Company Summary

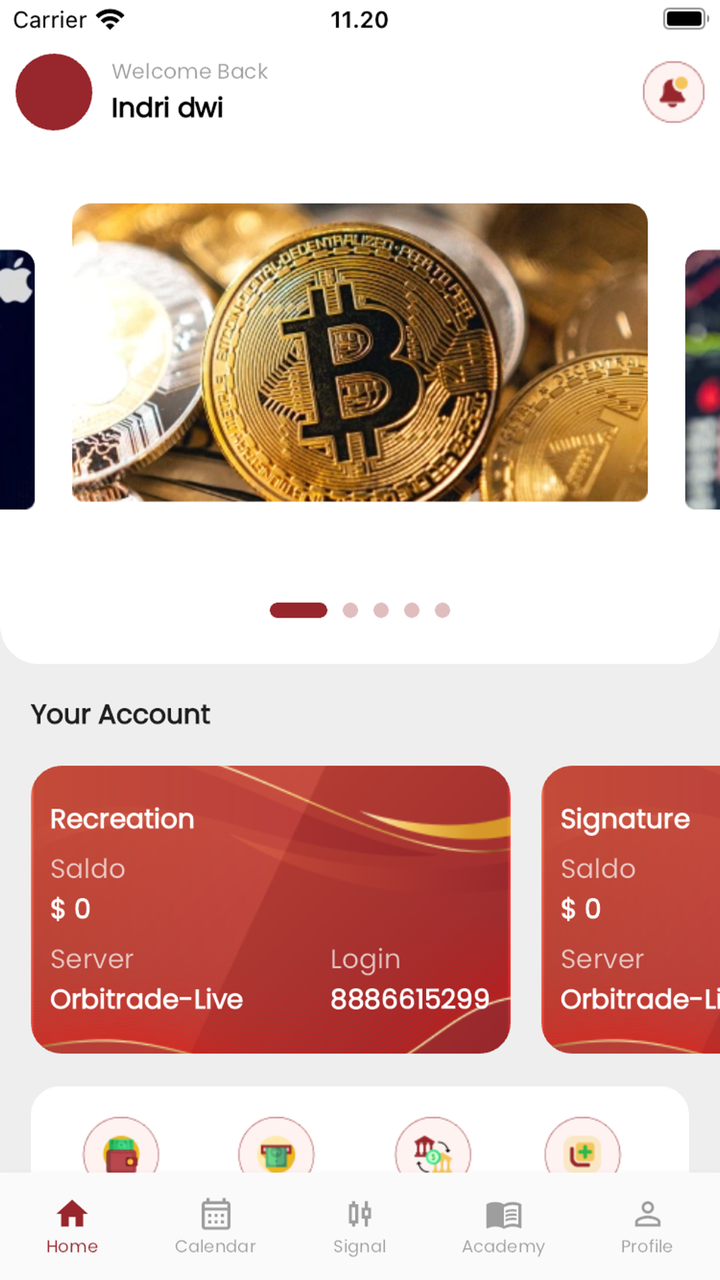

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | ORBI TRADE |

| Regulation | No Regulation |

| Minimum Deposit | $50 |

| Maximum Leverage | Recreation: 1:500Professional, Syariah, Signature: 1:200 |

| Spreads | Recreation: From 1.5 pipsSyariah: From 1 pip Professional, Signature: From 0.8 pips |

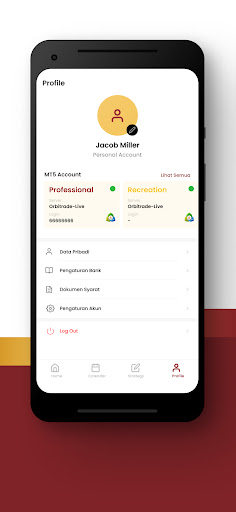

| Trading Platforms | MetaTrader 5 |

| Tradable Assets | CFDs on US stocks, Forex, commodities, stock indices |

| Account Types | Recreation, Newbie, Professional, Syariah, Signature |

| Demo Account | Available |

| Islamic Account | Syariah Account available |

| Customer Support | Email: info@orbitrades.comPhone: +1 (737) 232-2299 or +6221 2922 2999 (Bahasa) Office addresses in Seychelles and Indonesia |

| Payment Methods | Not specified |

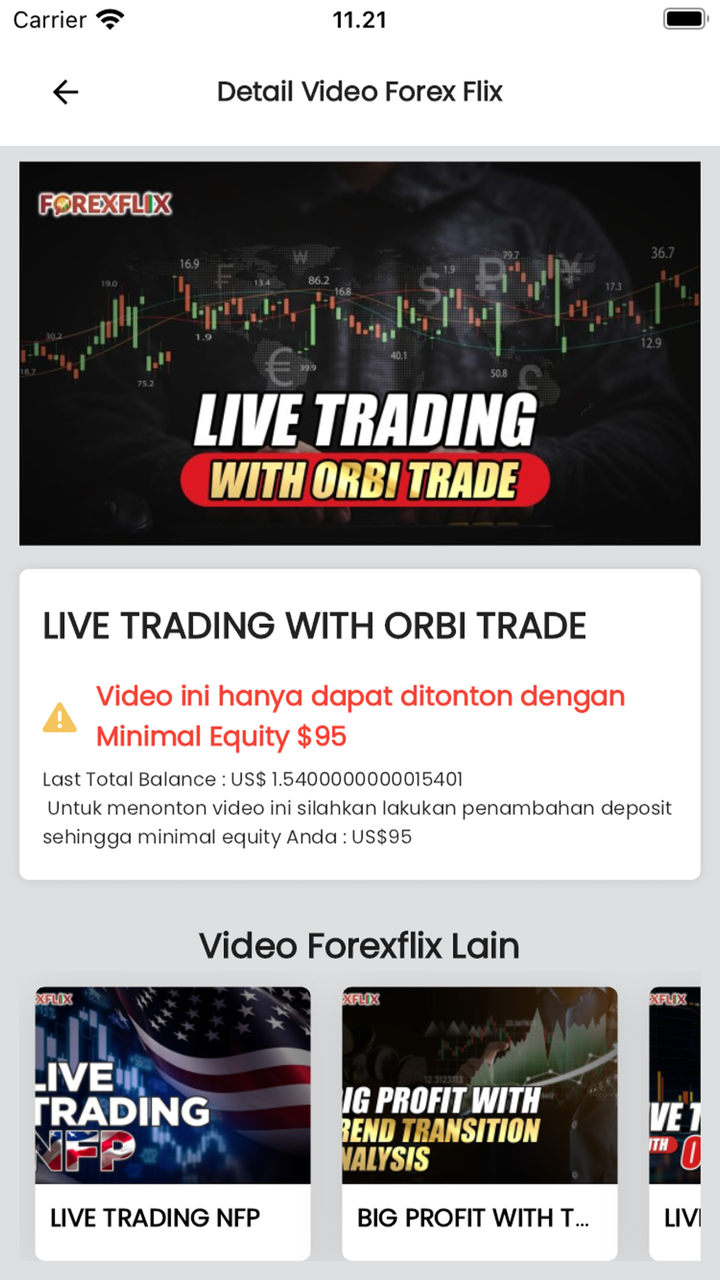

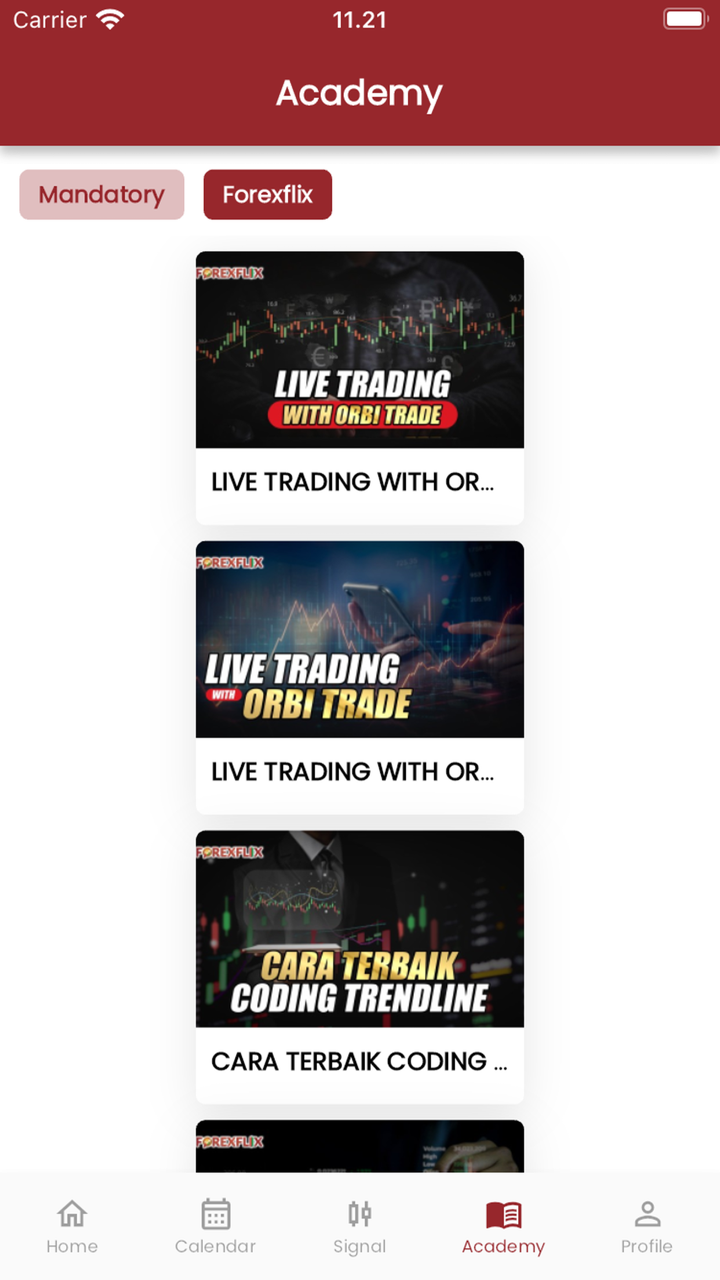

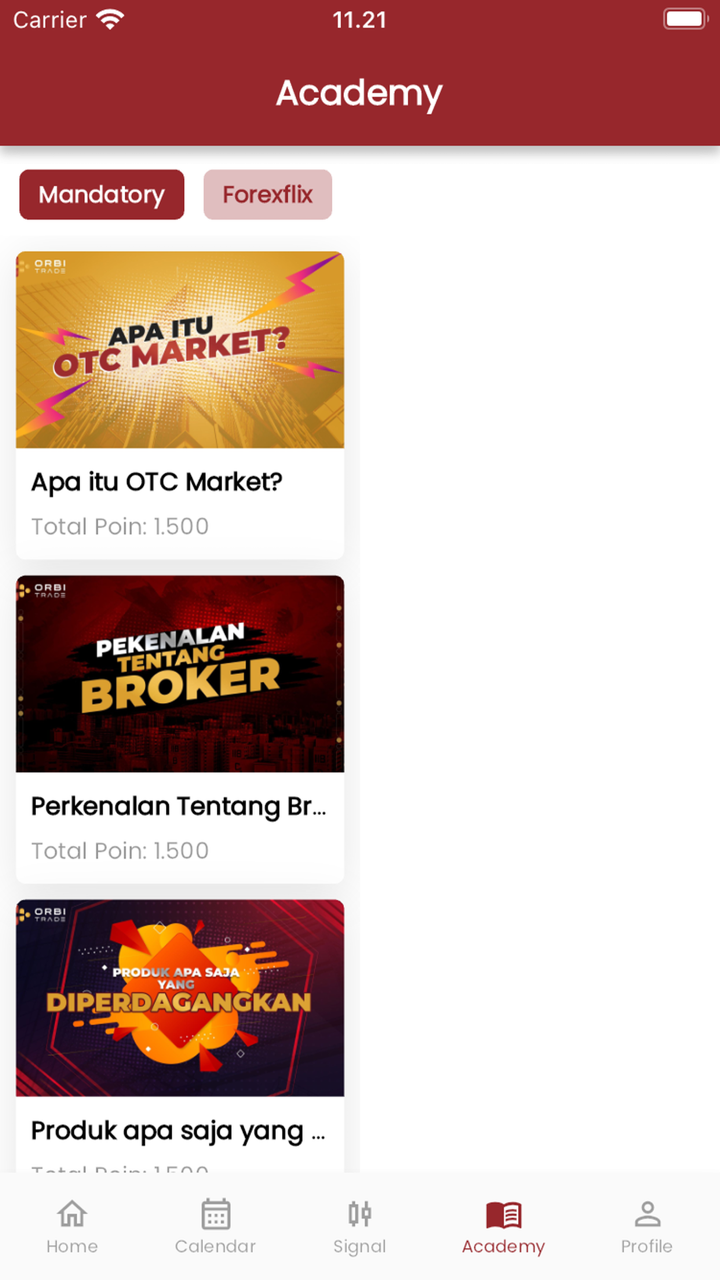

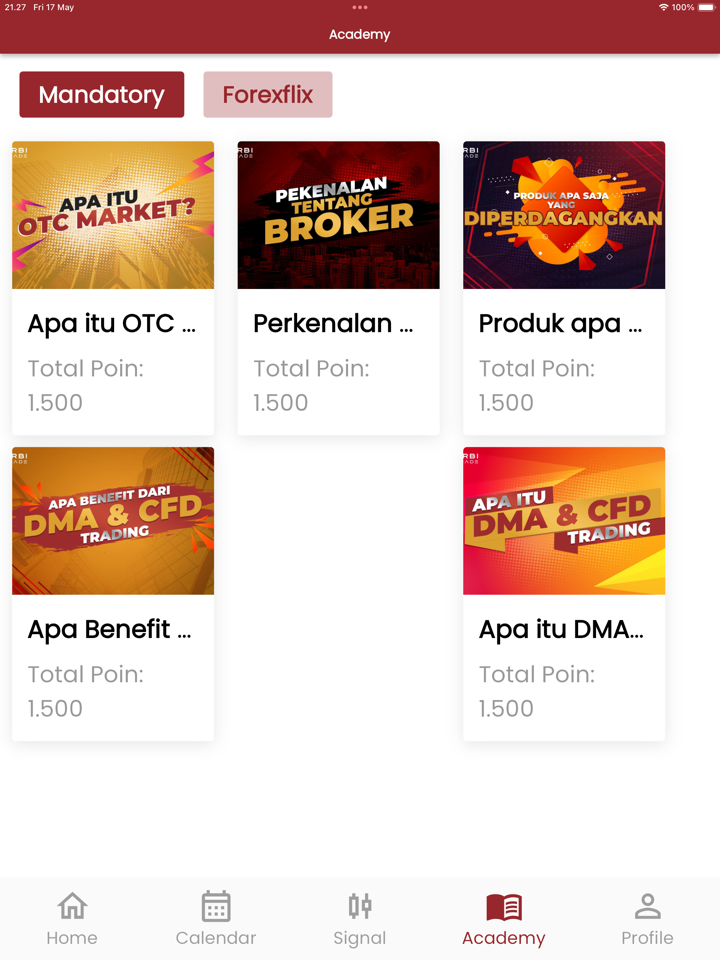

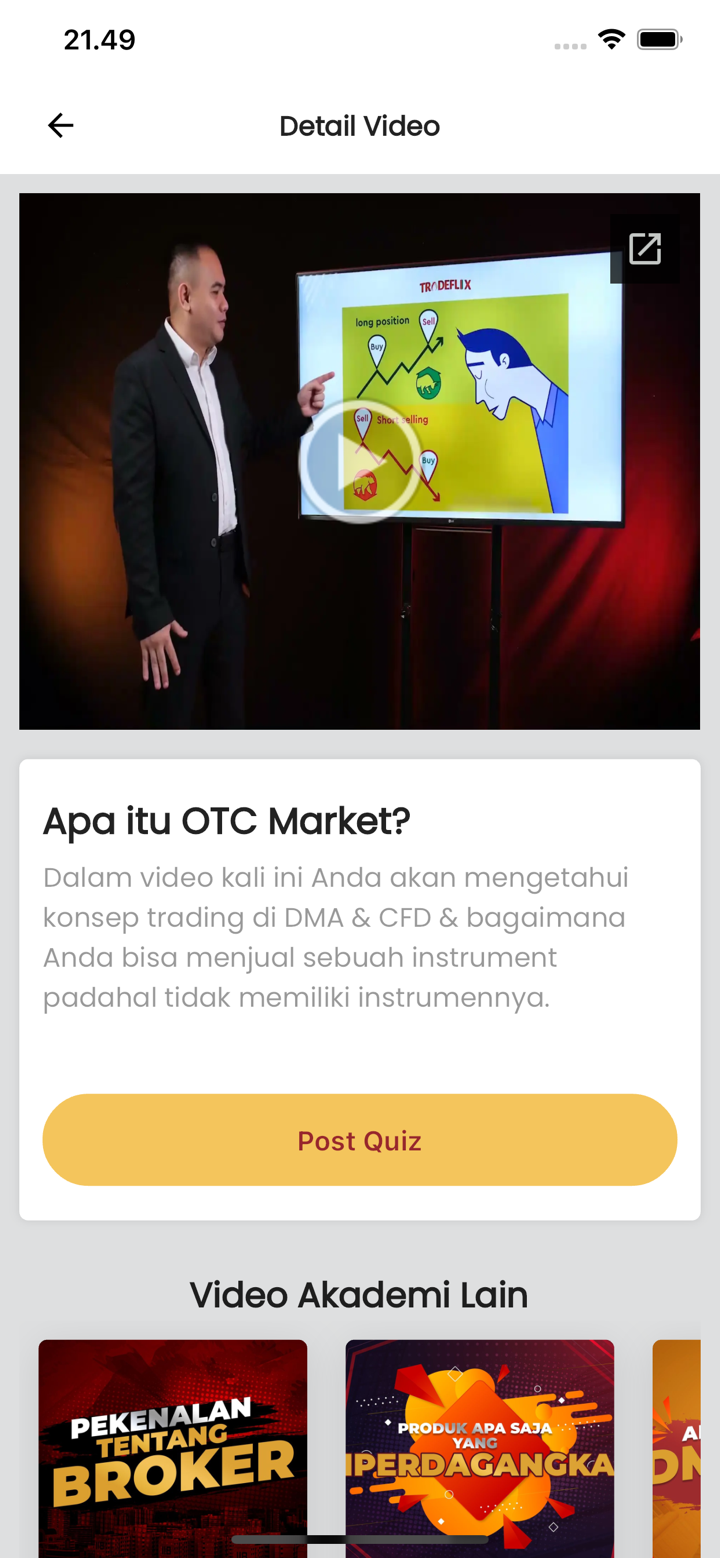

| Educational Tools | Not mentioned |

General Information

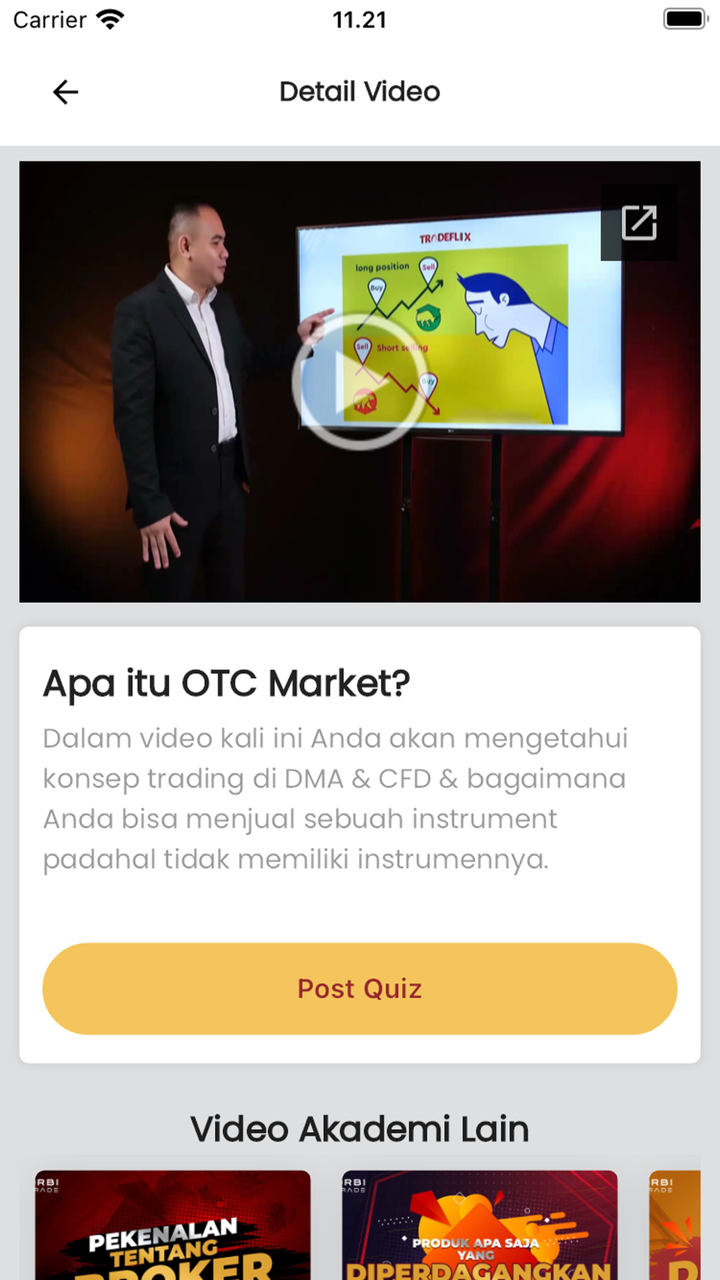

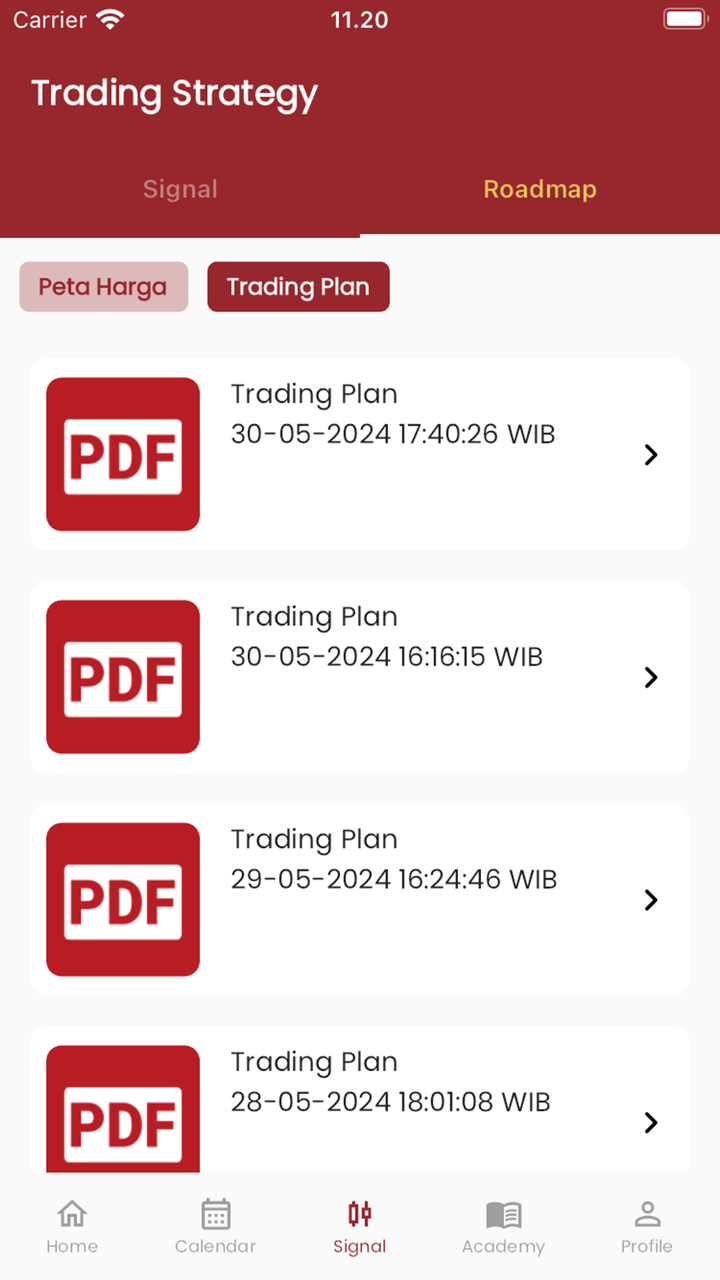

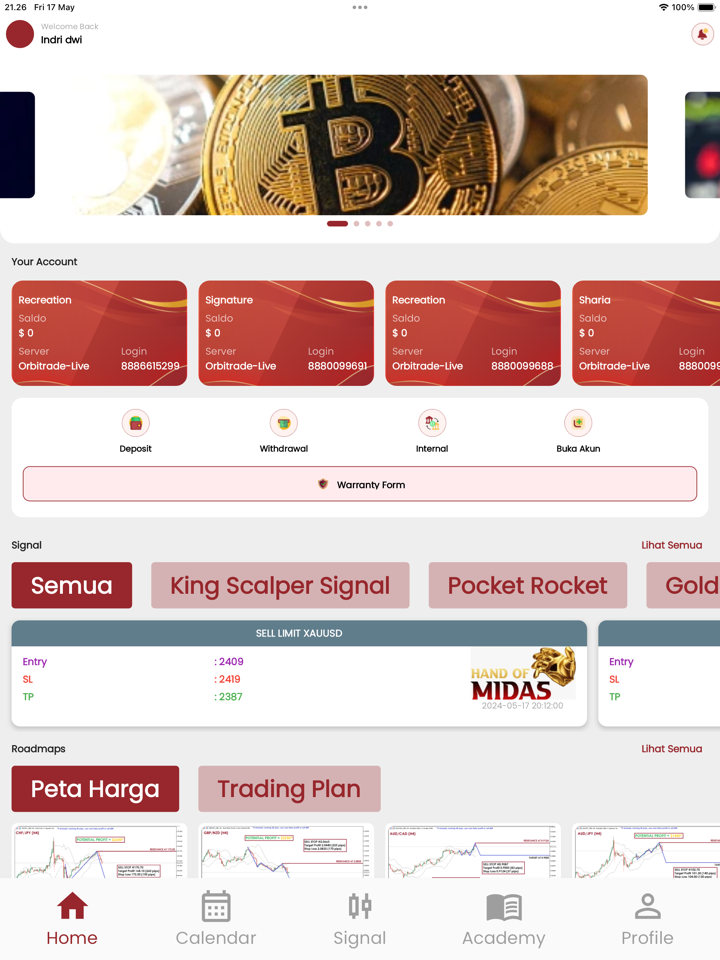

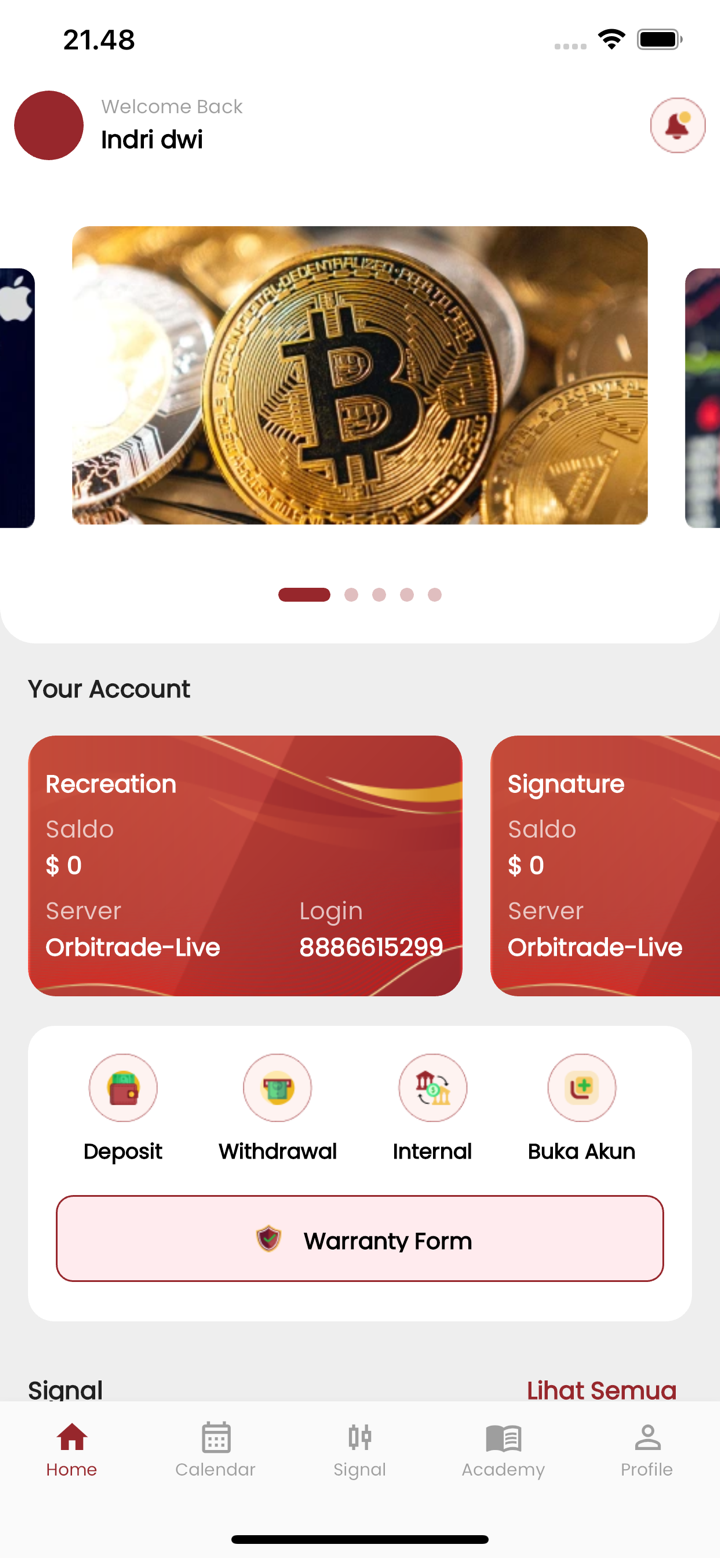

ORBI Trade is a direct market access CFD (Contract for Difference) broker based in Seychelles, providing direct connections to global exchanges for real-time price feeds on Forex, Gold, Silver, Oil, US Stocks, and Indices.

ORBI TRADE offers different account types, including Recreation, Newbie, Professional, Syariah, and Signature accounts, catering to various trading needs and capital levels. Each account type has specific features, such as minimum deposit requirements, leverage ratios, spreads, and commission charges. Traders can choose an account type based on their preferences and trading strategies.

The platform utilizes the MetaTrader 5 trading platform, which is widely recognized and provides advanced charting tools, technical analysis capabilities, and support for automated trading. It is available on multiple platforms, including Windows, macOS, and mobile devices.

ORBI TRADE provides customer support through various channels, including email, phone, and office visits.

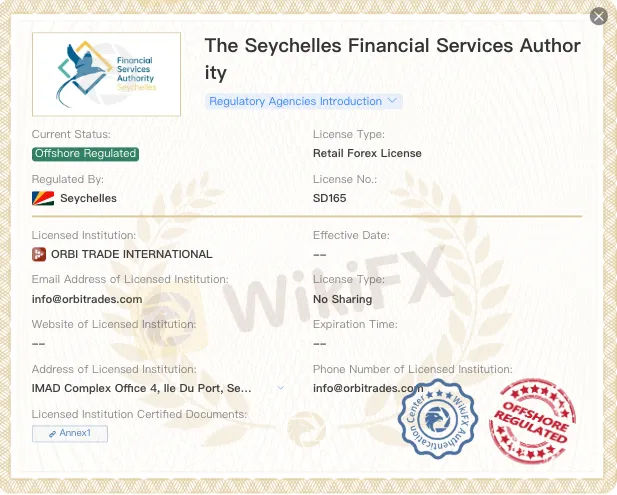

As for regulation, it has been verified that ORBI TRADE is offshore regulated by FSA.

Is ORBI TRADE legit?

ORBI TRADE is regulated by the Seychelles Financial Services Authority (FSA) under an offshore regulatory framework. The company holds a Retail Forex License, with the license number SD165. This regulatory status allows CG FinTech to offer its services in compliance with the standards set by the Seychelles authorities.

Pros and Cons

| Pros | Cons |

| Diverse range of investment products | Lack of transparency regarding trading conditions |

| Access to CFD trading | Potentially high-risk nature of CFD trading |

| Trade allowances on popular US stocks | |

| Demo account available for practice and learning | |

| Various account types to cater to different needs | |

| Wide availability of MetaTrader 5 trading platform |

Market Instruments

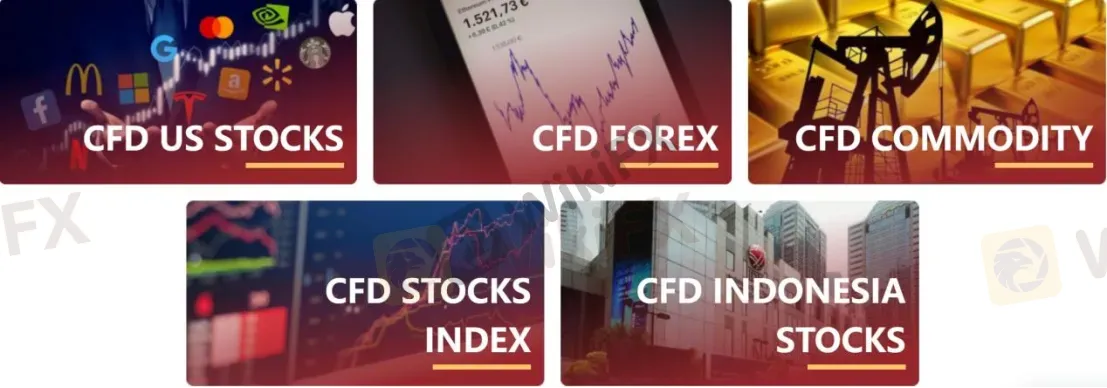

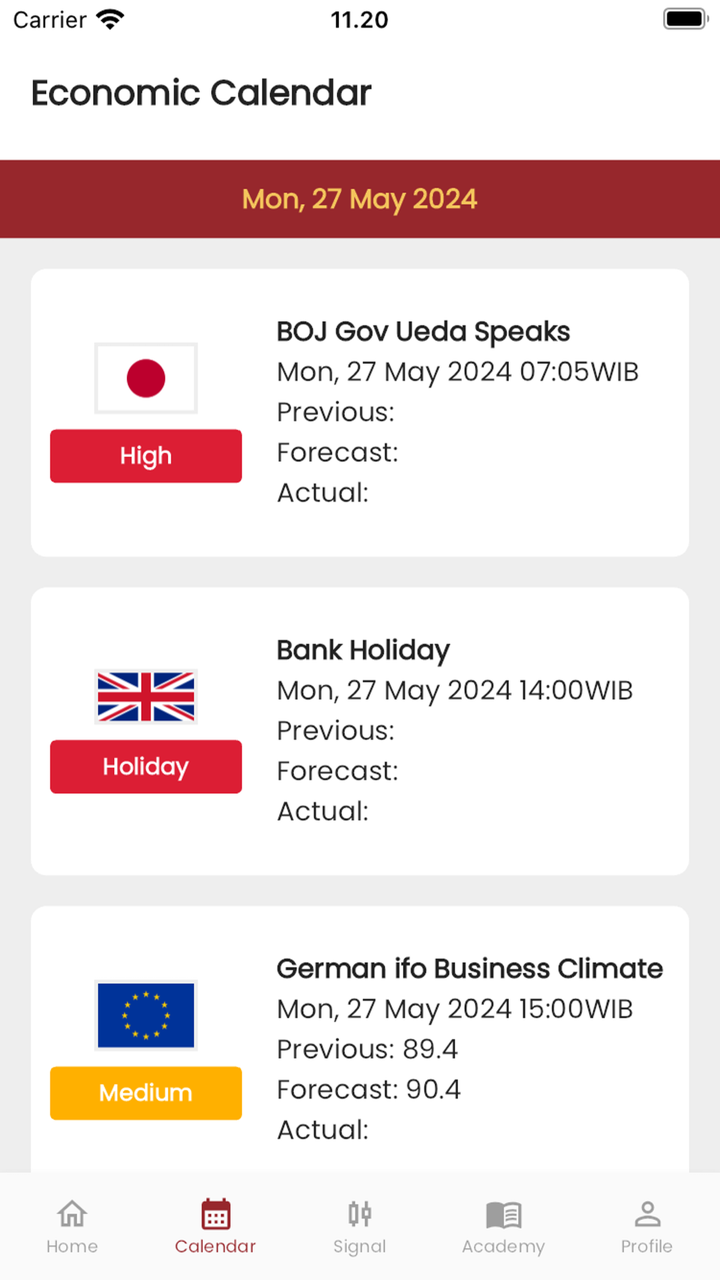

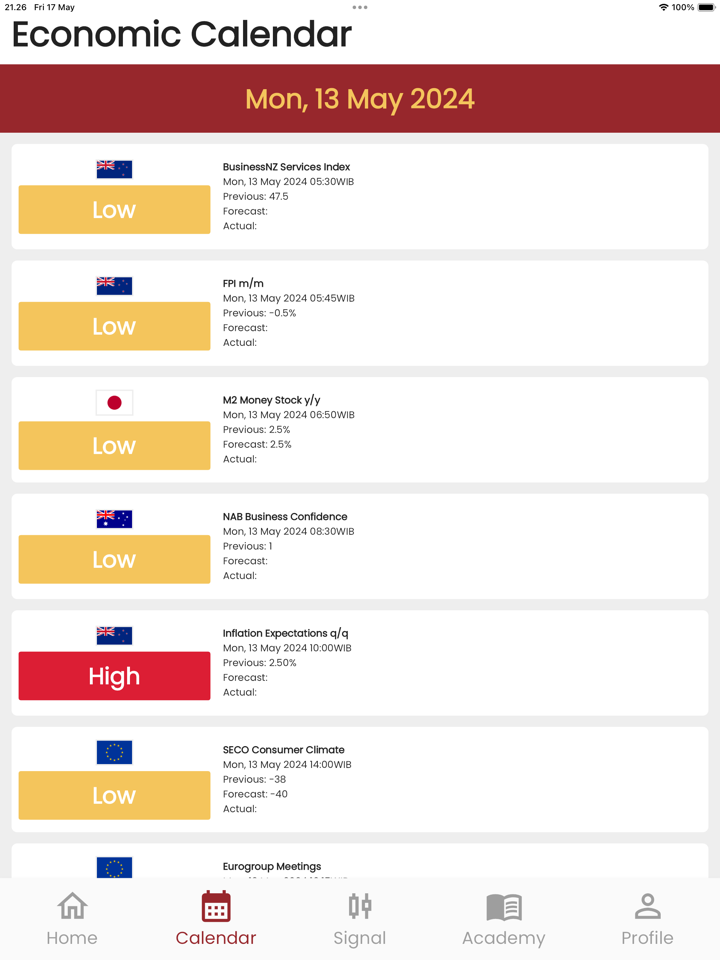

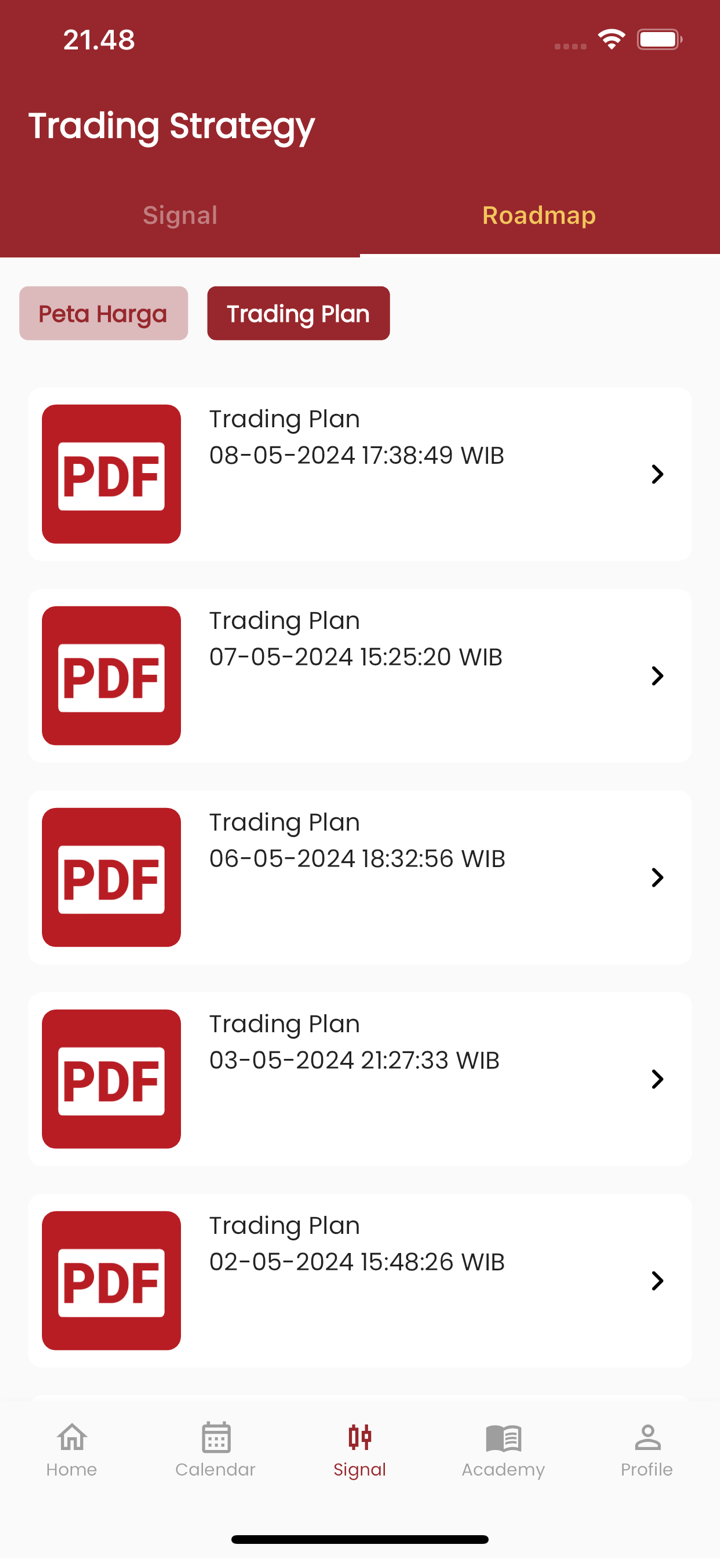

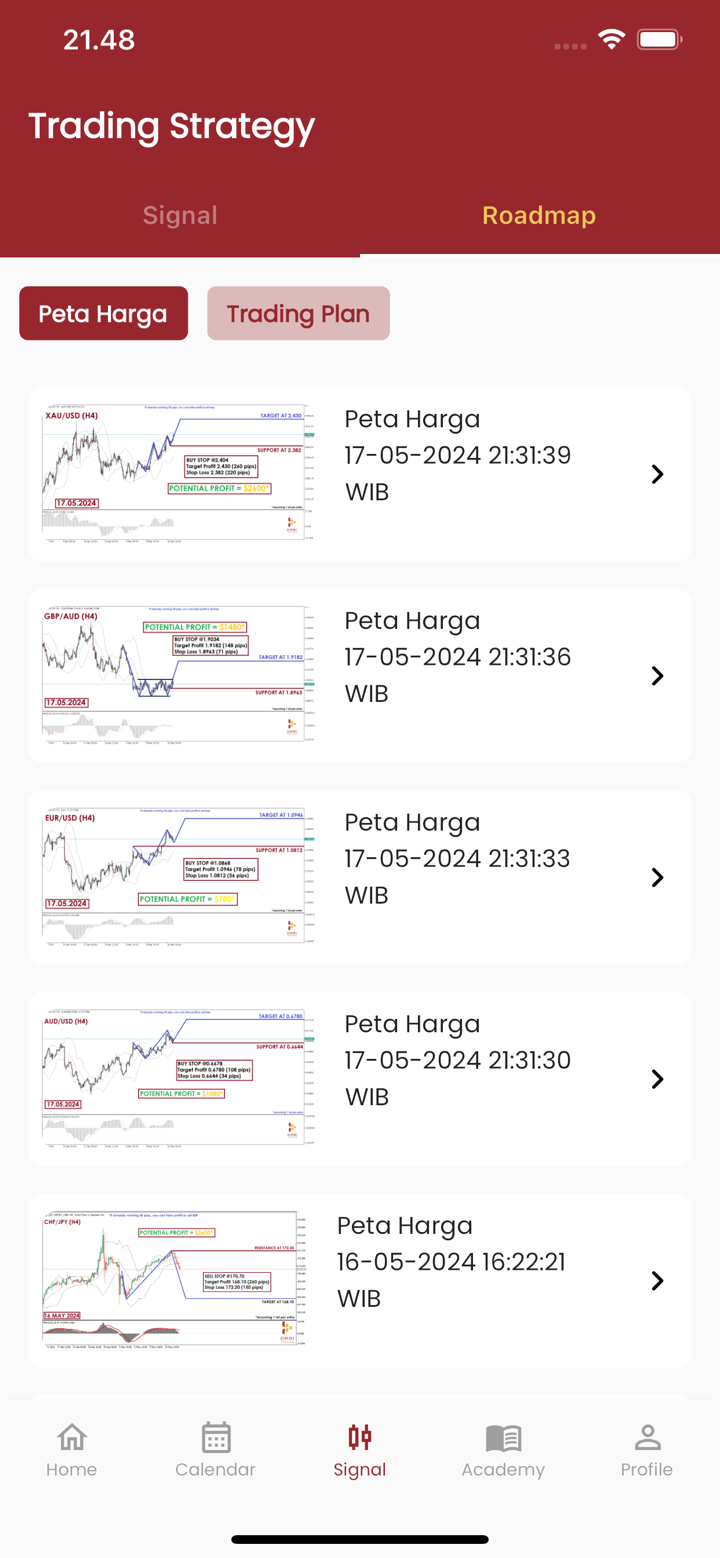

ORBI TRADE advertises that it offers access to 1,000 trading products, including CFDs on US stocks, forex, commodity, stocks index and Indonesia stocks.

CFD US Stocks: Market Instruments allows trading CFDs on a range of US stocks, including Alibaba Group Holding Ltd., Amazon.com Inc., Apple Inc., and more. Each contract size represents one unit of the respective stock, and the tick size and tick price determine the minimum price movement for trading. Trading is allowed for all the listed stocks.

CFD Forex: The platform offers CFD trading on Forex currency pairs, such as AUDJPY, AUDCAD, AUDCHF, and AUDNZD. The contract sizes and leverage ratios are standardized, and traders can take advantage of price movements in these currency pairs. The spread represents the difference between the buying and selling prices, with varying start spreads and maximum spreads for each pair.

CFD Commodity: Market Instruments provides CFD trading on commodities like XAUUSD (gold), XAGUSD (silver), and CLU (crude oil). The contract sizes, leverage ratios, and spreads differ for each commodity, allowing traders to speculate on price fluctuations in these markets.

CFD Stock Indices: The platform offers CFDs on US stock indices, including NASDAQ (US100), S&P 500 (US500), and DOW JONES (US30). Traders can speculate on the performance of these indices as a whole, rather than individual stocks. The contract sizes, leverage ratios, and spreads vary for each index.

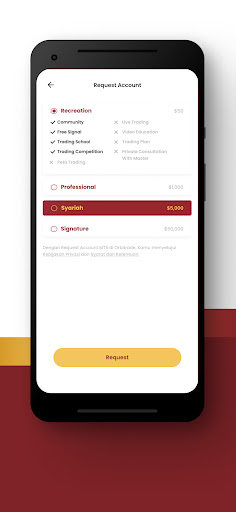

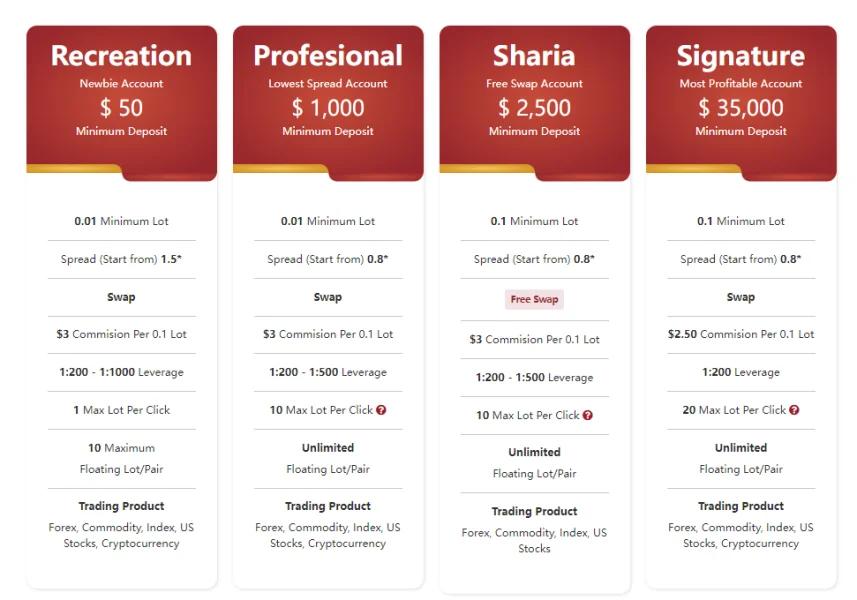

Account Types

Apart from demo accounts, ORBI TRADE claims to offer four types of real trading account types, namely Recreation, Professional, Syariah and Signature. The minimum initial deposit amount is only $50 for the Recreation account, while the other three account types have much higher minimum initial capital requirements of $1,000, $5,000 and $50,000 respectively.

Recreation Account:

The Recreation Account is designed for beginners and traders with limited capital. It requires a minimum deposit of $50 and offers a minimum lot size of 0.01. The maximum lot per click is 1, and the spread starts from 1.5. Swap charges apply, and there is a $3 commission per 0.1 lot. The leverage offered is 1/500, and traders have access to 1000 trading products.

Newbie Account:

Similar to the Recreation Account, the Newbie Account is suitable for novice traders. It has a minimum deposit requirement of $50 and offers a minimum lot size of 0.01. The maximum lot per click is 1, and the spread starts from 1.5. Swap charges apply, and there is a $3 commission per 0.1 lot. The leverage offered is 1/500, and traders can choose from 1000 trading products.

Professional Account:

The Professional Account is designed for experienced traders who can meet a higher minimum deposit requirement of $1,000. It offers a minimum lot size of 0.01 and a maximum lot per click of 10. The spread starts from 0.8, and swap charges apply. There is a $3 commission per 0.1 lot. The leverage offered is 1/200, and traders have access to 1000 trading products.

Syariah Account:

The Syariah Account caters to traders who prefer Sharia-compliant trading. It requires a minimum deposit of $5,000 and offers a minimum lot size of 0.10. The maximum lot per click is 10, and the spread starts from 1. This account type provides free swaps and a $3 commission per 0.1 lot. The leverage offered is 1/200, and traders can choose from 1000 trading products.

Signature Account:

The Signature Account is designed for high-net-worth individuals and experienced traders. It has a minimum deposit requirement of $50,000 and offers a minimum lot size of 0.5. The maximum lot per click is 20, and the spread starts from 0.8. Swap charges apply, and there is a $2.5 commission per 0.1 lot. The leverage offered is 1/200, and traders have access to 1000 trading products.

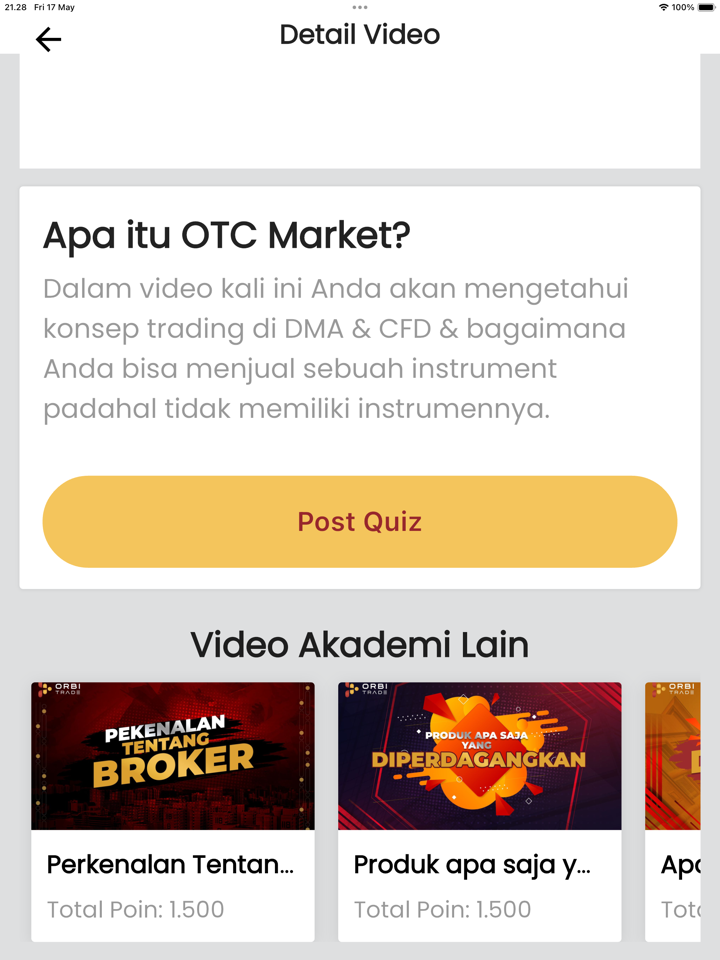

ORBI TRADE also offers a demo account option, allowing users to practice trading in a simulated environment without risking real money. This account provides a valuable opportunity for traders to familiarize themselves with the platform's features, test trading strategies, and gain experience before engaging in live trading.

How to Open an Account?

To open an account with ORBI TRADE, follow these steps:

- Visit the ORBI TRADE website and look for the “Sign Up” button or a similar call-to-action. It is usually prominently displayed on the homepage.

- Click on the “Sign Up” button, which will direct you to the registration page.

3. On the registration page, you will typically find a form to fill out with your personal details. Start by providing your full name in the designated field.

4. Enter your email address in the next field. Make sure to provide a valid and active email address as it will be used for account verification and communication purposes.

5. Enter your phone number in the format specified. In the example given, it asks for a phone number with the country code of +62.

6. Create a strong password for your ORBI TRADE account. The password should be unique and not easily guessable. It is recommended to include a combination of letters, numbers, and symbols for added security.

7. Confirm your password by entering it again in the designated field.

8. Review the provided information to ensure accuracy and completeness.

9. Once you have filled out all the required fields, click on the “Register” or “Sign Up” button to complete the account opening process.

10. After successful registration, you may be prompted to verify your email address by clicking on a verification link sent to your email. Follow the instructions provided in the email to complete the verification process.

Leverage

ORBI TRADE offers varying maximum leverage ratios for different account types. Clients on the Recreation account can enjoy a maximum leverage of 1:500, while the Professional, Syariah, and Signature accounts offer a maximum leverage of 1:200.

Spreads & Commissions

ORBI TRADE offers different spreads and commissions for their various account types. The Recreation account has spreads starting from 1.5 pips, the Syariah account offers spreads from 1 pip, and the Professional and Signature accounts provide spreads starting from 0.8 pips. In terms of commissions, the Recreation, Professional, and Syariah accounts have a $3 commission per 0.1 lot, while the Signature account incurs a slightly lower commission of $2.5 per 0.1 lot.

Trading Platform Available

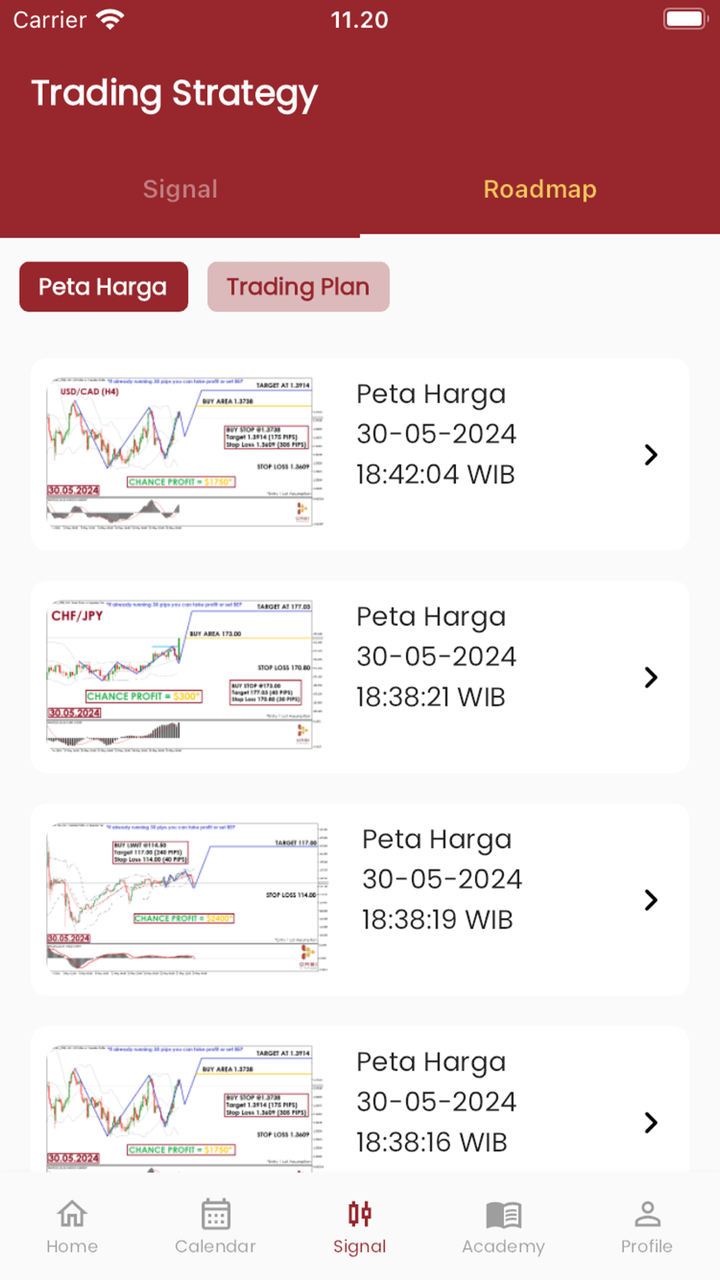

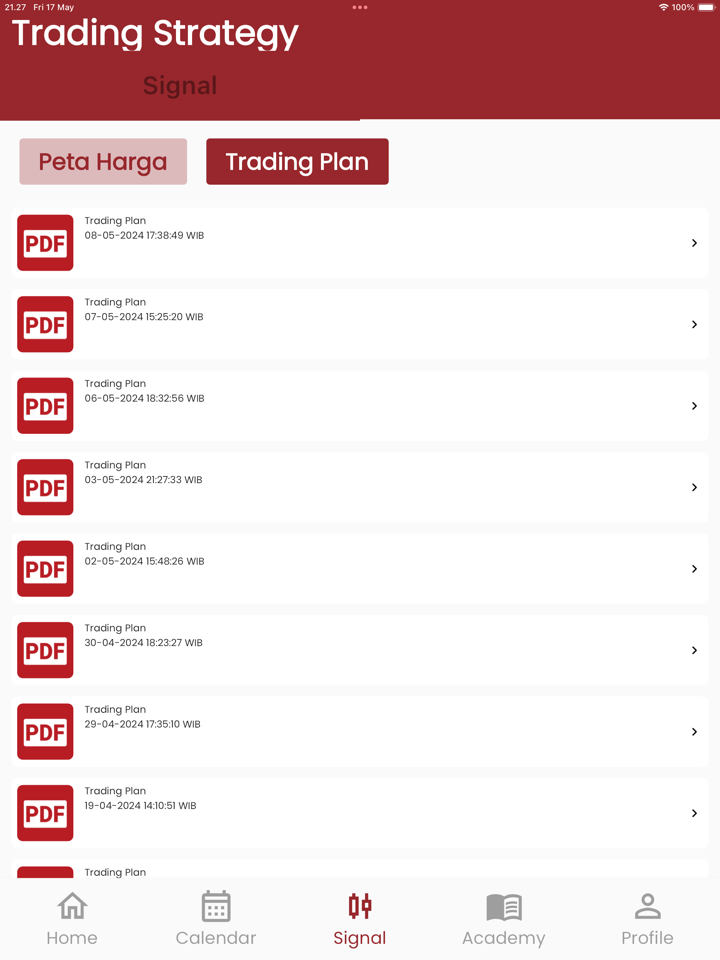

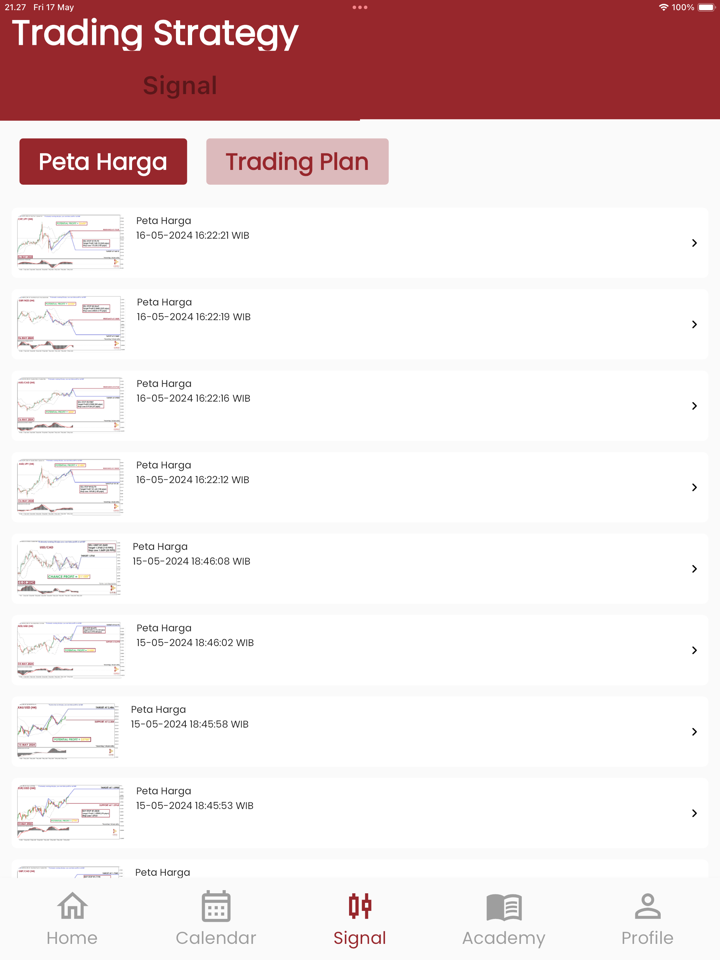

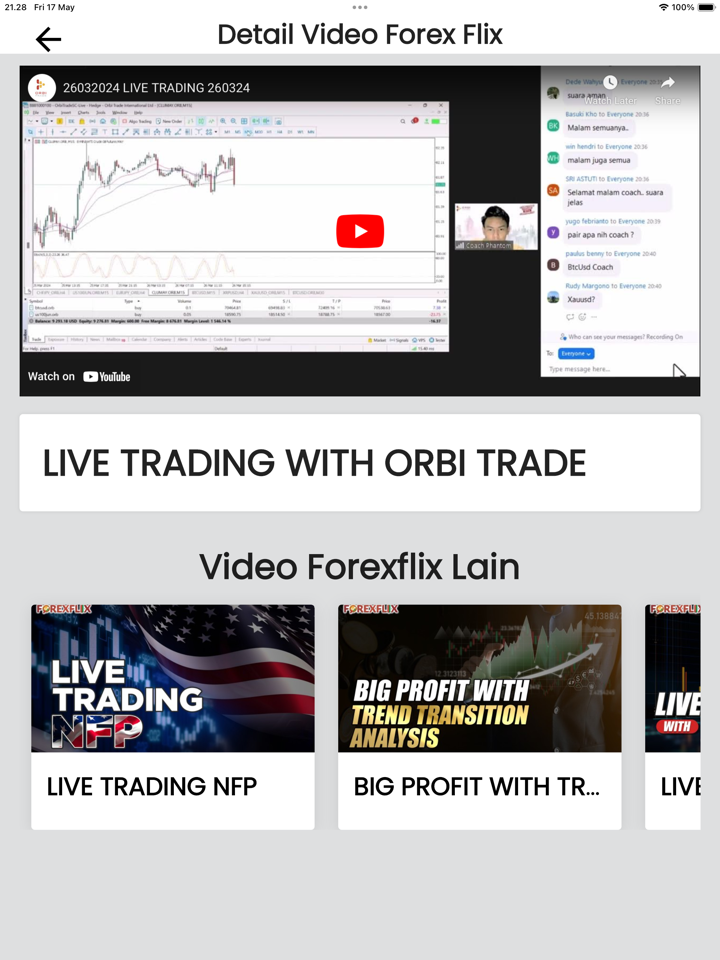

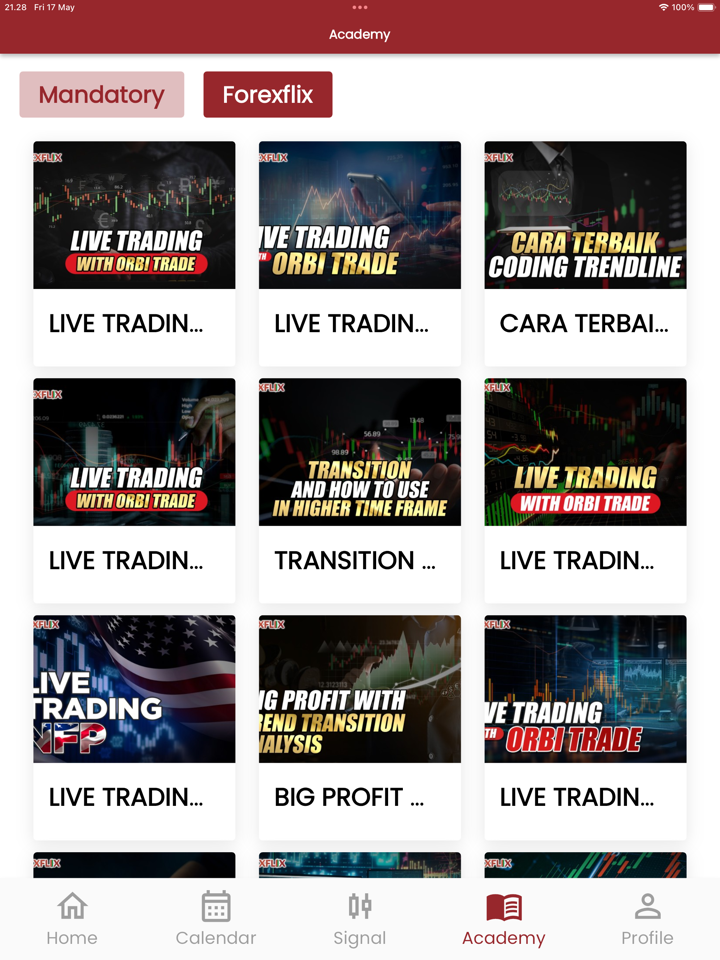

Platforms available for trading at ORBI TRADE are MT5 for Windows, MT5 for Android, MT5 for iOS and MT5 for MacOS. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

ORBI TRADE has a minimum initial deposit requirement of $50. However, the available information does not specify the deposit methods accepted by the platform. Regarding withdrawals, it appears that clients can only withdraw funds through bank transfers. No further details about the withdrawal process or available options are provided.

Customer Support

ORBI TRADEs customer support can be reached by telephone: +1 (737) 232-2299, +62 8111 717 999 (Bahasa), email: info@orbitrades.com, live chat or send messages online to get in touch. You can also follow this broker on social media platforms such as Instagram and YouTube. Company address: 1st Floor, First Saint Vincent Bank Ltd Building, James Street, Kingstown Kingstown, CA VC0100.

Customer Support

Finex provides customer support through various channels for addressing issues and inquiries related to ORBI TRADE INTERNATIONAL LTD. Customers can reach out to them via email by filling out the provided form on their website.

Finex has offices in Seychelles and Indonesia. The Seychelles office is located at Nobel Capital Limited, Room B11, First Floor, Providence Complex, Providence, Mahe, Seychelles. The Indonesia office is situated at THE PROMINENCE TOWER, Lantai 18, Jl. Jalur Sutera Barat No. 15, RT.003/RW.006, Kel. Panunggangan Timur, Kec. Pinang, Kota Tangerang, Prov. Banten, 15143, Indonesia.

Their customer care service operates 24 hours a day, seven days a week. Customers can contact them via phone at +1 (737) 232-2299 or +6221 2922 2999 (Bahasa). Additionally, inquiries can be sent to their email address info@orbitrades.com.

Overall, Finex provides multiple channels for customers to reach out for support, including email, phone, and office visits.

FAQs

What are the market instruments available on ORBI TRADE?

ORBI TRADE offers a range of financial products, including CFDs on US stocks, Forex currency pairs, commodities, and stock indices.

What are the different account types offered by ORBI TRADE?

ORBI TRADE provides several account types, including Recreation, Newbie, Professional, Syariah, and Signature accounts, catering to different trading needs and capital levels.

What leverage ratios are available on ORBI TRADE?

Leverage ratios vary based on the account type. The Recreation account offers a maximum leverage of 1:500, while the Professional, Syariah, and Signature accounts offer a maximum leverage of 1:200.

What are the spreads and commissions on ORBI TRADE?

Spreads start from 1.5 pips for the Recreation account, 1 pip for the Syariah account, and 0.8 pips for the Professional and Signature accounts. Commissions are $3 per 0.1 lot for the Recreation, Professional, and Syariah accounts, and $2.5 per 0.1 lot for the Signature account.

Xukar

Italy

ORBI TRADE has a really low minimum deposit, which is perfect for beginners or traders on a budget. And they offer a range of account types to fit different trading styles and goals. Overall, I'm happy with ORBI TRADE's options.

Positive

FX1494149797

Cyprus

So far so smooth. The real-time pricing is spot on for my trades, and I appreciate how clear they are about fees. Also, their e-learning system is a great touch for brushing up on trading tactics. Excellent platform!

Positive

FX1669530399

United States

User Interface is very Good. But the only problem is; sometimes I couldn't Deposit via UPI, it shows error or problem with bank or even sometimes money debited but didn't reflected in the ORBI TRADE Account.

Neutral

正月

Singapore

I would like to use my personal experience to remind everyone not to trade with institutions without regulatory licenses just for attractive trading conditions. This is tantamount to playing with fire, you may encounter a reliable company, but the possibility of being scammed is much higher.

Neutral