Let's start here:

Doo Prime is a regulated broker offering 10,000+ popular trading products with spreads starting at 0.1 pips. The platform provides access to MT4, MT5, Doo Prime InTrade, TradingView, and copy trading. While it appears promising, let's dive deeper to assess if it truly meets its claims of providing an exceptional trading environment.

What is Doo Prime?

Doo Prime is a wholly-owned subsidiary of Doo Prime Holding Group, founded in 2014, headquartered in London, UK, with operations offices in Hong Kong, Taipei, Dallas, Kuala Lumpur, and Singapore.

Doo Prime offers a diverse selection of tradable assets, including forex, contracts for difference (CFDs), indices, and cryptocurrencies. Doo Prime caters to a diverse range of traders by offering different account types to suit individual preferences. The Cent account is designed for beginners and those who prefer to start with smaller trade sizes, while the STP (Straight-Through Processing) and ECN (Electronic Communication Network) accounts are more suitable for experienced traders seeking direct market access and tighter spreads. Traders can commence their trading journey with a minimum deposit of $100, providing accessibility to a wide range of investors.

In terms of leverage, Doo Prime offers flexibility with leverage options of up to 1:1000, supporting multiple trading platforms to cater to various trading styles and preferences. The widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms provide an extensive range of analytical tools, indicators, and expert advisors for comprehensive market analysis and automated trading. The Doo Prime Intrade platform, tailored specifically for Doo Prime clients, offers advanced charting features and execution capabilities. Furthermore, the integration of TradingView, a popular charting and social trading platform, provides traders with additional flexibility and convenience.

Lastly, acknowledging the significance of customer support, Doo Prime provides 24/7 assistance through various channels, including email, live chat, and telephone.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Is Doo Prime Legit?

Yes, Doo Prime is legally operating in different jurisditions, as it is subject to regulatory oversight from multiple regulatory authorities, FSA (Financial Services Authority) in Seychelles, FINRA (Financial Industry RegulatoryAuthority), LFSA (Labuan Financial Services Authority), VFSC (Vanuatu Financial Services Commission), and ASIC (Australia Securities & Investment Commission).

Doo Prime Seychelles Limited, its entity in Seychelles, is authorized and regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number SD090, holding a license for Retail Forex operation.

PETER ELISH INVESTMENTS SECURITIES, its entity in the United States, is authorized and regulated by the Financial Industry Regulatory Authority (FINRA) under regulatory license number 24409 / SEC: 8-41551, holding a license for Financial Service.

Doo Financial Labuan Limited, its entity in Malaysia, is authorized and regulated by the Labuan Financial Services Authority (LFSA) under regulatory license number MB/23/0108, holding a license for Straight Through Processing (STP).

Doo Prime Vanuatu Limited, its entity in Vanuatu, is authorized and regulated by the Vanuatu Financial Services Commission (VFSC) under regulatory license number 70038, holding a license for retail forex operation as well.

DOO FINANCIAL AUSTRALIA LIMITED, its Australian entity, is authorized and regulated by the Australia Securities & Investment Commission (ASIC) under regulatory license number 222650, holidng a license for Investment Advisory Lincense.

Pros & Cons

Doo Prime offers over 10,000 popular tradable assets, and multiple trading platforms, providing flexibility and choice for traders. Furthermore, the availability of social trading features is proovided. However, traders should be mindful of the commission charged per trade and the limitations in terms of educational resources and account customization. Additionally, Doo Prime's promotional offerings may be limited. Overall, traders should carefully consider these pros and cons when evaluating Doo Prime as a potential brokerage option.

Market Instruments

Doo Prime offers a comprehensive range of market instruments to cater to the diverse trading needs of its clients. These instruments encompass a variety of asset classes, including securities, futures, forex, precious metals, commodities, and stock indices.

Doo Prime Minimum Deposit

To open a most basic account, that is Cent Account, $100 is required, same as its standard account requirement. However, $100 to open a cent account is a little bit sticky, compared to HTFX's $5 to open a cent account. Well, $100 to open a standard account is acceptable.

Here is a table to show Doo Prime's minimum deposit with other brokers:

Account Types

Doo Prime offers a variety of account types to cater to the diverse needs and preferences of traders.

The Cent account is designed for those who are starting their trading journey or prefer to trade with smaller volumes. With a minimum deposit of $100, the Cent account provides accessibility to the markets without the availability of a demo account. Traders can gradually build their trading skills and experience while managing lower trade sizes.

For traders looking for a Standard account, Doo Prime offers an option with a minimum deposit of $100. This account type allows traders to access a wider range of trading opportunities. The Standard account also provides the advantage of a demo account, enabling traders to practice their strategies and familiarize themselves with the platform before engaging in live trading. This feature helps traders gain confidence and refine their trading approach.

Doo Prime also offers an ECN account, specifically designed for more experienced traders seeking direct market access and enhanced trading conditions. With a higher minimum deposit requirement of $5000, the ECN account provides access to deep liquidity and tight spreads. Similar to the Standard account, the ECN account also includes a demo account option, allowing traders to test and fine-tune their trading strategies in a risk-free environment.

Doo Prime Demo Account

Notably, Doo Prime restricts demo accounts to Standard and ECN account holders. Additionally, if clients don't log in to their demo accounts for over 60 days, those accounts become inactive.

Here are some easy steps for you to open a demo account:

Step 1: Visit Doo Prime – Official Website and click “Demo Account”on the top right corner.

Step 2: Account Registration: Simply enter your phone number and email on the registration interface, choose verification via email or phone, click “Send Verification Code,” set your password upon successful verification, and then agree to the terms before clicking “Submit Registration.”

Step 3: Add a demo account: In the Doo Prime User Center, go to the homepage and choose “Add Account” below the demo account section.

Step 4: Customize your demo account: You can add an account by selecting the “Creation method,” “Trading Platform,” “Basic Account Type,” “Account Currency,” “Leverage,” and specifying the “Deposit Amount.” Then, set your “Trading Password” and “Read-only Password” to complete the process.

Step 5: Demo account is sucessfully opened: Once registration is complete, users can access their personal mailbox to retrieve their demo account login details, which include the chosen “Trading Platform,” “Demo Account,” and “Server Name.”

To add your demo account funds, follow just two steps:

Step1: Within the Doo Prime User Center's Demo Account screen, simply click the gear icon located in the upper right corner.

Step 2: Input the desired deposit amount into the “Deposit” field, then confirm by clicking “Yes.”

Then, the added amount will be displayed in the demo account.

Leverage

Leverage, in the context of trading, refers to the ability to control a larger position in the market with a smaller amount of capital. Doo Prime offers leverage of up to 1:1000. This means that for every dollar of trading capital, traders can control a position up to 1000 times larger.

Leverage is a double-edged sword, whch means it has the potential to magnify both profits and losses. When used wisely, leverage can amplify trading gains and allow traders to capitalize on market opportunities with a smaller investment. However, it's important to note that leverage also increases risk exposure. If the market moves against a leveraged position, losses can accumulate rapidly, potentially exceeding the initial investment.

Spreads & Commissions

Doo Prime offers spreads starting from 1 pip with a commission of USD 10 per trade. Spreads represent the difference between the bid and ask price of a financial instrument, indicating the cost that traders incur when entering a trade. With spreads starting from 1 pip, Doo Prime provides a competitive pricing structure that may appeal to traders seeking cost-effective trading opportunities.

In addition to spreads, Doo Prime applies a commission of USD 10 per trade. The commission is a fixed fee charged on each trade executed by the trader. This transparent commission structure ensures clarity regarding the cost of trading, allowing traders to accurately assess the expenses associated with their transactions.

Trading Platforms

As for the trading platform, Doo Prime provides its clients with many options. There are public platforms such as tradingview, MT5 and MT4 that have served many clients worldwide, also Doo Prime's own platform Doo Prime InTrade. If you didn't want to spend time familiarizing yourself with a new platform, you could choose public platforms. But Doo Prime's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

MetaTrader 5 (MT5): Doo Prime also supports the advanced MetaTrader 5 platform, which builds upon the features of MT4 and offers expanded functionalities. MT5 includes additional asset classes, improved charting tools, and enhanced order execution capabilities. Traders can access a more extensive range of analytical tools, utilize depth-of-market (DOM) functionality for more precise order placement, and benefit from advanced built-in indicators and graphical objects for comprehensive market analysis.

Doo Prime Intrade: Doo Prime introduces its proprietary trading platform, Doo Prime Intrade, designed specifically for its clients. This platform combines advanced charting features, intuitive navigation, and swift order execution. Traders can enjoy a seamless trading experience with access to real-time market data, customizable charting tools, and the ability to execute trades swiftly and efficiently.

TradingView: Doo Prime integrates with TradingView, a popular and powerful charting and social trading platform. TradingView offers an extensive range of technical analysis tools, customizable charting features, and the ability to follow and interact with other traders in the TradingView community. Traders can access a vast library of indicators, create and share their own trading ideas, and collaborate with other traders, fostering a social trading environment.

Social Trading

Social trading, a feature provided by Doo Prime, revolutionizes the way traders engage in the financial markets by combining the power of technology and social interaction. In social trading, traders have the opportunity to observe and replicate the trading activities of experienced and successful traders.

Through Doo Prime's social trading platform, traders can access a network of skilled traders and view their real-time trades, performance history, and trading strategies. This transparency enables aspiring traders to evaluate and select the traders they wish to follow based on their individual trading goals and risk appetite.

Deposit & Withdrawal

Doo Prime offers a variety of payment channels to facilitate deposit transactions, providing convenience and flexibility to its clients. The available payment channels, their supported payment currencies, deposit limits, and processing times are as follows:

Local bank transfers, allowing traders to deposit funds from their local bank accounts directly into their Doo Prime trading account. For traders using pay4broker CNY, deposits ranging from 1000 to 6800 CNY can be made within a 30-minute processing time. Another option is OTCP4B CNY, which allows for larger deposits. Traders can deposit between 15000 and 200000 CNY with a processing time of approximately 30 minutes. Additionally, OTCP4B CNY offers a range of deposit amounts from 450 to 6800 CNY, with a processing time of 5 to 30 minutes.

epay: Supports USD, HKD, GBP, EUR, AUD, THB, and AED as payment currencies. Deposits can be made within the range of $100 to $99,999, and the processing time is instant.

Skrill: Accepts multiple payment currencies, including USD, HKD, GBP, EUR, CHF, AUD, CAD, AED, PLN, NZD, ZAR, SEK, DKK, TWD, KRW, SGD, NOK, and INR. Deposits can be made between $100 and $6,000, with instant processing.

Fasapay: Supports USD and IDR as payment currencies. Deposits can be made within the range of $100 to $25,000, and the processing time is instant.

HWGC: Accepts TWD as the payment currency. Deposits can be made within the range of $100 to $710,000, and the processing time is approximately 45 minutes.

VISA, MASTERARD, APPLE PAY, GOOGLE PAY: Multiple payment currencies are supported, such as AED, AUD, BND, CAD, ZAR, VND, USD, TWD, THB, SEK, PLN, NZD, NOK, LAK, MMK, KHR, INR, HKD, GBP, EUR, DKK, CHF, and KRW. Deposits can be made between $100 and $6,500, with instant processing.

VISA, MASTERARD, APPLE PAY, GOOGLE PAY, AMERICAN EXPRESS: Accepts KRW and THB as payment currencies. Deposits can be made within the range of $100 to $400, and the processing time is instant.

Wire Transfer: Supports EUR, GBP, and USD as payment currencies. Deposits can be made within the range of $7,000 to $500,000, with a processing time of 2 to 5 working days.

Withdrawal

Doo Prime recommends a minimum withdrawal amount of USD 50, and it offers various withdrawal methods to accommodate the needs of its clients. For international wire transfers, withdrawals can be made in multiple currencies, including EUR, GBP, HKD, and USD. The processing time for international wire transfers is relatively quick, with funds typically being processed within one working day for withdrawal amounts up to USD 50,000. For withdrawal amounts ranging from USD 50,001 to 200,000, the processing time extends to two working days. Withdrawals of USD 200,001 to 1,000,000 require approximately five working days for processing, while withdrawals above USD 1,000,001 may take around six working days to complete.

For local bank transfers in CNY (Chinese Yuan) and VND (Vietnamese Dong), Doo Prime provides a good option for clients based in those respective regions. The processing time for local bank transfers may vary depending on the specific local banking systems. It is advisable to check with Doo Prime for the estimated processing time for local bank transfers in CNY and VND.

Educational Resources

Doo Prime offers access to renowned market analysis provider Trading Central, providing traders with research, technical analysis, and trading ideas across various financial markets.

Additionally, Doo Prime provides Virtual Private Server (VPS) services, which offer traders enhanced trading performance and uninterrupted connectivity. The VPS allows traders to execute their trading strategies with minimal latency and ensures that their trading activities are not affected by technical glitches or disruptions.

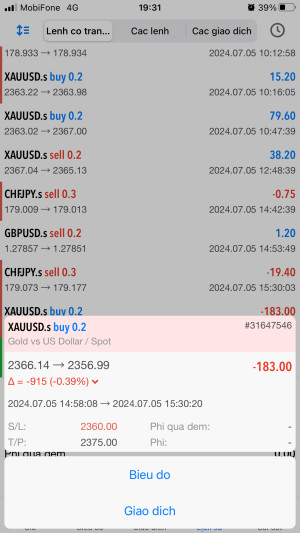

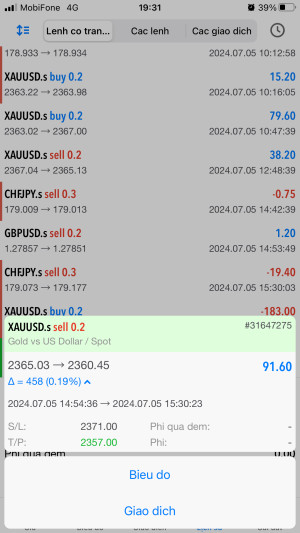

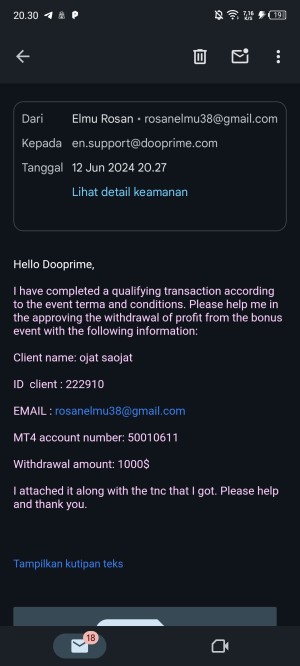

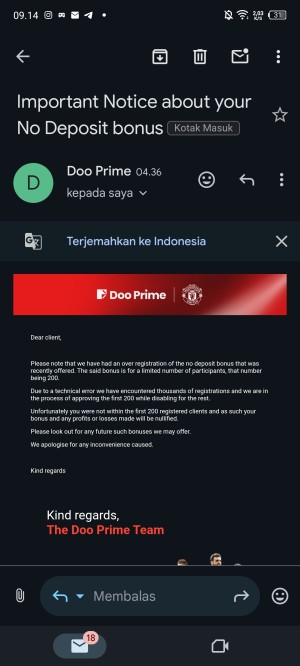

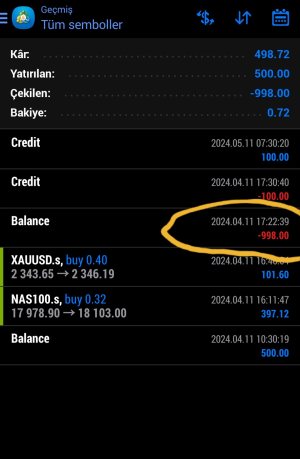

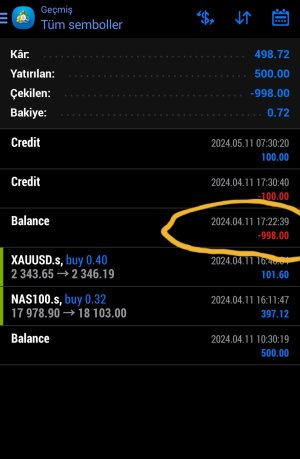

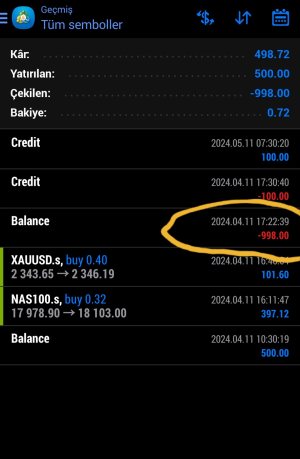

User Exposure on WikiFX

On WikiFX website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Support

Traders can reach out to the company through various channels to address their queries and concerns. The brokerage offers phone support, enabling clients to directly contact the relevant branch or office for personalized assistance. Additionally, an online chat feature is available for real-time communication, allowing traders to engage in instant conversations with customer support representatives. Furthermore, clients have the option to fill out a contact form on Doo Prime's official website, and the company will promptly respond and connect with them.

Doo Prime actively engages with its clients and provides additional avenues for communication and updates through various social media platforms. Traders have the opportunity to connect with Doo Prime on popular social media platforms like Facebook, Twitter, Instagram, and LinkedIn. By following Doo Prime on these platforms, clients can stay updated on the latest news, market insights, educational content, promotions, and company announcements.

Below are the details about the customer service.

Languages: English, Chinese, Japanese, Korean, Spanish, Thai, Vietnamese.

Service Hours: 24/7

Contact Form

Email: en.support@dooprime.com

Phone: +44 11 3733 5199

Social media: Facebook, Instagram, LinkedIn, twitter

Conclusion

In conclusion, Doo Prime presents itself as a well-established brokerage firm with several positive aspects and a few considerations to keep in mind. On the positive side, Doo Prime's regulatory oversight by respected authorities instills confidence in the company's adherence to financial standards and investor protection. The diverse range of account types, including Cent, STP, and ECN, caters to the varying needs and preferences of traders. Additionally, the flexibility of leverage options up to 1:1000 and competitive spreads starting from 0.6 pips offer potential cost advantages for traders. The availability of popular trading platforms like MT4, MT5, Doo Prime Intrade, and TradingView, along with a wide selection of tradable assets, provides traders with comprehensive market access and analysis tools. The inclusion of social trading features further enhances the trading experience, allowing traders to learn from and replicate successful strategies.

However, it is important to consider certain factors. Traders should also be mindful of the potential risks associated with high leverage and carefully manage their positions. Furthermore, while Doo Prime offers competitive spreads, traders should compare them with other brokers to ensure they are getting the best available rates. Additionally, the absence of a demo account for the Cent account type may limit opportunities for beginner traders to practice and familiarize themselves with the platform.

FAQs

Question: Is Doo Prime a regulated brokerage?

Answer: Yes, Doo Prime is regulated by FSA (Offshore), FINRA, LFSA, VFSC (Offshore), and ASIC.

Question: What is the minimum deposit required to open an account with Doo Prime?

Answer: The minimum deposit required to open an account with Doo Prime is $100.

Question: What is the maximum leverage available at Doo Prime?

Answer: 1:1000.

Question: What are the available trading platforms at Doo Prime?

Answer: MetaTrader 4 (MT4), MetaTrader 5 (MT5), Doo Prime Intrade, and TradingView.

Question: What assets can be traded on Doo Prime?

Answer: Forex currency pairs, contracts for difference (CFDs) on various financial instruments, indices, and cryptocurrencies.

WikiFX

WikiFX

WikiFX

WikiFX