No Regulation

Score

0 1 2 3 4 5 6 7 8 9

. 0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

/10

The WikiFX Score of this broker is reduced because of too many complaints!

atatong

United States | 2-5 years |

United States | 2-5 years | Suspicious Regulatory License | Suspicious Scope of Business | High potential risk

https://www.atatong.com/index.htm#

Website

Rating Index

Contact

https://www.atatong.com/index.htm#

90 S Cascade Ave, Colorado Springs, CO 80903, United States.

The WikiFX Score of this broker is reduced because of too many complaints!

Forex License

Forex License

No forex trading license found. Please be aware of the risks.

Warning: Low score, please stay away!

- This broker lacks valid forex regulation. Please be aware of the risk!

3

Basic Information

Registered Region  United States

United States

United States

United States Operating Period

2-5 years

Company Name

ATATONG FINANCIAL SERVICES GROUP LIMITED

Company Website

Company Address

90 S Cascade Ave, Colorado Springs, CO 80903, United States.

7

Website

Genealogy

Related Companies

Comment

Users who viewed atatong also viewed..

FXCM

9.40

Score Above 20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

FXCM

Score

9.40

Above 20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

IC Markets Global

9.09

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

IC Markets Global

Score

9.09

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

TMGM

8.55

Score ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

TMGM

Score

8.55

ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

Valetax

8.06

Score ECN Account2-5 yearsRegulated in MauritiusSecurities Trading License (EP)MT4 Full License

Valetax

Score

8.06

ECN Account2-5 yearsRegulated in MauritiusSecurities Trading License (EP)MT4 Full License

Official Website

Website

atatong.com

172.67.174.91Server LocationUnited States

ICP registration--Most visited countries/areas--Domain Effective Date--Website--Company--

Genealogy

Download APP

Related Companies

ATATONG FINANCIAL SERVICES GROUP LIMITED(Colorado (United States))

Abnormal

United States

Registration No.20228120896

Established

Related sourcesWebsite Announcement

User Reviews7

No more

Write a review

Exposure

Neutral

Positive

Content you want to comment

Please enter...

Submit now

Comment 7

Write a comment

7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

tokkevi

Japan

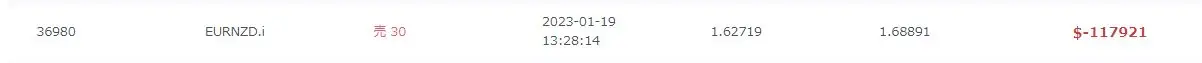

On January 19th, the EURNZD traded and was lost due to a large price movement above 1.78140-1.59990. Loses $117,921. You will be forced to deposit again, and you will not be able to withdraw additional funds after depositing. In the first place, it can only be said that it is a malicious fraud that a suspicious site intentionally loses assets and does not accept any withdrawals. After all, I deposited $120,517.18, but I can't withdraw at all. It is currently $3147.72 on the screen. Is it impossible to collect?

Exposure

ぶち

Japan

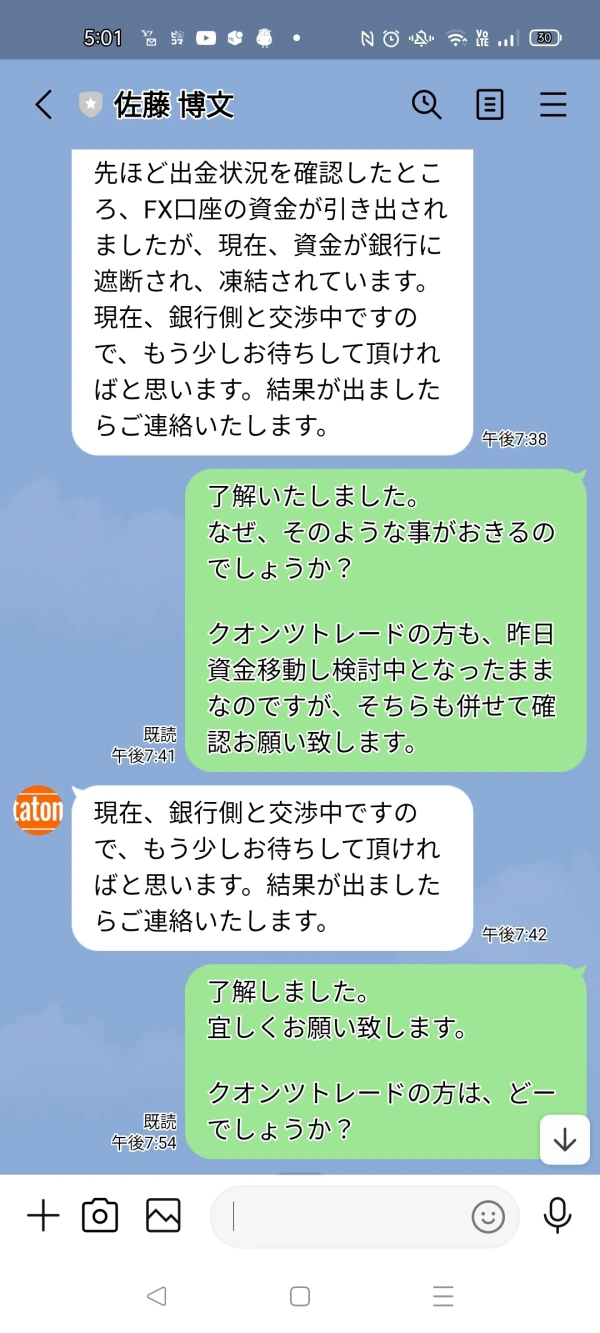

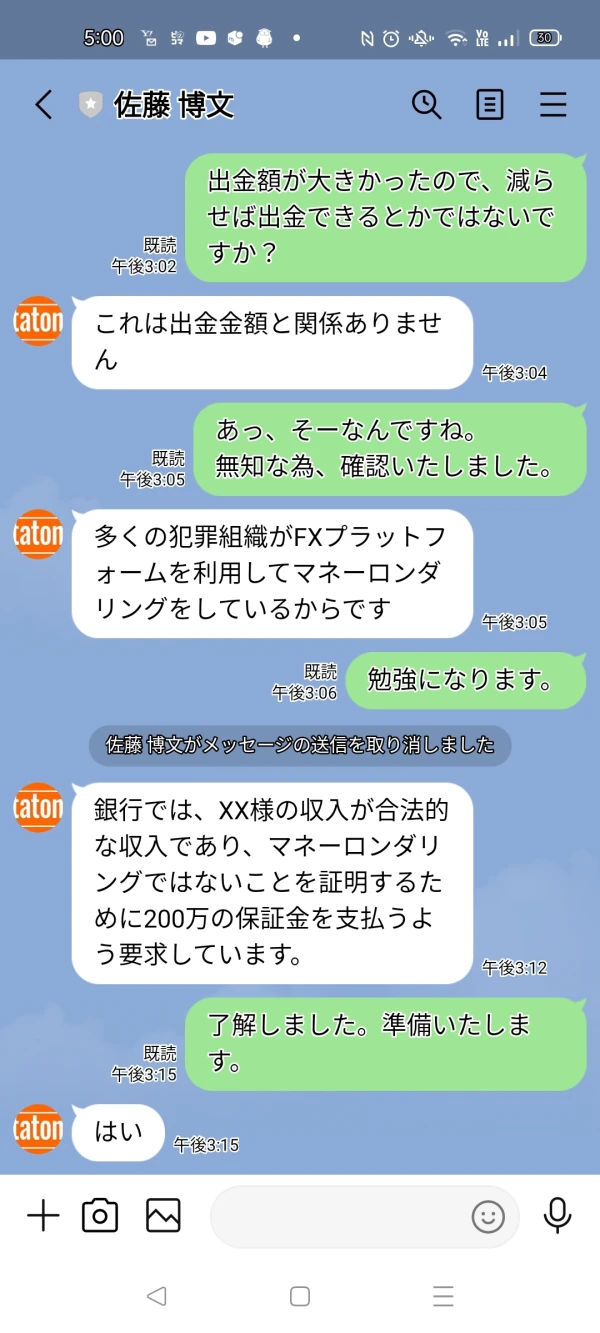

I opened an account on December 19, 2022, and started FX using MT5. I made several deposits and withdrawals and was able to withdraw without delay, so I deposited a large amount and made a profit, so I made a profit on February 20. When I tried to withdraw the day, I was informed that I could not withdraw. I was contacted that I wanted a security deposit of 2 million for withdrawal. Thank you for your support.

Exposure

tokkevi

Japan

On January 19, 2023, during the trading of EURNZD, there was a price fluctuation of 1.78140-1.59990 and lost lost $117, 921. There was no price change on other platforms. Is this change real?

Exposure

FX1544317459

Pakistan

Atatong has been my go-to trading platform for several years, and I've had a positive experience overall. The MetaTrader 5 platform they offer is robust and user-friendly, providing advanced features and seamless execution. The leverage of up to 1:500 is a great advantage, especially for forex trading. The competitive spreads starting from 0.0 pips have helped me minimize trading costs. I appreciate the flexibility of trading on different devices, including desktop, mobile (iOS and Android), ensuring I can manage my trades anytime, anywhere. While the lack of regulation is a concern, my personal experience has been satisfactory.

Neutral

悦好

Colombia

I'm new to trading, and when I faced a few questions regarding how to change money, the agents helped me right away. I also liked how quickly I got emails that told me what was going on. I'm not as stressed out as I was when I first started with online trading. It's also nice to know that this isn't a scam.

Positive

珍惜每一天

Malaysia

By enhancing my knowledge and fostering my experience, they helped me on my trading journey. They have been effective in delivering top-notch education, proactive assistance, and a better trading environment. They have greatly impressed me.

Neutral

tokkevi

Japan

I submitted a withdrawal request on February 5, but after one week, the withdrawal is still under review and has not been made. When I contacted the representative, all I get is the same reply, "Please wait a moment, the system is currently reviewing your request.

Exposure