Welcome to the Forex Encyclopedia Channel of WikiFX, a professional forex knowledge-sharing platform. Today We talk about the basic and important term “pips” in forex trading, providing a comprehensive breakdown of the term and how it's calculated, discussing the significance of “pips” in the FX market, and touching on some particularly interesting aspects of this metric.

What is a pip?

Forex traders who are just stepping into the forex world often question what is a pip, specifically, it means either “points in percentage” or “price in interest point.” The truth is “pip” is a frequent forex phrase that currency traders in the forex market need to get their heads around.

In currency trading, a pip, often known as a “point,” signifies the smallest possible change in the value of a currency pair.

For most major currency pairs, a pip is typically the fourth decimal place of an exchange rate.

Consider this example:

If the exchange rate of the EURUSD pair increases from 0.99641 to 0.99651, this is a 1 pip difference. Likewise, a movement of 1 pip occurs when the exchange rate falls from 0.99651 to 0.99641.

However, the Japanese yen (JPY) is expressed with two decimal places instead of the usual one.

If the USD/JPY moves from 106.45 to 106.46, there will be a 1 pip increase.

If the USD /JPY pair moves from 106.46 to 106.45, this is a 1 pip decline.

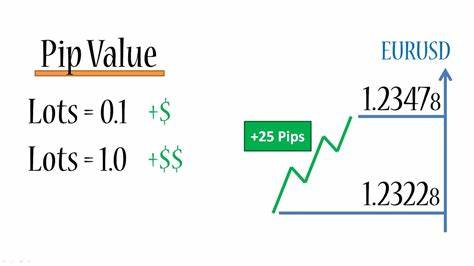

What is pip value? Does It Matter?

Pip value is like the currency “measuring stick” in forex trading. To put it simply, pip value is the amount of money you gain or lose for each pip the exchange rate moves. Think of pips as the “rulers” in the forex market that measure and describe how prices move. Pip value, in this context, is like the “money translator”, because it helps traders quantify potential gains or losses resulting from price changes. Together, pips and their associated pip values provide traders with a comprehensive understanding of the financial aspects of the forex market.

For instance, a trader, in a standard lot (100,000 euros) trade of EUR/USD, established a long position at a price of 1.1280 and set a stop loss at 1.1260 (which is 20 pips away from the entry price).

In this trading pair, the value of each pip is $10.

Two hours later, the EUR/USD exchange rate dropped to 1.1235, triggering Mr. Zhang's stop loss order. This trade incurred a loss of 20 pips. Calculating based on a pip value of $10, his total loss amounted to 20 * $10 = $200.

Pip value matters significantly in forex trading because it directly impacts your potential profits and losses.

Here's why it matters:

Risk Control: Knowing pip value helps you set the right levels for stopping losses and locking in profits, which is crucial for managing your risk wisely.

Size Your Trades: Understanding pip value lets you figure out the best trade size based on your comfort with risk and the amount of money you have in your trading account.

Counting Costs: It helps you figure out how much you're paying in spreads and fees because these costs are often measured in pips.

Strategize Better: Traders use pip value to make smart plans for their trades and set achievable goals for making money, all based on their unique trading strategies.

How to Calculate Pips in forex trading?

Calculating the value of a single pip is something that many Forex traders find to be an interesting endeavor, and pips pave the way to compute their losses and gains with each trade later.

Trading in foreign exchange occurs in 1,000-unit (micro) lots, 10,000-unit (mini) lots, and 100,000-unit (standard) lots due to the minute value of a pip.

Different position sizes have the following effect on the value of a single pip:

The pip value is simply the change in the value of a currency pair given a one-pip move in the currency pairs price. A few things will determine pip movements, including:

Currency Pair Being Traded

The Size of Position

The Current Exchange Rate

Here is the simple formula to calculate the value of a pip in a USD trading account:

See the following example for your easy understanding:

Suppose you purchased a standard lot of the GBP/USD pair at 1.3225 per unit. You decide to close the bet at 1.3250, resulting in a 25-pip profit.

To calculate your trade's profit, you must first establish the value of a single pip for the currency pair.

Value of pip = (0.0001/1.3250) x 100,000=7.54 GPB

Consider this profit example:A trade of 3 standard lots on EUR/USD is closed at 1.5560 with a profit of 30 pips. Then, what is the total profit of the trade?

Pip Value = (0.0001/1.5560) x 300,000=19.28 EUR

Total Profit: 30 pips x 19.28 EUR = 578.4 EUR

Here is the stop example:A trade of 100,000 USD on the USDJPY pair is closed at 110.25 with a loss of 40 pips. Then, what is the total loss of the trade?

Pip Value = (0.01/110.25) x100,000=9.07 USD

Total Loss: 40 pips x 9.07 = 362.8 USD

In addition, WikiFX is a professional forex tool that provides a wealth of knowledge, instructional materials, and other resources connected to foreign exchange, including the Pip Value Calculator and other forex calculators. Here are three simple steps to take to locate this content:

1.Open the official website of WikiFX (https://www.wikifx.com/).

2. Click on the “Forex Tools” button.

3.The following page will load, containing several high-quality forex calculators. You can pick any calculator that piques your attention to learn it inside and out.

What Affects Forex Pip?

At first glance, the spread seems to be just a simple number. However, it is, in reality, influenced by a multitude of factors. Let us now delve into the factors that exert an influence on forex pips:

Trading Volume - The larger the trading volume, the smaller the spread. This is because a significant volume of trades allows the trading platform to generate sufficient profits through quantity, without the need to widen the spread to expand profit margins. For active customers engaged in frequent trading, therefore, platforms often offer lower spreads to retain their business.

Market Volatility - When market volatility is high, the bid-ask spread widens, allowing trading platforms to earn a higher spread. In March 2020, the pandemic caused a global panic sell-off, greatly increasing spreads. For instance, the EUR/USD spread, usually around 1 pip, jumped to 30 pips. DJIA futures spread, normally 1 pip, surged to over 20 pips. This highlights how spreads significantly widen during market panics. Conversely, in stable market conditions, the bid-ask spread narrows, leading to a decrease in the spread.

Liquidity of Trading Instruments - Trading instruments with lower liquidity exhibit larger bid-ask spreads, resulting in higher spreads. Highly liquid trading instruments face more competition, leading to lower spreads.

Competition Among Trading Platforms- Trading platforms with intense competition may lower their spreads to attract customers. Exness competes fiercely in forex trading, offering low spreads, like a fixed 0.4-pip spread for EUR/USD, to attract customers.IC Markets, an Australian forex broker, has higher spreads (typically 1-1.5 pips for EUR/USD) due to strong local competition. Some regional forex brokers, with limited local competition, have spreads of 2 pips or more, which is a significant profit source. Banks offer ultra-low spreads, even near zero, to institutional clients due to their high trading volumes, making it a competitive advantage.

Profitability of the Trading Platform Itself - Spreads are one of the essential sources of profit for trading platforms. Platforms can adjust spreads to attain reasonable profit margins.

What Are Major Features of Pips in Forex Trading?

Forex pips are much more interesting once you go further, and they clearly share some distinct characteristics.

Spreads as Low as 0.0 Pips

Standard broker account spreads typically Run Between 1 and 1.5 Pips, and the lowest spreads can be obtained on ECN accounts as it gives investors the ability to trade on the interbank markets at the most competitive rates, with some offering as little as 0 pips.

Slippage Matters

The term “slippage” refers to the situation in which a trade order is executed at a price lower than the one requested. Slippage is more likely to occur in the forex market when there is a lack of market liquidity or a significant level of volatility. The concept of slippage is generally seen negatively, as trading efficacy can be severely hampered by slippage as small as 0.1 pips.

Easily Volatile

Extreme volatility is typical in the foreign exchange market just before and immediately after major economic data is released, such as the United States Nonfarm Payrolls report, or when a central banker holds a press conference. Trading costs are rising as spreads widen, making this a bad moment to enter or exit the market. Wider spreads are typical during periods of low market liquidity.

Good Pips Per Day

Set your stop loss at 15-20 pips and your take profit at 30-40 pips. This must be considered in light of the traders' current equity and risk management strategies. Overall, we conclude that the 30-pip-a-day technique is an exciting and risky way to increase your trading profits significantly.

Leverage Impact

The use of leverage amplifies both potential profits and losses, meaning that each pip movement has a more substantial effect on your trading account when leverage is applied.

Conclusion

To conclude, the smallest possible change in value is measured in “pips” for currency pairs other than those involving the Japanese yen, which corresponds to the value of the fourth decimal point.

When trading pairs that do not include the Japanese yen, the pip is found at the second decimal place. It is vital to grasp the difference between pips and pipettes in Forex trading, as many brokers use trading platforms with 5 decimal places rather than 4.

For any trader, pips and spreads are vital tools. They are a potent resource that can give you the upper hand in a variety of battles. Knowing about them and how to employ them effectively is all that is required.

We are confident that our knowledge will prove invaluable to you in your future undertakings.

WikiFX is a professional, global forex broker regulatory inquiry tool with extensive and easily accessible data on Forex Brokers (more than 38,000 brokers are now enlisted), the Forex Industry, News, Educational Resources, and more.

For more forex-related information and resources, please visit the WikiFX website or download WikiFX App now.

You Also Like

Differences between Bullish and Bearish Markets in Forex Trading

Dive into the dynamics of forex trading by understanding the uprising bullish markets and the falling bearish markets.

Differences between Dealing Desk & No Dealing Desk Forex Brokers

Learn about Dealing Desk & No Dealing Desk Forex Brokers, their roles, STP & ECN in NDD brokers, along with their pros & cons.

How to Use Currency Pair Correlations in Forex trading?

Dig into Currency Pair Correlations in Forex trading. Understand their concept, influence, importance, calculation, and common pairs.

What is Forex Technical Analysis? Pro & Cons Revealed

Uncover Forex Technical Analysis. Understand its core principles, strengths and weaknesses, and how to learn and apply it in Forex trading.