Company Summary

| TF4LReview Summary | |

| Founded | 2013 |

| Registered Country/Region | United States |

| Regulation | NFA (Suspicious clone) |

| Market Instruments | Equities, Forex, Interest Rates, Metals, Energy, Grains and Softs, Livestock |

| Demo Account | ✅ |

| Leverage | 1:50 |

| Spread | / |

| Trading Platform | Rithmic Trader Pro, CQG Integrated Trader, CTS Platform, Trading Technologies (TT) |

| Min Deposit | $2,500 |

| Customer Support | Phone: (312) 241-1982 |

| Contact Form | |

| Company Address: 700 N. GREEN STREET, SUITE 200, CHICAGO, IL 60642 | |

TF4L, also known as Trade Forex 4 Less, is an unregulated broker based in United States. Its market instrument includes Equities, Forex, Interest Rates, Metals, Energy, Grains and Softs, and Livestock. Its license was suspected to be a fake clone. Currently, this broker has been disclosed by the regulator.

Pros & Cons

| Pros | Cons |

| Wide range of tradable assets | Suspicious clone license |

| High minimum deposit requirement | |

| Lack of transparency |

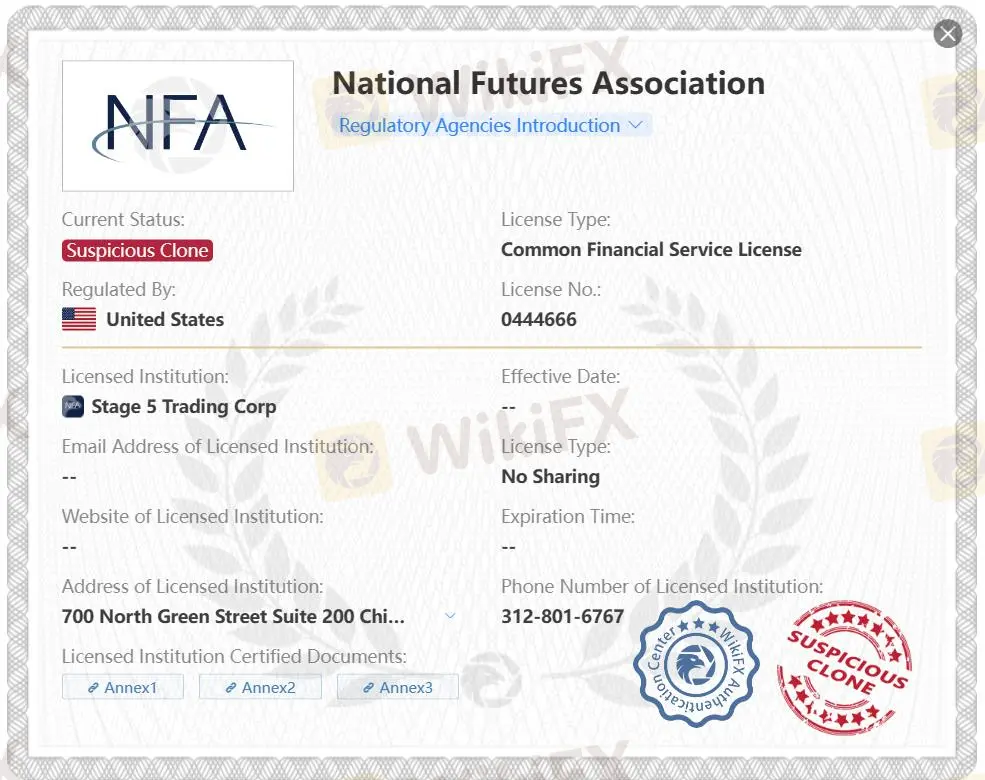

Is TF4L Legit?

| Regulated Country |  |

| Regulated Authority | National Futures Association (NFA) |

| Regulated Entity | Stage 5 Trading Corp |

| License Type | 0444666 |

| License Number | Common Financial Service License |

| Regulatory Status | Suspicious Clone |

What Can I Trade on TF4L?

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| commodities | ✔ |

| indices | ❌ |

| energies | ✔ |

| euqities | ✔ |

| cryptocurrencies | ❌ |

| options | ❌ |

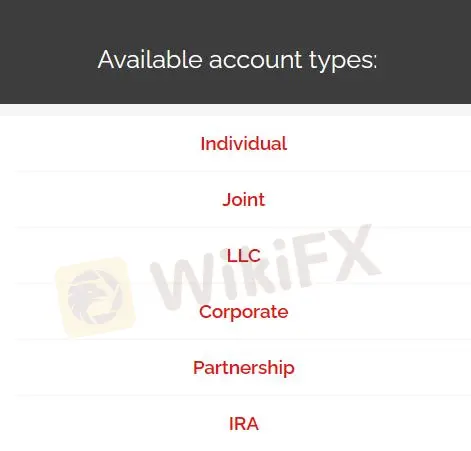

Account Type

TF4L offers six types of accounts: Individual, Joint, LLC, Corporate, Partnership, and IRA. Each account requires a minimum deposit of $2500 and charges a commission starting from $0.49.

Fees

TF4L claims to offer commission rates starting at $0.49 per side and as trading volume increases, commissions reduce automatically with rates as low as $0.25 per side for volume exceeding 20,000 contracts per month.

| Monthly Volume | Commission Per Side |

| 0-2000 | $0.49 |

| 2001-5000 | $0.40 |

| 5001-10000 | $0.35 |

| 10001-20000 | $0.30 |

| 20001+ | $0.25 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Rithmic Trader Pro | ✔ | / | Experienced traders |

| CQG Integrated Trader | ✔ | / | Experienced traders |

| CTS Platform | ✔ | / | Experienced traders |

| Trading Technologies (TT) | ✔ | / | Experienced traders |

| MT5 | ❌ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | Desktop, Mobile, Web | Beginner |