Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

Xtrade was founded in 2000 and based in Melbourne, Australia, is a online trading broker. It currently holds a full license from the Australian Securities and Investments Commission (ASIC), a suspicious clone license from the Cyprus Securities and Exchange Commission (CYSEC), and an offshore retail forex license from the Financial Services Commission (FSC) of Belize. Xtrade offers a wide range of tradable assets, including currencies, commodities, indices, stocks, and more. This diverse selection allows traders to access various global markets and create well-diversified portfolios. With Xtrade, traders have the flexibility to choose from various trading account types, catering to different levels of expertise and trading preferences. The minimum deposit required to open an account is$250, allowing traders with different budget sizes to participate in the markets.

Xtrade offers a competitive maximum leverage ratio of up to 1:400, enabling traders to amplify their trading positions. Spreads on different financial instruments vary, ensuring a diverse range of trading opportunities.

Traders can access the markets using Xtrade's user-friendly and feature-rich trading platforms. These platforms provide seamless trading experiences across multiple devices, including web, mobile, and desktop.For traders who wish to test their strategies or familiarize themselves with the platform, Xtrade provides a demo account. Additionally, the broker offers an Islamic account option for traders who follow Shariah principles.

Xtrade prioritizes customer support, providing assistance to traders through various channels, including live chat, email, and phone. Traders can reach out to the dedicated support team for any inquiries or assistance they may need. The broker also provides educational tools and resources to help traders enhance their trading knowledge and skills.

Is Xtrade legit or a scam?

Xtrade is a broker that is regulated by two regulatory authorities, namely the Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC). ASIC is an Australian regulatory body known for its strict oversight of financial services providers, ensuring fair and transparent practices.

The FSC, on the other hand, is the regulatory authority in Belize, where Xtrade operates as an offshore entity. While the FSC is responsible for overseeing financial services in Belize, it is important to note that the regulatory standards may differ from those of ASIC. Traders should be aware of the regulatory jurisdiction in which the broker operates and understand the associated risks.

Pros and Cons

Xtrade offers several advantages and disadvantages that should be considered by potential traders. On the positive side, the broker is regulated by reputable authorities like ASIC. They offer a wide range of trading instruments, including Forex, commodities, indices, and cryptocurrencies, providing diversification opportunities. Additionally, Xtrade provides educational resources and tools to support traders' knowledge and skills development. However, some drawbacks include the spreads not being highly competitive, which could affect the cost of trading, and the lack of transparency regarding commission charges, the absence of MT4 or MT5 trading platforms. Traders should carefully evaluate these factors before deciding to trade with Xtrade.

Market Instruments

Xtrade offers a diverse range of market instruments to cater to the trading needs of its clients. Traders can access a wide variety of indices, representing different global markets, allowing them to speculate on the overall performance of major stock exchanges. Additionally, Xtrade provides a selection of commodities, enabling traders to participate in the price movements of precious metals, energy resources, agricultural products, and more.

Furthermore, Xtrade grants access to a comprehensive range of shares, including stocks of renowned companies from around the world. This allows traders to invest in individual companies and potentially benefit from their performance and dividends. In the forex market, Xtrade offers a vast selection of currency pairs, enabling traders to capitalize on fluctuations in exchange rates between various currencies.

For those seeking diversification, Xtrade provides access to Exchange-Traded Funds (ETFs). ETFs are investment funds that track the performance of a specific index or sector, allowing traders to gain exposure to a basket of assets with a single trade. Moreover, Xtrade offers the opportunity to trade bonds, enabling traders to invest in fixed-income securities issued by governments or corporations.

With this extensive range of market instruments, Xtrade empowers traders to diversify their portfolios and take advantage of various trading opportunities across different asset classes.

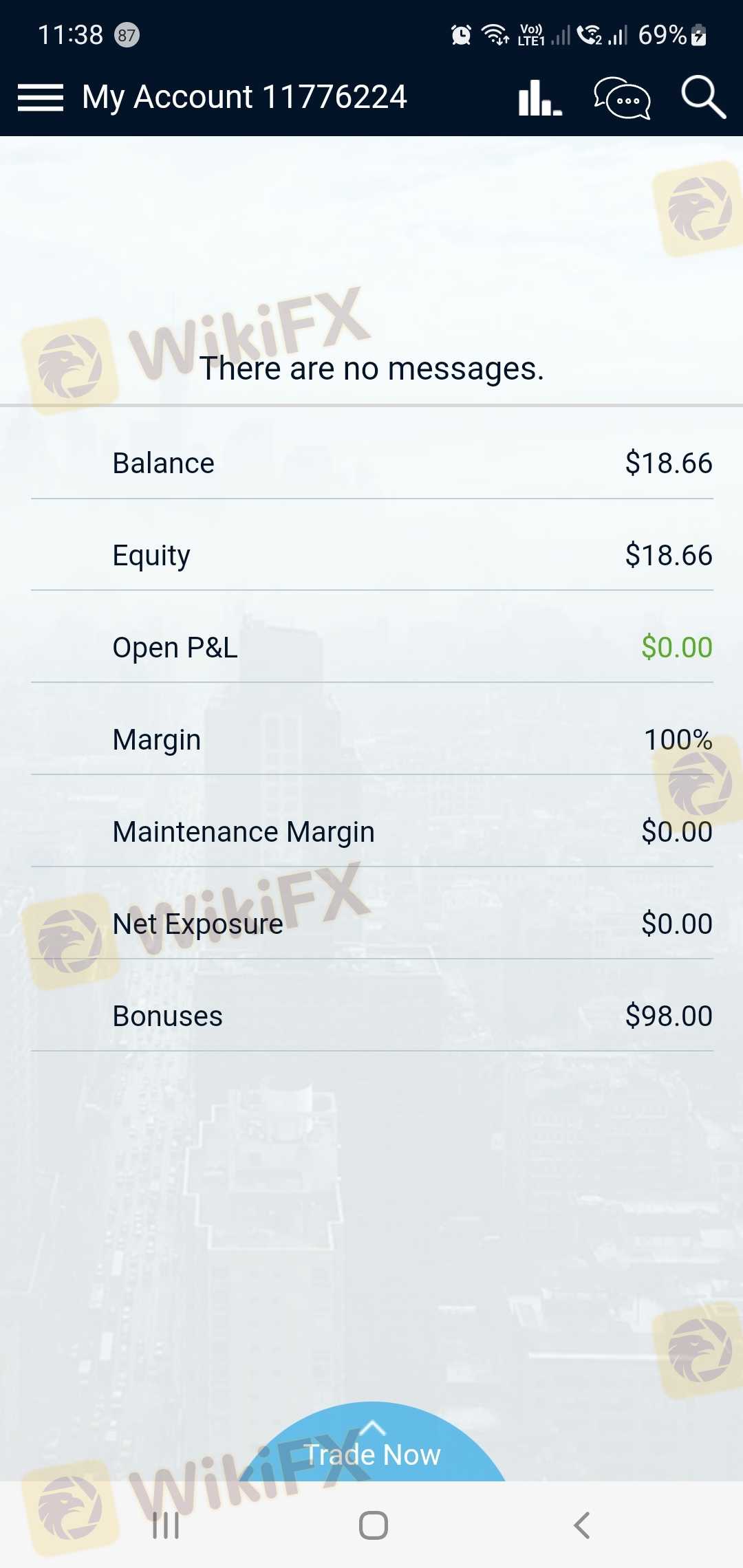

Account Types

Xtrade offers different account types to cater to the varying needs of traders, starting with the Standard account. With a minimum deposit requirement of $250, the Standard account is ideal for beginners who are new to trading or prefer to start with a smaller investment. This account provides access to a user-friendly trading platform, educational resources, and basic trading features, allowing traders to gain experience and knowledge in the financial markets.

Moving up the ladder, the Premium account requires a minimum deposit of $1,000. This account type is suitable for intermediate traders who have a bit more experience and seek competitive trading conditions. Traders with a Premium account can enjoy a wider range of tradable assets, receive regular market updates, and access customer support services to assist them in their trading journey.

For traders looking for an even higher level of service and benefits, Xtrade offers the Platinum account. Requiring a minimum deposit of $5,000, the Platinum account provides traders with enhanced features, including tight spreads, faster trade execution, and dedicated account managers who can offer personalized guidance and support. This account type is suitable for traders who desire a premium trading experience and want access to advanced trading tools.

Lastly, Xtrade offers the VIP account, which is designed for experienced and high-net-worth traders. With a minimum deposit requirement of $20,000, the VIP account provides exclusive benefits such as priority customer support, lower trading costs, and advanced trading tools. Traders with a VIP account can enjoy personalized services and assistance from dedicated account managers to meet their specific trading needs.

How to open an account?

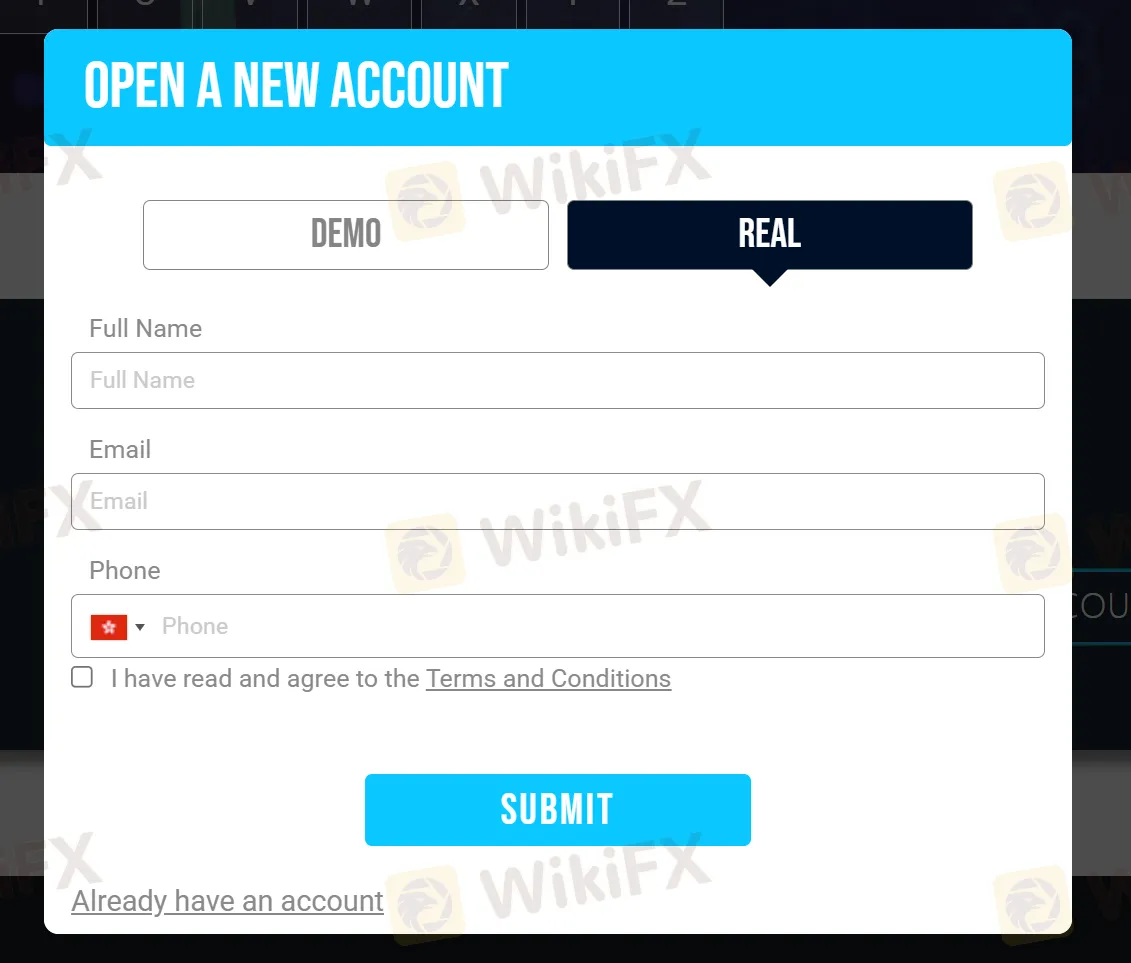

Opening an account with Xtrade is a straightforward process.

1. To begin, visit the Xtrade website and click on the “Open Account” button.

2. Fill out the registration form with your personal details, including your name, email address, and phone number.

3. Next, choose your desired account type and leverage level. After completing the form, review and accept the terms and conditions.

4. Finally, verify your account by providing the necessary identification documents as requested by Xtrade. Once your account is approved, you can proceed to fund it and start trading in the financial markets with Xtrade's user-friendly trading platform.

Leverage

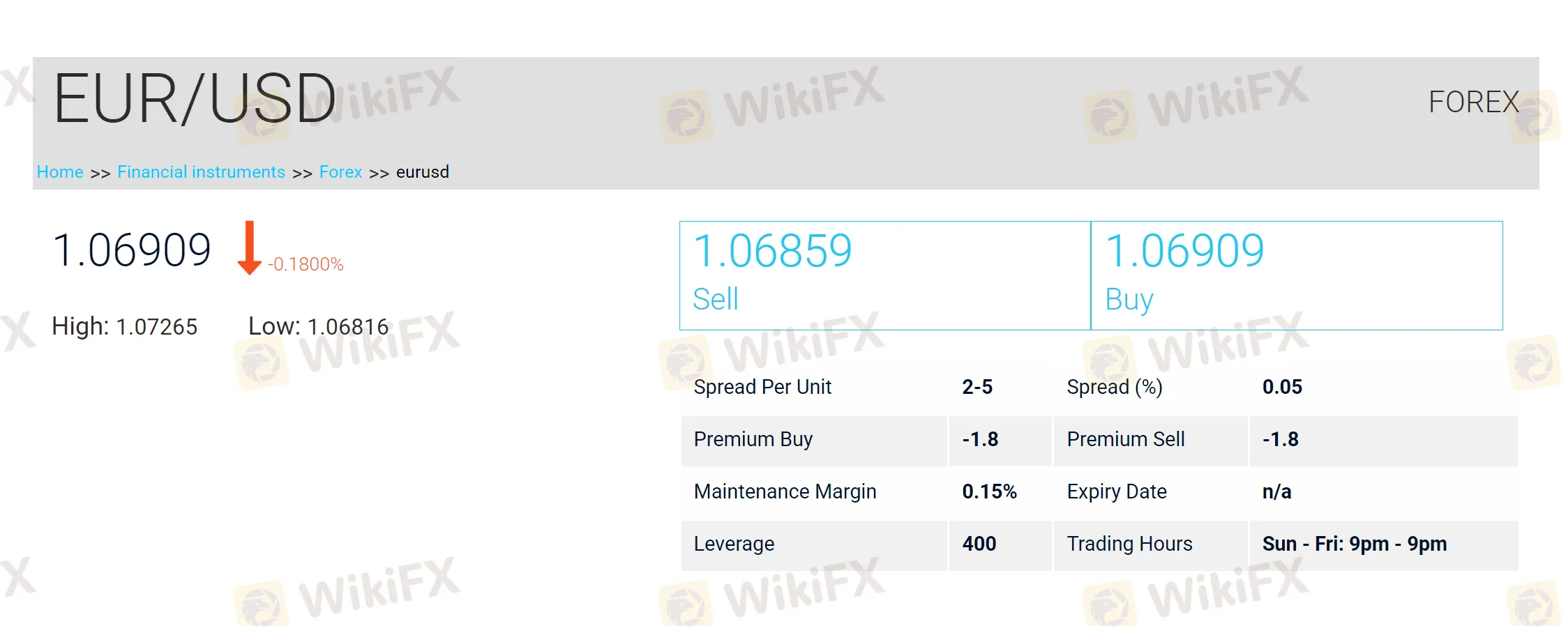

Xtrade provides traders with flexible leverage options across various instruments. The leverage offered by Xtrade varies depending on the trading asset. For forex trading, the maximum leverage available is up to 1:400, allowing traders to amplify their trading positions. When it comes to commodities, the leverage reaches up to 1:200, offering traders the opportunity to trade larger volumes with a smaller initial investment. Shares trading on Xtrade's platform has a maximum leverage of 1:10, enabling traders to take advantage of price movements in the stock market. Lastly, for cryptocurrency trading, the leverage ranges from 1:10 to 1:50, depending on the specific digital asset.

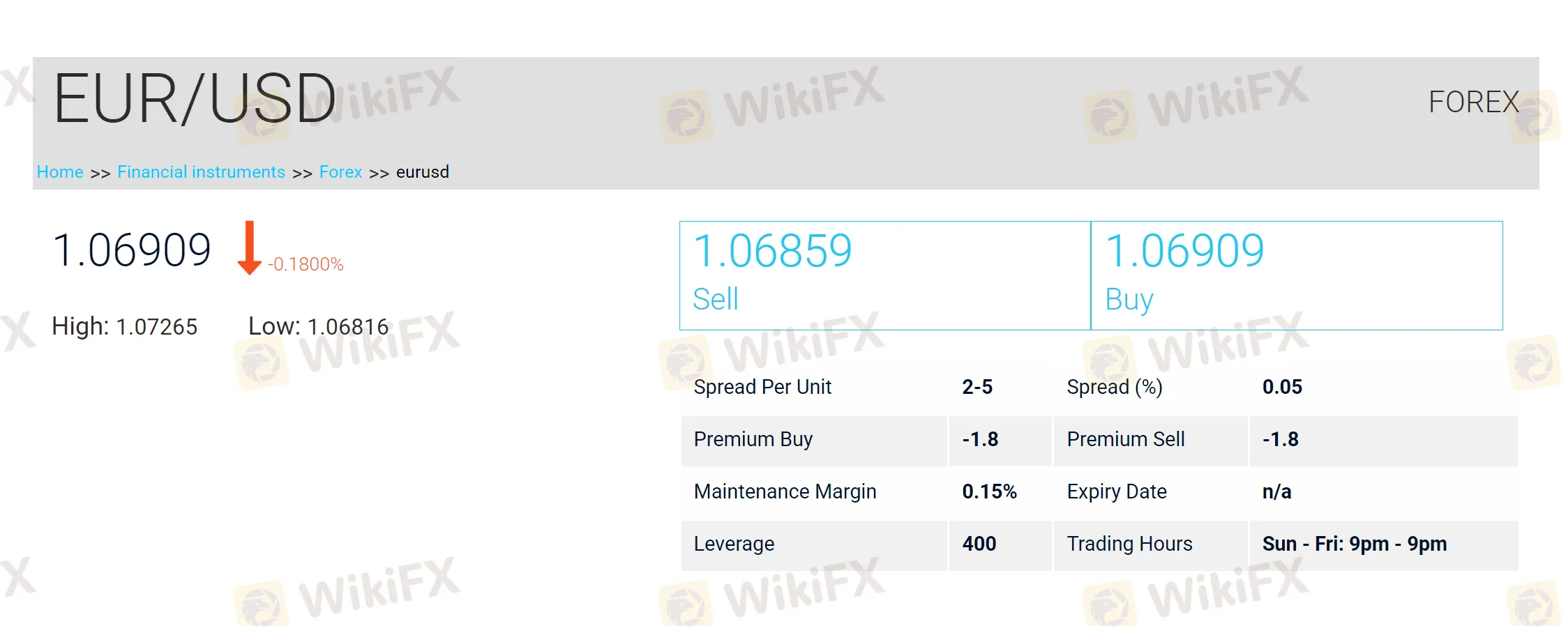

Spreads & Commissions (Trading Fees)

Xtrade offers spreads that are not considered highly competitive, with the benchmark spread on EURUSD ranging from 2 to 5 pips. The spreads indicate the difference between the buying and selling prices of a trading instrument, and in the case of Xtrade, they may be slightly wider compared to some other brokers in the market. It's important for traders to consider the spreads as they directly impact the overall cost of trading.

However, it's worth noting that the exact commission charges associated with trading on Xtrade's platform are not specified. Traders should evaluate the overall trading conditions, including spreads and any applicable commissions, to make informed decisions regarding their trading strategy on Xtrade.

Non-Trading Fees

Apart from trading fees, Xtrade may charge non-trading fees, which refer to fees not directly related to trading activities. These fees can include charges for account inactivity, withdrawal fees, or fees for certain payment methods. It is important for traders to familiarize themselves with the specific non-trading fees imposed by Xtrade, as they may vary depending on the account type and the services utilized. Being aware of these fees can help traders effectively manage their trading costs and make informed decisions.

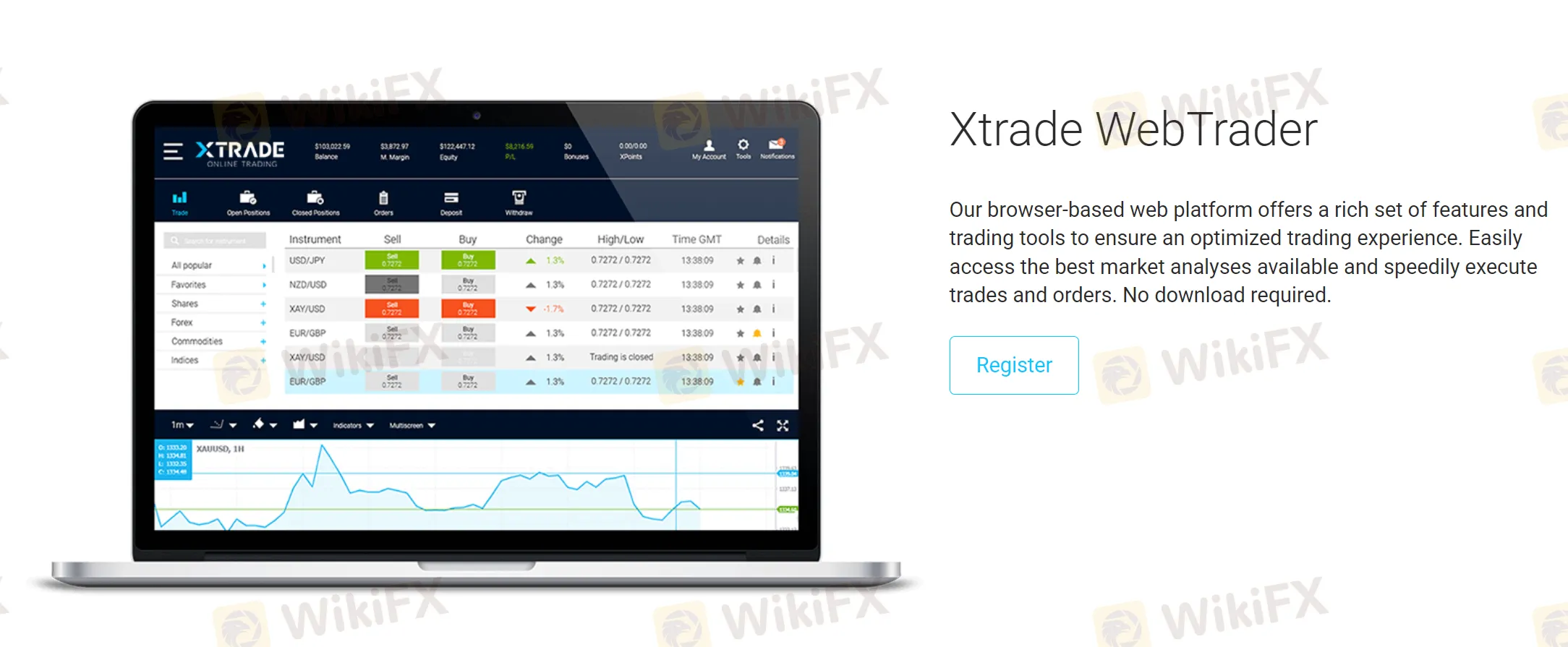

Trading Platform Available

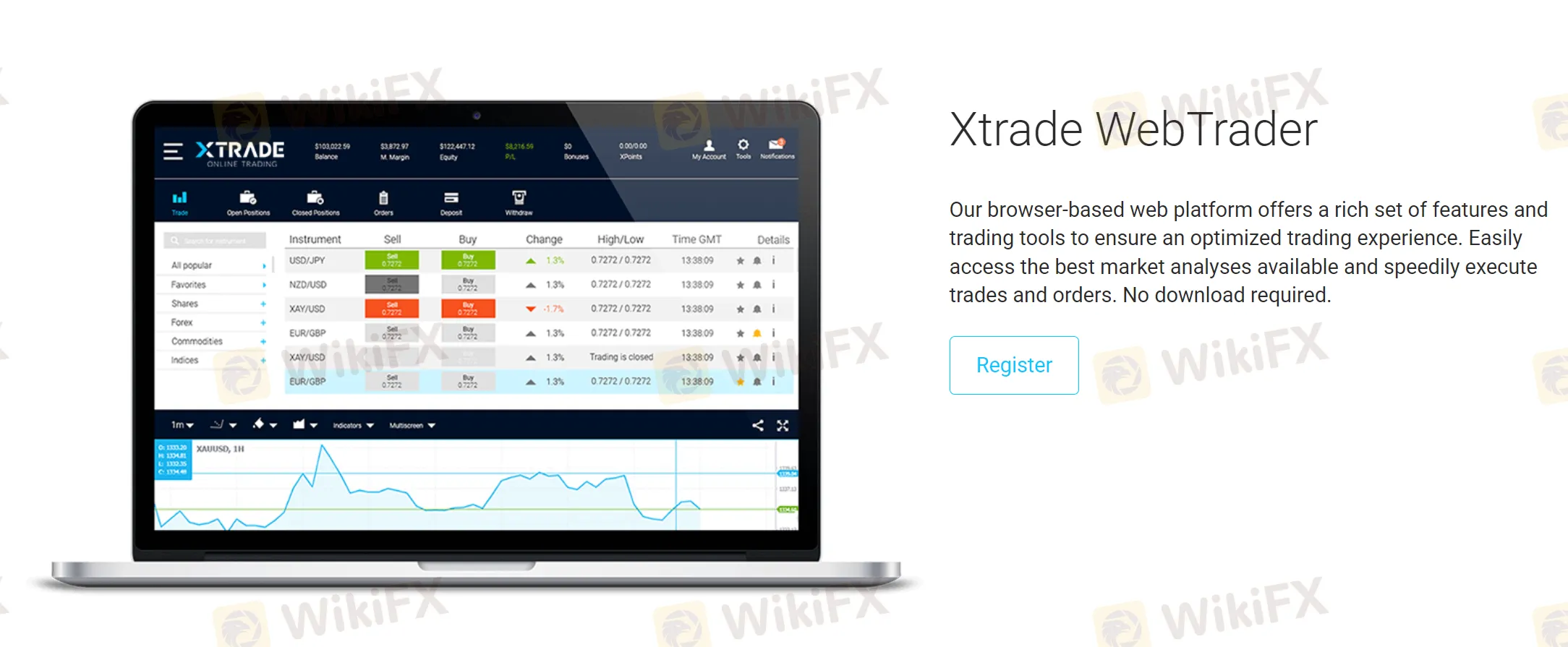

Xtrade offers a user-friendly trading platform designed to meet the needs of modern traders. One of the platform options available is the WebTrader, which allows traders to access their accounts and trade directly from their web browser. It provides a seamless trading experience with advanced charting tools, real-time market quotes, and an intuitive interface. The WebTrader platform is accessible from any device with an internet connection, making it convenient for traders who prefer trading on the go.

For traders who prefer to trade on their mobile devices, Xtrade provides a mobile trading app compatible with both iOS and Android systems. The mobile app offers full functionality, enabling traders to monitor their positions, place trades, and access real-time market information. It is designed to be user-friendly and responsive, providing a smooth and efficient trading experience even on smaller screens.

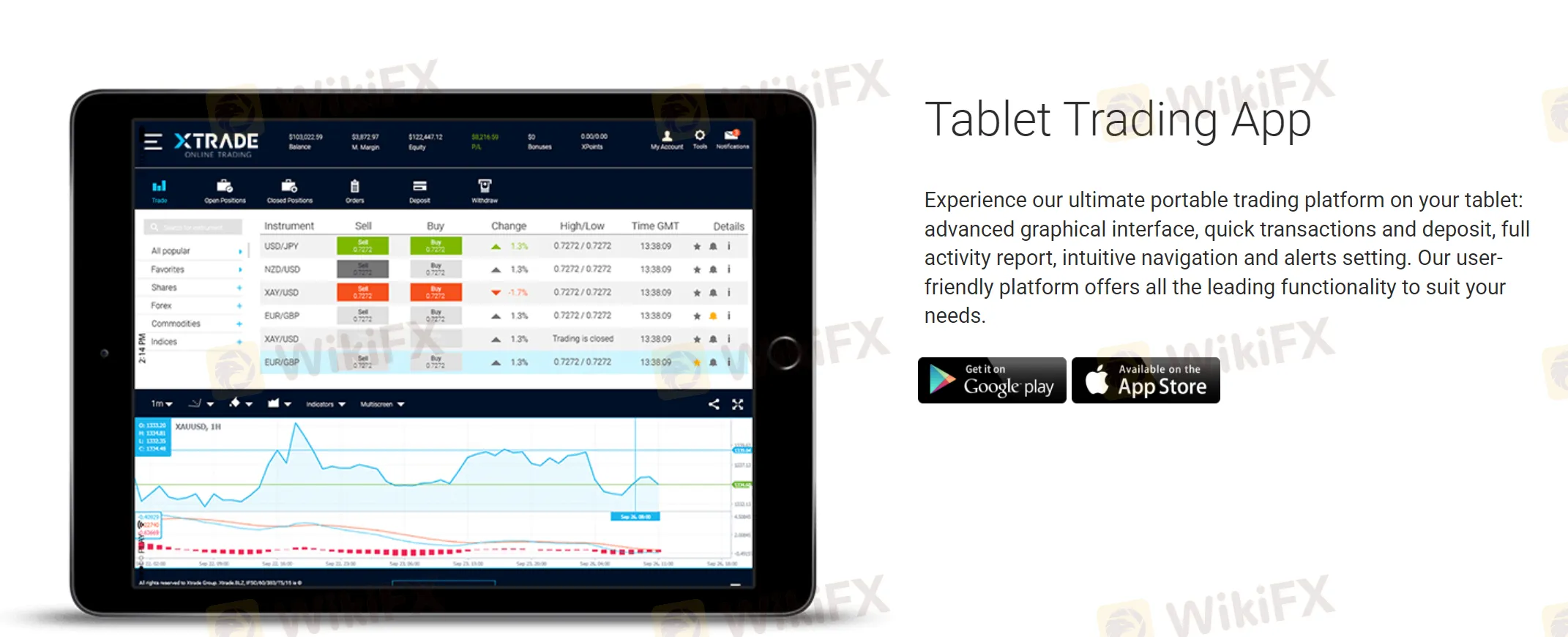

Additionally, Xtrade offers a tablet trading app, optimized for larger screens and providing enhanced features for tablet users. The tablet app combines the convenience of mobile trading with the expanded functionality of a larger display, allowing traders to analyze charts, execute trades, and manage their portfolios with ease.

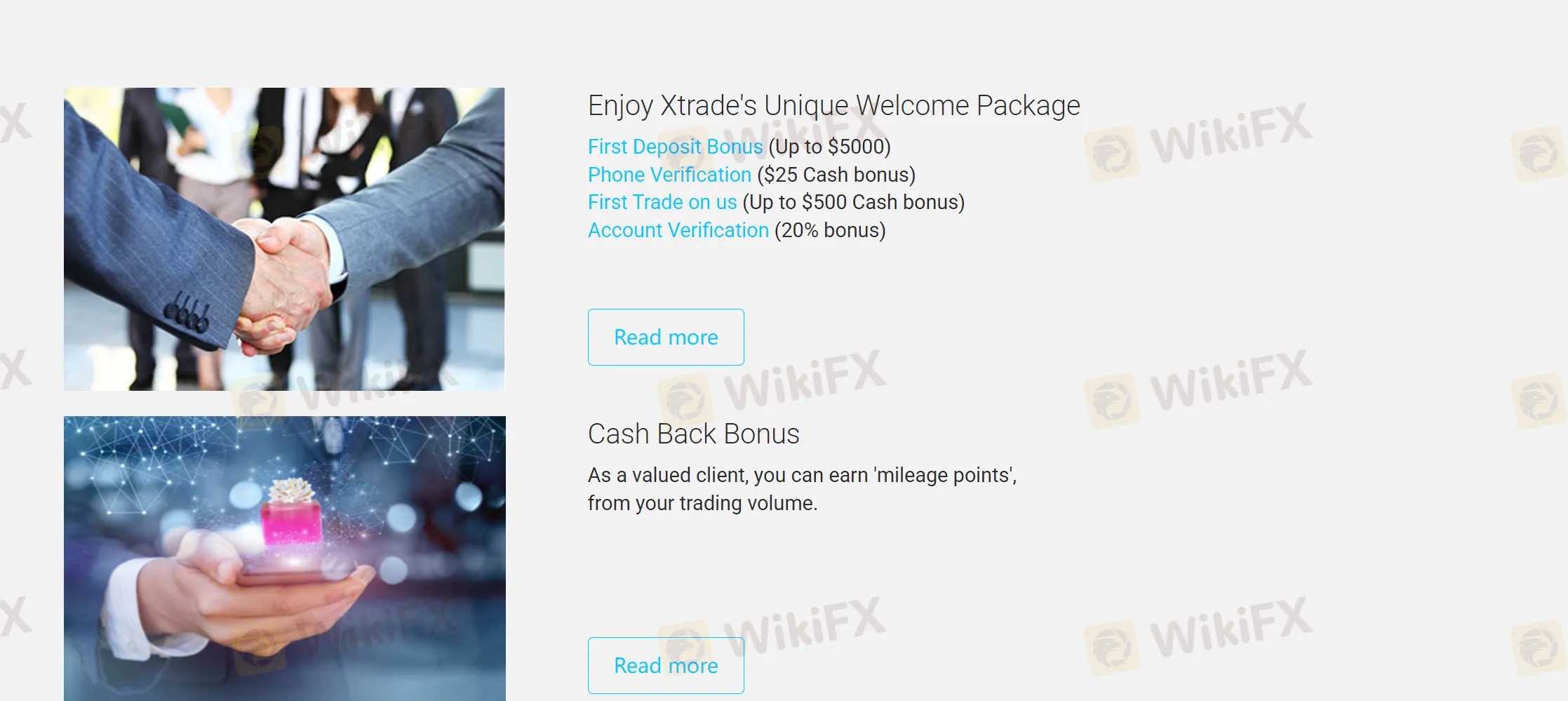

Promotions

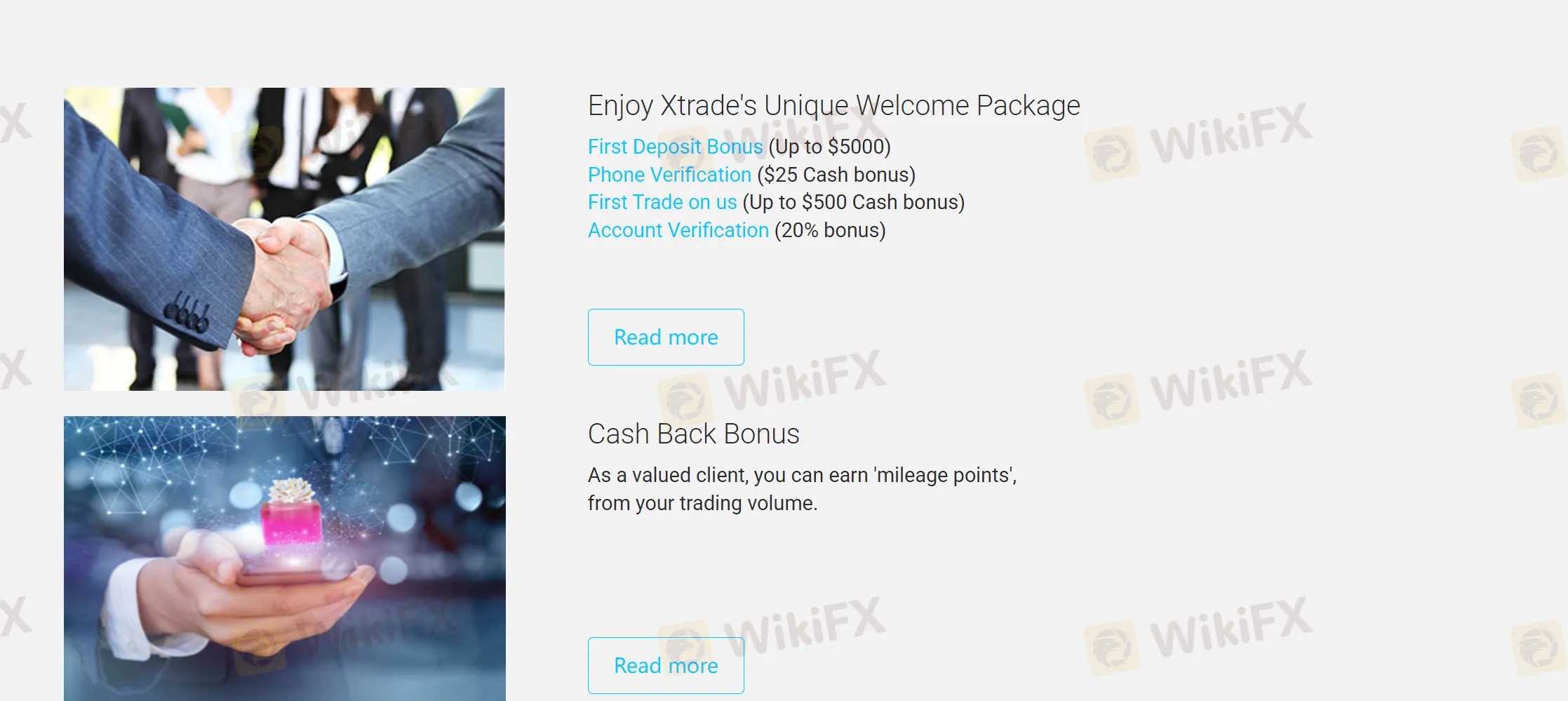

Xtrade presents a range of enticing promotions and bonuses to enhance the trading experience for its clients. Traders can take advantage of the First Deposit Bonus, which offers a rewarding boost of up to $5000 on their initial deposit. Additionally, by completing a simple Phone Verification process, traders can earn a $25 Cash bonus as a gesture of appreciation. The “First Trade on us” promotion allows traders to enjoy a cash bonus of up to $500 when placing their initial trade. Furthermore, by verifying their trading account, clients can receive a generous 20% bonus as part of the Account Verification promotion. These promotions provide traders with added value and potential rewards, giving them a head start in their trading journey with Xtrade.

Deposit & Withdrawal

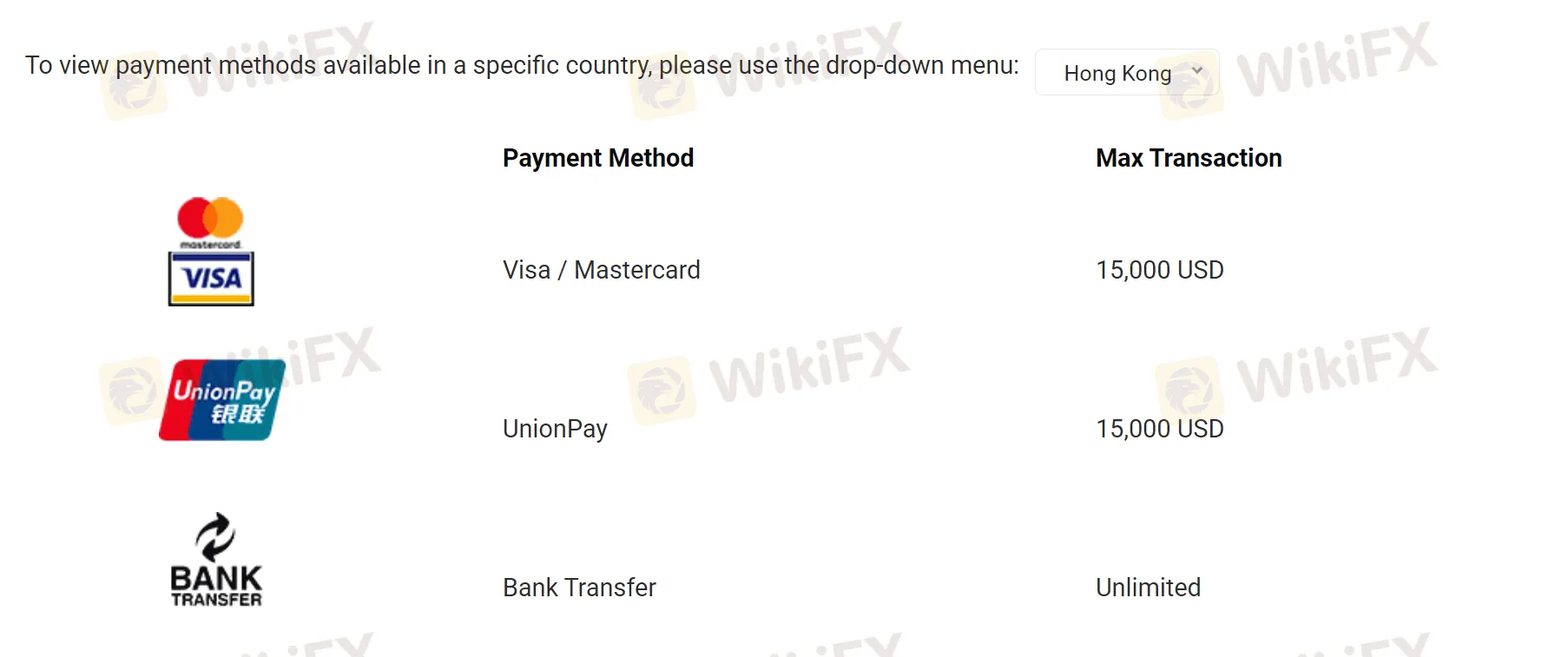

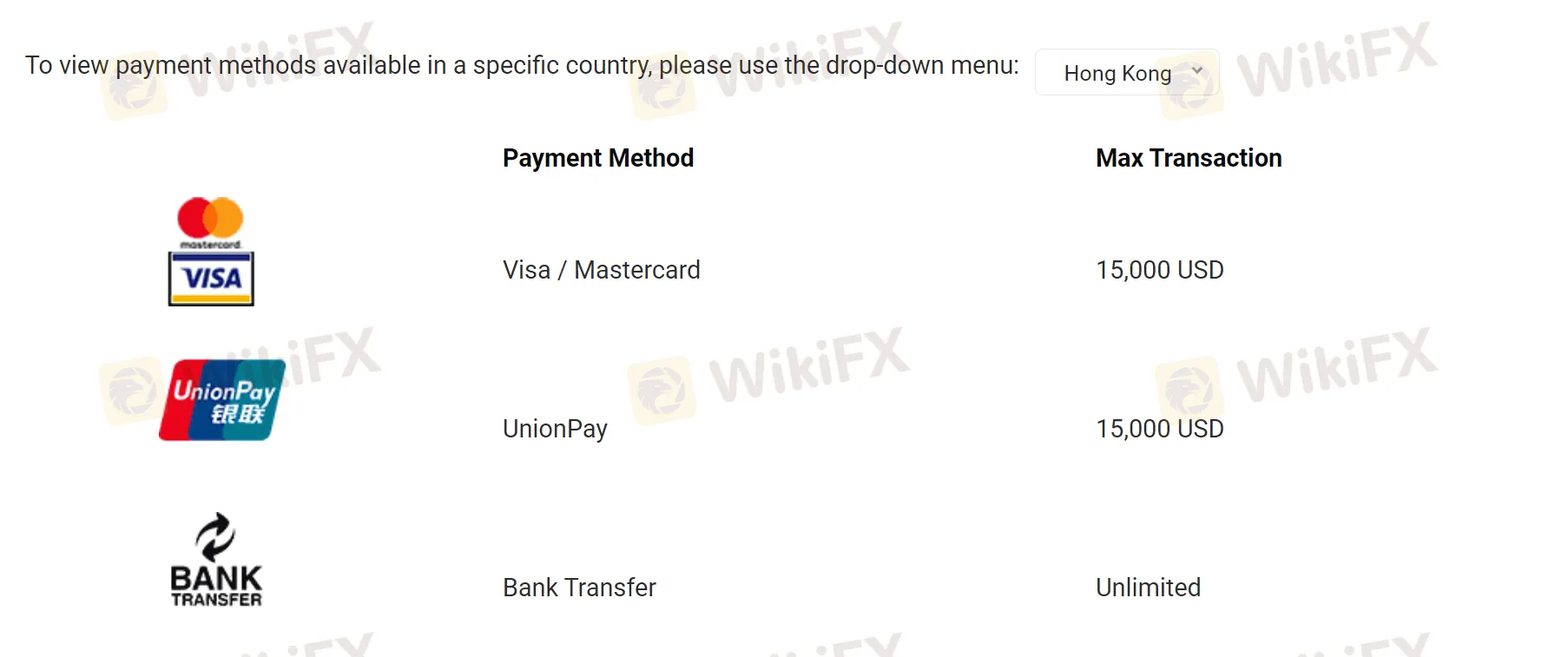

Xtrade offers flexible deposit and withdrawal options to cater to the diverse needs of its clients. While the standard minimum deposit is $250, Xtrade occasionally runs promotions that allow for lower deposit thresholds, providing more accessibility for traders. Clients can choose from various payment methods, including credit/debit cards, bank transfers, and American Express, among others. The availability of deposit options may vary depending on the country of residence.

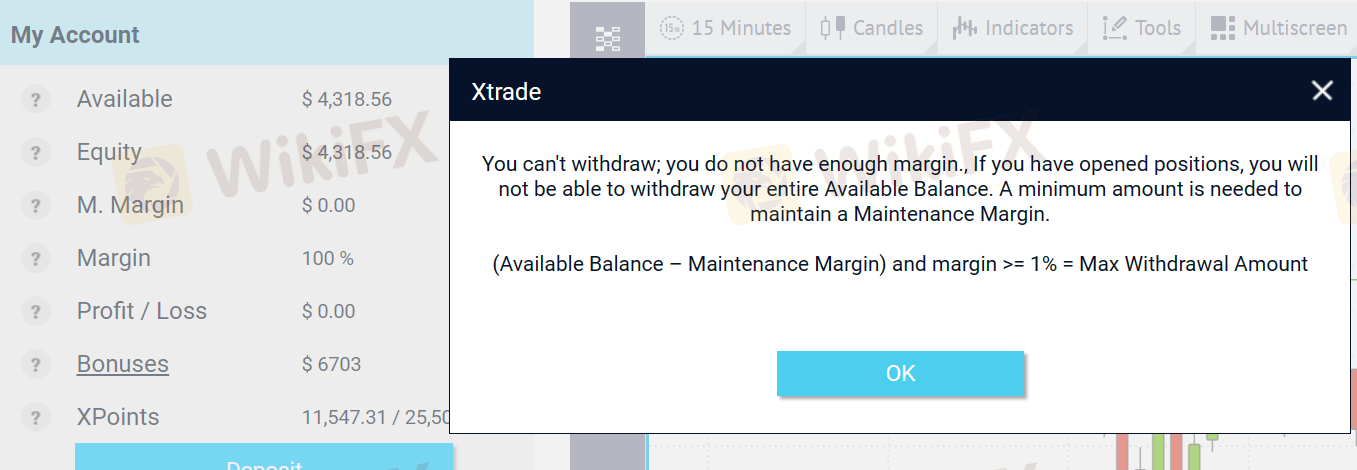

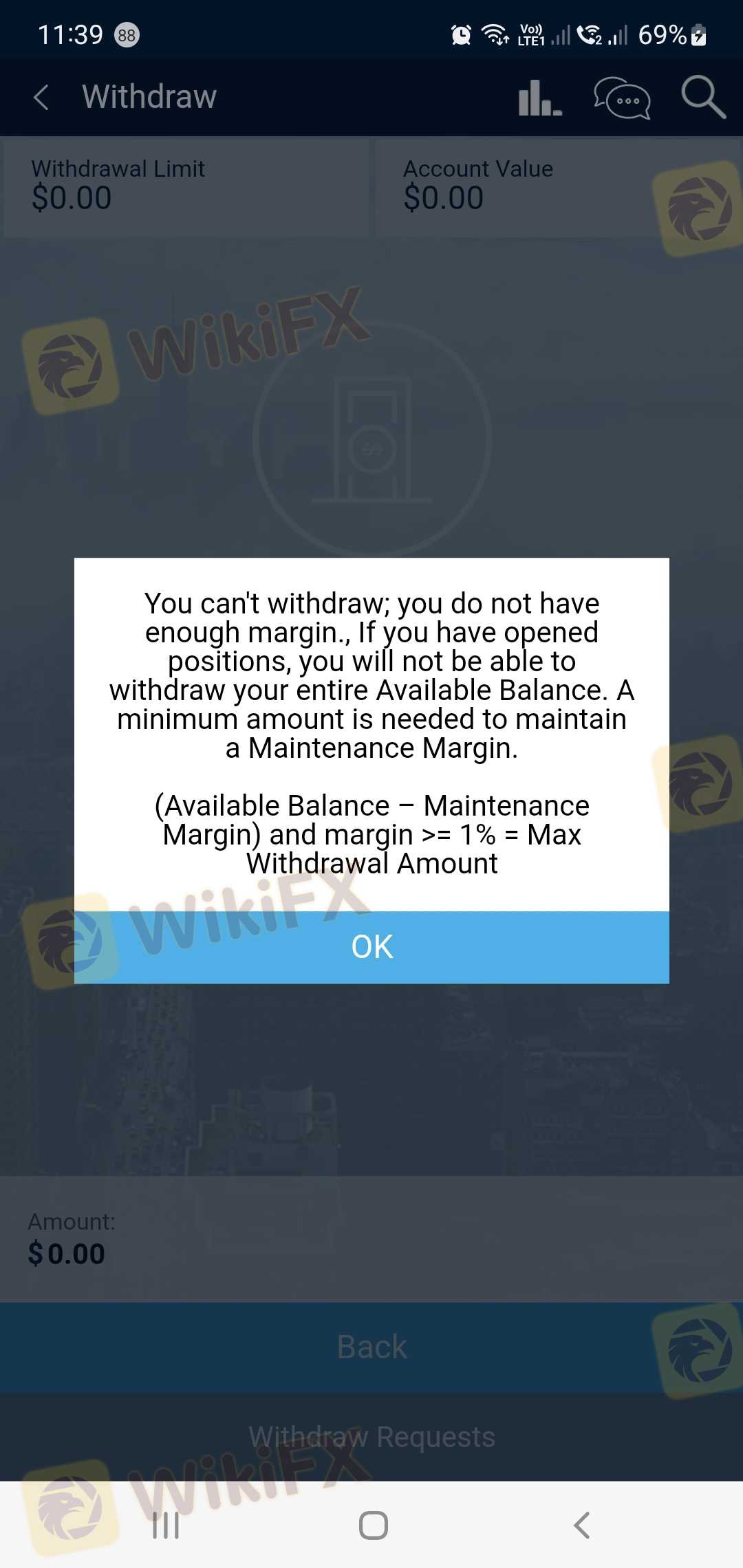

When you request a withdrawal, the funds are returned using the same method you used for depositing. For example, if you deposited funds using a credit card, the withdrawal amount will be credited back to that card. Similarly, if you used a bank transfer for deposit, the withdrawal will be transferred back to your bank account. In the case of deposits made through e-wallets like Skrill or Neteller, the withdrawal will be returned either through a bank transfer or directly to the e-wallet. It's important to note that withdrawal requests typically take up to five business days to process. However, please be aware that external factors beyond our control, such as credit card companies or intermediary banks, may cause delays of up to three weeks in extreme cases. Normally, bank transfer or credit/debit card refunds are completed within 10 business days, while e-wallet payments are processed instantly once the withdrawal is approved.

Customer Support

Xtrade prioritizes providing excellent customer support to its clients. With their dedication to customer satisfaction, Xtrade offers round-the-clock customer support, ensuring assistance is available 24 hours a day, 6 days a week. This allows traders from different time zones to access support whenever they need it. The customer support team is multilingual, capable of assisting clients in various languages, further enhancing the accessibility and inclusivity of their services.

Clients can reach out to Xtrade's customer support through multiple channels, including email, phone, and online chat. This diverse range of contact options allows traders to choose the method that suits them best for efficient and convenient communication. Whether clients prefer written correspondence, direct phone conversations, or real-time chat support, Xtrade accommodates their preferences.

To provide additional assistance and address common inquiries, Xtrade offers a detailed FAQ section. This comprehensive resource covers a wide range of topics, including account registration, deposits and withdrawals, trading platforms, trading conditions, and more. The FAQs provide clear and concise answers to frequently asked questions, empowering traders with the necessary information to navigate the platform and make informed decisions.

Educational Resources

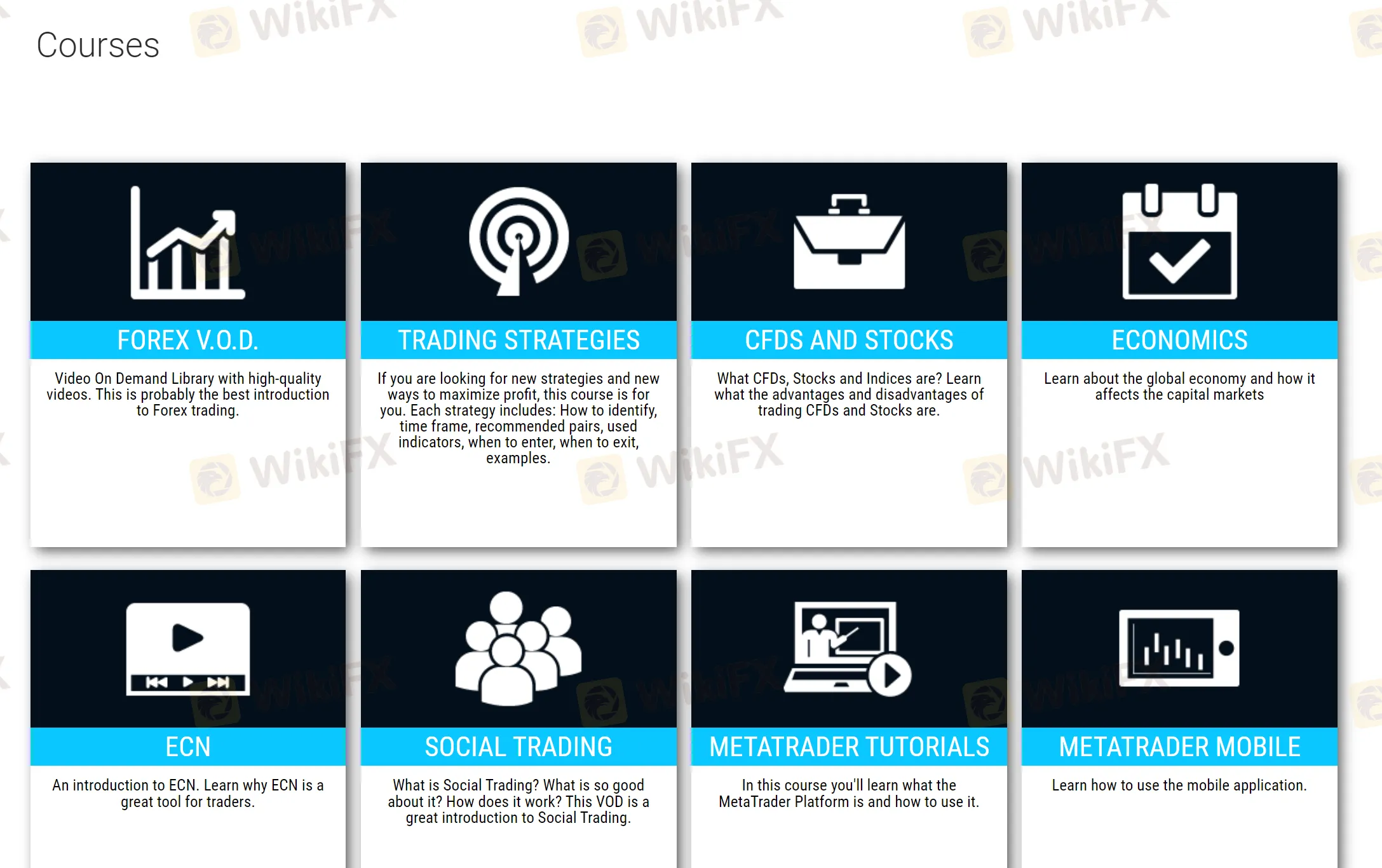

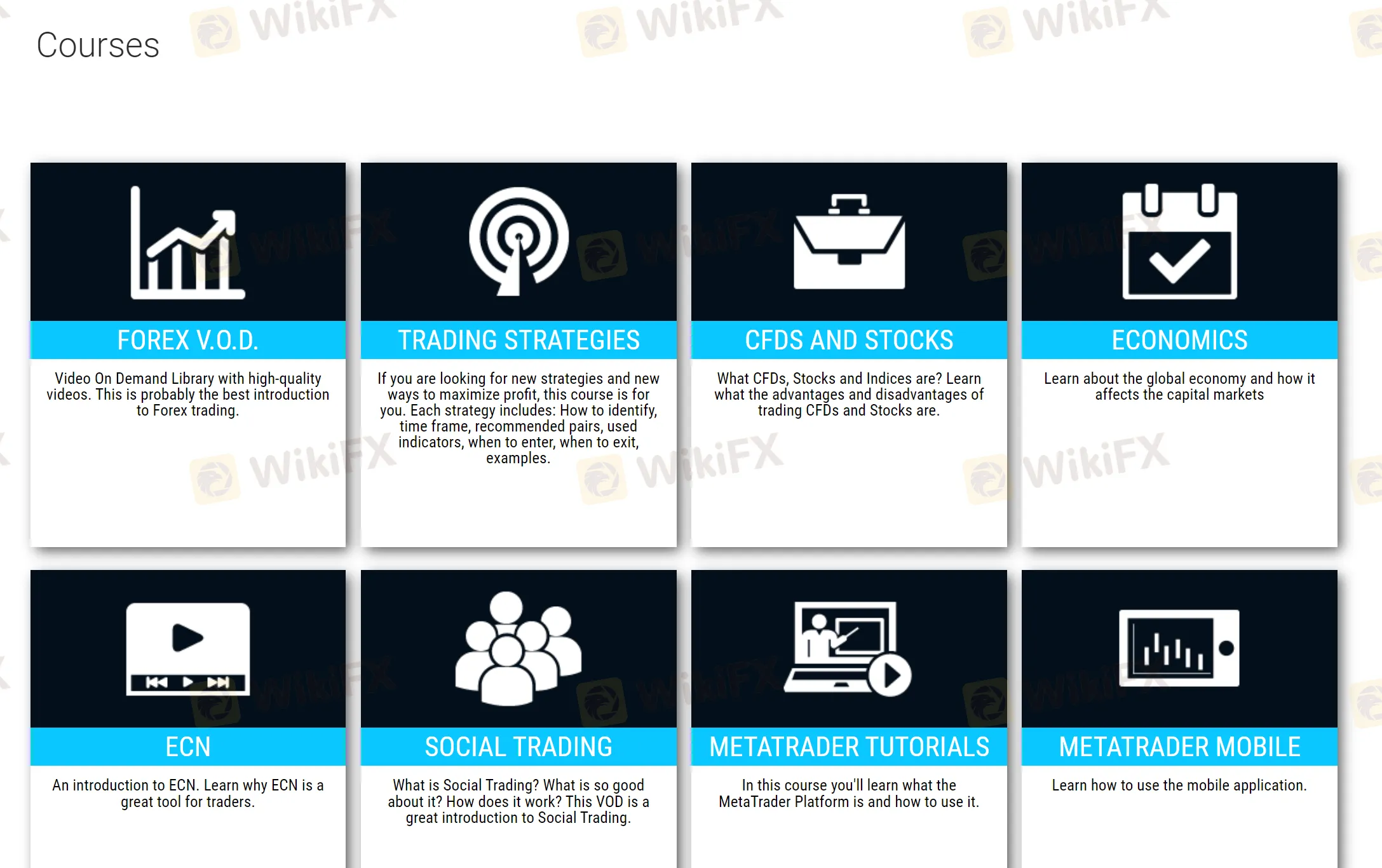

Xtrade offers a comprehensive range of educational resources designed to empower traders with knowledge and skills. Their educational offerings include video tutorials, which provide step-by-step guidance on various trading concepts and strategies. These tutorials are easy to follow and cater to traders of all levels, from beginners to advanced.

In addition to video tutorials, Xtrade provides interactive courses that cover a wide range of trading topics. These courses are carefully curated to provide traders with a structured learning experience, allowing them to delve deeper into specific areas of interest and enhance their trading proficiency.

For traders looking to familiarize themselves with industry terminology, Xtrade offers a comprehensive glossary. This glossary serves as a valuable reference tool, providing clear and concise definitions of key trading terms and jargon.

To keep traders informed about the latest market trends and developments, Xtrade offers a wealth of trading information. This includes real-time market news, analysis, and insights, enabling traders to stay updated and make informed trading decisions.

Xtrade's blog is another educational resource that offers a wealth of informative articles on various trading topics. From market analysis and trading strategies to risk management and psychology, the blog covers a wide range of subjects to help traders expand their knowledge and refine their trading approach.

Lastly, Xtrade prioritizes trading education and provides access to additional educational materials such as e-books, webinars, and seminars. These resources offer valuable insights and perspectives from industry experts, further enriching traders' learning experience.

Overall, Xtrade's educational resources aim to equip traders with the knowledge and skills necessary to navigate the financial markets effectively. By offering a diverse range of educational tools, Xtrade strives to support traders in their quest for continuous growth and improvement.

Conclusion

Xtrade offers a wide range of trading opportunities with its user-friendly platform and diverse tradable assets. The broker is regulated by ASIC and FSC, and the leverage provided offers flexibility to traders. Customer support is readily available, and the broker supports various payment methods. Xtrade also provides educational tools to enhance traders' knowledge and skills. On the downside, there may be delays in withdrawal processing, particularly when involving third-party payment methods. Besides, it is important to note that spreads may vary and some non-trading fees may apply. Overall, Xtrade presents an opportunity for traders to explore the financial markets, but it is important to consider both the advantages and limitations before engaging in trading activities.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX