Company Summary

| GFC Global Review Summary | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex, Stock Indices (CFDs), Commodities |

| Demo Account | Available |

| Leverage | Up to 400:1 |

| Spread | Tight spreads on over 120 currency pairs |

| Trading Platform | GFC Web Trader, MetaTrader 5, MetaTrader 4 |

| Min Deposit | $250.00 |

| Customer Support | Telephone number : +44 (0) 203 991 0502+52 55 4163 7602+01 210 595 3390Address: 25 Canada Square, London, E14, 5LQ |

GFC Global Information

GFC Global is a trading platform founded in 2021 and headquartered in the United Kingdom. It is not regulated by any particular regulatory authority. The company offers two main account types: Standard Forex trading account and Mini Forex Trading account. It offers several trading platforms, including GFC Web Trader, MetaTrader 5 and MetaTrader 4, and provides tradable assets such as forex, stock indices (CFDs) and raw materials.

Pros and Cons

| Pros | Cons |

| Tight Spreads on 120+ Currency Pairs | Lack of Regulation |

| Maximum Leverage up to 400:1 | Conversion Premium for Different Currency Deposits |

| Availability of Demo Account | No 24/7 Live Video Chat Support |

| Flexible Leverage Options | |

| Availability of Demo Account |

Is GFC Global Legit?

GFC Globalis currently in a state of no effective supervision.

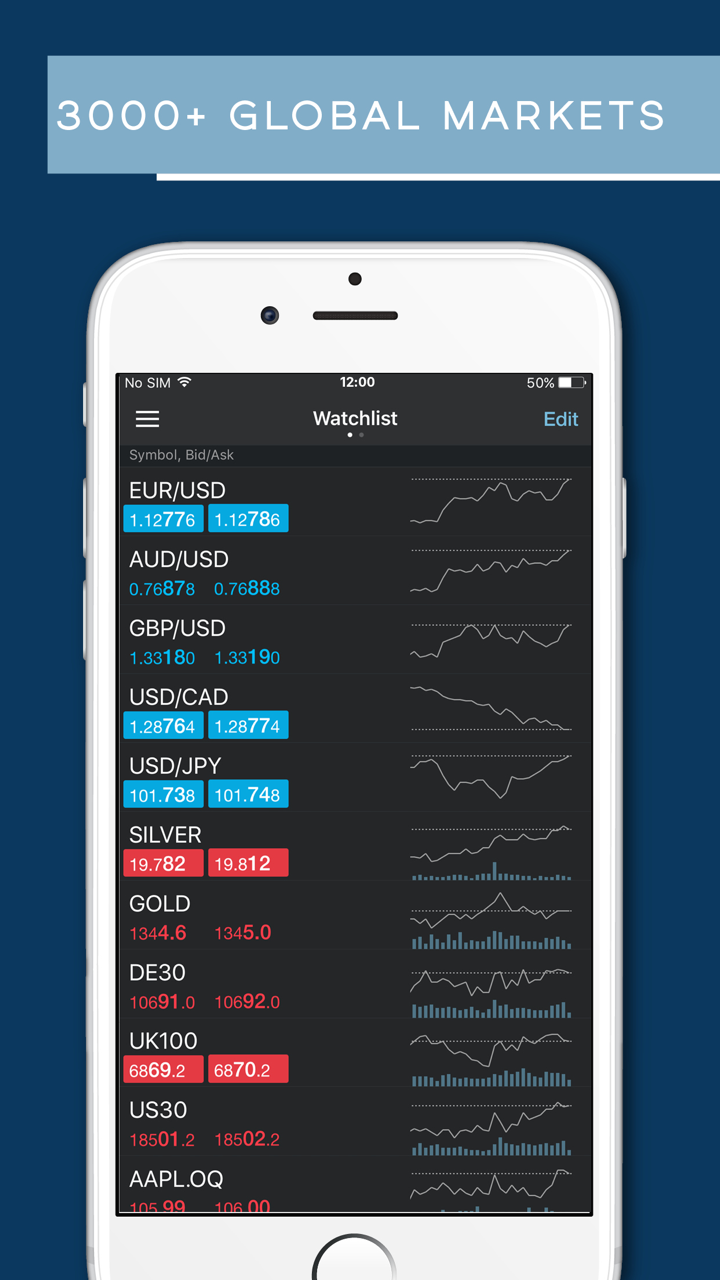

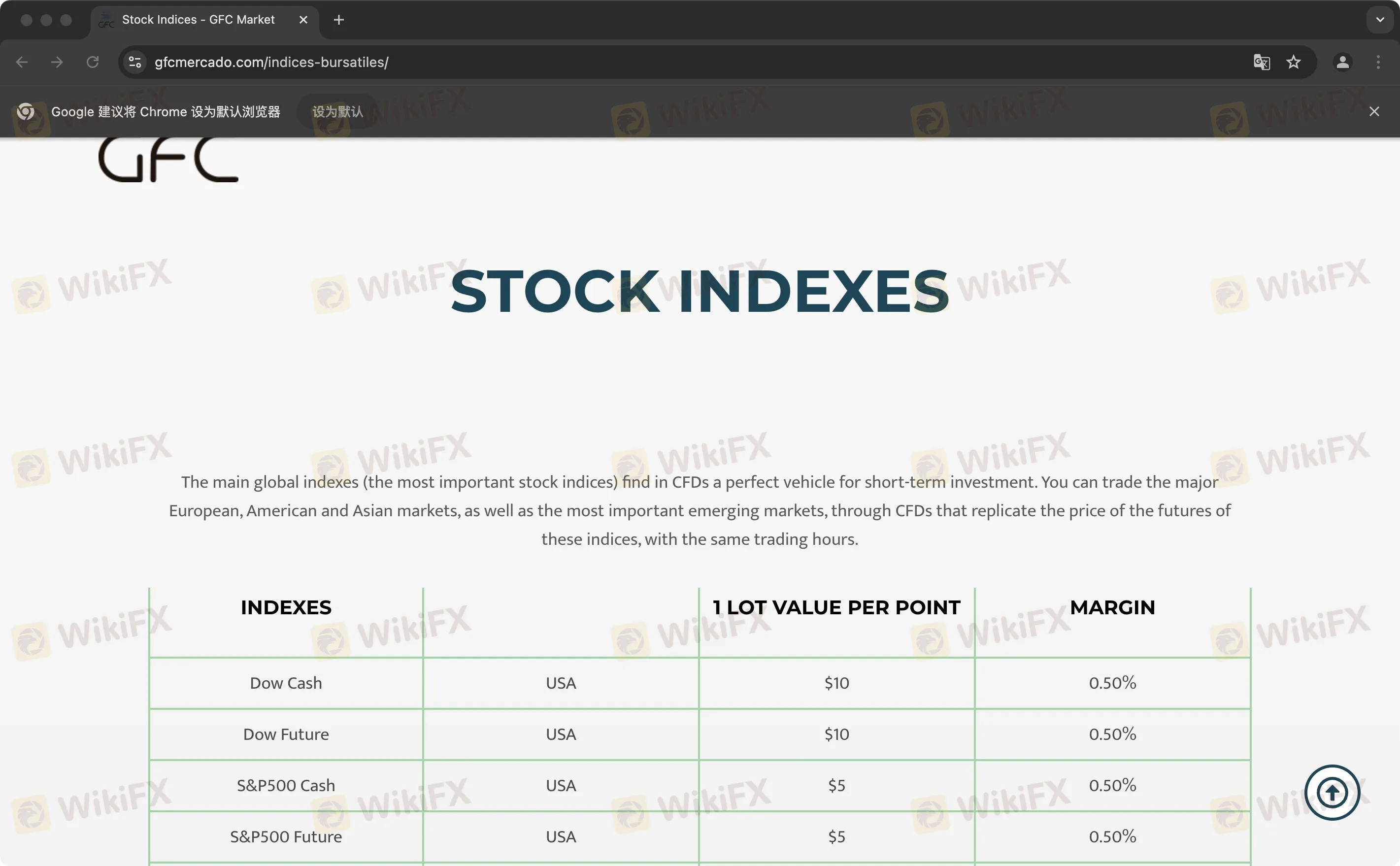

What Can I Trade on GFC Global?

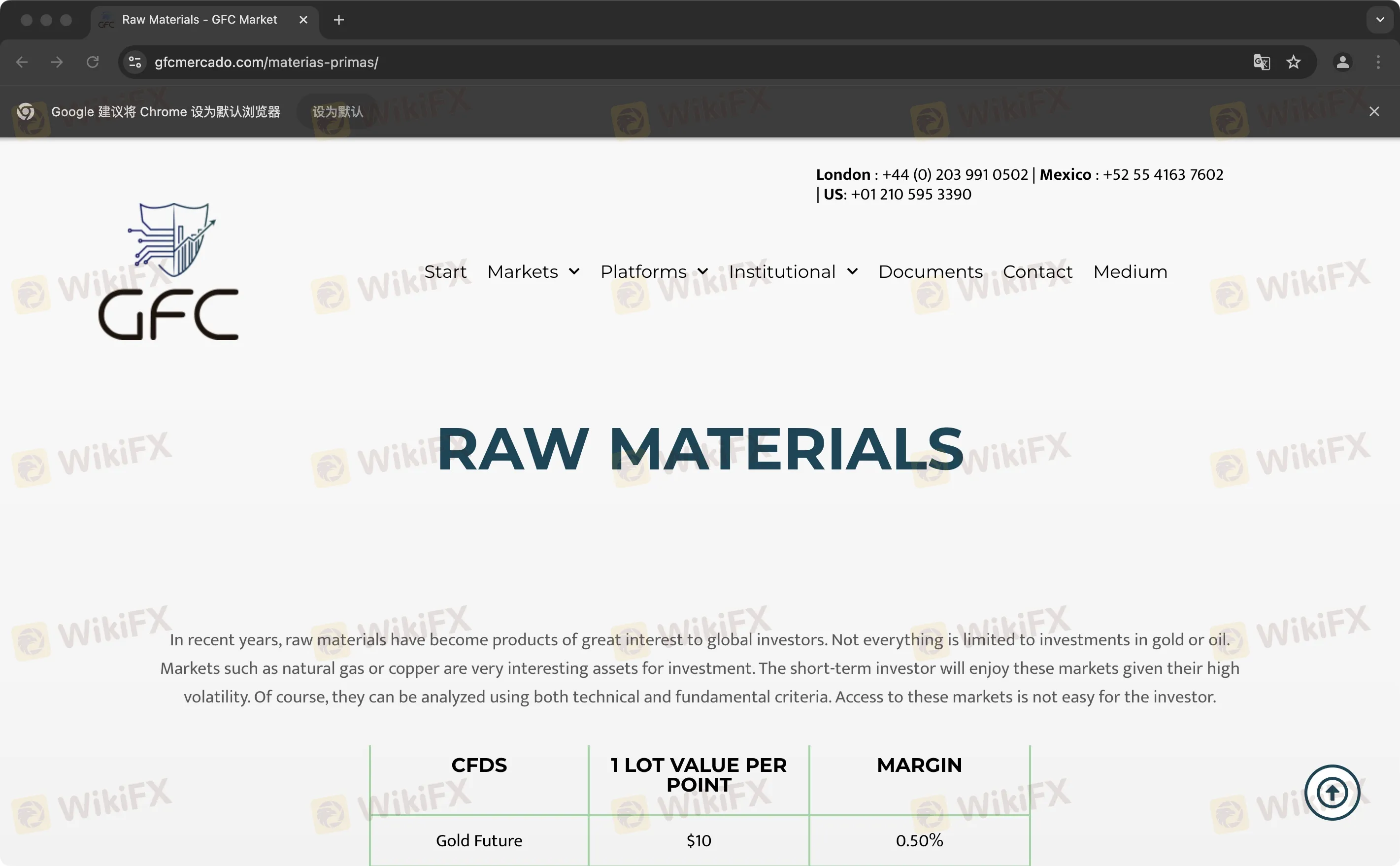

GFC Global offers traders the opportunity to trade forex, stock indices (CFDs) and raw materials.

| Tradable Instruments | Supported |

| Stock indices | ✔ |

| Forex | ✔ |

| Currencies | ❌ |

| Crypto currencies | ❌ |

| Raw materials | ✔ |

| Bonds | ❌ |

| Binary Options | ❌ |

| Mutual Funds | ❌ |

| Futures | ❌ |

Account Types

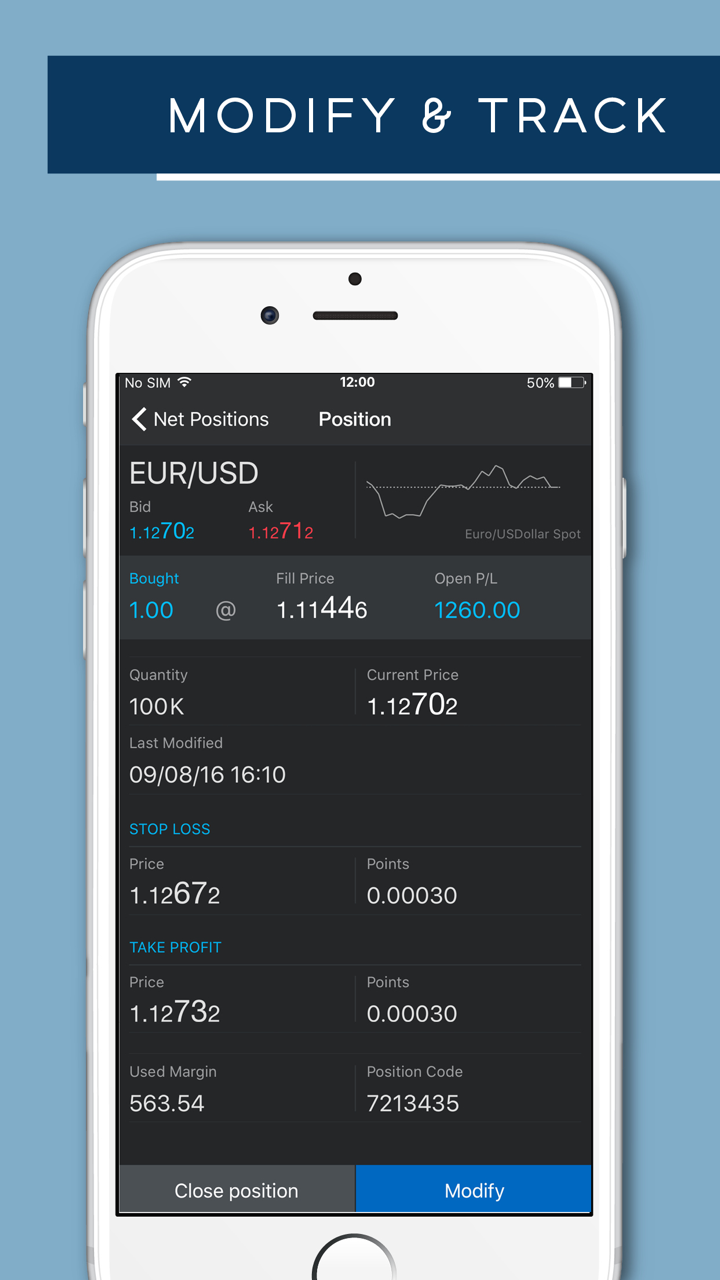

GFC Global offers two live account types, namely Standard Forex Trading Account and Standard Forex Trading Account.

The minimum deposit for a standard Forex trading account offered by GFC Global is USD 2,500.00. With this account type, users can leverage up to 400:1 in forex spot trading. Traders benefit from the spread of over 120 currency pairs.

Mini Forex trading accounts offered by GFC Global require a minimum deposit of $250. Traders enjoy up to 400:1 leverage and real-time profits.

| Aspect | Standard Forex Trading Account | Mini Forex Trading Account |

| Account Type | Standard | Mini |

| 24/7 Live Video Chat Support | Yes | No |

| Withdrawals | Standard procedures apply | Standard procedures apply |

| Demo Account | Available | Available |

| Copy Trading Tool | Yes | No |

| Bonus | N/A | N/A |

| Leverage Up to | 1:400 | 1:400 |

| Other Features | Real-time profits, Tight spreads on 120+ currency pairs | Real-time profits, Suitable for beginners, Lower minimum deposit |

Leverage

GFC Global allows clients to leverage up to 400:1.

GFC Global Fees

GFC Global claims to offer low-cost commission services. The exact amount of its fees was not disclosed.

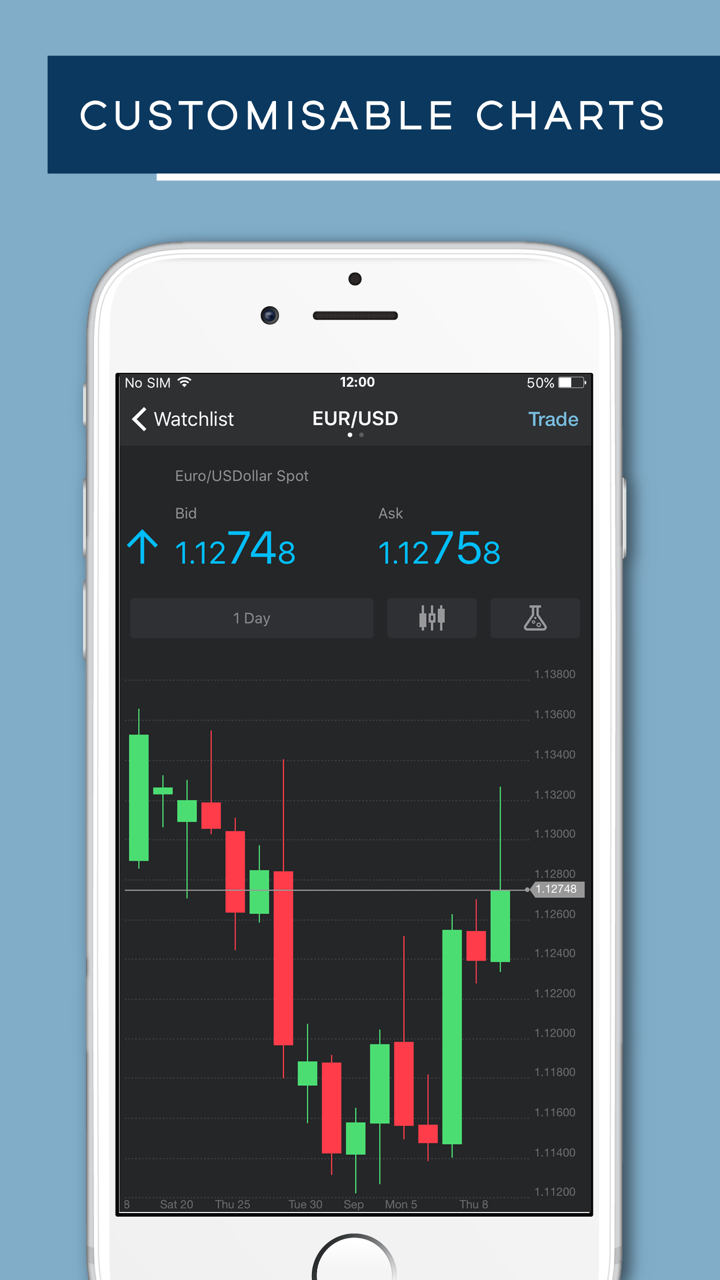

Trading Platform

MT5 is chosen by GFC Global to serve clients of different preferences.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

Deposit and Withdrawal

GFC Global opens a standard Forex trading account with a minimum deposit of US $2,500.00 and a Mini Forex trading account with a minimum deposit of US $250.00.

When making a deposit, please refer to the name and GFC account number of the account holder. It is important to emphasize that the currency of the deposit should be the same as the base currency of the account of the global financial company, as the bank can convert the funds for a nominal fee.

If funds need to be deposited in a currency other than the base currency of the GFC account, GFC Global will convert the funds at the current GFC request (buy) rate plus a conversion premium of up to 3%.