Company Summary

General Information

| Murrentrade Review Summary in 10 Points | |

| Founded | 2022 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Offshore regulated by MISA |

| Market Instruments | Forex, gold, indices, energies and commodities |

| Demo Account | Unavailable |

| Leverage | 1:1000 (Classic account/ Standard account)1:2000 (VIP account) |

| EUR/ USD Spreads | 0.1 pips (VIP account)0.3 pips (Standard account)1.2 pips (Classic account) |

| Trading Platforms | MT5 |

| Minimum Deposit | $100 (Classic account/ Standard account)$10,000 (VIP account) |

| Customer Support | Phone, email |

Murrentrade Information

MurrenTrade's brokerage services are provided by Trading Point of Financial Instruments Ltd. (operating under the trading name “MurrenTrade”).

The company provides traders with access to a range of trading platforms, including the popular MetaTrader 5 (MT5), known for its advanced charting tools, technical indicators, and customizable interface. Murrentrade aims to cater to both beginner and experienced traders by offering user-friendly platforms, educational resources, and competitive trading conditions.

Pros & Cons

| Pros | Cons |

| 15 years of experience | MISA offshore regulated |

| Leverage of up to 1:500 | Commissions and swaps charged |

| Three types of accounts to choose | Minimum deposit starting from $100 |

| Spreads from 0.1pips | |

| Copy trading available |

Murrentrade Alternative Brokers

There are many alternative brokers to Murrentrade depending on the specific needs and preferences of the trader. Some popular options include:

- Forex Club - A well-established forex broker offering a wide range of trading instruments, educational resources, and a user-friendly platform for traders of all experience levels.

- BlackBull Markets – A reputable forex and CFD broker known for its institutional-grade liquidity, competitive pricing, and advanced trading technology.

- Eightcap - A trusted forex and CFD broker that provides traders with competitive spreads, fast trade execution, and a comprehensive suite of trading tools and resources.

Is Murrentrade Safe or a Scam?

Murrentrade is currently regulated as an offshore entity, holding a Retail Forex License issued by the Comoros under license number T2023286.

This offshore regulatory status may imply certain risks, as offshore regulations often have fewer requirements and oversight compared to more established financial authorities.

Market Instruments

Murrentrade offers variety of trading instruments across different asset classes, including forex, gold, indices, cryptocurrencies, energies and commodities.

- Forex: Forex trading holds low entry barriers due to the fact that it is accessible to clients without requiring significant amounts of capital by trading on margin. The continuously fluctuating exchange rate enables market participants to make profits by executing successful trades.

- Gold: Gold is a popular trading instrument due to its status as a safe-haven asset and store of value. Traders should keep an eye on economic indicators, geopolitical events, and central bank policies as they can affect gold prices. Factors like inflation, interest rates, and currency fluctuations impact the value of gold.

- Indices: Traders can invest in global stock indices such as the S&P500, Nasdaq, DAX30, and FTSE100 through Murrentrade. Indices are calculated based on the market capitalization of the component companies. A variety of factors, including commodity prices, company announcements and financial results all play an important role in determining the indexs price.

- Cryptocurrencies: The platform offers traders access to major cryptocurrencies. They present the opportunity to trade 24/7. Cryptocurrencies only exist in the blockchain and are accessible through codes called private and public keys.

- Energies: Murrentrade provides access to the energy markets, where traders can invest in crude oil and natural gas. Energy Markets refer to commodities that refer specifically to the trade and supply of energy.

- Commodities: Murrentrade provides traders with access to a range of other commodities, including metals, agricultural products, and energy products like oil. Commodities are traded on the futures markets, and their values can be impacted by a variety of factors, such as supply and demand, geopolitical events, and weather patterns.

Accounts

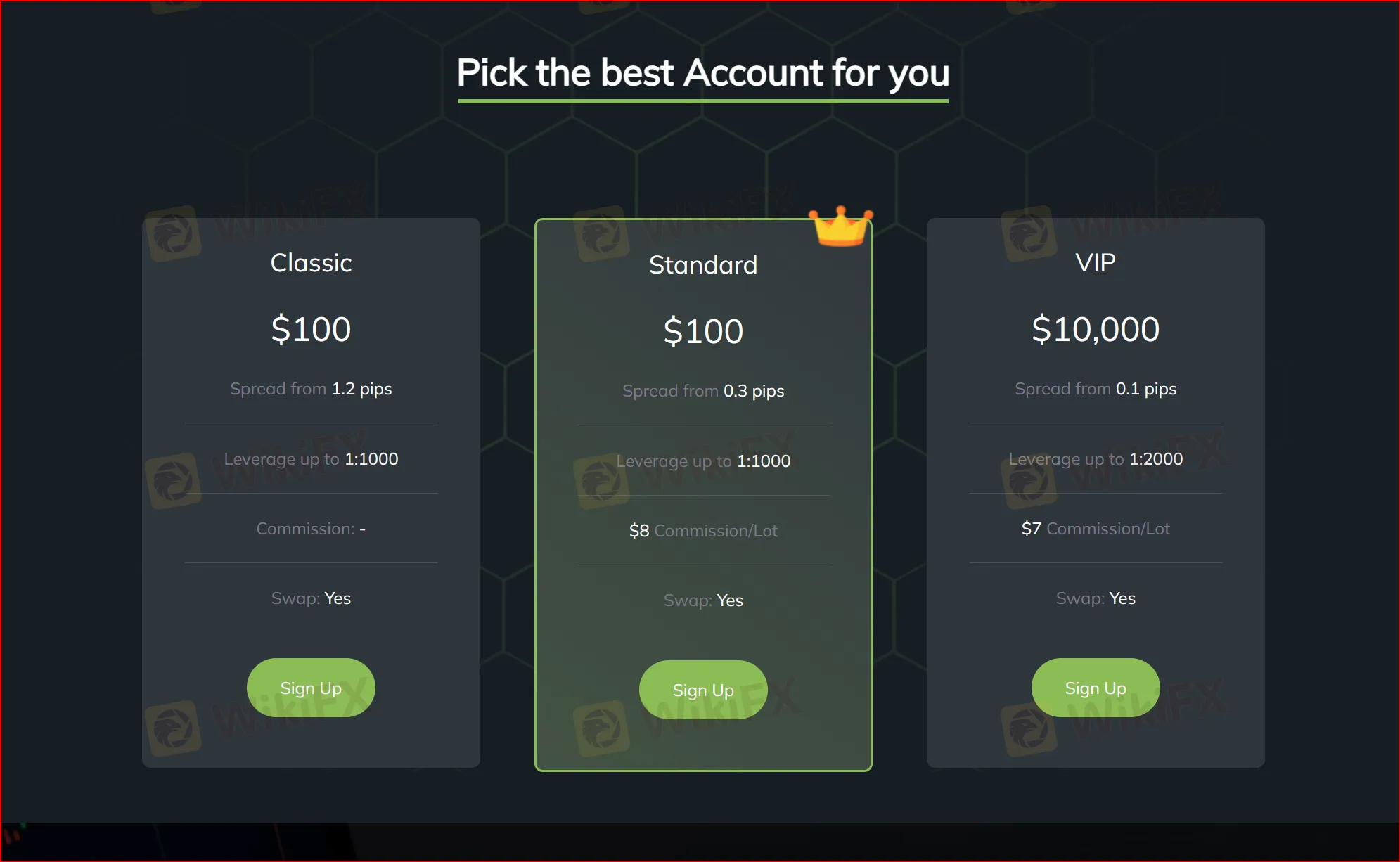

Murrentrade offers three live account types including Classic account, Standard account and VIP account with the minimum deposit requirement of $100, $100 and $10,000 respectively.

Classic Account:

It offers basic features and is suitable for beginners or traders with limited experience.

Standard Account:

It provides additional features and tools compared to the Classic account, making it a good choice for traders looking for more advanced functionalities.

VIP Account:

The VIP account is designed for experienced traders or individuals with larger trading volumes. It offers enhanced features, personalized services, and priority customer support.

Leverage

For the Classic and Standard accounts, Murrentrade offers a maximum leverage of 1:1000. This means that traders can trade with a position size up to 1000 times the amount of their initial deposit. For example, if a trader deposits $100, they can potentially control a trading position of up to $100,000.

Meanwhile, the VIP account provides even higher leverage, with a maximum of 1:2000. With this level of leverage, traders can control even larger positions relative to their initial deposit. For instance, a deposit of $10,000 could potentially allow traders to trade positions worth up to $20,000,000.

Spreads & Commissions

Murrentrade offers the spread from 0.1 pips for the VIP account, 0.3 pips for the Standard account and 1.2 pips for the Classic account.

Besides, Murrentrade offers $7 per lot for the VIP account and $8 per lot for the Standard account and is free for the Classic account .

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Murrentrade | 0.3 pips (Std) | $8 per lot (Std) |

| Forex Club | 2.0 pips | None |

| BlackBull Markets | 0.2 pips | None |

| Eigntcap | 0.1 pips | None |

Trading Platforms

Murrentrade offers MT5 for its clients. MT5 is a comprehensive trading platform that offers a wide range of features and tools to assist traders in making informed trading decisions.

The MT5 platform is known for its user-friendly interface, which makes it easy to navigate for both beginner and advanced traders. It provides access to various financial markets, including forex, stocks, commodities, and indices, allowing traders to diversify their portfolios and take advantage of different trading opportunities.

See the trading platform comparison table below:

| Broker | Trading Platform |

| Murrentrade | MT5 |

| Forex Club | MT4, MT5, Libertex |

| BlackBull Markets | MT4, MT5 |

| Eigntcap | MT5 |

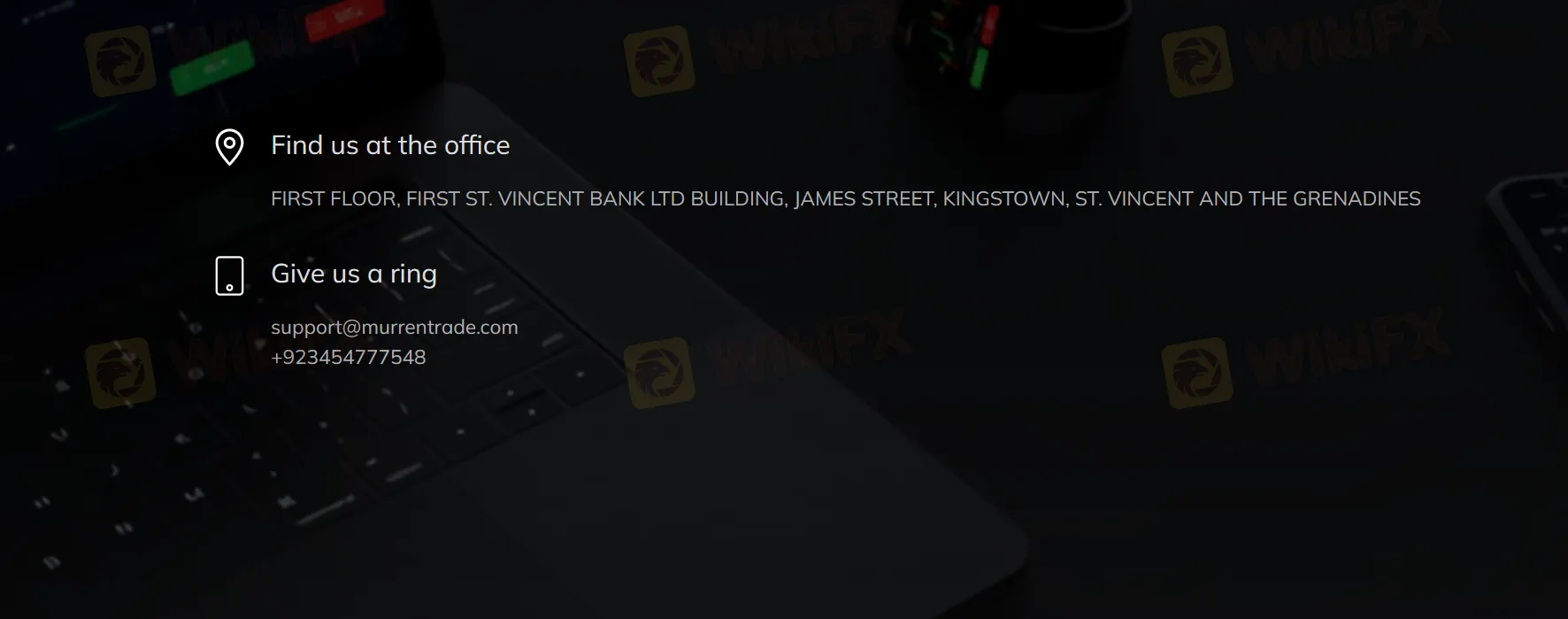

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +92 3454777548

Email: support@murrentrade.co

Address: FIRST FLOOR, FIRST ST. VINCENT BANK LTD BUILDING, JAMES STREET, KINGSTOWN, ST. VINCENT AND THE GRENADINES

Conclusion

In conclusion, Murrentrade is a trading platform that offers a range of services to its clients. The platform provides access to various financial markets, allowing traders to diversify their portfolios and capitalize on different trading opportunities. With its user-friendly interface and advanced charting tools, Murrentrade's trading platform, MT5, caters to the needs of both beginner and advanced traders.

However, its offshore regulatory status may imply certain risks, as offshore regulations often have fewer requirements and oversight compared to more established financial authorities.

Frequently Asked Questions (FAQs)

| Q 1: | Is Murrentrade regulated? |

| A 1: | Yes, it is offshore regulated by MISA. |

| Q 2: | How can I contact the customer support team at Murrentrade? |

| A 2: | You can contact via telephone, +92 3454777548 and email, support@murrentrade.co. |

| Q 3: | Does Murrentrade offer demo accounts? |

| A 3: | No. |

| Q 4: | Does Murrentrade offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT5. |

| Q 5: | What is the minimum deposit for Murrentrade? |

| A 5: | The minimum initial deposit to open an account is $100. |

| Q 6: | Is Murrentrade a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners because of its unregulated condition. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Generation

Malaysia

I have many good things to say about this broker. I tried withdrawing to my bank account in Malaysia several times and received it in less than 10 minutes. Their bonuses (welcome, referral, loyalty, celebrations etc.) up to 100% of USD500 are the highest in the industry. Their weekly real and demo competition prizes are very handsome too.

Positive

Chukwuemeka Okafor

Nigeria

Spreads here are not wide, and they offer automated and social trading features. It’s practical for different trading strategies, though the platform could be more powerful.

Neutral

FX1670584849

Cyprus

Great promt customer service , and order fills are great. Need to improve the delay in withdrawal, And overnight spread

Positive

FX1487113102

South Africa

Absolutely top-notch! Their platform offers prime conditions for trading a wide range of things like Forex, Metal, and Crypto. What’s more? Their leverage can go as high as 1:500 and you can start trading just from 0.01 lots! I'm totally down for their ‘Copy Trading’ service which is real-time. The registration, verification and funding processes are neat and easy. Amazing experience overall! 👍💰

Positive

M&C hair house -墨林

South Africa

Murrentrade is a great platform. I've been using the standard account for a while now and it's been smooth sailing. I haven’t experience any slippage and my first withdrawal went offwithout a hitch. I was so impressed that I've already made another deposit. I would recommend this brokerage firm without any hesitation and I never tell lies, trust me, guys.

Neutral