Company Summary

| Aspect | Information |

| Registered Country/Area | Belize |

| Founded Year | 2014 |

| Company Name | RS Global Ltd |

| Regulation | FSC, CYSEC |

| Minimum Deposit | $50 |

| Maximum Leverage | Up to 1000:1 |

| Spreads | From 0.9 pips |

| Trading Platforms | MT4, MT5, |

| Tradable Assets | CFDs on Currencies, Indices, Metals, Commodities, Energies, Shares, Fractional Stocks |

| Account Types | One Account, Scope Invest, Scope Elite |

| Demo Account | Yes |

| Islamic Account | Yes |

| Customer Support | Tel: +44 20 3519 3851 asiasupport@scopemarkets.com |

| Payment Methods | CUP, DC/EP, Alipay |

| Educational Tools | Economic Calendar, Dividends Calendar, Video Tutorials |

Overview of Scope Markets

Established in 2014 and regulated in multiple jurisdictions, Scope Markets is a part of the Rostro Group, a leading fintech and financial services provider. Scope Markets provides access to over 40,000 financial instruments, including equities, forex, commodities, and indices through popular powerful trading platforms like MT4, MT5, CQG, IRESS, and Bloomberg.

Scope Markets claims that it empowers clients to participate in global financial markets with its innovation and technology.

*The information published has different terms for SM Capital Markets Ltd (CySEC entity).

Pros and Cons

| Pros | Cons |

| Regulated by Cyprus Securities and Exchange Commission (CySEC) | Limited operating history (1-2 years) |

| Offers trading on indices, futures, spot energies, precious metals, shares, cryptocurrencies, and ETFs | Limited variety of account types |

| Provides access to over 40 forex currency pairs | Commission applies to CFD shares |

| Demo account available | |

| Various account types | |

| Maximum leverage up to 200:1 | |

| Multiple MT5 Version | |

| Offers trading tools like PIP Calculator, Margin Calculator, Swap Calculator, and Profit Calculator | |

| Deposit and withdrawal options with no fees |

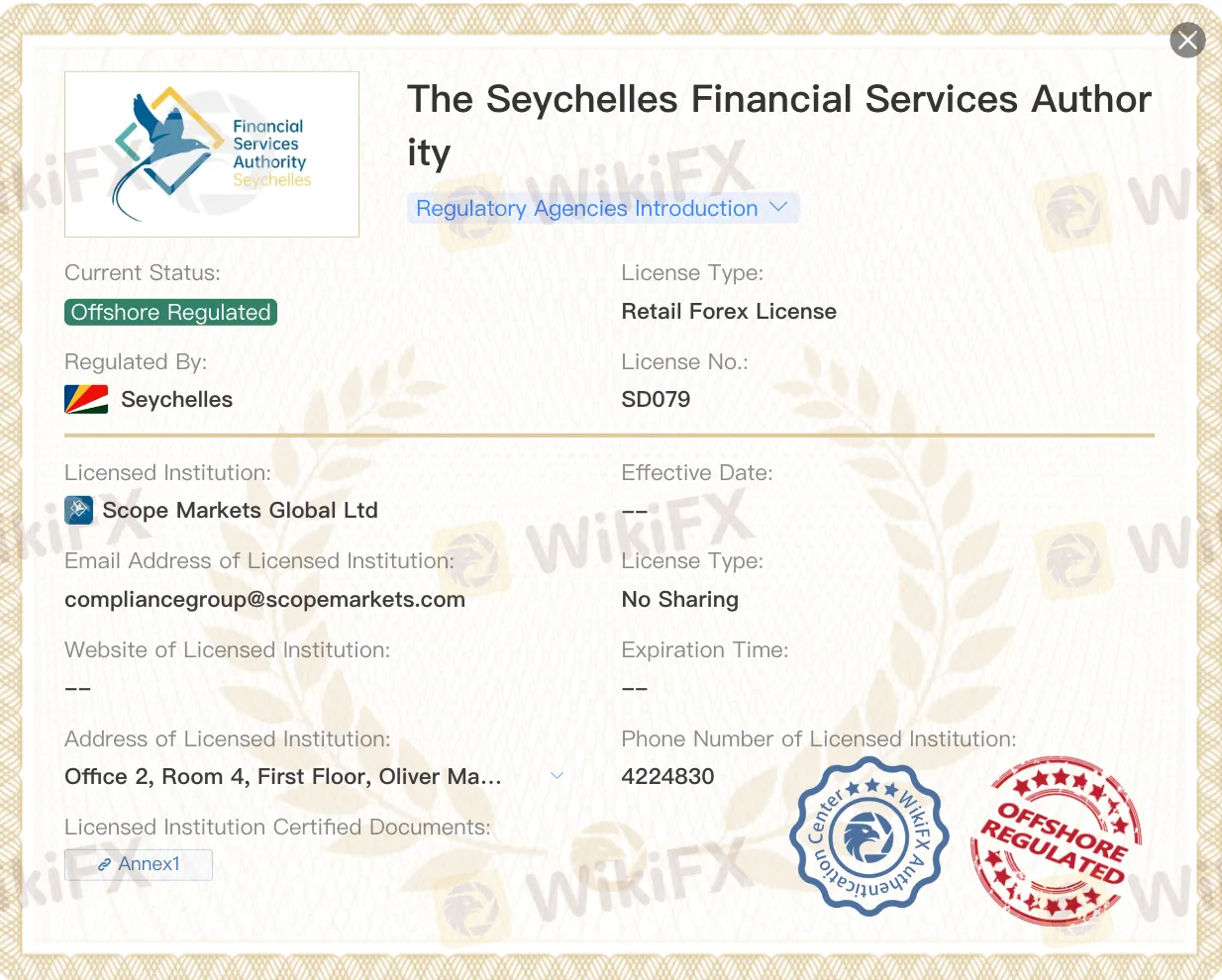

Is Scope Markets Legit?

Scope Markets is a regulated financial institution under the Cyprus Securities and Exchange Commission. It operates under the license number 339/17.

Scope Markets is a brand name used by RS Global Ltd, a company authorized and regulated by the Financial Services Commission of Belize (“FSC”) under the Securities Industry Act 2021 with registration number 000274/2. The company is engaged both in Straight Through Processing (STP) and as a market maker. The institution's address is 6160, Park Avenue, Buttonwood Bay, Lower Flat Office Space Front, Belize City, Belize.

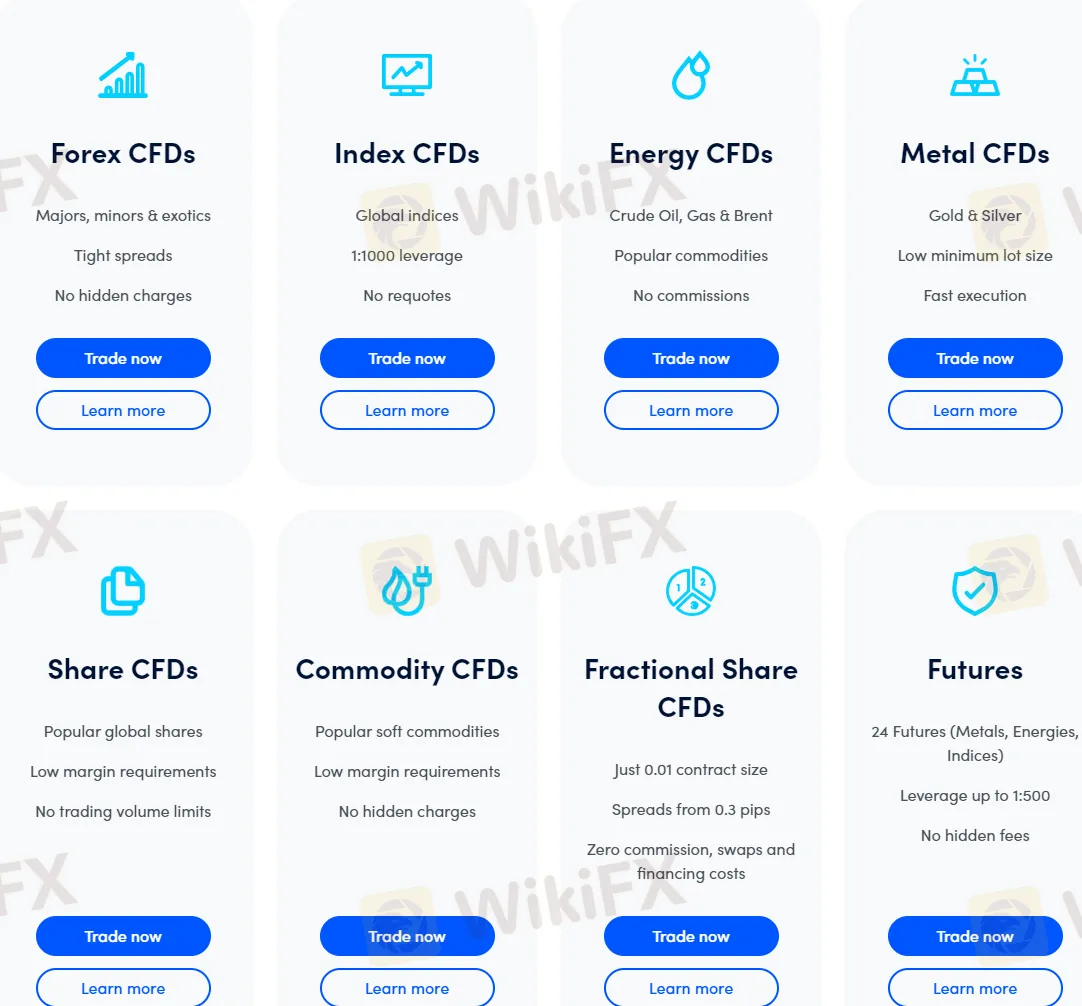

Market Instruments

Scope Markets offers a unique investment platform that empowers individuals to invest in fractional shares of their favorite companies. In addition, it offers a wide range of trading products, including Forex CFDs, Index CFDs, Energy CFDs, Metal CFDs, Share CFDs, Commodity CFDs, Fractional Shares, and Futures CFDs.

Account Types

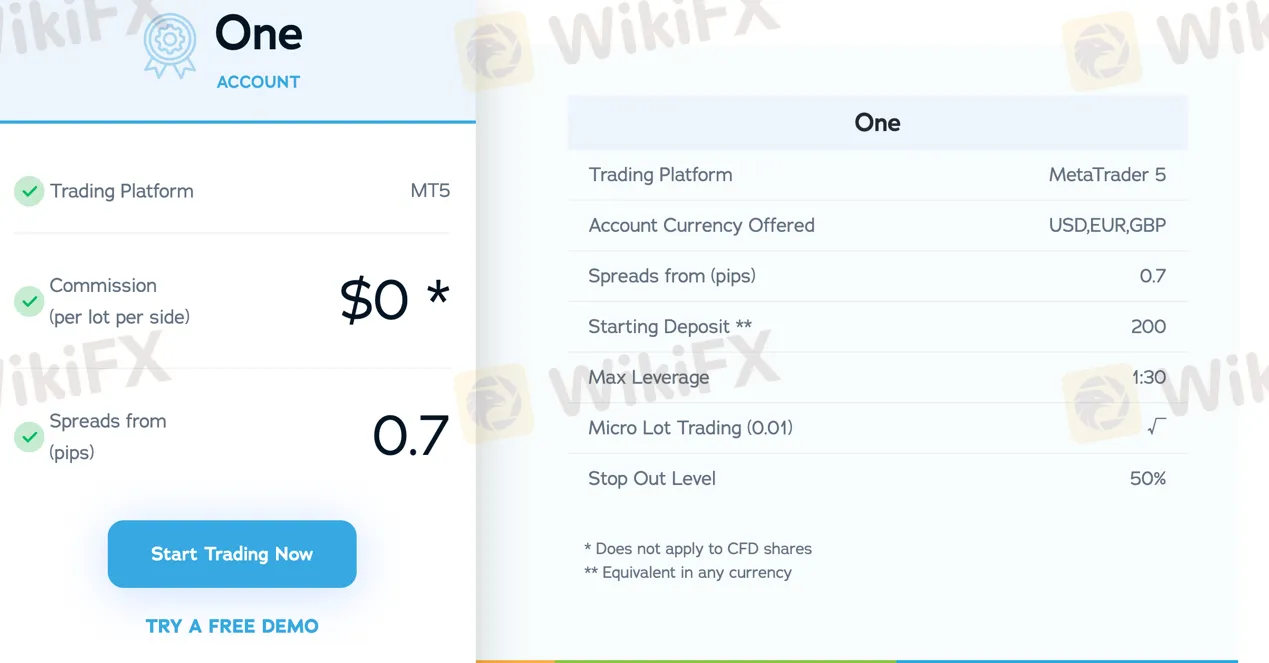

One Account:

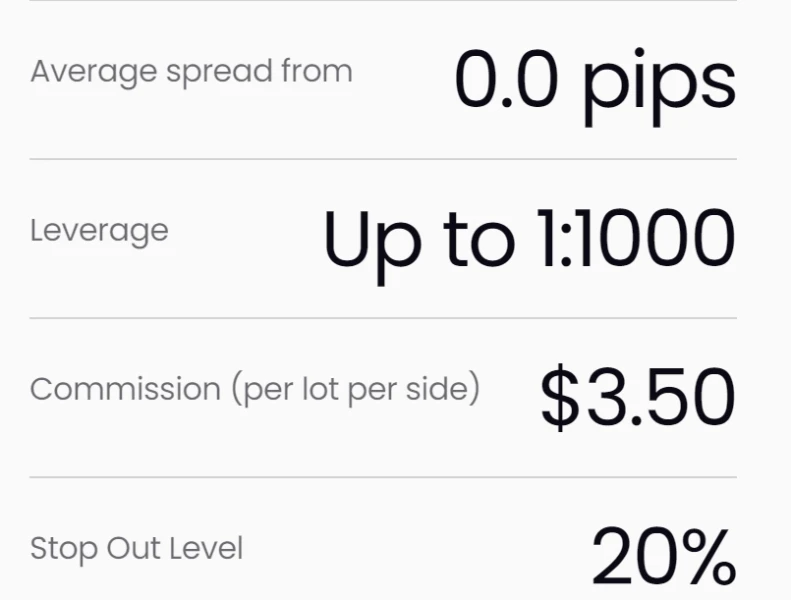

The One Account offered by Scope Markets operates on the MetaTrader 5 trading platform. It presents spreads from 0.7 pips and supports account currencies in USD, EUR, and GBP. The minimum starting deposit is $200, with a maximum leverage of 1:30. This account type allows for micro lot trading (0.01) and has a stop out level set at 50%. Commission per lot per side is $0, and it should be noted that this doesn't apply to CFD shares.

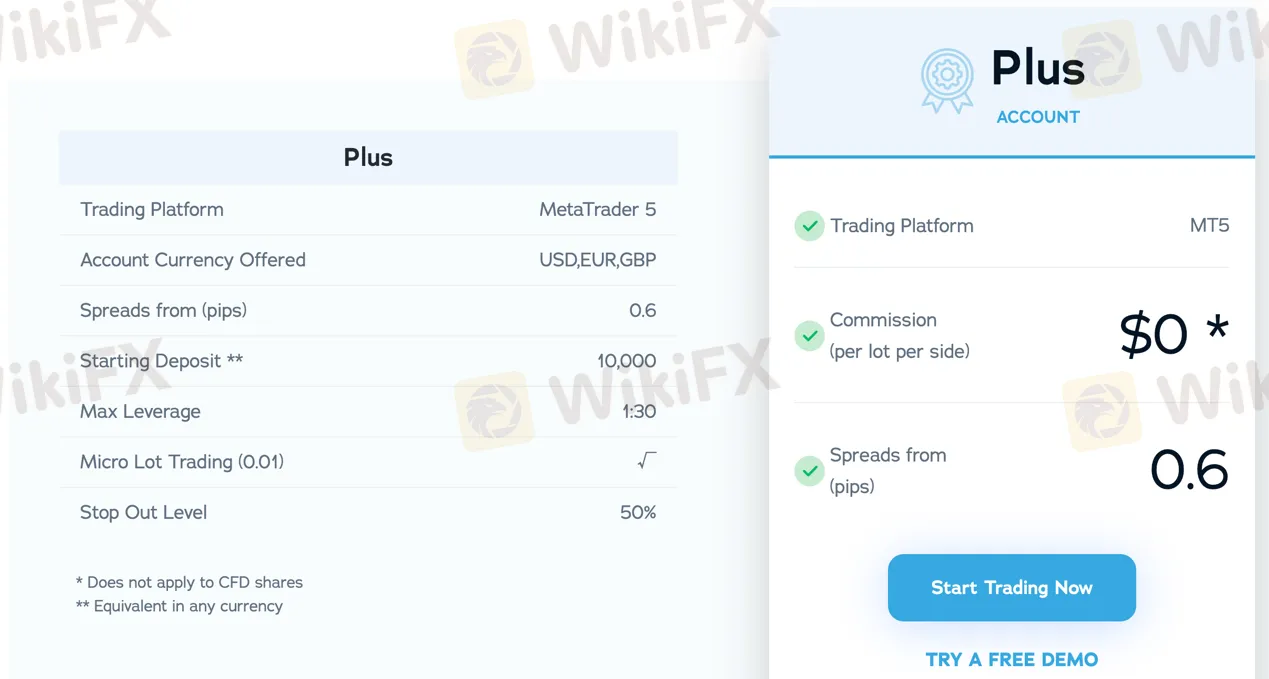

Plus Account:

The Plus Account, available on the MetaTrader 5 platform, showcases spreads starting from 0.6 pips. It offers account currencies in USD, EUR, and GBP, with a higher starting deposit of $10,000. The maximum leverage is 1:30, and micro lot trading (0.01) is supported. Similar to the Standard Account, the Plus Account also has a stop out level of 50%. Commission per lot per side is $0, excluding CFD shares.

Professional Clients:

For Professional Clients, Scope Markets provides enhanced features. Maximum leverage limits can reach up to 200:1, depending on the instrument being traded. The Margin Close Out Rule stands at 20% of the required margin.

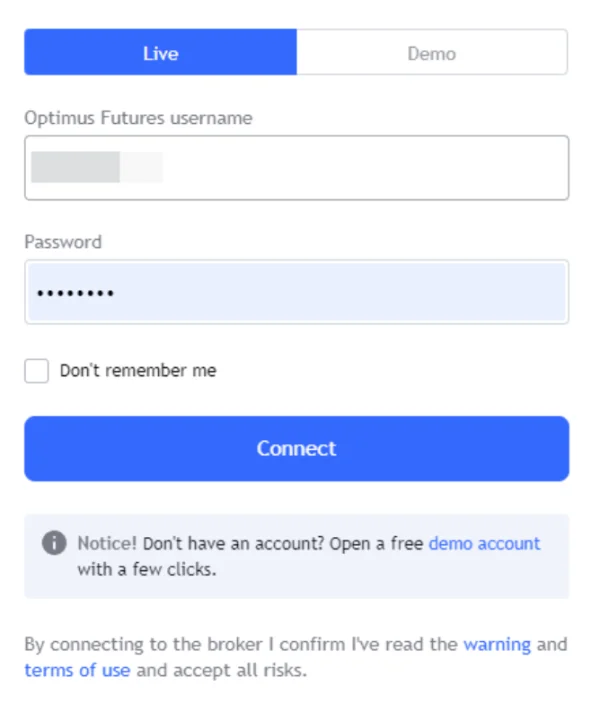

Scope Markets also offers a demo account option for traders. This allows individuals to practice and familiarize themselves with the trading platform and its features without using real money.

How to Open an Account?

To open an account with Scope Markets, follow these steps:

- Click on the “Register” button.

- Fill in your First Name, Last Name, Email, and select your Country of Residence.

- Choose your Phone Prefix (e.g., +1) and provide your Phone number.

- Create a Password for your account.

- Click “Register” to complete the account opening process. If you already have an account, you can choose to “Sign In” instead.

Leverage

Scope Markets offers a maximum leverage of 1:30 for retail clients and up to 200:1 for professional clients.

Spreads & Commissions

Scope Markets provides spreads starting from 0.7 pips for the One Account and 0.6 pips for the Plus Account. There is no commission for both account types, with the exception that the commission does not apply to CFD shares.

Minimum Deposit

Scope Markets sets a minimum deposit requirement of 200 USD for various account types.

Deposit & Withdrawal

Scope Markets offers deposit and withdrawal options for its clients. Bank transfers have a processing time of 3-5 working days for both deposits and withdrawals, with no fees. The minimum deposit is 200 USD, while there is no maximum deposit limit. For withdrawals, the minimum is 100 USD or equivalent, with unlimited maximum withdrawals. Nuvei (formerly Safecharge), VISA, and Mastercard transactions are usually processed within 10 minutes for deposits and take 3-5 working days for withdrawals. There are no fees, and the minimum deposit and withdrawal amounts are 200 USD and 100 USD, respectively. The maximum deposit per transaction is 10,000 USD, while the maximum withdrawal per day is 50,000 USD.

Trading Platforms

MT5 Desktop - Meta Trader 5: Meta Trader 5, a widely recognized trading platform, serves as one of the leading Forex platforms globally. It presents an array of trading and analytical tools, accompanied by additional services. This platform caters comprehensively to Forex trading needs, boasting features such as 21 timeframes, real-time symbol quotes, 38 technical indicators, and 4 order execution types. Notably, it incorporates an Economic Calendar offering macro-economic news updates that can influence financial instrument prices.

MT5 Web Trader - MT5 Webtrader: The MT5 Webtrader stands as another popular trading platform option. Equipped with real-time symbol quotes, over 50 technical indicators, and support for algorithmic trading EA & MQL5, it offers advanced charts and caters to various execution models and order types. This web-based platform provides market event alerts and news updates to facilitate trading decisions.

MT5 Mobile - MT5 for iOS and Android: This mobile app includes 3 chart types, 30 technical indicators, and full MT5 account functionality. Native applications for iPhone, iPad, and Android devices allow traders to manage positions, monitor markets, and perform technical analysis on-the-go.

Scope Trader - Browser-based Platform: Scope Trader is a browser-based platform offering trading opportunities in shares, indices, currencies, and commodities. With user-friendliness and advanced features at its core, Scope Trader provides a modern web application that requires no additional plug-ins or add-ons. This platform is equipped with in-depth financial analysis tools, technical analysis support, and one-click trading from charts.

Scope Trader App - Mobile Platform: Scope Trader App caters to mobile traders, providing access to shares, indices, currencies, and commodities. This native trading application offers features parallel to the Scope Trader Web version. It includes in-depth financial analysis tools and aligns with traders seeking an enhanced trading experience through mobile platforms.

Trading Tools

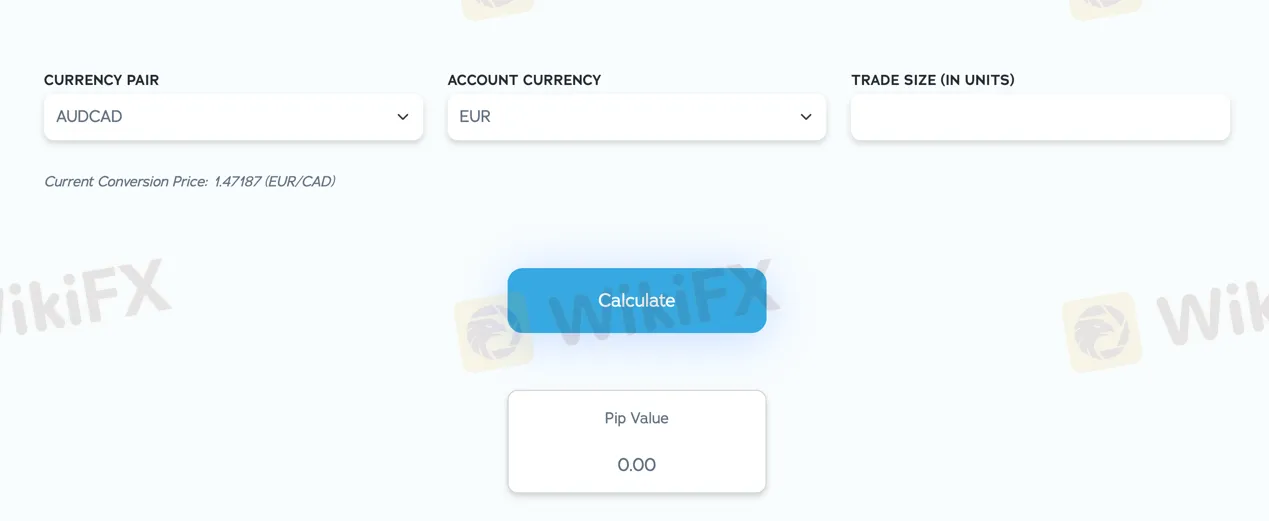

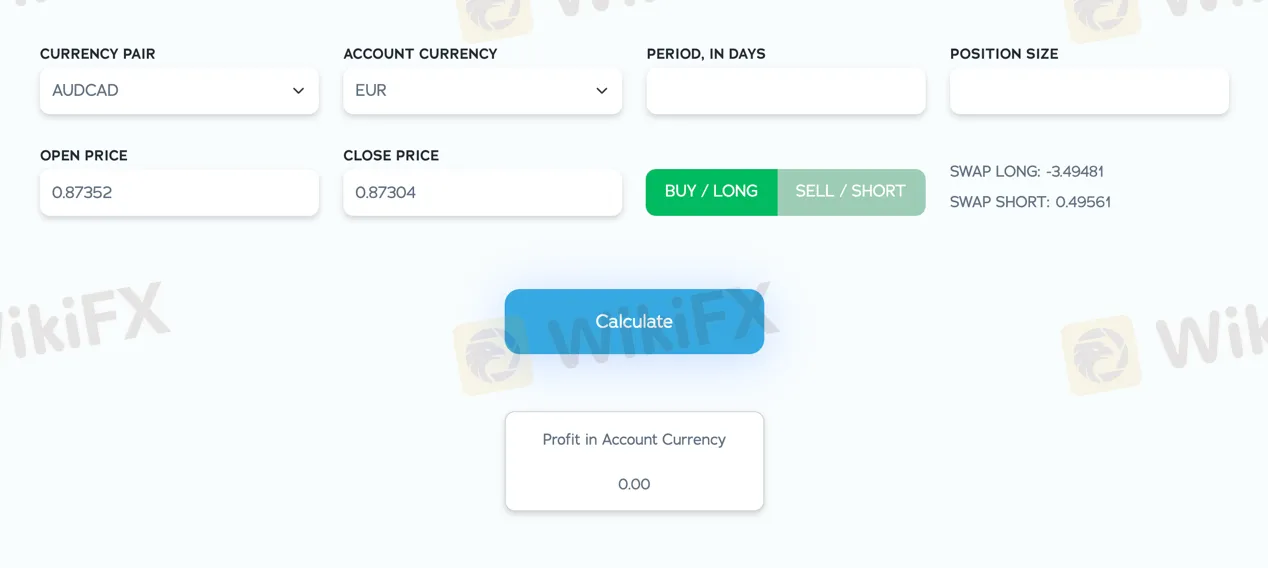

1. PIP Calculator:

Scope Markets offers a pip calculator that enables traders to calculate the pip value for their chosen trading currency. This tool assists in evaluating the potential risk associated with each trade.

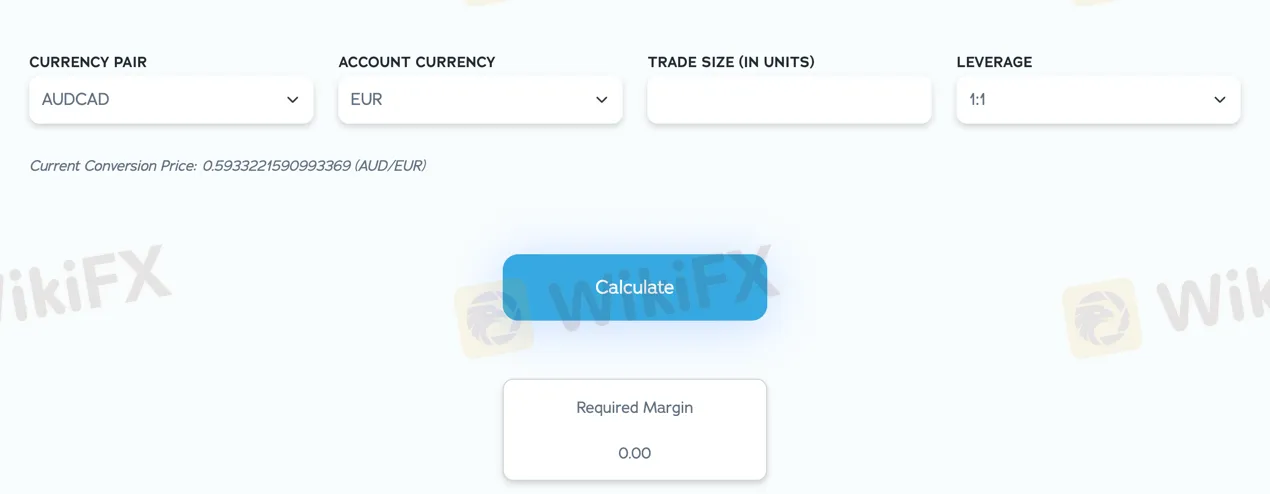

2. Margin Calculator:

The margin calculator provided by Scope Markets aids traders in determining the margin requirements necessary to initiate and maintain trading positions. It serves as an indicator for maintaining sufficient margin in the trading account to cover ongoing trades.

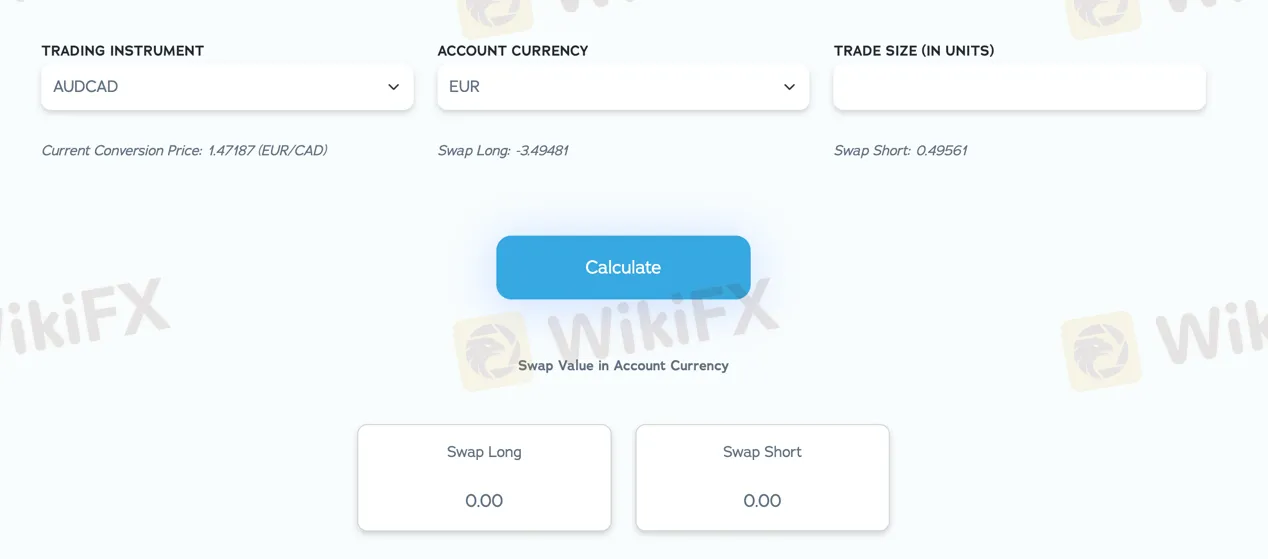

3. Swap Calculator:

Scope Markets presents a swap calculator to compute the interest rate difference between the two currencies in an open trade's currency pair. This tool calculates the overnight interest credited or debited directly to trades, impacting the overall account balance.

4. Profit Calculator:

The profit calculator offered by Scope Markets allows traders to assess the favorable outcome of a trade. This tool proves valuable for monitoring trade performance, especially when dealing with multiple positions simultaneously.

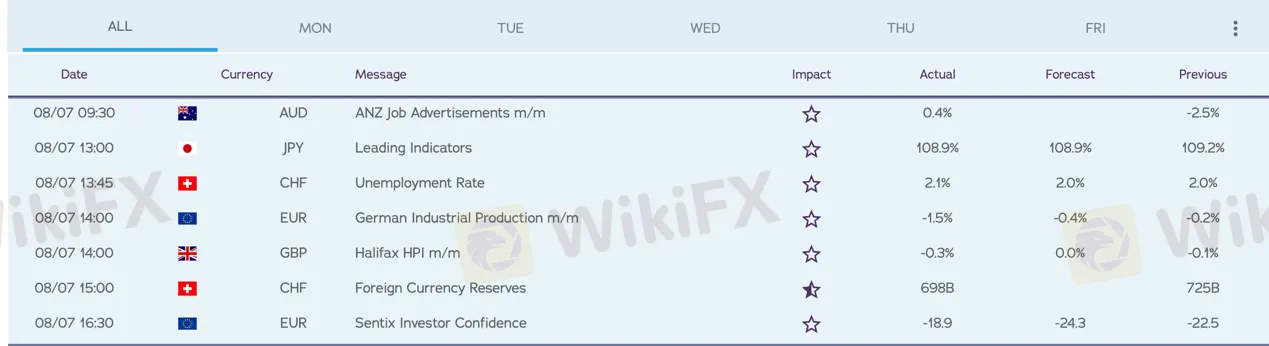

Economic Calendar

Scope Markets provides an Economic Calendar to keep traders informed about upcoming events, report releases, and announcements that could impact the markets. The calendar is a valuable tool for traders to track scheduled economic events, gaining insights into market changes and understanding the reasons behind these changes. By clicking on individual events, traders can access further information related to each event, contributing to a better grasp of market dynamics.

Customer Support

Scope Markets provides accessible customer support through various channels. Clients can reach out via email to support@scopemarkets.eu or info@scopemarkets.eu for assistance. Additionally, customer inquiries can be directed to +357 25281811. The company's physical address is Doma Building 1st floor, 227 Archeipiskopou Makariou III Avenue, 3105 Limassol, Cyprus.

Conclusion

In conclusion, Scope Markets is a regulated financial institution. It offers a range of market instruments, including forex, indices, futures, spot energies, metals, shares, cryptocurrencies, and ETFs. The company provides different account types, including the One Account and Plus Account, with varying starting deposits and leverage options. Traders can access the MetaTrader 5 trading platform, along with web and mobile versions. Scope Markets offers useful trading tools like pip, margin, swap, and profit calculators, aiding traders in risk assessment and performance evaluation.

FAQs

Can I change the time zone of the trading servers?

No, the trading servers' time zone remains fixed at GMT+3 Winter time and GMT+3 Summer time.

Are micro lots available on all platforms?

Yes, micro lots are accessible on all of Scope Markets EU's trading platforms.

When can I withdraw funds after closing positions?

After closing positions, you can withdraw the funds after a waiting period of 5 working days (T+5).

What are the transaction fees for physical stocks in different regions?

For EU Physical Stocks: 0.10% per side; For UK Physical Stocks: 0.10% per side + 0.5% Stamp Duty (buy trades); For US Physical Stocks & ETFs: 0.04 Cent per Share/ETF per side.

Ray95381

United Arab Emirates

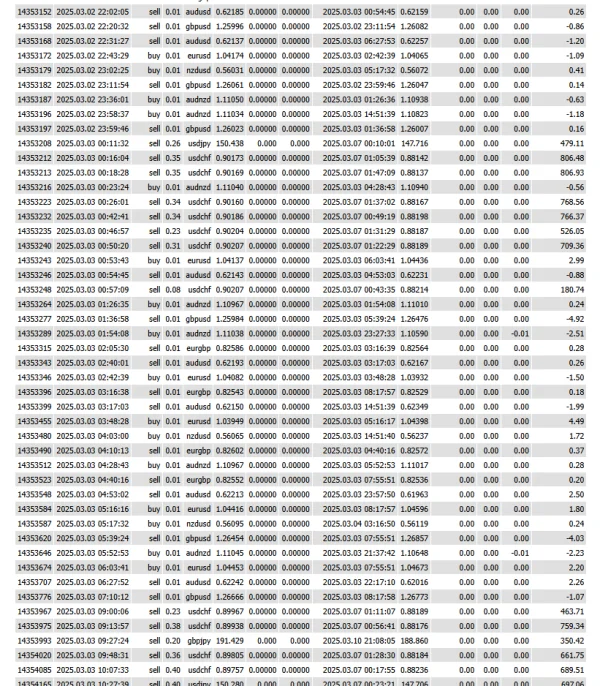

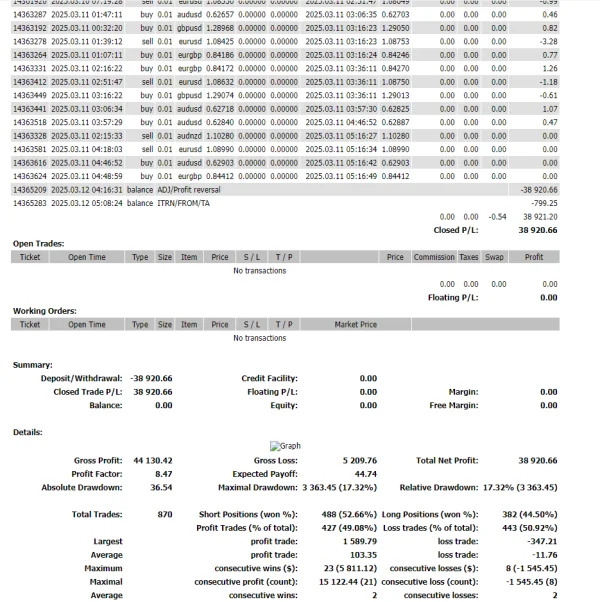

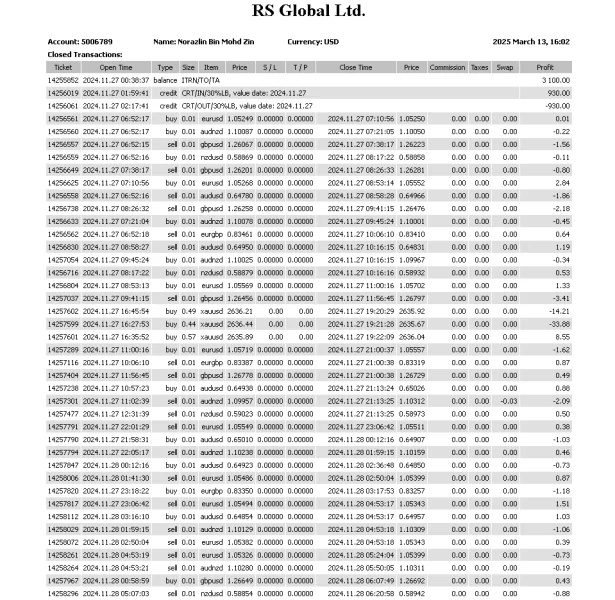

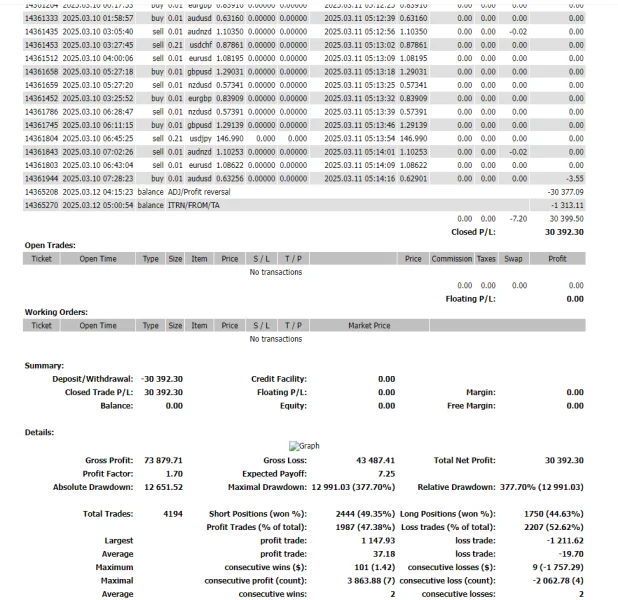

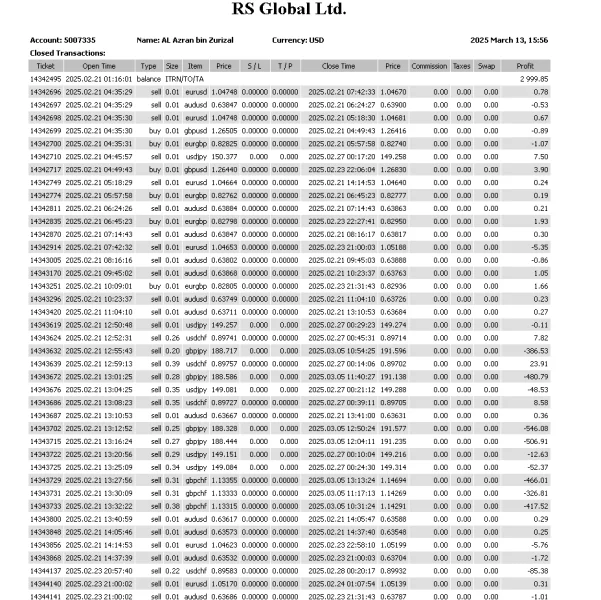

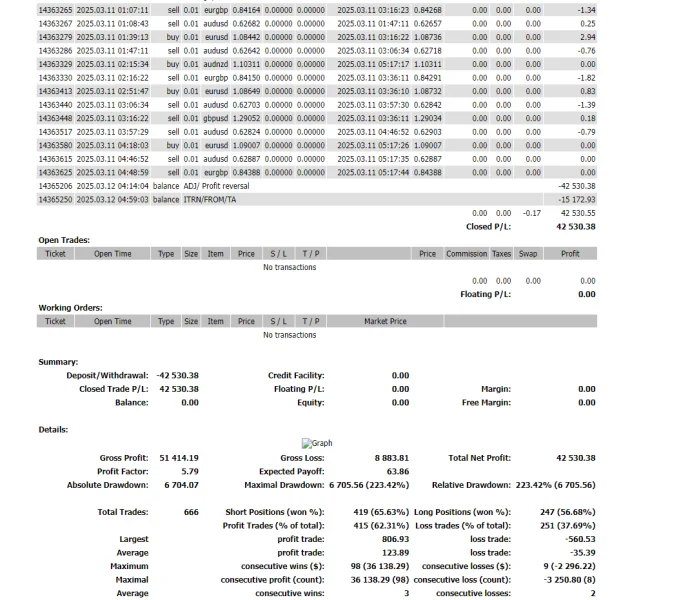

My name is Al Azran Bin Zurizal, and I hold trading account #5007335 with Scope Markets. On March 10, 2025, and again on March 12, 2025, Scope Markets unilaterally disabled my account and refused my withdrawal request of USD 43,520, alleging—without evidence—that my trading activity was “fraudulent” or “abusive.” I have traded with Scope Markets for [insert your duration of relationship] and have never breached their published terms or engaged in market manipulation. Despite my repeated requests for a full explanation and return of my funds, Scope Markets has invoked vague “risk-management” provisions and reversed profits, effectively seizing my capital. This conduct is arbitrary, non-transparent, and in contravention of the company’s obligation to treat clients fairly and to process legitimate withdrawal requests promptly. I hereby request your urgent intervention to: 1. Investigate Scope Marke 2. Order the immediate release of my USD 43,520 in accordance with industry best practice

Exposure

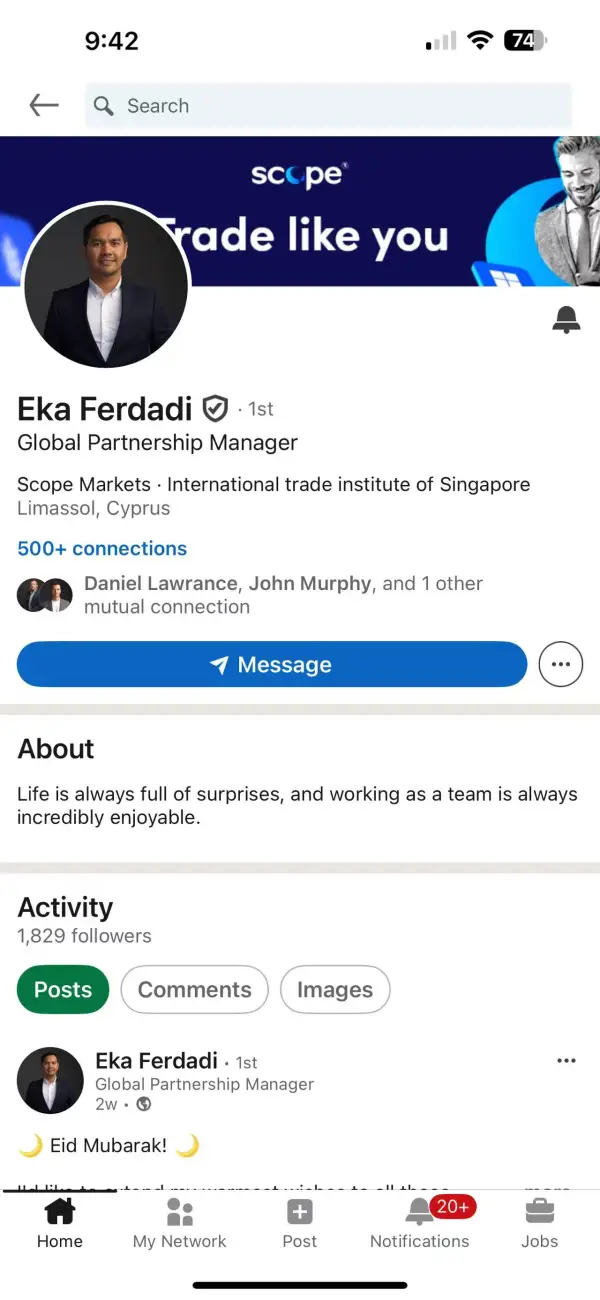

NORAZLIN BINTI MOHD ZIN

Taiwan

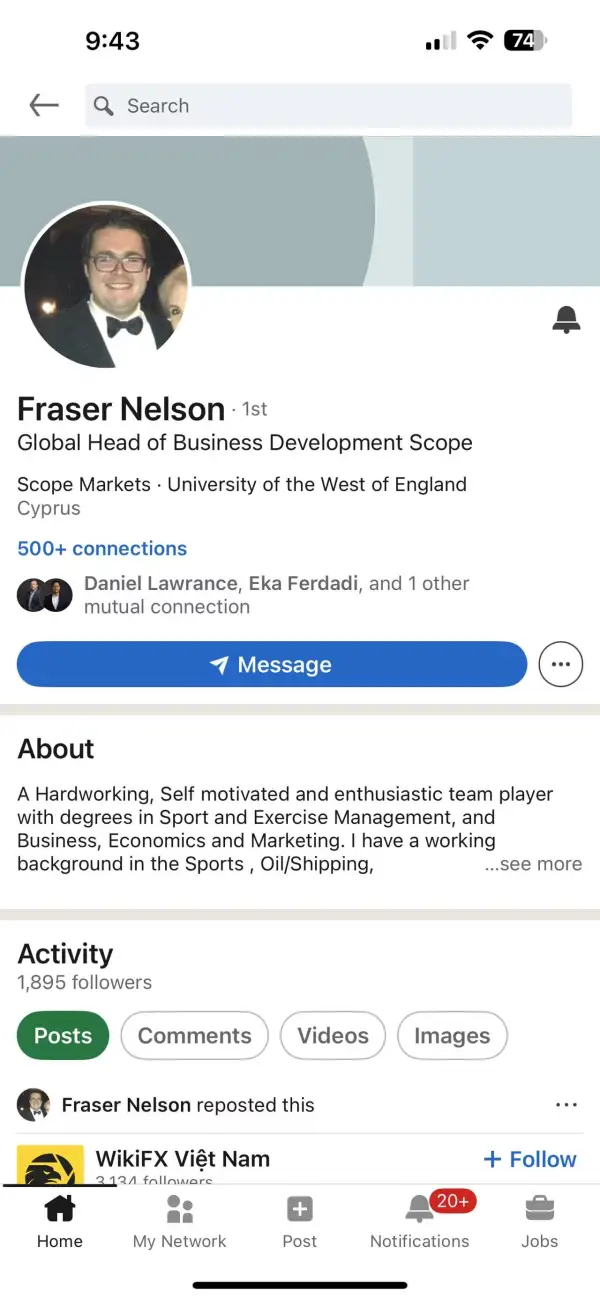

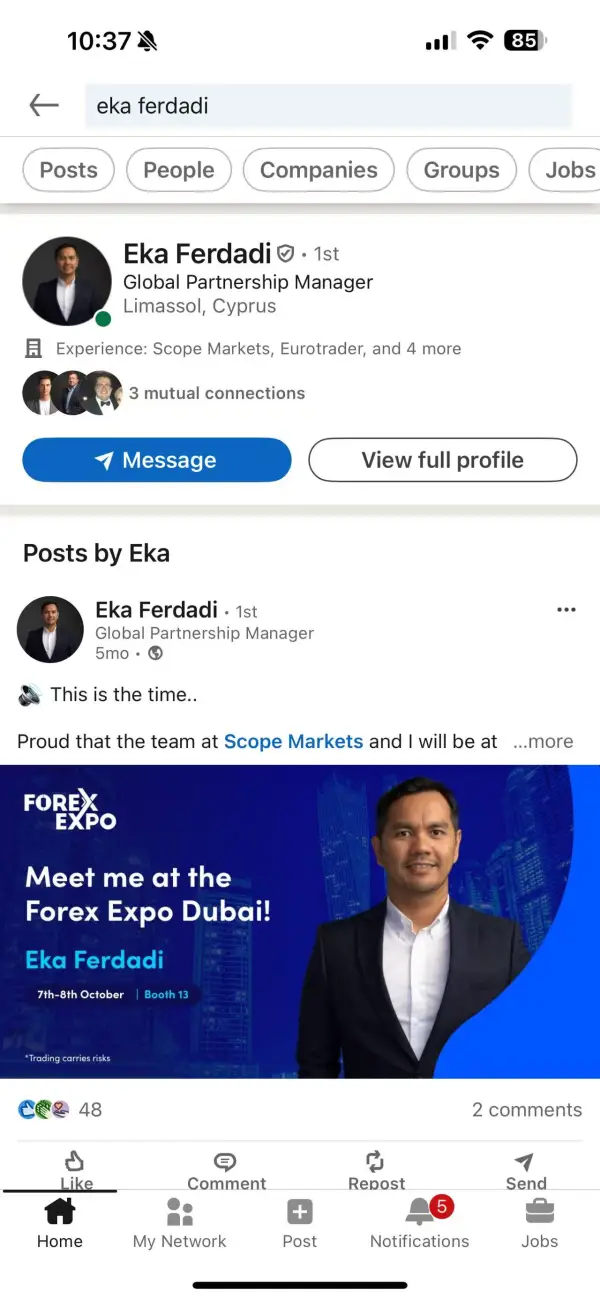

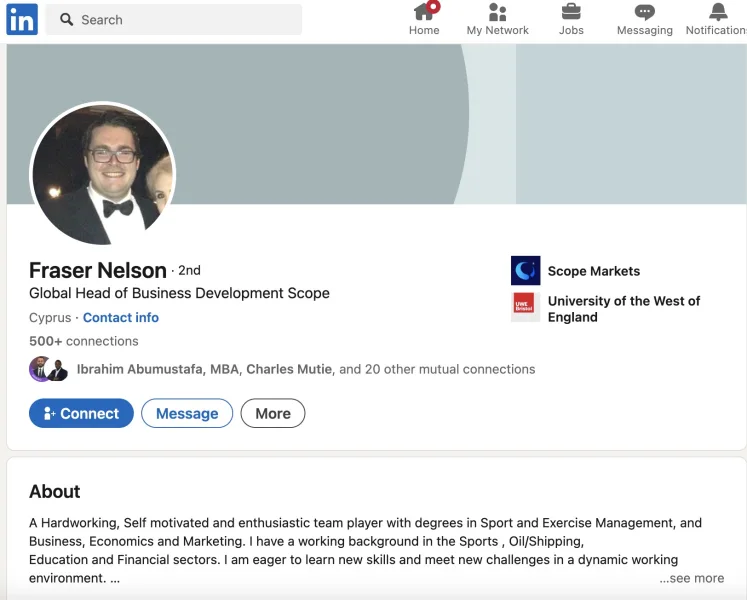

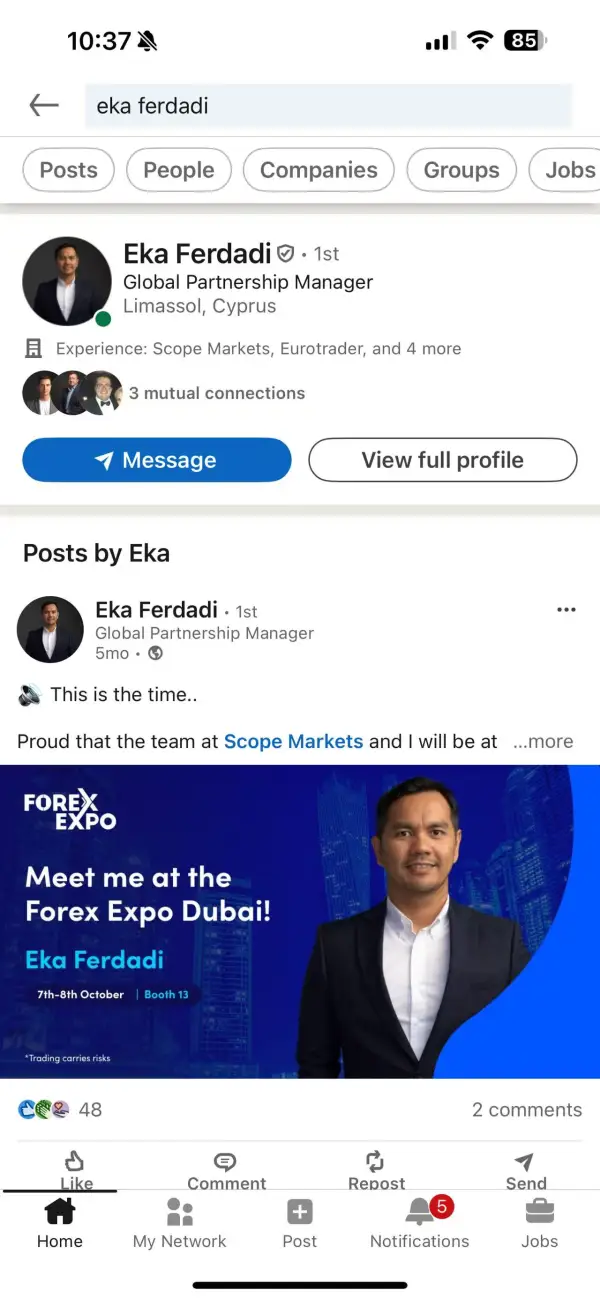

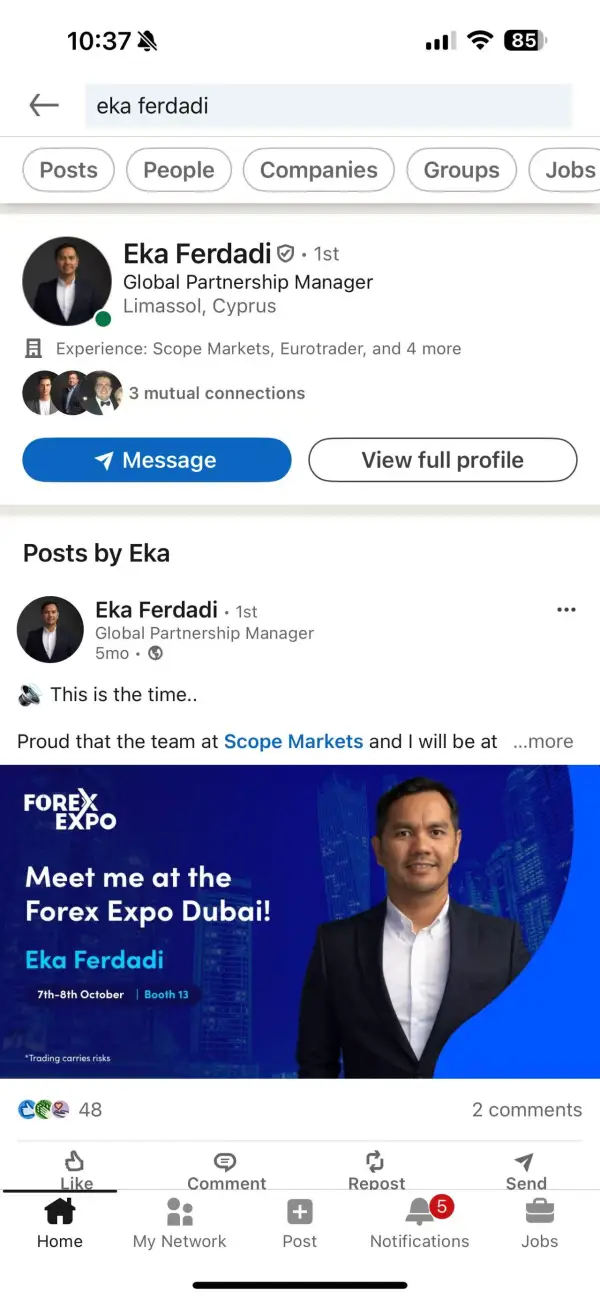

Complainant Name: AL AZRAN BIN ZURIZAL Platform Accused: Scope Market (RS Global Ltd) Account Information Account Opening Date: February 21, 2025 Trading Account Number: 5007335 Amount Illegally Deducted: $42,530.38 Incident Details: 1. Inducement to Deposit and False Promises: In September 2024, account manager EKA Ferdadi traveled from Cyprus to Malaysia, personally claiming that the trading was fully compliant and repeatedly induced me to add funds without providing any risk warnings or compliance documents. 2. Account Abruptly Closed: On March 10, 2025, I received an email from the platform unilaterally disabling my account, accusing me of "fraud" without presenting any evidence. I cooperated actively with identity verification, but Scope Market has refused to communicate and has not yet refunded the funds. 3. Platform Evasion and Regulatory Negligence: - The platform claimed "abuse of benefits," but failed to provide any records of rule violations or specific terms as a basis. - After filing a complaint, I only received automated responses. 4. Demands and Actions: I have filed formal complaints with CySEC and FSC, accusing Scope Market (RS Global Ltd) of suspected financial fraud. Stay away from Scope Market (RS Global Ltd)! This platform operates non-transparently and does not ensure the security of your funds.

Exposure

FX2199019902

Taiwan

Complainant Name: AL AZRAN BIN ZURIZAL Platform Accused: Scope Market (RS Global Ltd) Account Information Account Opening Date: February 21, 2025 Trading Account Number: 5007335 Amount Illegally Deducted: $42,530.38 Incident Details: 1. Inducement to Deposit and False Promises: In September 2024, account manager EKA Ferdadi traveled from Cyprus to Malaysia, personally claiming that the trading was fully compliant and repeatedly induced me to add funds without providing any risk warnings or compliance documents. 2. Account Abruptly Closed: On March 10, 2025, I received an email from the platform unilaterally disabling my account, accusing me of "fraud" without presenting any evidence. I cooperated actively with identity verification, but Scope Market has refused to communicate and has not yet refunded the funds. 3. Platform Evasion and Regulatory Negligence: - The platform claimed "abuse of benefits," but failed to provide any records of rule violations or specific terms as a basis. - After filing a complaint, I only received automated responses. 4. Demands and Actions: I have filed formal complaints with CySEC and FSC, accusing Scope Market (RS Global Ltd) of suspected financial fraud. Stay away from Scope Market (RS Global Ltd)! This platform operates non-transparently and does not ensure the security of your funds.

Exposure

FX3754429212

Taiwan

Complainant Name: AL AZRAN BIN ZURIZAL Platform Accused: Scope Market (RS Global Ltd) Account Information Account Opening Date: February 21, 2025 Trading Account Number: 5007335 Amount Illegally Deducted: $42,530.38 Incident Details: 1. Inducement to Deposit and False Promises: In September 2024, account manager EKA Ferdadi traveled from Cyprus to Malaysia, personally claiming that the trading was fully compliant and repeatedly induced me to add funds without providing any risk warnings or compliance documents. 2. Account Abruptly Closed: On March 10, 2025, I received an email from the platform unilaterally disabling my account, accusing me of "fraud" without presenting any evidence. I cooperated actively with identity verification, but Scope Market has refused to communicate and has not yet refunded the funds. 3. Platform Evasion and Regulatory Negligence: - The platform claimed "abuse of benefits," but failed to provide any records of rule violations or specific terms as a basis. - After filing a complaint, I only received automated responses. 4. Demands and Actions: I have filed formal complaints with CySEC and FSC, accusing Scope Market (RS Global Ltd) of suspected financial fraud. Stay away from Scope Market (RS Global Ltd)! This platform operates non-transparently and does not ensure the security of your funds.

Exposure

Tomorrow17412

United States

I am from bangladesh and i like the app a loti have given it 4 star

Positive

Giovanni Y

Italy

I upgraded to the Elite account a month ago, and it's been a big improvement. The spreads are way better, and I'm finding the trading signals really helpful. Plus, my account manager, Lubis, has been giving me some great tips.

Positive

FX3380723485

South Korea

Foreign exchange and oil trading withdrawals are not being processed I have raised this issue several times before Is there any guarantee deposit system for withdrawals? Is this another scam in the midst of scams?

Exposure

FX1685654954

Ukraine

Good spreads and execution on forex pairs. But the margin requirement for indices is too high and makes it too risky to trade, would be better if micro-lots are introduced for indices as well.

Neutral

Brooks Rly

Italy

Trading crude oil with Scope Markets, no commissons, which is good. Shares, no trading volume either. However, 150% margin call, which is too high for me.

Neutral

Dingdongo

Argentina

Then there's a scam alert. Fake support staff sweet-talked investments, got a friend involved, and after a hefty deposit, the Meta Trader 4 account stayed empty. Classic bait-and-switch move.

Neutral

Toand2

Vietnam

On September 22, I deposited money but the money did not go into my mt4 account. stk mt4:5000938. I deposited money but until today I still haven't seen any money in my account.

Exposure

BETO933

Ecuador

Good morning gentlemen SM CAPITAL MARKETS, my request is for your help in being able to withdraw my investment made in your company, which according to the provisions and guidelines issued by you until the present date, you have not provided me with any news or notification in this regard. I am sure to count on your help and I anticipate my gratitude.

Exposure

Mary9343

Ecuador

I request SM Capital to return the 3,000 dollars that I invested in this platform in May of the year 2022, and after two months of operation, it went into liquidation and promised its investors the return of the money with their respective interests until December of the same year, but to date, it has not fulfilled what was promised.

Exposure

FX1041124421

Vietnam

How to cheat customers automaticlly

Exposure

FX1041124421

Vietnam

automatically close your sell order and get money in your account in mt4

Exposure

FX4133095114

Vietnam

After listening to the nv of the H.Thuong exchange, inducing me to deposit money into my MT4 account to have the trading bonus and commitment of profit, I trusted to deposit a total amount of 691,500,000 VND. From September 10, 2021, nv deliberately induced me to order with a large amount, contrary to the trend, causing my account to be in negative status, unable to withdraw money and suspend my account in a short period of time. Now that I'm in debt, my house is ruined, I appeal to scope markets to settle my compensation.

Exposure

FX1041124421

Vietnam

The staff blew the account

Exposure

FX1041124421

Vietnam

Burned my account

Exposure

FX5256579402

Vietnam

Suggest to open account and promise 1 on 1 for profit. Then, they tell me to place a large amount of orders and there are many negative account, but they still say that it has no problem and send it. Then, it is the responsibility to deposit more money to apply the payoff insurance rate. but by the time you're back-in-the-line, and one-on-one support like before. And now I was committed to responsibility and waiting for the results of his account back, but I have not receive any results couple hours before.

Exposure

FX5256579402

Vietnam

1. In mid-June 2021 after listening to the sales consultant of this company for first timn, then support 1:1 trading on the first day of burning profit in July 2021 after nearly 3 weeks with the total deposit 37,000$ 2. The second time is 11/18, after a whole month, ask me to join the group to see expert orders and traders on the group and promise to commit to making a profit, but when there is a problem, they tell me to deposit. There is a tk insurance rate to return the old capital. I followed and the scenario continued. The total amount of deposit was up to 110,000$ and was burned.

Exposure

FX2323299262

Vietnam

At the beginning, broker, Dat, called many times to induce me to invest in international securities and provide me a proof of profit. After a few times like that, I was convinced and invested more than 500 USD (12 million VND). When the money arrived in my account, someone named THANH HA who claimed to be a technical expert called and said he was my direct supporter. Later on that day, HA gave me a profitable order so that I could believe it. HA coaxed me to add more money to play nonfram and said that it was sure to be profitable. Then, I would withdraw it because when I got out

Exposure

FX2956310652

Vietnam

After solicitation, I will receive 100% bunot and commit to a high return on investment. During the difficult epidemic period, I trusted and deposited the middle payment gateway Ctcp, reducing the amount many times of the total amount of 5,242,000,000 vnd. But they burned my account due to fraud, customer support is not dedicated to give orders against the trend and burn my account. Now I am in heavily debt, I have difficulty complaining to Scope Markets to solve the problem. Return my money back.

Exposure

FX1577662224

Vietnam

Technicians blow up investors' accounts due to taking too much orders.They abidicated their responsibilities and blamed the makret for this.

Exposure