Company Summary

| Kana Capitals | Basic Information |

| Registered Country/Region | United Kingdom |

| Founded in | 2019 |

| Regulation | Not regulated |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Account Types | Standard, ECN, Pro |

| Spreads & Commissions | Variable spreads, commission on ECN and Pro account |

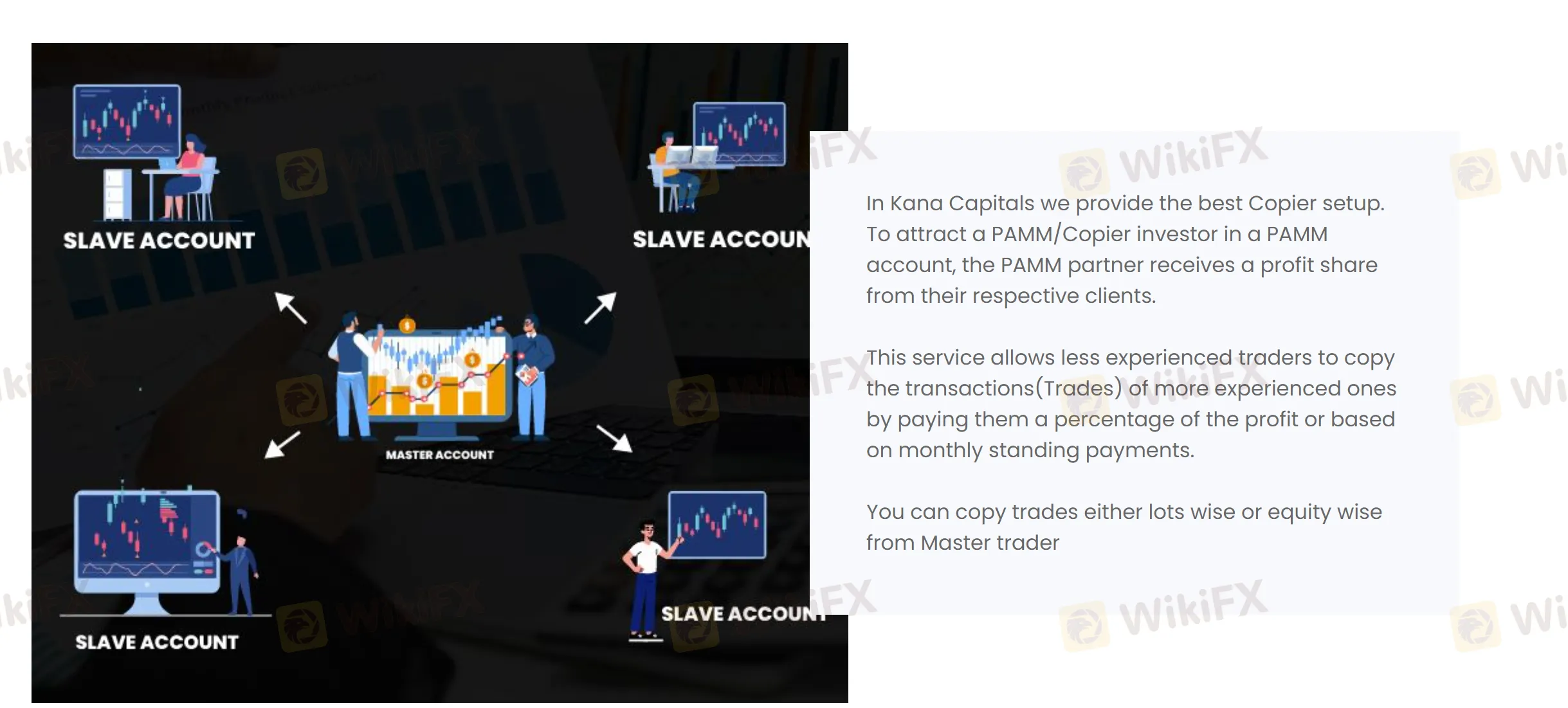

| Copy Trading | Available |

| Demo Account | Not available |

| Educational Resources | Limited |

| Trading Platform | MetaTrader 5 |

| Demo Account | Available |

| Deposit & Withdrawal Methods | Bank Transfer, Bitcoin, Skrill, Neteller, Perfect Money |

| Non-Trading Fees | No deposit or withdrawal fees, inactivity fee after 6 months |

| Customer Support | 7/24 Customer Support , Phone, Email, Social Medias |

| Educational Resources | Some Trading Tools |

*Please note that the information provided in this table is subject to change and should be verified on the official website of Kana Capitals.

Overview of Kana Capitals

Established in 2019, Kana Capitals is a UK-based forex broker that offers online trading services in the global financial markets. Kana Capitals offers a range of financial instruments, including forex, indices, crypto, and commodities, and provides traders with access to multiple trading platforms, educational resources, and customer support. Kana Capitals offers multiple choices of live trading accounts, which can be opened with a minimum deposit of $100, which is a relatively low amount compared to other brokers. The account offers tight spreads starting from 0.0 pips, no hidden fees, and leverage of up to 1:500 for all clients.

Kana Capitals offers the popular MetaTrader 5 (MT5) trading platform for desktop, web, and mobile devices. Kana Capitals also offers 24/7 customer support, which is a significant advantage for traders who need assistance outside of regular business hours. Furthermore, the broker provides copy trading services, which allows traders to automatically copy the trades of other successful traders.

Lastly, the broker also provides traders with a range of educational resources, including articles, tutorials, and trading tools, to help them improve their trading skills and knowledge. Here is the home page of this brokers official site:

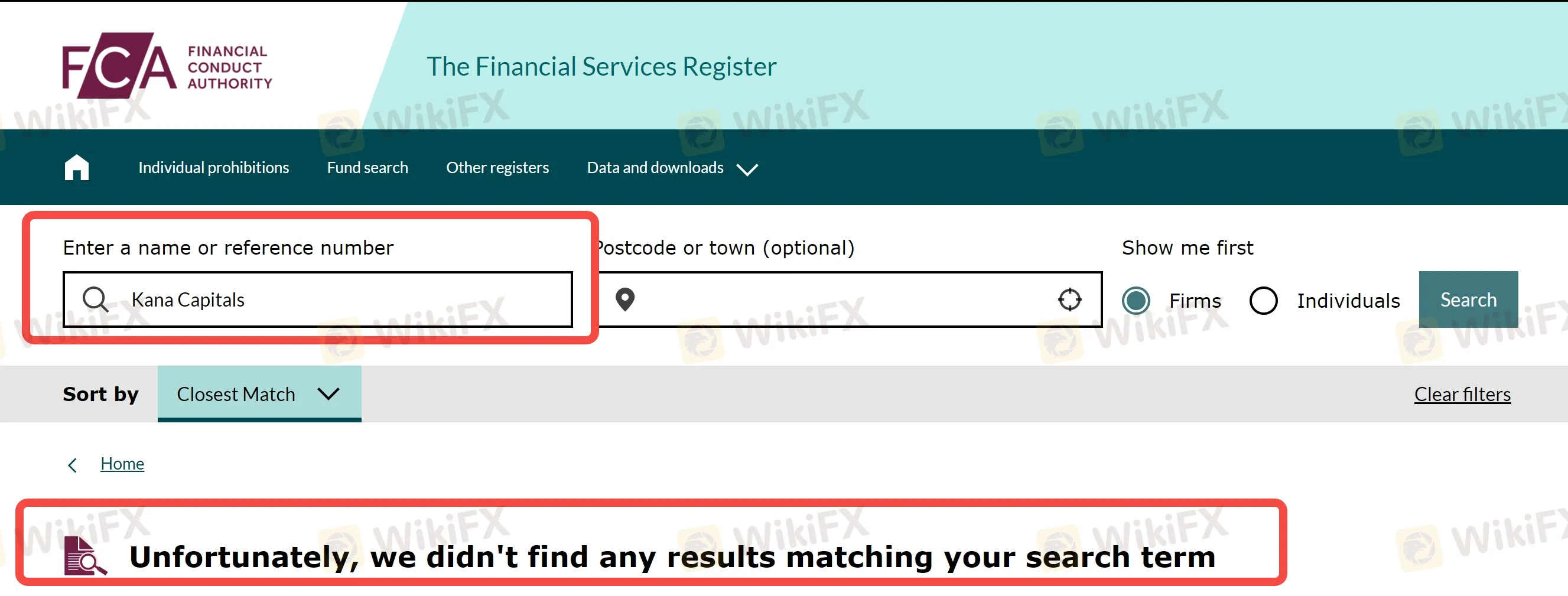

Is Kana Capitals legit or a scam?

It is important to note that Kana Capitals, a forex broker registered in the United Kingdom, does not appear to be regulated by the Financial Conduct Authority (FCA). The FCA is a well-respected regulatory body that oversees financial firms and protects consumers in the UK. It is mandatory for all financial firms operating in the UK to be authorized and regulated by the FCA, and their names should appear on the FCA's official website. However, a search for Kana Capitals on the FCA's website did not yield any results, indicating that this broker is not regulated by the FCA. It is important to keep in mind that trading with an unregulated broker can be risky and can lead to potential financial losses. Traders should always research and choose a reputable and regulated broker to ensure the safety of their funds and investments.

Pros and Cons

The table below summarizes the pros and cons of Kana Capitals, a forex broker registered in the United Kingdom. While the broker offers attractive features such as high leverage up to 1:500, low minimum deposit of $100, and 24/7 customer support, it also has some downsides that should be considered before investing. One of the main drawbacks is that Kana Capitals is not regulated by any reputable regulatory authority, which could expose investors to higher risks. Additionally, the broker only offers three types of trading accounts, which may not be suitable for traders with different needs and strategies. The lack of educational resources and research tools could also be a disadvantage for beginner traders who need guidance in their trading journey.

| Pros | Cons |

| Leverage up to 1:500 | Not regulated by any major regulatory authority |

| Multiple account types available | Limited range of trading instruments |

| 24/7 customer support | Lack of educational resources |

| Copy trading feature available | Limited payment options for deposits and withdrawals |

| Low minimum deposit of $100 | High spreads on some account types |

| Commission-free trading on some account types | No negative balance protection offered |

| Demo accounts available |

Market Intruments

Kana Capitals offers a diverse range of trading instruments to its clients. Some of the major financial markets that are available for trading include forex, stocks, indices, and cryptocurrencies. With forex, traders can access major, minor, and exotic currency pairs, providing ample opportunities for speculation and trading. The availability of stocks from a variety of global exchanges provides traders with the chance to invest in leading corporations from around the world. Indices represent a basket of stocks, and traders can speculate on the performance of leading indices from the US, Europe, and Asia. Additionally, the inclusion of cryptocurrencies offers traders access to a relatively new and exciting asset class, which has grown in popularity in recent years.

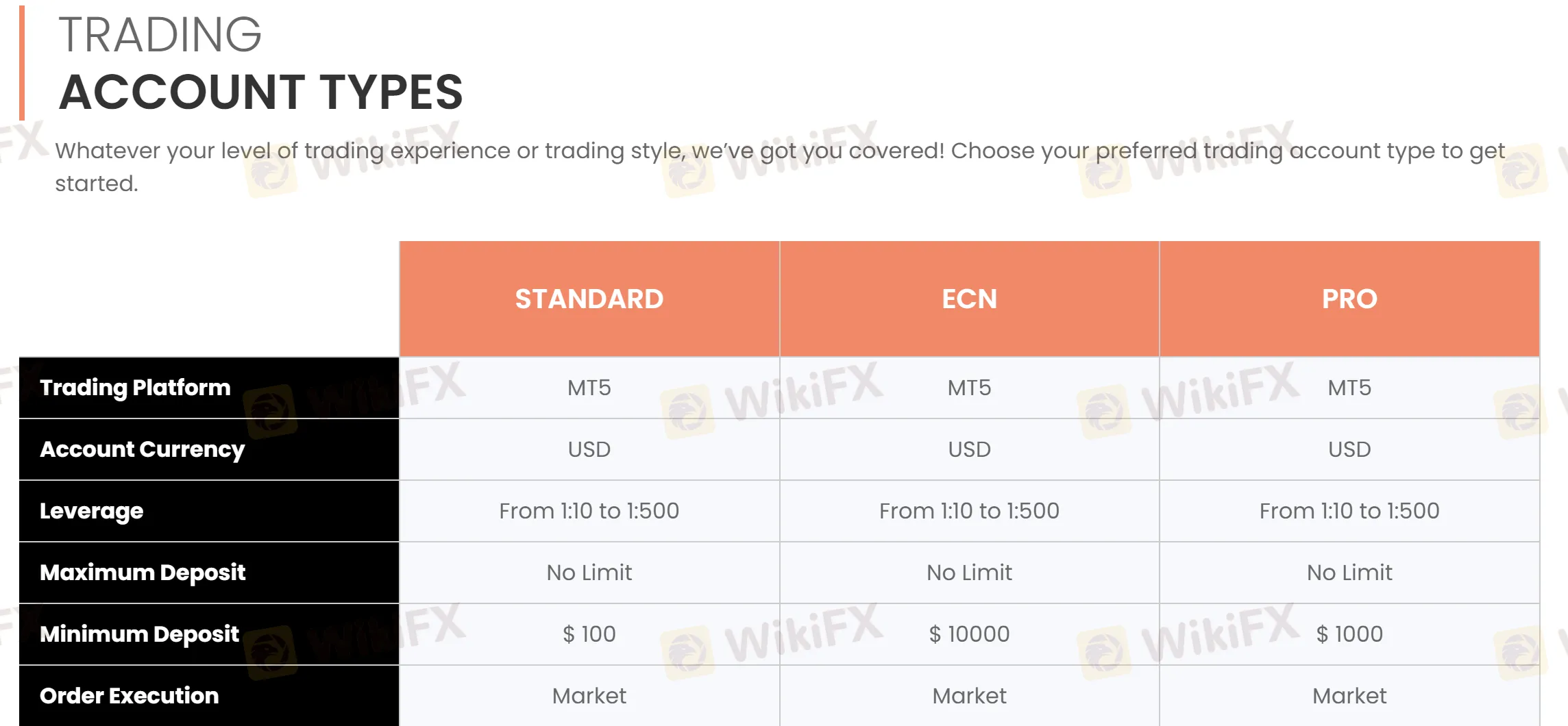

Account Types

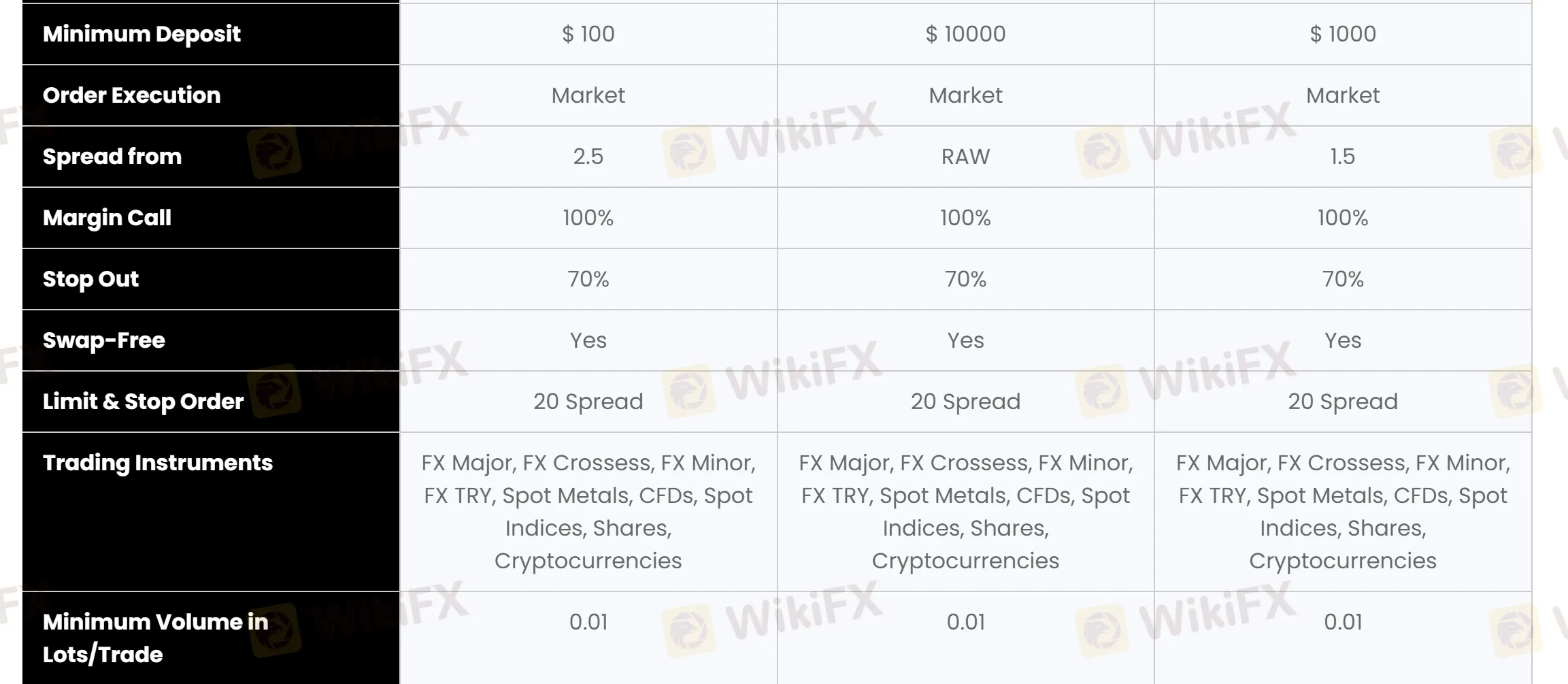

Kana Capitals offers a range of account types to cater to the diverse needs of traders. Whether you are a beginner or a seasoned professional, there is an account type that will suit your requirements. The available account types include the Standard, ECN, and Pro accounts.

The Standard account is designed for novice traders who are just starting in the forex market. This account type requires a minimum deposit of $100 and offers a maximum leverage of 1:500. The Standard account features fixed spreads, which makes it easier for beginners to understand the trading costs.

The ECN account, on the other hand, is for more experienced traders who prefer tighter spreads and faster execution speeds. This account type requires a higher minimum deposit of $1,0000, but it offers variable spreads and no re-quotes. The maximum leverage for the ECN account is also from 1:10 to 1:500.

The Pro account is tailored for professional traders who require access to more advanced trading tools and features. This account type requires a minimum deposit of $1,000 and offers a maximum leverage from 1:10 to 1:500. The Pro account features the tightest spreads, lowest commissions, and fastest execution speeds.

In addition to these account types, Kana Capitals also offers Islamic accounts for traders who follow the Shariah law. The Islamic accounts are swap-free and do not charge any interest in overnight positions.

Demo Accounts

With a demo account from Kana Capitals, traders can get a feel for the platform and test out different strategies and trading styles. The demo account offers a risk-free environment to practice and gain confidence before moving on to a live account.

It's worth noting that while a demo account can be a great way to get started, it may not accurately reflect the conditions of a live account. Slippage, execution speeds, and liquidity can all be different in a live trading environment, so it's important to keep that in mind when transitioning from a demo account to a live account.

How to open an account?

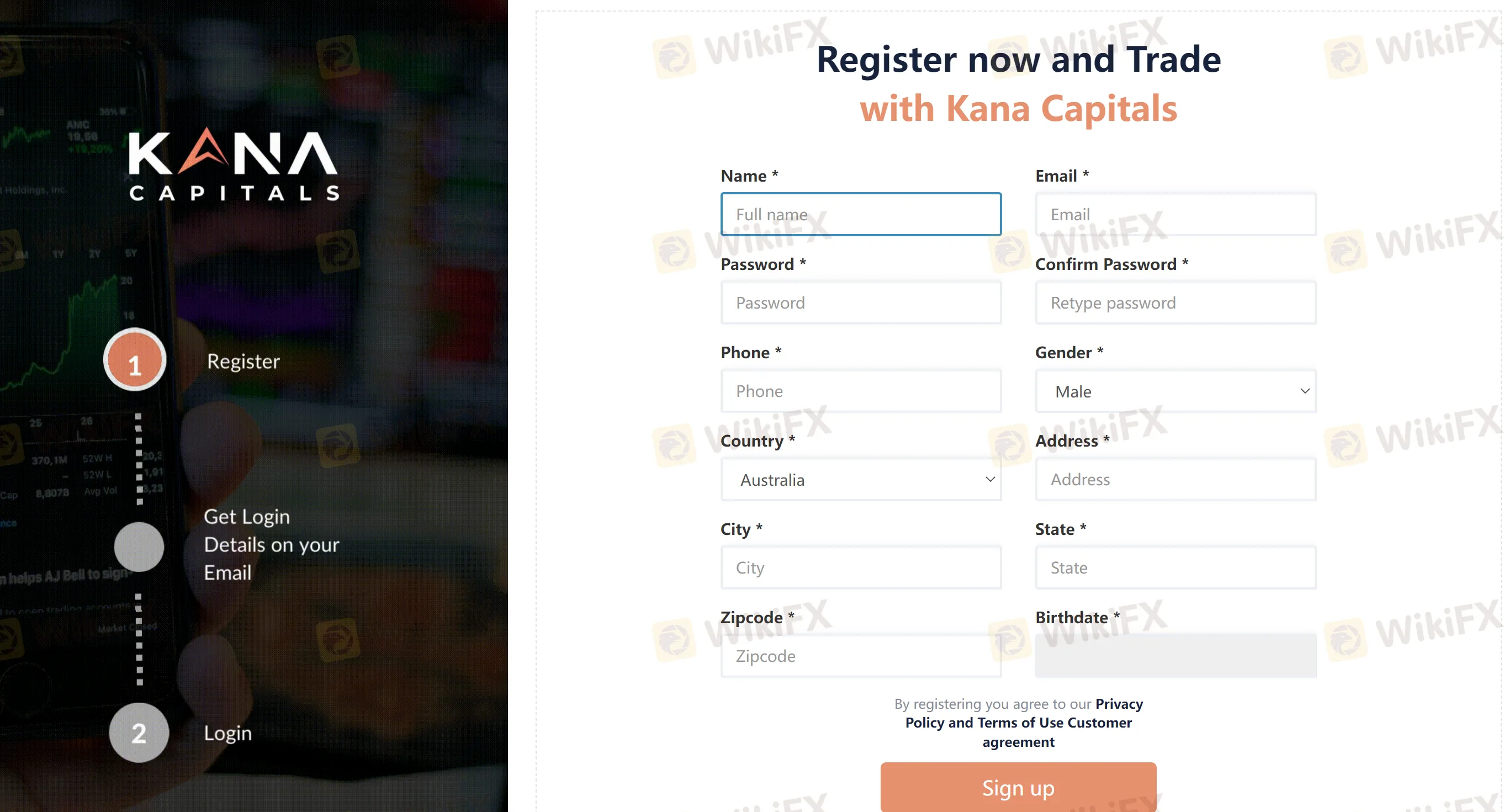

Opening an account with Kana Capitals is a straightforward process that can be completed online in just a few minutes.

To get started, you'll need to visit the broker's website and click on the “Register” button.

This will take you to a registration page where you'll need to enter some basic personal information such as your name, email address, and phone number.

Once you've filled out the registration form, you'll need to provide some additional information to complete the account opening process. This will include verifying your identity and providing some financial information such as your employment status, annual income, and net worth.

After your account has been approved, you'll be able to fund it and start trading. Kana Capitals offers a range of deposit and withdrawal methods, including Bank Transfer, Skrill, Neteller, and Bitcoin. Once you've funded your account, you'll be able to choose from a variety of trading instruments, including forex, stocks, indices, and cryptocurrencies.

Leverage

When it comes to trading, leverage is a crucial aspect that traders should consider before choosing a broker. Kana Capitals offers a maximum leverage of up to 1:500, which can be a significant advantage for experienced traders who want to maximize their potential profits. However, it is essential to note that leverage can also magnify losses, so traders should be careful and use risk management strategies when trading with high leverage.

The high leverage offered by Kana Capitals can be beneficial for traders who want to open large positions with a smaller amount of capital. With a high leverage ratio, traders can control larger positions with a smaller margin requirement, which means they can potentially earn higher profits with lower capital. However, high leverage also comes with increased risks, and traders must be prepared to handle the potential losses that come with it.

Spreads & Commissions (Trading Fees)

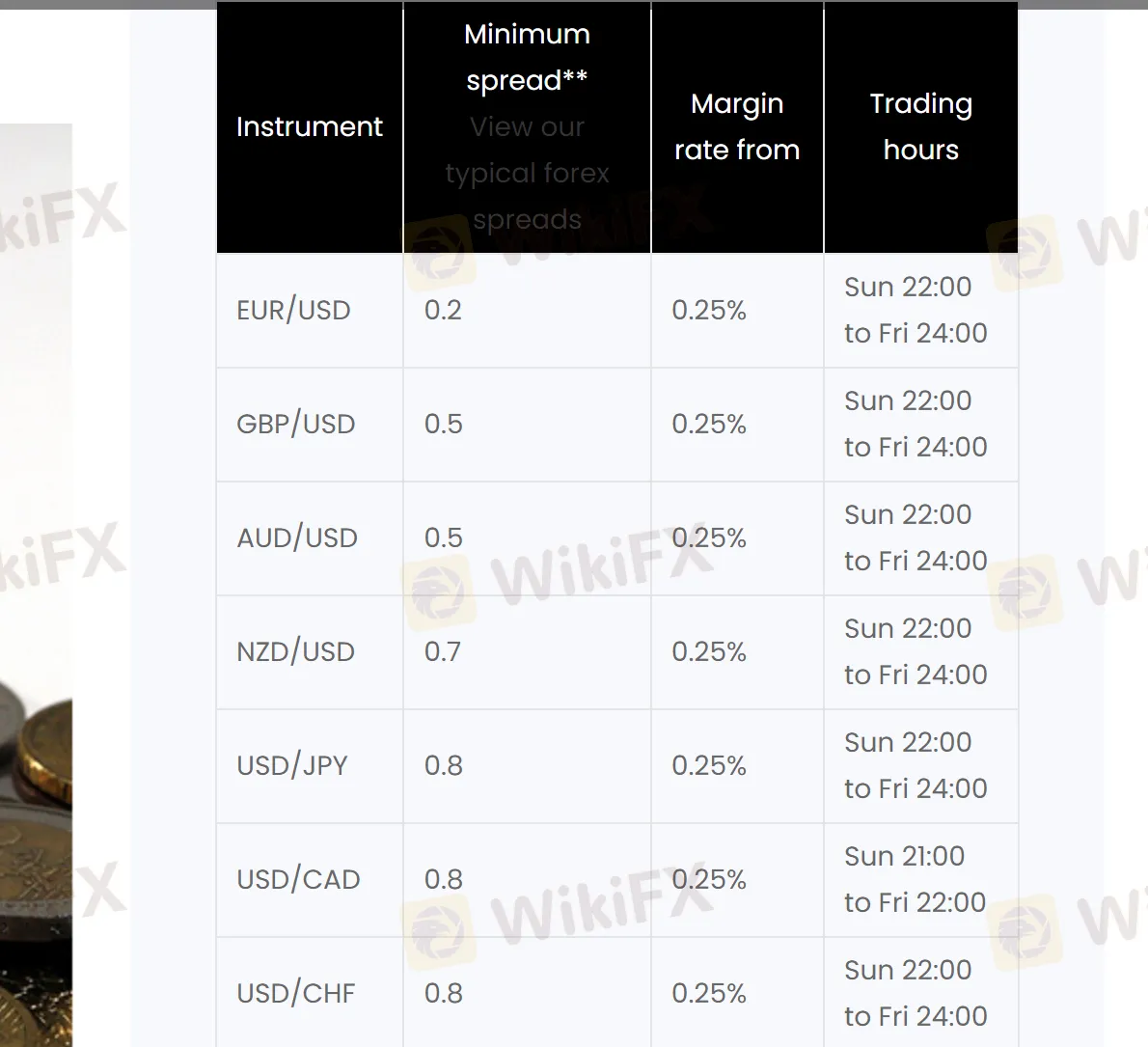

Kana Capitals, like many other forex brokers, offers its clients different types of trading accounts with varying spreads and commissions. The standard and pro accounts come with spreads starting from 2.5 pips and 1.5 pips, respectively. These accounts do not charge any commission on trades, making them suitable for traders who prefer not to pay extra fees. On the other hand, the ECN account offered by Kana Capitals features raw spreads, which are significantly lower than the spreads on standard and pro accounts. However, this account charges a certain commission on trades.

When it comes to trading the EUR/USD currency pair, Kana Capitals has an edge over other brokers with a minimum spread of 0.2 pips.

Non-Trading Fees

As with most brokers, Kana Capitals also has non-trading fees that traders should be aware of. These fees are not related to trading activities and can affect the overall cost of using the broker's services. Kana Capitals does not charge any deposit or withdrawal fees, regardless of the payment method used. However, traders should keep in mind that some payment providers may charge their own fees for processing transactions, which are beyond the control of the broker.

According to the information provided on the Kana Capitals website, there is an inactivity fee charged on accounts that have not been active for a period of six months or more. The fee is set at $50 or equivalent in another currency per month.

Trading Platform

Kana Capitals offers the popular and widely used MT5 trading platform to its clients. MT5 is the successor to the widely popular MT4 platform, and it offers several improvements over its predecessor. MT5 provides advanced charting tools, technical analysis, customizable indicators, and a range of order types, including stop loss and take profit orders. The platform is also available for download on desktop, mobile, and web-based versions, making it accessible for traders on the go. The MT5 platform also offers an extensive marketplace of add-ons and plugins, allowing traders to customize their trading experience further.

In addition to offering the MT5 trading platform, Kana Capitals also provides copy trading services to its clients. Copy trading allows less experienced traders to copy the trades of more successful traders in real-time.

Deposit & Withdrawal

Kana Capitals offers several convenient and secure options for both deposit and withdrawal, including bank transfer, Skrill, Neteller, Bitcoin, and Perfect Money. The minimum deposit required to open an account is $100. Deposits can only be made in USD.

Withdrawals are also processed through the same payment methods used for deposits. The minimum withdrawal amount is $50. However, the specific fees and processing time for each method are not disclosed on the website. It is recommended that clients should contact the broker's customer support team for more information regarding deposit and withdrawal fees and processing times.

Customer Support

Kana Capitals offers 24/7 customer support to its clients. Traders can contact the support team via email, or phone, or some social media platforms. The broker provides a dedicated phone number for clients who want to contact them. In addition, the broker has a detailed FAQ section on its website that covers a wide range of topics related to trading and the platform. The FAQ section can be helpful for traders who have general questions about the platform, trading, or account management.

Educational Resources

Kana Capitals provides some educational resources to help traders improve their knowledge and skills in the financial markets. These resources include a live chart, live prices, a glossary of trading terms, pivot point calculators, and an economic calendar that displays upcoming economic events and their potential impact on the markets.

Conclusion

Kana Capitals is an online forex and CFD broker that offers a range of account types and trading instruments. The broker offers competitive leverage up to 1:500 and a minimum deposit of $100, allowing traders to access the market with a relatively small investment. Kana Capitals provides its clients with various trading platforms, including the popular MetaTrader 5, along with copy trading, enabling traders to benefit from the experience and expertise of successful traders.

On the other hand, Kana Capitals does not seem to be regulated by any well-known regulatory authorities such as the FCA, which may raise concerns among some traders. The broker also lacks transparency in terms of specific fees and processing times for deposit and withdrawal options. In terms of trading fees, the spreads offered by the broker are relatively high, especially for the standard account type, while the commission charged for ECN accounts may not be suitable for some traders.

FAQs

Q: Is Kana Capitals a regulated broker?

A: No, Kana Capitals is not regulated by any regulatory authority.

Q: What is the minimum deposit required to open an account with Kana Capitals?

A: The minimum deposit required to open an account with Kana Capitals is $100.

Q: What is the maximum leverage offered by Kana Capitals?

A: Kana Capitals offers a maximum leverage of up to 1:500.

Q: Does Kana Capitals offer a demo account?

A: Yes, Kana Capitals offers a demo account for traders to practice and familiarize themselves with the trading platform and features.

Q: What are the account types offered by Kana Capitals?

A: Kana Capitals offers three account types: Standard, ECN, and Pro.

Q: What trading instruments are offered by Kana Capitals?

A: Kana Capitals offers Forex, Stocks, Indices, and Cryptocurrencies.

Q: What is the minimum spread on the EUR/USD pair offered by Kana Capitals?

A: The minimum spread on the EUR/USD pair offered by Kana Capitals is 0.2 pips.

Q: What trading platforms are offered by Kana Capitals?

A: Kana Capitals offers the popular MetaTrader 5 (MT5) trading platform.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.