Company Summary

| FPG SecuritiesReview Summary | |

| Founded | 2013 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Services | Aircraft investment services |

| Trading Platform | FPG Securities |

| Customer Support | Contact form |

| Tel: 03-5220-4200 (Monday ~ Friday 9:30 ~ 17:00) | |

| Fax: 03-5220-4230 | |

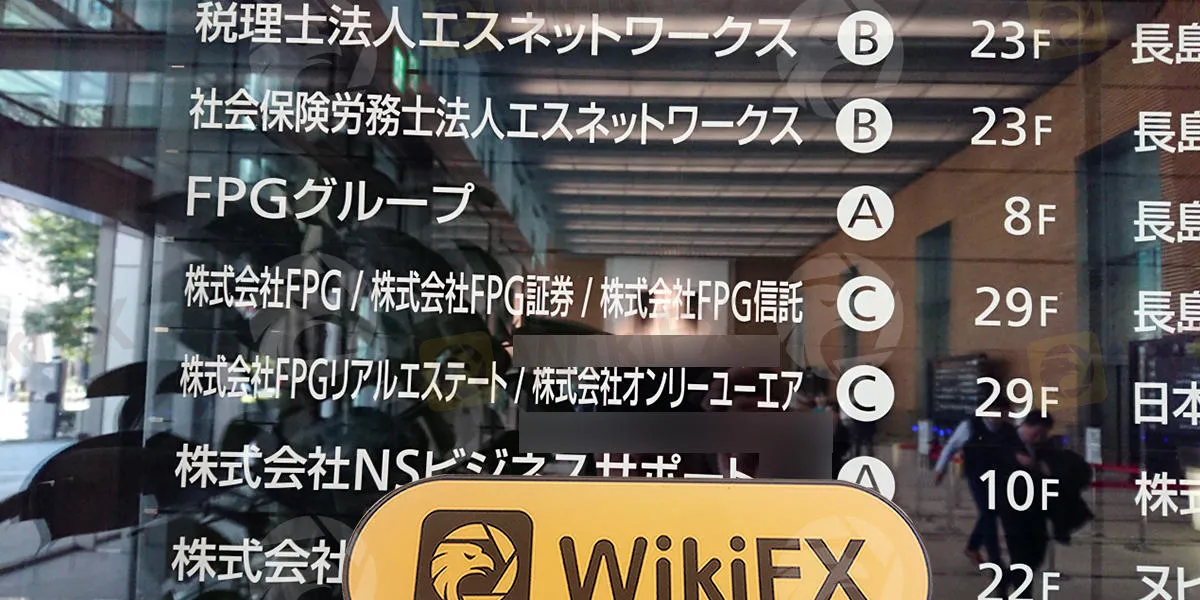

| Office: JP Tower 29th Floor, 2-7-2 Marunouchi, Chiyoda-ku, Tokyo 100-7029 | |

FPG Securities was registered in 2013 in Japan, which mainly specializes in aircraft investment services. It is regulated well by FSA in Japan, and it provides different channels for customer support.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited types of services |

| Long operation time | |

| Multiple channels for customer support | |

| Physical office proved |

Is FPG Securities Legit?

FPG Securities is regulated by Financial Services Agency (FSA) in Japan.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | 株式会社FPG証券 | Japan | Retail Forex License | 関東財務局長(金商)第153号 |

WikiFX Field Survey

WikiFX field survey team visited FPG Securities' address in Japan, and we found its physical office on site.

FPG Securities Service

FPG Securities provides services on aircraft investment. FPG Securities expertises in aircraft leasing, and customers do not need to file a tax return.

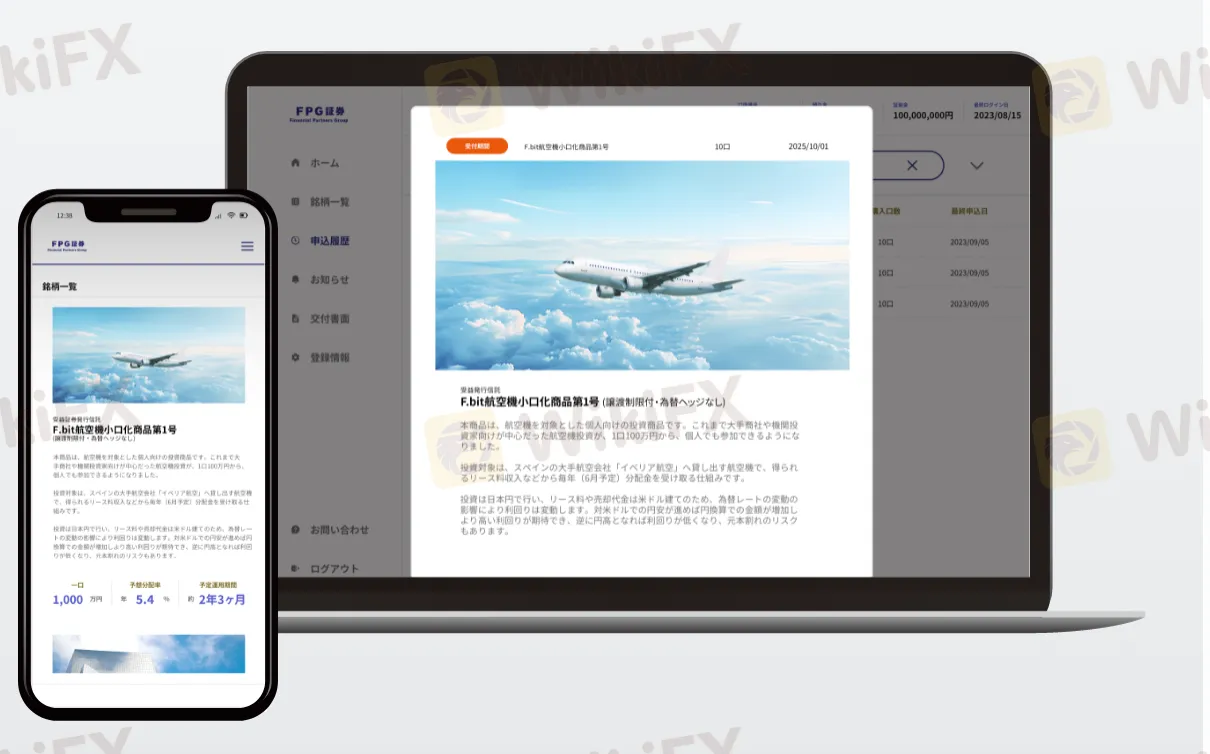

Trading Platform

FPG Securities uses its own trading platforms which can be accessed via PC and mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| FPG Securities | ✔ | PC, web, mobile | / |