점수

IG

영국|20년 이상| 거래환경 B|

영국|20년 이상| 거래환경 B|https://www.ig.com/en

공식 사이트

평점 지수

거래환경

거래환경

B

평균 거래 속도(ms)

MT4/5

전체 라이선스

IG-DEMO

자본 비율

Good

자본금

영향력

AAA

영향력 지수 NO.1

일본 8.88

일본 8.88거래환경

속도:C

슬리피지:C

비용:B

연결 끊김:AAA

롤오버:AA

MT4/5 감정

MT4/5 감정

전체 라이선스

자본 비율

자본 비율

Good

자본금

영향력

영향력

AAA

영향력 지수 NO.1

일본 8.88

일본 8.8811.55% 브로커를 초과

연락처

라이선스

호주 ASIC 전체 허가증(MM)

호주 ASIC 전체 허가증(MM)  호주 ASIC 전체 허가증(MM)

호주 ASIC 전체 허가증(MM)  영국 FCA 전체 허가증(MM)

영국 FCA 전체 허가증(MM)  일본 FSA 외화 판매 허가증

일본 FSA 외화 판매 허가증  뉴질랜드 FMA 전체 허가증(MM)

뉴질랜드 FMA 전체 허가증(MM)  프랑스 AMF 외화 판매 허가증

프랑스 AMF 외화 판매 허가증  뉴질랜드 FMA 직통 허가증(STP)

뉴질랜드 FMA 직통 허가증(STP)  싱가포르 MAS 외화 판매 허가증

싱가포르 MAS 외화 판매 허가증  아랍 에미리트 DFSA 외화 판매 허가증

아랍 에미리트 DFSA 외화 판매 허가증  남아프리카 공화국 FSCA 금융 서비스 기업

남아프리카 공화국 FSCA 금융 서비스 기업  영국 FCA 투자 컨설턴트 허가증

영국 FCA 투자 컨설턴트 허가증  독일 BaFin 보통 금융 허가증

독일 BaFin 보통 금융 허가증  미국 NFA 전체 허가증(MM)

미국 NFA 전체 허가증(MM) 싱글 코어

1G

40G

연락번호

+34 917 87 61 57

+61 (3)9860 1776

+44 (20) 7633 5430

기타 연락 방법

브로커 정보

More

원할 때마다 확인 가능

전체 정보를 보시려면 APP을 다운로드하십시오.

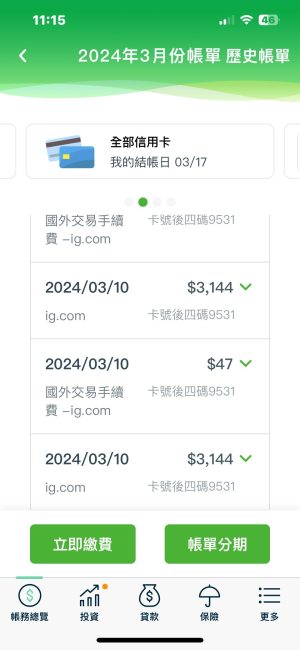

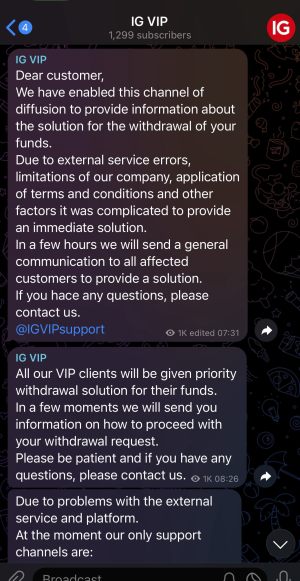

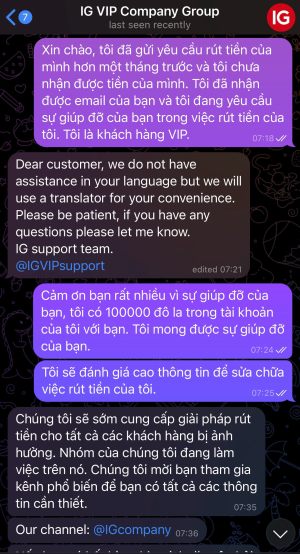

- WikiFX에서 지난 3개월 동안 이 브로커에 대한 신고를 38개 받았으니 위험에 유의하시기 바랍니다!

- 이 브로커의 현장 조사 나쁜 평가 수는 1개에 달했습니다. 위험과 잠재적인 사기에 유의하시기 바랍니다!

- 뉴질랜드 FMA(규제번호: 18923)의 규제 상태가 비정상입니다. 규제기관에서 공개한 상태는 취소됨입니다. 위험에 유의하시기 바랍니다!

- 뉴질랜드 FMA(규제번호: 18923)의 규제 상태가 비정상입니다. 규제기관에서 공개한 상태는 취소됨입니다. 위험에 유의하시기 바랍니다!

- 호주 ASIC(규제번호: 220440)의 규제 상태가 비정상입니다. 규제기관에서 공개한 상태는 취소됨입니다. 위험에 유의하시기 바랍니다!

- 소유한 독일 BaFin(규제 번호: 148759) BaFin Non-Forex Licence 규제 라이선스는 규정 영업 범위를 초과합니다. 위험에 유의하시기 바랍니다!

- 소유한 남아프리카 공화국 FSCA(규제 번호: 41393) National Futures Association-UNFX 규제 라이선스는 규정 영업 범위를 초과합니다. 위험에 유의하시기 바랍니다!

- 소유한 영국 FCA(규제 번호: 114059) Investment Advisory Licence 규제 라이선스는 규정 영업 범위를 초과합니다. 위험에 유의하시기 바랍니다!

- 해당 브로커가 주장한 미국 NFA 규제(규제 번호: 0509630)는 라이선스 도용으로 의심됩니다. 위험에 유의해 주세요!

IG을(를) 방문한 호주 - 사무실을 찾을 수 없음

조사 팀은 예정대로 호주로 가서 IG 브로커를 방문했지만 규제 주소에서 회사를 찾지 못했습니다. 이는 해당 브로커가 해당 장소에 물리적인 사무실이 없음을 의미합니다. 따라서 투자자들은 신중한 결정을 내리기 위해 충분한 심사숙고를 한 후에 결정을 내리도록 권고합니다.

호주

호주방문 IG 영국에서 - 사무실 발견

투자 IG ators는 포어를 방문하기 위해 영국 런던에 갔다 IG 엔 거래소 브로커 IG 예정대로 현재 등록된 사업장 주소에서 중개인의 이름을 발견하여 중개인이 여기에 실제 영업소가 있음을 나타냅니다. 아쉽게도 조사요원이 특별방문을 위해 회사에 출입하지 못하여 구체적인 사업규모는 알 수 없다. 투자자들은 엄마에게 조언합니다

영국

영국방문 IG uae 두바이 -- 사무실 발견

투자 IG ators는 포어를 방문하기 위해 두바이, uae에 갔다 IG n 교환 딜러 IG 계획대로, 그리고 그 앞에 딜러의 사무실을 찾았습니다 IG n 규제 주소를 교환합니다. 사무실 위치는 실제입니다. 투자자는 신중하게 딜러를 선택하는 것이 좋습니다.

아랍 에미리트

아랍 에미리트방문IG 일본 -- 사무실 존재 확인

설문 조사 팀은 딜러를 방문했습니다IG 예정대로 일본 도쿄에서 딜러의 로고는 공개된 주소에서 찾을 수 있으며 딜러가 실제 사업장을 가지고 있음을 나타냅니다. 그러나 측량사들이 추가 방문을 위해 회사에 들어가지 않아 구체적인 사업 규모는 알려지지 않았다. 이 브로커와 거래할 때 신중을 기하십시오.

일본

일본싱가포르 중개인 방문 IG

측량사 방문은 진위를 확인했다 IG 의 규제 주소. 이 조사관은 웹 사이트를 통해 브로커가 ASIC, FCA 및 FMA에서 발행 한 정식 라이센스 3 개와 FSA 및 MAS에서 발행 한 정식 외환 라이센스 2 개를 보유하고 있다는 사실을 알 렸습니다.

싱가포르

싱가포르IG을(를) 방문한 호주 - 사무실을 찾을 수 없음

조사 팀은 예정대로 호주로 가서 IG 브로커를 방문했지만 규제 주소에서 회사를 찾지 못했습니다. 이는 해당 브로커가 해당 장소에 물리적인 사무실이 없음을 의미합니다. 따라서 투자자들은 신중한 결정을 내리기 위해 충분한 심사숙고를 한 후에 결정을 내리도록 권고합니다.

호주

호주방문 IG 영국에서 - 사무실 발견

투자 IG ators는 포어를 방문하기 위해 영국 런던에 갔다 IG 엔 거래소 브로커 IG 예정대로 현재 등록된 사업장 주소에서 중개인의 이름을 발견하여 중개인이 여기에 실제 영업소가 있음을 나타냅니다. 아쉽게도 조사요원이 특별방문을 위해 회사에 출입하지 못하여 구체적인 사업규모는 알 수 없다. 투자자들은 엄마에게 조언합니다

영국

영국방문 IG uae 두바이 -- 사무실 발견

투자 IG ators는 포어를 방문하기 위해 두바이, uae에 갔다 IG n 교환 딜러 IG 계획대로, 그리고 그 앞에 딜러의 사무실을 찾았습니다 IG n 규제 주소를 교환합니다. 사무실 위치는 실제입니다. 투자자는 신중하게 딜러를 선택하는 것이 좋습니다.

아랍 에미리트

아랍 에미리트방문IG 일본 -- 사무실 존재 확인

설문 조사 팀은 딜러를 방문했습니다IG 예정대로 일본 도쿄에서 딜러의 로고는 공개된 주소에서 찾을 수 있으며 딜러가 실제 사업장을 가지고 있음을 나타냅니다. 그러나 측량사들이 추가 방문을 위해 회사에 들어가지 않아 구체적인 사업 규모는 알려지지 않았다. 이 브로커와 거래할 때 신중을 기하십시오.

일본

일본싱가포르 중개인 방문 IG

측량사 방문은 진위를 확인했다 IG 의 규제 주소. 이 조사관은 웹 사이트를 통해 브로커가 ASIC, FCA 및 FMA에서 발행 한 정식 라이센스 3 개와 FSA 및 MAS에서 발행 한 정식 외환 라이센스 2 개를 보유하고 있다는 사실을 알 렸습니다.

싱가포르

싱가포르WikiFX 감정

| 거래환경 | B |

|---|---|

| 최대 레버리지 | 200:1 |

| 최소 입금 | no minimum deposit requirement |

| 최소 스프레드 | EURUSD 0.6 Gold 0.3 |

| 거래 품종 | Foreign exchange, precious metals, CFD |

| 통화 | -- |

|---|---|

| 최소 포지션 | 0.1,0.01(MT4) |

| 지원 EA | |

| 입금 방식 | -- |

| 출금 방식 | -- |

| 커미션 | -- |

| 거래환경 | B |

|---|---|

| 최대 레버리지 | 200:1 |

| 최소 입금 | no minimum deposit requirement |

| 최소 스프레드 | EURUSD/0.142 |

| 거래 품종 | Foreign exchange, precious metals, CFD |

| 통화 | -- |

|---|---|

| 최소 포지션 | 0.1,0.01(MT4) |

| 지원 EA | |

| 입금 방식 | -- |

| 출금 방식 | -- |

| 커미션 | -- |

- 기본 항목(A)

- 추가 항목 합계(B)

- 부채 금액(C)

- 비고정 자본금(A)+(B)-(C)=(D) $52,666,667

- 리스크 상대 금액(E) $10,798,450

- 시장 위험 $162,791

- 거래 리스크 $4,062,016

- 기초 리스크 $6,565,891

자본금

87% 이상의 일본 브로커보다 높음 $775,194(USD)

리스크 관리

평균 마진 예치율

미체결 매도 주문 비율 차트

헤징 거래

- 데이트

- 기관

- 백분율

- 등급 평가

- 2024-06-30

- Fitch Rating Service

100.00%

BBB-

- 2024-05-31

- Fitch Rating Service

100.00%

BBB-

- 2024-04-30

- Fitch Rating Service

100.00%

BBB-

IG 을(를) 본 사용자는 다음도 보았습니다..

검색 소스

노출 언어

시장 분석

소재 노출

IG · 회사 소개

| 브로커 이름 | IG |

| 등록 국가 | 영국 |

| 규제 상태 | FCA, ASIC, FSA, NFA, FMA, MAS 및 DFSA, AMF |

| 설립 연도 | 1974 |

| 시장 상품 | 외환, 지수, 주식, 상품, 암호화폐, 채권, ETF, 옵션, 산업 부문, 이자율 |

| 최소 초기 입금액 | $50 (카드 결제), $0 (은행 송금) |

| 최대 레버리지 | 1:50 (미국 고객) |

| 최소 스프레드 | EURUSD 기준 1포인트 |

| 데모 계정 | 사용 가능 |

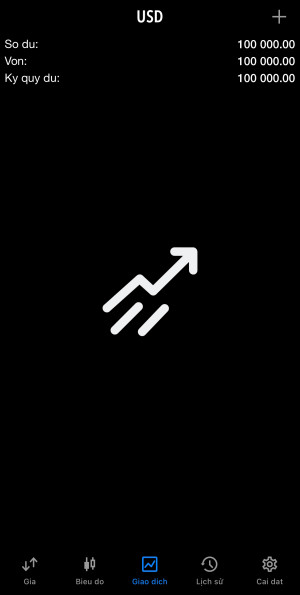

| 거래 플랫폼 | 직관적인 웹 플랫폼, MetaTrader 4, L2 딜러 및 모바일 앱 |

| 입출금 방법 | 신용/직불 카드, 은행 송금 |

| 고객 서비스 | 이메일/전화번호/주소/라이브 채팅 |

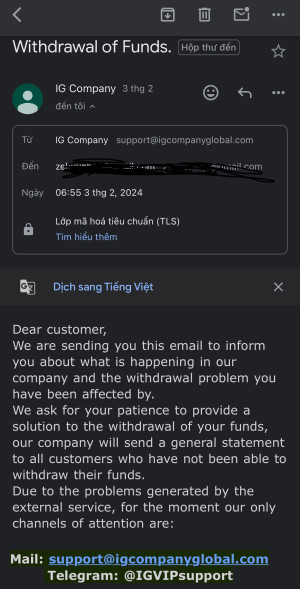

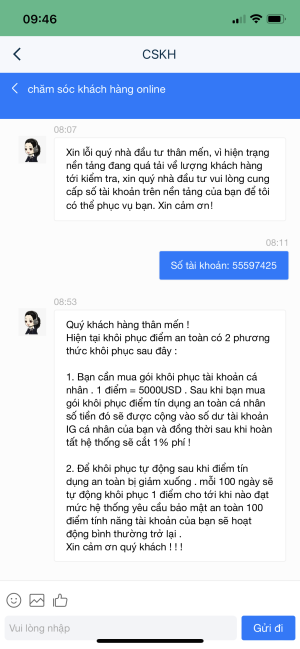

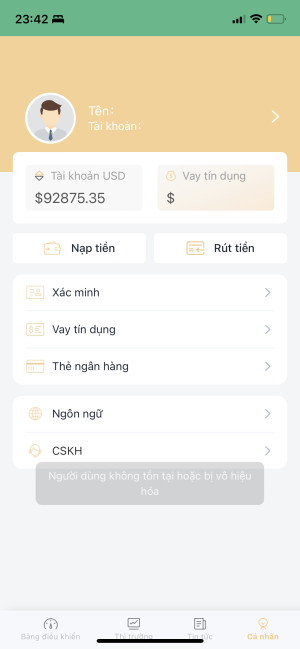

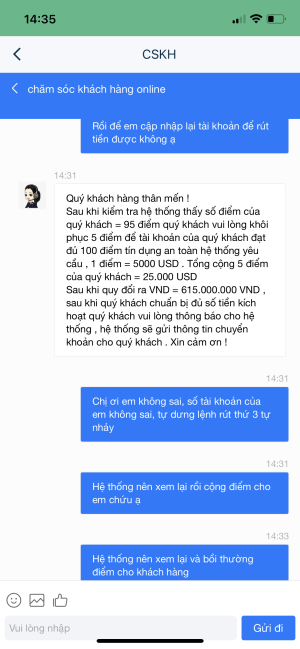

| 사기 혐의 | 있음 |

회사의 공식 비디오입니다.

이 리뷰에서 제공되는 정보는 회사의 서비스 및 정책이 지속적으로 업데이트되기 때문에 변경될 수 있음을 유의해야 합니다. 또한, 이 리뷰가 생성된 날짜도 고려해야 할 중요한 요소일 수 있으며, 정보가 그 이후로 변경되었을 수도 있습니다. 따라서 독자는 어떠한 결정이나 조치를 취하기 전에 항상 회사와 직접 최신 정보를 확인하는 것이 좋습니다. 이 리뷰에서 제공된 정보의 사용에 대한 책임은 독자에게 달려 있습니다.

이 리뷰에서 이미지와 텍스트 내용이 충돌하는 경우 텍스트 내용이 우선해야 합니다. 그러나 공식 웹사이트를 참고하여 자세한 상담을 받으시기를 권장합니다.

IG의 장단점

장점:

다양한 시장 및 상품 옵션.

직관적이고 사용자 정의 가능한 거래 플랫폼.

고급 기술적 분석 및 차트 도구에 접근 가능.

다국어, 다채널 고객 서비스.

가상 자금 $20,000으로 된 데모 계정.

실제 계정에는 최소 입금 요건이 없음.

최대 1:200의 레버리지 제공.

단점:

웹사이트에서 수수료 및 비용이 명확히 표시되지 않을 수 있음.

계정 유형에 대한 정보가 제한적임.

웹사이트에서 제공되는 교육 자료가 많지 않음.

자금 인출이 명확히 표시되지 않음.

일부 시장에는 최소 거래 금액이 높을 수 있음.

환영 보너스나 프로모션을 제공하지 않음.

신용카드 입금 수수료가 다른 브로커에 비해 높을 수 있음.

IG은 어떤 종류의 브로커인가요?

| 차원 | 장점 | 단점 |

| 브로커 모델 | IG는 시장 제작 모델로 인해 좁은 스프레드와 빠른 실행을 제공합니다. | IG는 고객의 거래에 대항하는 상대방으로서 이해관계 충돌이 있을 수 있으며, 이는 고객의 최선의 이익에 부합하지 않을 수 있는 결정으로 이어질 수 있습니다. |

IG는 시장 제작 (MM) 브로커로서 고객의 거래 작업에서 상대방으로서 행동합니다. 즉, 시장과 직접 연결하는 대신 IG는 중개인으로서 고객과 반대 포지션을 취합니다. 이로 인해 더 빠른 주문 실행 속도, 좁은 스프레드 및 레버리지 제공의 유연성을 제공할 수 있습니다. 그러나 이는 또한 IG가 고객과 일정한 이해관계 충돌을 가지고 있다는 것을 의미합니다. 이는 자산의 매수 및 매도 가격 차이에서 이익을 얻기 때문에 고객의 최선의 이익과 일치하지 않을 수 있는 결정을 내릴 수 있습니다. 거래자들이 IG 또는 다른 MM 브로커와 거래할 때 이러한 동적인 측면을 인식하는 것이 중요합니다.

일반 정보 및 규제 상태

IG는 영국 등록 회사로서 FCA, ASIC, FSA, NFA, FMA, MAS 및 DFSA를 포함한 여러 국제 금융 기관에 의해 규제를 받고 있습니다. 이는 통화, 지수, 암호화폐, 주식 및 상품을 포함한 다양한 금융 상품에 대한 액세스를 제공하며, 18,000개 이상의 시장을 제공합니다. 회사는 직관적인 웹 플랫폼, MetaTrader 4, L2 딜러 및 모바일 앱을 포함한 여러 거래 플랫폼을 제공합니다. 또한 전화, 이메일, 소셜 미디어 및 온라인 채팅을 통해 다국어 고객 지원도 제공합니다.

다음 글에서는 이 브로커의 모든 차원에서의 특징을 분석하여 쉽고 잘 구성된 정보를 제공할 것입니다. 관심이 있다면 계속 읽어보세요.

시장 기구

| 장점 | 단점 |

| 다양한 거래 기구 | 너무 많은 기구는 일부에게 혼란을 줄 수 있습니다. |

| 투자 포트폴리오 다변화 가능성 | 운영에는 더 많은 지식과 기술이 필요합니다. |

| 다른 조건을 활용할 수 있는 기회 | 다른 시장에 노출되어 더 많은 위험이 있을 수 있습니다. |

| 다양한 국제 시장에 대한 액세스 | 포지션 및 리스크 관리의 복잡성이 증가합니다. |

IG는 외환, 지수, 주식, 상품, 암호화폐, 채권, ETF, 옵션, 산업 부문, 이자율 등 17,000개 이상의 시장에 접근할 수 있습니다. 이 차원은 트레이더들에게 다양한 상품을 거래할 수 있는 장점을 제공하며 투자 포트폴리오를 다변화할 수 있도록 합니다. 또한, 이 다양한 상품 선택은 트레이더들이 다른 시장 조건과 기회를 활용할 수 있도록 합니다. 그러나 이 차원의 가능한 단점은 다른 시장에서 거래하기 위해 더 많은 지식과 기술이 필요하기 때문에 일부 트레이더들에게는 압도적일 수 있습니다. 또한, 다른 시장에 노출되는 것은 포트폴리오의 위험을 증가시킬 수 있으며 더 복잡한 포지션 및 리스크 관리를 요구할 수 있습니다.

스프레드 및 수수료

| 장점 | 단점 |

| - 스프레드가 상당히 경쟁력이 있습니다. - 웹사이트에서 스프레드를 확인할 수 있습니다. | - 수수료에 대한 정보가 많이 제공되지 않습니다. - 유동성이 적거나 거래량이 적은 시장에서 비용이 더 높을 수 있습니다. |

비용 측면에서, IG는 경쟁력이 있고 투명한 스프레드를 제공하며, EUR/USD의 평균 스프레드는 1포인트입니다. 그러나 수수료에 대한 정보가 많이 제공되지 않아 일부 트레이더들에게 불확실성을 야기할 수 있습니다. 또한, 유동성이 적거나 거래량이 적은 시장에서 비용이 더 높아질 수 있다는 점을 유의해야 합니다. 전반적으로, IG는 다른 브로커들과 비교했을 때 합리적이고 경쟁력 있는 비용 구조를 제공하는 것으로 보입니다.

IG에서 제공하는 거래 계정

IG의 데모 계정은 초보 트레이더들에게 매우 유용한 도구로, 자본을 위험에 빠지지 않고 안전하게 거래할 수 있는 환경을 제공합니다. IG의 가상 자금인 $20,000을 통해 트레이더들은 자본을 위험에 빠지지 않고 거래 기술을 연마할 수 있습니다. 또한, IG의 데모 계정은 거래 플랫폼과 라이브 계정에서 사용 가능한 모든 상품과 도구에 대한 접근을 제공하여 트레이더들이 플랫폼에 익숙해지고 다양한 거래 전략을 테스트할 수 있도록 합니다. 전반적으로, IG의 데모 계정은 트레이더들이 자신의 자본을 투자하기 전에 경험과 자신감을 쌓는 데 훌륭한 도구입니다.

| 장점 | 단점 |

| 데모 계정 제공 | 웹사이트에서 계정 유형에 대한 상세한 정보가 부족합니다. |

| 모든 고객을 위한 단일 계정 | 상세한 정보가 없어 새로운 고객들이 적합한 계정을 선택하기 어려울 수 있습니다. |

| IG의 모든 금융 상품에 대한 접근 |

IG은 고객들을 위해 단일 라이브 계정을 제공하며, 최소 입금액은 $250입니다. 라이브 계정 외에도 데모 계정도 사용 가능합니다.

IG에서 제공하는 운영 플랫폼

| 장점 | 단점 |

| 직관적이고 사용하기 쉬운 웹 플랫폼 | 웹 플랫폼은 다른 플랫폼보다 사용자 정의가 덜 될 수 있습니다. |

| 인기있고 잘 알려진 플랫폼인 MetaTrader 4 제공 | 플랫폼의 최신 버전인 MetaTrader 5는 제공되지 않습니다. |

| 경험 많은 트레이더를 위한 다양한 고급 도구와 기능을 제공하는 L2 Dealer | L2 Dealer는 초보 트레이더에게는 더 복잡할 수 있습니다. |

| iOS 및 Android용 모바일 앱 제공 | 모바일 앱은 웹 플랫폼보다 사용자 정의가 덜 될 수 있습니다. |

| 다양한 유형의 트레이더의 요구를 충족시키기 위한 다양한 플랫폼 선택 | IG에 독점적인 거래 플랫폼은 제공되지 않습니다. |

IG은 다양한 트레이더의 요구를 충족시키기 위해 여러 거래 플랫폼을 제공합니다. 웹 기반 플랫폼은 직관적이고 사용하기 쉽지만 다른 플랫폼보다 사용자 정의가 덜 될 수 있습니다. 또한, 외환 업계에서 인기있고 잘 알려진 MetaTrader 4도 제공합니다. 경험 많은 트레이더를 위해 L2 Dealer는 다양한 고급 도구와 기능을 제공합니다. 그러나 이 플랫폼은 초보 트레이더에게는 더 복잡할 수 있습니다. iOS 및 Android용 모바일 앱을 통해 트레이더는 이동 중에도 거래를 할 수 있습니다. 전반적으로, IG이 제공하는 플랫폼 선택은 트레이더에게 이점을 제공하지만, IG 독점 거래 플랫폼이 없는 점은 단점으로 여길 수 있습니다.

최대 IG 레버리지

| 장점 | 단점 |

| 한정된 자본으로 수익 가능성을 높일 수 있습니다. | 레버리지는 큰 손실의 위험도 증가시킵니다. |

| 대규모 시장에 대한 접근 가능성을 높일 수 있습니다. | 초보 트레이더는 레버리지를 올바르게 이해하고 관리하는 데 어려움을 겪을 수 있습니다. |

| 다양한 레버리지 수준의 여러 시장에서 투자 포트폴리오 다변화 기회 제공 | 레버리지는 트레이더에게 심리적 압력을 증가시킬 수 있으며, 이는 결정에 영향을 줄 수 있습니다. |

| 작은 시장 움직임에서 이익을 얻을 수 있도록 도와줍니다. | 트레이더가 레버리지와 관련된 위험을 올바르게 관리하지 않으면 초기 투자 금액보다 더 많은 손실을 입을 수 있습니다. |

IG의 최대 레버리지 차원에 대해 회사는 최대 1:200의 레버리지를 제공합니다. 이는 트레이더가 사용 가능한 자본보다 200배 큰 포지션을 개설할 수 있음을 의미합니다. 레버리지는 경험 많은 트레이더에게는 강력한 도구가 될 수 있으며, 제한된 자본으로 더 높은 수익을 얻을 수 있게 해줍니다. 그러나 이는 손실의 위험도 크게 증가시킬 수 있으므로, 트레이더가 레버리지의 위험과 제한을 충분히 이해한 후 사용해야 합니다. 전반적으로, IG의 최대 레버리지는 다른 온라인 브로커들과 비교할 수 있으며, 시장에서 더 큰 매수력을 원하는 사람들에게 적합할 수 있습니다.

입출금: 방법과 수수료

카드 결제의 최소 입금액은 $50이며, 은행 이체의 경우 최소 입금액은 필요하지 않습니다. 카드 등록 후 즉시 신용/직불 카드 거래를 통한 입금 옵션이 제공되며, 계정당 최대 다섯 장의 카드를 사용할 수 있습니다. 홍콩 고객을 위해 무료 FPS 홍콩 달러 이체가 가능하며, 일반적으로 1영업일 이내에 처리됩니다. 은행 이체도 지원됩니다. 자금 할당을 신속하고 정확하게 보장하기 위해 항상 계정 ID를 참조에 포함시키십시오. 그러나 비자 입금에는 1%의 수수료가 부과되며, 마스터카드 입금에는 0.5%의 수수료가 부과됩니다. 유감스럽게도 자금 인출에 대한 자세한 정보는 제공되지 않으며, 이는 일부 고객에게는 단점일 수 있습니다.

| 장점 | 단점 |

| 다양한 입금 방법 | 출금에 대한 자세한 정보가 제공되지 않음 |

| 비자 및 마스터카드 직불 카드로 무료 입금 | 신용카드 입금에 대한 수수료 |

| 은행 이체 가능 | skrill, neteller, perfect money 등의 다른 방법은 제공되지 않음 |

IG Markets은 모바일 앱을 통한 편리한 자금 조달을 가능하게 하며, iPhone 및 Android 사용자를 위한 '자금 추가' 섹션에서 액세스할 수 있습니다. 또한, Wise (이전 TransferWise)를 통해 이체를 할 수 있지만, IG Markets는 Wise와 관련이 없으므로 관련 수수료를 확인해야 합니다. Wise 이체의 경우 거래 증빙과 계정 세부 정보가 필요할 수 있습니다.

IG 교육 자료

다른 온라인 브로커와 달리, IG은 웹사이트에서 제한된 교육 자료를 제공하는 것으로 보입니다. 뉴스 및 분석 섹션과 경제 캘린더가 있지만, 트레이더들이 학습하고 거래 기술을 향상시키는 데 도움이 되는 온라인 자료는 많지 않습니다. 그러나 이에도 불구하고, IG은 금융 시장에서 오랜 역사와 경험을 가지고 있어 신뢰할 수 있는 플랫폼에서 거래를 진행하기 위해 경험 많은 트레이더들에게 큰 도움이 될 수 있습니다. 그러나 새로운 경험이 부족한 트레이더들은 금융 시장에 대한 이해를 향상시키고 효과적인 거래 기술을 개발하기 위해 추가 교육 자료를 찾아야 할 수도 있습니다.

IG 고객 서비스

고객 서비스는 어떤 비즈니스에 있어서 중요한 요소이며, IG의 경우 이 회사는 다양한 연락 수단을 제공합니다. 고객은 전화, 이메일, 소셜 미디어 및 온라인 채팅을 통해 소통할 수 있으며, 이는 사용자에게 큰 유연성과 편의성을 제공합니다. 또한, 고객 서비스는 다국어로 제공되어 국제 고객들에게 큰 장점을 제공합니다. 전반적으로, IG은 고객 서비스에 적절한 중요성을 두고 있는 것으로 보이며, 이는 고객 만족도를 보장하고 금융 시장에서 좋은 평판을 유지하기 위해 중요합니다.

결론

결론적으로, IG은 잘 정립되고 규제된 거래 플랫폼으로 다양한 금융 상품, 직관적인 웹 플랫폼 및 MetaTrader 4 및 L2 Dealer에 대한 액세스를 제공합니다. 데모 계정은 풍부한 가상 자금을 제공하지만, 실제 계정에 대한 정보는 제한적입니다. 다국어 고객 서비스는 다양한 채널을 통해 제공됩니다. 그러나 교육 자료의 부족과 인출에 대한 제한된 정보는 개선할 수 있는 부분입니다. 전반적으로, IG은 다양한 상품과 신뢰할 수 있는 거래 플랫폼을 제공하는 규제 플랫폼을 찾고 있는 트레이더들에게 견고한 선택입니다.

IG에 대한 자주 묻는 질문

질문: IG에서 계정을 개설하기 위해 필요한 최소 입금액은 얼마인가요?

답변: IG에서 계정을 개설하기 위한 최소 입금 요건은 없습니다.

질문: IG에서 허용되는 입금 방법은 무엇인가요?

답변: IG은 직불 카드, 신용 카드 및 은행 송금을 통한 입금을 허용합니다.

질문: IG에서 제공하는 최대 레버리지는 얼마인가요?

답변: IG은 특정 금융 상품에 대해 최대 1:200의 레버리지를 제공합니다.

질문: IG 고객 서비스에 어떻게 연락할 수 있나요?

답변: IG 고객 서비스에는 전화, 이메일, 온라인 채팅 또는 소셜 미디어를 통해 연락할 수 있습니다.

질문: IG에서 어떤 거래 플랫폼을 제공하나요?

답변: IG은 직관적인 웹 플랫폼, MetaTrader 4, L2 Dealer 및 모바일 애플리케이션을 제공합니다.

질문: IG에서 EUR/USD의 평균 스프레드는 얼마인가요?

답변: EUR/USD의 평균 스프레드는 1포인트입니다.

질문: IG은 트레이더를 위한 교육 자료를 제공하나요?

답변: IG은 다양한 실시간 웨비나 및 YouTube 채널에서 교육 콘텐츠를 제공합니다.

위험 경고

온라인 거래에는 투자 자본의 잠재적 손실을 포함한 내재적인 위험이 따릅니다. 모든 트레이더나 투자자에게 적합하지 않을 수 있습니다. 온라인 거래에 참여하기 전에 이러한 위험을 이해하고 인지하는 것이 중요합니다. 또한, 이 리뷰에서 제공된 정보는 회사가 서비스와 정책을 업데이트함에 따라 변경될 수 있습니다. 이 리뷰의 생성 날짜도 중요하며, 정보가 그 이후로 변화할 수 있습니다. 따라서 독자는 결정이나 조치를 취하기 전에 회사와 직접 최신 정보를 확인하는 것이 권장됩니다. 독자는 이 리뷰에서 제공된 정보의 사용에 대한 모든 책임을 전적으로 감당합니다.