Company Summary

| Ex Investment Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Montenegro |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Cryptocurrencies, Indices, Shares, Metals, Bonds |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| Spread | Starting from 0.1 pips |

| Trading Platform | MT4 |

| Min Deposit | $250 |

| Customer Support | Email at support@ex-investment.com |

Ex Investment Information

Established in 2022, Ex Investment is an unregulated brokerage company registered in Montenegro. This firm provides wide selection oftradable instruments with its popular trading platforms (MT4, MT5). Ex Investment gives two live trading accounts and one demo account.

However, no phone support option could be a barrier for some investors.

Pros and Cons

| Pros | Cons |

| A swath of investment choices | No valid regulatory certificates |

| Popular trading platforms (MT4, MT5) | Limited customer support channel |

| Leverage up to 1:Unlimited | |

| Competitive spreads as low as 0.2 pips |

Is Ex Investment legit?

Ex Investment operates without regulation from any recognized financial authority.

What Can I Trade on Ex Investment?

With Ex Investment, you can make a diversified portfolio in 7 asset classes, including Forex, Commodities, Cryptocurrencies, Indices, Shares, Metals, and Bonds.

This firm offers over 80 currency pairs, including majors, minors, and exotics. You can invest in hard and soft commodities like gold, silver, oil, and natural gas. You get access to popular digital currencies like Bitcoin, Ethereum, and Litecoin. This firm also provides major global indices like the S&P 500 and DAX through CFDs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Shares | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ✔ |

| Options | ❌ |

| Mutual Funds | ❌ |

| ETFs | ❌ |

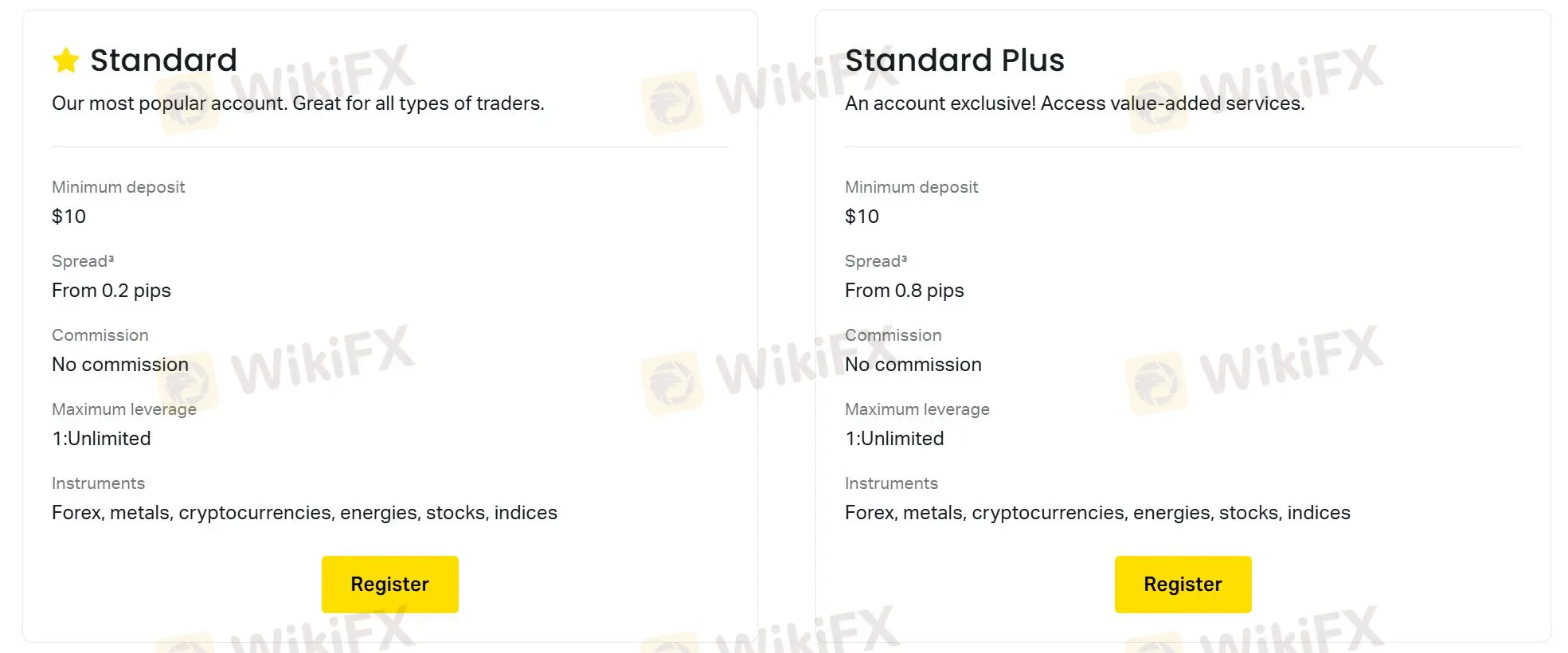

Account Types

Some online brokerages provide various account types. The bright side of this approach is that you might pay less in fees the more you invest. Ex Investment presents two live trading accounts: Standard and Standard Plus accounts. The minimum deposit of the two account types is as low as $10 and the leverage options are unlimited. There is also no commission fee in forex trading. A demo account is also available here.

| Account Types | Standard | Standard Plus |

| Leverage | Up to 1:Unlimited | Up to 1:Unlimited |

| Spreads | Starting from 0.2 pips | Starting from 0.8 pips |

| Commission | No commisson | No commisson |

| Minimum Deposit | $10 | $10 |

| Demo Account | Yes | Yes |

| Trading Platform | MT4 | MT4 |

Ex Investment Fees

Fees matter when building a portfolio. With Ex Investment, the fees depend on the account types. For example, the spreads for EUR/USD are as follows:

| Account types | Spreads |

| Standard | From 0.2 pips |

| Standard Plus | From 0.8 pips |

Trading Platform

MT4 (MetaTrader 4) and MT5 (MetaTrader 5) are available with Ex Investment. You can apply them on multiple devices, including Windows, MAC, Android, and iOS.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| MT5 | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| Proprietary platform | ❌ |