Company Summary

| Loyal Primus Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | ASIC |

| Market Instruments | Futures, Metals, Commodities, Forex |

| Demo Account | ❌ |

| Leverage | Up to 1:2000 |

| Spread | From 0.6 pips |

| Trading Platform | MT5, MT4, Loyal Primus APP |

| Minimum Deposit | $15 |

| Bonus | ✅ |

| Customer Support | Contact form |

| Tel: +971 54 389 2863 | |

| Email: support@loyalprimus.net | |

| Social media: Instagram, YouTube, Twitter, Facebook, LinkedIn, TikTok | |

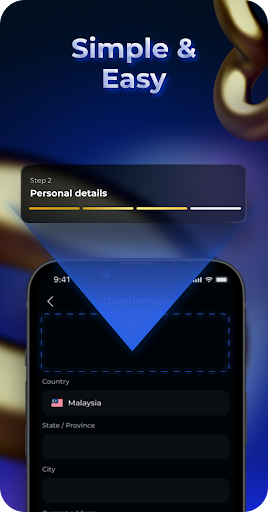

Loyal Primus was registered in 2023 in Saint Vincent and the Grenadines, specializing in the futures, metals, commodities, and forex market. This company is well regulated in Australia, and it provides various channels for customer support. However, it only offers a single type of account, with a minimum deposit of $15 and a maximum leverage of 1:2000.

Pros and Cons

| Pros | Cons |

| Regulated well | High leverage ratio |

| Low minimum deposit | No demo accounts |

| MT4 and MT5 supported | Limited types of account choices |

| Multiple channels for customer support | |

| No commission fees | |

| Promotion and bonus offered |

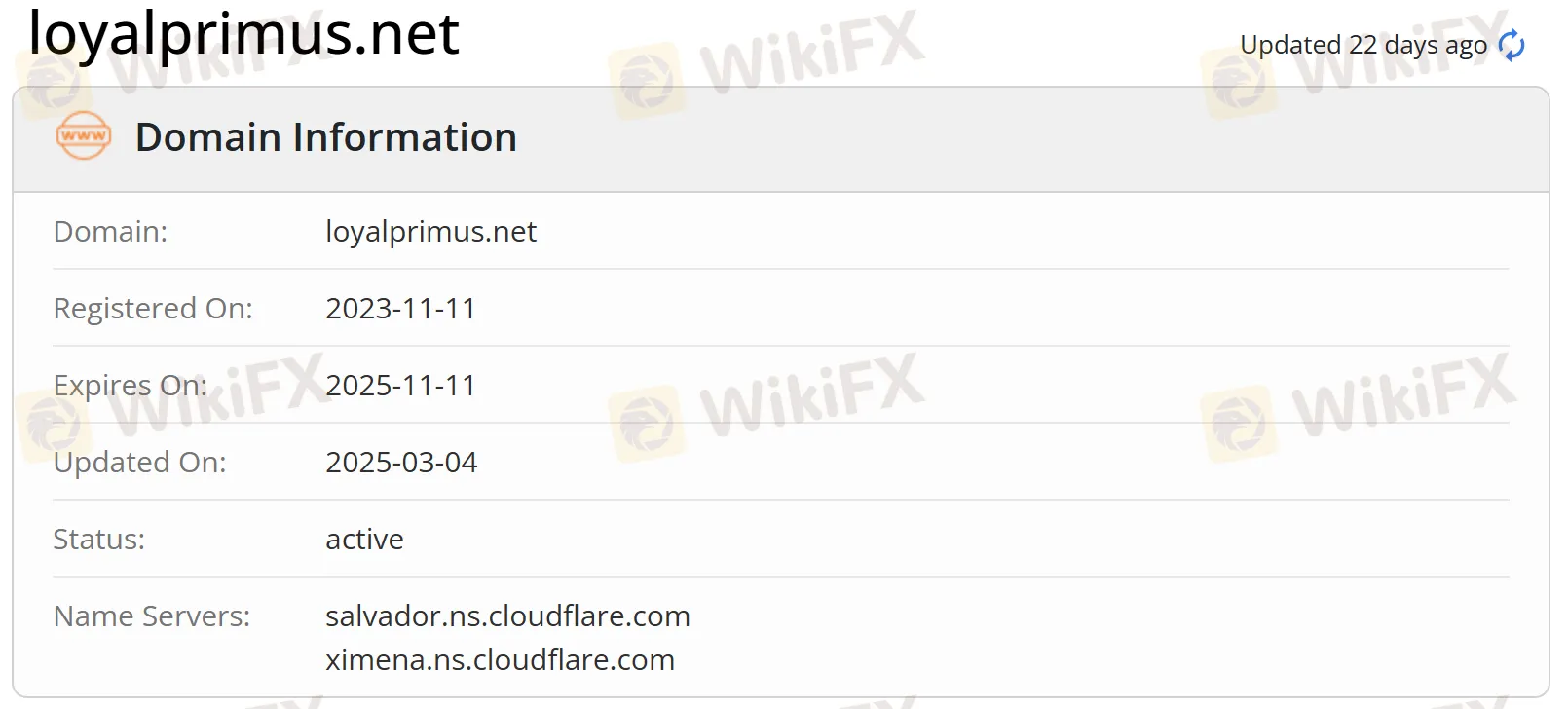

Is Loyal Primus Legit?

Loyal Primus is regulated by the Australia Securities and Investment Commission (ASIC). Besides, its domain status shows that it is active.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Australia Securities and Investment Commission (ASIC) | Regulated | LOYAL PRIMUS GLOBAL PTY LTD | Australia | Appointed Representative | 001310112 |

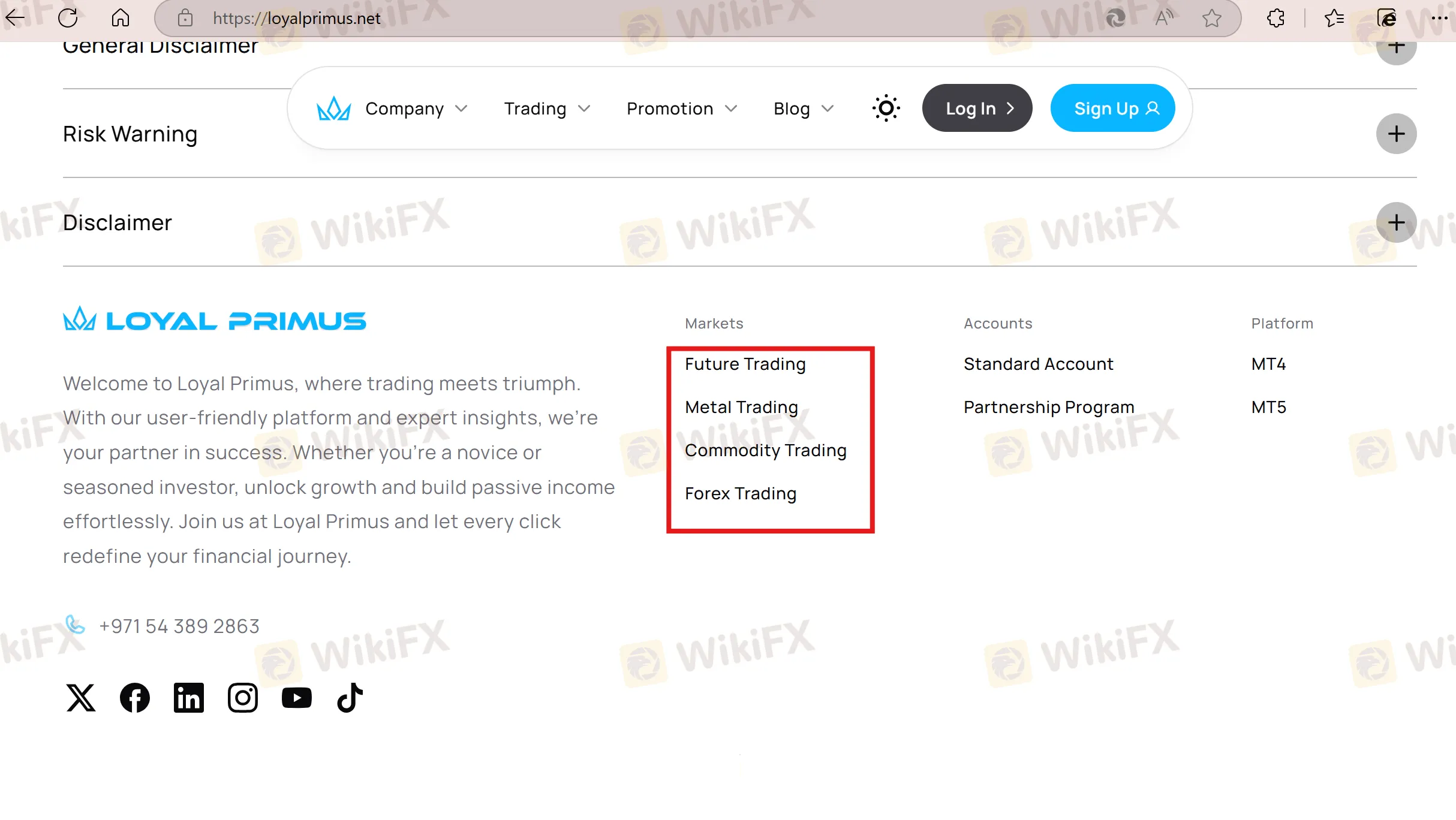

What Can I Trade on Loyal Primus?

Loyal Primus offers several types of products, including futures, metals, commodities, and forex.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Futures | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

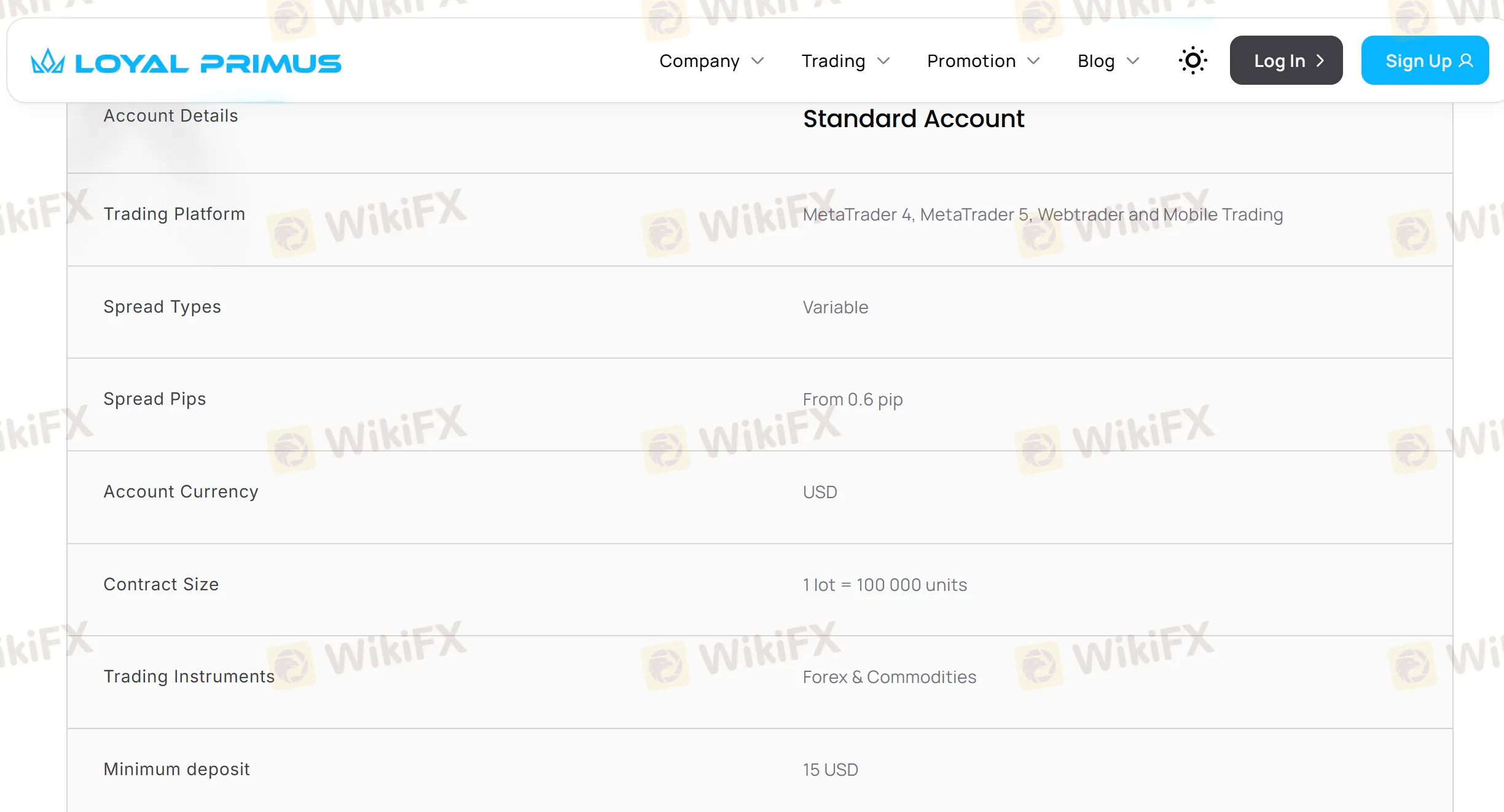

Account Type & Fees

Loyal Primus provides one type of account: Standard Account. Besides, it does not mention whether a free demo account is available or not.

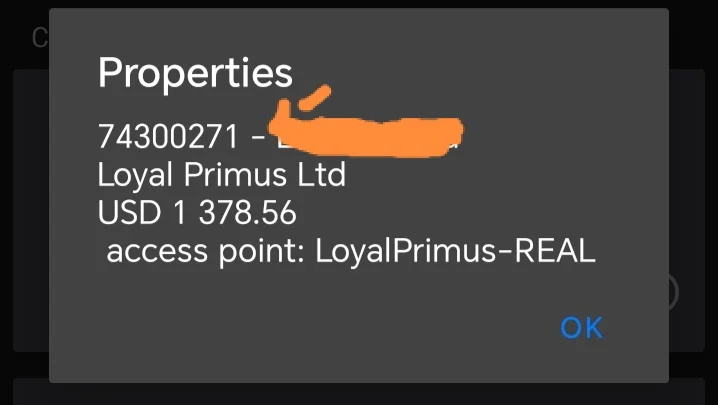

| Account Type | Minimum Deposit | Maximum Leverage | Spread | Commission |

| Standard | $15 | 1:2000 | From 0.6 pips | ❌ |

Leverage

The leverage can be up to 1:2000, which is relatively high. Traders need to consider carefully before investing, since high leverage is likely to bring high potential risks.

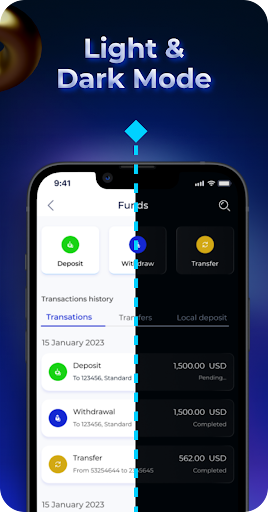

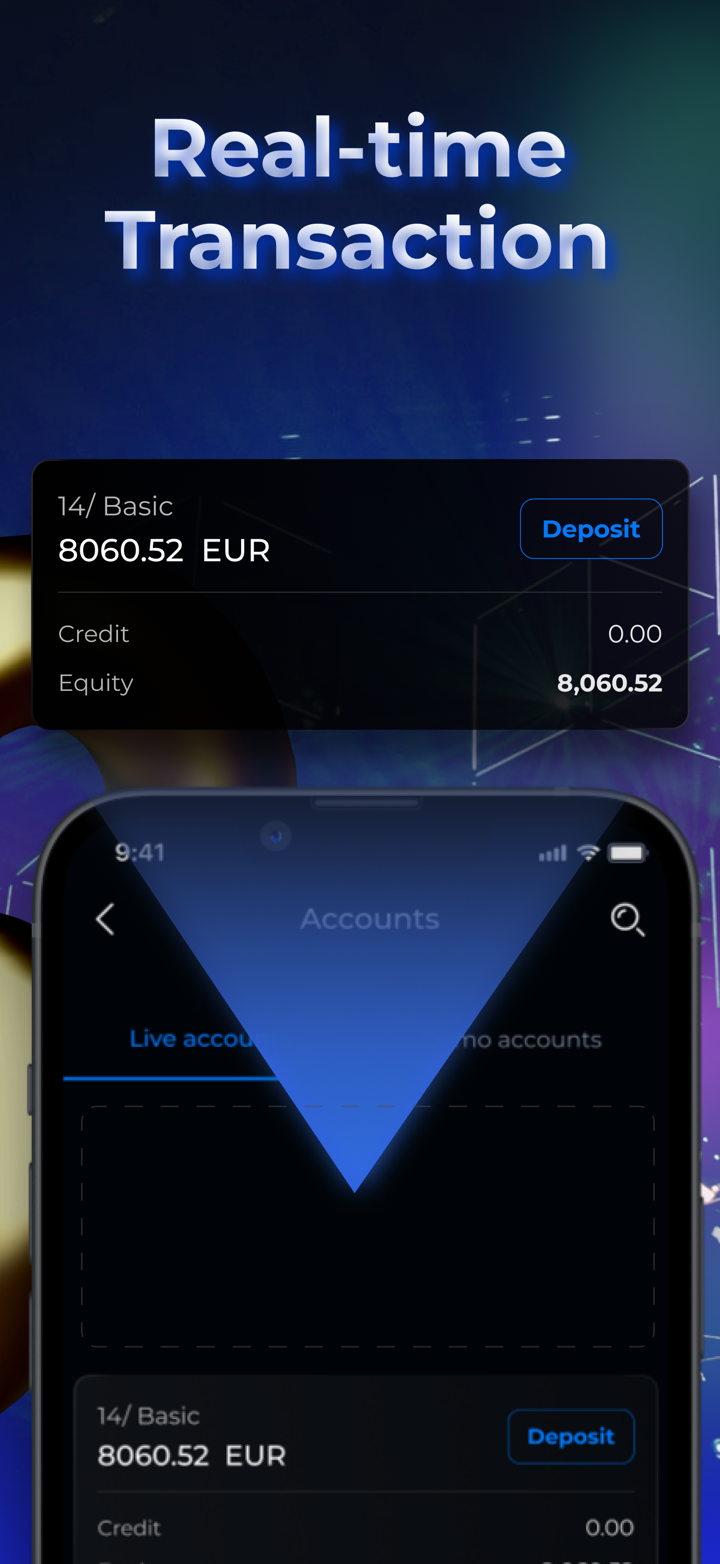

Trading Platform

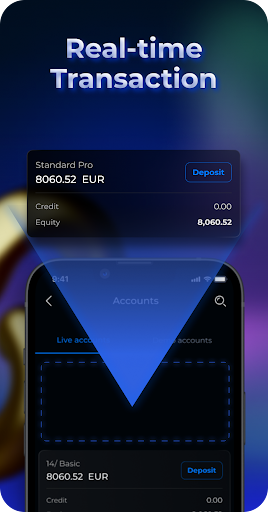

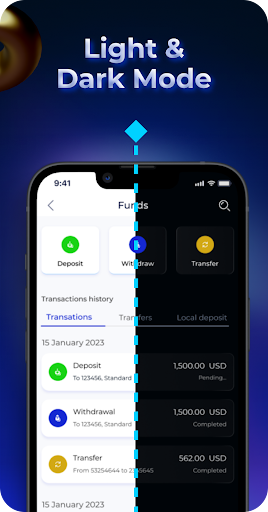

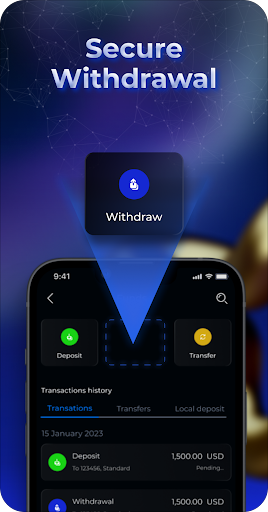

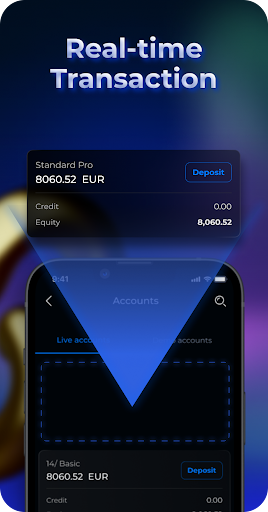

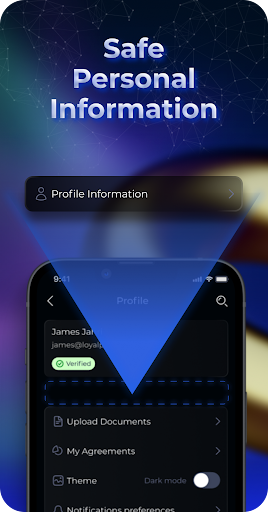

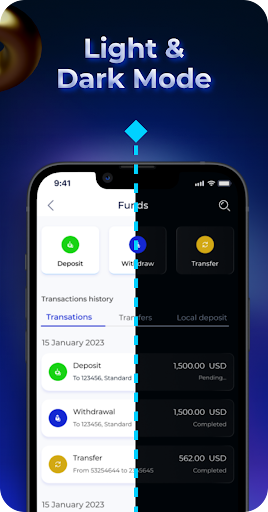

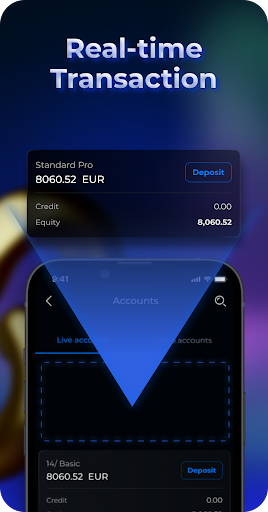

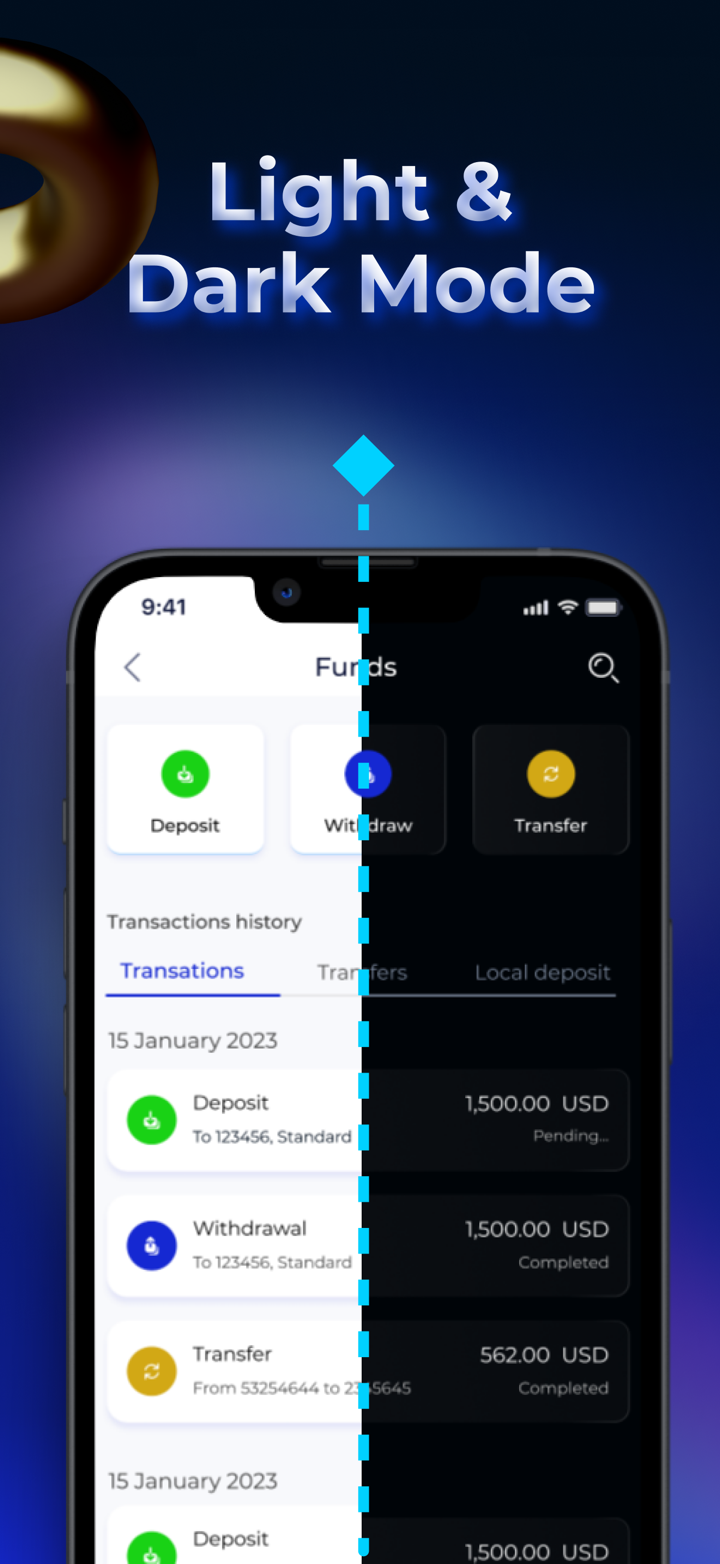

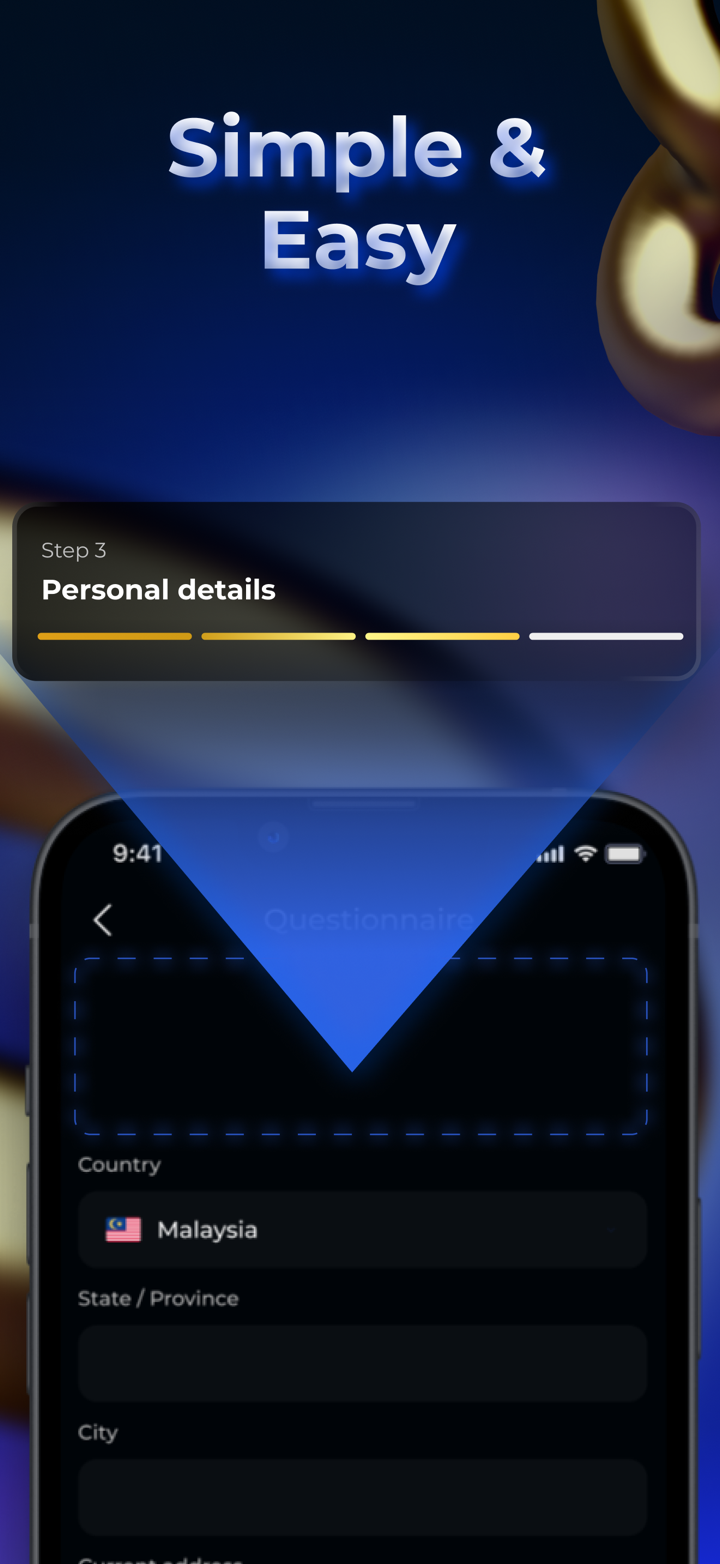

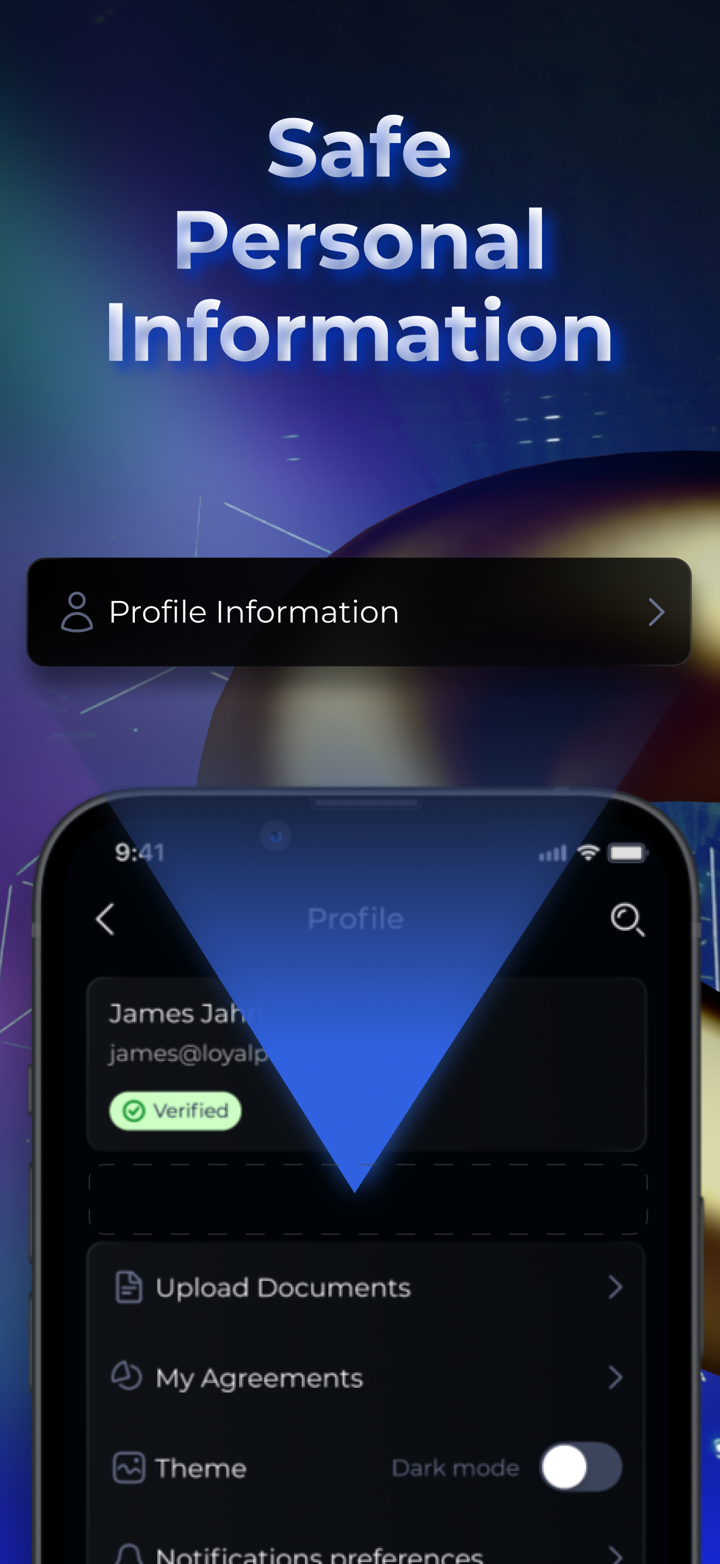

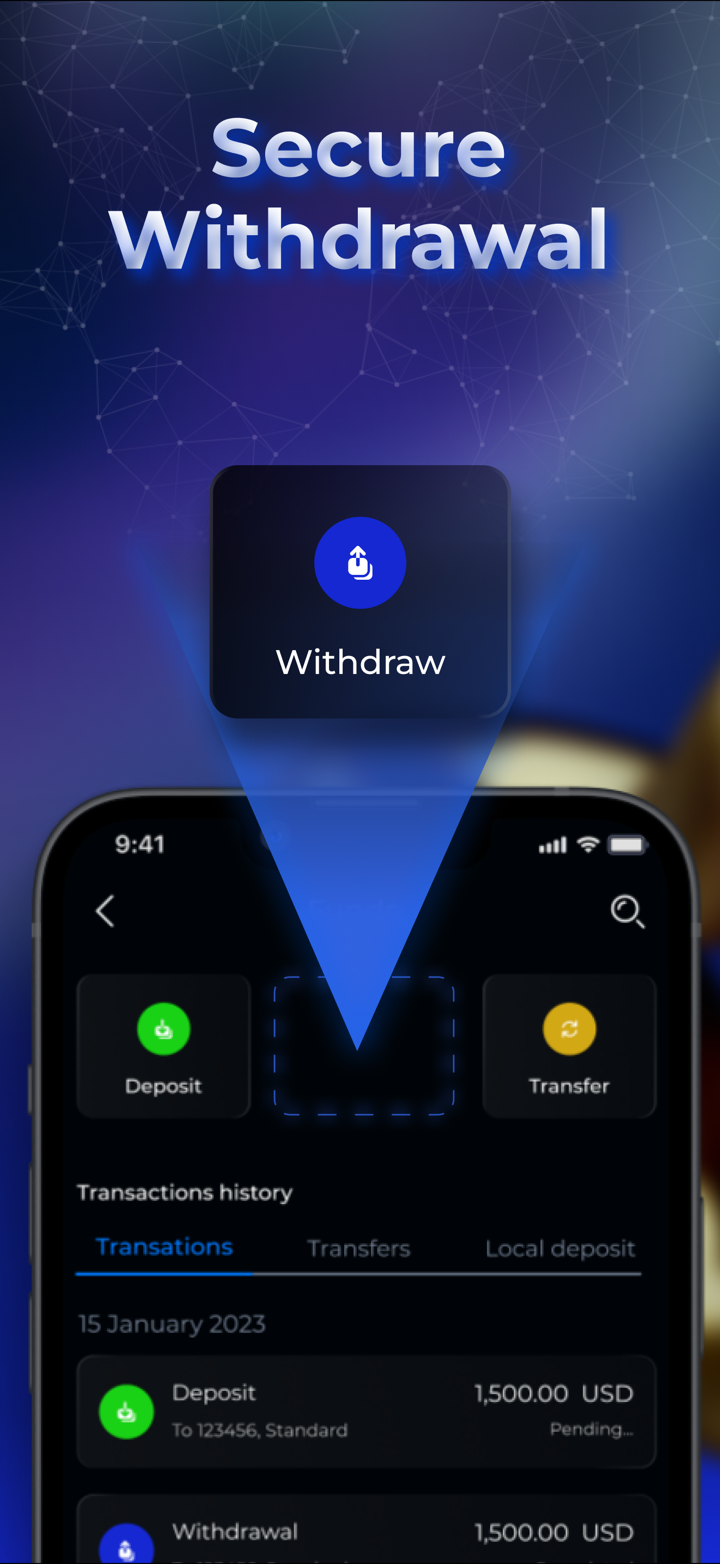

Loyal Primus supports the commonly used platforms including MT4 and MT5. Moreover, it also supports its own trading platform, which is available on mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC, web, mobile, mac | Beginners |

| MT5 | ✔ | PC, web, mobile, mac | Experienced traders |

| Loyal Primus APP | ✔ | Mobile | / |

Promotion & Bonus

Loyal Primus has trading promotions, including a welcome bonus of $30 and loyalty points which can be earned and used to exchange for commodities.

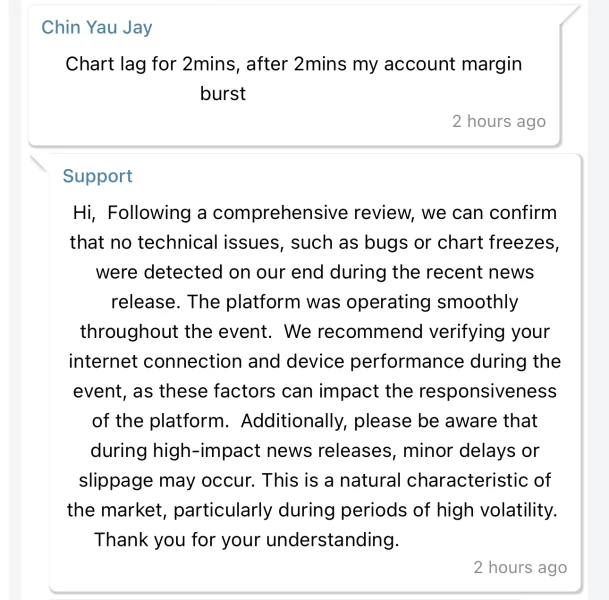

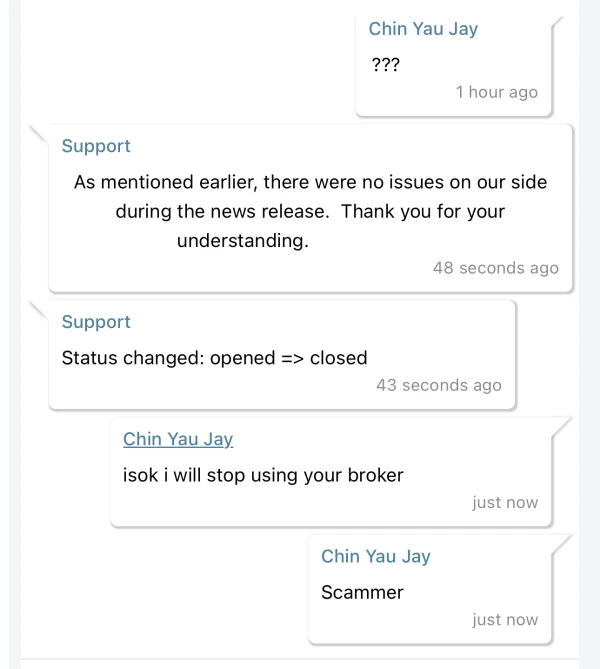

chin yau jay

Singapore

CPI news was 8:30pm, i entered trade at 8:29pm. my data was smooth until i was waiting for news. 8:30pm hit and broker chart lag for 2mins. $200usd burst. broker say they didnt have issue, from my side, broker lag for few minutes and back to normal. my data was smooth at that time no issues. live chat didnt help and refused to refund my deposit. just excused just because they dont want to refund

Exposure

FX1534966318

Brazil

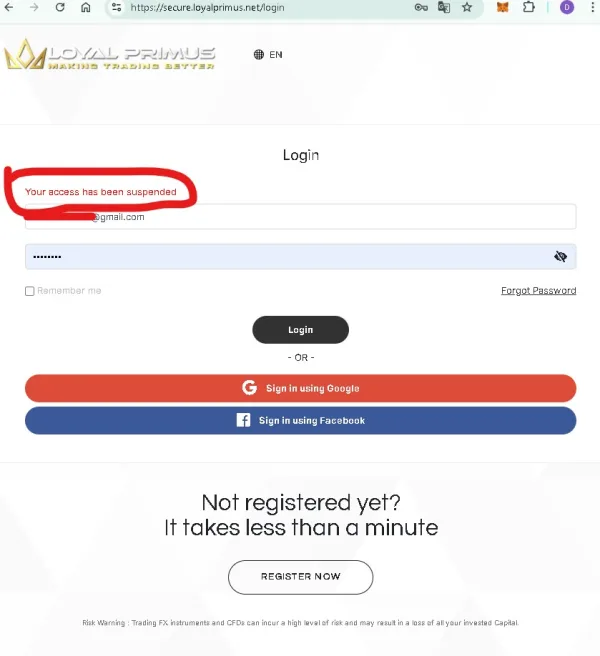

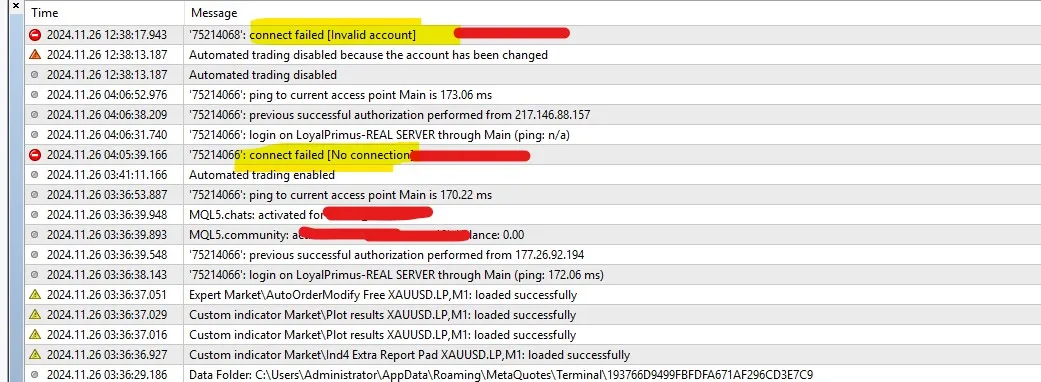

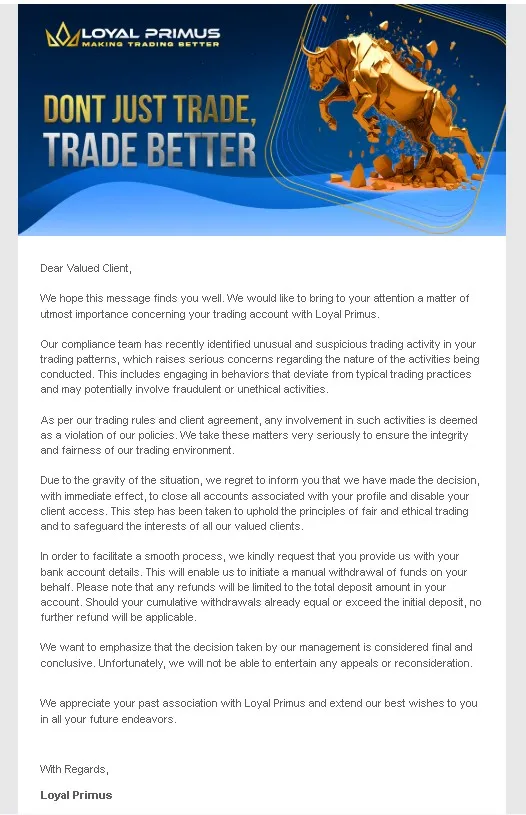

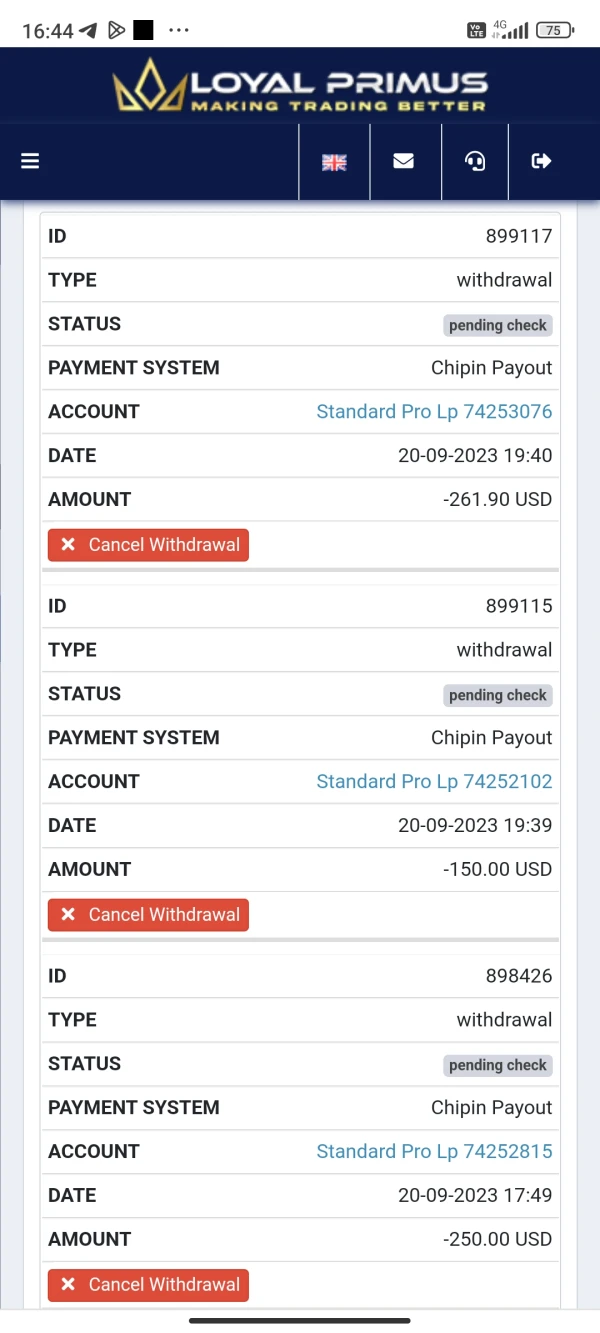

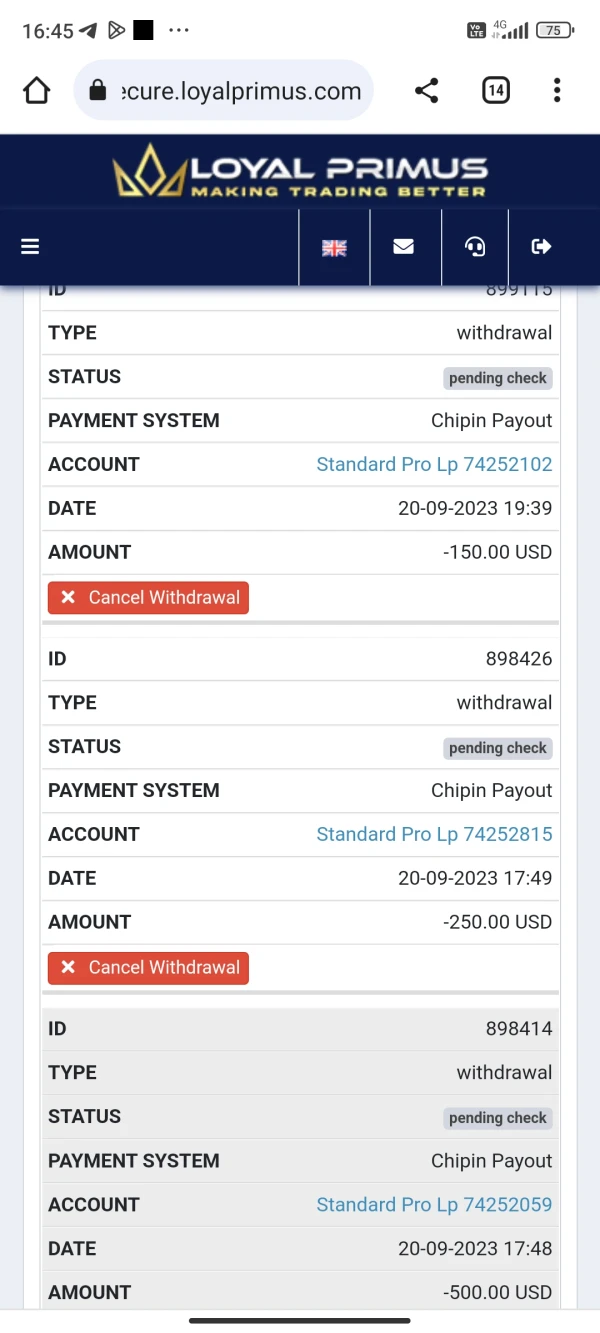

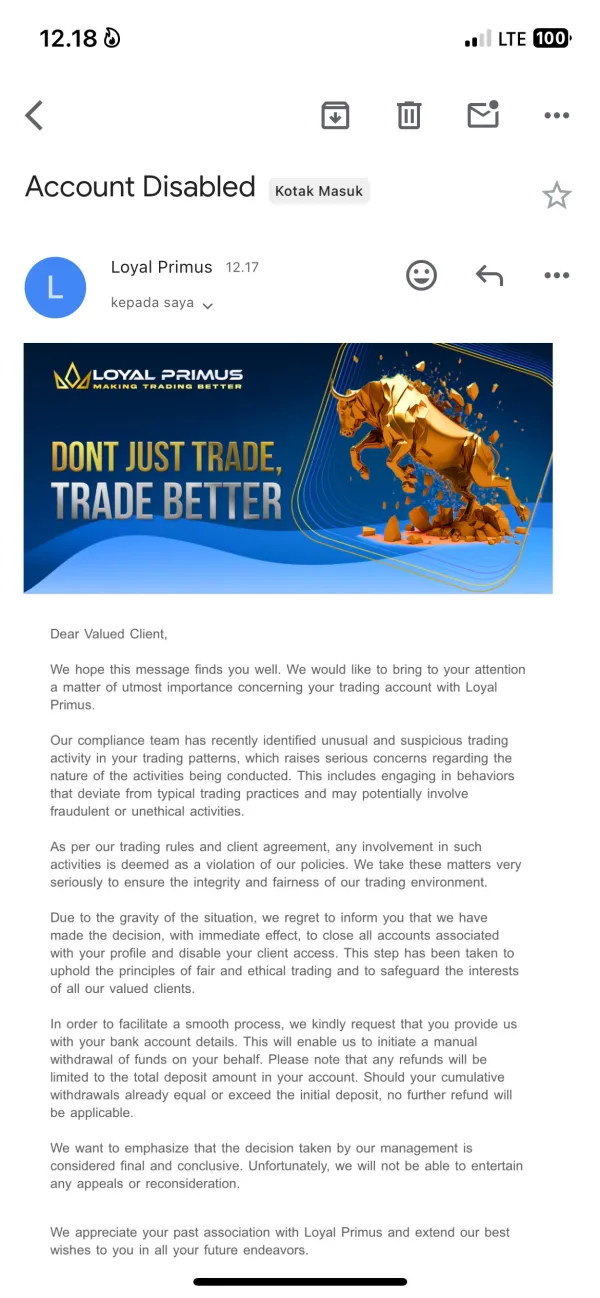

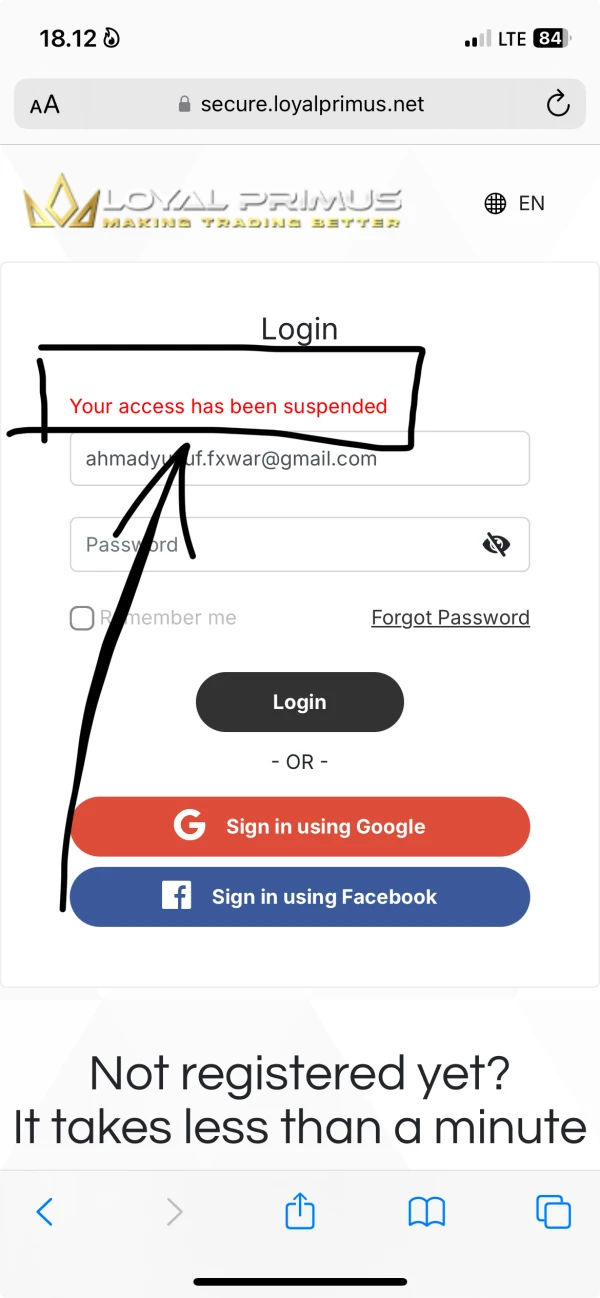

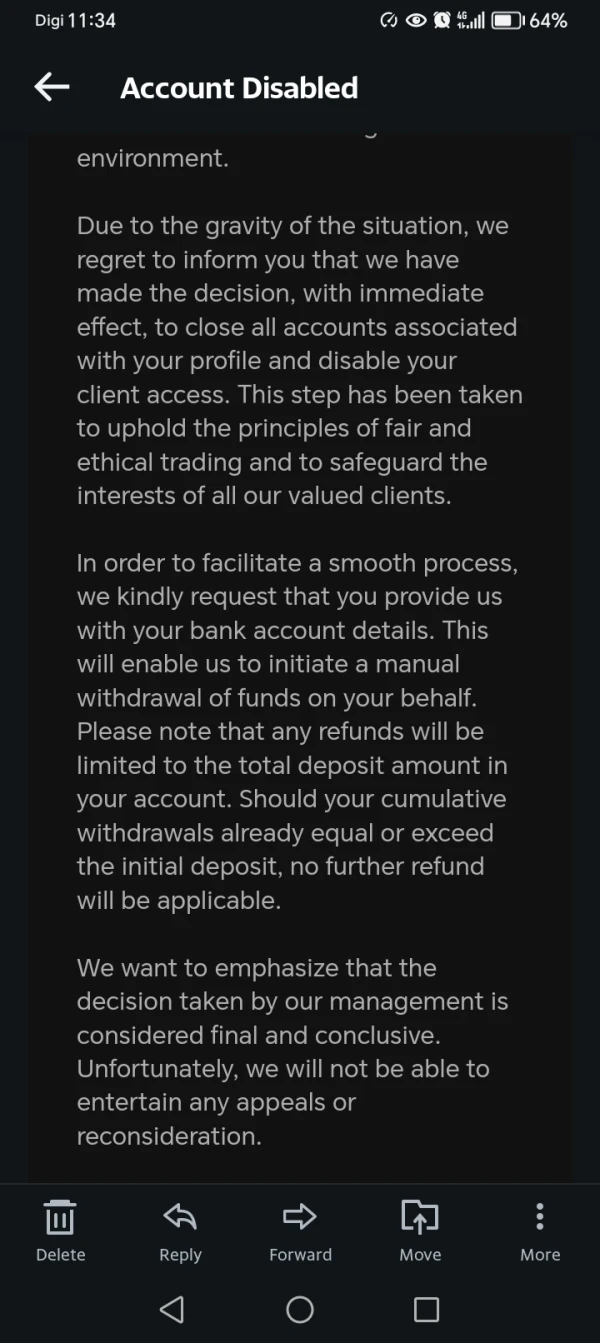

Stay away from this fraudulent broker. Yesterday I made a deposit of $600 USD, made a profit of 126 USD and decided to withdraw all my capital to go trade at another broker, but a few hours later my account was deactivated and they blocked me from accessing the dashboard. Now I have my $600 USD stuck in this fraudulent broker. They deactivated my 3 trading accounts too with profit and deposit of 600 usd. accounts 75214066, 75214069 and 75214068

Exposure

Nick Wong

Malaysia

It's been 4 days still haven't withdrawal my money.. I keep cancel and request again.. help desk support there no live chat, only messages.. at first is very fast until u realise is hard to withdraw after that.. deposit is can buy withdrawal can't..

Exposure

Akun Retail

Indonesia

I traded at this broker with a deposit of 307$. Immediately after that I just traded normally. My trading was in the Xauusd pair with a layering lot of 0.03 with 10 layers. I sold in the 2420 area and I closed at around 2395, making a profit of around $875. Immediately the next day after making the payment details I withdrew all my money amounting to $1182.30 but immediately after that my account was disabled by LoyalPrimus. I hereby hope for the good faith of the LoyalPrimus broker to immediately pay all my withdrawals.

Exposure

Sophian

Malaysia

Loyal Primus has got a lot of stuff to trade, from currencies to commodities to even crypto. And the minimum amount you need to start is pretty reasonable too. It's a good fit for traders who want options and don't wanna break the bank.

Positive

Anti scam

Malaysia

Profits cannot be withdrawn and the account is frozen directly. Fraud broker, freezes the account once the user makes a profit.

Exposure

Chen Miyagi

Singapore

Loyal Primus offers flexible leverage options, up to 1000:1, great for experienced traders like me! 👍👍👍

Positive

FX1496850438

Japan

Really appreciate Loyal Primus for their quick and efficient service. Deposits and withdrawals are speedy, and no commission is good. Looking forward to more promotional events!

Positive

Faisal af

Indonesia

Primus loyal broker cheated at 04.00 on 07.09.2023 candle was different from the others because he wanted to touch my SL. [d83d][de2d]

Exposure

魔豆~

Australia

Overall, the trading conditions offered by this broker were completely unexpected. The MT4 trading platform was as easy as ever, the demo account trading performed very well, and the minimum deposit of only $10 was friendly for newbies.

Positive

HIDE

Singapore

Multi-Asset Account with Low Spreads!!! I have one account for all instruments which I trade like futures, FX, metals & commodities. The spreads on my trading account were very traded friendly and I was offered a leverage of up to 1:1000.

Positive