Company Summary

| CCB InternationalReview Summary | |

| Founded | 2003 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Products & Services | Corporate finance & capital market services, investment business, asset management business, institutional sales & research, overseas business, domestic corporations & business |

| Trading Platform | 建銀國際交易寶 |

| Customer Support | Hong Kong-Tel: 852-3911 8000; Fax: 852-2530 1496 |

| Beijing-Tel : 8610-5630 2900, 8610-5630 2701; Fax : 8610-6656 2760 | |

| Shanghai - Tel : 8621-2057 6269; Fax : 8621-6063 5650 | |

| Shenzhen- Tel : 86755-2158 3100 | |

| WeChat Official Accounts | |

CCB International Information

CCB International is a local regulated broker, offering products and services on Corporate finance & capital market services, investment business, asset management business, institutional sales & research, overseas business and domestic corporations & business via a trading platform called “建銀國際交易寶”.

Pros and Cons

| Pros | Cons |

| Various contact channels | Not friendly for beginners |

| Various trading products and services | |

| Complex fee structures |

Is CCB International Legit?

Yes. ATFX is licensed by the Securities and Futures Commission of Hong Kong (SFC, License No. AMB276).

Products and Services

| Products & Services | Supported |

| Corporate finance & capital market services | ✔ |

| Investment business | ✔ |

| Asset management business | ✔ |

| Institutional sales & research | ✔ |

| Overseas business | ✔ |

| Domestic corporations & business | ✔ |

Account Type

CCB International offers three account types, namely Individual, Join, and Corporate,and each account type contains margin accounts and cash accounts.

CCB International Fees

Trade-related services:

| Fee | Detail |

| Commission | 0.25% or below: min $100 |

| Stamp duty | 0.1% of transaction amount, rounded up to the nearest dollar (collected for HKSAR Government) |

| Transaction levy | 0.0027% of transaction amount (collected for the SFC) |

| Trading fee | 0.00565% of transaction amount (collected for the SEHK) |

| AFRC Transaction Levy | 0.00015% of transaction amount (collected for the AFRC) |

| CCASS settlement fee | ❌ |

Scrip handling and settlement-related services:

| Fee | Detail |

| Settlement instruction “SI” for share deposit via CCASS | ❌ |

| Investor settlement instruction “ISI” for share deposit via CCASS | ❌ |

| Settlement instruction “SI” for share withdrawal via CCASS | $100 per transaction |

| Investor settlement instruction “ISI” for share withdrawal via CCASS | $100 per transaction |

| Physical scrip deposit | ❌ |

| Physical scrip withdrawal | $5 per board/odd lot (included CCASS Fee) (min $100 per stock) |

| Transfer deed stamp duty | $5 per transfer deed (collected for HKSAR Government) |

| Default fee for late delivery of settlement | 0.5% multiplied by market value (based on the closing price quoted on the Exchange on the due date) of the corresponding short stock position, subject to a maximum fee of HK$100,000 for each corresponding short stock position |

Account maintenance:

| Fee | Detail |

| Safekeeping fee per month for account with trading | ❌ |

| Safekeeping fee per month for account with NO trading in past 12 months | $0.012 per board/odd lot (min $20) |

| Dormant account fee (no trading within 12 months) | $200 per annum |

| Stock segregated account (with CCASS Statement) Service | $500 per annum |

Nominee services and corporate actions:

| Fee | Detail |

| Cash dividend collection / dividend collection on scrip option | 0.12% of dividend amount (min $30, max $15,000) |

| Collection of bonus shares, bonus warrants / rights issue | Handling fee of $30 per stock |

| Scrip registration and transfer fee | CCASS scrip registration and transfer fee $1.5 per board / odd lot |

| Rights subscriptions, warrants conversions or preferential offers | $0.8 per board/odd lot (max: $15,000 per stock); plus handling fee of $50 per stock |

| Cash offer, open offers | $0.8 per board/odd lot (max $15,000 per stock); plus handling fee of $50 per stock |

| Share split / consolidation | ❌ |

| Handling fee for voting instruction (e.g., AGM, EGM/SGM, etc.) | ❌ |

| Claim for uncollected benefit entitlements | $500 per claim plus counterparty charges |

| IPO application fee | $100 per application |

| ADR Depository Fee (through ADR Depository Agents) | USD 0.01 – 0.05 per unit (subject to the fees charged by ADR Depository Agents) |

Financing and other charges:

| Fee | Detail |

| Annual interest rate of late settlement for trade (for custody account) | China Construction Bank (Asia) HKD Prime rate + 5% p.a. |

| Returned cheque | $200 for each HKD returned cheque |

| Stop payment by cheque | $150 per cheque |

| Same day value HKD local transfer (CHATS) | $300 per transaction |

| Same day value HKD overseas transfer (TT) | $300 per item plus correspondent bank's charges |

| Audit confirmation handling fee | $100 per application |

| Re-issue monthly statement | Within 3 months: ❌ |

| For past 3 months - 1 year: $50 per Statement | |

| For past 1 - 3 years: $100 per Statement | |

| For past 3 - 6 years: $500 per statement | |

| Asset confirmation or other ad-hoc service request | $500 plus out-of-pocket expenses |

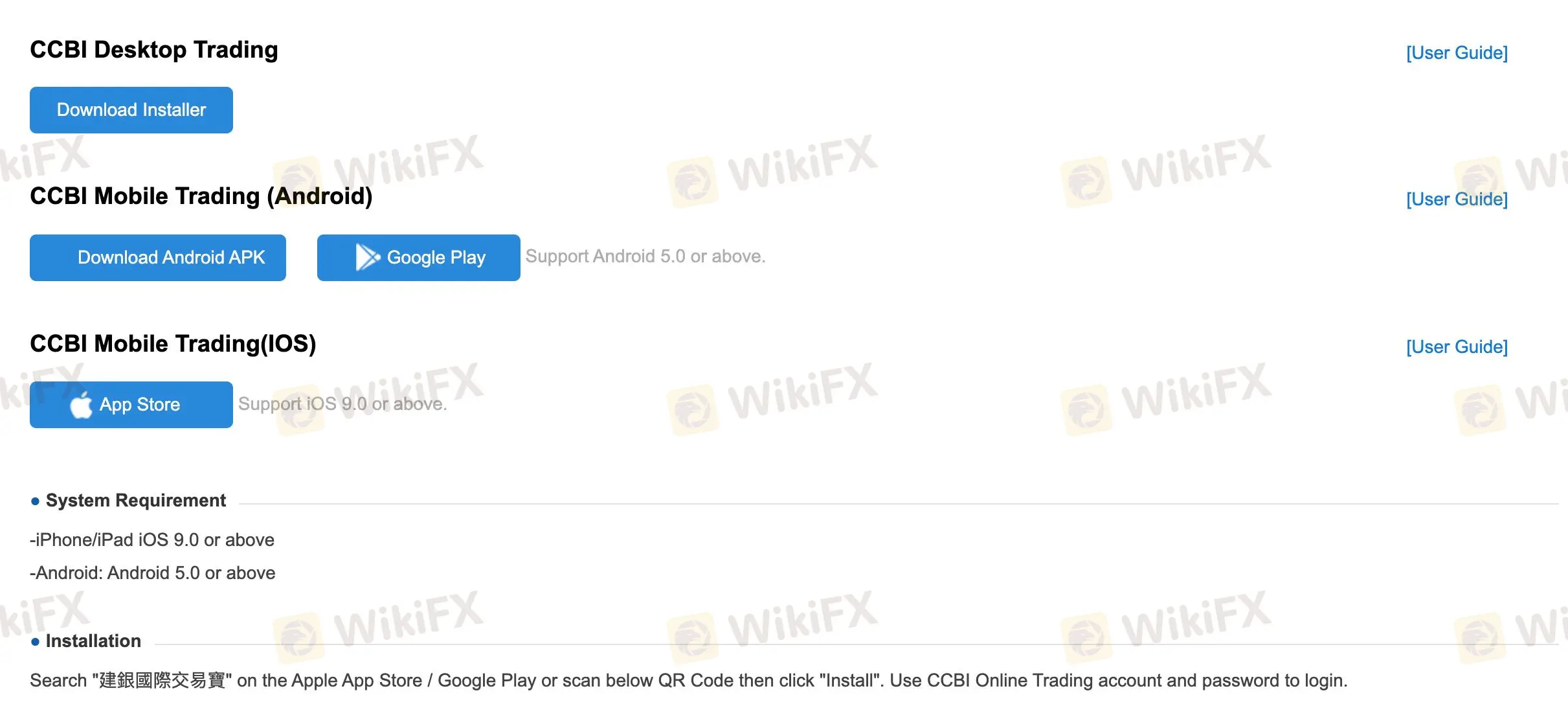

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| 建銀國際交易寶 | ✔ | Desktop, Android, IOS | Experienced traders |

Deposit and Withdrawal

The broker accepts payments done via CHATs, remittance and cheque.