Company Summary

Note: Wandt's official website: https://www.wandt.cc is currently inaccessible normally.

| Wandt Review Summary | |

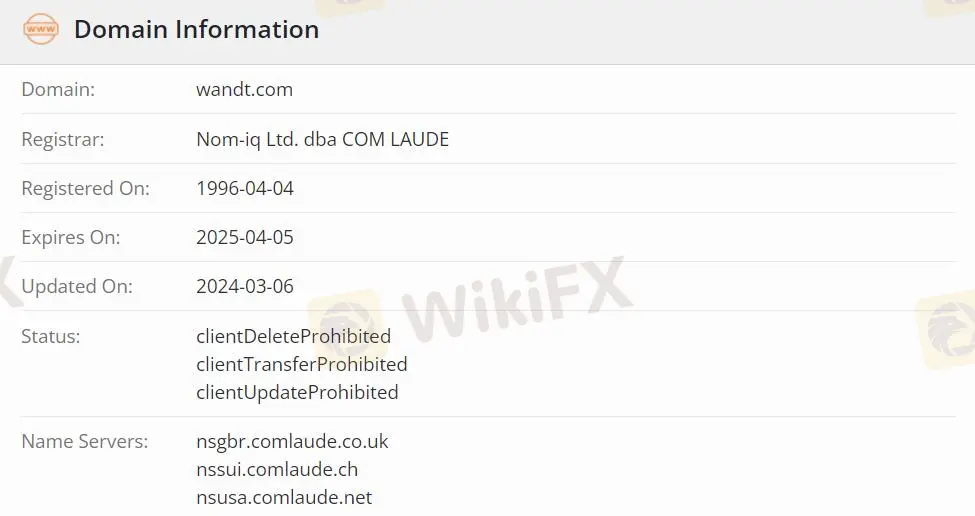

| Found | 1996 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Forex, Metals & Commodities, Indices |

| Demo Account | ✔ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Account Type | Standard & ECN |

| Trading Platform | MT4 |

| Min Deposit | $200 |

| Commission | No commissions for Standard account, $6 commission per lot for the ECN account |

Wandt Information

Wandt, founded in 1996, is a brokerage registered in the United States. The trading instruments it provides cover Forex, Metals, Commodities, Indices. It provides 2 accounts and MT4 platform. But it is currently unregulated and lacks security.

Pros and Cons

| Pros | Cons |

| Multiple Market Instruments | No Regulation |

| Diverse Account Types | No customer support channels provided |

| Demo account available | |

| Competitive spreads starting from 0.0 pips | |

| Utilization of MetaTrader 4 trading platform |

Is Wandt Legit?

It is clear that Wandt, which was registered in 1996 and is currently unregulated, is insecure.

What Can I Trade on Wandt?

Wandt offers traders the opportunity to trade over Forex, Metals, Commodities, Indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

| Options | ❌ |

Account Types

Wandtoffers 2 different types of accounts to traders - Standard Account and ECN Account. The two accounts' minimum deposit is $200. Wandt also provides a demo account.

Leverage

Wandt offers the maximum trading leverage of up to 1:500. It is worth noting that high leverage means high returns but also high risks.

Wandt Fees

Wandt claims to offer low spreads.The Standard Account spreads starts from 1 pips and charges no commissions. The ECN Account spreads starts from 0.0 pips, but it charges $6 per round trade.

| Account Type | Spresds | Commissions |

| Standard | 1pips | $0 |

| ECN | 0.0pips | $6 |

Trading Platform

Wandt's trading platform is MT4, which supports traders on PC and Mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, Mobile | Beginner |

| MT5 | ❌ |