Company Summary

| DLSMReview Summary | |

| Founded | 2001 |

| Registered Country/Region | Vanuatu |

| Regulation | ASIC, VFSC (offshore) |

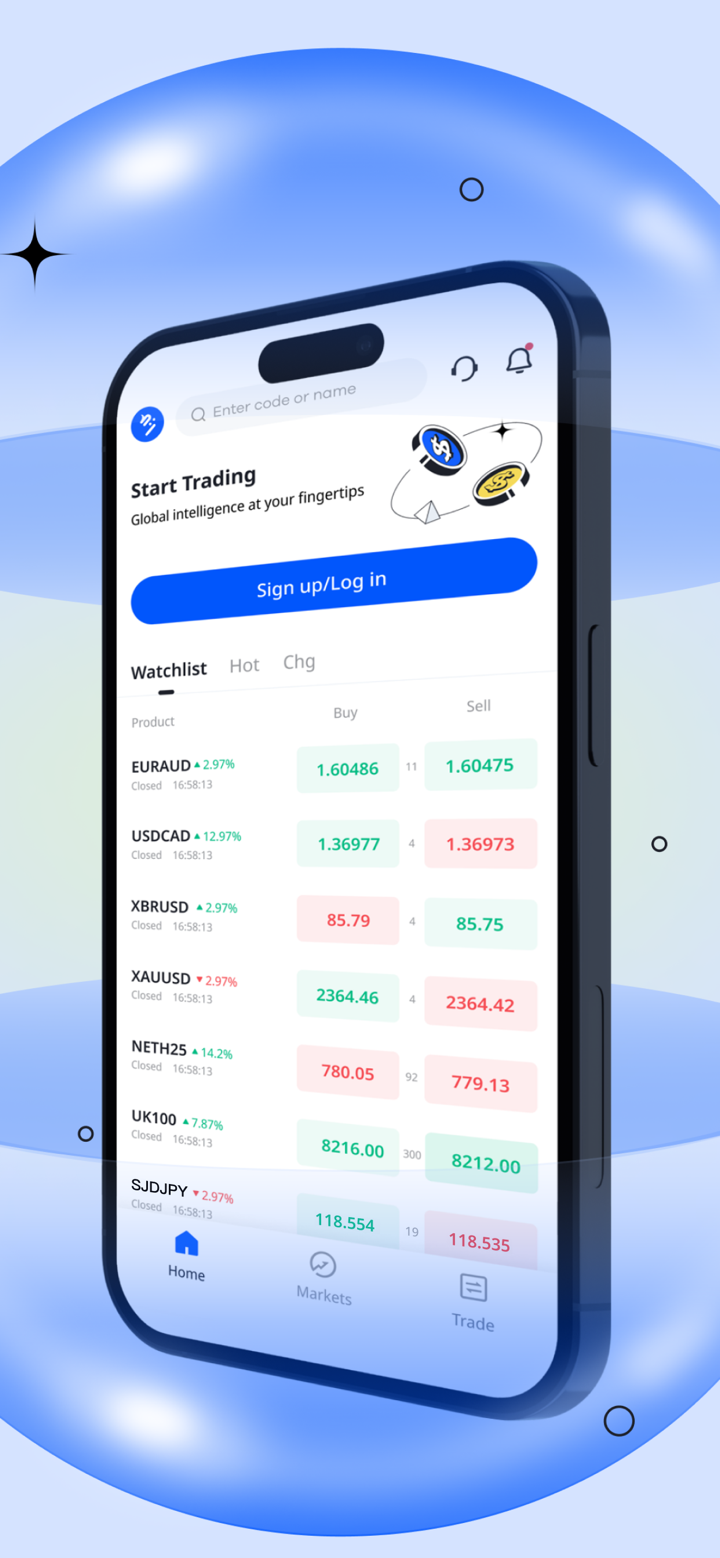

| Market Instruments | Currencies, indices, metals, commodities, stocks |

| Demo Account | ❌ |

| Leverage | Up to 1:1000 |

| Spread | From 0 pip |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $100 |

| Social Trading | ✅ |

| Customer Support | Live chat |

| Email: support@dlsm.com | |

| Social Media: LinkedIn, Instagram, Telegram, YouTube | |

| Address: Unit 3, 3rd Floor, Bayview House, Lini Highway, 11/OD22/003. Vanuatu | |

| Regional Restriction | US |

DLSM Information

DLSM, founded in 2001, is a brokerage registered in Vanuatu. The trading instruments it provides cover currencies, indices, metals, commodities, and stocks. It is regulated by ASIC and offshore regulated by VFSC, providing two account types, with a minimum deposit of $100 and leverage up to 1:1000.

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | Offshore regulation risks |

| MT4 and MT5 supported | Regional restriction |

| Wide range of trading instruments | Limited payment options |

| Low commissions and spreads | No demo account |

| No withdrawal fees | |

| Multi-lingual support | |

| Social trading available | |

| Promotions offered |

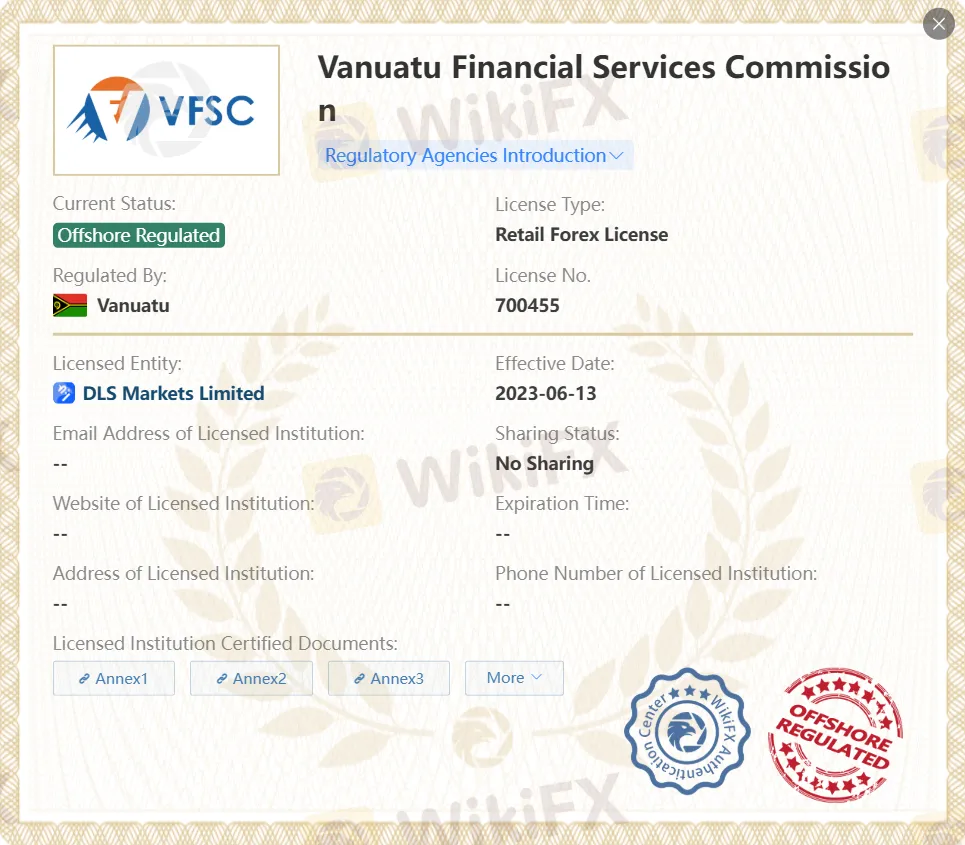

Is DLSM Legit?

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| Australia | The Australian Securities and Investments Commission (ASIC) | Regulated | DLS MARKETS (AUST) PTY LTD | Financial Service | 000296805 |

| Vanuatu | The Vanuatu Financial Services Commission (VFSC) | Offshore Regulated | DLS Markets Limited | Retail Forex License | 700455 |

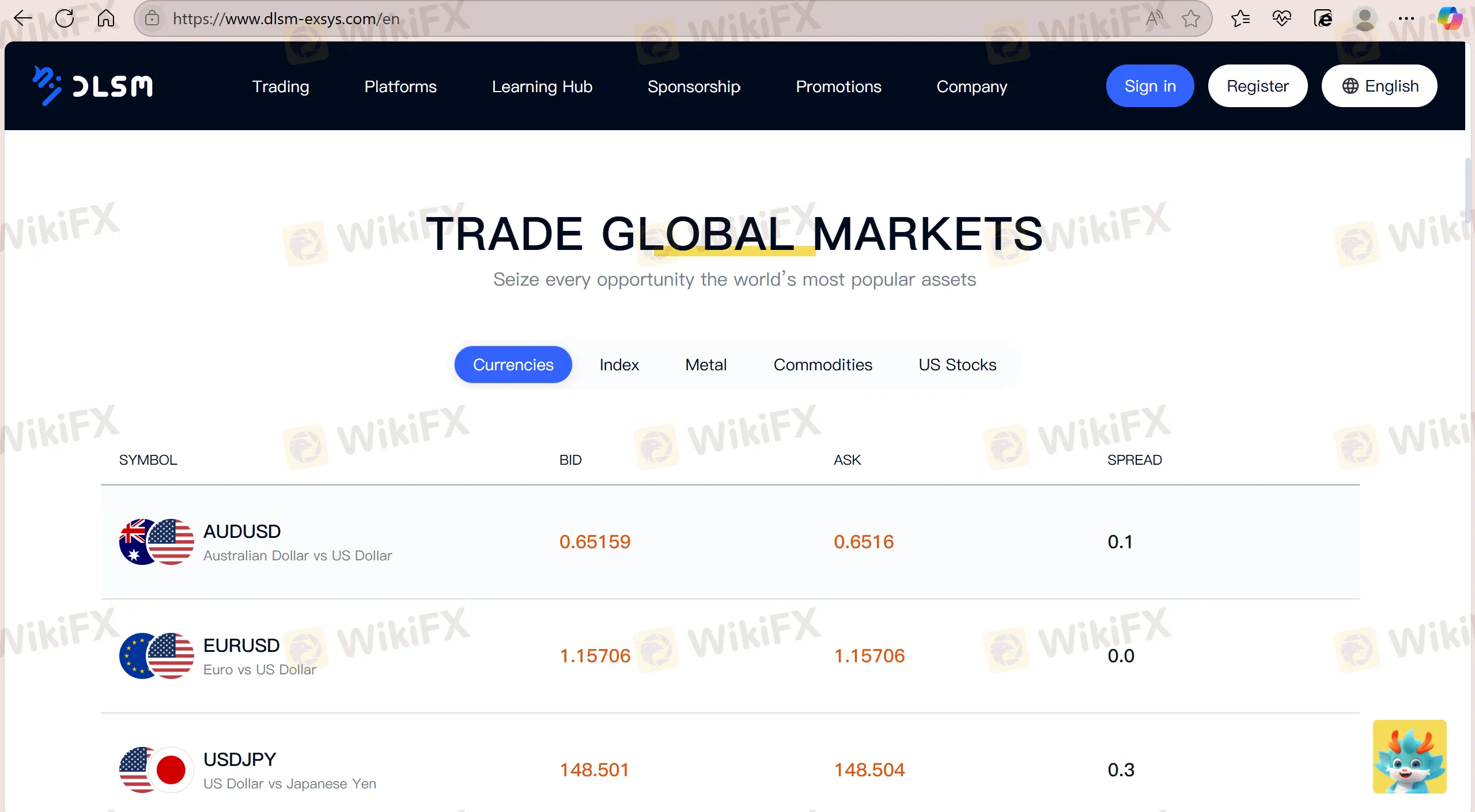

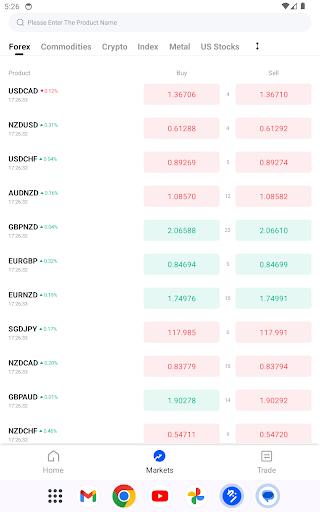

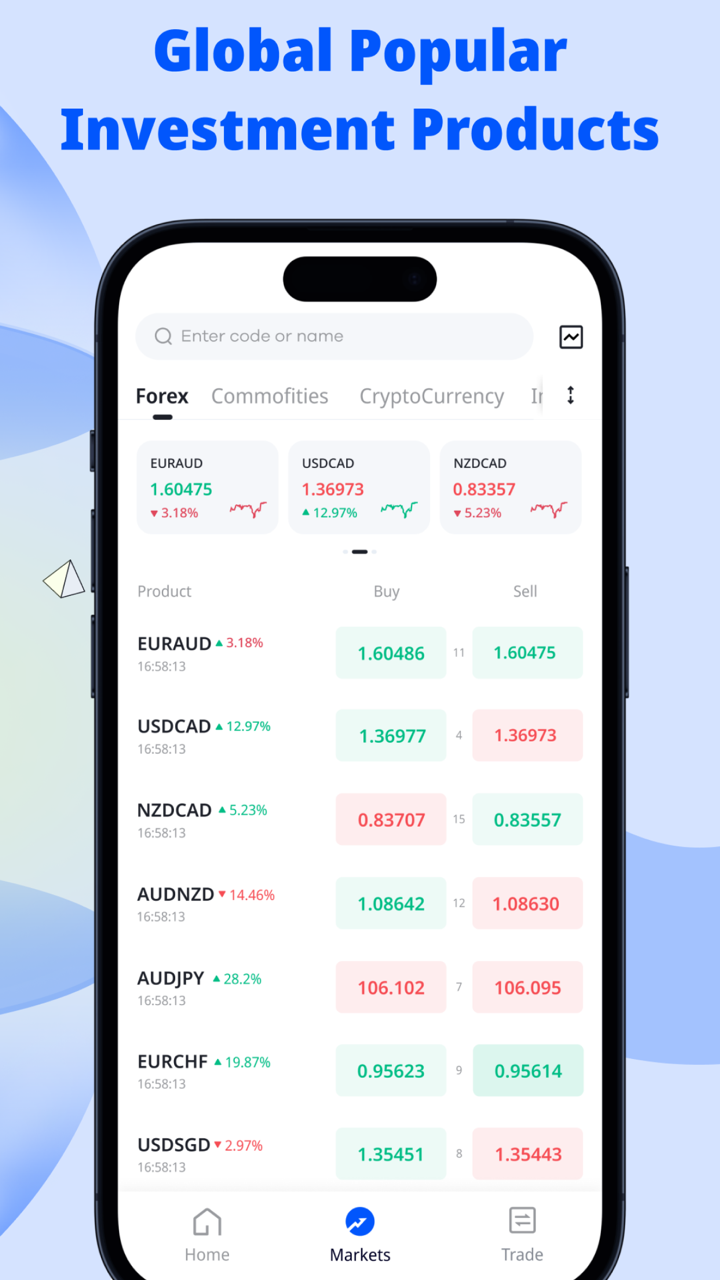

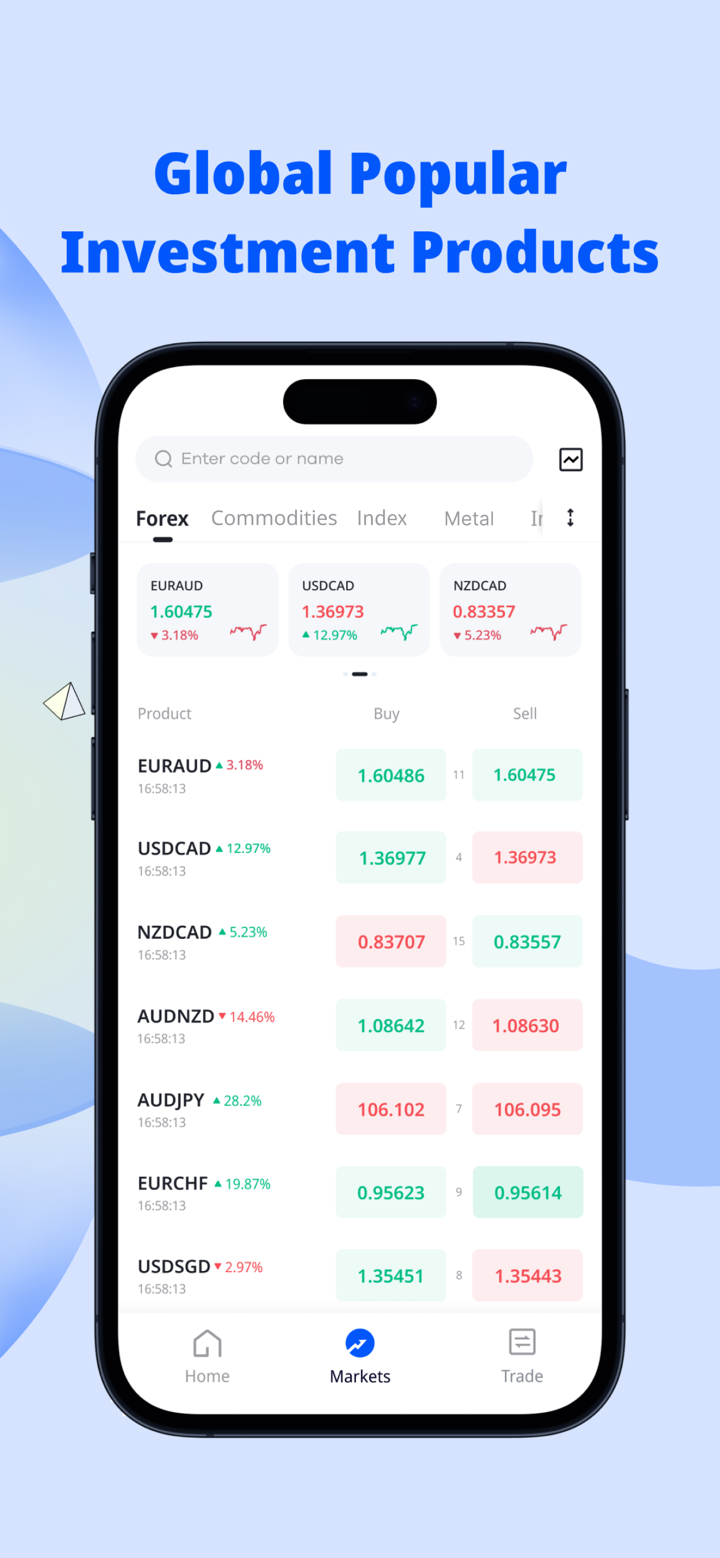

What Can I Trade on DLSM?

DLSM offers traders the opportunity to trade currencies, index, metal, commodities, stocks.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

| Options | ❌ |

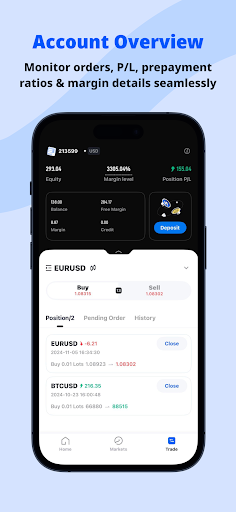

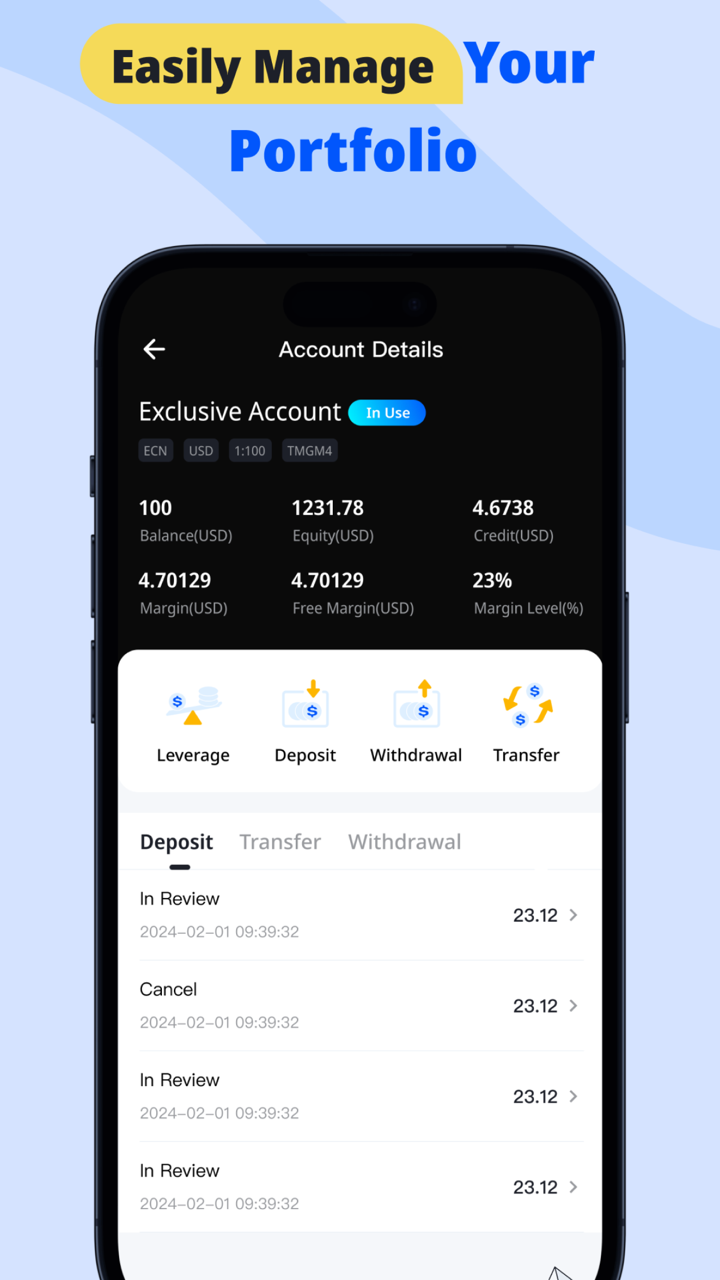

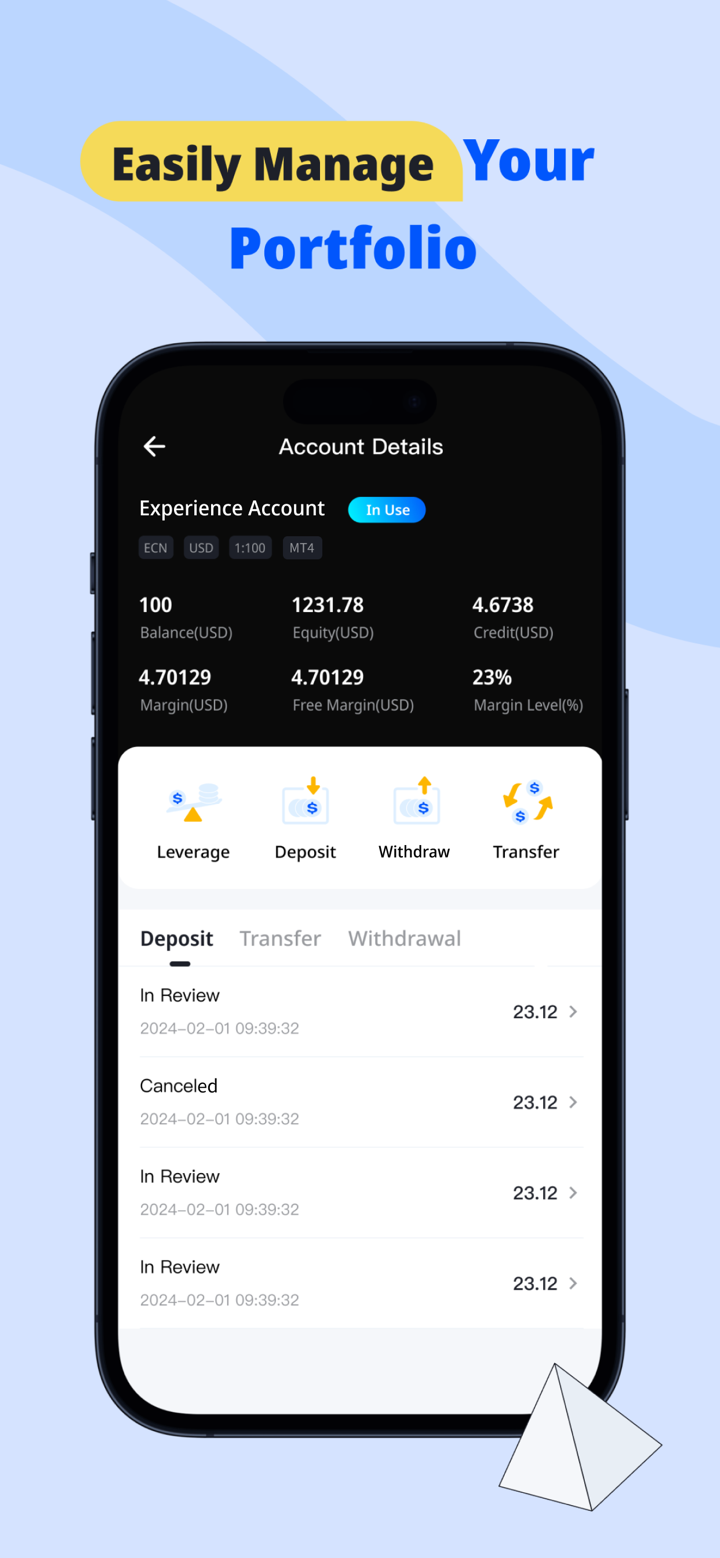

Account Types

DLSM offers 2 different types of accounts to traders, which are Standard Account and ECN Account.

| Account Type | Standard Account | ECN Account |

| Minimum Deposit | $100 | $100 |

| Maximum Leverage | 1:500 | 1:1000 |

| Spreads | From 1.2 pips | From 0 pips |

| Commissions (per lot) | $0 | $4 |

| Withdrawal Fee | 0 | 0 |

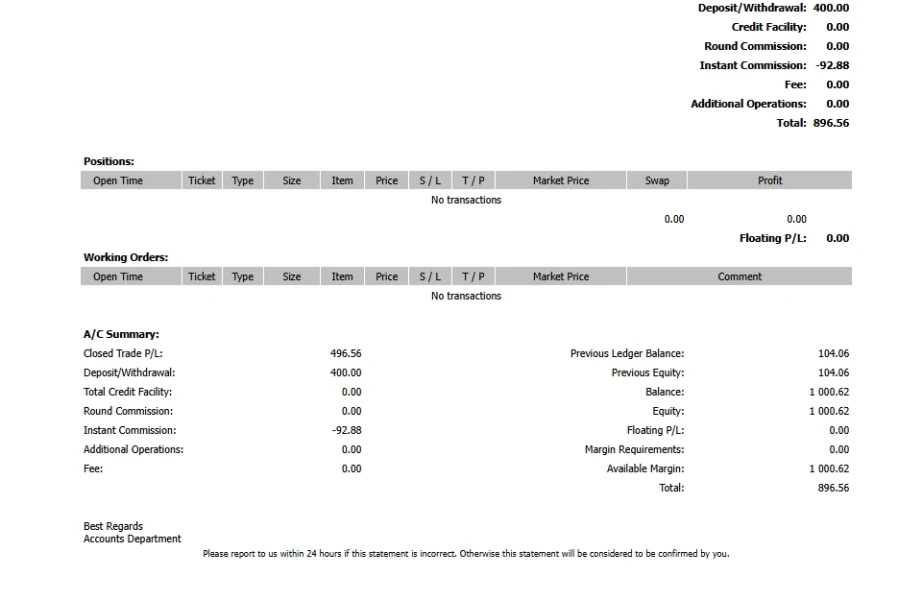

DLSM Fees

DLSM claims to offer low spreads and commissions. For Standard Account, it provides spreads from 1.2 pips and charges $0 commissions. For ECN Account, it it provides spreads from 0 pips and charges $4 commissions per lot.

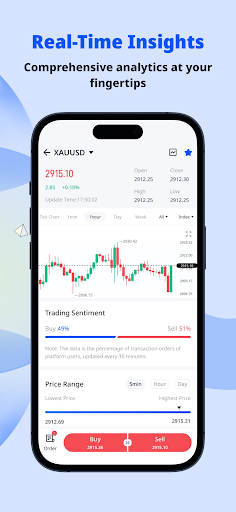

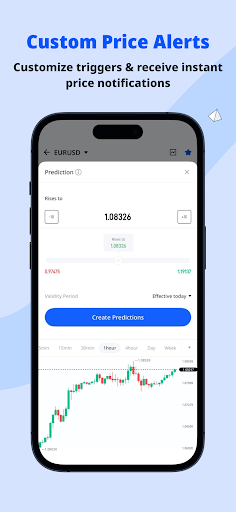

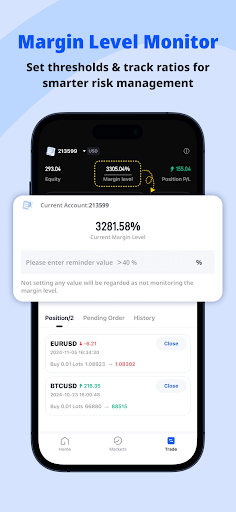

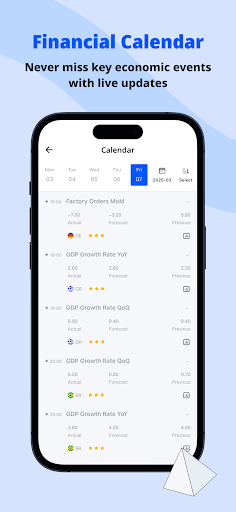

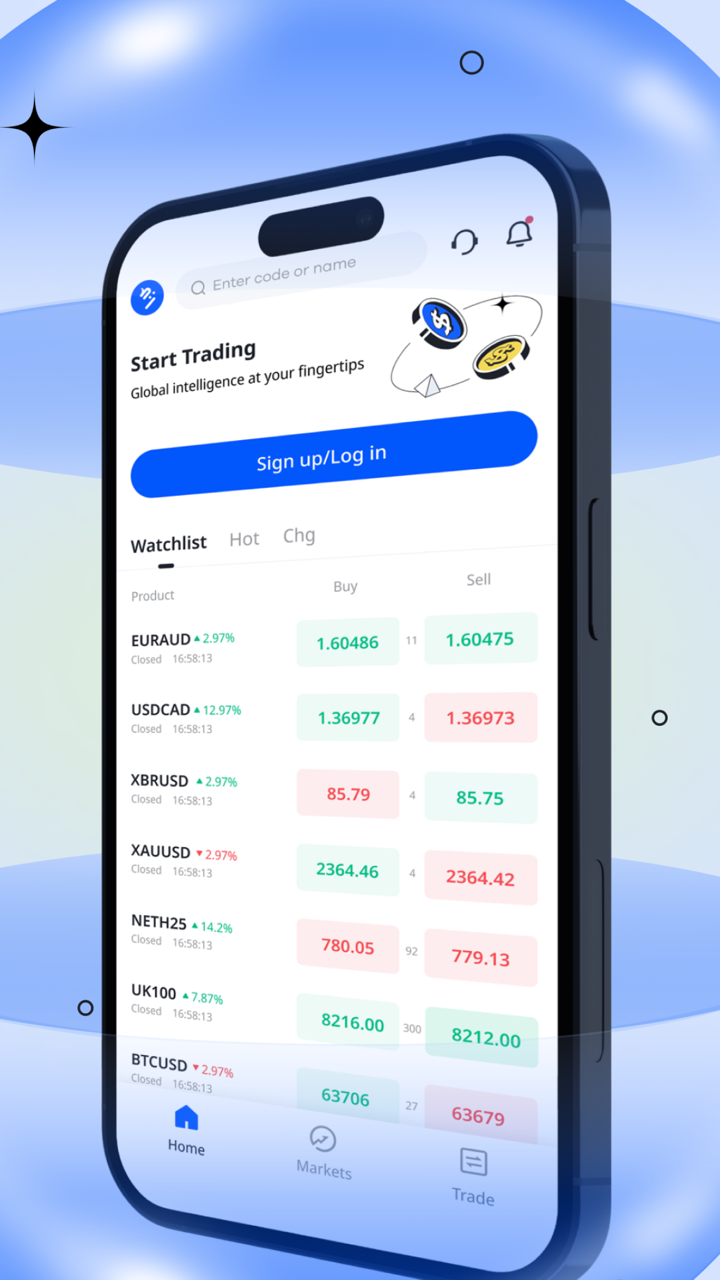

Trading Platform

DLSM's trading platforms are MT4 and MT5, which support traders on PC and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, Mobile | Beginners |

| MT5 | ✔ | Web, Mobile | Experienced traders |

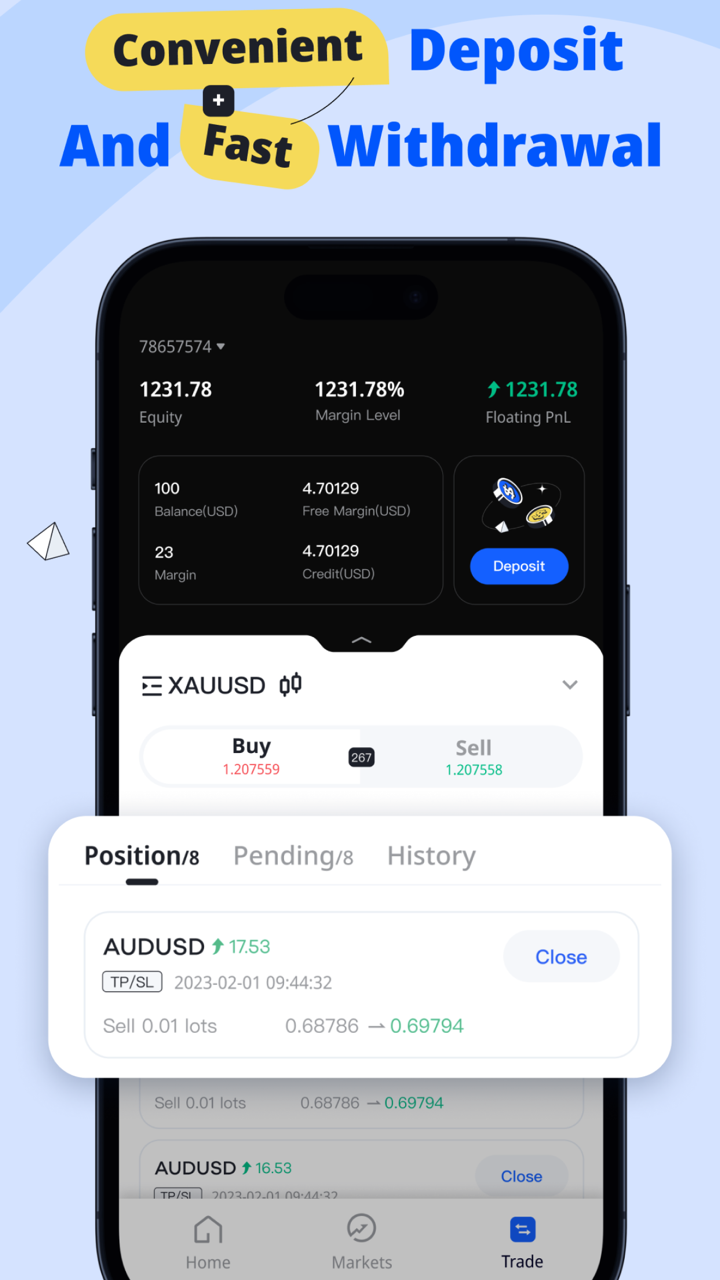

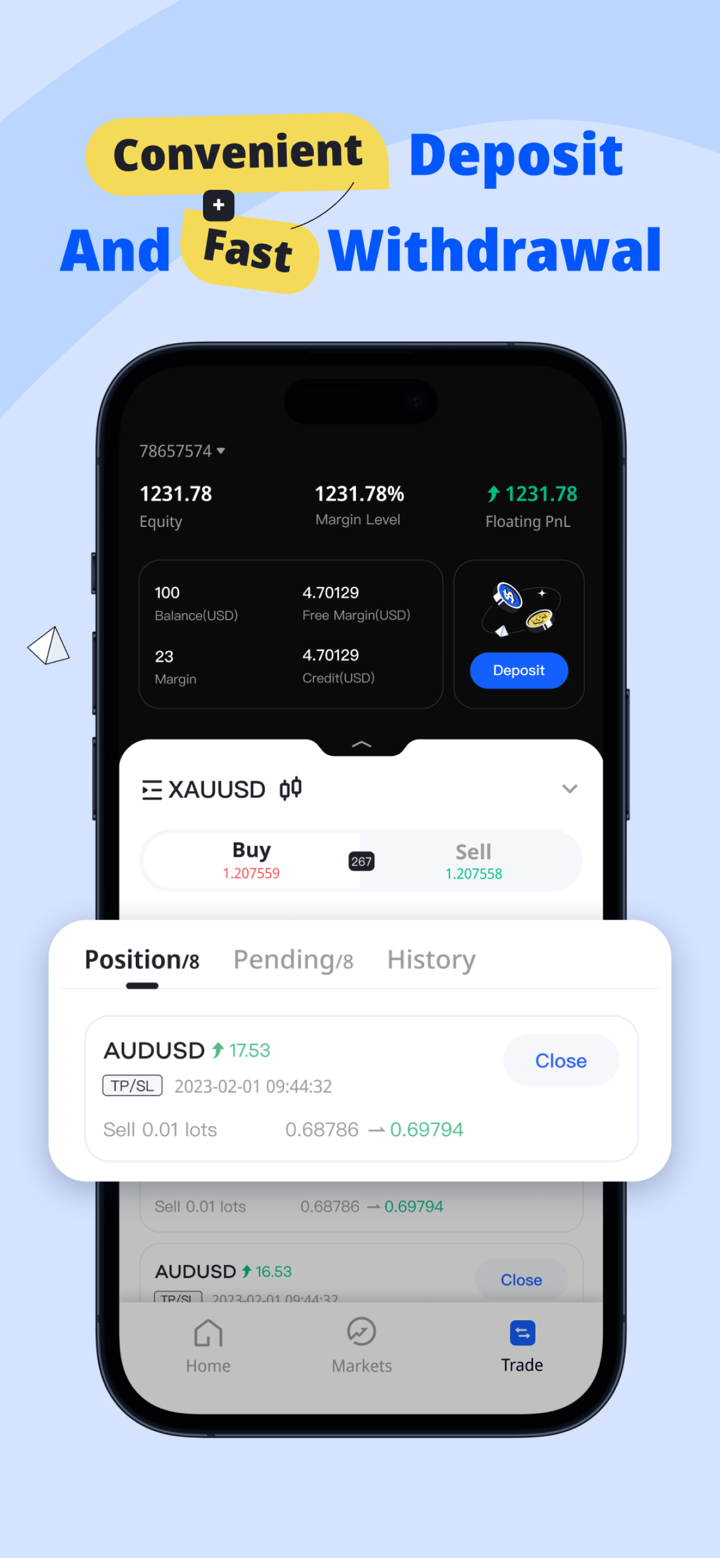

Deposit and Withdrawal

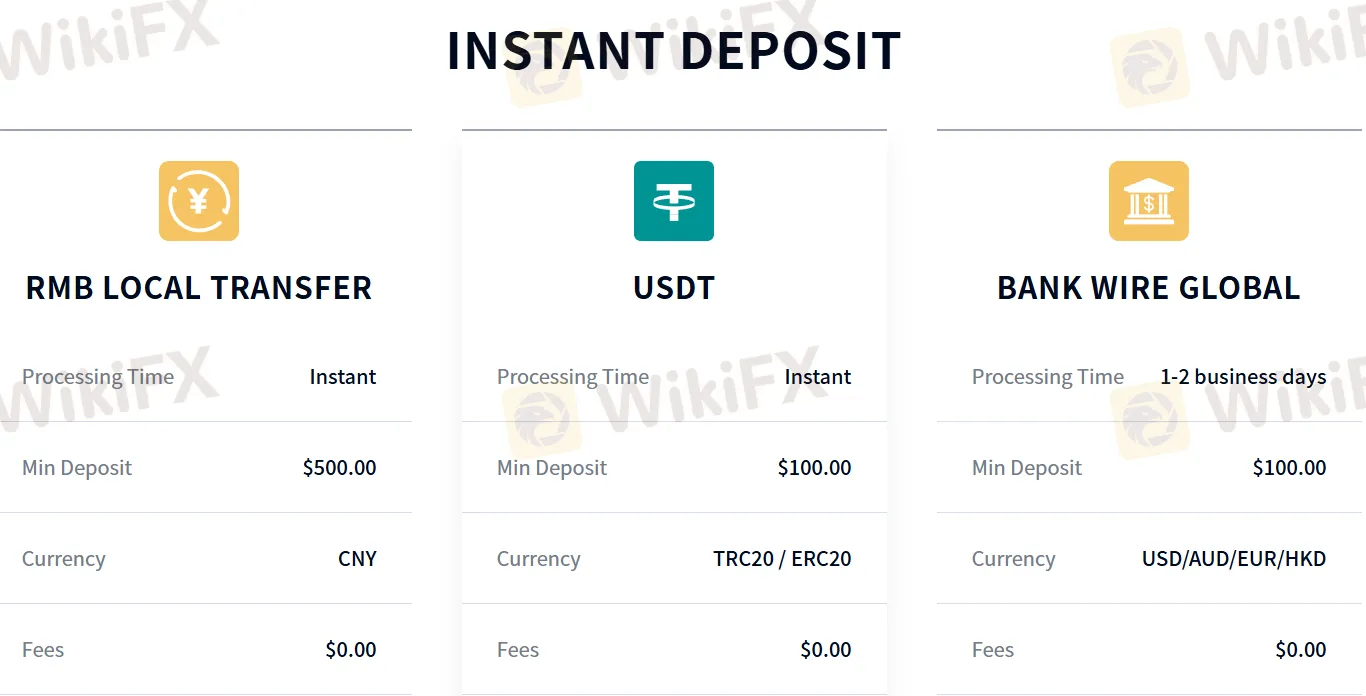

The broker doesn't charge withdrawal fees. It supports 3 types of deposit and withdrawal methods, which are RMB local transfer, USDT, Bank wire global.

| Deposit Methods | RMB Local Transfer | USDT | Bank Wire Global |

| Processing Time | Instant | Instant | 1-2 business days |

| Minimum deposit | $500 | $500 | $100 |

| Fees | $0.00 | $0.00 | $0.00 |

| Currency | CNY | TRC20 / ERC20 | USD/AUD/EUR/HKD |

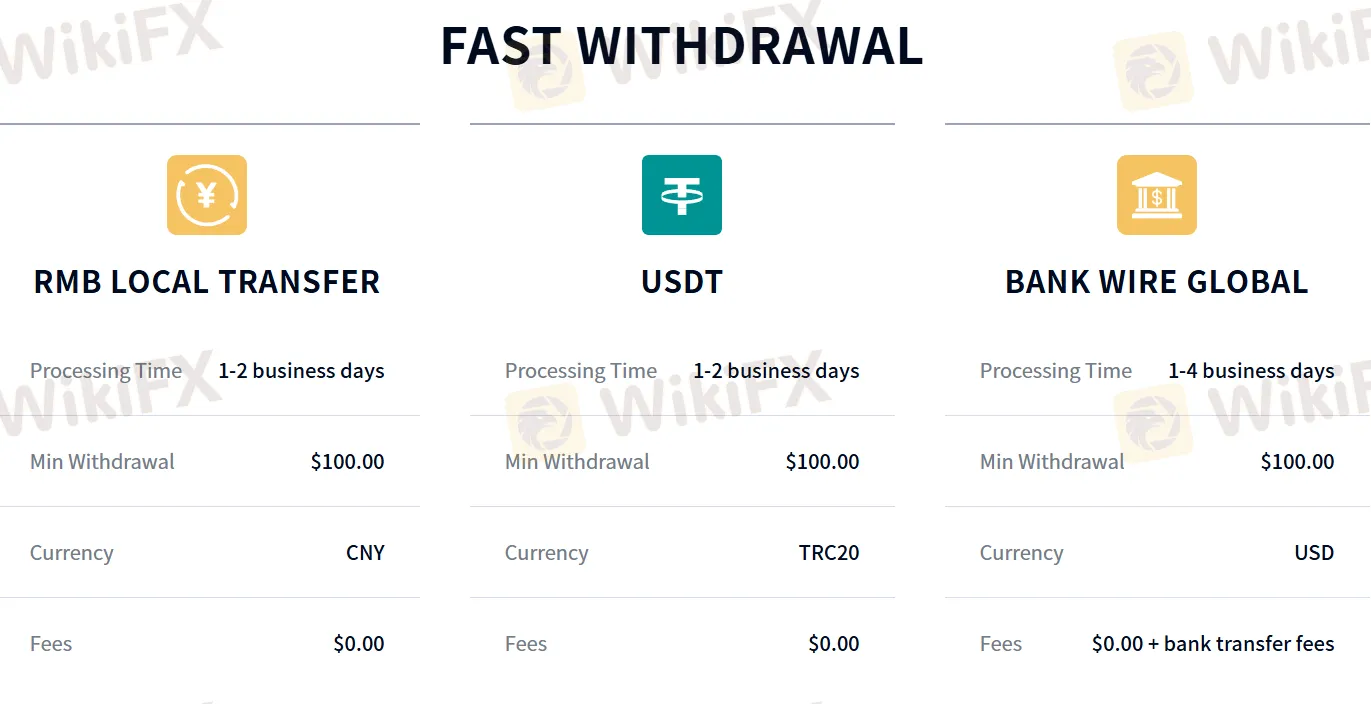

| Withdrawal Methods | RMB Local Transfer | USDT | Bank Wire Global |

| Processing Time | 1-2 business days | 1-2 business days | 1-4 business days |

| Minimum Withdrawal | $100 | $100 | $100 |

| Fees | $0.00 | $0.00 | $0.00 + bank transfer fees |

| Currency | CNY | TRC20 | USD |

Mick890

Czech Republic

PURE SCAM! Beware! DLSM stolen my initial deposit of 500 USDT. Refused to refund, stopped communicating. Scammers!

Exposure

Gensenly

Pakistan

I' m really happy with the platform, I would certainly recommend to others. I'm really happy with the service, my account manager christopher demetriou has provided me with.

Positive

Nlkjkio

Malaysia

I like your charts very much.Easy to understand and use.I can chat for information and the service is very good,but the most important thing is trust.I feel I can trust you as a company.When I trade,I like to know that there is no interference from anybody.If I win or lose,I know it is honest.I did not give 5 stars because there is always room for improvement,although I can't see where.

Positive

Suyond

Kazakhstan

My only wish is they had more educational resources. It's a bit of a DIY situation if you're looking to brush up on your trading skills.

Neutral