Company Summary

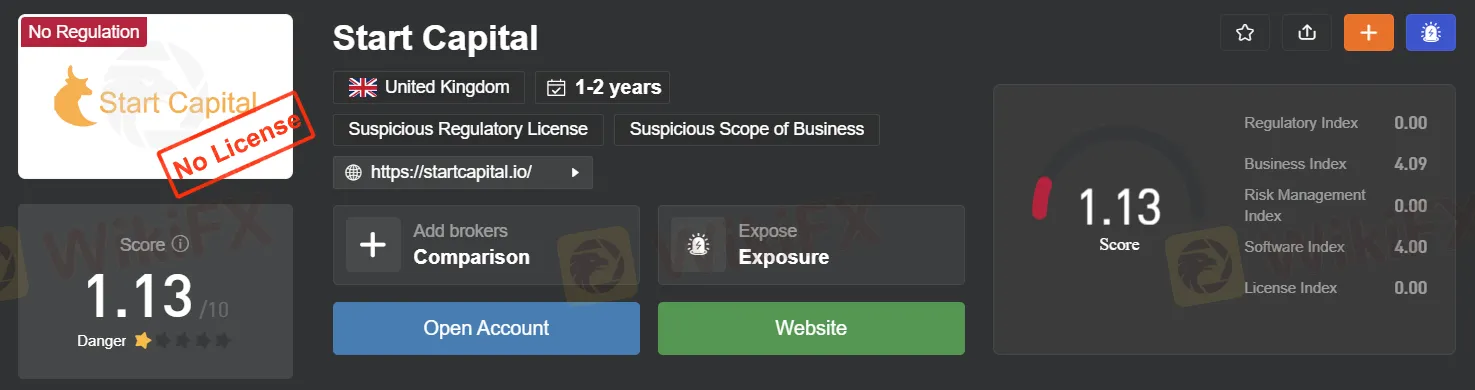

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 2021 |

| Company Name | Start Capital |

| Regulation | Lacks formal oversight, raising concerns |

| Minimum Deposit | Varies based on account type, starting from $250 |

| Spreads | Provided for different account types, range not specified |

| Trading Platforms | Mobile trading app and online platform offered |

| Tradable Assets | Stocks, indices, commodities, forex, cryptocurrencies |

| Account Types | Starter, Bronze, Silver, Gold, Platinum, VIP |

| Islamic Account | Available upon conversion, adhering to Islamic principles |

| Customer Support | Phone, Skype, Email |

| Payment Methods | Visa, Mastercard, Skrill, Neteller |

Overview

Start Capital, founded in 2021 and headquartered in the United Kingdom, operates without formal regulation, raising concerns about investor protection. The company offers a variety of account types, including Starter, Bronze, Silver, Gold, Platinum, and VIP, with minimum deposits starting from $250. Spreads are provided for different account types, but specific ranges are not specified. Traders have access to a diverse range of tradable assets, including stocks, indices, commodities, forex, and cryptocurrencies. Start Capital provides customer support through phone, Skype, and email, and accepts payments via Visa, Mastercard, Skrill, and Neteller. Additionally, the company offers Islamic accounts upon conversion, adhering to Islamic principles.

Regulation

Start Capital operates in a regulatory gray area, lacking formal oversight from any governing body. This absence of regulation raises concerns about investor protection and financial transparency within the organization. Investors should exercise caution and conduct thorough due diligence before engaging with Start Capital.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

Start Capital presents several advantages, including a diverse range of market instruments and a variety of account types to accommodate different trader preferences. Additionally, the platform offers comprehensive trading platforms and multiple payment methods for added convenience. However, the absence of regulation poses concerns regarding investor protection, while the inherent risk of online trading underscores the importance of risk management.

Market Instruments

At Start Capital, investors have access to a diverse range of market instruments tailored to different risk appetites and investment strategies:

Stocks:

Access a variety of individual company shares, allowing for targeted investment opportunities.

Invest in stocks from global companies, offering the potential for passive income with moderate risk.

Indices:

Supercharge your chances of making gains by tapping into various indices representing different market segments.

Trade with diversified portfolios of stocks, offering exposure to multiple companies and sectors simultaneously.

Commodities:

Capitalize on the stability and tangible value of these assets in times of market volatility.

Safeguard your assets against major economic changes by investing in commodities such as metals, energy resources, and agricultural products.

Forex Trading:

Take advantage of both mainstream and niche currency pairs to maximize profit potential in the forex market.

Engage in high-volume trading of currency pairs, providing opportunities for significant gains as exchange rates fluctuate.

Crypto:

Participate in the next big thing by learning about and investing in various cryptocurrencies, offering both volatility and potential for substantial returns.

Dive into the rapidly growing market of digital currencies, exploring crypto trading as one of the most dynamic investment opportunities.

Each market instrument available at Start Capital offers unique advantages and opportunities for investors to diversify their portfolios and pursue their financial goals.

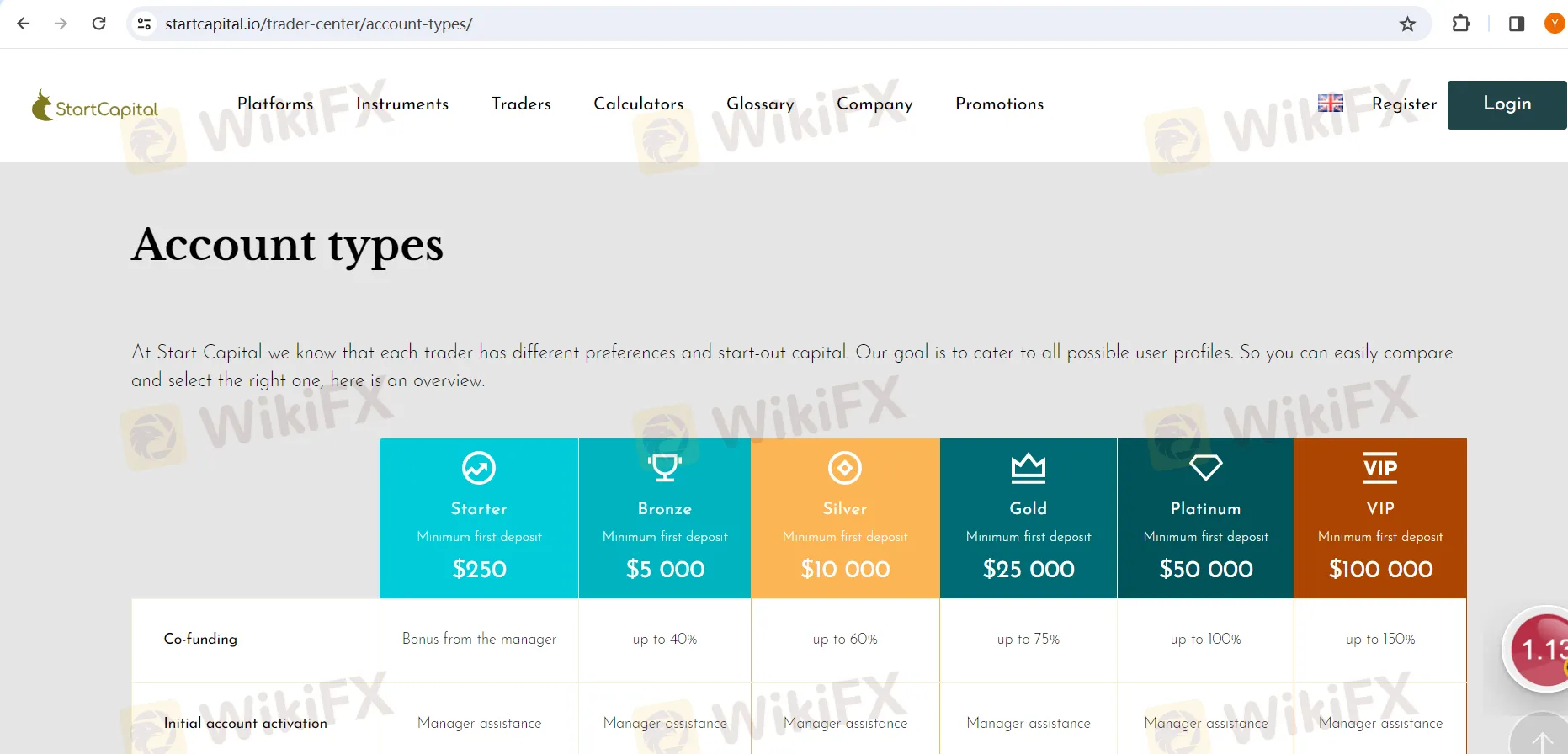

Account Types

Start Capital offers a range of account types to suit traders of varying experience levels and financial capabilities:

Starter Account: Minimum first deposit of $250. Ideal for beginners looking to learn without significant investment, with standard services and spreads.

Bronze Account: Minimum first deposit of $5,000. Suited for progressing traders, offering bonuses up to 60%, access to trading signals, and average spreads.

Silver Account: Minimum first deposit of $10,000. Provides medium priority in online chat, strategy training, and introduction to financial analyst services.

Gold Account: Minimum first deposit of $25,000. Offers low spreads, joint trading opportunities, investment portfolios, and high priority in online chat.

Platinum Account: Minimum first deposit of $50,000. Tailored for experienced traders with personalized trading and training, customized investment plans, and access to VIP analyst services.

VIP Account: Minimum first deposit of $100,000. Geared towards affluent traders, with up to 150% co-funding bonus, top priority in online chat, and exclusive access to all analyst capabilities.

All account types can be converted to Islamic Accounts, adhering to Islamic financial principles.

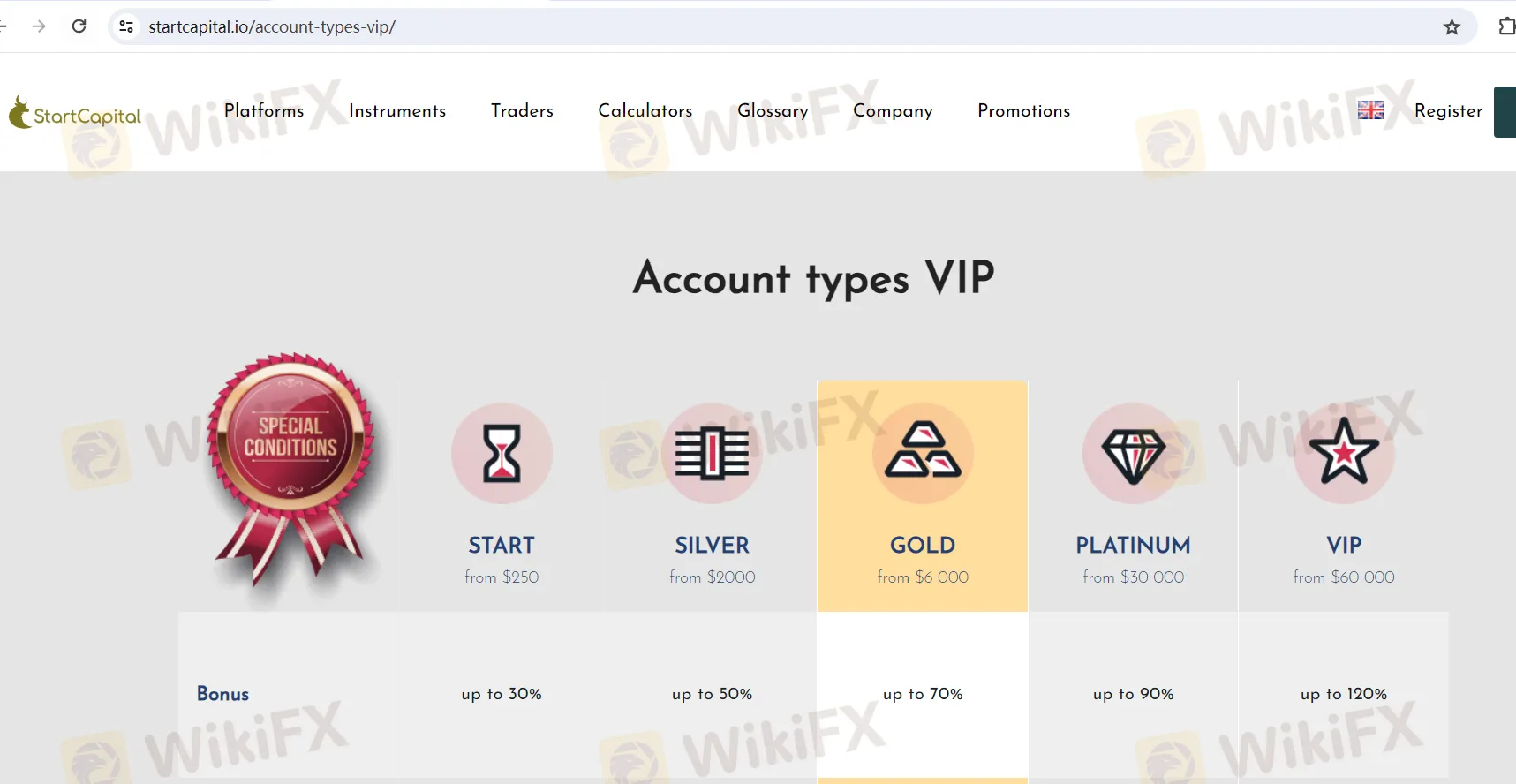

Start Capital also offers a range of VIP account types tailored to meet the needs of discerning traders seeking premium services and benefits:

VIP Account:

Spreads: By Invitation

Trading Based on Earnings Season: Minimum

Special Offers: Priority Participation

Webinars: Private VIP Webinars

Investment Portfolios: Customized Portfolios

Passive Income: Higher Yield

Trading Academy: Full Course with a Diploma

Trading Techniques: VIP Techniques

Account Analysis: Individual Work

Financial Analyst: Accompanied by a VIP Analyst

Web Platform Training: Customized Schedule

Withdrawal Speed: Highest Priority

Bonus: Up to 120%

Minimum Deposit: Starting from $60,000

Platinum Account:

Spreads: Low

Trading Based on Earnings Season: Limited Version

Special Offers: Communication Once a Week

Webinars: Free Access to Paid Webinars

Passive Income: Average Yield

Trading Academy: Half of the Training Course

Trading Techniques: Advanced Techniques

Account Analysis: Standard

Financial Analyst: Once a Week for up to 2 hours

Web Platform Training: Once a Week for up to 2 hours

Withdrawal Speed: High Priority

Bonus: Up to 90%

Minimum Deposit: Starting from $30,000

Gold Account:

Spreads: Average

Trading Based on Earnings Season: Limited Version

Special Offers: Communication Once a Week

Webinars: Webinars on Major Economic Events

Passive Income: Standard Yield

Trading Academy: Introductory Lecture

Trading Techniques: 2 Trading Techniques

Account Analysis: Limited

Financial Analyst: Once a Week for up to 1 hour

Web Platform Training: Once a Week for up to 1 hour

Withdrawal Speed: Medium Priority

Bonus: Up to 70%

Minimum Deposit: Starting from $6,000

Silver Account:

Spreads: Standard

Trading Based on Earnings Season: Limited Version

Special Offers: Once a Week Communication

Webinars: Limited Version

Passive Income: Standard

Trading Academy: For Beginners

Trading Techniques: 1 Trading Technique

Account Analysis: Standard

Financial Analyst: Once a Week for up to 30 minutes

Web Platform Training: Once a Week for up to 30 minutes

Withdrawal Speed: Standard Priority

Bonus: Up to 50%

Minimum Deposit: Starting from $2,000

Start Account:

Account Analysis: Standard

Financial Analyst: Standard

Web Platform Training: For Beginners

Withdrawal Speed: Standard Priority

Bonus: Up to 30%

Minimum Deposit: Starting from $250

Each VIP account type offers a unique combination of benefits, services, and privileges, tailored to meet the diverse needs and preferences of traders at different levels of expertise and investment capabilities.

Spreads

The table provides a breakdown of spreads for various currency pairs across different account types offered by Start Capital:

Mini Account: This account type generally features the highest spreads among all tiers, making it suitable for traders with smaller capital or those who prefer to trade with limited risk exposure.

Standard Account: Spreads for standard accounts are slightly lower compared to mini accounts, providing a more competitive trading environment for traders with a moderate level of experience.

Silver Account: With further reduced spreads, silver accounts offer improved trading conditions and may be suitable for traders looking for enhanced profitability and efficiency.

Gold Account: Gold accounts typically feature even lower spreads compared to silver accounts, attracting traders who seek optimal trading conditions and are willing to commit higher initial deposits.

Platinum Account: Platinum accounts offer the lowest spreads among all account types, catering to experienced traders or those with larger capital who prioritize tight spreads and efficient trade execution.

Overall, tighter spreads generally indicate more favorable trading conditions, allowing traders to potentially maximize profits and minimize costs associated with trading. Additionally, the variation in spreads across different currency pairs reflects market dynamics and liquidity conditions specific to each pair.

Payment Methods

Start Capital offers multiple payment methods for depositing and withdrawing funds, including Visa, Mastercard, Skrill, and Neteller. With Visa and Mastercard, traders can use their debit or credit cards for instant transactions. Skrill and Neteller provide e-wallet options for secure and fast transfers from bank accounts or cards. These methods ensure convenient and efficient handling of funds for trading activities.

Trading Platforms

Start Capital offers two powerful trading platforms:

Start Capital Trading Application:

Provides access to charts, quotes, and order management on the go.

Allows real-time trading, analysis, and account management.

A mobile app for iOS and Android devices.

Start Capital Online Platform:

Allows traders to create customized portfolios and communicate via web chat support.

Features risk management tools, trade history analysis, and Autochartist.

Offers over 170 trading tools.

Customer Support

Start Capital provides comprehensive customer support through various channels:

Phone: Customers can contact the support team directly by phone at +443300272590 for immediate assistance.

Skype: Users can reach out to Start Capital via Skype using the username start_capital@outlook.com for inquiries or support.

Email: For general inquiries and assistance, customers can email support@startcapital.org. In case of claims or disputes, they can contact the claims department at dispute@startcapital.org.

These channels ensure that customers can easily reach out to Start Capital for any queries, assistance, or dispute resolution they may require, thereby ensuring a smooth and responsive customer support experience.

FAQs

Q1: What trading platforms does Start Capital offer?

A1: Start Capital provides a mobile trading app for iOS and Android devices, as well as an online trading platform accessible via web browsers.

Q2: What account types are available at Start Capital?

A2: Start Capital offers a range of account types, including Starter, Bronze, Silver, Gold, Platinum, and VIP accounts, catering to traders with varying experience levels and investment capabilities.

Q3: What market instruments can I trade with at Start Capital?

A3: Start Capital offers a diverse range of market instruments, including stocks, indices, commodities, forex trading, and cryptocurrencies, providing ample opportunities for investors to diversify their portfolios.

Q4: How can I contact customer support at Start Capital?

A4: Customers can reach Start Capital's customer support team via phone, Skype, or email, with dedicated channels for general inquiries, support, and claims or disputes resolution.

Q5: Is there a risk associated with online trading at Start Capital?

A5: Yes, online trading carries substantial risk, and investors should be aware of the potential for total loss of invested funds. It's essential to understand the risks fully before engaging in trading activities.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.