Company Summary

| DingXin | Basic Information |

| Company Name | DingXin |

| Founded | 2023 |

| Headquarters | Canada |

| Regulations | Not regulated |

| Tradable Assets | Forex, stocks, indices, commodities, cryptocurrencies |

| Account Types | Standard, ECN, VIP, Islamic, Cent, Demo |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Vary by account type and asset |

| Commission | Vary by account type and asset |

| Deposit Methods | Credit/debit card, bank wire, e-wallets |

| Trading Platforms | WebTrader, Desktop MetaTrader 4 (MT4) |

| Customer Support | Live chat, email, phone (24/5) |

| Education Resources | Webinars, articles, video tutorials |

| Bonus Offerings | None |

Overview of DingXin

DingXin is a relatively new trading platform that was founded in 2023 and is headquartered in Canada. Despite its recent establishment, it has quickly garnered attention in the financial markets due to its diverse range of tradable assets and multiple account types designed to cater to a wide spectrum of traders. However, it's important to note that DingXin operates without valid regulatory oversight, raising concerns about its legitimacy and the safety of traders' funds and interests.

One of DingXin's notable strengths is its extensive offering of tradable instruments. Traders on the platform can access over 60 currency pairs in the forex market, trade more than 10,000 stocks from various global markets, engage in index trading with major indices like the S&P 500 and FTSE 100, invest in commodities such as gold, silver, and oil, and even participate in the cryptocurrency market with options like Bitcoin and Ethereum.

While DingXin provides a range of educational resources, including webinars, articles, and video tutorials, it's essential to exercise caution when considering this platform due to its lack of regulation. Regulatory oversight is a critical factor in ensuring the security and fairness of trading environments, and traders should carefully weigh the potential risks associated with trading on an unregulated platform.

Is DingXin Legit?

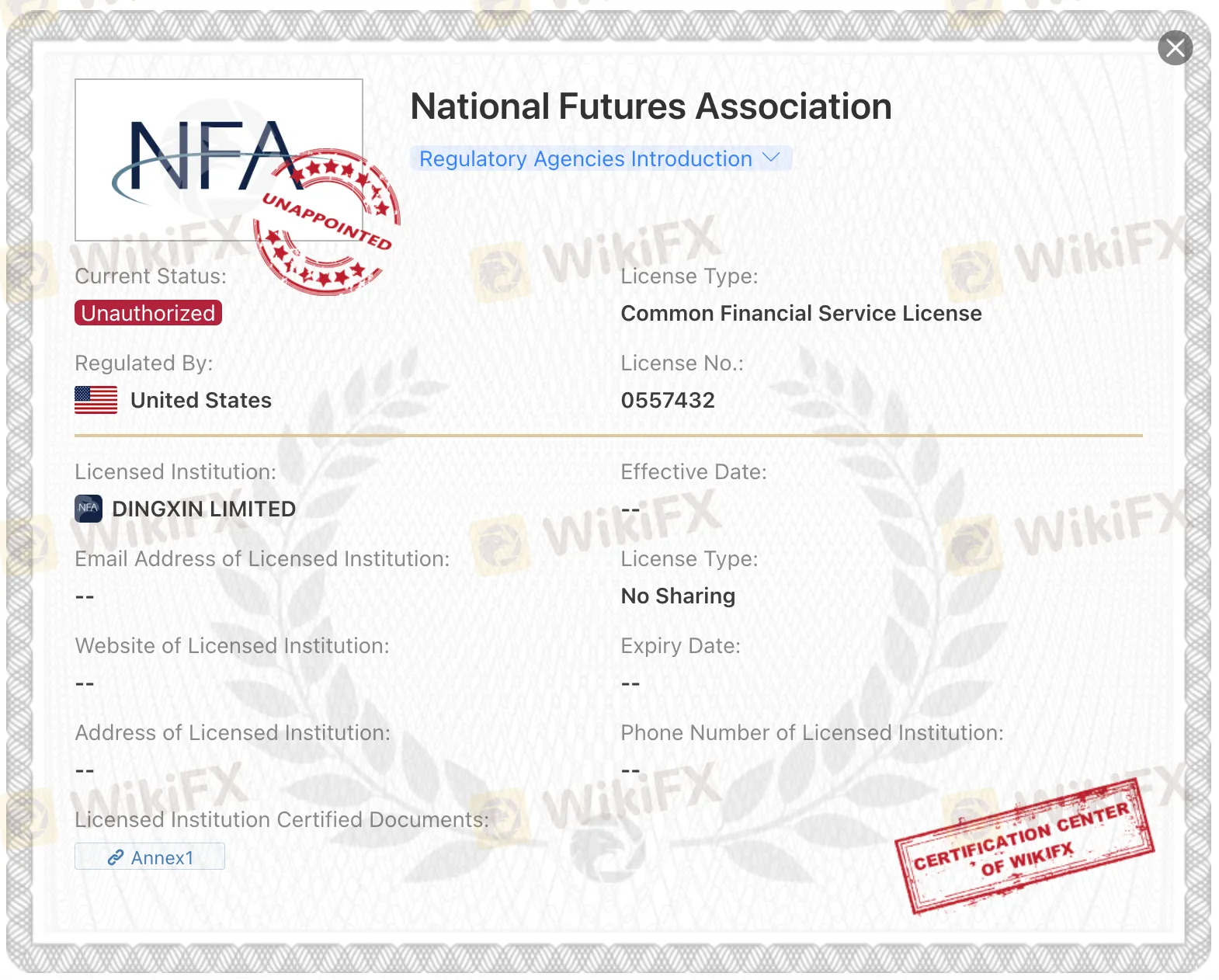

DingXin is not regulated by any valid regulatory authority. The United States NFA (National Futures Association) regulatory status for DingXin, with license number 0557432, is marked as “Unauthorized,” indicating that the broker does not have official regulatory authorization. Traders and investors should exercise caution and be aware of the associated risks when considering dealing with an unregulated broker, as regulatory oversight is crucial for ensuring the safety and protection of traders' funds and interests.

Pros and Cons

DingXin offers a diverse range of tradable assets and provides multiple account types, catering to various trader preferences. The availability of high leverage can be attractive for those seeking potentially amplified profits. Additionally, DingXin offers educational resources like webinars, articles, and video tutorials, which can be valuable for traders looking to improve their skills. However, the broker faces significant drawbacks, primarily the absence of valid regulation, which raises concerns about the safety of traders' funds. Furthermore, there's limited transparency regarding spreads and commissions, and non-trading fees may impact the overall cost of trading with DingXin. Traders should weigh these pros and cons carefully when considering this brokerage.

| Pros | Cons |

| Diverse Range of Tradable Assets | Lack of Regulation: Not regulated and marked as “Unauthorized” by the NFA. |

| Multiple Account Types | Limited Transparency on Spreads and Commissions. |

| High Leverage | Non-Trading Fees, including an account inactivity fee and withdrawal fee. |

Trading Instruments

DingXin offers a wide range of trading instruments, including:

Forex: DingXin offers trading on over 60 currency pairs, including major pairs such as EUR/USD and GBP/USD, as well as minor and exotic pairs.

Stocks: DingXin offers trading on over 10,000 stocks from markets around the world, including the US, UK, and China.

Indices: DingXin offers trading on major stock market indices, such as the S&P 500, the Dow Jones Industrial Average, and the FTSE 100.

Commodities: DingXin offers trading on a range of commodities, including gold, silver, oil, and wheat.

Cryptocurrencies: DingXin offers trading on a number of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indices | Stock | ETF | Options |

| DingXin | Yes | Yes | Yes | No | Yes | Yes | No | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| IC Markets | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Exness | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

Account Types

DingXin offers four main account types:

Standard Account: This is the most basic account type, and it is suitable for both beginners and experienced traders. Standard accounts have a minimum deposit requirement of $100, and they offer a range of trading products, including forex, stocks, indices, and commodities.

ECN Account: ECN accounts are designed for experienced traders who are looking for the best possible execution prices. ECN accounts have a minimum deposit requirement of $500, and they charge a commission on each trade.

VIP Account: VIP accounts are designed for high-volume traders who are looking for the best possible trading experience. VIP accounts have a minimum deposit requirement of $20,000, and they offer a range of benefits, such as a dedicated account manager, personalized trading plans, and exclusive trading webinars.

Islamic Account: Islamic accounts are designed for Muslim traders who follow the Islamic Sharia law. Islamic accounts do not charge interest or rollover fees.

In addition to these four main account types, DingXin also offers a number of other account types, such as:

Cent Account: Cent accounts are designed for beginner traders who want to practice trading with a small amount of money. Cent accounts allow traders to trade with micro-lots, which are 1/100th of a standard lot.

Demo Account: Demo accounts are designed for traders who want to practice trading without risking any real money. Demo accounts are funded with virtual currency, and they allow traders to test their trading strategies in a real-time market environment.

Leverage

DingXin provides traders with access to significant leverage, offering a maximum leverage of up to 1:1000 across all of its trading products. This level of leverage allows traders to control positions that are much larger than their initial investment, potentially amplifying both profits and losses. While high leverage can be appealing to some traders for its profit potential, it also carries a heightened level of risk due to the magnification of market movements.

It's essential for traders to exercise caution and fully understand the implications of using high leverage. While it can enhance trading opportunities, it can also lead to substantial losses if not managed carefully. Therefore, DingXin traders should carefully consider their risk tolerance and trading strategy when utilizing the available leverage to ensure a responsible and informed approach to trading.

Spreads and Commissions (Trading Fees)

DingXin's spreads and commissions vary depending on the account type and the asset being traded. Standard accounts have fixed spreads, while ECN accounts have variable spreads that are typically lower than the spreads on Standard accounts. VIP accounts have access to the lowest spreads and commissions.

Here are some examples of DingXin's spreads and commissions:

EUR/USD: 1.5 pips on Standard accounts, 0.5 pips on ECN accounts, and 0.2 pips on VIP accounts.

GBP/USD: 1.6 pips on Standard accounts, 0.6 pips on ECN accounts, and 0.3 pips on VIP accounts.

Gold: $0.50 per ounce on Standard accounts, $0.25 per ounce on ECN accounts, and $0.10 per ounce on VIP accounts.

Non-Trading Fees

DingXin has several non-trading fees that traders should be aware of:

Account Inactivity Fee: A monthly fee of $10 is charged if your account remains inactive for over 90 days.

Withdrawal Fee: DingXin imposes a $30 fee for all withdrawal transactions.

Overnight Financing Fee: This fee, calculated based on the position size and prevailing interest rates, applies to positions held overnight.

It's important to consider these fees as they can impact your overall trading costs on the DingXin platform.

Deposit & Withdraw Methods

DingXin accepts deposits and withdrawals via a variety of methods, including:

Credit/debit card: Deposits are processed instantly and withdrawals are processed within 3-5 business days.

Bank wire transfer: Deposits are processed within 1-3 business days and withdrawals are processed within 3-5 business days.

E-wallets: Deposits are processed instantly and withdrawals are processed within 1-2 business days.

Minimum Deposit Required: The minimum deposit required to open an account with DingXin is $100.

Here is a comparison table of minimum deposit required by different brokers:

| Broker | DingXin | Exnova | Tickmill | GO Markets |

| Minimum Deposit | $100 | $10 | $100 | $200 USD |

Trading Platforms

DingXin provides two trading platforms:

WebTrader: This user-friendly web-based platform is accessible from any device with an internet connection. It offers essential trading features and is suitable for traders who value accessibility and flexibility.

Desktop MetaTrader 4 (MT4): MT4 is a robust and feature-rich platform known for its advanced charting tools and automated trading options. It's preferred by experienced traders who require in-depth analysis tools.

Both platforms offer distinct advantages, allowing traders to choose the one that suits their trading style best. DingXin may also provide mobile trading apps for added convenience.

Customer Support

DingXin provides customer support services through various channels to ensure traders have access to assistance when needed. These support channels include live chat, email, and phone. One notable aspect of DingXin's customer support is its availability during the trading week, with services offered 24 hours a day from Monday to Friday. This aligns with the typical trading hours of the global financial markets, allowing traders to seek help and resolve issues promptly during active trading sessions.

Educational Resources

DingXin offers a variety of educational resources, including:

Webinars: DingXin hosts regular webinars on a variety of trading topics.

Articles: DingXin publishes a variety of articles on its website that cover a range of trading topics.

Video tutorials: DingXin offers a variety of video tutorials on its YouTube channel that cover a range of trading topics.

Conclusion

In conclusion, DingXin presents a mixed picture for traders. While it offers a wide range of tradable assets, multiple account types, and educational resources, its major disadvantage is the lack of valid regulation, which can pose risks to traders' funds. Additionally, the transparency of spreads and commissions is limited, and non-trading fees may impact overall trading costs. The availability of high leverage can be enticing but also comes with increased risk. Traders should exercise caution and carefully evaluate their risk tolerance when considering DingXin as their broker of choice, as regulatory oversight is crucial for ensuring the safety of their investments.

FAQs

Q: Is DingXin regulated?

A: No, DingXin is not regulated by any valid regulatory authority.

Q: What account types does DingXin offer?

A: DingXin offers Standard, ECN, VIP, Islamic, Cent, and Demo account types to cater to different trading preferences.

Q: What is the maximum leverage offered by DingXin?

A: DingXin provides a maximum leverage of up to 1:1000 across all trading products.

Q: Are there non-trading fees associated with DingXin?

A: Yes, DingXin charges non-trading fees, including an account inactivity fee, withdrawal fee, and overnight financing fees.

Q: What trading platforms are available on DingXin?

A: DingXin offers WebTrader, a web-based platform, and Desktop MetaTrader 4 (MT4), a robust desktop trading platform known for its advanced features.

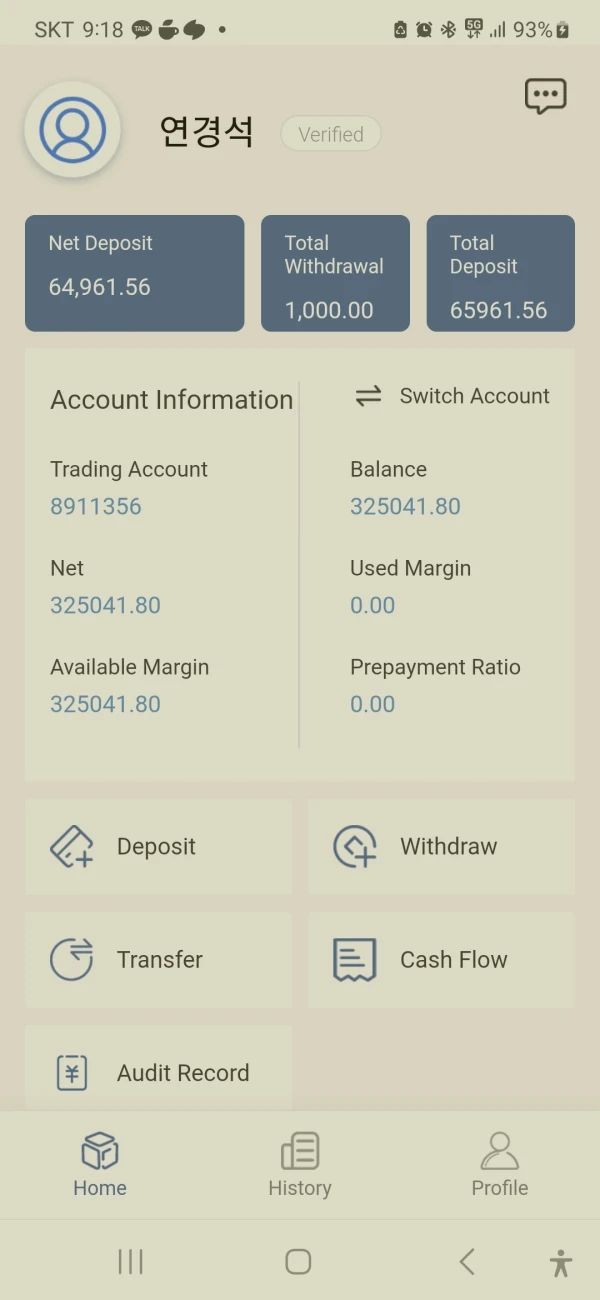

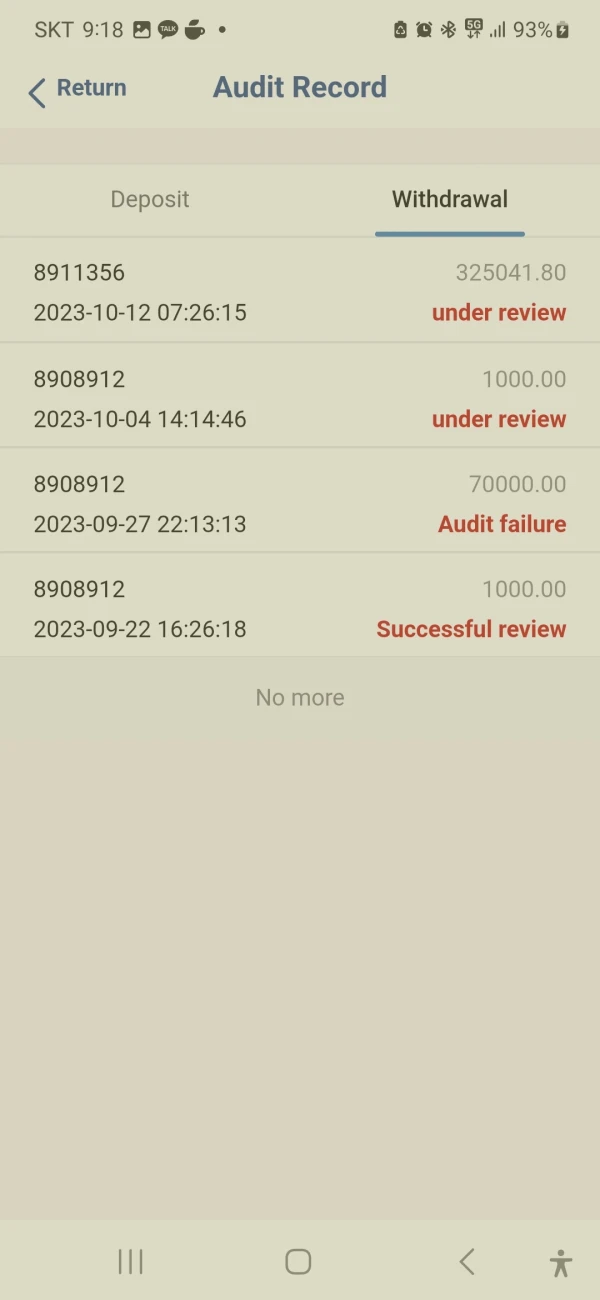

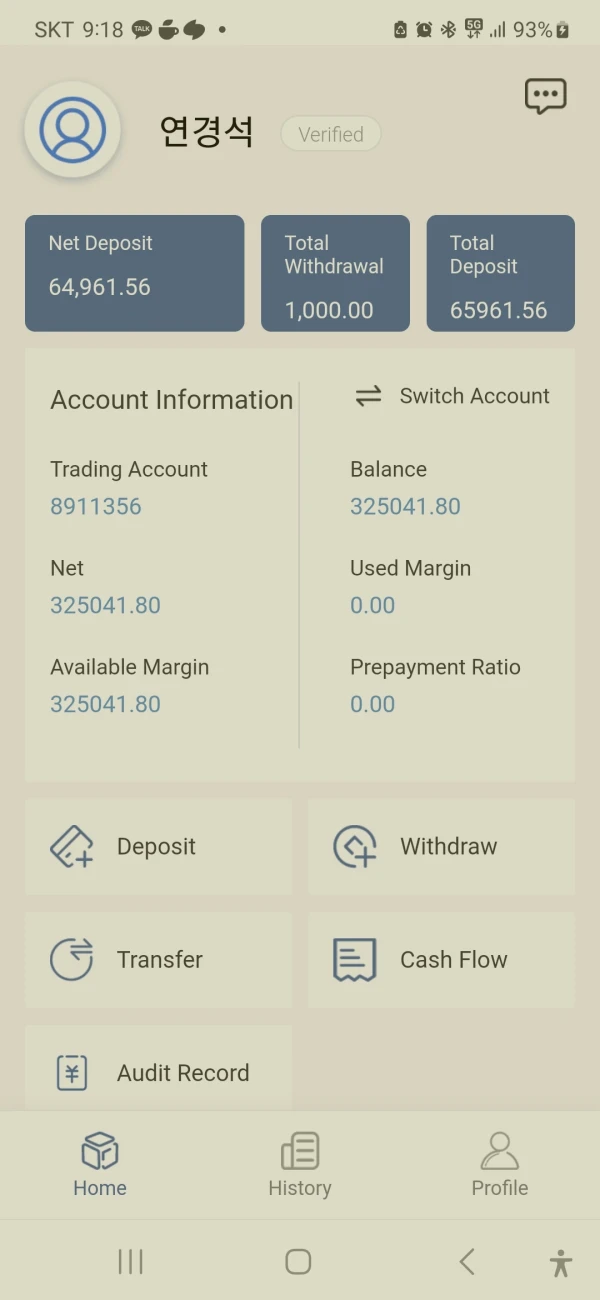

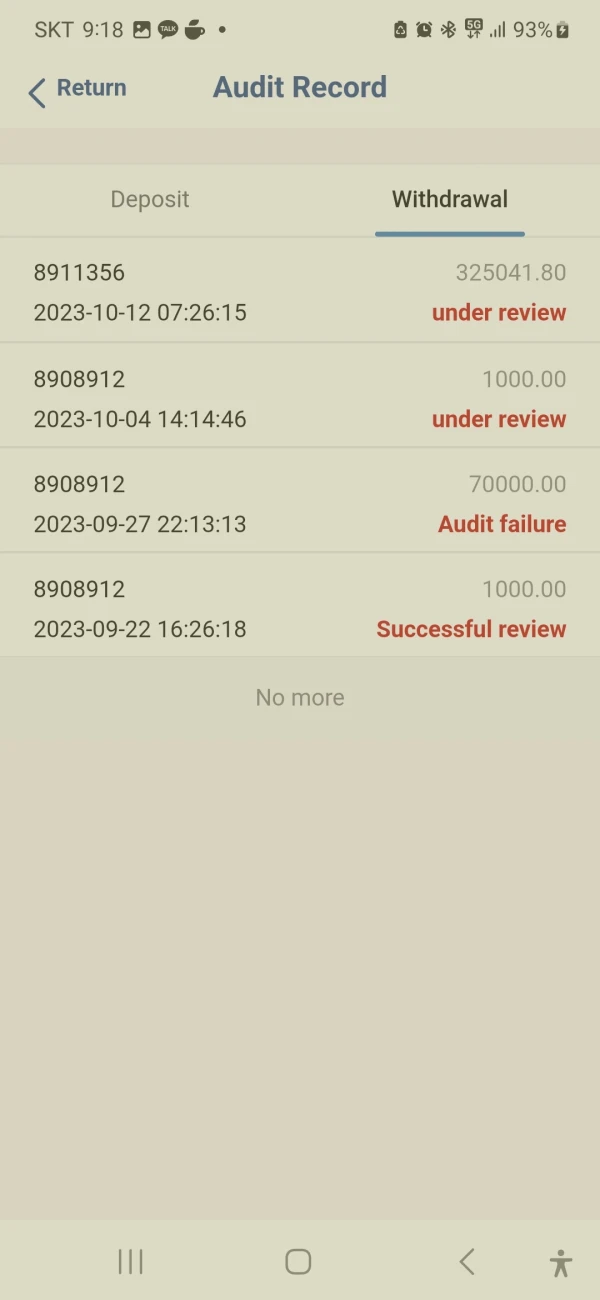

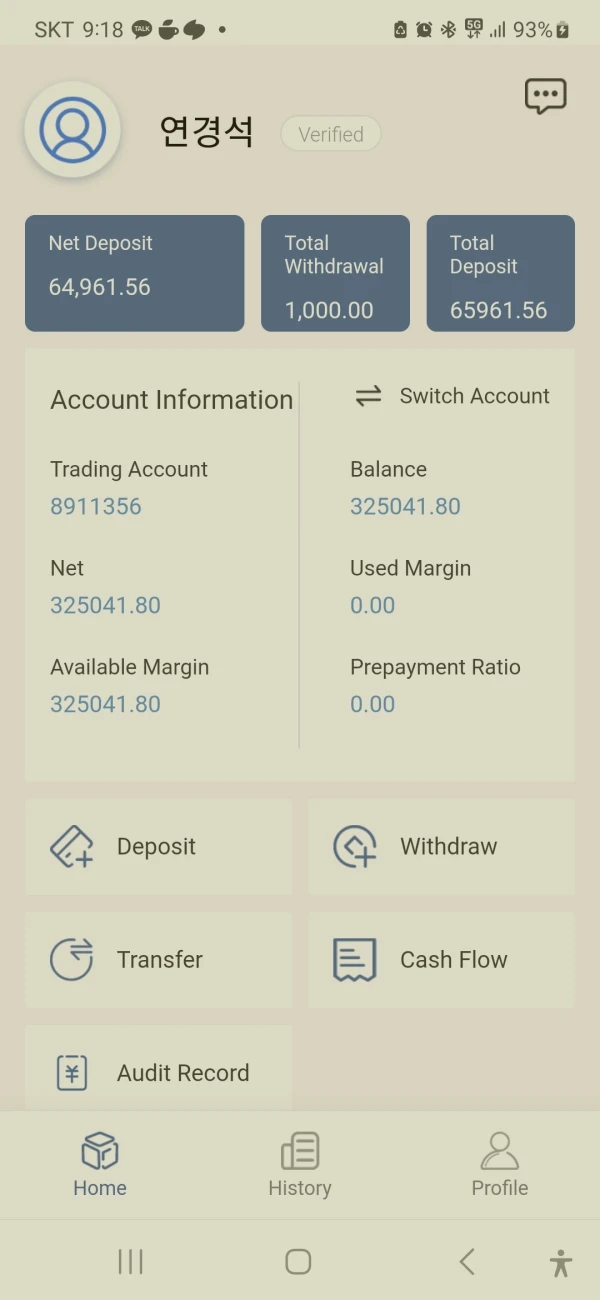

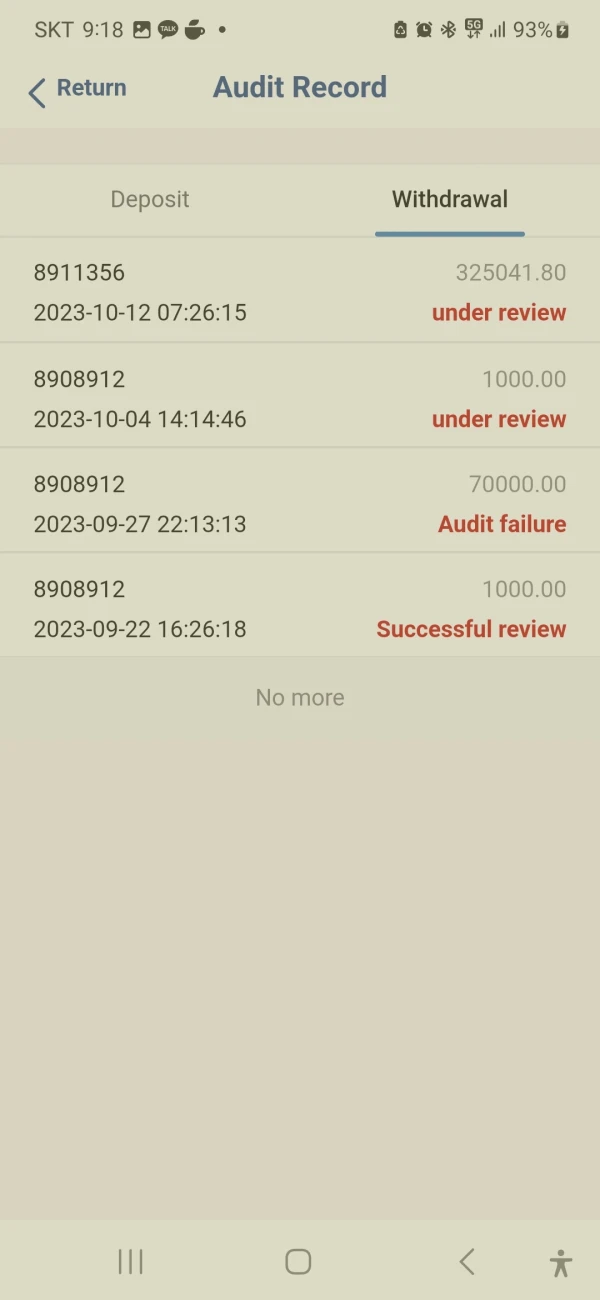

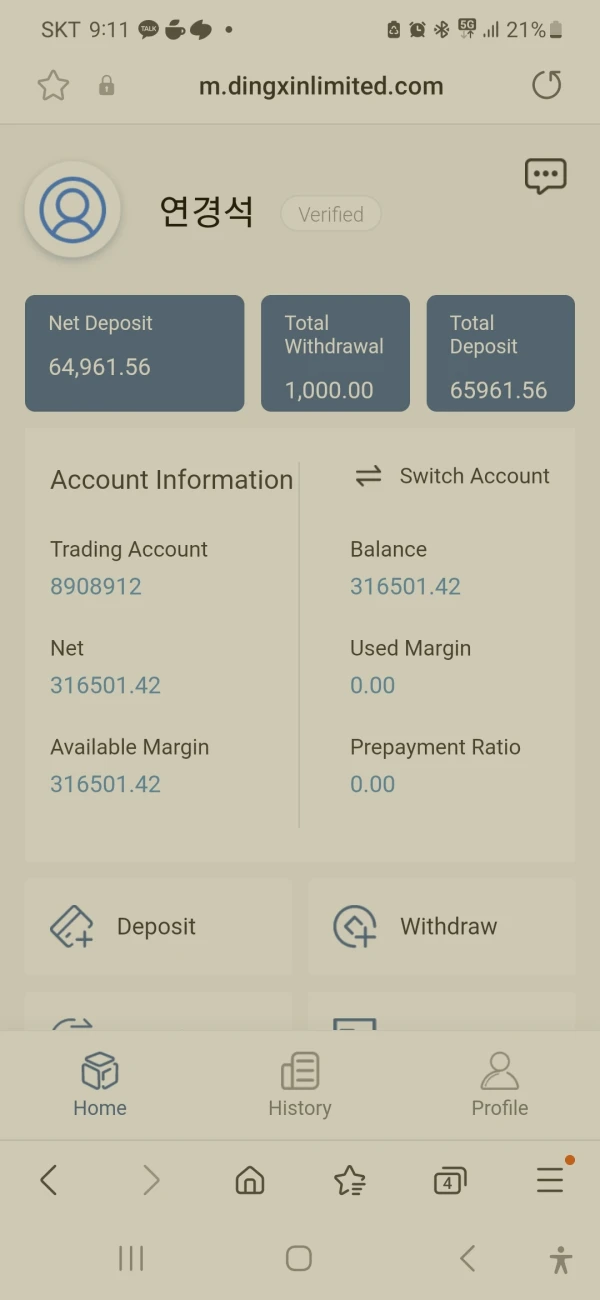

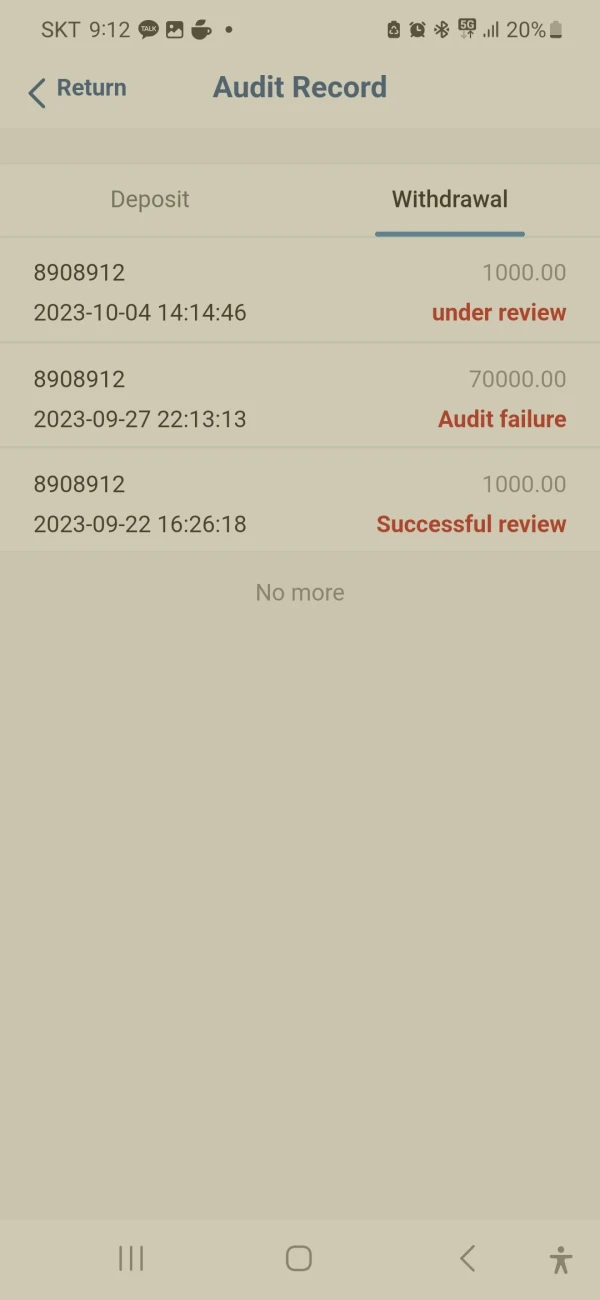

왕대박발견

South Korea

They doesn't give money

Exposure

mike0078140

South Korea

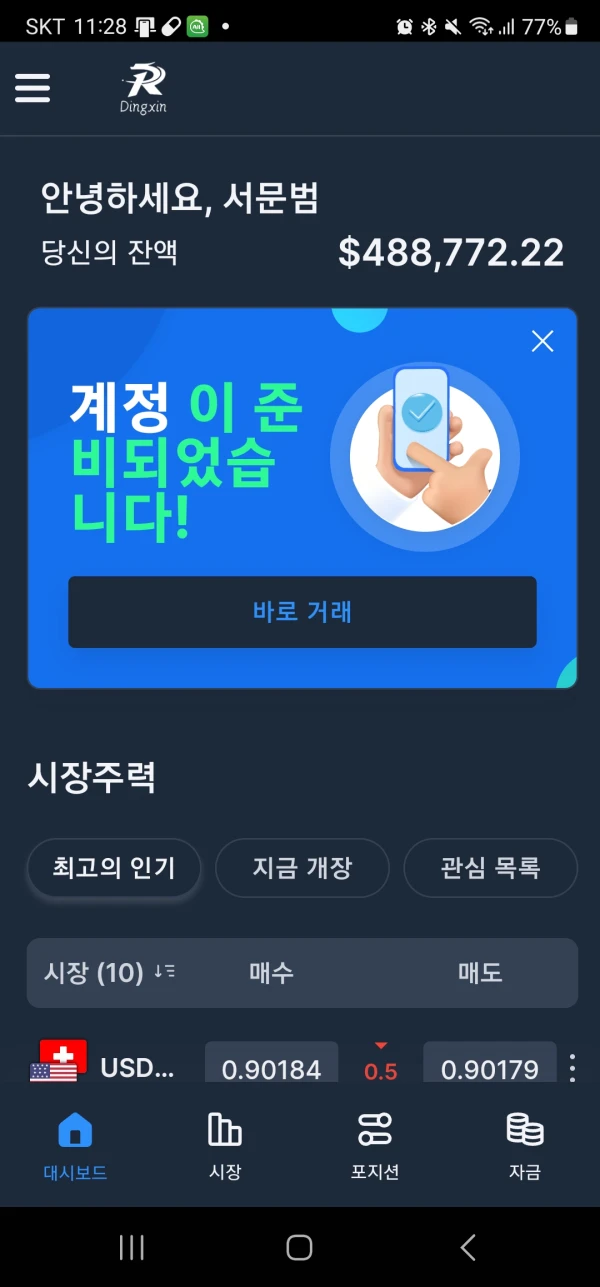

I invested through the DingXin Limited (dingxincotd.com) exchange, but I cannot withdraw the money. The people in charge of Korea receive the investment money and cannot be contacted and the investment money that is in the account cannot be withdrawn.

Exposure

왕대박발견

South Korea

They doesn't withdraw money

Exposure

왕대박발견

South Korea

They don't withdraw money

Exposure

왕대박발견

South Korea

why unable withdraw my money?

Exposure

왕대박발견

South Korea

I unable to withdraw my money

Exposure