What is CJC Markets?

Based in Auckland, New Zealand, CJC Markets (Carrick Just Capital Markets Limited) is a regulated online NDD (No Dealing Desk) trading broker that allows clients to trade multiple financial assets with flexible leverage up to 1:400 and floating spreads on the MT4 trading platform via 3 different live account types, as well as 24/5 customer support service.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros & Cons

CJC Markets has several advantages including a wide range of tradable instruments, a variety of deposit and withdrawal options, and 24/5 customer support. However, there are also some significant drawbacks, including high minimum deposit requirements, and mixed reviews from clients. Overall, traders should exercise caution and carefully consider these factors before deciding whether to trade with CJC Markets.

CJC Markets Alternative Brokers

There are many alternative brokers to CJC Markets depending on the specific needs and preferences of the trader. Some popular options include:

FP Markets - An ASIC and CySEC-regulated broker with a wide range of trading instruments, competitive spreads, and multiple trading platforms, suitable for both novice and experienced traders.

FXDD - An offshore broker offering ECN trading accounts with a variety of trading instruments and low spreads, but lacks regulatory oversight and has mixed reviews from clients.

Global Prime - An ASIC-regulated broker with a focus on transparency, offering ECN trading accounts with competitive spreads and a range of trading tools, but has limited trading instruments and high minimum deposit requirements.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Market Instruments

CJC Markets provides investors with 500+ instruments including Forex, Metals, Equity Indices, US Shares, Asia Shares, EUR Shares, Cryptocurrency CFDs. The broker provides access to more than 100 currency pairs, such as the EUR/USD, GBP/USD, and USD/JPY. Clients can also trade precious metals such as gold and silver, as well as a variety of equity indices such as the S&P 500 and the Nasdaq 100. CJC Markets also offers a broad selection of shares from the US, Europe, and Asia. Additionally, the broker provides access to popular cryptocurrency CFDs such as Bitcoin, Ethereum, Ripple, Litecoin, and Tether.

Account Types

There are three account options available on the CJC Markets platform: Standard, VIP and ECN. The minimum initial deposit for a Standard account is $1,000, way too high for most regular traders to get started. The high minimum initial deposit can be a disadvantage for many traders, especially beginners who want to start with a smaller amount of money.

However, the higher minimum deposit requirement for the Standard account may be suitable for more experienced traders who want access to higher leverage and other advanced trading features. The VIP and ECN accounts require a minimum initial deposit of $25,000 and $50,000 respectively, which may not be feasible for many traders.

Leverage

In terms of trading leverage, the maximum leverage for the Standard account is up to 1:400, up to 1:300 for the VIP account and up to 1:200 for the ECN account. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Spreads and commissions with CJC Markets are scaled with the accounts offered. Specifically, the spread starts from 1.5 pips on the Standard account, from 1 pip on the VIP account, and raw spreads on the ECN account. As for the commission, there is no commission charged on the Standard and VIP accounts, while unspecified on the ECN account.

While the Standard and VIP accounts do not charge commissions, the spreads are higher, which may not be as cost-effective in the long run. Traders should carefully consider their trading style and needs when choosing an account type with CJC Markets.

Below is a comparison table about spreads and commissions charged by different brokers:

Note that these rates are subject to change and may vary depending on account type and market conditions. Traders should always confirm the most up-to-date rates directly with the broker.

Trading Platform

CJC Markets offers the leading MT4 trading platform for iOS, Android, Windows, and Mac to meet a wide range of user needs. MT4 is currently the most popular forex trading platform on the market, with a user-friendly interface, and powerful charting tools. With a user-friendly interface, powerful charting tools, and a large number of custom indicators, MT4 is available for automated trading and EA trading, helping traders of all levels to develop different trading strategies and help traders to get ahead in the financial markets.

See the trading platform comparison table below:

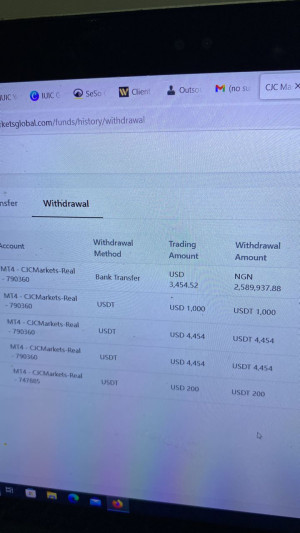

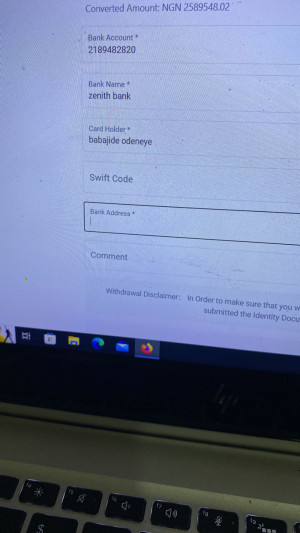

Deposits & Withdrawals

From the logos shown at the foot of the home page on CJC Markets official website, we found that this broker seems to accept numerous means of deposit and withdrawal choices, consisting of Visa, MasterCard, Bitcoin, bit wallet, BTPay, Bank Wire, dragon pay, help2ay, PayTrust, Skrill, Neteller, and Tether.

Having multiple payment options provides more convenience and flexibility for traders to deposit and withdraw their funds. It's worth noting that certain payment methods may have fees or restrictions, so it's essential to check with the broker's website or customer service before making any transactions.

CJC Markets minimum deposit vs other brokers

See the deposit & withdrawal fee comparison table below:

Note: Withdrawal fees for FXDD vary depending on the payment method used. Please refer to the broker's website for more information.

Customer Service

The CJC Markets customer support team can be contacted 24/5 through telephone, email, social media, or live chat. You can also follow this broker on social networks such as Facebook, Instagram and LinkedIn. FAQ section is also available. Alternatively, traders can visit their physical office in Auckland, New Zealand.

It's worth noting that having a physical office can provide additional peace of mind for traders who value face-to-face communication and transparency with their broker. The availability of multiple channels for customer support is also a plus, as traders can choose the most convenient way to reach out for help. However, the lack of 24/7 customer support may be a disadvantage for traders who need immediate assistance outside of regular business hours.

Please note that these pros and cons are based on the information available and may not be exhaustive.

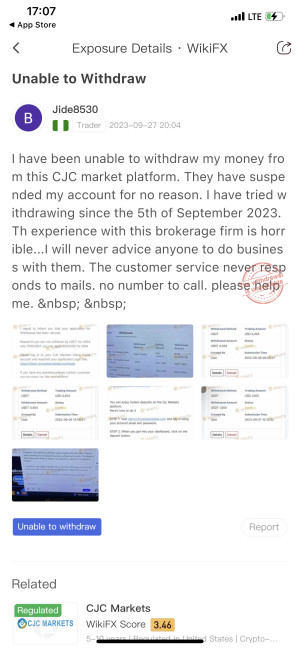

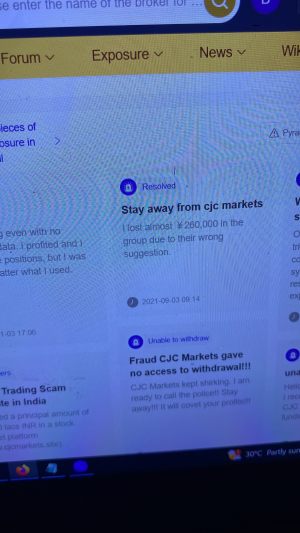

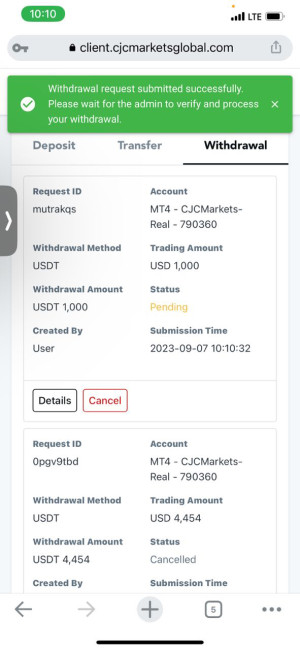

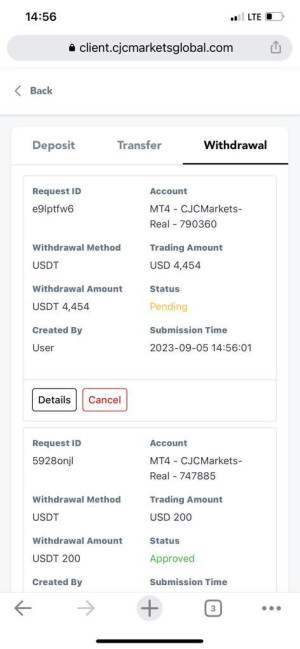

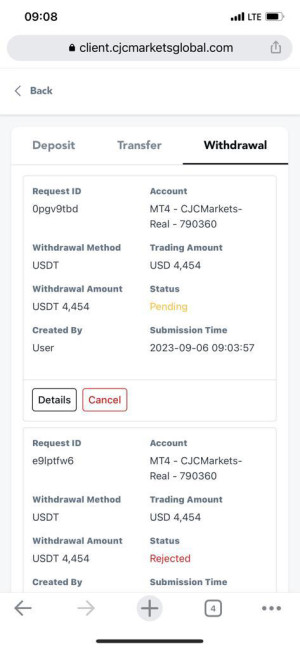

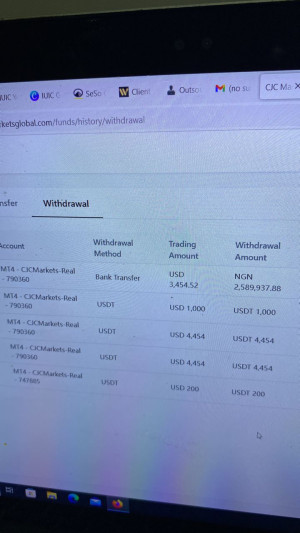

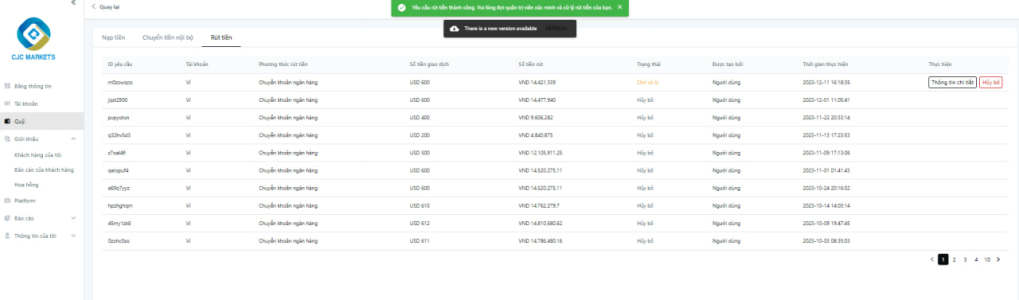

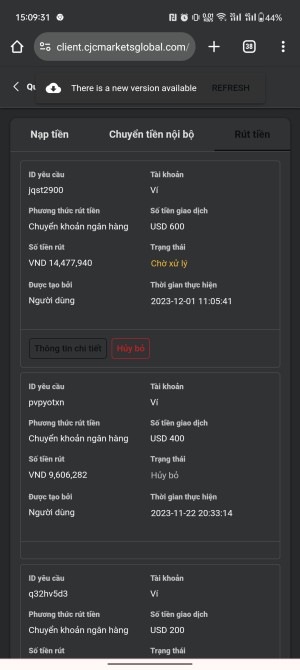

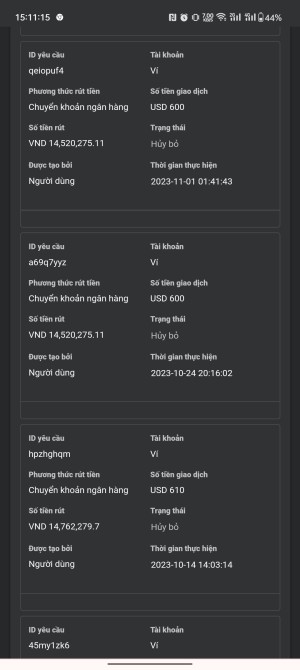

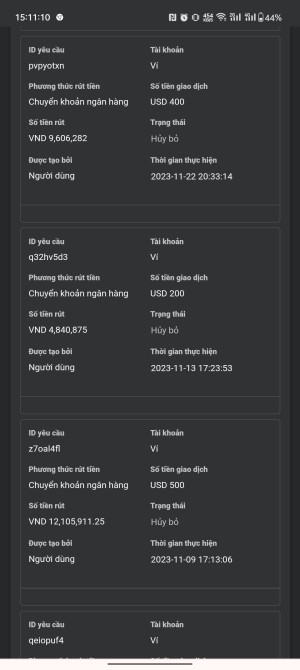

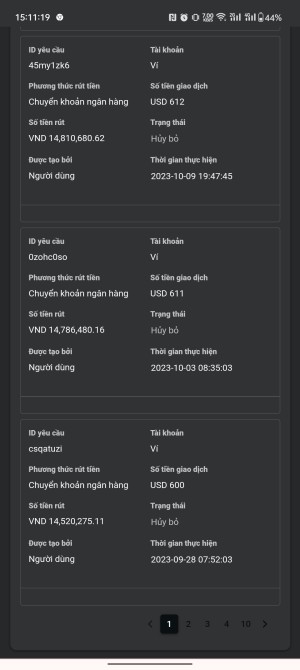

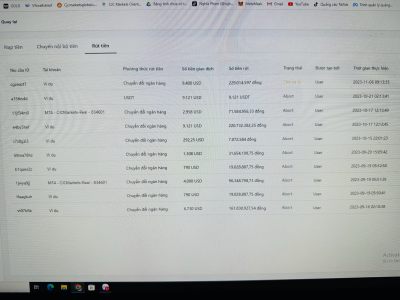

User Exposure on WikiFX

On our website, you can see that some users have reported scams and unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

Generally, CJC Markets is a regulated broker that provides a range of instruments. However, the high minimum deposit requirement and negative reviews from clients raise concerns about the safety of the platform. On the other hand, the broker offers balance protection up to $500, and there is a range of deposit and withdrawal options available. The customer support team can be contacted 24/5. Overall, traders should approach CJC Markets with caution and consider the potential risks before investing.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX