简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP: What To Expect From BoE

Abstract:GBP: What To Expect From BoE

Next to Friday‘s non-farm payrolls report, tomorrow’s Bank of England monetary policy announcement is the second most important event of the week. Like the Reserve Bank of Australia, the BoE is widely expected to leave policy unchanged. There is only a small chance of tapering, but theres a very high chance of upgraded economic projections. The BoE has a lot to be optimistic about. The UK is leading the developed world in vaccinations, with more than half of its population receiving at least one dose of the COVID-19 shot. New daily virus cases have fallen below 2,000, which is a dramatic improvement from the more than 68,000 cases reported on Jan. 8. Along with a low double-digit to single-digit death toll, the UK economy is ready to reopen fully by ending all lockdown restrictions on June 21. Restaurants, pubs and gyms have been open for a few weeks, and the economy is already beginning to reap the benefits, with the PMI index rising to its highest level in 89 months. When the country fully reopens, we will see an even bigger boost to growth.

While the BoE anticipated a recovery, the momentum has been stronger than expected because of how fast the government managed to vaccinate more than half of the population. Combined with the robust recovery in the U.S. and inevitable reopening of euro-area nations, the outlook for the UK is clearer and brighter today than in February, when its last economic forecasts were released. In addition to raising its economic projections we also expect the BoE to lay the groundwork for summer tapering, which should reignite the rally in GBP.

It is actually surprising that sterling traded only marginally higher against the U.S. dollar and the euro on the eve of the BoE meeting, but positioning has a lot to do with this. Sterling has been in an uptrend for the past six months, and these gains are a reflection of investors positioning for a less dovish BoE. There‘s little doubt that the central bank will taper before the Fed, and there’s a very good chance it will be the first to raise interest rates as well. So unless the central banks statement is littered with concerns or it refrains from upgrading its economic assessment, which is very unlikely, GBP/USD should trade higher following the monetary policy announcement.

Our bullish GBP/USD outlook is reinforced by today‘s disappointing U.S. economic reports. To everyone’s surprise U.S. service sector activity expanded at a slower pace in the month of April. Economists predicted an increase in the ISM services index, but it declined from 63.7 to 62.7 due to fewer new orders. Like the manufacturing sector, services is affected by shortages and supply constraints. The employment component increased, which is encouraging for Friday‘s NFP report. According to ADP, job growth was very strong last month, with companies adding 742,000 private sector jobs. However, like ISM, economists hoped for more. The U.S. dollar’s mixed performance is a sign that investors are worried that non-farm payrolls will also fall victim to unmatched expectations.

Downwardly revised Eurozone PMIs kept the euro under pressure, while the commodity currencies soared. Better-than-expected labor market numbers from New Zealand helped to propel NZD higher. The Reserve Bank of New Zealand also warned that it is, if required, “prepared to further tighten lending conditions for housing,” if prices do not fall. The housing market is also very strong in Australia, where building permits surged 17% in March, significantly faster than the 3% consensus forecast. USD/CAD fell to fresh three-year highs despite falling oil prices.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

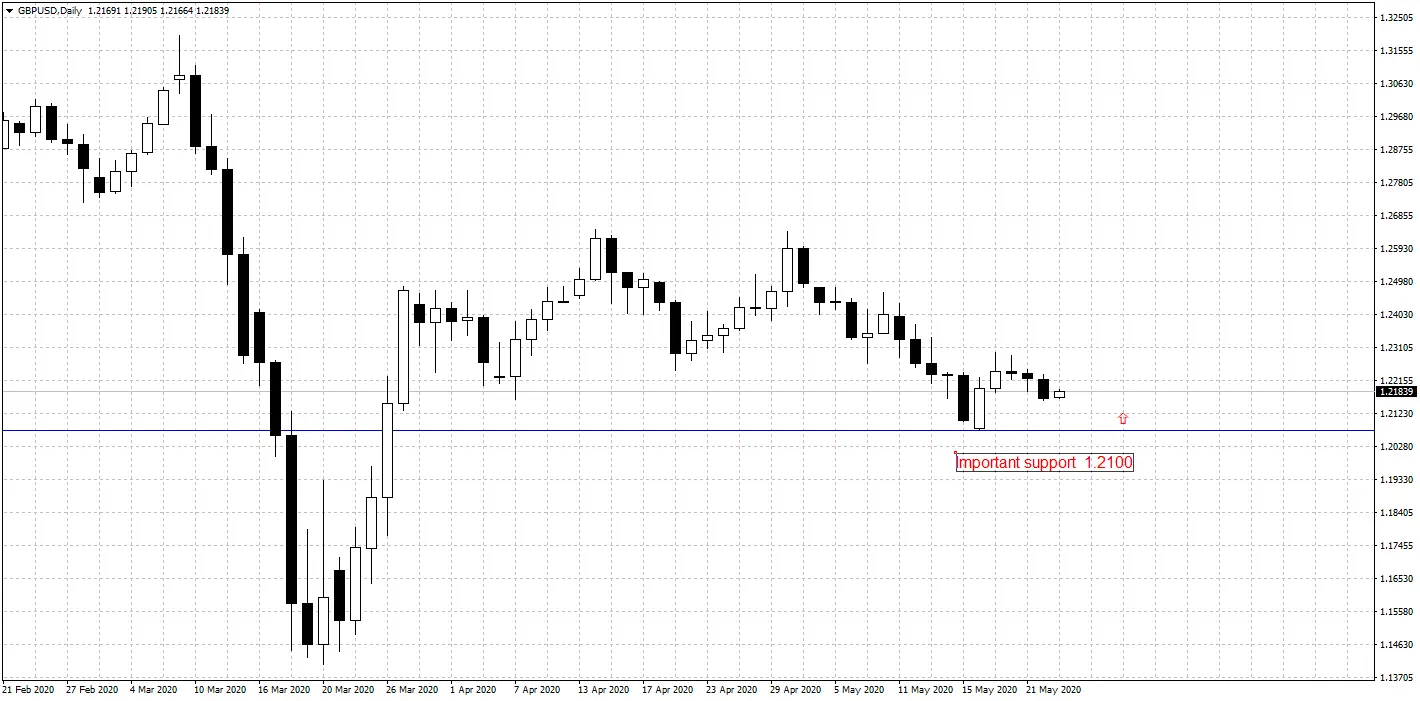

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

British Pound (GBP) Price Outlook: More Losses Likely for GBP/USD

GBP This Week: Poised for Huge Risk

The British pound opened the week marginally higher across a range of currencies, with GBP/USD up above 1.2762.

Worse-than-expected Jobs Data May Spark Reversal in GBP

At 14:00 today (GMT+8), the U.K. released its jobs data, which is worse than expected. In this condition, investors should pay heed to reversal signals on GBP/USD and GBP/JYP.

Bank of England Is Assessing Negative Rate Policy

Bank of England Governor Andrew Bailey change his comment last week that negative rate “is not an approach we’re considering or planning to take” and said it’s the right time to review and assess all policy tools

WikiFX Broker

Latest News

FCA bans and fines James Lewis £120,300 for putting investors at risk

BSP Approves Coins.ph to Launch Peso Stablecoin

Exploring Swing Trading vs Scalping: A Strategy Comparison

Oppenheimer & Co. Fined $500K for Supervision Lapses

FCAA Warns Against Morgan Stern

Robinhood to Fight SEC Over Crypto Business in Court

Scope Markets Boosts UAE Offer with 23 New Dubai Stocks CFDs

FCA Warns Against CryptosMarket

FCA Warns Against SolidusMarkets

INFINOX Leads the Financial Sector with Green Initiatives

Currency Calculator