Forex trading isn't solely about self-discovery. More often than not, it involves learning from successful traders. Out of every 100 forex traders, merely 4-5 achieve success, leaving a staggering 95% facing losses. From these successful forex traders, we not only acquire valuable trading strategies but also gain insights into their exceptional risk management skills. That's the crux of it all. Here, we've compiled a list of the Most Successful Forex Traders in the World to discern their common traits and what regular forex traders can glean from their experiences.

8 Most Successful Forex Traders in the world

| |

Why are they listed as Most Successful Traders in the World? |

| Known as “the man who broke the Bank of England” in 1992 when he successfully executed a massive short sale of £10 billion, making a $1 billion profit. | |

| Known for turning an initial trading account of $30,000 into an impressive $80 million during his career in trading. | |

| Boasting an outstanding 30-year streak of double-digit annual returns and is renowned for orchestrating the famous trade that led to breaking the Bank of England in 1992, generating a staggering profit of $1 billion. | |

| Throughout his career, he has earned a considerable fortune of over $300 million through his currency trading. | |

| A key figure in the world of Forex trading, gained prominence through his groundbreaking work on the Taylor Rule. | |

| During the stock market crash of 1987, famously known as “Black Monday,” one of his standout trades occurred. Jones accurately predicted the crash and capitalized on it by shorting the stock market. | |

| From forex beginners, grown to be a rich man with a net worth exceeding $1 billion today, one of the most successful FX traders in the world. | |

| Kreiger seized an opportunity by leveraging a short position for the NZD, utilizing a 1:400 ratio back in 1987, ultimately earning $300 million. |

Overview of Most Successful Traders in the World

No.1 George Soros

Net Worth: 6.7 billion USD (2025)

Born in Hungary in 1930, Soros chairs Soros Fund Management, a highly successful firm in the hedge fund industry's annals. One of George's most triumphal feats stemmed from his Pound Sterling trade. In 1992, he gained immense recognition as one of the most successful currency traders, amassing a staggering net profit of $2 billion in just a month. Soros' strategy is often characterized by its impulsive nature. He relies on reflexivity as the lichpin of his investment approach — a unique method that evaluates assets by leveraging market feedback to assess how the broader market perceives these assets. Utilizing reflexivity, Soros forecasts market bubbles and identifies various market opportunities.

No.2 Michael Marcus

Net Worth: 1.4 billion USD (2025)

Michael Marcus, revered among Forex traders, utilized compounding to transform an initial $30,000 investment into a staggering $80 million over two decades. Among his successful maneuvers, he notably bought German marks during the Reagan presidency in 1980 when the DEM was notably undervalued. This proved to be a shrewd move as the German currency surged against the US dollar between 1985 and 1987, resulting in Marcus raking in millions of dollars during this period.

No.3 Stanley Druckenmiller

Net Worth: 6.2 billion USD (2025)

Stanley Druckenmiller, an esteemed American investor, hedge fund manager, boasts a career spanning over four decades, establishing himself as one of history's most prosperous Forex traders. Managing George Soros Quantum Fund from 1988 to 2000 and subsequently founding Duquesne Capital, he's garnered attention for his astounding 30-year streak of double-digit annual returns and famously orchestrating the trade that broke the Bank of England in 1992, netting a profit of $1 billion.

Druckenmillers trading philosophy hinges on three fundamental principles: robust macroeconomic analysis, stringent risk management, and an unwavering focus on seizing the finest trading prospects.

No.4 Bill Lipschutz

Net Worth: 6.2 billion USD (2025)

Bill Lipschutz, born in 1956 in Farmingdale, New York, ventured into trading after inheriting $12,000 in stocks from his grandmother. While at Cornell University, he used this inheritance to delve into the market, transforming the initial $12,000 into a remarkable $250,000 over a span of four years. From 1981 to 1990, Lipschutz held the role of Global Head of Foreign Exchange at Solomon Brothers. During his tenure, he played a pivotal role in advancing both exchange-traded and over-the-counter foreign exchange option markets. He's held various influential positions within the forex industry.

Key trading strategies embraced by Lipschutz involve assessing the risk and reward of a trade in its current state, adapting positioning size according to market changes, and remaining flexible with trading approaches.

No.5 John R. Taylor Jr

Net worth: Unknown

John R. Taylor Jr. is widely recognized in the world of Forex trading due to his innovative contributions to the Taylor Rule. This mathematical model serves as a robust predictor of central bank interest rate alterations, playing a pivotal role in Taylor's prosperous trading endeavors.

The Taylor Rule, a simple yet impactful formula, is utilized to gauge an appropriate interest rate considering macroeconomic circumstances and economic policy objectives. Its fundamental structure can be described as:

i = r + π + 0.5 * (π — π) + 0.5 * (y — y*)**.

Where:

i represent the nominal interest rate

r* is the real equilibrium interest rate

π is the current inflation rate

π* is the target inflation rate

y is the actual GDP

y* is the potential GDP

No.6 Paul Tudor Jones II

Net worth: 8.1 billion USD (2025)

Paul Tudor Jones II is renowned for his macro trading strategies, particularly his ventures into interest rates and currencies. He gained widespread recognition for his strategic short position during the 1987 stock market crash, often dubbed “Black Monday.” His astute foresight regarding the crash resulted in substantial profits, exceeding $100 million, further cementing his status as a legendary trader.

Jones places considerable emphasis on robust risk management, stressing the importance of capital preservation and the avoidance of significant losses. Furthermore, he employs trend-following techniques to harness market momentum. His disciplined trading approach, coupled with a profound understanding of market psychology, has been pivotal in his remarkable success.

No.7 Bruce Kovner

Net worth: 7.7 billion USD (2025)

Bruce Kovner, known as “the market wizard,” initiated his trading journey by borrowing $3,000 on his MasterCard in the early months of 1977. Employing automated trading techniques focused on Forex and Forex futures, he earned acclaim for his exceptional risk management prowess and the swiftness with which he trimmed losses when trades turned adverse.

Kovner's trading methods are heavily rooted in risk control. He emphasizes that understanding risk management is pivotal in trading. His strategy revolves around adapting to the evolving market dynamics, utilizing a “trend-following” approach to capitalize on existing market trends.

No.8 Andrew Kreiger

Net worth: Around 3 billion USD (2025)

In 1986, Andrew Kreiger commenced his trading career upon joining Bankers Trust. The following year, in 1987, he astutely observed the New Zealand dollar's considerable overvaluation. Seizing the opportunity, Kreiger ventured into a risky yet calculated move, initiating a short position for the NZD with a leverage of 1:400.

Despite the substantial risk involved, Kreiger's strategic decision proved to be highly profitable. The New Zealand dollar devalued by 5% against the US dollar, resulting in an impressive $300 million profit for the firm. Leveraging strategic long option strategies, Kreiger managed to secure substantial returns amidst turbulent market conditions.

Forex Trading Knowledge Questions and Answers

Who is the most successful forex trader?

George Soros. Renowned for his historic feat of “breaking the Bank of England” in 1992, George Soros made an astounding profit of over $1 billion from that trade alone.resently estimated to hold a net worth of around 6.7 billion USD, Soros remains an iconic figure in the financial world. His Quantum Fund boasted an outstanding average annual return of 20%, consistently maintained for a staggering period of over 30 years. All this establishes his status as the most successful forex trader in the world.

How many people succeed in forex trading?

Within the Forex community, a widely recognized statistic claims that approximately 90% of retail traders in the Forex market fail to succeed. Some estimates even place this number closer to 95%. The staggering failure rate stems from multiple factors, with flawed trading strategies, insufficient risk management, emotional trading are major ones. Forex trading, simply put, is not that easy.

What do most successful traders have in common?

Successful traders often have much in common, exploring the habits and qualities commonly found among them can be helpful to other traders. Some key traits that are shared by most successful forex traders, including:

Strong Risk Management: Successful traders master setting up prudent position sizing, stop-losses and leverage. For instance, they never risk more than 2-3% of the account on any single trade.

Keep Disciplined: Adhering to precise trading plans and rules is crucial. Successful traders always target pre-charted limit orders, never chasing random entries based on emotions.

Being Patient: Top traders, typically, spend much time conducting multi-period analysis on price movements and indicators before making mighty trade decisions backed by conviction.

Great Confidence: Successful traders grasp the inherent nature of both winning and losing in trading. However, they hold a strong belief in their capability to win by understanding market changes and applying effective trading strategies. Even amidst frequent setbacks, they persist without feeling defeated.

Decisive Actions: Successful traders tend to act swiftly based on signals as opportunities don't last long in fast financial markets. While most regular traders often hesitate and second-guess, missing out on potential profits.

Open-Minded Learning: Successful traders soak up trading wisdom from various sources like courses, forums and expert podcasts with a growth mindset. They keep sharpening their skills through practice, journalling trades and observing the markets regularly.

What beginners can learn from successful traders?

Avoid Emotional Trading: Don't chase trades impulsively or escalate position sizes during wins/losses. Make rational moves aligned to strategy. Open small positions first to contain risk while developing discipline.

Small Positions at First: Scale position quantities logically to control larger risk exposures. For instance, size lots at only 1-5% of capital to limit loss impacts during the testing phase.

Avoid Overtrading: Frequent reckless trades trying to recover small losses often exacerbate matters. Patiently act based on quality signals on sustainable edge. Less is more sometimes.

Learn From Your Failures: Note trading journal details on losing trades - reasons, psychology and exit cues. This data offers insights to improve rules and risk-reward over time.

Learn Risk Management: Master techniques like stop losses, hedging and diversification to optimize income within loss tolerance. Letting losses spiral is the biggest downfall.

What types of forex trading is most successful?

Forex trading involves numerous trading strategies and here we explore the following three most successful trading strategies based on a series of factors including their potential profits, easy operation, and popularrity.

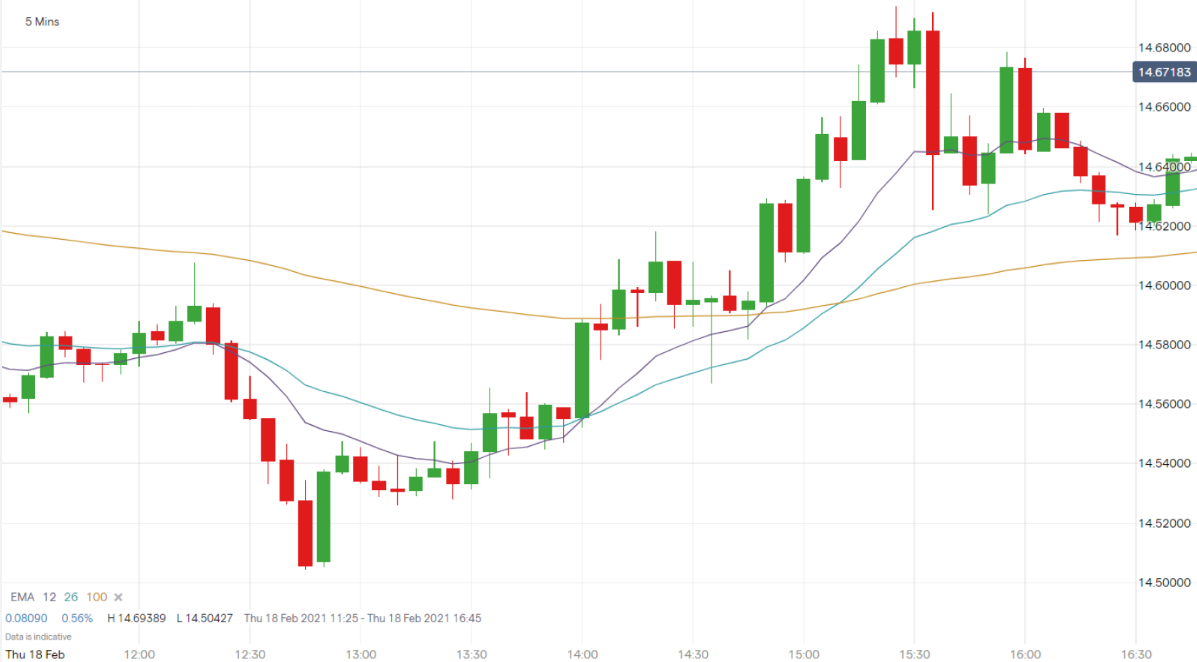

Daytrading

Day trading involves opening and closing positions within a single trading day. Traders aim to capitalize on short-term market movements, frequently using technical analysis and charts to identify opportunities. Continuous monitoring of the markets and quick decision-making is extremely vital. Successful day trading relies on high-frequency trading, swift market analysis, adept risk management, and a disciplined approach as its core components.

Scalping

Scalping is an ultra-short-term strategy where traders make multiple quick trades within minutes or seconds. This method aims to gain small profits from slight price movements. Scalpers heavily rely on tight spreads and leverage for profit.A keen eye for market volatility, quick execution, robust risk management, and access to a reliable platform with low latency are crucial for successful scalping.

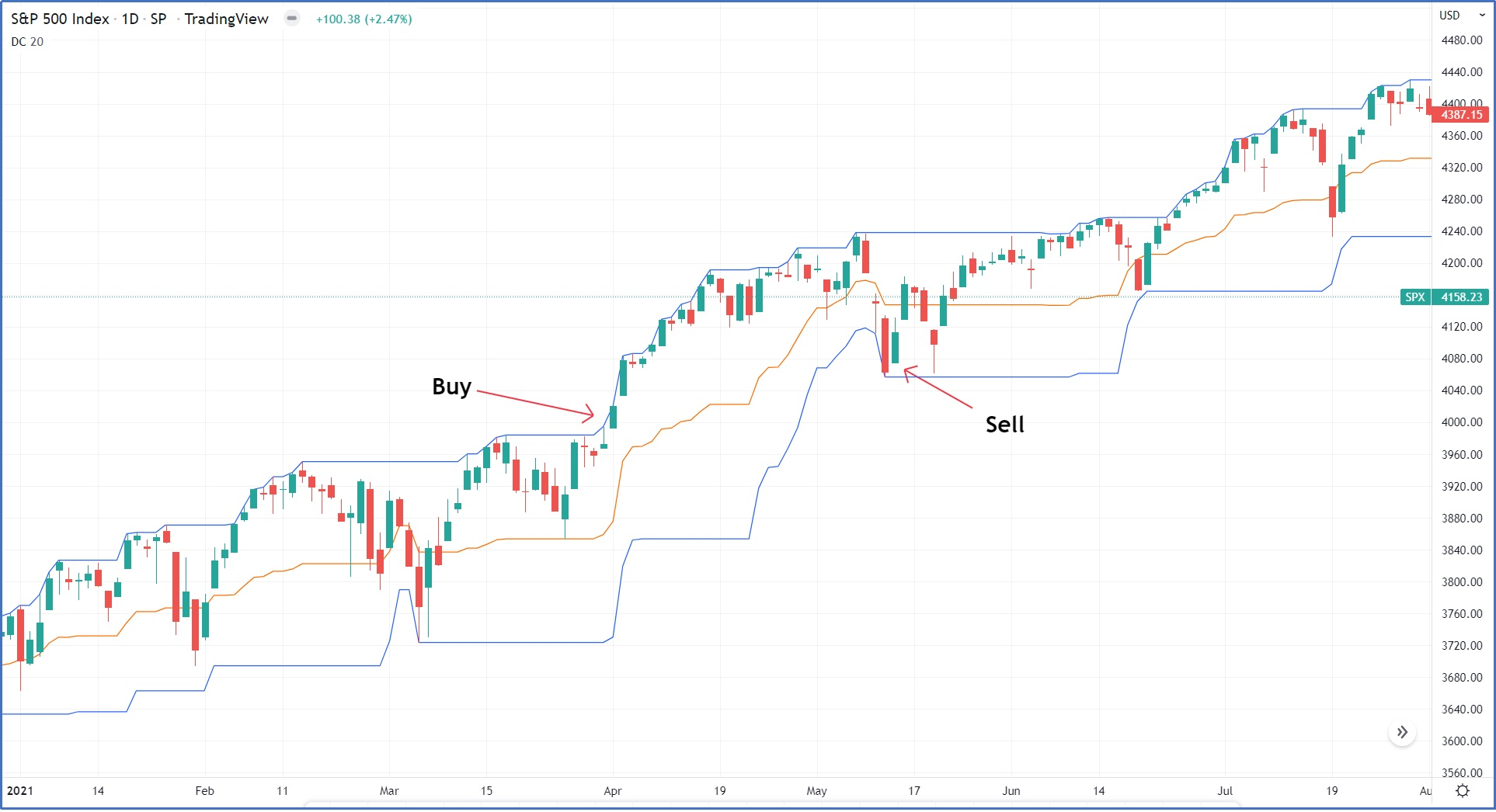

Position trading

Position trading involves long-term trading, where positions are held for weeks, months, or even years. Traders base their decisions on fundamental analysis and macroeconomic trends rather than short-term fluctuations. Mastering fundamental analysis, being patient amidst market fluctuations, practicing effective risk management, and the capacity to ride long-term trends are essential for successful position trading.

Can I beome rich with forex trading?

While a select few traders achieve wealth through forex trading, the vast majority—approximately 95%—find themselves losing their invested funds. For most everyday retail forex traders, the prospect of becoming wealthy through trading seems implausible unless they are genius. However, for the experienced few who employ effective trading strategies, exercise patience, and possess a deep understanding of the markets, turning this dream into reality might just be within reach.

Can I start forex with $10?

Technically, yes, you can start forex with $10. Some brokers, such as OANDA, HFM, and FBS, CMCMarkets, even allow for lower initial deposits. Opting for such a tiny initial investment is an excellent choice, especially for beginners dipping their toes into the forex market. Here we have selected some brokers with the minimum deposit below $10 for you:

⭐OANDA- Minimum deposit of $0

⭐FBS - Minimum deposit of $0

⭐HFM - Minimum deposit of $5

⭐Exness - Minimum deposit of $5

⭐CMCMarkets - Minimum deposit of $5

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Online Forex Trading Courses of 2026

Dive into Forex trading with top 7 online courses, providing powerful insights on strategies, risk management, and hands-on trading experience.

10 Best Prop Trading Firms in 2026

Uncover the top 10 proprietary trading firms, delving into their strategies, success rates, and returns!

Follow the Best Forex Educators and Mentors in 2026

Join the ultimate Forex trading journey; learn from the best educators and mentors, master proven strategies, and unlock trading success!

Top 9 Best Forex Robot Traders 2025

Master Forex trading with world's top traders' secrets & unlock robot trading's potential!