Company Summary

| Just2Trade Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Cyprus |

| Regulation | Regulated |

| Market Instruments | Forex, Stocks, Futures, CFDs, Bonds, Metals, Options, CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| Spread | 0.5 |

| Trading Platform | MT5, MT4, CQG, Sterling Trader Pro |

| Min Deposit | $100 |

| Customer Support | Phone: +357 25055966 |

| E-mail: 24_support@j2t.com | |

| Social Media: Facebook, Instagram, Linkedin, Youtube, Twitter | |

| Online Chat: 24/7 | |

| Physical Address: Lime Trading (CY) LtdMagnum Business Center, Office 4B, Spyrou Kyprianou Avenue 78Limassol 3076, Cyprus | |

Just2Trade Information

Just2Trade, founded in 2016, is from Cyprus. It is currently regulated by CYSEC and offers trading services for Forex, Stocks, Futures, CFDs, Bonds, Metals, Options, CFDs, etc. There are four trading platforms as well as three accounts for traders to choose from. In addition, this brokerage also supports commission and spread 0 start.

Pros and Cons

| Pros | Cons |

| Spreads can be as low as 0 pips | |

| Commission starts at $0 | |

| Diversified trading products | |

| 20+ withdrawal and deposit options | |

| 4 trading platforms |

Is Just2Trade Legit?

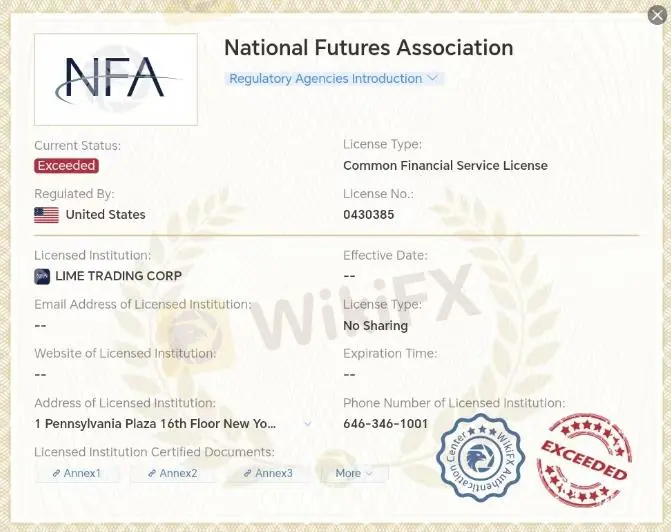

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| CYSEC | Lime Trading (cY) Ltd | Market Making(MM) | 281/15 | Regulated |

| NFA | LIME TRADING CORP | Common Financial Service License | 0430385 | Exceeded |

| CBR | Oбшество с ограниЧенной ответственность“ФИHAM ФOPEKC” | Retail Forex License | 045-13961-020000 | Suspicious Clone |

What Can I Trade on Just2Trade?

On Just2Trade, traders can trade more than 60 Forex pairs, 7 precious metals, stocks from 14 countries, more than 20 futures, a variety of bonds. Options and CFDs from the US and Poland can also be traded.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Futures | ✔ |

| CFDs | ✔ |

| Stocks | ✔ |

| Bonds | ✔ |

| Options | ✔ |

| CFDs | ✔ |

| ETF | ❌ |

| Commodities | ❌ |

Account Types

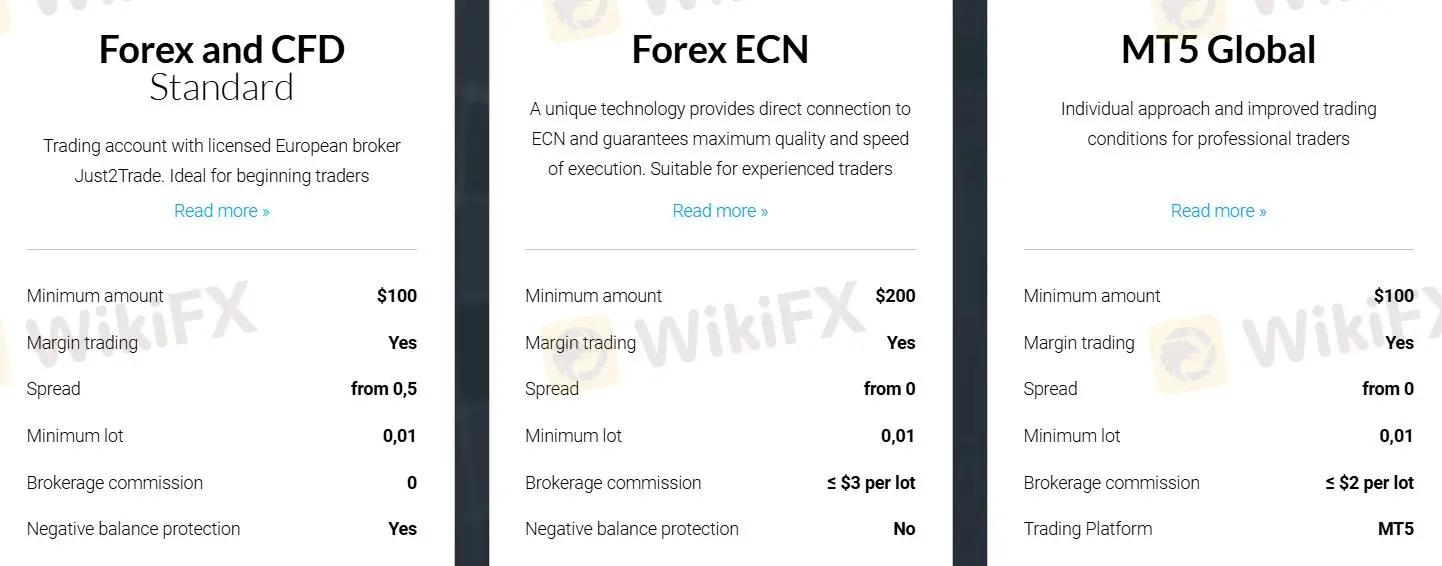

Just2Trade has three types of accounts -Forex and CFD Standard Account, Forex ECN Account and MT5 Global Account.

Of the three accounts, the minimum deposit requirement is $100, with spreads and commissions starting at 0.

| Account Types | Forex and CFD Standard | Forex ECN | MT5 Global |

| Minimum amount | $100 | $200 | $100 |

| Margin trading | Yes | Yes | Yes |

| Spread | from 0.5 | from 0 | from 0 |

| Minimum lot | 0.01 | 0.01 | 0.01 |

| Brokerage commission | $0 | ≤$3 per lot | ≤$2 per lot |

| Negative balance protection | Yes | No | - |

| Trading Platform | - | - | MT5 |

Just2Trade Fees

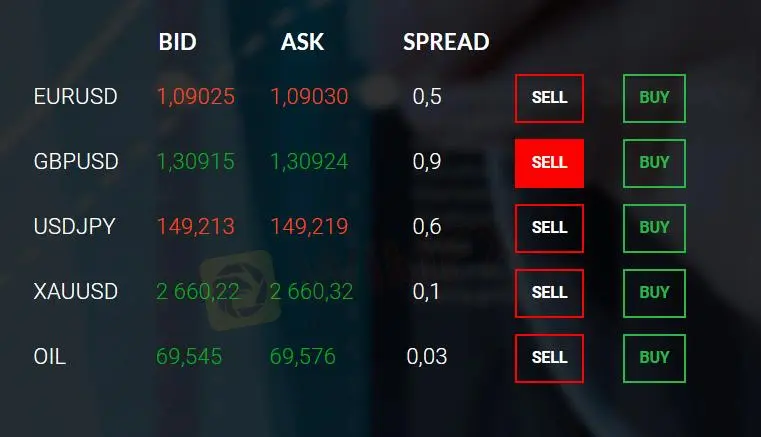

The spread of the three accounts can start from 0 and start from 0.5 respectively. Commissions range from $0 to $3 per lot.

In the forex pairs given by Just2Trade, the spread of EUR/USD is 0.5, and the spread of the rest of the forex pairs remains in the range of 0.03 to 0.9.

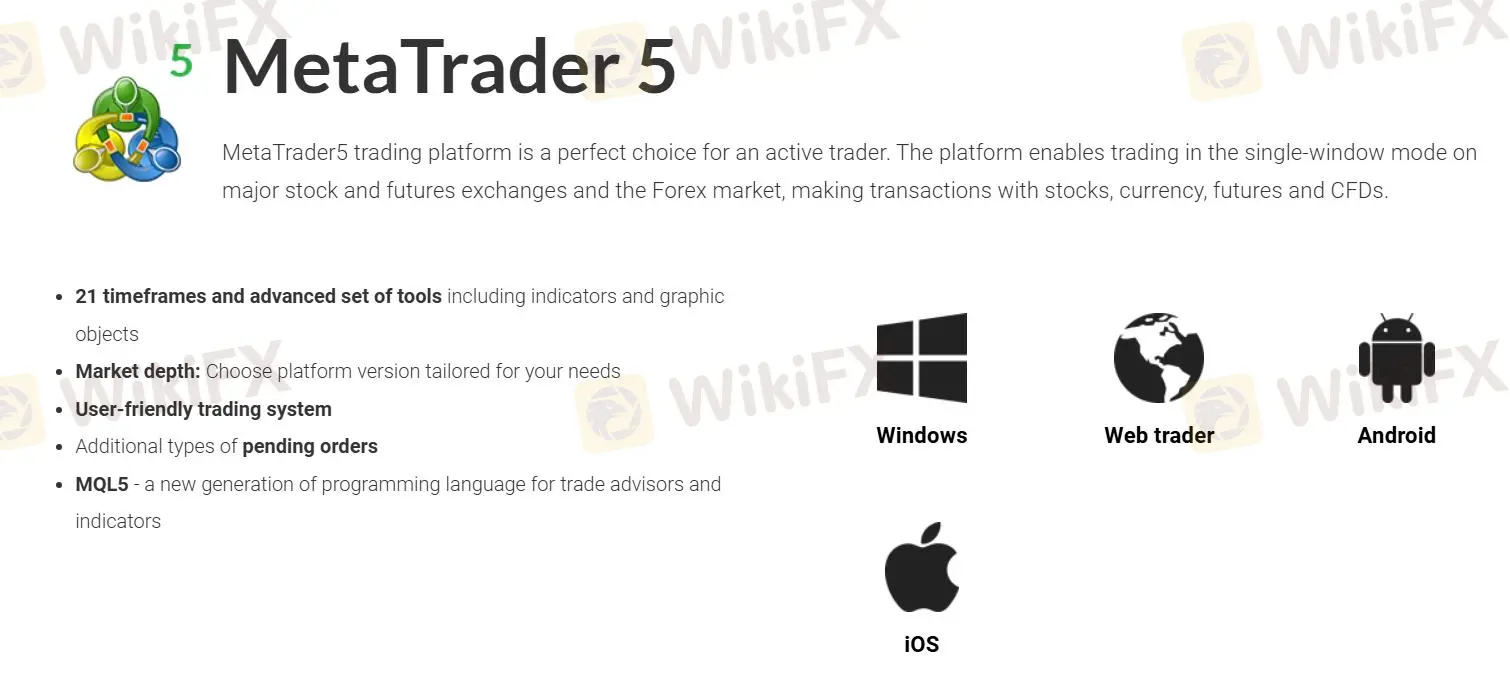

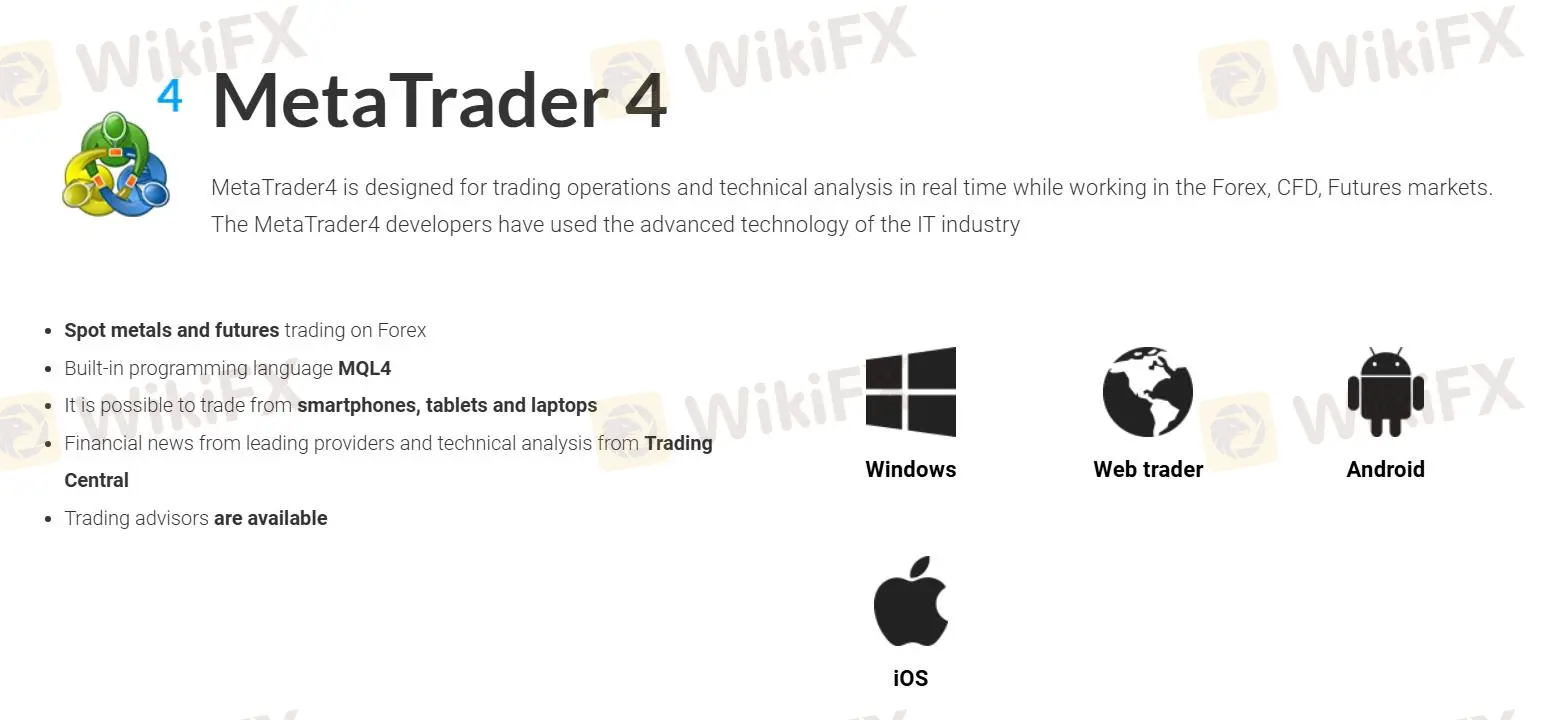

Trading Platform

Just2Trade supports 4 platforms MT5, MT4, CQG, Sterling Trader Pro. They can be used on different devices for a variety of traders.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, Desktop, Mobile | Skilled Trader |

| MT4 | ✔ | Web, Desktop, Mobile | Beginner |

| CQG | ✔ | Desktop, Mobile | Skilled Trader |

| Sterling Trader Pro | ✔ | Desktop | Skilled Trader |

Deposit and Withdrawal

Just2Trade has 20+ withdrawal and deposit options available in different currencies.

| Deposit Options | Commission | Currency | Processing Time |

| Bank Transfer | Your bank's fee | EUR, USD, RUB | 2-3 business days |

| Credit card | 0% | USD, EUR, RUB | instant funding |

| Skrill (Moneybookers) | 0% | USD, EUR | instant funding |

| Giropay (by Skrill) | 0% | USD, EUR | instant funding |

| iDeal (by Skrill) | 0% | USD, EUR | instant funding |

| Dankort (by Skrill) | 0% | USD, EUR | instant funding |

| Nordea (by Skrill) | 0% | USD, EUR | instant funding |

| POLi (by Skrill) | 0% | USD, EUR | instant funding |

| P24 (by Skrill) | 0% | USD, EUR | instant funding |

| Neteller | 0% | USD, EUR | instant funding |

| Klarna (by Skrill) | 0% | USD, EUR | instant funding |

| PayPal | 0% | USD, EUR, RUB | instant funding |

| OXXO | 0% | MXN | instant funding |

| SPEI | 0% | MXN | instant funding |

| Davivienda | 0% | COP | instant funding |

| 7eleven | 0% | MXN | instant funding |

| Local Cards in Mexico | 0% | MXN | instant funding |

| Withdrawal Options | Commission | Currency | Processing Time |

| FINAM Bank | RUB - 0%,USD - 0,5% (min. $10) | RUB, USD | 2-3 days |

| Transfer to another bank account | RUB - 500 RUB,USD - 0,4%(min. $80 - max. $1100, or custom if the amount > $250,000)EUR - 25 EUR(inside the bank - 10 EUR) | RUB, USD, EUR | 2 days |

| Neteller | 2% | USD, EUR | 2-days term |

| Direct payment in local currency (AstroPay) | 2.8% | BRL, COP, MXN, PEN, CLP... | 2-3 days |

| China UnionPay | 0% | CNY | During a day(if submitted until 2 p.m.) |

| Skrill (Moneybookers) | 2%, minimum commission 1 USD / 1 EUR | EUR | During a day |

| PayPal | 2% | EUR / USD / RUB | During a day |

| Credit Card | 2.5%, minimum commission €1/$1/₽50.Withdrawal commission is not charged, when refunding to the same card takes place. | EUR / USD / RUB | Usually 5-10 minutes from sending**(In rare cases, transfer to the card may take up to 5 days depending on issuing bank.) |

FX7829135422

Argentina

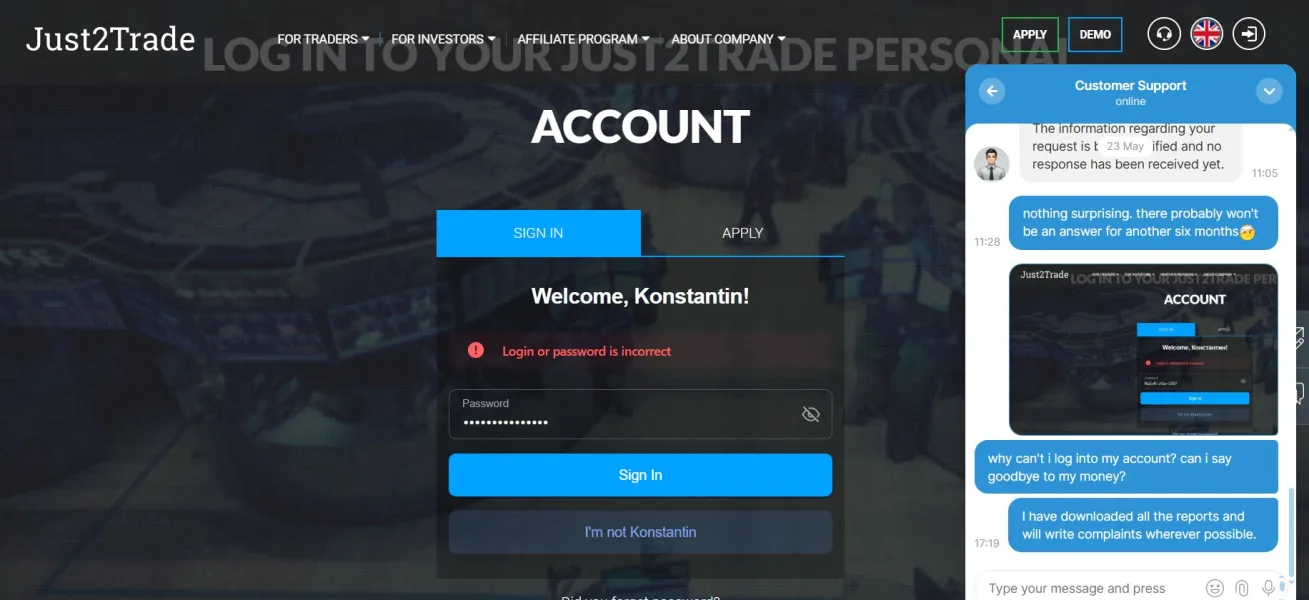

after 10 days about closing the account. they just closed the account with my money, writing that they moved it somewhere for storage and wait for a response. the broker is a scammer who will take your money and close your access to the account

Exposure

FX7829135422

Argentina

I traded with this company for 4 months, after two months I started having problems with withdrawals, the withdrawal button simply became inactive, technical support did not help at all. I decided to terminate the contract, but this did not work either, and only after 1.5 months they sent me a contract for termination, but even after that the withdrawal button is inactive and the company does not give any answers.

Exposure

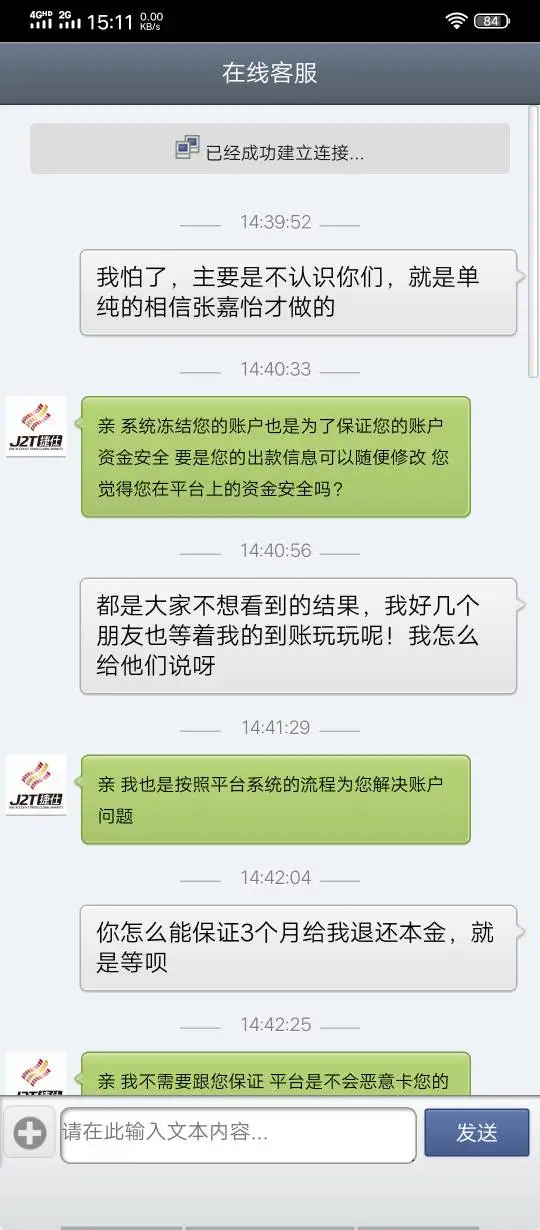

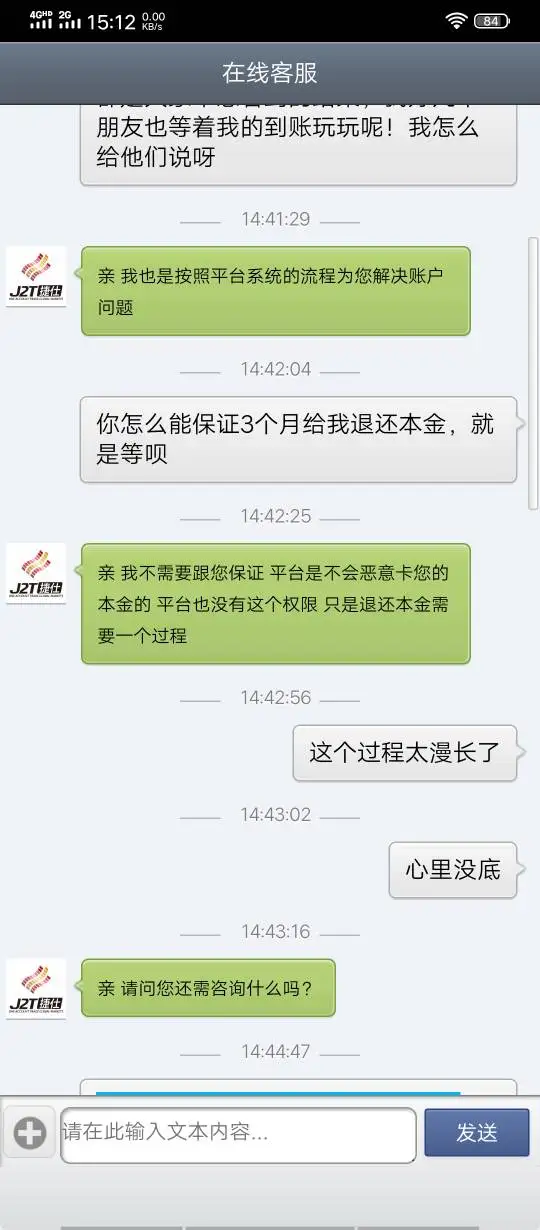

刘磊37740

Hong Kong

I deposited 70000 RMB in Just2Trade .After operation,the trader claimed that there was a risk in my account and advised me to add 70000 RMB to make a withdrawal.On the next day, they claimed that my bank information was wrong and asked me to add 190000 RMB again to unfreeze it.I felt cheated.It promised to return the fund in 3 months, which was a rip-off.

Exposure

bulent5114

Iran

STAUNCHVIEW.ORG really pleased me despite my lack of knowledge; they were kind and competent throughout the procedure, and I was able to withdraw money that I had assumed was gone forever. I would suggest them to anyone in a similar situation, and I am very grateful for the help you provided.

Neutral

Barolomew

Portugal

Just2Trade has been decent in my year of use. User-friendly platforms like MT4/5, tight spreads, and good regulation under CYSEC. They offer various instruments and 24/7 customer support. However, reports of withdrawal issues and scams are concerning. Exercise caution and research thoroughly.

Neutral

Quintillius

Spain

Their learning resources are downright lifesavers for beginners. But when we get to customer service, it's a bit of a mixed bag. Some days, they're quick off the mark; other days, they're slower than molasses in January. And as for the trading instruments - leaves a lot to be desired. If you're an old hand at trading and like options aplenty, Just2Trade might not hit the mark. But, for trading greenhorns, it's a decent starting point!

Neutral

kk1950

Hong Kong

Just2Trade is a good platform.

Positive

just 4644

Hong Kong

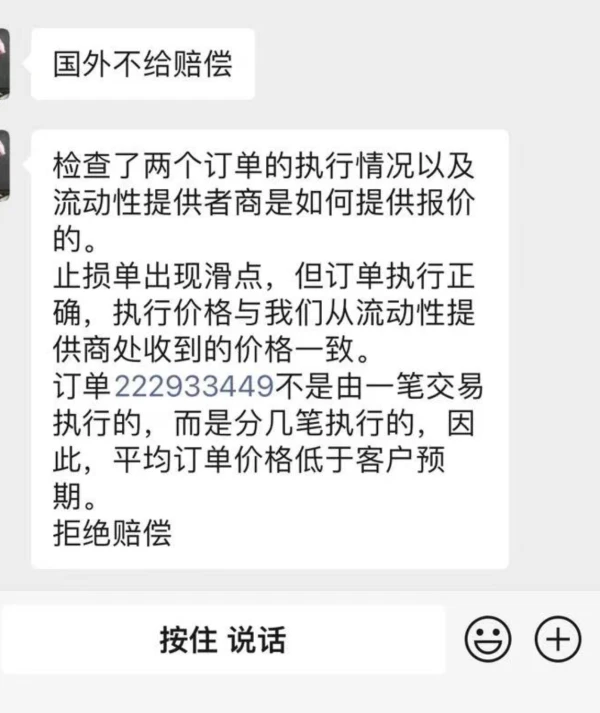

The short order for U.S. crude oil at 10.03 should be priced at 64.664, and the highest price is only 64.66, so let me slip the transaction at 64.71. The same is true for the stop loss. At that time, there was no quotation at this price, and the direct loss was more than 1,000 US dollars. It was originally a profit-making order, but I changed it to a loss. I asked customer service for an explanation and said that it was all handled by foreigners. They refused to pay. Slippage is normal. Bullying people, my monthly salary of several thousand yuan was cheated into depositing and investing in foreign exchange, and now I tell myself that making money is a slippage that leads to losses, is there any reason!! ! I saved the screenshots at the time as evidence! ! ! A fraud platform that takes everything from customer

Exposure

FX1215839020

Thailand

Just2Trade’s free CQG Desktop is my favorite, simple and user-friendly, serving as an excellent partner of my future trading and option trading. However, CQG Qtrader Costs $75 per month, not a good option for me.

Neutral

霄辰

Taiwan

I love using Just2Trade, and its excellent trading environment made me feel quite comfortable. I didn’t encounter any big problems when trading with this broker, like inability to withdraw funds. Overall, I recommend it.

Neutral

FX3689531922

Hong Kong

My two usd/try orders on the mt5 platform on 2022/6/9 were liquidated. First of all, I opened a hedging order, and there should be no losses on both sides of the liquidation. Second, regarding the quotation at that time, it is obviously a wrong quotation or deliberate slippage. I see that other brokers did not have such a big price difference at that time. Needless to say, the quotation of just2trade itself on mt4 at that time was the same as that of my trading account. The price difference is very far. Under normal circumstances, the two should be the same and within a few points at most, but the difference between the lowest price at that time was more than 4,000 points, and the price that I was liquidated did not appear on mt4. It was obviously me. The account has been deliberately slipped or the quotation is wrong. Therefore, my position should not be liquidated, I should be compensated accordingly, please help me to report the problem.

Exposure

I一帆风顺

Hong Kong

This platform deceive me to deposit and does not allow to withdraw. The customer service manager blocked me on Wechat and said that they just scam me and will not withdraw a penny for me. It is useless to expose.

Exposure

FX2511275637

Hong Kong

Cannot withdraw after deceiving me to deposit. After I make a research on the internet, everyone is exposing this fraud platform. Suggest everyone stays away from fraud platform.

Exposure

I一帆风顺

Hong Kong

Beware and stay away from this platform. It was likely to run away. Please withdraw at once to avoid losses. The customer service was of bad attitude. They rejected all withdrawal.

Exposure

I一帆风顺

Hong Kong

Unable to withdraw. They stole my money, which annoyed me so much.

Exposure

I一帆风顺

Hong Kong

Unable to withdraw. They did not reply for several months. They answered that I deserved it.

Exposure

I一帆风顺

Hong Kong

It deducted $370 from my principal. Severe slippage. My commission decreased $1500. The customer service ignore my problem.

Exposure

I一帆风顺

Hong Kong

Stay away from it. I was cheated by it and lost $1500.

Exposure

I一帆风顺

Hong Kong

Stay away from it.

Exposure

I一帆风顺

Hong Kong

It deducted $370 from my account.

Exposure

I一帆风顺

Hong Kong

I suffered losses of thousands of dollars and it even took $370 from my balance.

Exposure

I一帆风顺

Hong Kong

It scammed me of hundreds of dollars. Stay away from it.

Exposure

I一帆风顺

Hong Kong

Unable to withdraw. It got my principal away after I deposited. Stay away from just2trade.

Exposure