No data

Do you want to know which is the better broker between instaforex and eXcentral ?

In the table below, you can compare the features of instaforex , eXcentral side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: --

Long: -6.23

Short: 0.8

Long: -21.82

Short: -7.01

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of instaforex, excentral lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 5-10 years |

| Trading instruments | currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5 |

| Deposit and withdrawal method | Bank wire transfer and many other methods |

| Customer Service | Email/phone number/address/live chat/more |

| Fraud Complaints Exposure | No for now |

General information and regulations of InstaForex

InstaForex brand was founded in 2007 and claims to be the choice of more than 7 million brokers. InstaForex website may be very complex at first glance, but if you take a moment to look at it closely, you will find a wealth of content. The information bar on both sides of the page is full of attractive content, such as news, widgets, real-time charts, customer service and much more.

In the following article, we will analyze the features of this merchant in all its dimensions, providing you with easy and well-organized information. If you are interested, read on. Reading this article will take you approximately 7 minutes.

At the end of the article, we will also briefly extract the most significant advantages and disadvantages so that you can get an idea of the broker's features at a glance.

Market instruments

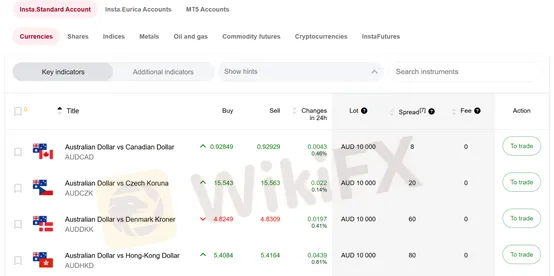

As we have said before, InstaForex web pages are very informative. On this trading products page you can see not only the trading products, but also the difference in commissions and spreads between different accounts. We can trade currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures.

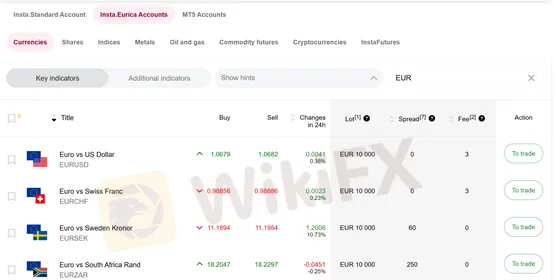

Spreads and commissions for trading with InstaForex

Let's take currency pairs as an example. Spreads and commissions vary on different accounts. On the MT5 and Standard accounts the spread is about 3 pips and there is no commission, while on the Eurica account the spread is 0 and the commission varies from 3-12 USD.

We can venture to conclude that Eurica is suitable for long-term traders who trade less frequently, while the other two accounts are suitable for short-term traders who trade more frequently.

Account Types for InstaForex

Demo account: InstaForex offers a demo account for testing a little on the financial market without the risk of losing money. Opening a demo account, according to the company, is as easy as ABC.

Live account: there are in total 4 types of accounts: insta standard, insta eurica, cent standard and cent eurica. The minimum deposit for opening an account at InstaForex is just 1 USD, and the trading conditions also seem to be quite favorable.

Trading platforms offered by InstaForex

As for trading platforms, clients can choose from the market leaders MetaTrader4 and MetaTrader5, which can be accessed from any device.

However, have you ever wondered or are you wondering which platform you should use? Our team has the corresponding article for your reference. The article details the similarities and differences between the two and gives specific advice.

https://www.wikifx.com/es/wikishow/202207208464173722.html

Leverage offered by InstaForex

InstaForex offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and withdrawal methods and fees

Unlike some brokers that lack information, InstaForex is very generous in providing information. If you carefully browse their website, you can find a wealth of information. As for deposits and withdrawals, InstaForex shows all methods, required fees and arrival times clearly on a single page.

Educational resources

InstaForex educational resources are extensive. Online charts, market analysis, Forex calculators, indicators, articles, questions and answers, glossary... Whether you choose InstaForex as your broker or not, you can make the most of the resources available here.

Customer support of InstaForex

Call back, live chat, WhatsApp, email...with numerous channels and 24/7 service, clients could get help whenever they have trading-related problem.

Here are more details about the customer service.

Languages: there are total sixteen languages on InstaForex website, which could meet the needs of most of its customers.

Service hours: 24/7

Phone: you could fill in a form, indicating your country, your preferred language and time, the team will call you whenever you want, and the service is totally free of charge.

Email: support@mail.instaforex.com

Social networks: Facebook, Twitter, YouTube, Telegram, Instagram

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time.

Advantages and disadvantages of InstaForex

Advantages:

Well regulated

MT4, MT5

Sufficient information

Educational resources

Many instruments available

Demo account

Disadvantages:

Low leverage

Frequent asked questions about InstaForex

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC in Cyprus.

Does this broker offer MT4/MT5?

Yes, InstaForex offers both MT4 and MT5 for you to choose from.

| Aspect | Information |

| Company Name | eXcentral |

| Registered Country/Area | South Africa |

| Founded Year | 2018 |

| Regulation | Revoked |

| Minimum Deposit | $1,000 |

| Market Instruments | Forex,Commodities,Indices |

| Account Types | Classic,VIP,Gold |

| Leverage | Up to 1:30 |

| Spreads&commissions | Spreads:0.06-2.5pip,no commissions |

| Trading Platforms | MT4,MT5 platform |

| Demo Account | Available |

| Customer Support | Email:inquiriesaexcentral-int.com,Phone:+278 71 951005 |

| Deposit & Withdrawal | Bank transfer,debit/credit card,third party payment |

eXcentral, founded in 2018 and based in South Africa, is a financial services company that has had its regulation revoked. The firm requires a minimum deposit of $1,000 and offers trading in Forex, commodities, and indices.

eXcentral provides various account types including Classic, VIP, and Gold, catering to different levels of traders. The company offers leverage of up to 1:30 and boasts competitive trading conditions with spreads ranging from 0.06 to 0.1 pip, without charging commissions.

Traders have access to both MT4 and MT5 platforms, popular choices for their robust features and user-friendliness. A demo account is also available for practice trading. Customer support can be reached via email at inquiriesaexcentral-int.com or by phone at +278 71 951005.

For deposits and withdrawals, eXcentral accepts bank transfers, debit/credit cards, and third-party payments. However, the revocation of its regulation takes about its credibility and the safety of client funds.

eXcentral, operating under the licensed institution OM BRIDGE (PTY) LTD, had its regulatory status revoked by the Financial Sector Conduct Authority in South Africa.

The company, which held the license number 48296 since June 6, 2017, was categorized as a Financial Service Corporate. The revocation of its license raises significant concerns regarding its compliance with financial regulatory standards and the overall safety and legitimacy of its operations.

The licensed institution is located at UNIT 6C3, 159 Rivonia Road Sinosteel Plaza, Morningside Ext 39 Sandton, and can be contacted at the phone number 27072 216 2542. However, given the revocation of its regulatory status, caution is advised when considering any engagement with eXcentral.

The reason for the revocation and the current operational status of the company would require further investigation for anyone considering their services.

| Pros | Cons |

| Diverse Market Instruments | Regulation Revoked |

| Multiple Account Types | High Minimum Deposit |

| Competitive Spreads | Uncertain Operational Status |

| Access to MT4 and MT5 Platforms | Limited Information on Licensed Institution |

| Demo Account Availability | Potential Risk to Investors |

Pros:

Diverse Market Instruments: Offers trading in Forex, commodities, and indices, providing a range of options for traders.

Multiple Account Types: Availability of Classic, VIP, and Gold accounts caters to different levels of traders, offering flexibility and tailored trading experiences.

Competitive Spreads: Claims to offer low spreads ranging from 0.06 to 0.1 pip, which can be beneficial for cost-effective trading.

Access to MT4 and MT5 Platforms: Both platforms are well-regarded in the trading community for their advanced features and user-friendly interfaces.

Demo Account Availability: Provides a demo account, allowing new traders to practice and get acquainted with the platforms without financial risk.

Cons:

Regulation Revoked: The revocation of its regulatory status by the Financial Sector Conduct Authority in South Africa is a major red flag, indicating potential issues with compliance and reliability.

High Minimum Deposit: A minimum deposit of $1,000 might be relatively high for beginner traders or those looking to test the waters with smaller investments.

Uncertain Operational Status: The revocation of its license raises questions about the current operational status and the safety of client funds.

Limited Information on Licensed Institution: Lack of detailed information about the licensed institution OM BRIDGE (PTY) LTD, including its website and email address, hinders transparency.

Potential Risk to Investors: Given regulatory concerns, there is a heightened risk for anyone considering investing or trading with eXcentral.

eXcentral offers trading in a range of market instruments, which include:

Forex: This includes a variety of currency pairs, allowing traders to speculate on the changing values of currencies against each other.

Commodities: These typically involve trading in natural resources such as gold, silver, oil, and agricultural products. Commodities trading can be a way to diversify a trading portfolio beyond forex and indices.

Indices: Trading in indices involves speculating on the price movements of index funds, which represent the aggregated performance of a selection of stocks. Indices usually reflect the performance of a particular sector or the broader market.

Classic Trading Account:

The Classic Trading Account at eXcentral is designed for entry-level traders, offering leverage up to 1:30. It features a 2.5 spread on EUR/USD and a $0.10 spread on Crude Oil, catering to those who prefer trading in major forex pairs and commodities.

This account includes negative balance protection, which can be a safety net for traders against going into debt. Additionally, it comes with free trading education, providing resources for beginners to learn and develop their trading skills.

VIP Account:

eXcentral's VIP Account is tailored for more advanced traders, maintaining the same leverage of up to 1:30. It offers narrower spreads, with 0.9 on EUR/USD and $0.06 on Crude Oil, which can be appealing for more frequent or experienced traders.

This account enhances the trading experience with added features like educational webinars, SMS MTE trading signals for timely market insights, and weekly account overviews for a regular summary of trading performance.

The VIP Account is a step up for those seeking more in-depth market analysis and educational support.

Gold Account:

The Gold Account at eXcentral is geared towards serious, committed traders, providing leverage up to 1:30. It offers competitive spreads of 1.8 on EUR/USD and $0.08 on Crude Oil.

Alongside the benefits found in the VIP Account, the Gold Account introduces a monthly account overview for comprehensive performance tracking and the services of a dedicated senior account manager for personalized trading support.

Exclusive one-on-one sessions are a standout feature, offering bespoke guidance and strategy discussion, making this account suitable for those seeking a highly tailored trading experience.

| Account Type | Leverage | EUR/USD Spread | Crude Oil Spread |

| Classic | Up to 1:30 | 2.5 | $0.10 |

| VIP | Up to 1:30 | 0.9 | $0.06 |

| Gold | Up to 1:30 | 1.8 | $0.08 |

Opening an account with eXcentral typically involves the following four steps:

Account Selection:

Begin by choosing the type of trading account that best suits your trading needs and experience level. eXcentral offers Classic, VIP, and Gold accounts, each with different features and spreads.

Registration Process:

Complete the registration form on eXcentrals website. This process usually requires providing personal information such as your name, address, contact details, and possibly some financial information to assess your trading experience and risk tolerance.

Verification (KYC Process):

As part of the Know Your Customer (KYC) process, submit the necessary documents for identity verification. This typically includes a government-issued ID (like a passport or drivers license), proof of residence (such as a utility bill or bank statement), and possibly additional financial documents.

Fund Your Account:

Once your account is verified, deposit funds to meet the minimum deposit requirement, which is $1,000 for eXcentral. Choose a suitable deposit method from the options available, such as bank transfer, debit/credit card, or third-party payment methods.

After completing these steps, youll be able to access the trading platform (MT4 or MT5) provided by eXcentral and start trading with the chosen account type.

eXcentral offers leverage of up to 1:30 across its trading accounts, which includes the Classic, VIP, and Gold account types. This level of leverage allows traders to control a larger position with a relatively smaller amount of capital.

For example, with a leverage of 1:30, a trader can hold a position worth up to 30 times their account balance. While this can amplify potential profits, it also significantly increases the risk of losses, especially in volatile market conditions.

Therefore, it's important for traders to use leverage cautiously and understand its implications fully. Leverage is a powerful tool in trading, but it requires a good understanding of risk management to use effectively, particularly for less experienced traders.

eXcentral offers trading conditions with competitive spreads and no commission fees. The specifics of their spreads and commissions are as follows:

Spreads

eXcentral advertises spreads as low as 0.06 to 2.5 pip, which is quite tight and can be beneficial for traders looking to minimize their trading costs.

For example, the spread for EUR/USD ranges from 0.06 pip in the VIP account to 2.5 pips in the Classic account. Similarly, the spread for Crude Oil varies from $0.06 in the VIP account to $0.10 in the Classic account.

Such low spreads are particularly advantageous for high-frequency traders or those who trade large volumes.

Commissions:

The company states that it charges no commissions on trades. This means that traders don't have to pay a separate fee for each trade they execute, which is a cost-effective feature for active traders.

While these trading conditions appear attractive, especially for those looking to keep their trading costs low, it is crucial for traders to consider the overall context of the brokerage, including its regulatory status and reliability.

| Account Type | Spread from | Commission ($) |

| Raw | 0.2 | 7 |

| Real 1.0 | 1.5 | No |

| Real 2.0 | 2.5 | No |

eXcentral offers its clients two well-regarded trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT4 Platform: MT4 is one of the most popular trading platforms in the forex and CFD trading community. It is known for its user-friendly interface, robust technical analysis tools, a wide array of charting options, and support for automated trading through Expert Advisors (EAs).

MT5 Platform: As the successor to MT4, the MT5 platform offers extended features and capabilities. It supports more types of trading orders and has additional timeframes for analysis. MT5 also provides access to more indicators and analytical tools, along with enhanced charting capabilities.

Both platforms offer mobile versions, allowing traders to manage their accounts and trade from anywhere. The choice between MT4 and MT5 typically depends on the trader's preference, trading style, and the specific instruments they wish to trade.

eXcentral offers various options for deposit and withdrawal, including a specific minimum deposit requirement:

Minimum Deposit: The minimum amount required to open an account with eXcentral is $1,000. This sets a relatively high entry barrier, especially for novice traders or those who prefer to start with a smaller capital investment.

Payment Methods:

Bank Transfer: Allows for direct transfer of funds from a trader's bank account to their trading account. This method is typically secure but may take several days to process.

Debit/Credit Card: Offers a quick and convenient way to deposit funds using widely accepted cards like Visa and MasterCard.

Third-Party Payment: Accepts deposits via various third-party payment systems, which could include digital wallets or online payment services. These methods often provide quick and easy transactions.

eXcentral provides customer support through multiple channels, aiming to assist clients with their queries and issues. Customers can reach out via email at inquiriesaexcentral-int.com, offering a direct line of communication for support, queries, or feedback.

Additionally, they provide phone support at +278 71 951005, which can be beneficial for immediate assistance or for discussing more complex issues. The availability of these support options suggests a commitment to maintaining accessible customer service.

In summary, eXcentral, based in South Africa and founded in 2018, offers Forex, commodities, and indices trading on both the MT4 and MT5 platforms, with account options including Classic, VIP, and Gold. They provide leverage up to 1:30 and competitive spreads with no commission fees.

However, a significant concern is their revoked regulatory status, which poses serious questions about the firm's credibility and the safety of client investments.

While they offer a minimum deposit of $1,000 and multiple channels for customer support, potential clients should approach with caution and thoroughly evaluate the risks due to the regulatory concerns.

Q:What trading platforms does eXcentral offer?

A:eXcentral provides the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for trading.

Q:What is the minimum deposit required to open an account with eXcentral?

A:The minimum deposit required to open an account with eXcentral is $1,000.

Q:What types of trading accounts does eXcentral offer?

A:eXcentral offers three types of accounts: Classic, VIP, and Gold, each with different features and spreads.

Q:What leverage does eXcentral offer?

A:eXcentral offers leverage up to 1:30 across all its trading accounts.

Q:How can I deposit or withdraw funds from eXcentral?

A:Deposits and withdrawals can be made via bank transfer, debit/credit card, or third-party payment methods.

Q:How can I contact eXcentral's customer support?

A:Customer support can be reached via email at inquiriesaexcentral-int.com or by phone at +278 71 951005.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive instaforex and excentral are, we first considered common fees for standard accounts. On instaforex, the average spread for the EUR/USD currency pair is Fixed 2-7 pips, while on excentral the spread is EUR/USD 2.5, GBP/USD 2.8, USD/JPY 2.8, Crude Oil $0.14.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

instaforex is regulated by CYSEC. excentral is regulated by FSCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

instaforex provides trading platform including Standard Trading Accounts,Eurica Trading Accounts,ECN Trading Account,ECN Pro Trading Account,Scalping trading account and trading variety including --. excentral provides trading platform including Classic,Silver,Gold,VIP and trading variety including --.