Company Summary

Note: Wizifx's official website: https://wizifx.co.uk/ is currently inaccessible normally.

| WizifxReview Summary | |

| Founded | 2022 |

| Registered Country/Region | China |

| Regulation | Not regulated |

| Market Instruments | Forex, Cryptocurrencies, Global Indices, Precious Metals, Commodities, CFDs on Shares |

| Demo Account | / |

| Leverage | Up to 1:1000 |

| Spread | From 1.5 pips |

| Trading Platform | Wizifx trading platform |

| Min Deposit | $100 |

| Customer Support | Contact form |

Wizifx provides many trading assets, including Forex, Cryptocurrencies, Global Indices, Precious Metals, Commodities, CFDs on Shares with leverage up to 1:1000 and spread from 1.5 pips. However, it currently has no valid regulations.

Pros and Cons

| Pros | Cons |

| Various trading assets | Wide spreads |

| Multiple account types | No MT4/5 |

| Limited contact channels | |

| Not regulated |

Is Wizifx Legit?

Wizifx operates without regulation. It doesn't need to obey the rules of any financial authorities. Traders should be careful when choosing brokers.

What Can I Trade on Wizifx?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Cryptocurrencies | ✔ |

| Global Indices | ✔ |

| Precious Metals | ✔ |

| Commodities | ✔ |

| CFDs on Shares | ✔ |

| Options | ❌ |

Account Type

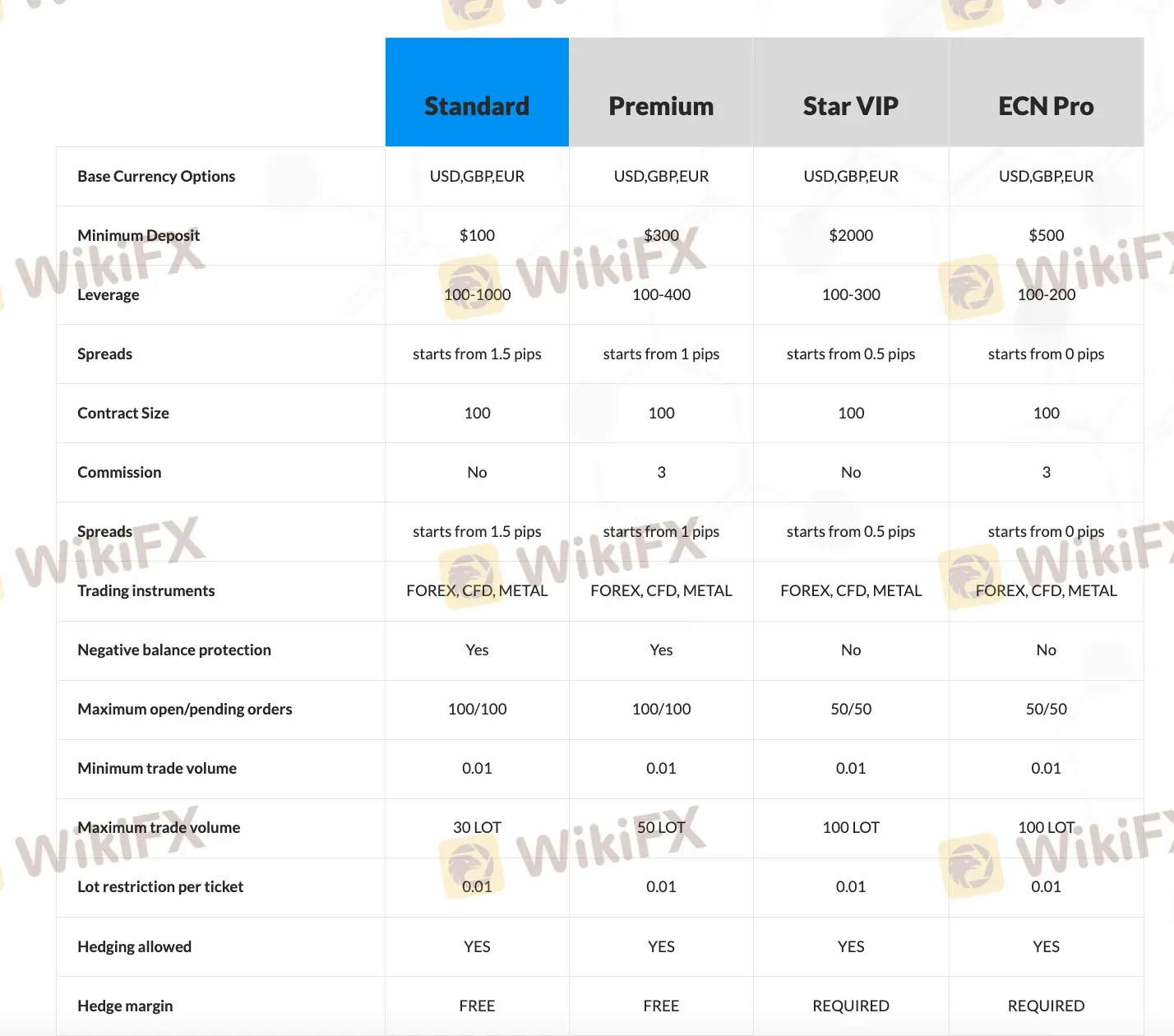

Wizifx offers four account types: Standard, Star VIP, ECN Pro and Premium.

| Account Type | Minimum Deposit |

| Standard | $100 |

| Star VIP | $2000 |

| ECN Pro | $500 |

| Premium | $300 |

Leverage

Leverage varies by account types. The maximum leverage of Wizifx is up to 1:1000 on the Standard account. Star VIP's leverage is 1:300, ECN Pro's leverage is 1:200 and Premium is 1:400. Gains and losses can be high when leverage is high.

Spreads and Commissions

The spreads and commissions of Wizifx also vary depending on the account types.

The Standard account' spreads starting from 1.5 pips and commission is free.

The Premium account offers spreads starting from 1 pip, with a $3 per lot commission payable per side.

The Star VIP account needs spreads starting from 0.5 pips and commission is free.

The ECN Pro account's spreads starting from 0 pips but its commission needs $3 per lot.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

| Wizifx trading platform | ✔ | PC, web browsers, and mobile | Experienced traders |

Deposit and Withdrawal

Wizifx can deposit and withdraw through electronic payment systems and bank cards, and the minimum deposit is $100.