No data

Do you want to know which is the better broker between FXOpen and instaforex ?

In the table below, you can compare the features of FXOpen , instaforex side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: --

Long: -6.23

Short: 0.8

Long: -21.82

Short: -7.01

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxopen, instaforex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 5-10 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks |

| Minimum Initial Deposit | $300 |

| Maximum Leverage | 1:30 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5, own platform TickTrader |

| Deposit and withdrawal method | Bank Wire Transfer, Credit Card |

| Customer Service | Email/phone number/address/live chat |

| Fraud Complaints Exposure | No for now |

General information and regulations of FXOpen

FXOpen is a trading name of FXOpen EU Ltd. FXOpen EU Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 194/13. FXOpen offers retail and professional trading available markets including forex instruments, indices, commodities, shares through popular MT4 & MT5 trading platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

At the end of the article, we will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Market instruments

Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks.....FXOpen allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on FXOpen.

Spreads and commissions for trading with FXOpen

The spreads and commissions depend on instruments and accounts. Only ECN account has a commission of 1.5 USD, and its spreads level is also lower.

Account Types for FXOpen

Demo Account: FXOpen provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: FXOpen offers a total of 2 account types: Beginner, Trader, Expert and VIP. The minimum deposit to open both accounts is 300 USD o EUR. Their major differences consist in the business model, spreads, commissions and the access to the markets. The ECN account has a commission of 1.5 USD and a wider range of market access.

Trading platforms offered by FXOpen

As for the trading platform, FXOpen provides its clients with many options. There are public platforms such as MT5 and MT4 that have served many clients worldwide, also FXOpen's own platform TickTrader. If you didn't want to spend time familiarizing yourself with a new platform, you could choose MT5 and MT4. But FXOpen's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

Leverage offered by FXOpen

The maximum leverage offered by FXOpen is only 1:30, which may seem too low to you. In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

Deposit and withdrawal methods and fees

In terms of deposit and withdrawal, like many good brokers, FXOpen provides a detailed form with important information about currency, payment method, minimum amount, arrival date, fees, etc. The feasible payment methods are

We noted that for withdrawals with bank transfer, there is a commission of 30 USD/15 GBP/15 USD.

Educational resources

A series of educational resources is available at FXOpen, such as margin and pip value calculator, economic calendar, market news, market pulse, basic knowledge, etcetera.

Customer support of FXOpen

Below are the details about the customer service.

Language(s): English, French, German, Italian, Spanish, Turkish, Chinese, Portuguese, Russian, etcetera.

Service Hours: 9am-8pm (Eastern European Time)

Email: support@fxopen.eu

Phone Number: +357 25024000

Address: 38 Spyrou Kyprianou Street, CCS BLDG - Office N101, 4154 Limassol, Cyprus

Social media: Facebook, Instagram, LinkedIn, YouTube, twitter, telegram

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time. However, this does not necessarily mean that this broker is safe and you should remain vigilant to prevent being scammed.

Advantages and disadvantages of FXOpen

Advantages:

Well regulated

MT4, MT5

Sufficient information

Educational resources

Many instruments available

Demo account

Negative balance protection

Disadvantages:

Deposit and withdrawal fees

No copy trading

Frequent asked questions about FXOpen

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC in Cyprus.

How much leverage does this broker offer?

The maximum leverage of FXOpen is 1:30. Please note that this leverage may only be available for some accounts and products. Please consult our articles or the dealer's website for specific information.

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 5-10 years |

| Trading instruments | currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5 |

| Deposit and withdrawal method | Bank wire transfer and many other methods |

| Customer Service | Email/phone number/address/live chat/more |

| Fraud Complaints Exposure | No for now |

General information and regulations of InstaForex

InstaForex brand was founded in 2007 and claims to be the choice of more than 7 million brokers. InstaForex website may be very complex at first glance, but if you take a moment to look at it closely, you will find a wealth of content. The information bar on both sides of the page is full of attractive content, such as news, widgets, real-time charts, customer service and much more.

In the following article, we will analyze the features of this merchant in all its dimensions, providing you with easy and well-organized information. If you are interested, read on. Reading this article will take you approximately 7 minutes.

At the end of the article, we will also briefly extract the most significant advantages and disadvantages so that you can get an idea of the broker's features at a glance.

Market instruments

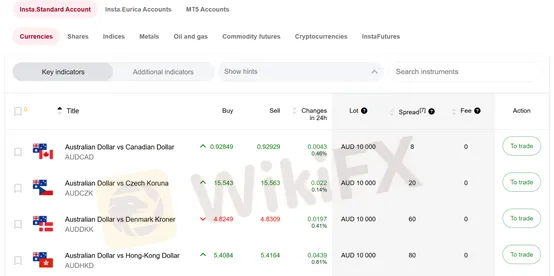

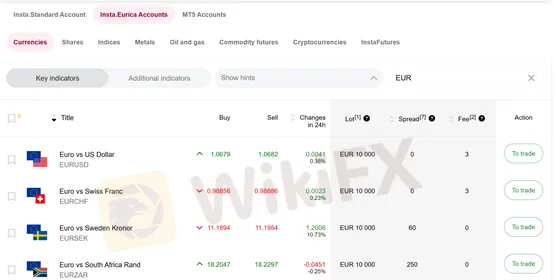

As we have said before, InstaForex web pages are very informative. On this trading products page you can see not only the trading products, but also the difference in commissions and spreads between different accounts. We can trade currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures.

Spreads and commissions for trading with InstaForex

Let's take currency pairs as an example. Spreads and commissions vary on different accounts. On the MT5 and Standard accounts the spread is about 3 pips and there is no commission, while on the Eurica account the spread is 0 and the commission varies from 3-12 USD.

We can venture to conclude that Eurica is suitable for long-term traders who trade less frequently, while the other two accounts are suitable for short-term traders who trade more frequently.

Account Types for InstaForex

Demo account: InstaForex offers a demo account for testing a little on the financial market without the risk of losing money. Opening a demo account, according to the company, is as easy as ABC.

Live account: there are in total 4 types of accounts: insta standard, insta eurica, cent standard and cent eurica. The minimum deposit for opening an account at InstaForex is just 1 USD, and the trading conditions also seem to be quite favorable.

Trading platforms offered by InstaForex

As for trading platforms, clients can choose from the market leaders MetaTrader4 and MetaTrader5, which can be accessed from any device.

However, have you ever wondered or are you wondering which platform you should use? Our team has the corresponding article for your reference. The article details the similarities and differences between the two and gives specific advice.

https://www.wikifx.com/es/wikishow/202207208464173722.html

Leverage offered by InstaForex

InstaForex offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and withdrawal methods and fees

Unlike some brokers that lack information, InstaForex is very generous in providing information. If you carefully browse their website, you can find a wealth of information. As for deposits and withdrawals, InstaForex shows all methods, required fees and arrival times clearly on a single page.

Educational resources

InstaForex educational resources are extensive. Online charts, market analysis, Forex calculators, indicators, articles, questions and answers, glossary... Whether you choose InstaForex as your broker or not, you can make the most of the resources available here.

Customer support of InstaForex

Call back, live chat, WhatsApp, email...with numerous channels and 24/7 service, clients could get help whenever they have trading-related problem.

Here are more details about the customer service.

Languages: there are total sixteen languages on InstaForex website, which could meet the needs of most of its customers.

Service hours: 24/7

Phone: you could fill in a form, indicating your country, your preferred language and time, the team will call you whenever you want, and the service is totally free of charge.

Email: support@mail.instaforex.com

Social networks: Facebook, Twitter, YouTube, Telegram, Instagram

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time.

Advantages and disadvantages of InstaForex

Advantages:

Well regulated

MT4, MT5

Sufficient information

Educational resources

Many instruments available

Demo account

Disadvantages:

Low leverage

Frequent asked questions about InstaForex

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC in Cyprus.

Does this broker offer MT4/MT5?

Yes, InstaForex offers both MT4 and MT5 for you to choose from.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxopen and instaforex are, we first considered common fees for standard accounts. On fxopen, the average spread for the EUR/USD currency pair is -- pips, while on instaforex the spread is Fixed 2-7.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxopen is regulated by CYSEC. instaforex is regulated by CYSEC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxopen provides trading platform including STP,ECN and trading variety including --. instaforex provides trading platform including Standard Trading Accounts,Eurica Trading Accounts,ECN Trading Account,ECN Pro Trading Account,Scalping trading account and trading variety including --.