Company Summary

Note: JAS's official website: https://www.jas.hu/main/main/en is currently inaccessible normally.

JAS Information

JAS is an unregulated brokerage company registered in Hungary. The broker's official website has been closed, so traders cannot obtain more security information.

Is JAS Legit?

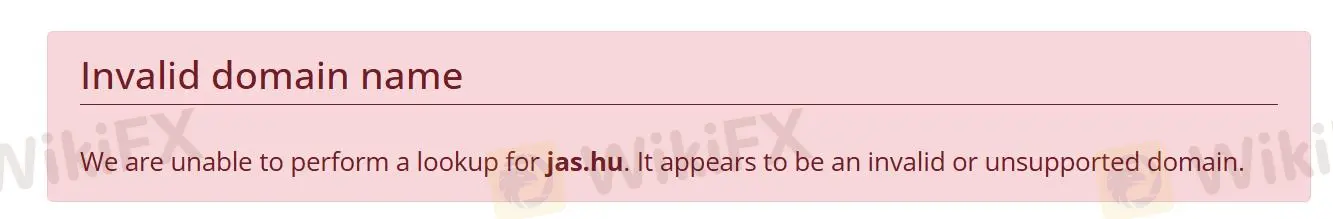

After a Whois query, we found that this company's domain name is invalid, which shows that this company has not registered it securely.

Downsides of JAS

- Unavailable Website

JAS's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since JAS does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

JAS domain name is invalid, which increases the possibility of fraud.

Conclusion

JAS Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status and invalid domain name indicate that this brokers trading risks are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.