial markets.

Accounts

In terms of accounts offered, both demo accounts and live trading accounts are available on the ACY Securities platform.

Demo Accounts

ACY Securities demo accounts are funded with $100,000 in virtual funds, replicating the real trading experience. Traders can access over 2,200 tradable assets through the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, allowing them to familiarize themselves with the platform's features and functionalities before committing real capital.

Live Trading Accounts

For live trading accounts, ACY Securities presents three options: Standard, ProZero, and Bespoke. The Standard account requires an initial minimum deposit of $50, with subsequent minimum deposits set at $50 as well. Both the ProZero and Bespoke accounts mandate a higher initial minimum deposit of $200 and $10,000, respectively. Regardless of the account type, all three options allow traders to open positions with a minimum trading volume of 0.01 lot. Notably, while the Standard account offers swap-free (Islamic) trading, this feature is not available for ProZero and Bespoke accounts.

All account base currencies are available in USD, AUD, EUR, GBP, NZD, CAD, JPY, targeting traders from a broader range of areas.

Leverage

ACY Securities currently provides 50:1, 100:1, 200:1, 300:1, 400:1, and 500:1 leverage to meet investors' various needs. The maximum leverage for commodities and precious metals is 1:500, the stock index is 1:100, and for share CFDs is 1:25.

While leverage can amplify potential profits, it also increases the risk of significant losses. Therefore, it's important for traders to understand the risks involved and use leverage responsibly, especially for beginner traders who should start with lower leverage until they gain more experience.

Spreads & Commissions

Spreads and commissions with ACY Securities are scaled with the accounts offered. Specifically, the spread is variable on the Standard account, and from 0.0 pips on the ProZero and Bespoke accounts.

Note that the ProZero and Bespoke accounts have a commission-based pricing structure, which means that while the spreads can be tighter, traders need to pay a commission on top of the spread. Specifically, $3 per lot per side on the Bespoke account, 2.5/lot per side on the Bespoke account. In contrast, there is no commission charged for the Standard account.

Below is a comparison table about spreads and commissions charged by different brokers:

Note: Spreads can vary depending on market conditions and volatility.

Trading Platforms

ACY Securities provides clients with the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms for desktop, mobile, and web. These platforms are renowned for their user-friendly interfaces and advanced charting capabilities, as well as their extensive range of technical indicators and trading tools.

With MT4 and MT5, traders can customize their trading experience to suit their individual needs, and execute trades quickly and efficiently. The mobile and web versions of the platforms allow traders to access their accounts on-the-go, ensuring that they can always stay up-to-date with market conditions and execute trades at their convenience.

Overall, the availability of these well-established trading platforms can be a significant advantage for traders who are looking for a reliable and versatile trading experience.

See the trading platform comparison table below:

Trading Tools

ACY Securities offers a variety of trading tools to enhance clients' trading experience. Capitalise.ai is a trading automation platform that enables traders to automate their strategies using natural language. MetaTrader Scripts are designed to help traders automate some repetitive actions in the MT4 and MT5 platforms, such as opening multiple orders or closing all positions at once.

Signal Start is a platform that provides signals from third-party signal providers, which traders can use to make informed trading decisions. Forex VPS is a virtual private server service that allows traders to run their trading platform and expert advisors (EAs) 24/7 without interruptions. With these trading tools, traders can optimize their trading strategies, improve efficiency, and potentially increase profitability.

Deposits & Withdrawals

ACY Securities offers approximately 20 funding options including China Union Pay, QR codes, credit/debit cards, e-wallets (PayTrust, DragonPay, Skrill, Neteller), bank transfers, and cryptocurrencies (USDT, BTC, ETH). Minimum deposits range from $50 to $1,000 depending on the method. No deposit fees are charged, and processing time is typically within 24 hours. The platform targeting traders globally with multi-currency support.

ACY Securities minimum deposit vs other brokers

You can make 3 free withdrawals per month, and after that, you will be charged $25 per withdrawal in your base currency, or you can wait for the new month to get your free withdrawals again. The amount you withdraw must be the same as the deposit, and you must withdraw within 20 days of the transaction.

ACY Securities processes withdrawal requests on the same day if received before 16:00 AEST; requests received after that time will be processed on the next business day. The speed of receiving and clearing funds depends on the withdrawal method chosen. Bank transfers take 2-3 business days, while card withdrawals take 3-5 business days.

See the deposit/withdrawal fee comparison table below:

Please note that the fees may vary depending on the specific payment method used and the country of the trader. It is important to check the broker's website for the most up-to-date information on fees and charges.

Customer Service

ACY Securities provides multiple channels for clients to get in touch 24/5, including phone, email, live chat, and an online messaging system. Clients can also follow the broker on various social media platforms such as Twitter, Facebook, Instagram, YouTube, LinkedIn, and TikTok. In addition, an FAQ section is available on the website to answer common questions. Overall, ACY Securities' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Note that these pros and cons are based on user feedback and experiences, and may not necessarily be representative of everyone's experience with ACY Securities' customer service.

Education

ACY Securities places great emphasis on forex education, providing a wide range of learning resources to help traders improve their trading skills and strategies. The broker offers a variety of educational materials, including webinars, e-books, and premium training resources, catering to traders at all levels, from beginners to experienced professionals.

The Market Analysis Webinar provides insight into market trends and helps traders stay up to date with the latest news and events affecting the forex market. The Forex E-books are comprehensive guides that cover various trading strategies, tools, and techniques. The Premium Training Resources are designed to provide traders with personalized education tailored to their individual needs, helping them gain a deeper understanding of the forex market and improve their trading performance.

Conclusion

As a whole, ACY Securities is a regulated and reputable broker that offers a wide range of trading instruments, multiple account types, and various trading platforms. The broker also provides traders with educational resources, trading tools, and excellent customer support. However, there have been some reports of slippage and withdrawal issues, which should be taken into consideration.

ACY Securities may be a suitable broker for experienced traders looking for a diverse range of trading options and strong support, but potential investors should be aware of the risks involved and exercise caution before investing.

Frequently Asked Questions (FAQs)

Is ACY Securities regulated?

Yes. It is regulated by the (AUS) in Australia.

Does ACY Securities offer demo accounts?

Yes. Demo accounts funded with $100, 000 in virtual funds are offered.

Does ACY Securities offer the industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available.

What is the minimum deposit for ACY Securities?

The minimum initial deposit to start trading is $50.

Is ACY Securities a good broker for beginners?

No. ACY Securities is not a good choice for beginners. Though it advertises very well, there are too many complaints on the Internet.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX