In the ever-evolving world of forex trading, automated systems have become a significant part of successful strategies. Ensuring round-the-clock operation, elimination of emotional bias, and the ability to process large sets of data quickly, these forex robot traders are essential tools. Stay with us as we unveil the “Top 9 Best Forex Robot Traders 2025”, showcasing the most reliable, innovative, and efficient bots shaping the future of forex trading.

Our research involved:

Functionality and Usability

We assessed the proficiency of the forex robot traders in executing trades, analyzing market trends, and managing risks. Ease of use and setup process were also pivotal factors.

Performance

We scrutinized verified track records available, such as Myfxbook accounts, to evaluate the robots' real-time performance. Backtesting results were also analyzed, although it was recognized they do not necessarily predict future results.

Compatibility and Flexibility

We gauged the versatility of the robot traders to handle different market conditions and the variety of currency pairs they are compatible with.

Customer Support and Updates

Quality of customer support provided, the regularity of updates, and users' reviews were taken into account.

Transparency

We appreciated providers that clearly disclosed the potential risks involved and did not make unrealistic promises on returns.

By taking all these facets into account, we have strived to provide a holistic and unbiased ranking.

Best Forex Robot Traders Reviewed

Ranking List

| Rank | Forex Robot Traders | Best for |

| ① | ForexTruck | Best for traders looking for a robust, automated forex trading system across multiple pairs |

| ② | Forex Robotron | Best for users seeking an automated and flexible forex trading system |

| ③ | Fxstabilizer | Best for Forex traders seeking an easy-to-use trading robot with multiple trading modes |

| ④ | Forex Fury | Best for traders of all skill levels seeking a versatile automated Forex trading solution with various risk strategies |

| ⑤ | GPS Forex Robot | Best for individuals looking for a quick, automated forex trading program with a high success rate |

| ⑥ | Wallstreet Forex Robot 3.0 Domination | Best for traders seeking an automated Forex trading system with protection against unethical brokers |

| ⑦ | Coinrule | Best for creating automated cryptocurrency trading strategies across multiple platforms, without any coding skills required |

| ⑧ | Forex Incontrol Full | Best for automated, diversified forex trading with stringent drawdown control and long-term backtesting |

| ⑨ | EA Builder | Best for creating custom indicators and automated trading strategies across multiple platforms without requiring any programming skills |

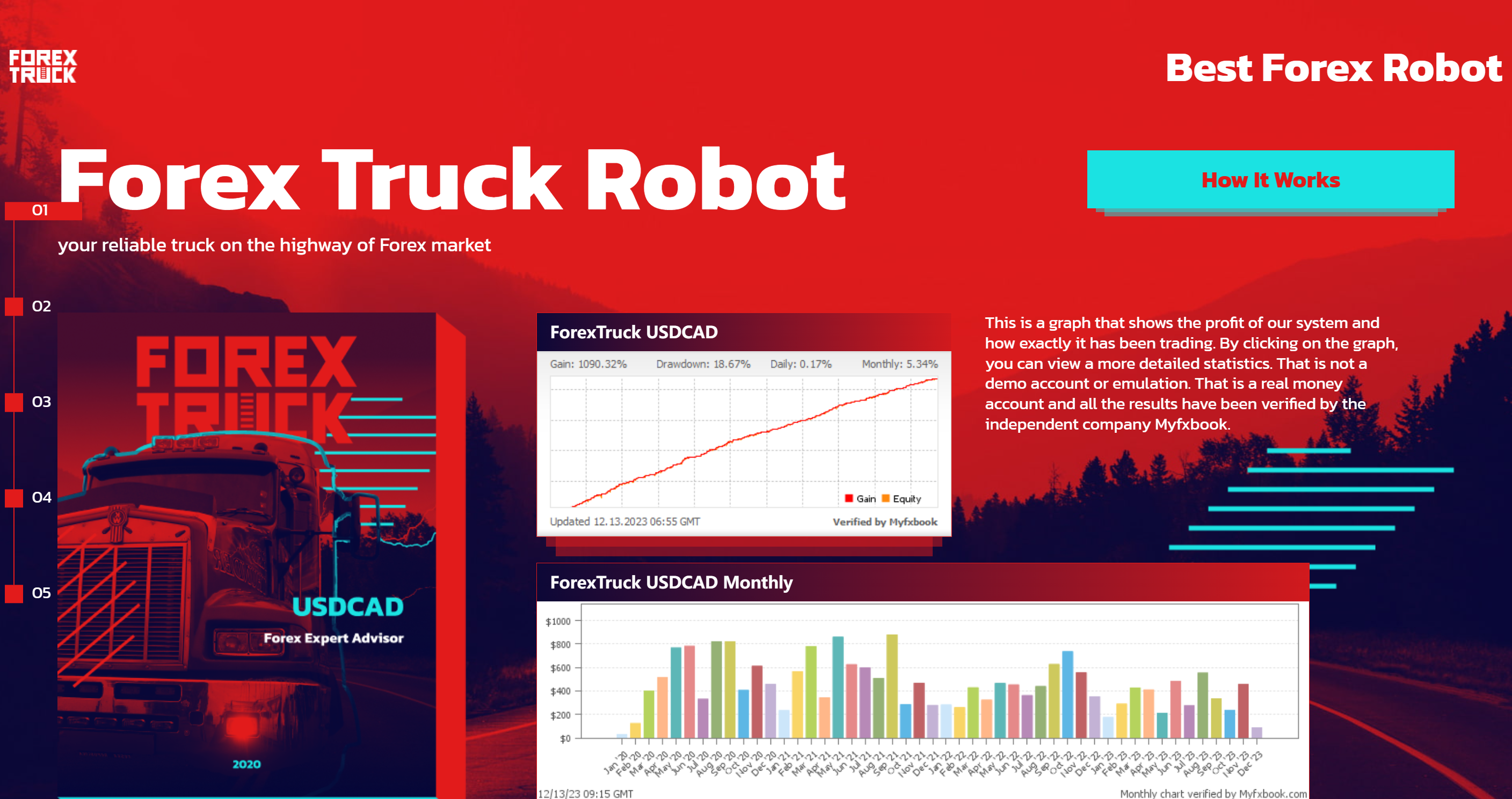

① ForexTruck

Best for traders looking for a robust, automated forex trading system across multiple pairs

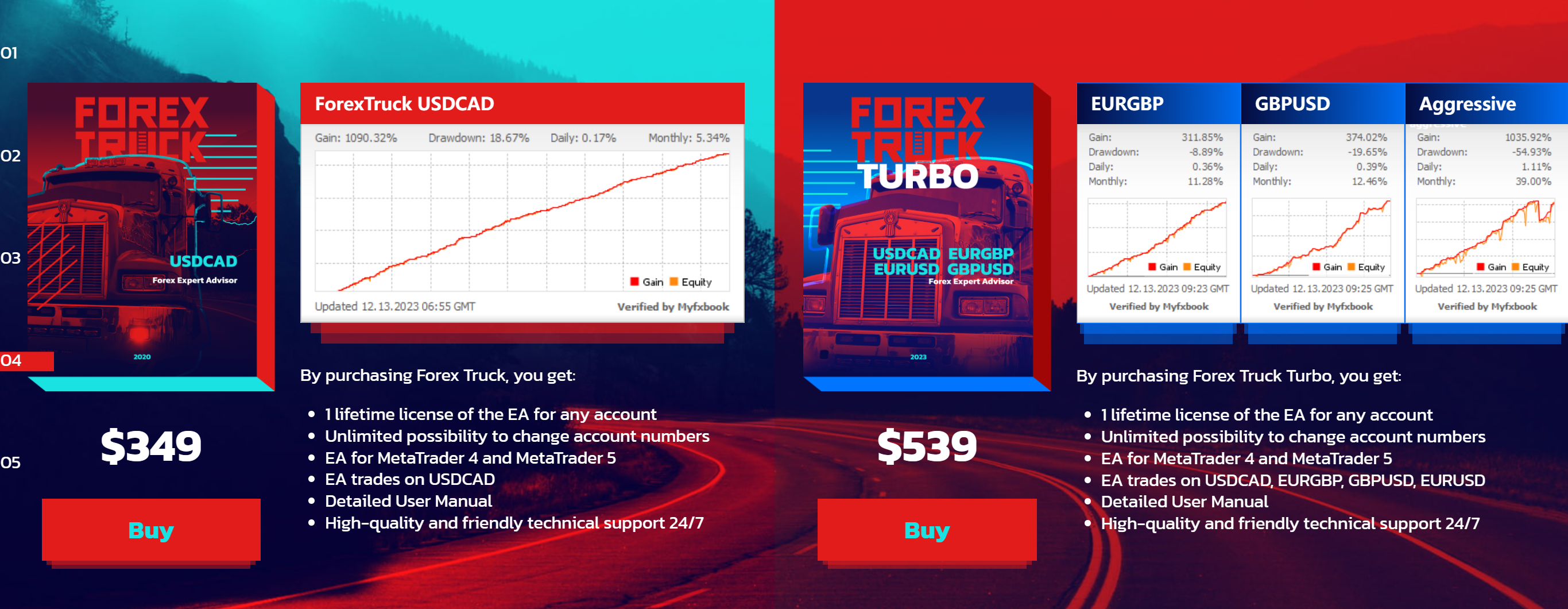

ForexTruck is an automatic trading robot compatible with both MetaTrader 4 and MetaTrader 5 platforms. With a strategy embedded in its two operational blocks, Forex Truck does not require a broker with special trading conditions - any broker is suitable. It is engineered for 100% automatization and works excellently with USDCAD, GBPUSD, EURGBP and EURUSD pairs.

| ForexTruck Feature | |

| Rating | ⭐⭐⭐⭐⭐ |

| Official Website | https://forextruck.com/ |

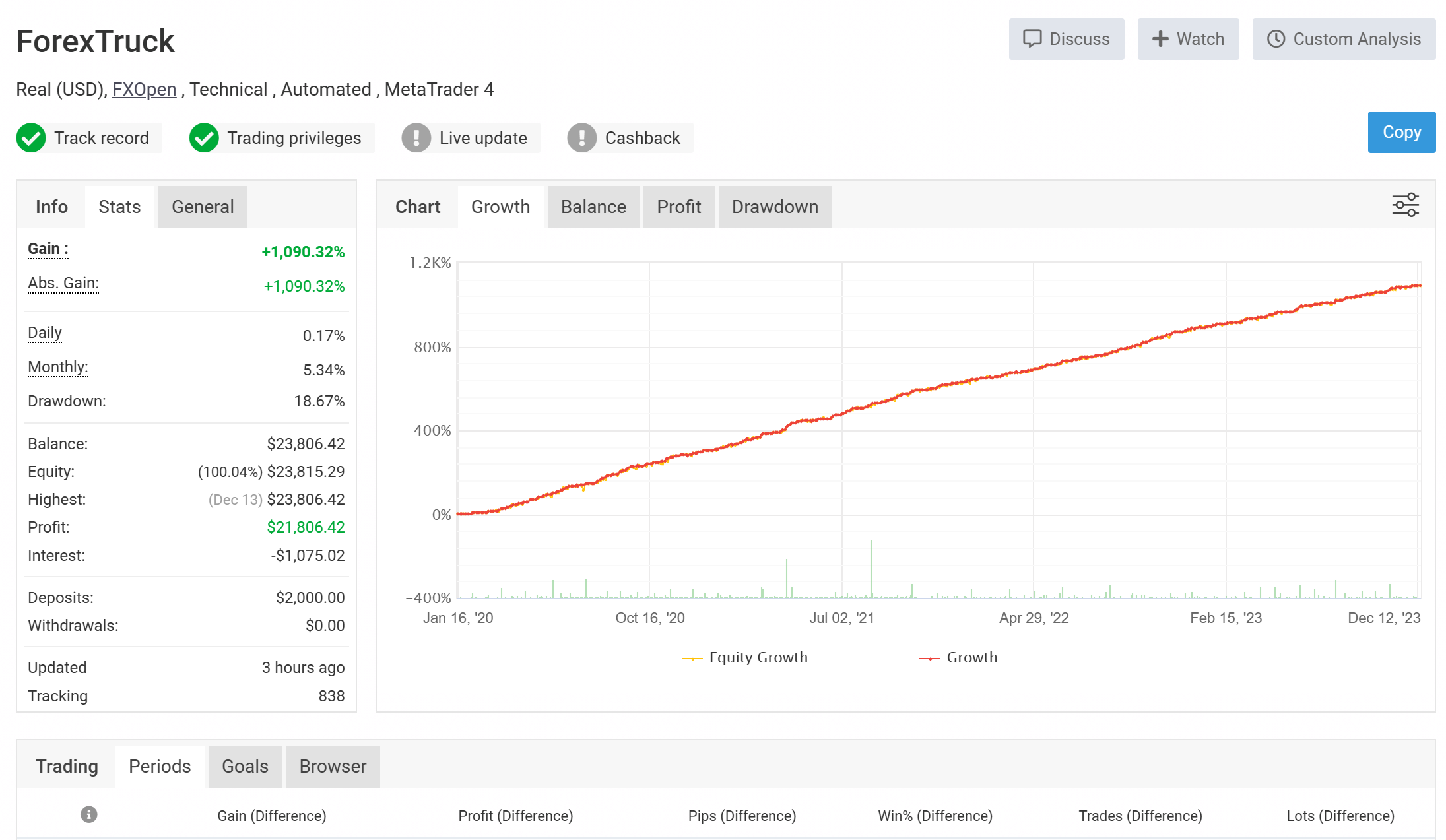

| Track Record | A general gain of +1,090.32%, a daily gain of 0.17%, a monthly gain of 5.34%, and a drawdown of 18.67% |

| Time Frame | / |

| Supported Assets | Forex Truck: USDCAD |

| Forex Truck Turbo: USDCAD, EURGBP, GBPUSD, EURUSD | |

| Price (1 lifetime license of the EA for any account) | $349 (Forex Truck), $539 (Forex Truck Turbo) |

| Platform Compatibility | MT4, MT5 |

The first block is responsible for opening orders, ensuring they are closed at a profit. When the market changes, the block may also close trades at a small profit or even a small loss to avoid prolonged drawdowns. The second block is designed to close all trades in total profit when the situation becomes challenging for the first block. Risks are controlled through a reliable system for limiting drawdowns to protect your funds.

Packages that include lifetime EA licenses, ability to change account numbers, detailed user manuals and quality 24/7 technical support are available for purchase. Prices start from $349 and a 30-day money-back guarantee is also offered.

Based on the latest data from Myfxbook, ForexTruck has showcased impressive current performance outcomes. The general gain is a substantial +1,090.32%, with a daily gain of 0.17% and a monthly gain of 5.34%. The reported drawdown level is at 18.67%, illustrating the maximum decline in the system's equity value after a series of losses. As always keep in mind, these are only indications of past performances, and does not guarantee future results, as Forex trading involves considerable risks.

ForexTruck Pros & Cons

Pros:

√ Automation: Forex Truck is a fully automated trading system, minimizing the need for human intervention and emotion in trading decisions.

√ Flexibility: The system is compatible with both MetaTrader 4 and MetaTrader 5 platforms and works with USDCAD, EURGBP, GBPUSD, and EURUSD pairs.

√ Risk Management Features: It includes a drawdown limiting system and real-time order monitoring to minimize trading losses.

√ Ease of Use: No special broker requirements are needed, and setup is designed to be user-friendly.

Cons:

× Price: The cost for the system can be a significant investment for some traders.

Why ForexTruck Made the List?

ForexTruck made the list due to its highly automated system, flexibility with both MetaTrader 4 and MetaTrader 5 platforms, and compatibility with multiple currency pairs. The impressive performance, based on historical backtest data and current Myfxbook data, as well as solid risk management features and easy setup, also contributes to its inclusion.

② Forex Robotron

Best for users seeking an automated and flexible forex trading system

Forex Robotron is an automated trading robot designed for use with the MetaTrader 4 platform. Its expertise lies in analyzing charts, identifying trading signals, and managing trades with minimal user input. Compatible with multiple currency pairs, Forex Robotron stands out because of its longstanding track record that is backed by both backtesting and real, verified Myfxbook accounts. The system's flexibility allows the users to customize settings according to their preferences.

| Forex Robotron Feature | |

| Rating | ⭐⭐⭐⭐⭐ |

| Official Website | https://forexrobotron.com/ |

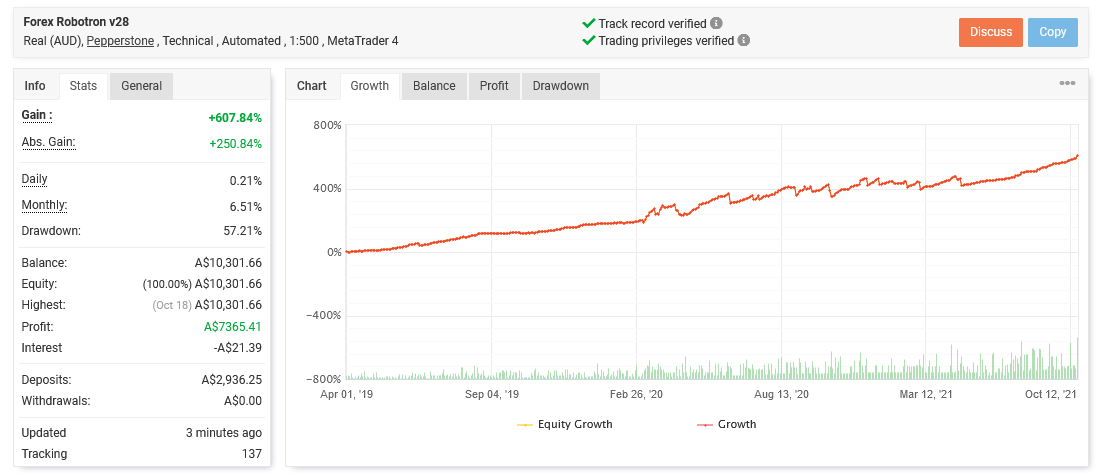

| Track Record | A general gain of +607.84%, a daily gain of 0.21%, and a monthly gain of 6.51% |

| Time Frame | / |

| Supported Assets | All instruments |

| Price | $297 (Basic plan), $497 (Pro plan), $997 (Premium plan) |

| Platform Compatibility | MT4 |

Forex Robotron has included trade commissions of $7 per lot per round turn in its backtests, ensuring that the results take into account the broker fees generally encountered in actual forex trading.

There are three packages available for Forex Robotron:Basic Plan, Pro Plan, and the Premium Plan. Currently, they are offering these plans on sale, with a discount of 75% off the regular price.

The Basic Plan, originally priced at $1,188, is now available for $297. The Pro Plan, initially costing $1,988, can now be availed for just $497. Lastly, the Premium Plan, which usually retails for $3,988, is now on sale for $997. Each plan offers a different level of perks and features, designed to cater to various trading needs and levels of investment.

The latest Myfxbook data shows that Forex Robotron has a general gain of +607.84%, a daily gain of 0.21%, and a monthly gain of 6.51%. The drawdown, or the measure of decline from a historical peak in some variable (typically the cumulative profit or total open equity of a financial trading strategy), stands at 57.21%. However, remember that these results are based on past performance, and past performance does not guarantee future results in investments.

Forex Robotron Pros & Cons

Pros:

√ Multicurrency Compatibility: The robot is designed to operate on multiple currency pairs, offering broad market coverage and diversification for users.

√ Strong Track Record: Verified Myfxbook data suggests that the bot has performed well, with promising gains and a reasonable drawdown over its operational timeline.

√ Inclusion of Trade Commissions in Backtesting: This feature ensures that backtest results are closer to the reality of live trading, as they consider potential broker costs.

Cons:

× Cost: Even though the bot is currently on sale, the original prices of the packages are relatively high, which may be a barrier to entry for some users.

Why Forex Robotron Made the List?

Forex Robotron made the list due to its impressive track record, with Myfxbook data showing strong gains and a reasonable drawdown. It also offers an automated trading system, making it user-friendly for both novice and experienced traders. Its compatibility with multiple currency pairs and its ability to adjust to various market conditions strengthen its position. The inclusion of trade commissions in backtesting, ensuring a more accurate assessment of potential broker costs, is another positive aspect.

③ Fxstabilizer

Best for Forex traders seeking an easy-to-use trading robot with multiple trading modes

| Fxstabilizer Feature | |

| Rating | ⭐⭐⭐⭐⭐ |

| Official Website | https://fxstabilizer.com/ |

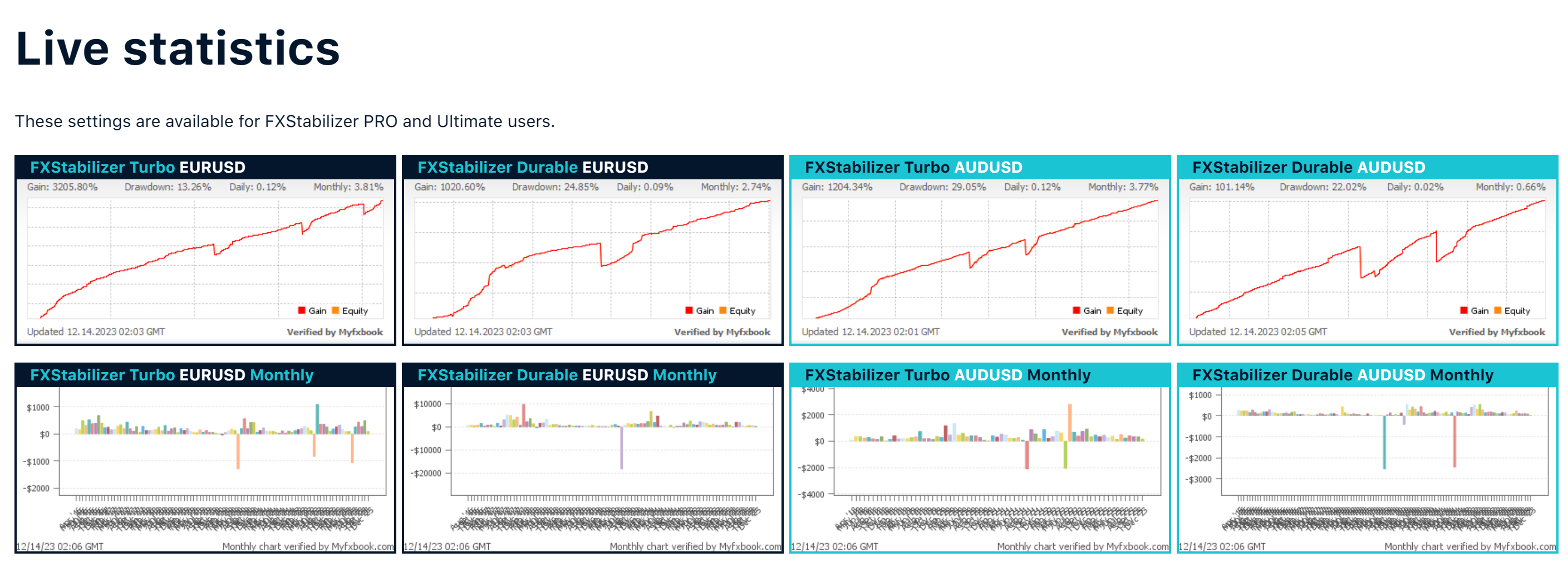

| Track Record | Live trading since 2015 |

| Time Frame | / |

| Supported Assets | Fxstabilizer Pro: EURUSD, AUDUSD, EURJPY, USDJPY, USDCAD, CHFJPY, EURGBP and GBPCHF |

| Fxstabilizer Ultimate: EURUSD, AUDUSD, EURJPY, USDJPY, EURGBP, CHFJPY | |

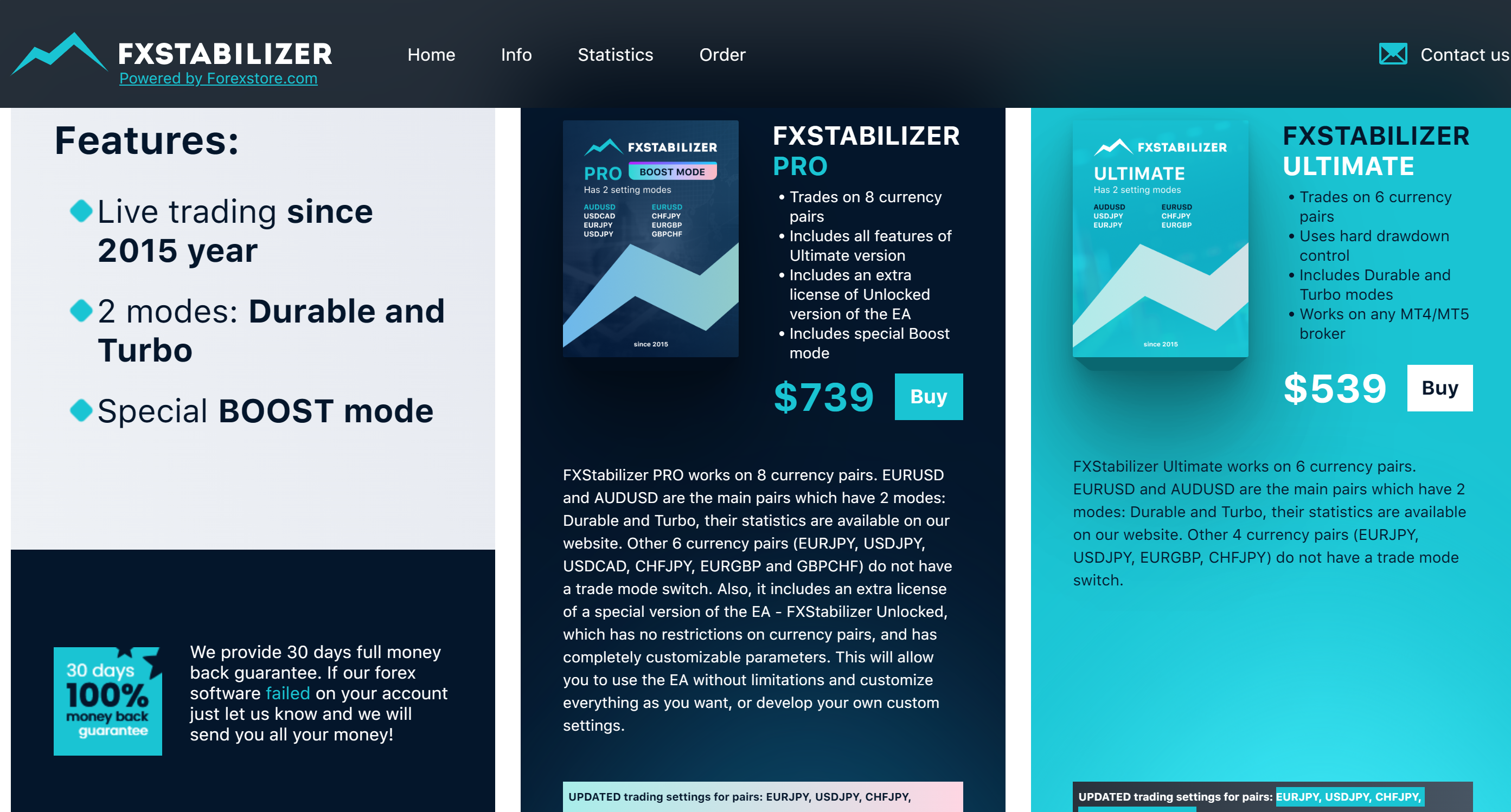

| Price | $739 (Fxstabilizer Pro), $539 (Fxstabilizer Ultimate) |

| Platform Compatibility | MT4, MT5 |

Fxstabilizer is a forex robot that has been trading live since 2015 and offers both a PRO and Ultimate version.

The PRO version, priced at $739, trades on 8 currency pairs. It includes Durable and Turbo trading modes, an additional license for an unrestricted EA, and a special Boost mode that can supercharge trading performance for a limited time.

The Ultimate version, available at $539, operates with 6 currency pairs. It also offers Durable and Turbo trading modes, and is equipped with a protective hard drawdown control feature to limit potential losses.

Both versions offer updated trading settings for multiple currency pairs and work with any MT4/MT5 broker. FxStabilizer prides itself on its consistent profit, reliability, and ease of use, especially commending its precise trade-opening calculations.

Furthermore, FxStabilizer provides 30 days full money back guarantee. Upon purchase of either version, you will receive a lifetime of free updates.

Pro version purchasers will also receive an extra license for the FXStabilizer Unlocked, which has no restrictions on currency pairs and customizable parameters.

FxStabilizer provides live trading statistics for both PRO and Ultimate users, which can be accessed on their website. This real-time data provides necessary insights into the performance of this bot, enabling traders to understand its effectiveness and make informed decisions. Please note that all FxStabilizer's live performance results are verified by Myfxbook, a reputable third-party company. This ensures the credibility and transparency of the results presented.

Fxstabilizer Pros & Cons

Pros:

√ Trading on Multiple Currency Pairs: Both versions trade on multiple popular currency pairs, increasing diversity and potential profitability.

√ Various Trading Modes: Offers Durable and Turbo modes for flexibility based on market conditions and users' risk appetite.

√ Unlocked Version: The Pro version includes an extra license for an unrestricted EA, allowing full customization.

√ Hard Drawdown Control: The Ultimate version uses hard drawdown control to protect your investment.

√ 30 Days Full Money Back Guarantee: If the software fails on your account, they promise to return all your money within 30 days.

Cons:

× Cost: With prices at $739 for the Pro version and $539 for the Ultimate version, these robots may be too expensive for some traders.

× Boost Mode: The Boost mode has the potential for great profits, but it also removes drawdown restrictions and can be highly risky.

Why Fxstabilizer Made the List?

FxStabilizer made the list due to its features and proven track record. Both the Pro and Ultimate versions trade on multiple currency pairs, offer a variety of trading modes, and are easily usable by even inexperienced traders. The Pro version additionally offers a Boost mode and an unrestricted EA for advanced customization, while the Ultimate version has a hard drawdown protection feature.

④ Forex Fury

Best for traders of all skill levels seeking a versatile automated Forex trading solution with various risk strategies

Forex Fury is a highly rated FX robot, boasting a 93% winning track record verified by Myfxbook. It's designed for all skill levels offering full installation guides, responsive support, profitable settings, and both safe and aggressive trading opportunities. Fury can trade on any pair, indices, or crypto, and works with all MT4/MT5 trading brokers.

| Forex Fury Feature | |

| Rating | ⭐⭐⭐⭐⭐ |

| Official Website | https://www.forexfury.com/ |

| Track Record | 93% winning track record |

| Time Frame | / |

| Supported Assets | Any Pair, Indices, or Crypto |

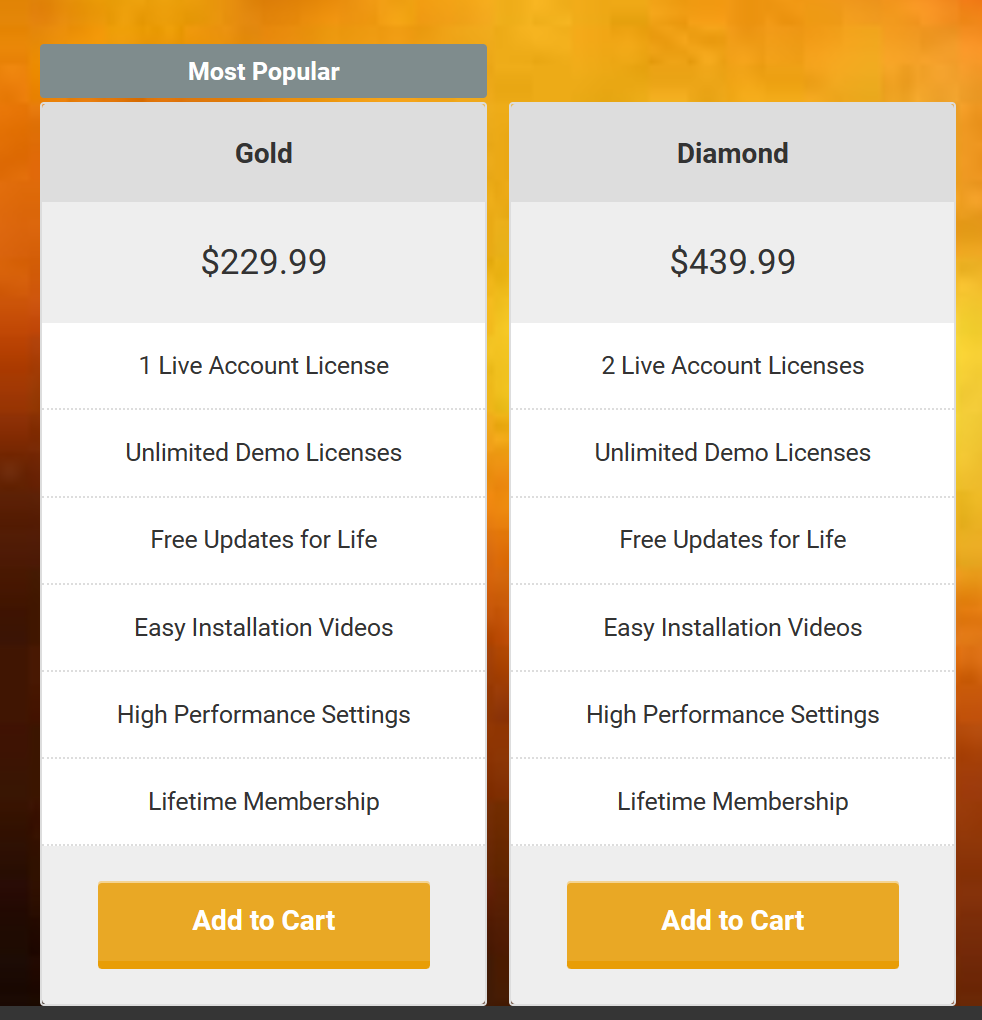

| Price | $229.99 (Gold), $439.99 (Diamond) |

| Platform Compatibility | MT4, MT5 |

It offers various risk strategies and effective money management for sustainable growth. It comes in two versions: Gold at $229.99 for one live account license, and Diamond at $439.99 for two live account licenses, both offering unlimited demo licenses, free updates for life, easy installation videos, high-performance settings, and lifetime membership. Their website also provides up-to-date live and demo trading results.

Forex Fury Pros & Cons

Pros:

√ High Winning Track Record: It boasts a 93% winning track record, verified by Myfxbook.

√ Suitable for All Skill Levels: It offers full installation guides, a responsive support team, and both safe and aggressive trading opportunities, suitable for beginners and experts alike.

√ Flexible Trading: Can trade any pair, indices, or crypto, compatible with all MT4/MT5 trading brokers.

√ Variety of Risk Strategies: It offers low, medium, and high-risk strategies to suit different risk appetites.

√ Effective Money Management: Promotes sustainable growth with effective money management practices.

Cons:

× Cost: The costs for the licenses may be too high for some potential users, with prices at $229.9 for the Gold version and $439.99 for the Diamond version.

× No Free Trial: Forex Fury does not offer a free trial of its software.

Why Forex Fury Made the List?

Forex Fury made the list because of its high win rate, versatility to trade on any pair, various risk strategies, excellent customer support, and solid money management strategy.

⑤ GPS Forex Robot

Best for individuals looking for a quick, automated forex trading program with a high success rate

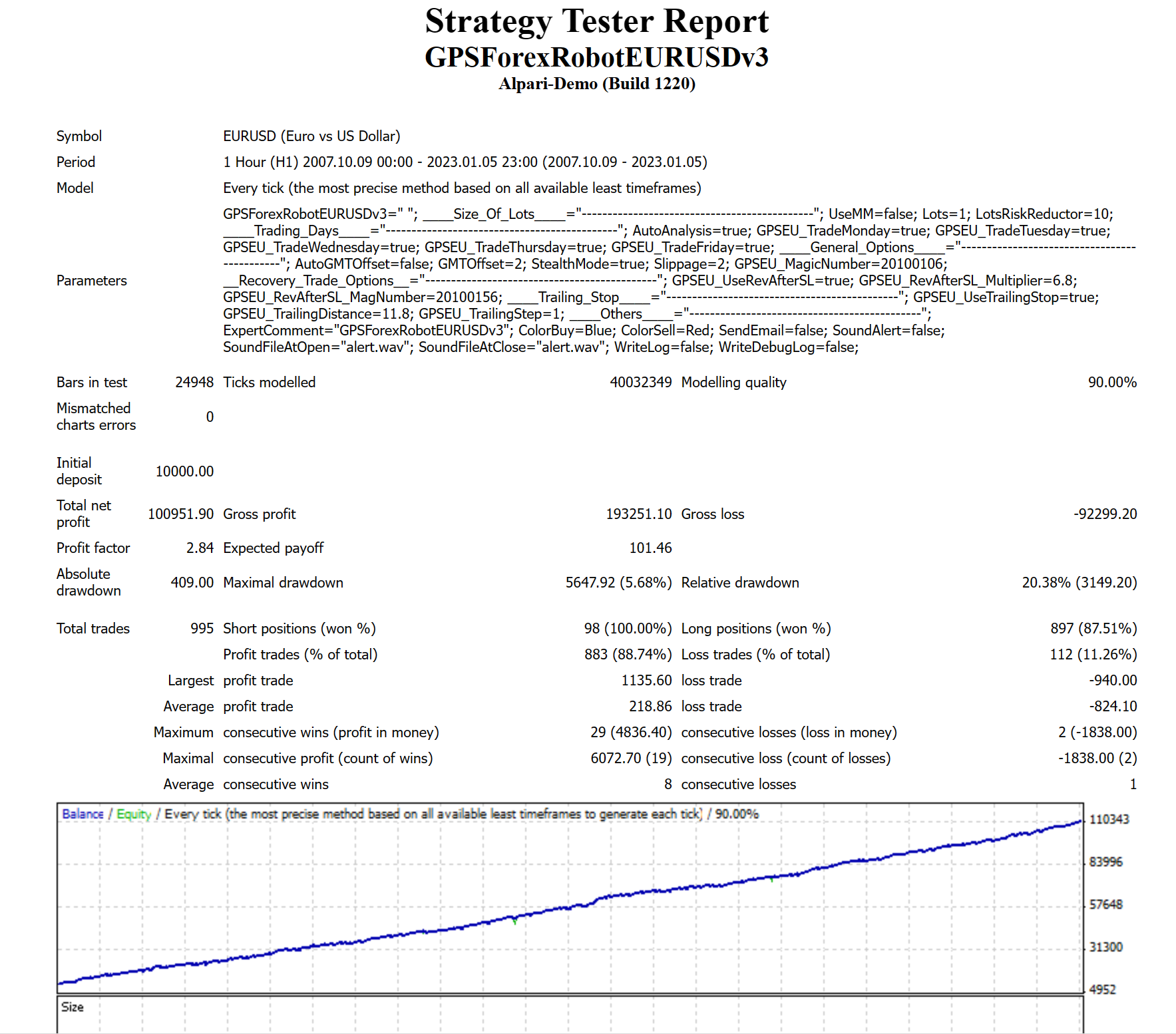

GPS Forex Robot 3 is an automated trading robot presented by Mark Larsen, a known figure in the forex trading industry, and is suitable for new traders and experienced ones. The robot predicts the short-term movement of the forex market with a high probability and is capable of working four times faster after recent updates, leading to improved profitability.

| GPS Forex Robot Feature | |

| Rating | ⭐⭐⭐⭐ |

| Official Website | https://gpsforexrobot.com/ |

| Track Record | Profitable over 30% a month |

| Time Frame | Short-term |

| Supported Assets | EUR/USD, EUR/GBP, USD/CHF, etc. |

| Price | Onetime fee of $149 |

| Platform Compatibility | / |

It also brings with it a new additional function that optimizes settings according to the current market situation, in real-time trading. The one-time fee for the GPS Forex Robot is $149 and it guarantees satisfaction with a 60-day money back provision if it fails to achieve your goals. This forex robot doesn't utilize tricks such as martingale, grid, or no-stop-loss trading, reducing the risk of blowing your account. It is also fully verified by an independent monitoring service, Myfxbook.

GPS Forex Robot Pros & Cons

Pros:

√ Long Track Record: The system has been around for several years with live trading results.

√ Versatile settings: It allows you to change primary parameters and adapt to your own trading style.

√ Functionality: The latest version is said to work four times faster, suggesting increased effectiveness.

√ 60-day money back guarantee: If it doesnt meet your expectations, you can get a full refund.

Cons:

× Upfront payment: A one-time fee of $149 is required to use the robot. Although there is a refund policy, the payment requirement could be a barrier for some users.

× Limited flexibility: Its mostly a plug-and-play system, so it might not be suitable for traders who prefer hands-on control over their trades.

× No details about compatibility: Details about platform compatibility are not clearly specified, leaving potential users unsure about whether it would work with their chosen trading platforms.

Why GPS Forex Robot Made the List?

GPS Forex Robot is popular due to its high success rate, ability to trade multiple currencies, quick performance, and a long positive track record. It's user-friendly and offers a 60-day money-back guarantee.

⑥ Wallstreet Forex Robot 3.0 Domination

Best for traders seeking an automated Forex trading system with protection against unethical brokers

Wallstreet Forex Robot 3.0 Domination is a professional trading system offered by FXAutomater. This Expert Advisor (EA) is designed for automated trading and has a history of high success rates. It has been tested rigorously, performing reliably in varying market conditions over a decade of extensive backtesting.

One of its unique features is the “Broker Spy” module which serves to protect your capital against unfair practices by unscrupulous brokers. The “Market Bias” algorithm is another distinctive feature that tracks the direction of big, savvy institutional money.

The purchase of the Robot comes with lifetime service, and FXAutomater is committed to providing 24/7 support, lending credibility to its operations. Moreover, WallStreet Forex Robot 3.0 also comes with a 60-day 100% money-back guarantee, providing a risk-free opportunity for users to try the product.

| Wallstreet Forex Robot 3.0 Domination Feature | |

| Rating | ⭐⭐⭐⭐ |

| Official Website | https://www.wallstreet-forex.com/ |

| Track Record | 22% monthly profit |

| Time Frame | / |

| Supported Assets | 10 supported currency pairs |

| Price | Basic ($187), Premium ($247), Ultimate ($347) |

| Platform Compatibility | MT4, MT5 |

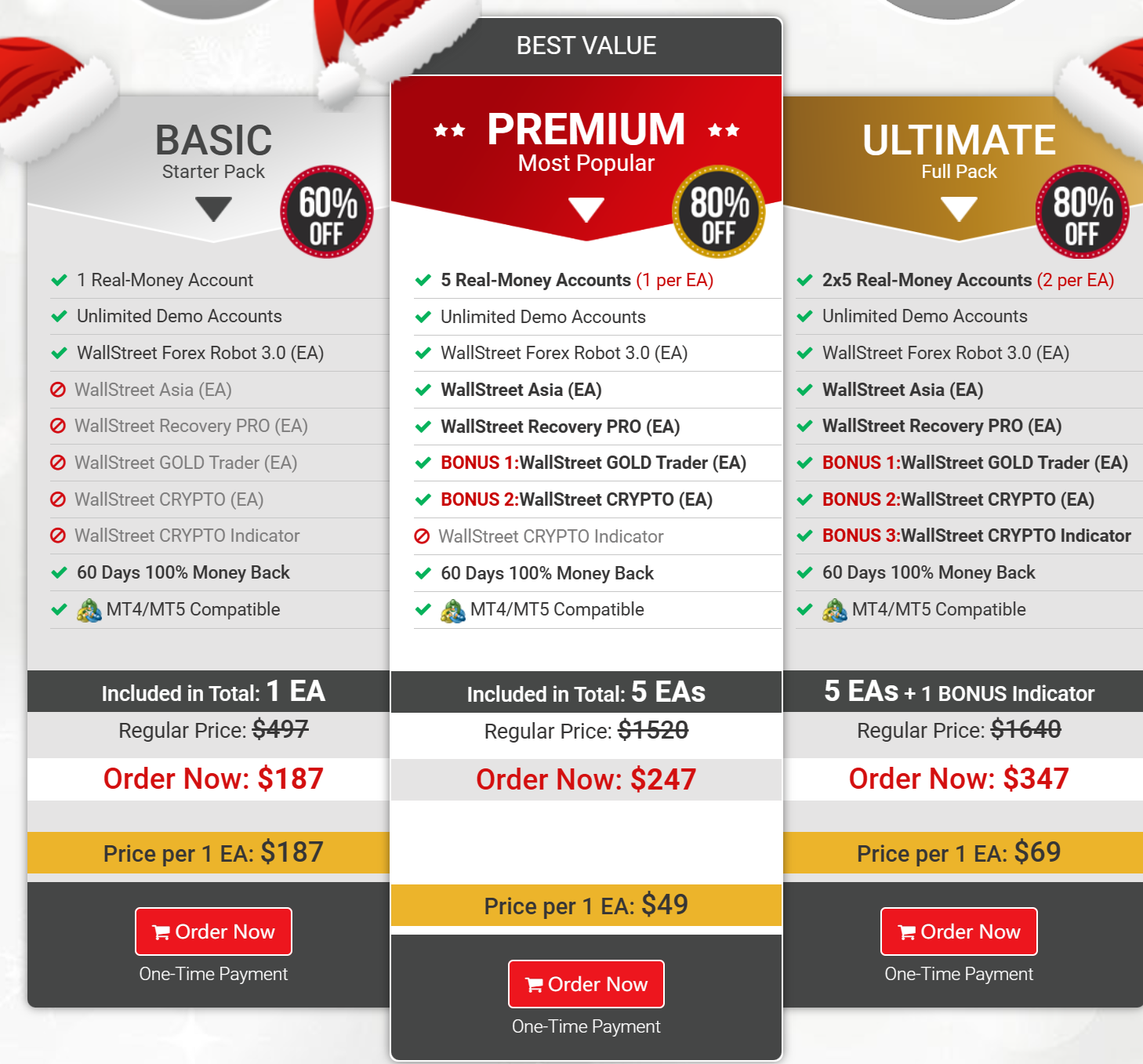

FXAutomater is offering a Christmas promotion with three package tiers.

The 'Basic (starter pack)' is offered at a 60% discount. It includes 1 real-money account and 1 EA. The regular price is $497 but you can now buy it for $187.

The 'Premium (most popular)' pack includes 5 real-money accounts, and two bonus EAs (the WallStreet GOLD Traders and the WallStreet Crypto). It includes a total of 5 EAs. The regular price is $1520, but it can be ordered now for $247, a huge 80% discount.

The 'Ultimate (full pack)' provides another 80% discount. It includes 2 sets of 5 real-money accounts, all the bonus EAs from the Premium pack, plus an extra bonus WallStreet Crypto Indicator. This pack includes 5 EAs and 1 bonus indicator in total. The regular price is $1640, but it is available now for $347 as part of the promotion.

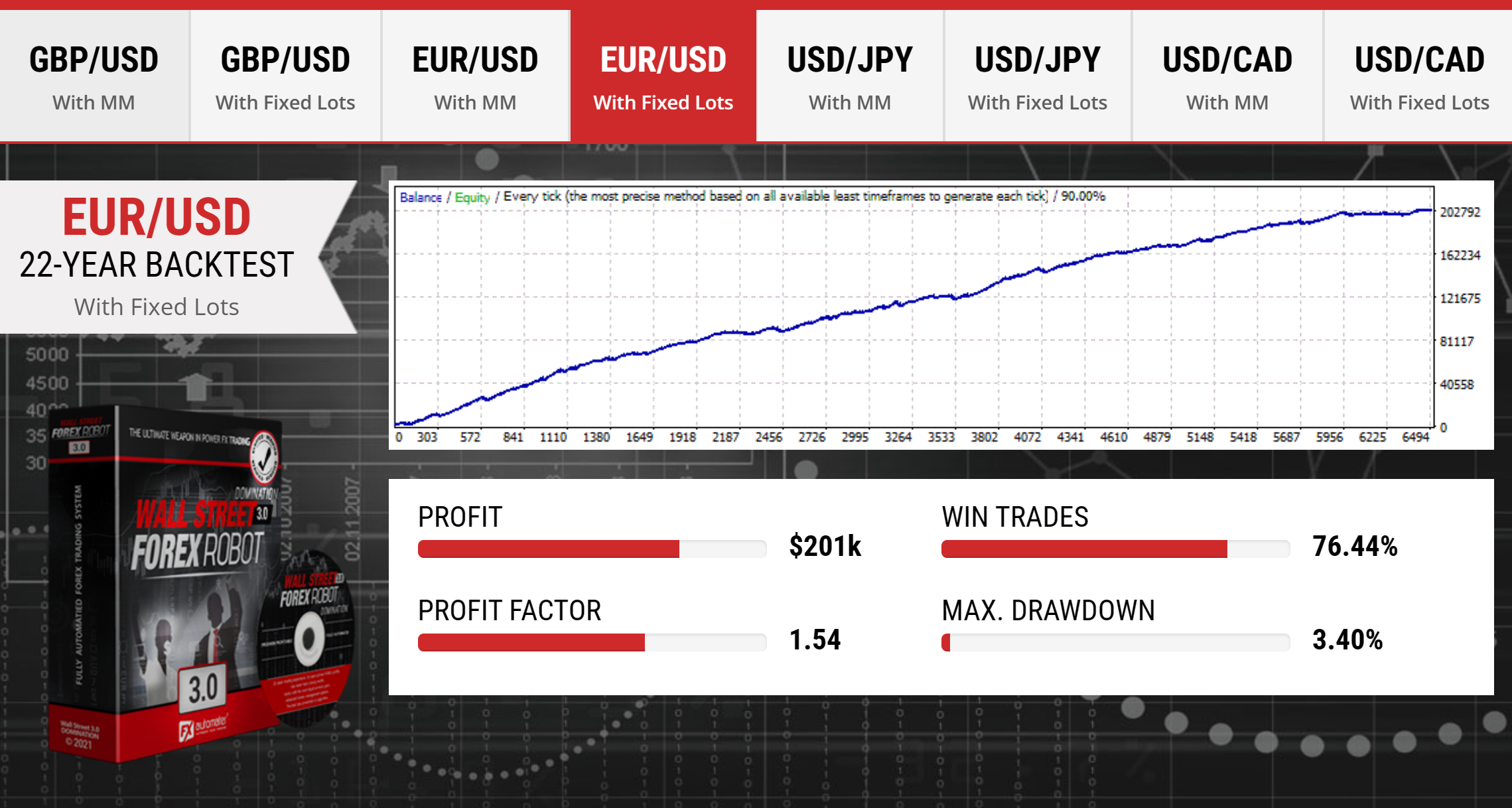

The 22-year backtest on EUR/USD with fixed lots achieved a profit of $201k. The percentage of winning trades was 76.44%. The profit factor, a measure of the system's efficiency, was 1.54. Meanwhile, the maximum drawdown, which represents the largest loss from a peak to a trough during the period, was quite low at 3.40%. These statistics suggest strong and stable performance over the tested period.

Wallstreet Forex Robot 3.0 Domination Pros & Cons

Pros:

√ Broker Spy Module: It offers protection against unfair practices by brokers.

√ Market Bias Tool: It provides insights into the direction of institutional money.

√ Money-Back Guarantee: It comes with a 60-day 100% money-back guarantee, meaning there's no financial risk for trying it out.

√ Lifetime Service & Support: It provides 24/7 ongoing system support.

Cons:

× Initial Investment: Some users may find the cost of purchasing the system to be a barrier.

Why Wallstreet Forex Robot 3.0 Domination Made the List?

WallStreet Forex Robot 3.0 made the list due to its automation, protective features against unfair brokers, proven track record, and real-time adaptability. Plus, it comes with a 60-day money-back guarantee and 24/7 support.

⑦ Coinrule

Best for creating automated cryptocurrency trading strategies across multiple platforms, without any coding skills required

Coinrule is a platform that allows users to create personalized trading strategies and automated trading bots, with no coding skills required. It offers military-grade security, compatibility with major investment platforms, and a variety of template strategies. It also enables trading across multiple exchanges like Binance, Coinbase, Kucoin, and Kraken.

| Coinrule Feature | |

|---|---|

| Rating | ⭐⭐⭐⭐ |

| Official Website | https://coinrule.com/ |

| Track Record | / |

| Time Frame | / |

| Supported Assets | A variety of crypto assets |

| Price | Free Plan, Hobbyist Plan ($29.99/m), Trader Plan ($59.99/m), Pro Plan ($449.99/m) |

| Platform Compatibility | 10+ Popular Investment Platforms |

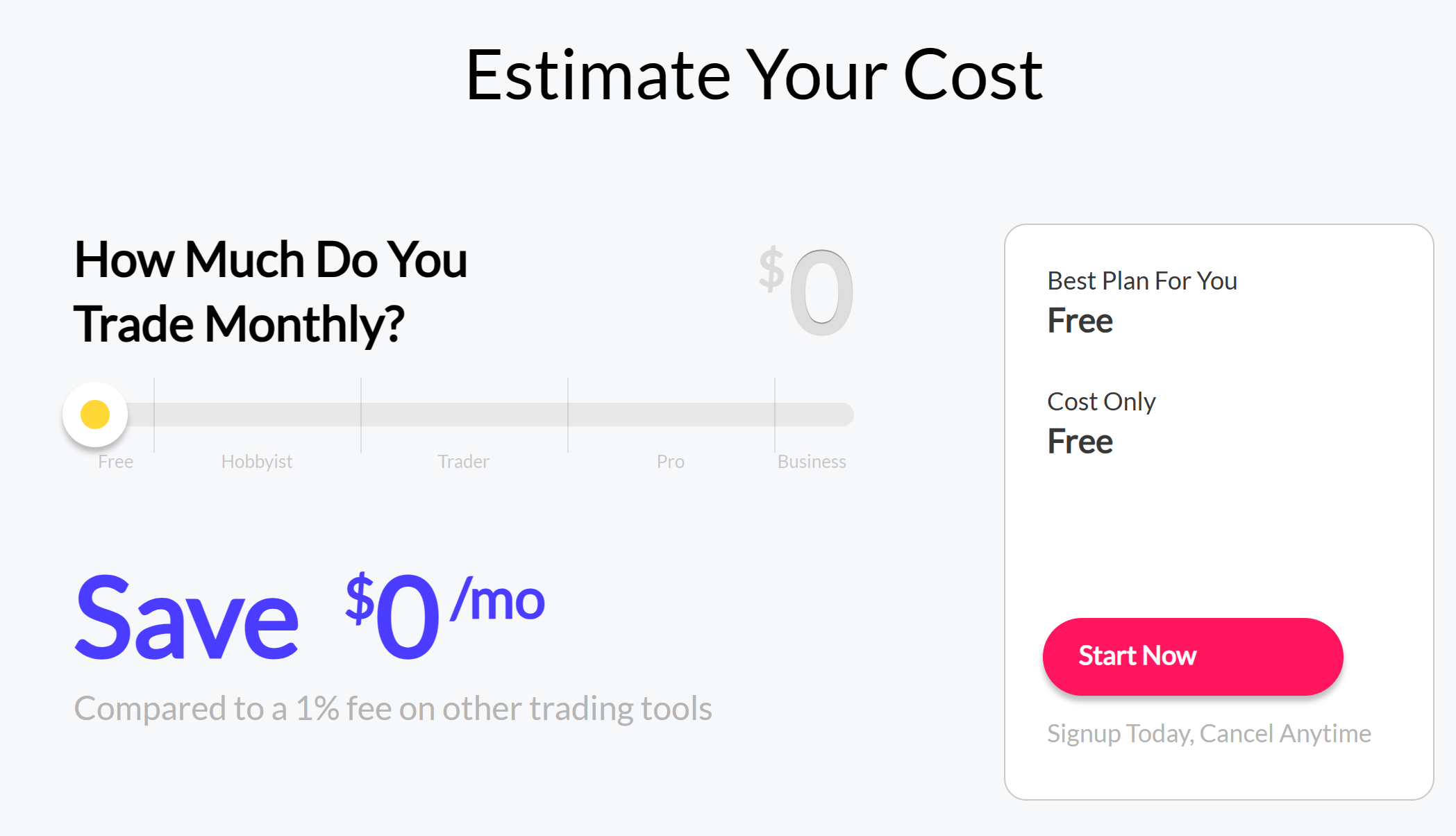

The platform also provides market updates and new indicators. It has four pricing tiers: 'Starter' (free), 'Hobbyist' ($29.99/m), 'Trader' ($59.99/m), and 'Pro' ($449.99/m), each offering varying amounts of live rules, demo rules, template strategies, connected exchanges, and monthly trade volumes. Each tier is tailored to cater to different levels of trading activity. As of now, there is a 25% discount on all plans.

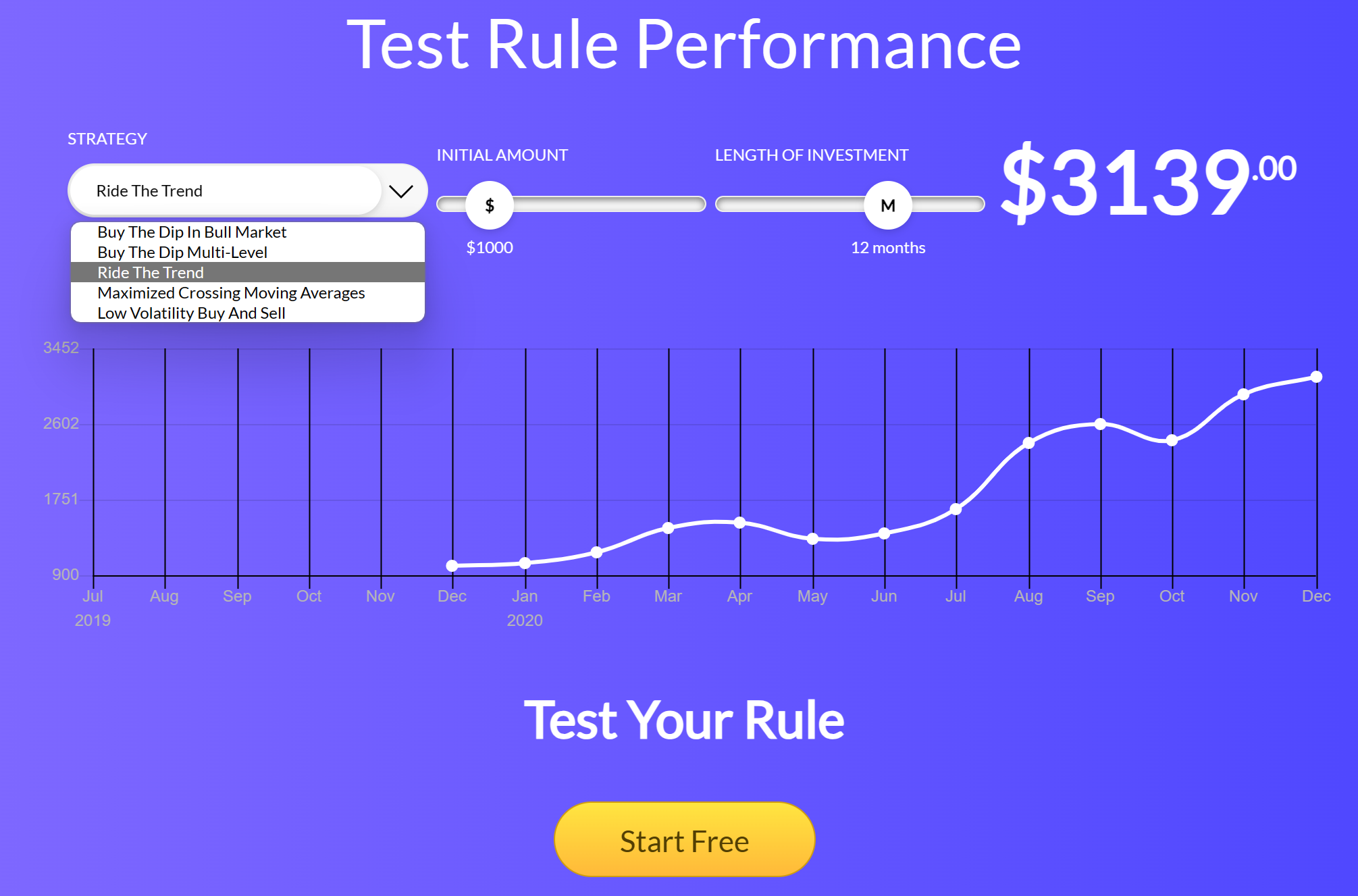

Coinrule offers a unique feature where you can test rule performance based on your strategy, initial investment amount, and investment duration. This allows you to simulate the potential outcomes of your strategy before implementing it.

Also, they offer a helpful cost estimator tool on their website where you input your monthly trade volume, and it will automatically estimate your monthly cost and recommend the best plan that suits your trading activity. This can assist you in making an informed decision about which plan would provide the best value for your specific needs and trading habits.

Coinrule Pros & Cons

Pros:

√ No coding skill required: It allows both beginners and experts to create trading rules easily.

√ High level of compatibility: It is compatible with the top 10+ popular investment platforms, including Binance, Coinbase, and Kraken.

√ Customization: It provides high degrees of customization options with varying template strategies.

√ Various pricing options: Coinrule offers different levels of service packages including a free version.

Cons:

× More suited for active traders: Due to its emphasis on rule creation and automation, it may be more suitable for frequent traders rather than long-term holders.

× Different learning curve: While the platform is designed to be intuitive, new users may require some time to adjust and understand how best to utilize the tools available.

Why Coinrule Made the List?

Coinrule made the list due to its user-friendly interface, compatibility with many exchanges, strong security, customization features, various pricing options, and the capability to automate trading strategies without any coding skills required.

⑧ Forex inControl 3.0

Best for automated, diversified forex trading with stringent drawdown control and long-term backtesting

Forex inControl is a reliable and profitable Expert Advisor that works on MT4 and MT5 platforms, compatible with any broker. Key features include hard control of drawdown, trading on 4 different currency pairs, and a long history of results over 18-20 years. It offers three different modes of trading styles: Conservative, Normal, and Aggressive.

| Forex inControl 3.0 Feature | |

| Rating | ⭐⭐⭐⭐ |

| Official Website | https://forex-incontrol.com/ |

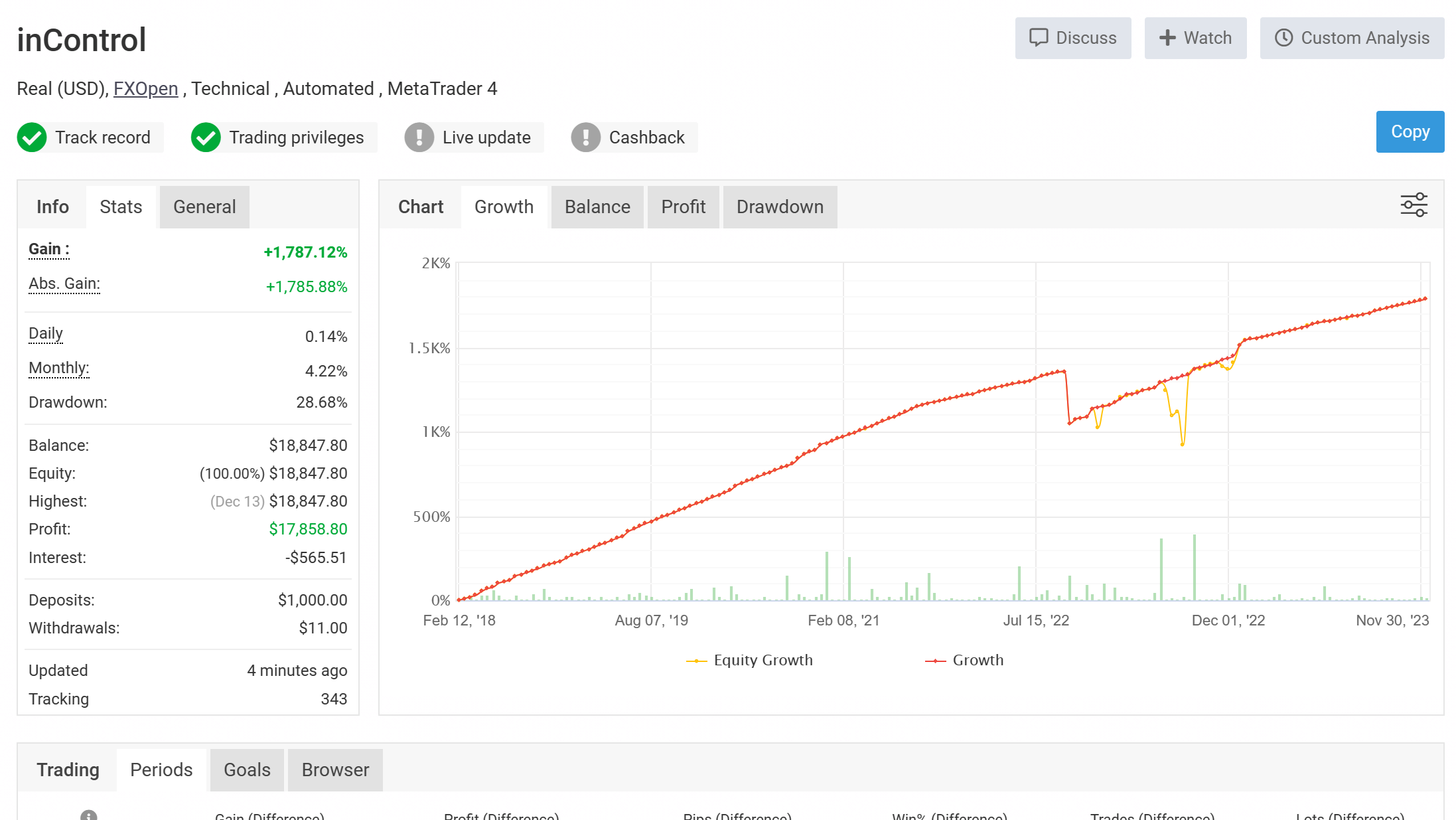

| Track Record | A general gain of +1787.12%, daily gain of 0.14% and monthly gain of 4.22%, a drawdown of 28.68% |

| Time Frame | / |

| Supported Assets | Forex inControl 3.0: AUD/USD, EUR/GBP |

| Forex inControl 3.0 Complete: AUD/USD, EUR/GBP, USD/CAD, EUR/JPY | |

| Price | $299 (Forex inControl 3.0), $349 (Forex inControl 3.0 Complete) |

| Platform Compatibility | MT4, MT5 |

The purchase of Forex inControl comes with the EA, a detailed user manual, free updates, 24/7 professional support, and a 30-day money-back guarantee. It trades patiently and does not open orders all the time, waiting for the most favorable moments to enter the market. There are two versions: Forex inControl 3.0 priced at $299, and Forex inControl 3.0 Complete priced at $349.

It's great to see the positive evaluation on Myfxbook for Forex inControl 3.0. With a general gain of +1787.12%, daily gain of 0.14% and monthly gain of 4.22%, it indicates a commendable and consistent performance. Despite a drawdown of 28.68%, which is a measure of peak to trough decline, the overall gain suggests its benefits.

Forex inControl 3.0 Pros & Cons

Pros:

√ Hard Control of Drawdown: It has a mechanism to limit a possible drawdown on each currency pair.

√ Compatibility: Works on both MT4 and MT5 platforms, and is compatible with any broker.

√ Different Trading Styles: It offers Conservative, Normal, and Aggressive modes of trading.

Cons:

× Cost: The EA comes with a price tag, starting from $299.

× Aggressive Trading Risk: Although it allows aggressive trading, this can result in substantial financial loss.

Why Forex inControl 3.0 Made the List?

Forex inControl 3.0 made the list due to features like trading on four different currency pairs, hard control of drawdown, long-term backtesting, compatibility with MT4 and MT5 and any broker, and different trading styles.

⑨ EA Builder

Best for creating custom indicators and automated trading strategies across multiple platforms without requiring any programming skills

EA Builder is a platform that offers you the ability to create your indicators and strategies for Forex, stocks, and other financial markets without programming. Supported platforms include MetaTrader 4 & 5 and TradeStation. Some of its main features include creating unlimited indicators for free, customizing arrows and alerts for trading conditions, conversion of manual systems to automated, and money management techniques.

| EA Builder Feature | |

| Rating | ⭐⭐⭐⭐ |

| Official Website | https://www.eabuilder.com/ |

| Track Record | / |

| Time Frame | / |

| Supported Assets | Forex, Stocks and Futures |

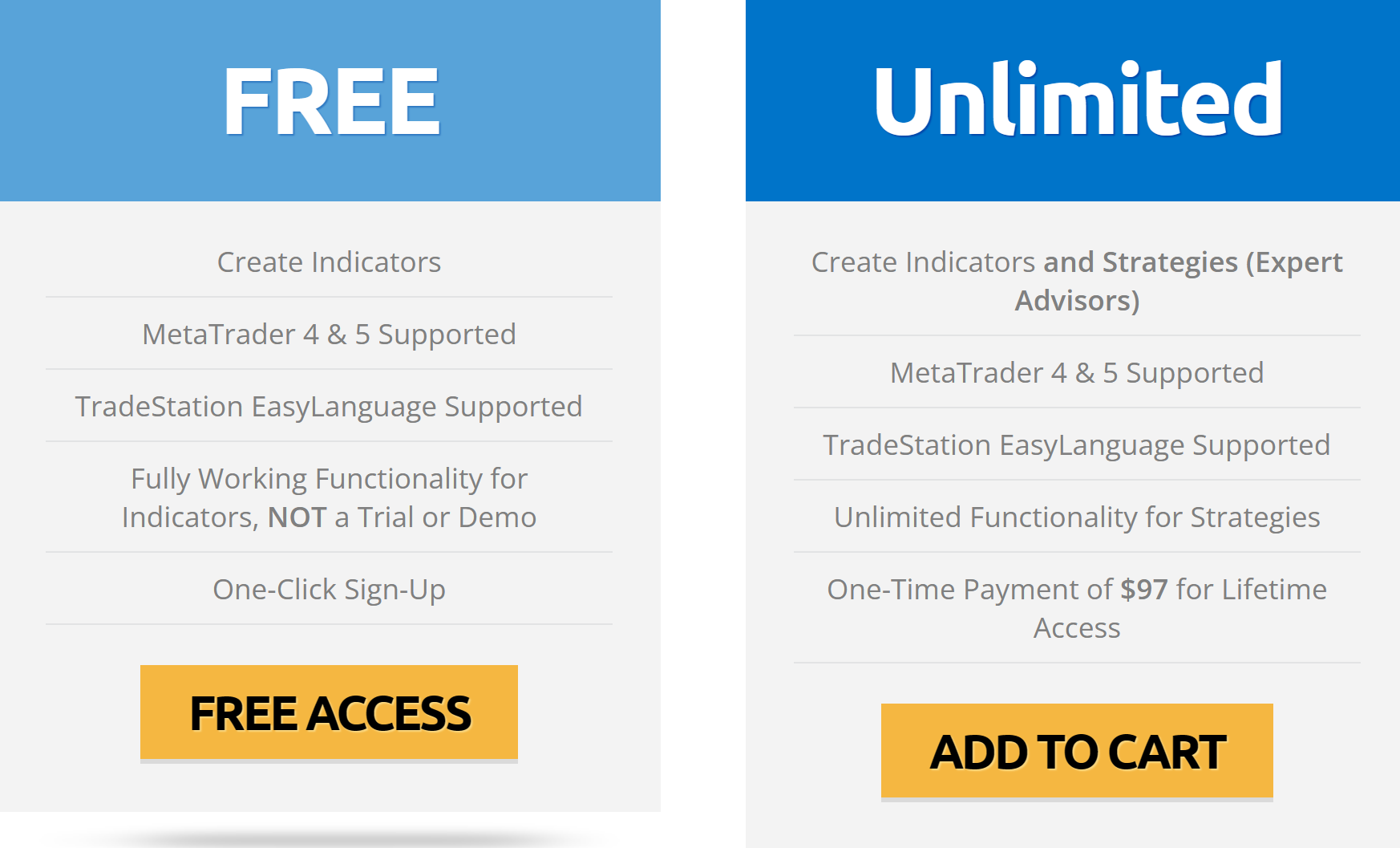

| Price | Free and Unlimited (one-time payment of $97 for lifetime access) |

| Platform Compatibility | MT4, MT5, TradeStation |

The platform offers free access to create indicators, or a one-time payment of $97 for creating both indicators and strategies. It has a user-friendly interface ideal for beginners and professionals alike.

EA Builder Pros & Cons

Pros:

√ No Coding Skills Required: You can create indicators and automated strategies without knowing any programming language.

√ Supports Multiple Platforms: EA Builder supports MetaTrader 4 & 5 and TradeStation.

√ Customization: Offers custom indicators, functions, and alerts based on your trading conditions.

√ Education: Offers video tutorials for guidance.

Cons:

× Paid Version Necessary for Automated Strategies: While you can create indicators for free, creating automated strategies requires a one-time payment.

× Limited Advanced Features: It doesn't use advanced functions like objects and classes in its generated code.

× Single File Code: All code is contained in a single file, which may affect organization and understanding for complex strategies.

× Binary Options on MT4 only: Binary options trading is only available on MetaTrader 4.

Why EA Builder Made the List?

EA Builder is included because it allows users to create custom indicators and strategies without programming skills, supports multiple platforms, offers money management features, and has educational guides. Its one-time payment for unlimited strategies makes it cost-effective.

Forex Robot Traders FAQs

What is a forex robot?

A forex robot is a computer program based on a set of forex trading signals that help determine whether to buy or sell a currency pair at a given point in time. These robots are designed to remove the psychological element of trading and can be fully automated or semi-automated. They analyze market actions, such as time, price, orders, and volume and are developed to allow traders to execute more trades than they could do manually.

How do forex robots work?

Forex robots work by analyzing forex market data and making trading decisions based on that analysis. They can be programmed with specific parameters to execute trades on a trader's behalf.

Market Analysis

The robot analyzes historical and real-time market data. This encompasses a variety of indicators, including price trends, economic news, and other data that can impact forex markets.

Trading Strategy

The robot applies pre-programmed trading strategies to the analyzed market data. These strategies are often based on technical analysis algorithms, which may involve indicators like moving averages, stochastic oscillators, or Fibonacci sequences.

Trade Orders

Based on the trading strategy and the market analysis, the robot then decides whether to place a trade. This decision process typically involves determining the trading volume, the currency pair to trade, whether to buy or sell, and the timing of the trade.

Automated Execution

Once the robot decides to place a trade, it can do so automatically. This means the robot can execute a trade even when the trader is not physically present.

Continuous Monitoring

The robot continues to monitor the market after executing a trade. It tracks market movements and, based on the trading strategy in place, decides whether to exit the trade or open new ones.

Using a forex robot can streamline the trading process and remove the possibility of human errors and emotional interference. However, keep in mind that while forex robots can automate trading, they are not infallible and still require monitoring. Furthermore, they do not guarantee profits, and trading forex involves risk.

Types of forex robots

Forex robots can generally be placed into two broad categories - Fully Automated Forex Robots and Semi-Automated Forex Robots.

Fully Automated Forex Robots

Also known as Expert Advisors (EAs), these robots operate completely independently and handle all trading operations without the need for human intervention. They analyze market conditions, execute trades, and even manage active trades based on the algorithm they've been programmed with.

Semi-Automated Forex Robots

This type of trading robot analyzes the forex market and provides trading signals to the trader. It's up to the trader to decide whether or not to execute trades based on these signals. In other words, these robots relieve traders of the technical analysis process but still leave the final decision to them.

Moreover, there are different forex robots designed for specific types of trading strategies.

| Types of trading strategies | Detail |

| Scalper Robots | Specifically focus on making many trades over a short time span while aiming to profit from very small price changes. |

| Breakout Robots | Designed to detect key breakout points in the market and initiate trades based on these points. |

| Hedge Robots | Aim to secure the current investment position by initiating trades that aim to offset potential losses. |

| News Trading Robots | Programmed to react to market news that may impact currency prices. |

| Grid Trading Robots | Place and manage trades according to a set grid of variable parameters, including price and time. |

Pros & cons of using forex Robots

Pros

Automated Trading: Forex robots can automate the trading process, which is a major advantage for traders who lack the time to constantly monitor the markets.

Emotionless Trading: Robots are not affected by emotions like humans. They strictly follow pre-set rules and strategies without deviating due to fear, greed or any other emotion, which can lead to poor decision making.

Speed and Efficiency: Forex robots can process vast amounts of data and react to market changes more quickly than a human, potentially opening up more trading opportunities.

24/7 Operation: Forex markets run around the clock, and forex robots can operate at all times, ensuring you dont miss a trading opportunity.

Consistency: Since robots execute trades based on pre-programmed strategies, they provide the benefit of consistency, executing the same trading strategy over and over again.

| Pros √ | Cons × |

| · Automated Trading | · Lack of Control |

| · Emotionless Trading | · Risk of Overtrading |

| · Speed and Efficiency | · Risk from Software or Mechanical Failures |

| · 24/7 Operation | · False Promise of Quick Profits |

| · Consistency | · No Replacements for Human Judgement |

Cons

Lack of Control: When using a fully automated forex robot, traders hand off control of their trading activities. This can lead to unwanted trades if the robot misinterprets market conditions.

Risk of Overtrading: Since a robot can execute trades more quickly and more often than a human, theres a risk of overtrading, which can lead to losses.

Risk from Software or Mechanical Failures: Robots depend heavily on internet connection and computers running efficiently. Any mechanical failures can lead to missed trading opportunities or loss in investment.

False Promise of Quick Profits: There are many forex robots in the market today that make unrealistic promises of quick and high returns. It's crucial to be aware of such scams.

No Replacements for Human Judgement: Despite their efficiency, forex robots cannot replace human judgment. They can't interpret news and economic indicators like humans can.

⚠ As with all trading, using a forex robot carries inherent risk, and past performance does not guarantee future results.

Are forex robots legal?

Yes, using forex robots is legal in most jurisdictions, provided the use of such systems is allowed by the broker and complies with the regulations set by the relevant financial authorities. However, regulations can vary from one country to another, so it's essential to understand the local rules and regulations related to forex trading in your specific location. Some brokers might not allow the use of trading robots, so it is also important to read the rules of the broker you are considering.

Are forex robots profitable?

Forex robots can be profitable, but success isn't guaranteed. The profitability of forex robots can be influenced by a lot of factors, such as market conditions, the quality of the robot's programming and algorithms, the chosen trading strategy, and the amount of capital at risk.

Some forex robots have demonstrated profitability in the past, but past performance can never guarantee future earnings. In addition, profit levels will always be impacted by how often the robot trades, the risk level of its trading strategy, the size of profits it is programmed to target, and the loss level it is set to tolerate.

Are forex robots free to use?

Some forex robots are available for free, while others require either a one-time purchase or a subscription. Free robots may offer fewer features than paid ones, and their performance may also vary. Note that even though a forex robot may be free to use, trading itself can result in financial losses, and you may also need to meet certain requirements or make deposits to use them.

What are the risks of trading with a forex robot?

Trading with a forex robot comes with several risks:

Mechanical Failures

Forex robots rely on technology. If there's a glitch in the system, a lost internet connection or computer failure, this could lead to trades not being executed as planned.

Monitoring

Despite the automated nature of forex robots, they still require monitoring. Market conditions change and the robot needs to be adjusted to continue to perform optimally. Leaving a forex robot unmonitored can lead to poor trading results.

Reputation of the Forex Robot

Not all robots are created equal. Some have been carefully designed and tested, while others are less reliable or could even be scams. It's important to use a reputable forex robot.

Overtrading

Robots trade algorithmically and can place trades very quickly. This can result in overtrading, which can quickly lead to significant losses.

Lack of Human Judgment

A robot won't have the same gut instincts or intuition as a human. It will strictly follow programmed instructions and won't be able to react to unprecedented market events as effectively as a human trader.

Risk of Unwanted Trades

A major disadvantage of using robots for trading is the potential for placing unwanted trades. If there is a mistake in the algorithm, it could result in the placement of trades that the trader didn't anticipate.

Costs

While some forex robots are free, many come at a price. You'll need to consider whether the cost of the robot is offset by the potential profits it could make.

Final Thoughts

In conclusion, the landscape of forex trading is becoming increasingly dynamic and complex. As the currencies fluctuate and markets evolve, robots like those listed in our “Top 9 Best Forex Robot Traders 2025” offer traders cutting-edge technology coupled with sophisticated analysis to navigate the financial tides. Remember, these tools are designed to assist you – the investor – and while they can do much of the heavy lifting, they're not infallible. Before you plunge into the realm of automated forex trading, ensure you understand the risks involved. May you find the best companion in these robots as you venture onto your forex trading journey.

On WikiFX, we've meticulously compiled a variety of ranking lists influenced by factors such as geographical location and trading conditions, among others. We wish you every success as you explore these platforms and discover which one is the perfect fit for your financial ambitions. Follow us for further insights and to deepen your understanding of forex trading.

Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

7 Best Online Forex Trading Courses of 2026

Dive into Forex trading with top 7 online courses, providing powerful insights on strategies, risk management, and hands-on trading experience.

10 Best Prop Trading Firms in 2026

Uncover the top 10 proprietary trading firms, delving into their strategies, success rates, and returns!

Follow the Best Forex Educators and Mentors in 2026

Join the ultimate Forex trading journey; learn from the best educators and mentors, master proven strategies, and unlock trading success!

Top 9 Best Forex Robot Traders 2025

Master Forex trading with world's top traders' secrets & unlock robot trading's potential!