It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of DCFX

Pros:

A wide range of tradable instruments including forex, commodities, indices, stocks, and cryptocurrencies.

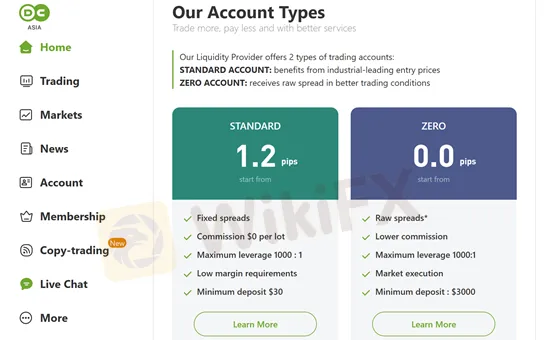

Two types of accounts, including a Standard account with a low minimum deposit and Zero account with low spreads and commissions.

A comprehensive range of educational resources, including an economic calendar, newsflash, and a YouTube channel.

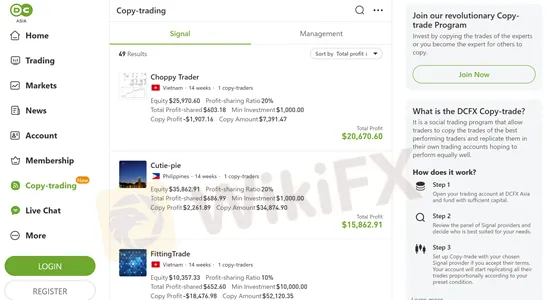

Copy trading feature available, which allows traders to copy trades of successful traders.

Multiple customer support options including live chat, email, Facebook, and YouTube.

Cons:

Limited information about deposit and withdrawal methods on the company's website.

No information on the website about regulatory authorities in Indonesia.

The maximum leverage offered by the company is extremely high at 1:1000, which can lead to high risk and potential losses for inexperienced traders.

The website lacks transparency about the company's history, management team, and ownership structure.

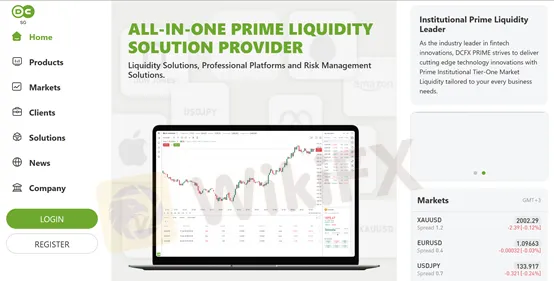

What type of broker is DCFX?

DCFX operates as a Straight Through Processing (STP) broker. This means that they do not act as a market maker, instead, they pass their clients' orders directly to liquidity providers such as banks or other brokers. By doing so, they can provide their clients with a transparent trading environment with no conflict of interest. This also eliminates the need for requotes as the prices offered are taken directly from the liquidity providers. However, since DCFX does not control the spreads, they may be higher than what market makers offer. In addition, slippage can occur during high market volatility since there is no guarantee that the order will be filled at the requested price. Nonetheless, STP brokers like DCFX are often preferred by traders who value transparency and fair trading conditions.

General information and regulation of DCFX

DCFX is an Indonesia-registered forex broker that provides access to a range of financial markets, including forex, commodities, indices, stocks, and cryptocurrencies. The company is regulated by the FCA, JFX, BAPPEBTI, and MAS. DCFX offers two types of trading accounts, a demo account, and a range of educational resources for traders. Additionally, the company provides copy trading services and multiple customer support channels, including live chat and email.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

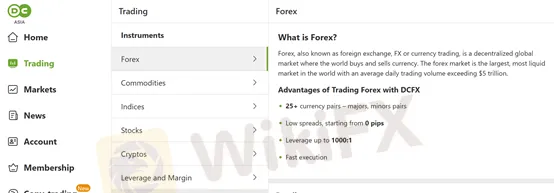

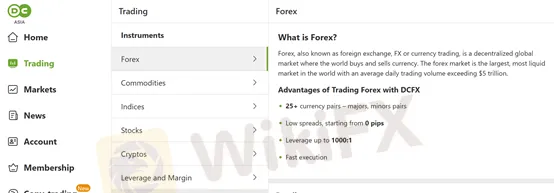

Market instruments

DCFx offers a range of trading instruments across multiple markets, allowing traders to diversify their investment portfolios. Traders can access over 25 major and minor currency pairs with ultra-competitive spreads that start from 0.0 pips, as well as trade on gold, silver, and WTI to further diversify their investments. The broker also offers access to major international stock indices, such as the Dow Jones and the S&P 500, with competitive spreads and low margin requirements. Additionally, traders can buy and sell international stocks, such as Facebook, Amazon, Apple, and many more with low commissions. Finally, DCFx also provides traders the opportunity to buy and sell crypto CFDs on leading cryptos such as Bitcoin and Ethereum with ease. However, there are some disadvantages to consider, such as higher volatility and risks associated with some instruments such as cryptocurrencies and limited range of available instruments compared to other brokers.

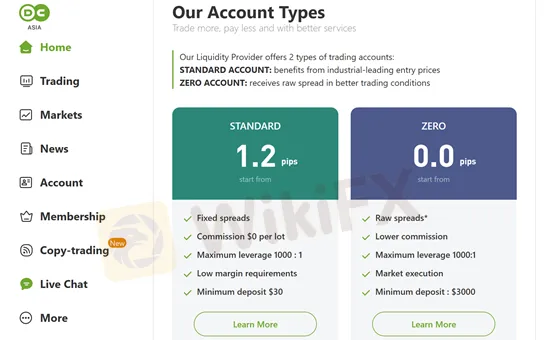

Spreads and commissions for trading with DCFX

DCFx offers two types of accounts - Standard and Zero - with different pricing options for traders. The Standard account has zero commission and spreads starting from 1.2 pips, while the Zero account has low commissions and spreads starting from 0.0 pips. Both accounts offer transparent pricing with no hidden costs, and traders can access both account types depending on their trading preferences.

Trading accounts available in DCFX

DCFX offers two main account types for traders, the Standard account and the Zero account. The Standard account requires a minimum deposit of only 30 USD, and offers leverage up to 1:1000 with zero commission fees, making it a good choice for beginner traders. The Zero account, on the other hand, requires a higher minimum deposit of 3000 USD, but offers lower spreads starting from 0.0 pips and commission fees. Both accounts also offer high leverage up to 1:1000, which is a benefit for traders who want to maximize their profit potential. Additionally, a demo account with a virtual balance of $10,000 is also available for traders who want to practice their trading strategies. Overall, DCFX's account types offer a good range of options for traders of all levels.

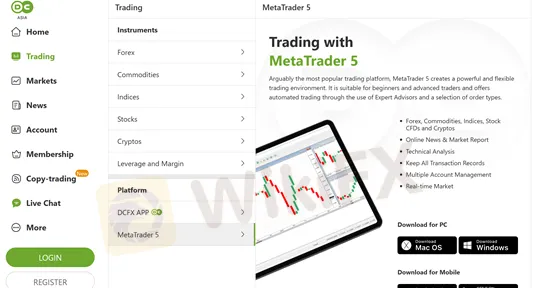

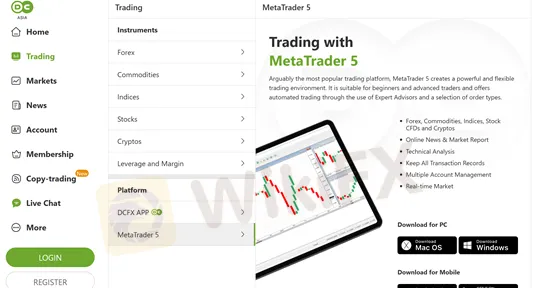

Trading platform(s) that DCFX offers

DCFX offers both the MT5 platform and the DCFX app to its clients. The MT5 platform is an advanced trading platform that offers a wide range of trading tools and features for experienced traders. It may not be as user-friendly for beginners, but it is well-suited for traders who are looking for more advanced features. On the other hand, the DCFX app is a user-friendly and convenient option for traders who want to trade on-the-go. The app may not have all the advanced features available on the MT5 platform, but it offers easy access to a variety of trading instruments. The availability of two different platforms provides traders with more options, although some traders may prefer other platforms that are not available through DCFX.

Maximum leverage of DCFX

The maximum leverage offered by DCFX of up to 1:1000 can be both an advantage and a disadvantage for traders. While it provides the potential for increased profits and greater flexibility in trading strategies, it also carries a higher risk of significant losses and can encourage risky trading behavior. Traders should be aware of the risks involved with high leverage and implement strict risk management practices before engaging in high-leverage trading.

Deposit and Withdrawal: methods and fees

The company claims to have a fast deposit and withdrawal process, and no deposit or withdrawal fees are mentioned. However, there is a lack of specific information on payment methods and no information on deposit and withdrawal fees. Additionally, there is limited information on minimum deposit and withdrawal amounts, which may cause inconvenience for some clients. Overall, the deposit and withdrawal dimension could be improved by providing more transparent and detailed information on payment methods, fees, and minimum amounts.

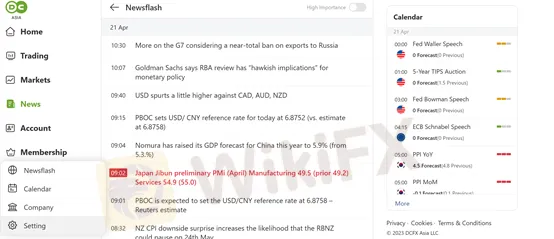

Educational resources in DCFX

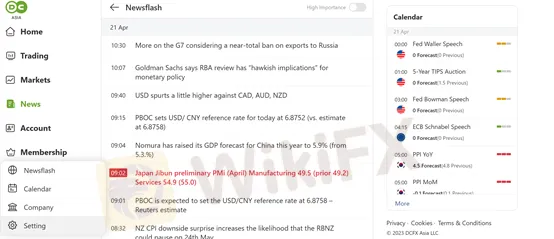

DCFX provides clients with a range of educational resources to help them improve their trading knowledge and skills. The economic calendar and newsflash keep traders up-to-date on market-moving events and economic indicators. Additionally, DCFX offers a range of resources on their official YouTube channel, including video tutorials and analysis, which can be accessed for free by all clients. While these resources are helpful for beginner traders to gain knowledge about trading, they may not cover all topics in-depth and may not be sufficient for more advanced traders. Nevertheless, the availability of educational resources can assist in making informed trading decisions.

Here is a livestreaming of market analysis.

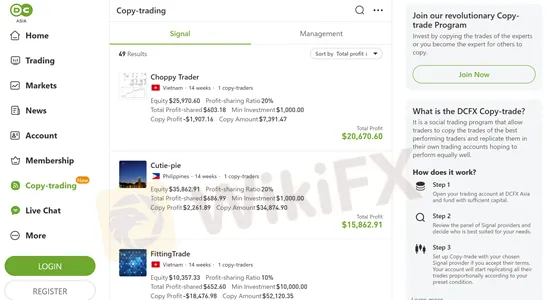

Copy trading

Copy trading is a popular feature offered by many forex brokers, including DCFX. It allows inexperienced traders to follow and copy the trades of more experienced traders. This can be beneficial for those who may not have the knowledge or time to make their own trading decisions. The process is relatively simple, as traders can choose which trader to follow and automatically replicate their trades in their own account. However, there are some disadvantages to consider. The main disadvantage is that losses can occur if the trader being copied performs poorly. Additionally, traders may become too reliant on copying others and fail to develop their own trading skills. Nevertheless, copy trading provides an opportunity to learn from more experienced traders and can be a valuable tool for traders who are still developing their skills.

Customer service of DCFX

DCFX offers a variety of customer support options, including 24/7 live chat support and email support for longer inquiries. The company also has an active social media presence on Facebook and YouTube, providing customers with an additional channel to reach out and get help. However, the lack of phone support may be a disadvantage for some customers who prefer to speak with a representative directly. Additionally, while the live chat support is available around the clock, there are no other customer support options beyond email and social media, which could be seen as limited by some users. Overall, DCFX seems to offer decent customer care options with a good balance of accessibility and responsiveness.

Conclusion

In conclusion, DCFX is an Indonesia-based forex broker that is regulated by several authorities, including the FCA, JFX, BAPPEBTI, and MAS. The broker offers a range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. They have two types of accounts, the Standard and Zero account, with varying minimum deposits, spreads, and commissions. The maximum leverage offered is 1:1000. DCFX provides various educational resources, such as an economic calendar and newsflash, as well as copy trading services. Customer support is available through multiple channels, including live chat, email, Facebook, and YouTube. Overall, DCFX has several advantages, including competitive spreads, a wide range of trading instruments, and a user-friendly trading platform. However, some potential drawbacks include limited information on deposit and withdrawal methods, and the lack of regulatory oversight from the Indonesian regulatory body.

Frequently asked questions about DCFX

Q. What is DCFX?

A. DCFX is an Indonesia-based forex broker regulated by FCA, JFX, BAPPEBTI, MAS, that offers trading services in forex, commodities, indices, stocks, and cryptocurrencies.

Q. What are the account types available on DCFX?

A. DCFX offers two account types: Standard account and Zero account. Standard account requires a minimum deposit of 30 USD, zero commission and spreads start from 1.2 pips. The Zero account requires a minimum deposit of 3000 USD, low commission, and spreads start from 0.0 pips.

Q. What is the maximum leverage offered by DCFX?

A. DCFX offers up to 1:1000 leverage, allowing clients to trade with higher volumes than their initial deposit. However, it is important to note that high leverage can also magnify losses.

Q. Does DCFX offer educational resources for traders?

A. Yes, DCFX provides traders with a range of educational resources, including an economic calendar, newsflash, and educational videos on their official YouTube channel.

Q. Can I copy trade on DCFX?

A. Yes, DCFX offers a copy trading feature where traders can automatically copy the trades of experienced traders.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX