Company Summary

| BANDS Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Agriculture, Metals, Energy & Environmental, Freight, Industrial & Chemical, Forex, Bonds, and Equities |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Proprietary platform |

| Minimum Deposit | / |

| Customer Support | Phone: +852 3903 6000 |

| Email: info@bands.financial | |

| Social Media: LinkedIn, WeChat, YouTube | |

| Address: BANDS Financial Limited, Unit 1007, Level 10, Cyberport 1, 100 Cyberport Road, Hong Kong | |

BANDS Information

BANDS Financial was established in 2015 and is registered in Hong Kong. It offers a diverse range of trading instruments, including agriculture, metals, energy and environment, shipping, industry and chemicals, foreign exchange, bonds, and stocks. In addition, BANDS Financial can quickly process funds entering and leaving China through overseas intermediary mechanisms, usually within two hours, ensuring smooth capital flow.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | No MT4/MT5 platform |

| A variety of products | Limited info on deposit and withdrawal |

| No minimum account fees |

Is BANDS Legit?

Yes. BANDS Financial Limited is regulated by Securities and Futures Commission of Hong Kong (SFC) and holds a futures contract trading license (License Number: BFW669), indicating that it is legally qualified to engage in futures trading.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | BANDS Financial Limited | Dealing in futures contracts | BFW669 |

What Can I Trade on BANDS?

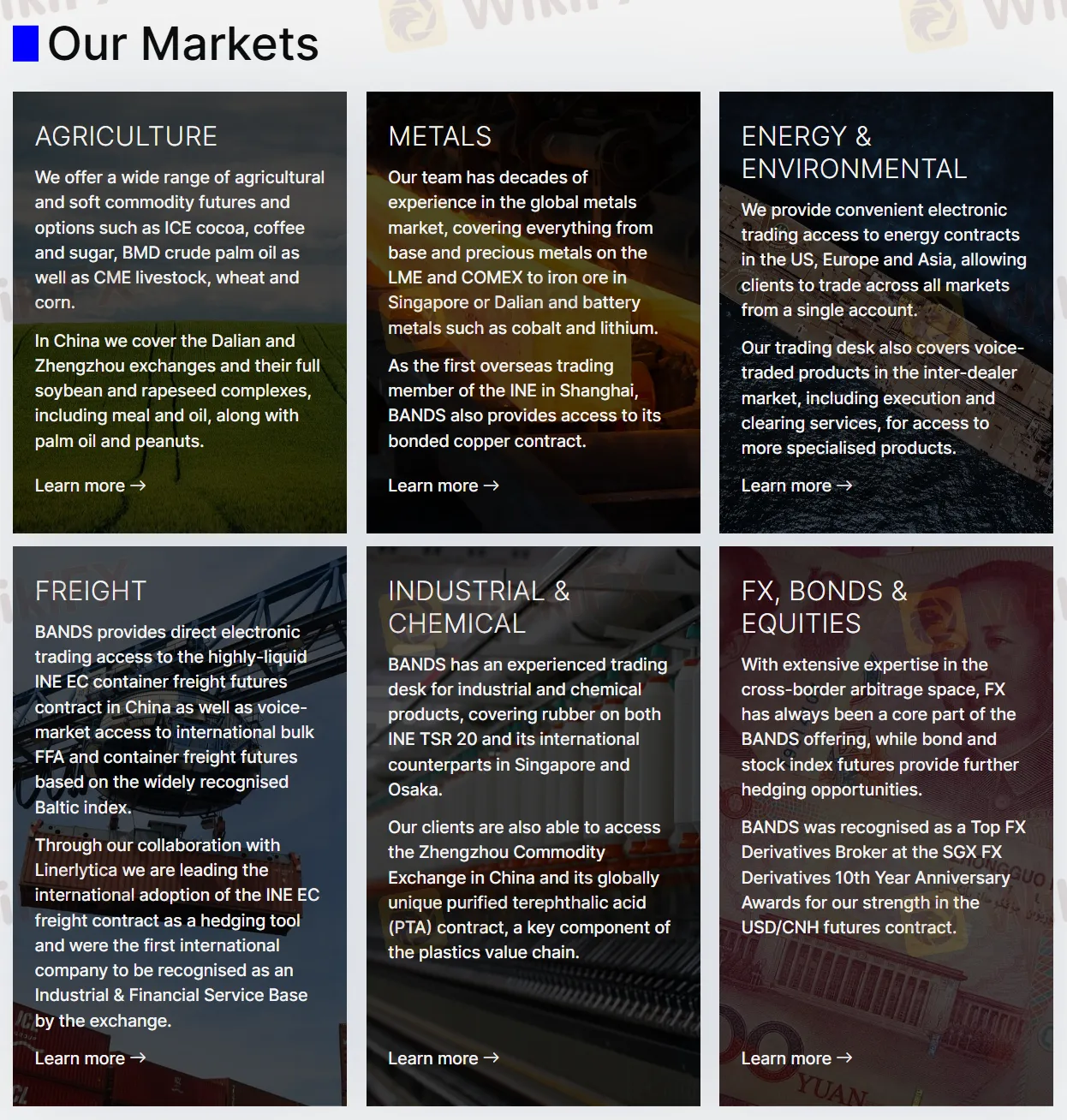

BANDS offers a wide range of tradable instruments, including Agriculture, Metals, Energy & Environmental, Freight, Industrial & Chemical, Forex, Bonds, and Equities.

| Tradable Instruments | Supported |

| Agriculture | ✔ |

| Metals | ✔ |

| Energy & Environmental | ✔ |

| Freight | ✔ |

| Industrial & Chemical | ✔ |

| Forex | ✔ |

| Bonds | ✔ |

| Equities | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Fees

BANDS does not charge minimum account fees.

Trading Platform

| Trading Platform | Supported | Suitable for |

| Proprietary platform | ✔ | / |

| MT4 | ❌ | Beginners |

| MT5 | ❌ | Experienced traders |

Deposit and Withdrawal

Through overseas intermediary mechanisms, BANDS Financial can quickly process fund transfers in and out of China, usually within two hours, ensuring smooth capital flows.

No amount restrictions: Customers are free to choose the amount of funds to withdraw, without being subject to daily limits.