CWG Markets Information

CWG Markets is a regulated international broker offering a diverse range of CFD trading instruments, including forex, indices, commodities, and futures. With a focus on trust and security, the platform provides global traders with access to competitive spreads, advanced trading technology, and multilingual support.

Pros & Cons

CWG Markets is a trading platform that offers a range of financial instruments for traders.

One notable advantage of CWG Markets is its user-friendly interface, which makes it easy for both beginners and experienced traders to navigate the platform. Additionally, the platform provides access to a wide variety of markets, including forex, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios. Another benefit is the availability of educational resources, such as webinars and tutorials, which can help traders enhance their knowledge and skills.

On the downside, some users have reported occasional technical issues, such as slow execution times and occasional server interruptions. Overall, CWG Markets offers a user-friendly platform with a diverse range of trading options, but it could benefit from addressing technical issues.

Is CWG Markets Legit?

According to the information provided, CWG Markets is regulated by two different authorities:

Financial Conduct Authority (FCA): CWG Markets Ltd is licensed and regulated by the Financial Conduct Authority in the United Kingdom. Their license number is 785129, and they are authorized for Market Making (MM) activities. The address of the licensed institution is 76 Cannon Street, 3rd Floor, London, EC4N 6AE, United Kingdom.

2. Vanuatu Financial Services Commission (VFSC): CWG Markets Ltd is also licensed by the Vanuatu Financial Services Commission. Their license number is 41694, and they hold a Retail Forex License under the offshore regulation.

Please be aware that the offshore regulation in Vanuatu may come with certain risks, as indicated by the WikiFX Risk Alerts that mention the offshore regulation and the number of complaints received in the past 3 months. It's recommended to exercise caution and conduct further research before engaging in any financial activities with CWG Markets.

Market Instruments

Foreign exchange, precious metals, crude oil, global hot stocks, stock indexes, futures, spots and other CFDs .....CWG Markets allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on CWG Markets.

Forex: CWG offers a range of forex instruments, including major currency pairs such as EURUSD, AUDUSD, GBPUSD, USDCHF, USDJPY, and USDCAD. These instruments allow traders to speculate on the exchange rate fluctuations between different currencies. The forex market is the largest and most liquid market globally, providing opportunities for traders to engage in currency trading.

CFD Stock: CWG provides Contract for Difference (CFD) instruments on various stocks. These CFDs allow traders to speculate on the price movements of individual stocks without owning the underlying asset. Some of the stocks offered by CWG include ADBE (Adobe Inc), AMZN (Amazon.com Inc), ATVI (Activision Blizzard Inc), BIDU (Baidu Inc), PEP (PepsiCo Inc), C (Citigroup Inc), COP (ConocoPhillips), DAL (Delta Air Lines Inc), DELL (Dell Technologies Inc), JPM (JPMorgan Chase & Co), and F (Ford Motor Co).

Precious Metals: CWG offers trading instruments on precious metals like XAGUSD (Silver) and XAUUSD (Gold). These instruments allow traders to speculate on the price movements of these precious metals. Precious metals are often considered as safe-haven assets and can serve as a hedge against inflation or economic uncertainties.

Energy: CWG provides trading instruments related to energy markets. UKOIL (Brent Crude Oil) and USOIL (WTI Crude Oil) are offered by CWG. These instruments allow traders to participate in the price movements of these energy commodities, which are influenced by factors such as supply and demand dynamics, geopolitical events, and global economic conditions.

Indices: CWG offers trading instruments based on various global stock indices. These indices represent the performance of a group of stocks from specific regions or sectors. Some of the indices available for trading include DE30 (Germany 30), FR40 (France 40), ES35 (Spain 35), EU50 (Euro Stoxx 50), HK50 (Hong Kong 50), JP225 (Japan 225), and US500 (US 500). Traders can speculate on the overall performance of these indices without directly owning the underlying stocks.

Commodity Futures: CWG provides trading instruments on commodity futures. These instruments allow traders to speculate on the future price movements of commodities like UK100NGAS (UK Natural Gas), COPPER, and USOIL (Crude Oil). Commodity futures trading involves predicting the price direction of these commodities and taking positions accordingly.

Spreads & Commissions

Spreads and commissions in CWG Markets vary based on the type of instrument and account. Taking the example of an advanced account, the spreads are typically as low as 0.0 pips, indicating a potentially narrow spread between the bid and ask price. On the other hand, there is a commission of $3 per side, which means that for each trade, there would be a separate charge for opening and closing the position.

Account Types

Demo Account: CWG Markets provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: CWG Markets offers a total of 3 account types: classic, advanced and institutional. The minimum deposit to open an account is $50, $200 and $50,000 respectively. If you are still a beginner and don't want to invest too much money in Forex trading, a classic account will be the most suitable option for you. However, we should also realize that too little capital not only reduces losses, but also reduces profitability. Therefore, you may find it “unexciting” or unprofitable. In addition, accounts with smaller initial deposits tend to have poorer trading conditions.

How to Open an Account?

To open an account with CWG Markets, you can follow these steps:

Visit the CWG Markets website: Go to the official website of CWG Markets, which is www.cwgmarkets.co.uk.

Register: Look for the ‘Open a live account’ button on the website and click on it. You will be directed to the registration page.

3. Fill in personal information: Provide the required personal information, including your full name, email address, phone number, and country of residence. In this case, since you are from the United States, select the United States as your country.

4. Phone Number: Enter your phone number accurately as requested.

5. Email Verification: You will receive an email verification code to the email address you provided. Check your inbox and enter the verification code in the appropriate field on the registration page.

6. Set Password: Create a password for your CWG Markets account. The password should be between 8 to 15 characters and must contain both uppercase and lowercase letters. Make sure to choose a strong and secure password that you can remember.

7. Complete the registration: After setting your password, review the terms and conditions, and any other relevant information provided by CWG Markets. If you agree to the terms, click on the “Register” or “Sign Up” button to complete the registration process.

8. Account Verification: Depending on the requirements of CWG Markets, you may need to verify your identity and provide additional documents to activate your account fully. Follow the instructions provided by CWG Markets to complete the verification process if necessary.

Trading Platforms

Trading platforms offered by CWG Markets:

CWG MetaTrader 4: MetaTrader 4 is a widely recognized and popular trading platform used by millions of traders worldwide. It provides a user-friendly interface and a comprehensive set of trading tools. Traders can access the platform from various devices, including Windows computers. The platform offers features like real-time market quotes, advanced charting capabilities, and the ability to execute trades with multiple order types.

2. CWG MetaTrader 5: MetaTrader 5 is another industry-leading trading platform offered by CWG Markets. It is chosen by banks and traders from over 30 countries. Traders can download and install the platform on their Windows devices to access a wide range of trading instruments. MetaTrader 5 provides enhanced trading features, improved charting tools, and advanced order execution options. Additionally, CWG Markets offers the MetaTrader 5 app for Android and iOS devices, allowing traders to trade on the go.

Leverage

Although some brokers offer leverage up to 1:500 or even 1:1000, the leverage of 1:100 offered by CWG Markets is sufficient for the average trader. This is because the more leverage you have, the more risk you take with your money. Even professional traders, let alone novices, should not be tempted to use leverage as large as 1:500.

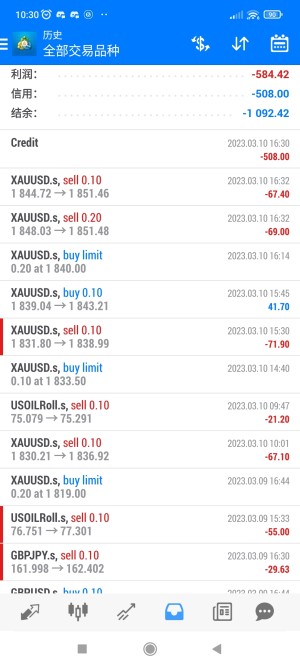

Deposit & Withdrawal

In terms of deposit and withdrawal, like many good brokers, CWG Markets provides a detailed form with important information about currency, payment method, minimum amount, arrival date, fees, etc. however, the feasible payment methods are only bank transfer, Skrill and neteller, and there is also an extra fee for the second and subsequent withdrawals per month and international bank transfer withdrawal below 500 USD.

Customer Support

The customer support of CWG Markets is available to assist traders with their inquiries and concerns. Here are the details regarding their customer service:

Language: The customer support is available in English.

Service Hours: The service hours for customer support are from Monday to Friday, 07:30-01:00 (GMT +8).

Email: Traders can reach out to CWG Markets through email at service@cwgmarkets.com for trading problems, complaints, suggestions, and account assistance. It is advised to use the registered email address and include relevant account details and questions for prompt support.

Phone: CWG Markets provides a hotline for global inquiries. The phone numbers are as follows: +44 2037699268 and +60 1800819380.

Address: The company's physical address is 1276, Govant Building, Kumul Highway, PORT VILA, VANUATU.

Social Media: CWG Markets can also be contacted through various social media platforms such as Facebook, Instagram, LinkedIn, YouTube, and Twitter.

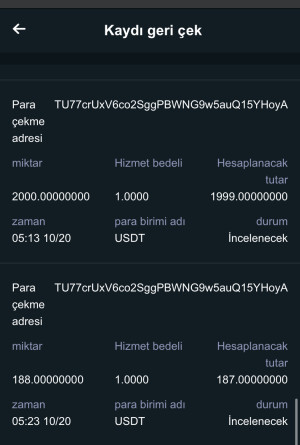

Users Exposure on WikiFX

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Trading Tools

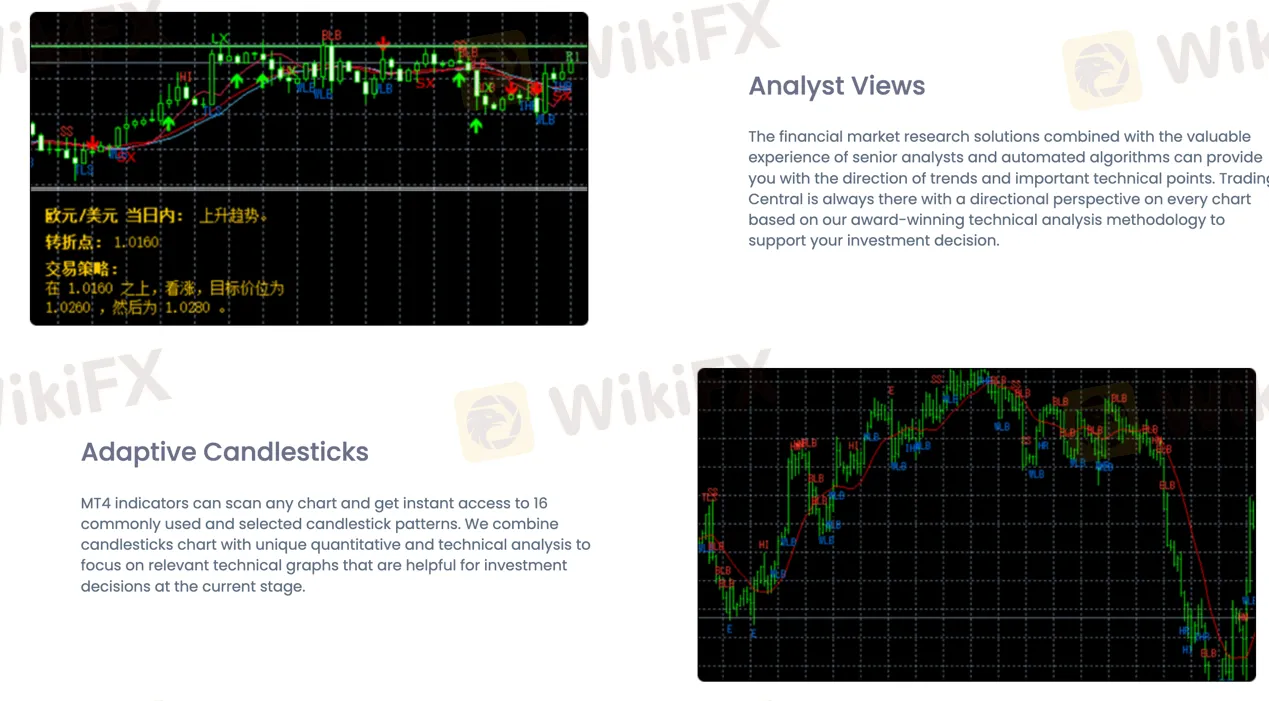

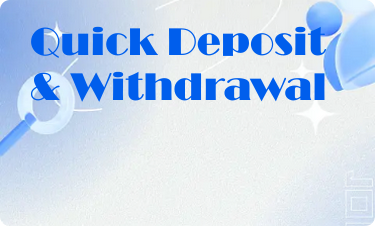

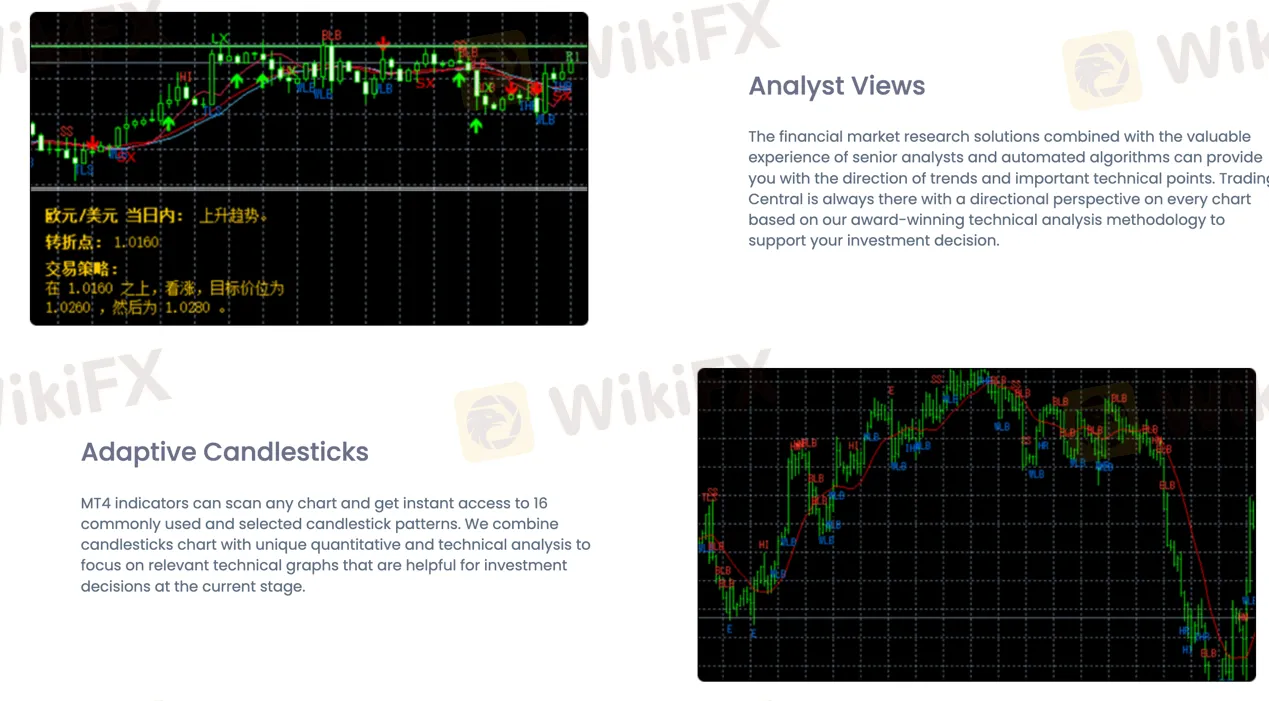

CWG Markets offers a range of trading tools to enhance the trading experience of its users. These tools include:

MT4 Indicators: CWG Markets provides powerful Trading Central technical analysis indicators integrated with the MetaTrader 4 (MT4) platform. These indicators help users identify trading opportunities in real time, increasing confidence in their trading decisions. They offer access to 16 commonly used candlestick patterns, combining candlestick charts with quantitative and technical analysis.

2. Economic Calendar: The Economic Calendar provided by CWG Markets offers real-time, actionable macro-economic data. Traders can easily monitor, anticipate, and act on potentially market-moving events. The calendar allows users to track each event in real-time and provides insights into how similar events have previously affected prices.

3. PAMM/MAM Software: The PAMM (Percent Allocation Management Module) and MAM (Multi-Account Manager) software is designed for asset managers and traders who manage multiple accounts. It broadens the capabilities of the MetaTrader platform, allowing the management of multiple accounts through a single interface. This software is particularly useful for those who use Expert Advisors (EAs) for trading.

4. API Trading: CWG Markets offers API trading, which enables users to connect their trading accounts with custom-built platforms. With API integration, traders gain direct access to CWG's ecosystem, allowing for faster order execution and more control over their trading. API trading provides live market data, historical prices, and the ability to execute trades without manually searching for information from various sources.

Educational Resources

CWG Markets provides a range of educational resources to support traders in making informed decisions and enhancing their trading skills. These resources include:

CWG TV: CWG TV offers video tutorials and educational content covering various aspects of trading, including strategies, technical analysis, market trends, and more. It provides traders with visual and engaging materials to better understand trading concepts.

Daily Analysis: CWG Markets provides daily analysis reports that cover important market events, news, and economic indicators. This analysis helps traders stay updated with the latest market developments and make more informed trading decisions.

Technical Views: Technical analysis is a crucial tool for traders, and CWG Markets offers technical views that provide insights into price patterns, trends, and key support and resistance levels. Traders can leverage this information to identify potential entry and exit points for their trades.

Featured Ideas: CWG Markets delivers personalized trade ideas in real-time through their Featured Ideas service. These ideas are generated based on both technical and fundamental analysis, and they can assist traders in identifying potential investment opportunities.

Glossary: CWG Markets provides a glossary of trading terms and definitions to help traders understand commonly used terminology in the financial markets. This resource can be particularly useful for beginners who are new to trading.

Overall, the educational resources offered by CWG Markets aim to empower traders with the knowledge and insights they need to make confident trading decisions. By providing access to analysis, educational videos, trade ideas, and a glossary, traders can enhance their understanding of the markets and develop their trading skills.

Conclusion

In conclusion, CWG Markets is a regulated brokerage firm, authorized by the Financial Conduct Authority (FCA) in the United Kingdom and the Vanuatu Financial Services Commission (VFSC) under offshore regulation. CWG offers forex pairs, CFD stocks, precious metals, energy commodities, global indices, and commodity futures, providing traders with diverse trading opportunities. It offers multiple account types, including Islamic accounts, and provides a range of trading instruments through the popular MetaTrader 4 and MetaTrader 5 platforms.

However, some drawbacks include limited feasible payment methods, higher minimum deposits for certain account types, and the reduced WikiFX score due to complaints. Traders should also consider the offshore regulatory oversight and exercise caution before engaging in financial activities with CWG Markets.

FAQs

Is CWG Markets regulated?

Yes, CWG Markets is regulated by two different authorities. They are licensed and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with license number 785129 for Market Making (MM) activities. They are also licensed by the Vanuatu Financial Services Commission (VFSC) with license number 41694 for a Retail Forex License under offshore regulation.

What is the leverage ratio offered by CWG Markets?

1:100.

What are the available trading platforms at CWG Markets?

MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

What are some of the trading tools offered by CWG Markets?

CWG Markets offers a range of trading tools, including MT4 indicators for technical analysis, an Economic Calendar for monitoring market events, PAMM/MAM software for management of multiple accounts, and API trading for direct access and faster execution.

What educational resources are provided by CWG Markets?

CWG Markets provides educational resources such as video tutorials through CWG TV, daily analysis reports, technical views for price patterns and trends, personalized trade ideas, and a glossary of trading terms.

Risk Warning

Online trading involves huge risks and you can lose all your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained herein is for general information purposes only.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX