Company Summary

| BMO Capital Markets Review Summary | |

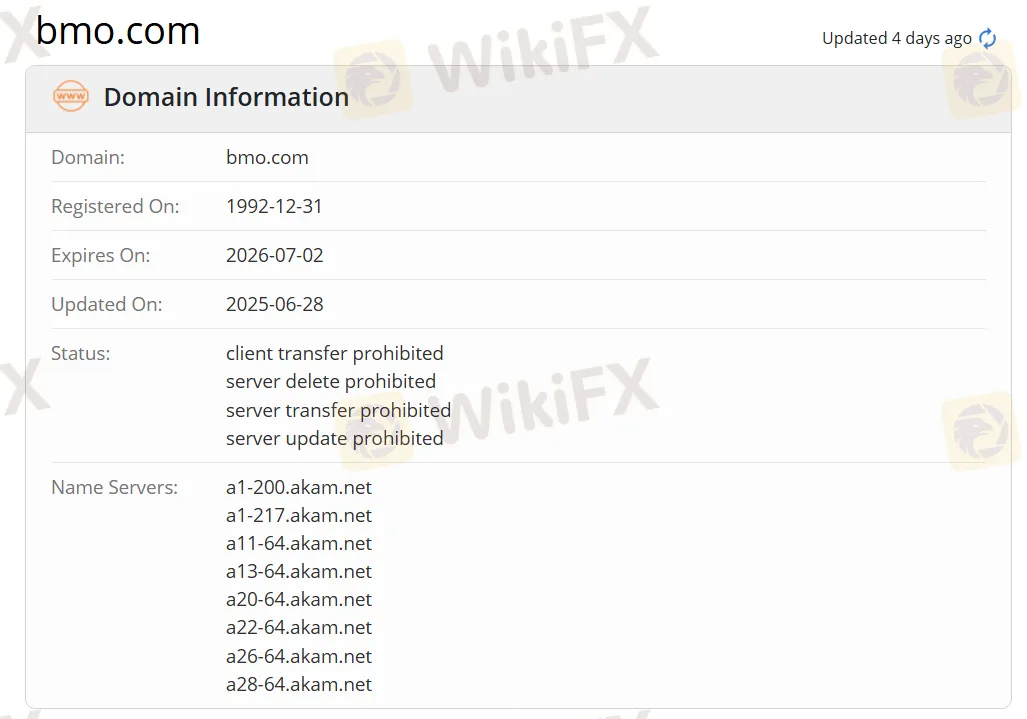

| Founded | 1992 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Exceeded) |

| Services | Capital Raising, Carbon Advisory, Carbon Markets, Credit Development, Global Banks & Global Trade, Institutional Investing, Investment Products, Market Risk Management, Research & Strategy, Sustainable Finance, Treasury Services |

| Customer Support | Social Media: YouTube, Twitter, LinkedIn, Facebook, Instagram |

BMO Capital Markets Information

BMO Capital Markets was established in 1992 and is registered in the United Kingdom. It operates across multiple sectors including energy transition, global metals and mining, real estate, and technology, and offers diversified services such as capital raising, carbon consulting, and sustainable finance.

Although the company claims to be regulated and holds an FCA license (number 170937), its regulatory status is marked as “exceeded”.

Pros and Cons

| Pros | Cons |

| Long history | Exceeded FCA license |

| Multiple services support | Unclear fee structure |

Is BMO Capital Markets Legit?

BMO Capital Markets holds an FCA license with license number 170937, but it is marked as “exceeded.” Although BMO Capital Markets claims on its official website that it is regulated, it is unregulated. Traders should exercise caution and use funds prudently when trading.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | Exceeded | BMO Capital Markets Limited | Investment Advisory License | 170937 |

BMO Capital Markets Services

BMO Capital Markets' business spans multiple industries, including diversified industries, financial institutions, financial sponsors, food and retail, energy (particularly energy transition), global metals and mining, power, utilities and infrastructure, healthcare, industrial, real estate, regional investment banking, and technology.

BMO Capital Markets offers a wide range of services, including Capital Raising, Carbon Advisory, Carbon Markets, Credit Development, Global Banks & Global Trade, Institutional Investing, Investment Products, Market Risk Management, Research & Strategy, Sustainable Finance, Treasury Services.