Company Summary

| Pro Fx Review Summary | |

| Registered Country/Area | UK |

| Founded Year | 2011 |

| Company Name | Pro Fx Ltd |

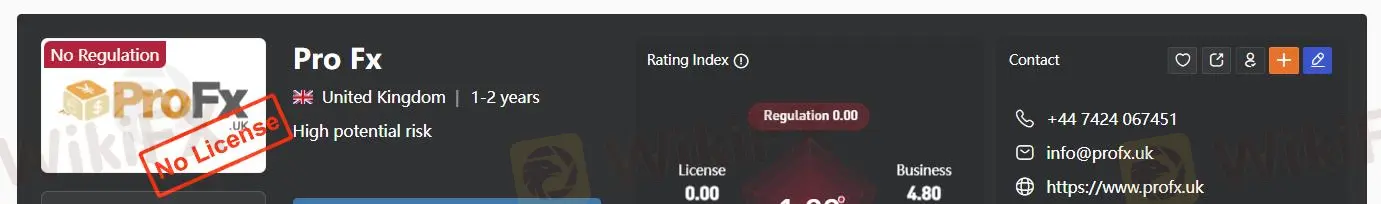

| Regulation | Unregulated |

| Minimum Deposit | $500 (ECN Account) |

| Maximum Leverage | 1:1000 |

| Spreads | Starting from 0 pips for ECN |

| Trading Platforms | VERTEX FX |

| Tradable Assets | Forex, Commodities, CFDs, Indices, Cryptocurrencies |

| Account Types | ECN, ECN Prime, Pro |

| Demo Account | Yes |

| Islamic Account | Yes |

| Customer Support | Website: https://www.profx.uk |

| Phone: +44 7862 068336 | |

| Email: info@profx.uk、support@profx.uk | |

| Social Media: Facebook (https://www.facebook.com/profxgb) and Instagram (https://www.instagram.com/profxgb) | |

| Payment Methods | Bank Wire; Tether; Perfect Money; Bitcoin |

Pro Fx Information

ProFX is a UK-based trading platform established in 2011, offering five types of financial instruments, including forex, commodities, CFDs, indices, and cryptocurrencies. It features variable spreads and three account types, but it operates without regulatory oversight.

Is Pro Fx legit?

ProFX is not regulated and does not hold any licenses. Its domain profx.com was registered on October 11, 1996, and is set to expire on October 10, 2025.

Pros and Cons

| Pros | Cons |

| 5 market instruments | Unregulated |

| 3 account types | High leverage up to 1:1000 |

| No deposit or withdrawal fees | |

| 4 customer supports |

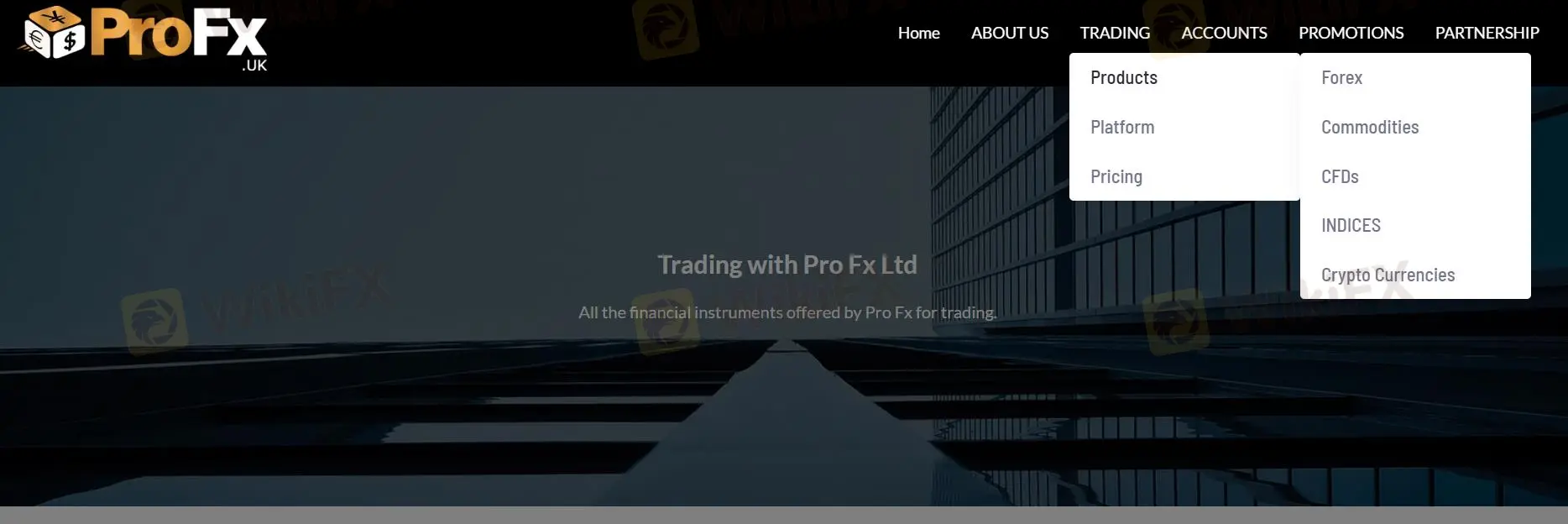

What Can I Trade on ProFx?

ProFX offers five types of instruments: forex, commodities, CFDs, indices, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| CFDs | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

Account Types

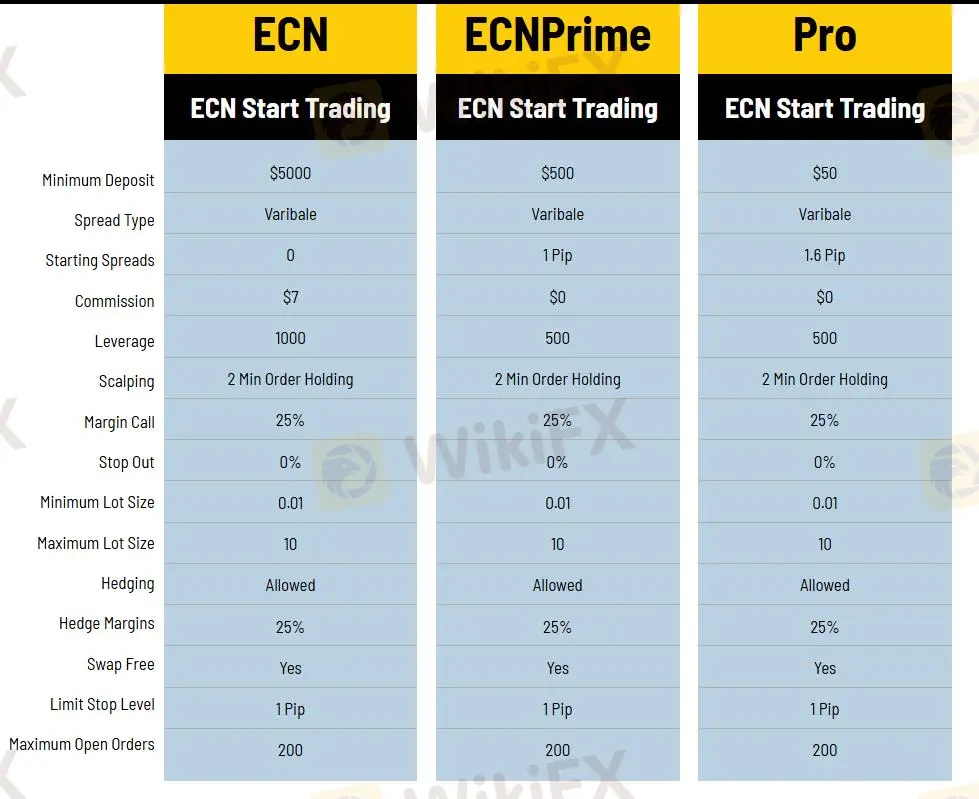

ProFX offers three types of live trading accounts: ECN, ECNPrime, and Pro. ECN is suitable for high-volume traders, while ECNPrime is designed for moderate-volume traders. Pro is ideal for beginners or low-volume traders. The platform also provides a demo account and Islamic accounts.

Leverage

ProFx provides leverage options as follows: ECN accounts offer leverage up to 1:1000, while both ECNPrime and Pro accounts offer leverage up to 1:500.

| Account Type | Leverage |

| ECN | 1:1000 |

| ECNPrime | 1:500 |

| Pro | 1:500 |

Spreads and Commissions

The spreads start from 0 pips, and both the ECNPrime and Pro accounts have no commissions.

| Account Type | Spreads | Commission per Round Turn Trade |

| ECN | From 0 pips | $7 |

| ECNPrime | From 1 pip | No commission |

| Pro | From 1.6 pips | No commission |

Trading Platform

ProFx supports the VERTEX FX trading platform, which is designed for traders of all experience levels. However, there are no access of MT5 platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| VERTEX FX trading platform | ✔ | Mobile and Desktop(Windows & macOS) | All Traders |

| MT5 | ❌ | Mobile and Desktop(Windows & macOS) | Experienced Traders |

Deposit & Withdrawal

This broker does not charge any deposit or withdrawal fees. The minimum deposit required is $10.

Deposit Methods:

| Processor | Minimum Deposit | Deposit Fee | Deposit Time |

| Bank Wire | $50 | Depends | 24-48 Hours |

| Tether | $10 | 0% | Instant |

| Perfect Money | $10 | 0% | Instant |

| Bitcoin | $10 | 0% | Instant |

Withdrawal Methods:

| Processor | Minimum Withdrawal | Withdrawal Fee | Withdrawal Time |

| Bank Wire | $50 | 0% | 24-48 Hours |

| Tether | $20 | 0% | 24 Hours |

| Perfect Money | $20 | 0% | 24 Hours |

| Bitcoin | $20 | 0% | 24 Hours |