User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

6

CommentsWrite a review

2022-11-22 14:53

2022-11-22 14:53

2022-11-21 18:16

2022-11-21 18:16 2022-11-17 11:54

2022-11-17 11:54 2022-11-17 11:36

2022-11-17 11:36

2022-11-17 10:36

2022-11-17 10:36

Japan|10-15 years|

Japan|10-15 years| http://www.shikoku-alliance-sec.co.jp/index.html

Website

Influence

C

Influence index NO.1

Japan 6.94

Japan 6.94Single Core

1G

40G

More

Shikoku Alliance Securities Co.,Ltd.

Shikoku

Japan

Pyramid scheme complaint

Expose

| Aspects | Information |

| Registered Country/Area | Japan |

| Founded Year | 10-15 years |

| Company Name | Shikoku Alliance Securities Co., Ltd. |

| Regulation | Regulated in Japan, holds a retail forex license from the Financial Services Agency (FSA) |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | From 0.0 pips |

| Trading Platforms | Not specified |

| Tradable Assets | Domestic stocks, foreign stocks, domestic bonds, foreign currency-denominated bonds, structured bonds |

| Account Types | Individual Customer Account, Corporate Customer Account |

| Demo Account | Not specified |

| Customer Support | Available through store locator, toll-free number, and service hours |

| Service Hours | Weekdays: 8:45 AM to 5:00 PM |

Shikoku Alliance Securities Co., Ltd. is a licensed financial institution regulated by Japan's Financial Services Agency (FSA). With a retail forex license, Shikoku Alliance Securities offers various financial services and products to individual and corporate investors. The company's website, http://www.shikoku-alliance-sec.co.jp/index.html, provides information about their offerings and market instruments.

Shikoku Alliance Securities offers a diverse range of market instruments, including domestic stocks listed on the Tokyo Stock Exchange, foreign stocks listed on the New York Financial Instruments Exchange, domestic and foreign currency-denominated bonds, and structured bonds. They provide two types of accounts: individual customer accounts and corporate customer accounts, catering to the needs of different investors.

While Shikoku Alliance Securities is regulated and offers a range of investment opportunities, it's advisable to review their specific offerings, spreads, commissions, and services directly through their official channels or by contacting their customer support for up-to-date and accurate information.

Shikoku offers a diverse range of market instruments, including domestic and foreign stocks, domestic and foreign currency-denominated bonds, and structured bonds. This allows customers to access a wide variety of investment opportunities. Shikoku also provides two types of accounts, individual customer and corporate customer accounts, catering to different needs. Their customer support services are available through various channels, including a toll-free number and physical branch locations.

However, there are some concerns to be aware of. The license type of Shikoku Alliance Securities is “No Sharing,” indicating that they do not have a trading software. This might limit certain functionalities or features that other brokers may provide. There is also a risk alert from WikiFX associated with this broker, suggesting potential risks that need to be considered. Additionally, some details such as the provided email address and website information are not available, which may pose challenges in terms of accessibility and communication.

| Pros | Cons |

| Regulated by Japan's FSA | License type suggests no trading software |

| Offers a diverse range of market instruments | Risk alert from WikiFX |

| Provides individual and corporate customer accounts | Limited information provided (email, website) |

| Various customer support channels |

Based on the provided information, it appears that the licensed institution, Shikoku Alliance Securities Co., Ltd. (四国アライアンス証券株式会社), is regulated by Japan's Financial Services Agency (FSA). The institution holds a retail forex license, with license number 5500001016700. The effective date of the license is July 31, 2012.

However, there are some additional details worth noting. The license type mentioned is “No Sharing,” which suggests that the licensed institution does not have a trading software. This information is accompanied by a risk alert from WikiFX, indicating that there might be some concerns associated with this broker. The provided email address for the licensed institution is not available, and the website information is also not provided.

Shikoku Alliance Securities offers a diverse range of market instruments to cater to customer needs. Here are the market instruments they provide, described in English:

1. DOMESTIC STOCKS: Shikoku Alliance Securities deals with stocks listed on the Tokyo Stock Exchange, providing opportunities for customers to invest in domestic companies.

2. FOREIGN STOCKS: Shikoku Alliance Securities also handles a selection of stocks listed on the New York Financial Instruments Exchange. This allows customers to access and trade stocks of international companies.

3. DOMESTIC BONDS: Shikoku Alliance Securities offers various types of domestic bonds, including government bonds (including those designed for individual investors), government-guaranteed bonds, publicly offered local government bonds, and corporate bonds.

4. FOREIGN CURRENCY-DENOMINATED BONDS: Shikoku Alliance Securities provides a wide range of foreign currency-denominated bonds issued by foreign governments, domestic and international corporations. These bonds are available in major currencies such as the US dollar, euro, and Australian dollar, as well as bonds denominated in emerging market currencies.

5. STRUCTURED BONDS: Shikoku Alliance Securities offers structured bonds that incorporate various derivative transactions such as options, swaps, and futures. These bonds are available through public offerings, and the company also customizes products according to customers' specific needs.

For “domestic over-the-counter transactions,” which involve trading at independently presented over-the-counter prices, the company provides information on foreign securities based on the Financial Instruments and Exchange Act. Customers interested in purchasing foreign stocks through domestic over-the-counter transactions are advised to review the “Foreign Securities Information” provided by Shikoku Alliance Securities in advance.

| Pros | Cons |

| Diverse range of market instruments | Absence of specific trading software |

| Access to domestic and foreign stocks | High complexity and risk associated with derivative transactions |

| Customization options for structured bonds | Limited liquidity for certain bond markets |

Shikoku Alliance Securities Co., Ltd. offers two types of accounts to accommodate different customer needs:

1. INDIVIDUAL CUSTOMER ACCOUNT:

· This account type is designed for individual investors.

· Individual customers can open and operate this account to access Shikoku Alliance Securities' complete range of financial products and trading platforms.

· It allows individuals to manage their personal investments, execute trades, and access various brokerage services provided by Shikoku Alliance Securities.

2. CORPORATE CUSTOMER ACCOUNT:

· This account type is tailored for corporate entities.

· Corporate customers, such as businesses, organizations, or institutions, can open and maintain this account.

· The Corporate Customer Account grants access to the full suite of financial products and trading platforms offered by Shikoku Alliance Securities.

· It enables corporations to handle their investment needs, engage in trading activities, and avail themselves of the securities brokerage services provided by Shikoku Alliance Securities.

Both account types provide customers with the opportunity to engage in a wide range of investment activities and take advantage of the financial products and services offered by Shikoku Alliance Securities. These accounts give individuals and corporate entities the ability to manage their portfolios, execute trades, and benefit from the comprehensive support and resources provided by Shikoku Alliance Securities Co., Ltd.

| Pros | Cons |

| Access to a comprehensive range of financial products and trading platforms. | Limited information on the specific features and benefits of each account type. |

| Individuals can manage their personal investments and execute trades efficiently. | Lack of details on account requirements and eligibility criteria. |

| Corporate entities can handle their investment needs and engage in trading activities. | Possible variations in account features and services based on individual or corporate account types. |

| Availability of securities brokerage services. | Potential lack of transparency on fees, charges, and commissions. |

| Risk of potential restrictions or limitations on certain trading activities or financial products. |

Shikoku Alliance Securities applies various fees and commissions for different types of transactions and services. Here is an overview of the spreads and commissions associated with their services:

1. Brokerage Commission for Domestic Stocks:

- The commission fee for buying and selling domestic listed stocks is based on the contract amount and includes tax.

- For contracts of 1 million yen or less, the basic fee is 2,750 yen, with a minimum commission rate of 1.21%.

- The commission structure varies depending on the contract amount, with different percentage rates and additional fees for higher contract amounts.

- The maximum commission amount is capped at 275,000 yen.

- Fractional share trading commission applies to trades involving less than one unit of shares and is calculated proportionally based on the number of shares traded.

2. Brokerage Commission for Domestic Convertible Bonds (CB) with Stock Acquisition Rights:

- The commission fee for buying and selling domestically listed corporate bonds with stock acquisition rights is also based on the contract amount and includes tax.

- Similar to domestic stock transactions, the commission structure varies based on the contract amount, with different percentage rates and additional fees for higher contract amounts.

- The maximum commission amount is capped at 269,500 yen.

3. Stock Trading Commission:

- Shikoku Alliance Securities offers a 50% discount on stock trading commissions compared to over-the-counter transactions.

4. Domestic Investment Trust Purchase Fee:

- There is a 20% discount on the purchase fee for domestic investment trusts compared to over-the-counter transactions.

- It's important to note that purchases of investment trusts are not eligible for sales commission discounts, even for contract applications made through online trading.

5. Exchange Spread:

- When conducting transactions in foreign currencies, an exchange rate is applied, taking into account the exchange spread specified in the provided table.

- The exchange spread varies for different currencies and depends on the transaction amount.

Please keep in mind that specific details and rates may vary, and it's advisable to refer to the official documentation or contact Shikoku Alliance Securities directly for precise and up-to-date information regarding spreads and commissions.

| Pros | Cons |

| 50% discount on stock trading commissions compared to over-the-counter transactions | Higher commission fees for smaller contract amounts |

| Discounted commission fees for stock trading | Fractional share trading commission may lead to additional costs |

| Discounted purchase fees for domestic investment trusts | Purchases of investment trusts not eligible for sales commission discounts through online trading |

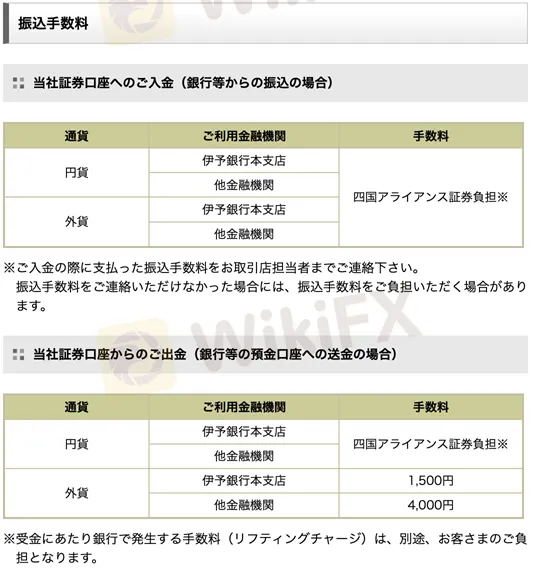

Shikoku Alliance Securities applies fees for certain transactions and services. Here is a general overview of the fees associated with transfers and withdrawals:

Transfer Fee:

- For payments made to securities account from a bank or other financial institution in Japanese yen, the commission fee will depend on customers financial institution.

- Specifically, if the customers are transferring funds from Iyo Bank Main Branch, there may be a commission fee charged by Shikoku Alliance Securities. It is recommended to contact the designated person at the transaction store for information regarding the transfer fee at the time of payment. Failure to inform the company of the transfer fee may result in the customer being required to pay the fee.

Withdrawal Fee:

- When withdrawing funds from securities account and remitting them to a bank account or other financial institution, the commission fee will depend on financial institution.

- If withdrawing Japanese yen to an Iyo Bank Main Branch, there may be a commission fee. Additionally, customers are responsible for the handling fee (lifting charge) imposed by the bank when receiving the money.

- For withdrawals in foreign currency to an Iyo Bank Main Branch, there is a fixed commission fee of 1,500 yen.

- For withdrawals foreign currency to another financial institution, there is a fixed commission fee of 4,000 yen.

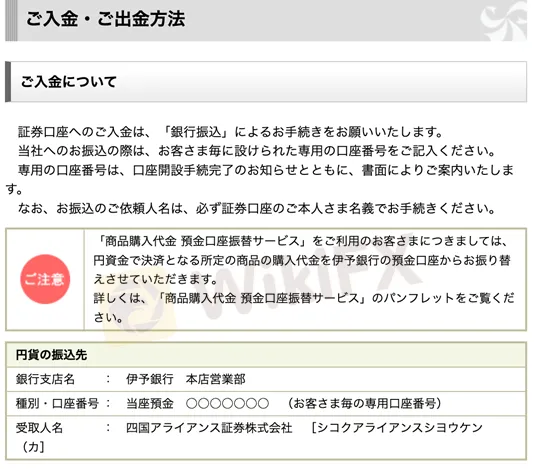

DEPOSIT:

For depositing funds into securities account with Shikoku Alliance Securities Co., Ltd., the recommended method is “bank transfer.” When making the transfer to the company, please ensure to enter the dedicated account number assigned to each customer.

Please note that customers utilizing the “商品購入代金 預金口座振替サービス” (Service for transferring purchase amounts from a deposit account) will have the purchase amount for designated products settled in Japanese yen by transferring funds from their Iyo Bank deposit account. For more details, please refer to the brochure for the “商品購入代金 預金口座振替サービス.”

Bank Transfer Details for Japanese Yen:

Bank Branch: Iyo Bank, Head Office Sales Department

Account Type/Number: Current Account ○○○○○○○ (Dedicated account number for each customer)

Recipient's Name: Shikoku Alliance Securities Co., Ltd. [シコクアライアンスシヨウケン(カ]

WITHDRAWAL:

As per the customer's instructions, Shikoku Alliance Securities will transfer funds within the range of Nomura MRF and deposits to the registered deposit account held in the customer's name.

Shikoku Alliance Securities provides various services with specific service times. Here is an overview of the service times for different types of transactions:

1. Domestic Stocks:

- Weekdays: Orders can be sent from 6:00 until the closing time of each exchange on that day. The execution date is on the same day. Cancellation and correction orders can be made from 6:00 on the day of each exchange closing time until 15:35. After 15:35 until 2:00 the next day, the cancellation and correction orders will be processed on the next working day.

- Holidays: Orders can be sent from 6:00 to 2:00 the next day. The execution date is on the next working day. Cancellation orders and correction orders can be made throughout the day until 6:00 on the next business day.

- The effective period of an order can be specified up to 7 business days after the first business day after the order is received. However, it cannot exceed the final contract date with rights. The validity period cannot be corrected.

2. Domestic Investment Trust:

- Weekdays: Orders can be sent from 6:00 until the closing time for each brand. The execution date is on the same day. Cancellation orders can be made from 6:00 on the day of each brand's closing time until the closing time for each stock (usually around 15:35). After 15:35 until 2:00 the next day, cancellation orders will be processed on the next business day.

- Holidays: Orders can be sent from 6:00 to 2:00 the next day. The execution date is on the next business day. Cancellation orders can be made from 6:00 on the next business day until the closing time for each issue.

- For periodical purchase contracts (application for investment trust accumulation contract), the hours of use are from 6:00 to 2:00 the next day on weekdays and holidays. Applications made after 20:00 will be processed on the next business day.

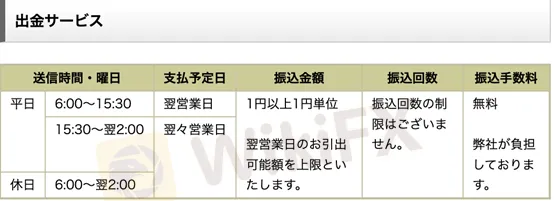

3. Withdrawal Service:

- Weekdays: Withdrawal requests can be sent from 6:00 to 15:30. The payment is due on the next working day.

- After 15:30 until 2:00 the next day and on holidays, withdrawal requests will be processed on the next business day.

- There is no limit on the number of transfers, and Shikoku Alliance Securities bears the transfer fee.

4. Electronic Delivery Service for Transaction Reports:

- Weekdays: Registration processing for electronic delivery of transaction reports and other documents is completed on the same day if the application is made between 6:00 and 19:00. Applications made between 19:00 and 2:00 the next day will be processed on the next working day.

- Holidays: Applications can be made from 6:00 to 2:00 the next day, and the processing will be done on the next business day.

It's important to note that these service times are subject to change, and it's advisable to refer to the official documentation or contact Shikoku Alliance Securities for the most up-to-date and accurate information regarding their service times.

Pros and Cons

| Pros | Cons |

| Wide availability of service hours | Limited service availability during holidays |

| Same-day execution for weekday orders | Limited time for cancellation and correction |

| Orders placed after 15:35 processed on next working day |

Shikoku Alliance Securities provides customer support through various channels to assist clients with their inquiries and concerns. Here is an overview of their customer support services:

1. Store Locator: To visit a physical branch, the Store Locator on the Shikoku Alliance Securities website is available to find the nearest branch location. The Store Locator tool will provide with the necessary information, such as address and contact details, to help locate the branch.

2. Toll-Free Number: For general inquiries and assistance, please contact the Shikoku Alliance Securities Sales Planning Department using their toll-free number: 0120-14-5514. This number allows to reach their customer support representatives free of charge.

3. Service Hours: The customer support service is available on weekdays from 8:45 AM to 5:00 PM. Please note that the service hours exclude Saturdays, Sundays, national holidays, and the year-end and New Year holiday period.

By contacting their Sales Planning Department, one can receive guidance and support regarding various aspects of Shikoku Alliance Securities' products, services, account-related inquiries, and any other assistance.

In conclusion, Shikoku Alliance Securities Co., Ltd. presents itself as a regulated institution in Japan, offering a range of financial products and services to individual and corporate customers. The company holds a retail forex license and provides access to various market instruments, including domestic and foreign stocks, bonds, structured bonds, and foreign currency-denominated bonds. However, there are certain disadvantages to consider, such as the absence of trading software and the risk concerns raised by WikiFX. Additionally, specific details about the broker's website and contact information are not provided. While Shikoku Alliance Securities offers customer support and has a favorable regulatory score, potential clients should carefully evaluate the available information and conduct further research before making any investment decisions.

Q: Is Shikoku Alliance Securities a legitimate institution?

A: Based on the provided information, Shikoku Alliance Securities Co., Ltd. appears to be a legitimate institution. It is regulated by Japan's Financial Services Agency (FSA) and holds a retail forex license.

Q: What types of accounts does Shikoku Alliance Securities offer?

A: Shikoku Alliance Securities offers two types of accounts: Individual Customer Account and Corporate Customer Account. The Individual Customer Account is designed for individual investors, while the Corporate Customer Account is tailored for corporate entities.

Q: What market instruments does Shikoku Alliance Securities provide?

A: Shikoku Alliance Securities offers a diverse range of market instruments, including domestic stocks, foreign stocks, domestic bonds, foreign currency-denominated bonds, and structured bonds.

Q: What are the spreads and commissions associated with Shikoku Alliance Securities' services?

A: Shikoku Alliance Securities applies various fees and commissions for different types of transactions. The spreads and commissions can vary depending on the specific service. For example, brokerage commissions for domestic stocks are based on the contract amount and include tax, while stock trading commissions offer a 50% discount compared to over-the-counter transactions.

Q: What are the deposit and withdrawal options with Shikoku Alliance Securities?

A: Shikoku Alliance Securities recommends bank transfer as the preferred method for depositing funds into securities accounts. For withdrawals, the funds can be transferred within the range of Nomura MRF and deposited into the registered deposit account held in the customer's name.

Q: What are the service hours of Shikoku Alliance Securities?

A: The service hours of Shikoku Alliance Securities can vary depending on the type of transaction. For example, for domestic stocks and domestic investment trusts, orders can be sent on weekdays from 6:00 until the closing time of each exchange. Withdrawal requests can be sent on weekdays from 6:00 to 15:30.

Q: How can I contact customer support at Shikoku Alliance Securities?

A: Shikoku Alliance Securities provides customer support through various channels. You can use the Store Locator on their website to find the nearest branch location. Additionally, you can contact their toll-free number, 0120-14-5514, to reach their customer support representatives during the service hours on weekdays.

Sort by content

User comment

6

CommentsWrite a review

2022-11-22 14:53

2022-11-22 14:53

2022-11-21 18:16

2022-11-21 18:16 2022-11-17 11:54

2022-11-17 11:54 2022-11-17 11:36

2022-11-17 11:36

2022-11-17 10:36

2022-11-17 10:36