Company Summary

| Information | Details |

| Company Name | Hibiki(Moomoo) |

| Registered Country/Area | Japan |

| Founded Year | 2007 |

| Regulation | Regulated by Financial Services Agency(FSA) |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:25 |

| Spreads | Variable spreads from 0 pips |

| Trading Platforms | Web, mobile app |

| Tradable Assets | Stocks, ETFs, options, futures |

| Account Types | Cash, margin |

| Demo Account | Available |

| Customer Support | Email, phone |

| Deposit & Withdrawal | Bank transfer, credit card |

| Educational Resources | Articles, videos, webinars |

Overview of Hibiki/moomoo

Hibiki/moomoo is an online brokerage founded in 2007 and owned by Futu Holdings Limited, a financial technology company headquartered in Hong Kong. Hibiki serves the Japanese market while moomoo is aimed at international audiences.

The brokerage provides retail investors access to trade stocks, ETFs, options, futures and other assets on an easy-to-use proprietary trading platform. Key services include low commission fees, advanced charts and data, research reports, and access to global exchanges. Hibiki/moomoo targets digitally savvy investors and traders seeking a modern, mobile-first brokerage experience. With regulation in multiple jurisdictions, the brokerage combines digital innovation and compliance to meet the needs of its international client base.

Overall, Hibiki/moomoo provides the trading tools and asset access desired by retail investors within a reliable and secure environment.

Regulatory Status

Hibiki/moomoo is regulated by the Financial Services Agency in Japan. It holds a Retail Forex License with the license number 関東財務局長(金商)第3335号.

Regulation by reputable authorities provides investors protection against fraud and market manipulation. It also demands transparency from companies, requiring them to disclose important operational and financial information. This ensures a safer investment environment and builds trust within the financial system.

Pros and Cons

| Pros | Cons |

| Low commission fees | Limited payment methods |

| Advanced trading platforms | High minimums |

| Global asset access | No fractional shares |

| Strong research/analytics | Minimal educational resources |

| Regulatory compliance | Lower leverage than competitors |

Pros:

Low commission fees - No commissions on stocks and ETF trades. Low margin rates.

Advanced trading platforms - Proprietary web and mobile apps with extensive tools.

Global asset access - Stocks, options, futures across global exchanges.

Strong research and analytics - AI-powered analytics and risk management features.

Regulatory compliance - Licensed in multiple jurisdictions worldwide.

Cons:

Limited payment methods - Only bank transfers or card deposits/withdrawals allowed.

High minimums - High minimum balances required for certain asset classes.

No fractional shares - Can't invest in fractions of shares.

Minimal educational resources - Sparse materials beyond beginner guides.

Lower leverage - Maximum 1:25 leverage is lower than competitors.

Market Instruments

Hibiki/moomoo provides access to stocks, ETFs, options, futures, IPOs, leveraged ETFs, fixed income securities, and fractional ETF investing across global markets.

Stocks

Access to stocks on exchanges globally including NYSE, NASDAQ, HKEX, SGX, etc.

ETFs

Wide range of US and international ETFs covering various assets classes and sectors

Options

Cash-settled options on US stocks and ETFs

Simple and complex options strategies supported

Futures

Futures contracts on indices, commodities, currencies, bonds, and other assets

Global futures offerings across major exchanges

IPOs

Upcoming and recent IPO listings in the US and Asia

Fractional Shares

Unlike stocks, fractional ETF investing is offered

Leveraged Products

Leveraged and inverse ETFs providing amplified exposure

Fixed Income

US Treasuries, municipal bonds, and CDs

Account Types

Hibiki/moomoo offers two main account types - cash and margin - with different features and requirements.

The cash account has no minimum deposit, variable spreads from 0 pips, and no leverage. It allows trading in stocks, ETFs, options, and futures.

The margin account requires a $2,000 minimum deposit. It offers variable spreads from 0.4 pips, up to 1:25 leverage, and access to broader products including IPOs, leveraged ETFs, and fixed income.

| Account | Minimum Deposit | Spread | Leverage | Products |

| Cash | $0 | Variable from 0 pips | None | Stocks, ETFs, options, futures |

| Margin | $2,000 | Variable from 0.4 pips | Up to 1:25 | Expanded products including IPOs, leveraged ETFs, fixed income |

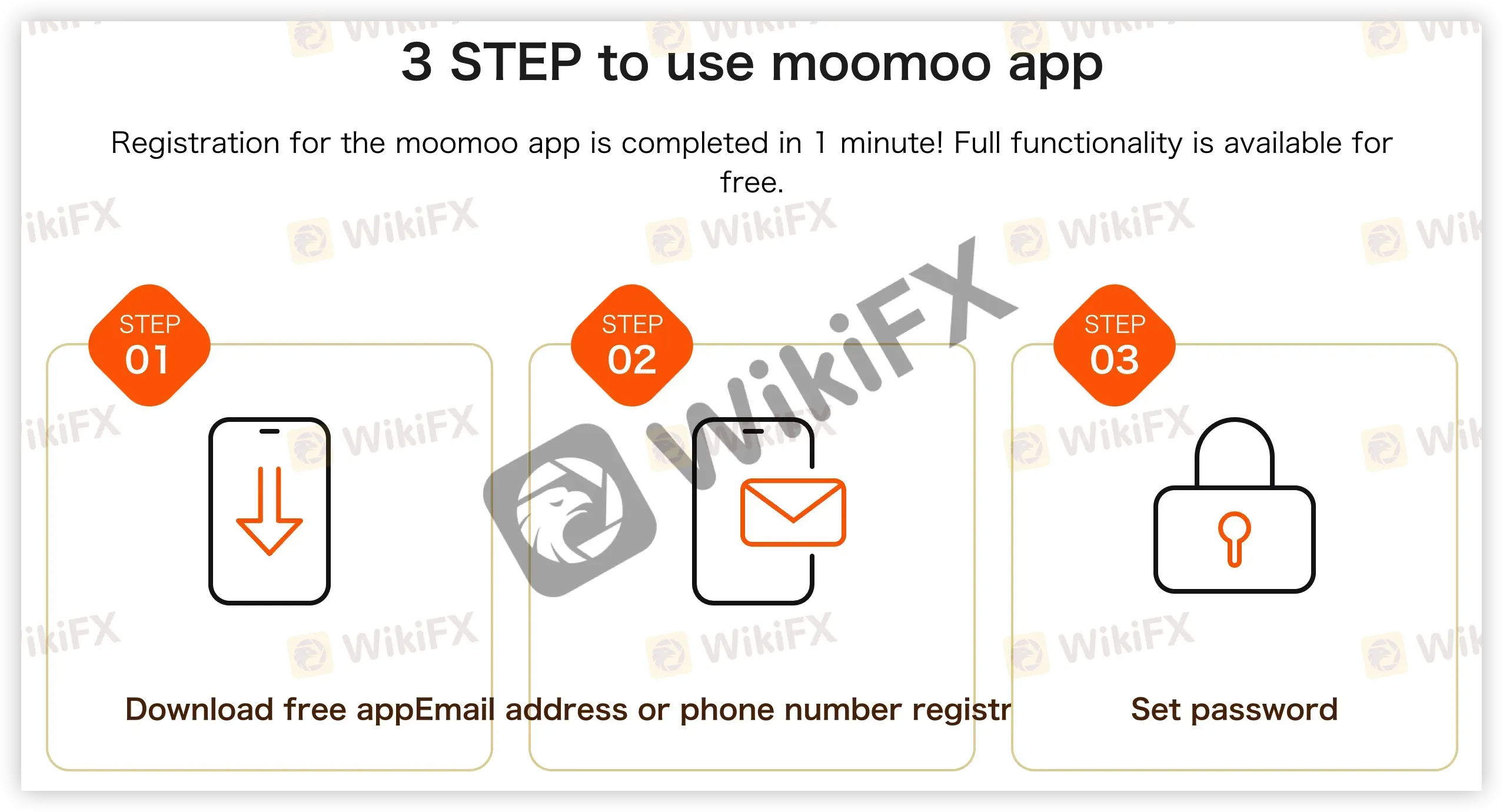

How to Open an Account?

Here are the key steps to open an account with Hibiki/moomoo:

Provide personal information - Fill out online form with details like name, contact information, employment status.

Verify identity - Upload ID documents like passport, driver's license for verification.

Fund account - Make initial deposit through bank transfer or card payment. Minimum $0 for cash account, $2000 for margin.

Review agreements - Read and consent to client agreements, terms of service, disclosures.

Access account - Download trading platforms and login to access new account.

The account opening process typically takes 1-2 business days provided all information and funding is readily available. Users must complete identity verification and make an initial deposit to finalize account activation.

The online application streamlines opening either a cash or margin account. Specific features like level of leverage and tradable products will depend on the type of account opened.

Leverage

The maximum leverage offered across all products is 1:25. This is available on major stock index futures contracts. Leverage decreases for other assets, with stocks/ETFs and options capped at 1:4, and fixed income products having no leverage.

| Trading Product | Leverage |

| Stocks/ETFs | Up to 1:4 |

| Options | Up to 1:4 |

| Futures: | |

| - Major Indices | 1:25 |

| - Commodities | 1:10 |

| - Bonds/Currencies | 1:05 |

| IPOs | 1:02 |

| Leveraged ETFs | No leverage |

| Fixed Income | No leverage |

Spreads and Commissions

There are variable spreads on all products based on market conditions and commissions charged on certain transactions beyond spreads. Stocks and ETFs have no commissions for cash accounts but a small charge for margin trades.

| Product | Spreads | Commissions |

| Stocks/ETFs | Variable, from 0 pips | No commission (cash account) or 0.03% per side (margin account) |

| Options | Variable, from 0.3 pips | $0.65 per contract |

| Futures | Variable, from 0.4 pips | $2.50 per contract per side |

| IPOs | Variable, from 0.5 pips | 0.5% of transaction amount |

| Fixed Income | Variable, from 1 pip | $1 per bond |

Other Trading Costs

There are no major trading costs at Hibiki/moomoo beyond the spreads and commissions already covered.

The main additional costs to be aware of are:

Margin interest - Overnight margin interest is charged on leveraged positions held past market close. The annual rate ranges from 1.5% to 5% depending on account balance.

Inactivity fees - Accounts with no trading activity for 6 months may be charged an inactivity fee. This ranges from $10-$20 per month based on account type.

Wire transfer fees - Charges of $10-$25 may apply for domestic and international wire transfers.

Trading Platform

Hibiki/moomoo offers two main proprietary trading platforms - a desktop platform and mobile app:

Desktop Platform:

Advanced charting - Customizable charts with technical indicators, drawing tools, and analysis.

Level 2 market data - Real-time depth of market quotes, orders, and trades.

Customizable workspaces - Tailor platform with specific widgets, windows, layouts.

Order types - Limit, market, stop limit orders plus options strategies.

Research tools - News feed, analyst ratings, earnings calendar, SEC filings.

Mobile App:

Mobile trading - Execute trades and manage positions on iOS and Android.

Charting - Interactive charts with flexible timeframes and indicators.

Account management - Monitor balances, positions, orders, and history.

Alerts - Customizable price alerts and push notifications.

Research - News, data, analytics available on the go.

In summary, Hibiki/moomoo's desktop and mobile platforms cater to both active traders and long-term investors with robust tools for analysis, research, order management, and execution.

Deposit and Withdrawal

Hibiki/moomoo offers convenient deposit and withdrawal options for clients to efficiently fund accounts and access capital.

Customers can deposit instantly using bank transfers or debit/credit cards free of charge. Withdrawals can be made to bank accounts or debit cards, with bank transfers being the fastest option taking just 1-3 days.

Here is an overview of the key deposit and withdrawal details:

| Feature | Details |

| Deposit Options | Bank transfer, Debit/credit card |

| Withdrawal Options | Bank transfer, Debit card, Check |

| Fees | Free deposits, Free bank withdrawals, $25 check fee |

| Timing | 1-3 days bank transfers, Up to 10 days for check |

| Limits | $0 minimum, $50k daily max withdrawal |

The deposit and withdrawal options aim to make funding accounts and accessing money convenient and low-cost for Hibiki/moomoo clients. Bank transfers are the fastest withdrawal method available.

Customer Support

Hibiki/moomoo provides comprehensive customer support through various contact channels to ensure clients receive timely assistance.

Phone Support:

Japan: +81-3-4577-3515 (English, Japanese)

Hong Kong: +852-2680-7878 (English, Chinese, Korean)

Hours: 24/7

Email Support:

support@hibiki.co (Japanese)

cs@moomoo.com (English)

Response time: 1-2 hours

Live Chat:

Available 24/7 via online trading platforms and website

Languages: English only

Educational Resources

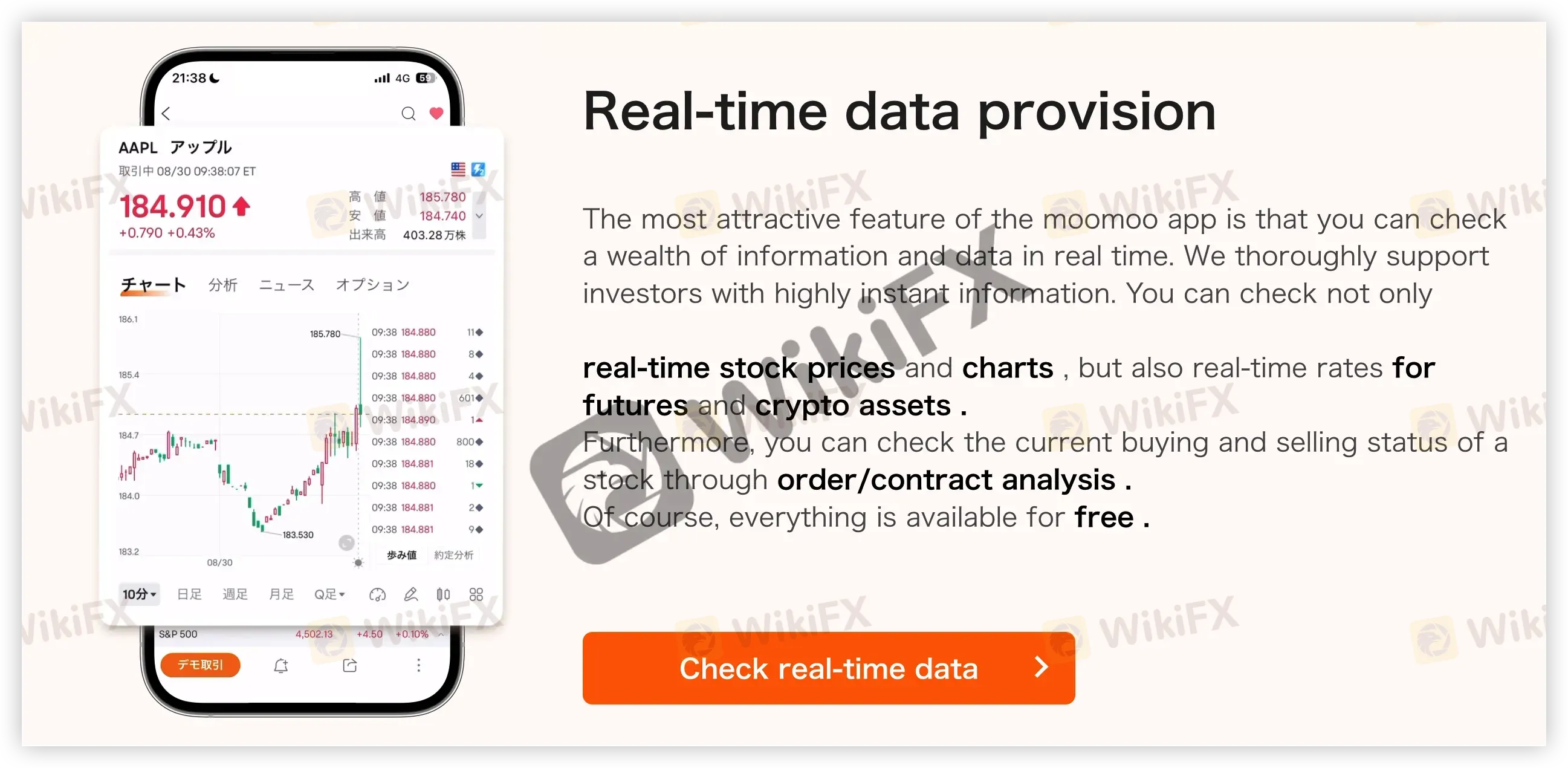

The moomoo app provides individual investors with professional-grade stock information, emphasizing the difference in information volume between professional traders and individual investors. One of the main attractions of the moomoo app is its ability to provide abundant information and data in real-time, supporting investors with timely information. This includes real-time stock prices, charts, futures, and even cryptocurrency rates. Additionally, the app offers comprehensive features that cater to both beginners and advanced investors, such as insights into institutional investor trends, technical analysis indicators, and analyst ratings.

User Experience and Additional Features

Hibiki/moomoo aims to provide an optimal user experience for traders through its proprietary desktop and mobile platforms. The interfaces offer a clean, modern design with ample customization options to tailor workspaces. Traders can execute complex order strategies with ease and analyze markets using flexible charting and screening tools. Real-time notifications and seamless mobile syncing create a responsive trading environment.

Beyond core trading capabilities, Hibiki/moomoo provides a range of innovations like auto-trading algorithms, social community forums, and paper trading modules. These cater to active investors seeking more advanced features. The broker also offers ancillary services including referral programs, simulated contests, and fee promotions to benefit clients.

Comparison with Similar Brokers

Hibiki/moomoo blends interactive platforms, research capabilities, and reasonable pricing to differentiate itself from pure low-cost brokers like Interactive Brokers and purely easy-to-use firms like Tiger.

| Broker | Spreads | Platforms | Research | Ease of Use |

| Hibiki/moomoo | Variable, low | Advanced proprietary web/mobile | Robust tools/analysis | Intuitive interface |

| Interactive Brokers | Extremely low | Desktop/web/mobile | Extensive market data | Less user-friendly |

| Tiger Brokers | Low | Easy-to-use apps | Minimal materials | Simple platform |

Conclusion

Moomoo, also known as Hibiki in some contexts, is a financial brokerage firm that offers its services through a platform recognized for its advanced features. The company is registered as a financial products trading business under the FSA (registration number: 3335).

Furthermore, moomoo is affiliated with the Japan Securities Dealers Association and the Japan Investment Advisers Association. The platform emphasizes its commitment to transparency, security, and customer service, as evidenced by its various policies and contact channels.

In conclusion, moomoo/Hibiki stands as a reputable and reliable brokerage firm in the financial industry, ensuring that its clients receive top-tier services backed by robust regulatory compliance and ethical standards.

FAQs

Q: How to trade odd lot in the HK Market?

A: Moomoo provides guidelines for trading odd lots in the Hong Kong stock market, catering to diverse trading needs.

Q: What are margin trading and short selling at Moomoo?

A: Margin trading allows users to borrow funds to purchase securities, while short selling involves selling securities not currently owned, anticipating a price drop.

Q: What is A-shares and what are the trading rules for A-shares Market?

A: A-shares represent shares in mainland China-based companies. Moomoo offers a comprehensive set of rules for trading in the A-shares market.

Q: How to place a paper order and create a paper trading account?

A: Moomoo offers a demo trading feature, allowing users to place paper orders and create paper trading accounts to practice without real money.

Q: What is the theory of quantity and price in technical analysis?

A: The theory of quantity and price is a technical analysis concept that Moomoo provides insights on, helping traders understand market dynamics.