IEXS Information

IEXS is a forex and CFD broker regulated by the FCA and ASIC. It offers a wide range of trading instruments, including forex pairs, commodities, stocks, indices, options, bonds, futures, crypto, and funds. The minimum initial deposit is $200, and the maximum leverage is 1:500. IEXS offers three trading platforms: MT4, MT5, and IEXS WebTrader. It also offers a variety of deposit and withdrawal methods, including Bitcoin, Litecoin, Ethereum, Tether, UnionPay, Help2Pay, and AfrAsia. IEXS customer service is available 24/5 via email, phone, live chat, and an FAQ section. The broker has no history of fraud complaints.

Regulatory Status

IEXS is regulated by the Australian Securities and Investments Commission (ASIC), with the license number of 001301063.

Additionally, this broker also operates under regulation of FCA, with regulatory license number 923324.

Pros and Cons of IEXS

IEXS presents a diverse array of trading instruments, including forex, indices, shares, metals, and cryptocurrencies, making it suitable for various trading strategies. Its utilization of the popular MetaTrader 4/5 platform enhances user experience and accessibility.

However, the platform lacks comprehensive educational resources, which may hinder novice traders' learning curve. Moreover, information regarding commissions and payment methods remains unclear, potentially causing confusion for users. Despite these drawbacks, IEXS operates with regulatory oversight, providing a level of security for traders. Additionally, the platform offers multi-lingual 24/5 support, ensuring assistance is available when needed. Overall, while IEXS provides trading opportunities, traders should exercise caution due to the limited support resources and potential ambiguities regarding fees and payment methods.

What Type of Broker is IEXS?

IEXS operates as a Straight Through Processing (STP) broker. This means that they do not act as a market maker, instead, they pass their clients' orders directly to liquidity providers such as banks or other brokers. By doing so, they can provide their clients with a transparent trading environment with no conflict of interest. This also eliminates the need for requotes as the prices offered are taken directly from the liquidity providers. However, since IEXS does not control the spreads, they may be higher than what market makers offer. In addition, slippage can occur during high market volatility since there is no guarantee that the order will be filled at the requested price. Nonetheless, STP brokers like IEXS are often preferred by traders who value transparency and fair trading conditions.

Market Instruments

IEXS offers a diverse range of instruments for trading, with a focus on forex, index CFDs, metals, energy, and shares. With over 63 forex pairs, traders have a broad selection to choose from, including both major and emerging pairs. The availability of CFDs on global index instruments also provides opportunities for traders to diversify their portfolios. In addition, IEXS offers a range of metals and energy products, including gold, silver, and Brent and West Texas crude oil, as well as reputable shares and other investment instruments like options, bonds, futures, crypto, and funds. However, there are some limitations, such as a limited selection of shares compared to other brokers, no options on individual stocks, and a relatively small selection of bonds, futures, and cryptocurrencies.

Spreads and Commissions for Trading with IEXS

IEXS provides customers with transparent and detailed information on spreads and commissions, which is commendable. The trading instruments interface displays a comprehensive table showing the spreads, margin call, lot value, and margin stop levels for each instrument. This makes it easy for customers to compare the costs of different instruments and make informed trading decisions. The spreads for major currency pairs such as EURUSD are competitive, with a spread of 1.8 pips. Additionally, there are no hidden fees or charges, and there are no requotes. However, some spreads and commissions may be higher than competitors, and certain accounts may have higher commissions. Furthermore, there are no discounts for high volume traders or VIP clients.

Forex Trading:

EURUSD: Spread of 1.4 pips

USDJPY: Spread of 2.1 pips

GBPUSD: Spread of 2.2 pips

AUDUSD: Spread of 2.2 pips

USDCAD: Spread of 2.3 pips

USDCHF: Spread of 2.4 pips

NZDUSD: Spread of 2.4 pips

AUDCAD: Spread of 2.6 pips

AUDCHF: Spread of 2.8 pips

AUDJPY: Spread of 2.5 pips

Metals & Energy:

XAUUSD (Gold): Spread of 2.9 pips

XAGUSD (Silver): Spread of 2.4 pips

UKOUSD (Crude Oil): Spread of 5.0 pips

USOUSD (Crude Oil): Spread of 5.0 pips

Indices & Shares:

DE30: Spread of 2.0 pips

EU50: Spread of 21.0 pips

HK50: Spread of 12.0 pips

JP225: Spread of 18.0 pips

UK100: Spread of 19.0 pips

US30: Spread of 22.0 pips

CSI300: Spread of 16.8 pips

AU200: Spread of 27.0 pips

FR40: Spread of 17.0 pips

UT100: Spread of 18.0 pips

Crypto Currency:

BTCUSD (Bitcoin): Spread of 240 pips

ETHUSD (Ethereum): Spread of 400 pips

Trading Accounts Available in IEXS

IEXS offers two account types to cater to different trading needs, with a minimum deposit requirement of USD 200 for the Standard Account and USD 10,000 for the DMA Account.

The Standard Account, requiring a minimum deposit of $200, is tailored for traders seeking a traditional FX trading experience. With ultra-competitive spreads and no commissions, it provides an accessible option for those starting out or preferring simplicity.

On the other hand, the DMA Account, requiring a higher minimum deposit of $10,000, is designed for traders desiring direct market access, deep liquidity, and maximum control over their execution strategy.

Lastly, IEXS provides a demo account with $100,000 virtual capital, allowing traders to practice and familiarize themselves with the platform risk-free before committing real funds.

Maximum Leverage

The Standard account provides a maximum leverage of 1:800, while the DMA Account offers a maximum leverage of 1:400.

Trading Platform(s)

IEXS offers traders a range of platforms including the widely popular MetaTrader 4 and 5, as well as their own WebTrader platform. These platforms are highly customizable, user-friendly and come with advanced charting tools, technical analysis capabilities, and the ability to use expert advisors and automated trading strategies. In addition, the WebTrader platform is browser-based, making it easily accessible from anywhere with an internet connection. However, some of the drawbacks include limited educational resources for beginners, limited integration with third-party tools and plugins, and no support for social trading features like copy-trading or signals. Overall, IEXS provides a reliable and robust trading platform for traders of all levels.

MetaTrader 4: Designed for trading and analyzing financial markets, MT4 is particularly tailored for Forex and CFD trading. It is available for both PC and mobile devices, with compatibility for Windows, Mac, iOS, iPad, and Android platforms. Additionally, a web trader version for MT4 is anticipated to be launched soon, enhancing accessibility for traders.

MetaTrader 5: MT5 is another powerful trading platform offered by IEXS, providing advanced trading features and analysis tools for various financial markets.

IEXS Trading App: The IEXS Trading App is a versatile investment platform that allows traders to access different markets and products conveniently.

Here is an introducing video about their MT4 channel on their official YouTube website.

Trading Tools

IEXS offers powerful trading tools to support traders:

Economic Calendar: Stay informed about upcoming economic reports and volatility to make informed trading decisions.

Trading Calculator: Our Forex calculator automates essential calculations like margin requirements, commissions, and pip values. This simplifies risk management and trade planning.

Forex Margin Calculator: Easily determine required margins for new positions.

Forex Pip Value Calculator: Manage trade risk by calculating pip risk-to-reward ratios.

Forex Profit & Loss Calculator: Estimate potential profits and assess trading strategies effectively.

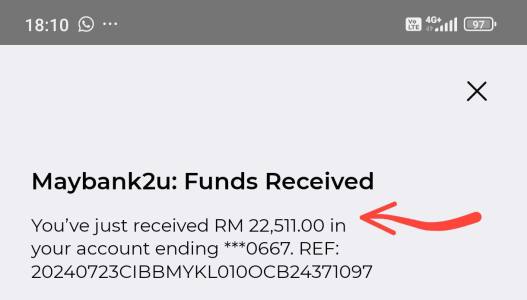

Deposit and Withdrawal

IEXS offers the following payment methods for clients to make deposits and withdrawals:

Bitcoin (₿):

Litecoin (Ł):

Ethereum (Ξ):

Tether (₮):

UnionPay:

Help2Pay:

AfrAsia:

Educational Resources in IEXS

IEXS provides a decent range of educational resources to help their traders stay informed and make informed decisions. The economic calendar and market news keep traders up-to-date on the latest developments in the markets they trade.

Additionally, daily analysis reports and technical analysis tools are available to help traders analyze and make sense of market movements. Trading calculators and risk management tools help traders calculate and manage risk when making trades. While IEXS lacks a formal education program or courses, they do offer investor protection resources such as negative balance protection. The only downside is the limited market analysis tools and the absence of live webinars or seminars for traders to learn and interact with experienced professionals.

Customer Service of IEXS

When it comes to customer care, IEXS offers various channels for customers to reach out to them for support, such as email, phone and FAQ section on their website. Additionally, they offer 24/5 customer support, which means that their support team is available for assistance during trading hours throughout the week. While these are certainly positive aspects of their customer care dimension, they do not offer live chat support, which is a popular and convenient method for customers to get quick answers to their queries.

Conclusion

In conclusion, IEXS is a UK-based forex broker that offers a range of trading instruments including forex, indices, metals, energy, shares, options, bonds, futures, crypto and funds. The company provides access to three trading platforms, including MT4, MT5, and IEXS WebTrader, as well as a demo account for traders to practice their strategies. IEXS also offers educational resources, an economic calendar, and market news to assist traders in making informed trading decisions. While IEXS offers competitive spreads and leverage up to 1:500, there are limitations in terms of the lack of transparency around deposit and withdrawal methods and fees. Additionally, the minimum deposit for the DMA account is quite high at USD 10,000. Overall, IEXS provides a reliable trading environment for traders seeking access to multiple financial markets with excellent customer service and support.

Frequently Asked Questions About IEXS

What kind of broker is IEXS?

IEXS is a UK registered STP forex broker regulated by the FCA and ASIC. The company offers trading in forex, indices, metals & energy, shares, options, bonds, futures, crypto and funds.

Is IEXS a regulated broker?

Yes, IEXS is regulated by two major regulatory bodies: the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

What trading platforms does IEXS offer?

IEXS offers three trading platforms: MetaTrader 4, MetaTrader 5, and IEXS WebTrader.

What is the minimum deposit requirement for opening an account with IEXS?

The minimum deposit requirement for a standard account is USD 200, while for a DMA account, the minimum deposit is USD 10,000.

Risk Warning

Trading online carries substantial risk, and there's a possibility of losing your entire investment capital. It's important to recognize that online trading may not be suitable for all traders or investors. Before proceeding, ensure you fully comprehend the associated risks. Additionally, note that the details provided in this review could be subject to change as the company updates its services and policies regularly. Furthermore, consider the date when this review was generated, as information may have evolved since then. Therefore, it's recommended to verify the most current information directly with the company before making any decisions or taking action. The reader bears sole responsibility for utilizing the information provided in this review.

WikiFX

WikiFX

WikiFX

WikiFX