Company Summary

| InterMagnum Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (Offshore regulated) |

| Market Instruments | Forex, Stocks, Indices, and Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | Fixed |

| Trading Platform | InterMagnum |

| Minimum Deposit | $250 |

| Customer Support | 24/7 support |

| Email: support@intermagnum.email | |

| Phone: United Kingdom: 447477171790 | |

| Ecuador: 593963871774 | |

| Peru: 5115104079 | |

| Mexico: 524291380075 | |

| Panama: 5078511275 | |

| Chile: 56412909764 | |

| Colombia: 576018418530 | |

| Costa Rica: 50641018215 | |

| El Salvador: 50321366850 | |

| Brazil: 556135505544 | |

| Address: Office No. 3, Room 2, 1st Floor, Dekk House, Zippora Street, Providence Industrial Estate, Mahe, 673310, Seychelles | |

InterMagnum Information

InterMagnum is a broker registered in Seychelles, offering trading in Forex, Stocks, Indices, and Commodities with leverage up to 1:400 and fixed spreads on InterMagnum platform. The minimum deposit is as high as $250. It offers a variety of account types and flexible payment methods.

Pros and Cons

| Pros | Cons |

| 24/7 support | Account inactivity fees charged |

| Various trading instruments | Offshore regulation risks |

| Demo accounts available | No MT4 or MT5 |

| Various payment methods | High minimum deposit |

| Real-time signals andprice alerts | |

| Live market updates | |

| Fast execution of orders |

Is InterMagnum Legit?

InterMagnum is offshore regulated by the Seychelles Financial Services Authority (FSA).

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Seychelles Financial Services Authority (FSA) | Offshore Regulated | Magnum International Markets Ltd | Retail Forex License | SD132 |

What Can I Trade on InterMagnum?

These are the instruments that can be traded on InterMagnum: Forex, Stocks, Indices, and Commodities.

| Trading Assets | Available |

| Forex | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| Funds | ❌ |

| ETFs | ❌ |

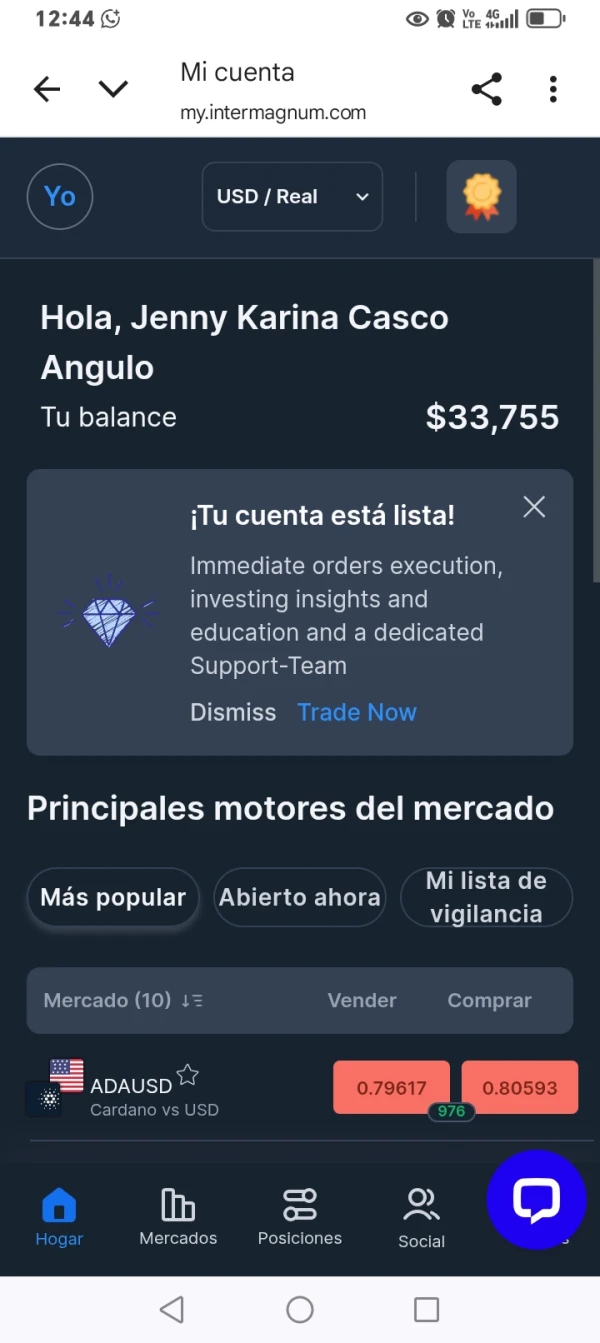

Account Type

InterMagnum provides a demo account that allows clients to conduct testing without real money.

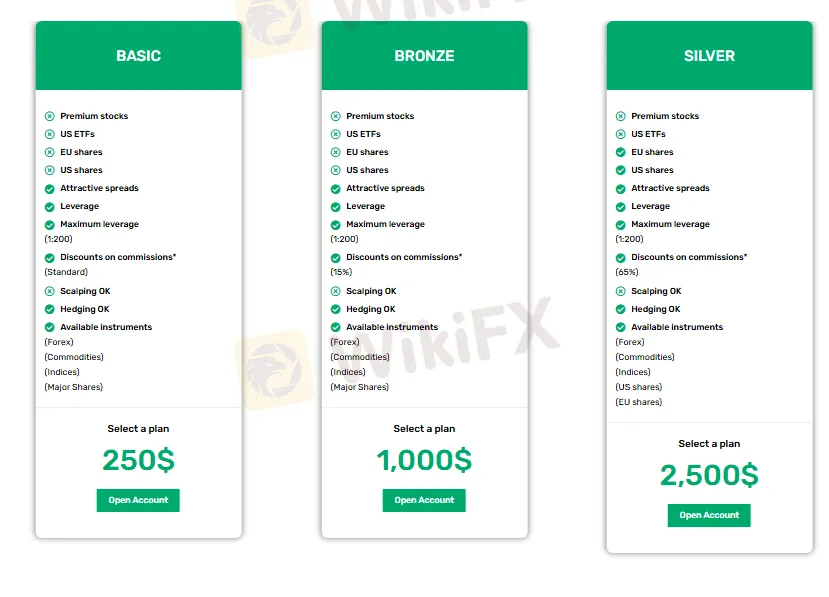

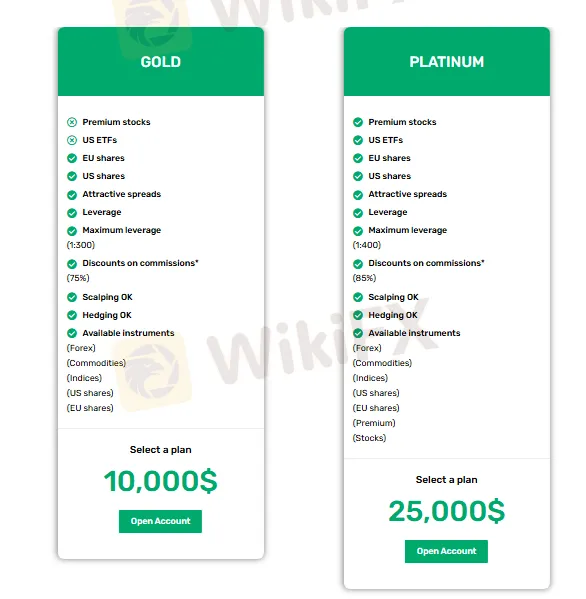

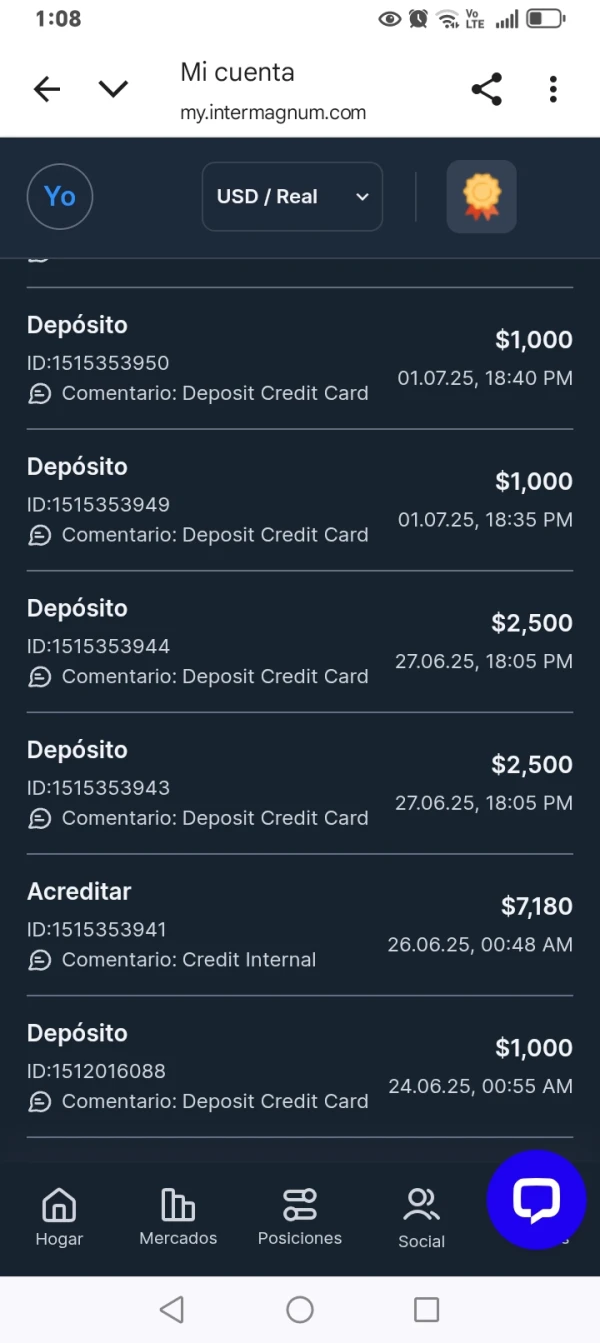

InterMagnum offers five liveaccounts: Basic, Bronze, Silver, Gold, and Platinum. These accounts allow for the trading of distinct instruments. The higher the deposit amount, the greater the variety of products that can be traded. Here is information on the five types of accounts:

| Account Type | Minimum Deposit | Maximum Leverage | Commission Discount |

| Basic | $250 | 1:200 | Standard |

| Bronze | $1,000 | 15% | |

| Silver | $2,500 | 65% | |

| Gold | $10,000 | 1:300 | 75% |

| Platinum | $25,000 | 1:400 | 85% |

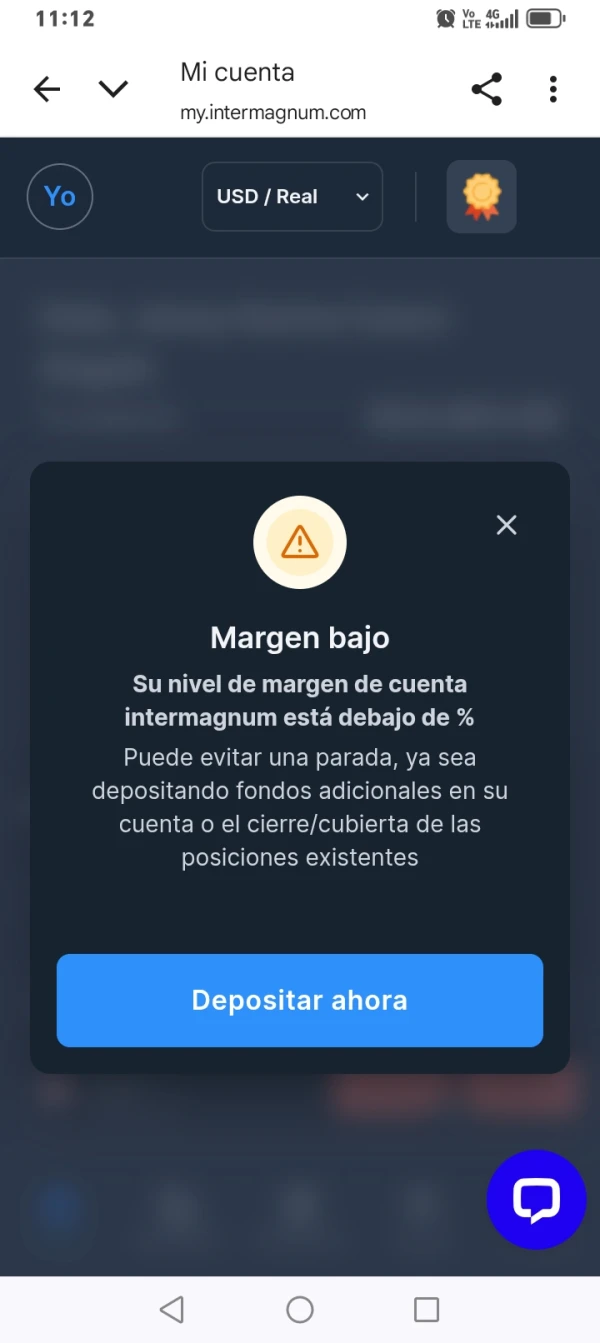

Fees

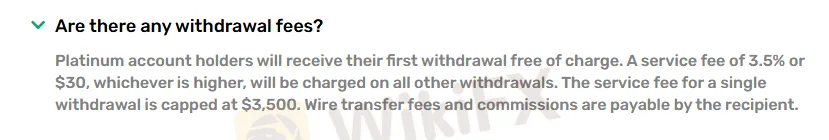

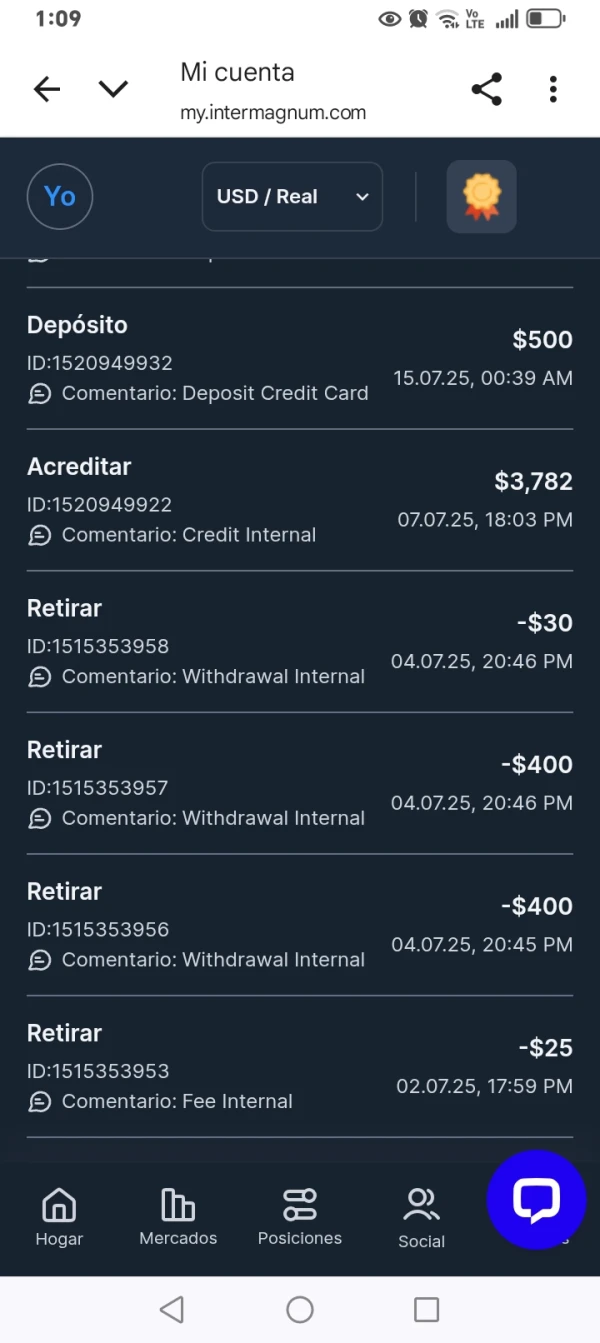

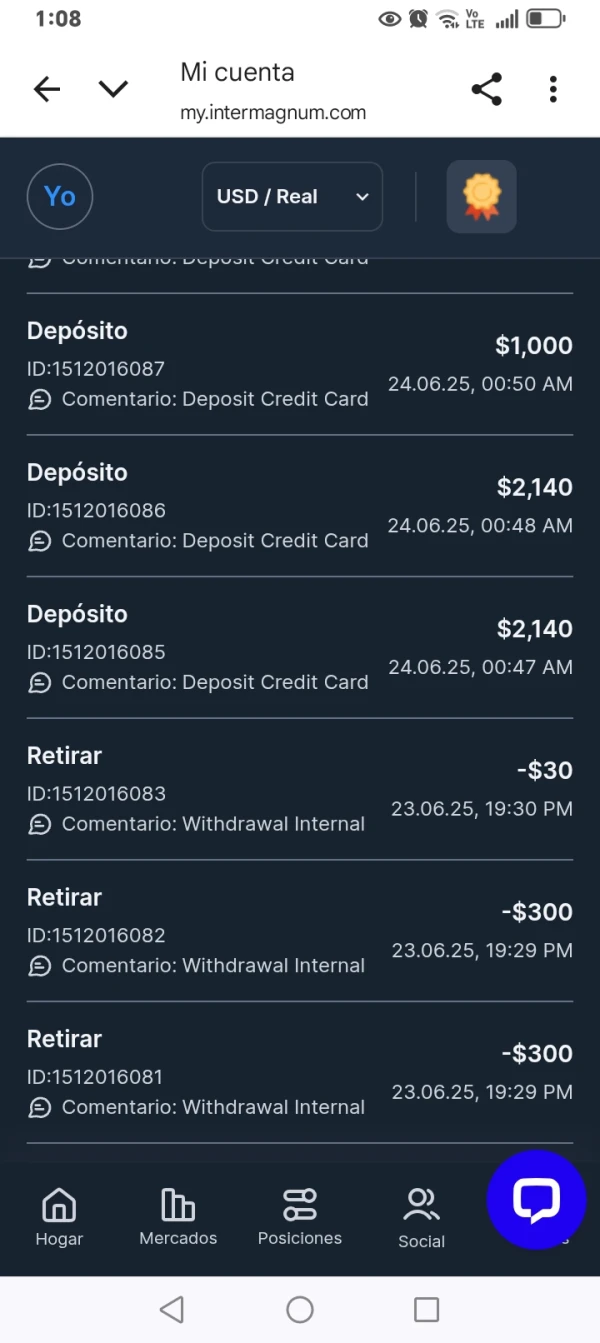

Platinum account holders will be charged a service fee of 3.5% or $30 USD on all other withdrawals except for the first withdrawal, whichever is higher.

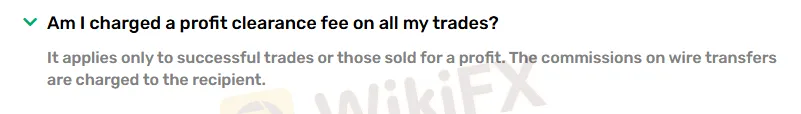

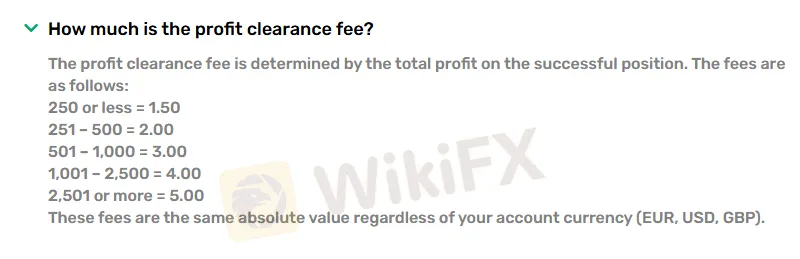

Traders need to pay a profit clearance fee when trading on the InterMagnum platform. This depends on the profit generated by each position.

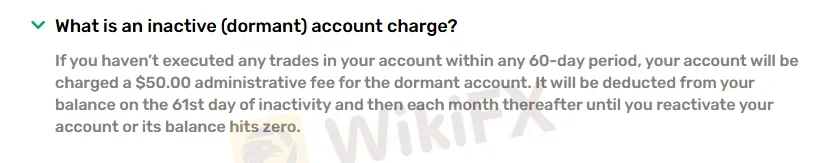

Accounts that do not execute any trades within 60 days will be charged a $50 dormant account management fee. It is deducted every month thereafter until the account is reactivated or its balance reaches zero.

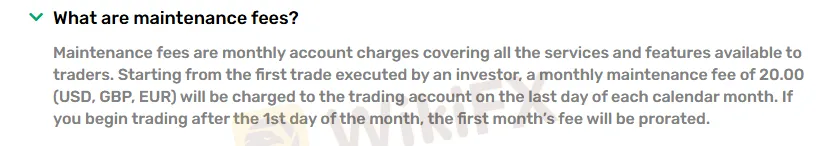

InterMagnum will charge a monthly maintenance fee to traders who have made trades.

Trading Platform

Intermagnum is a cutting-edge automated software specifically designed for trading Bitcoin and other cryptocurrencies.

| Trading Platform | Supported | Available Devices | Suitable for |

| InterMagnum | ✔ | Desktop, Mobile, Tablet | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

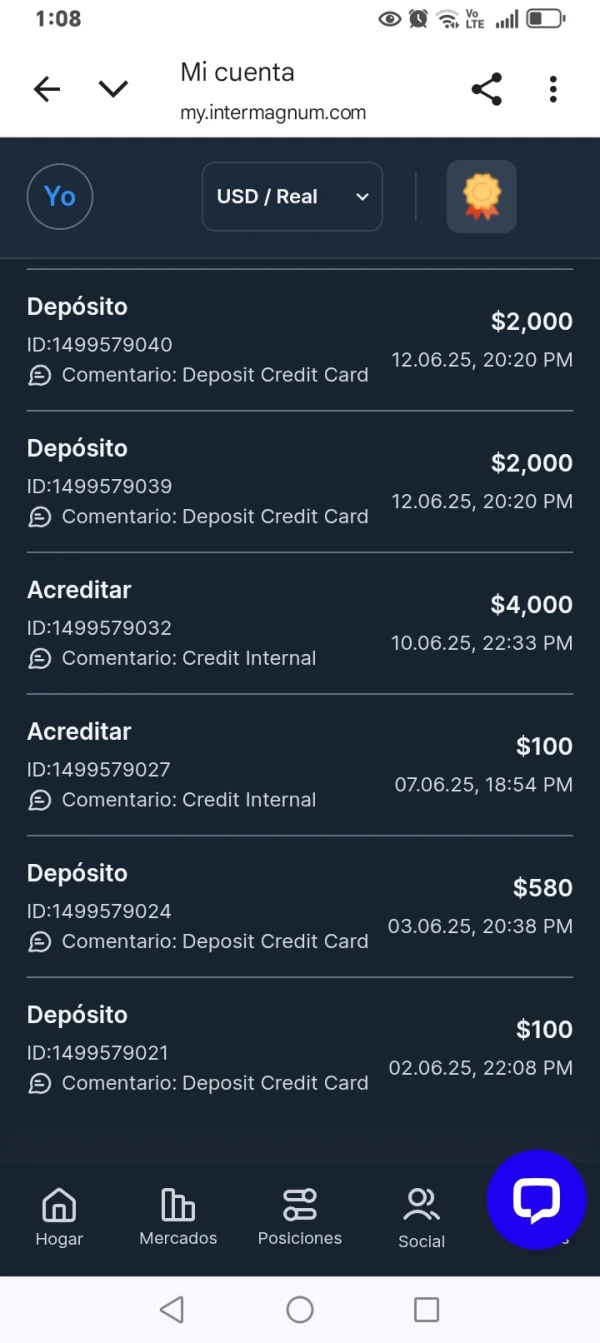

Deposit and Withdrawal

InterMagnum offers the following payment methods: Comodo, Visa, Mastercard, Wire Transfer, Instant EFT, and Wealth.

FX3411035512

Peru

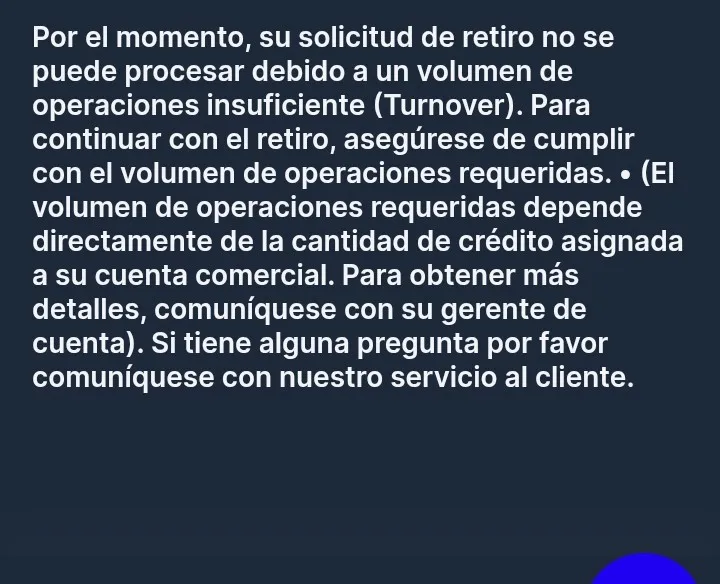

They deceived me, they told me you were going to withdraw, and they made me pay fees and commissions. After paying, the interest came, and the amount became so high. Now I have to pay more because the interest rates went up, and they keep rising. Now I have to make more deposits, and there's no end in sight. They drove me to bankruptcy with debts, and I ended up sick from the stress. I have children who depend on me. It's not fair that they deceived me like this. Now they threaten to close my account—they're relentless about the payments. I can't take it anymore.

Exposure

Marta Lizcano

Spain

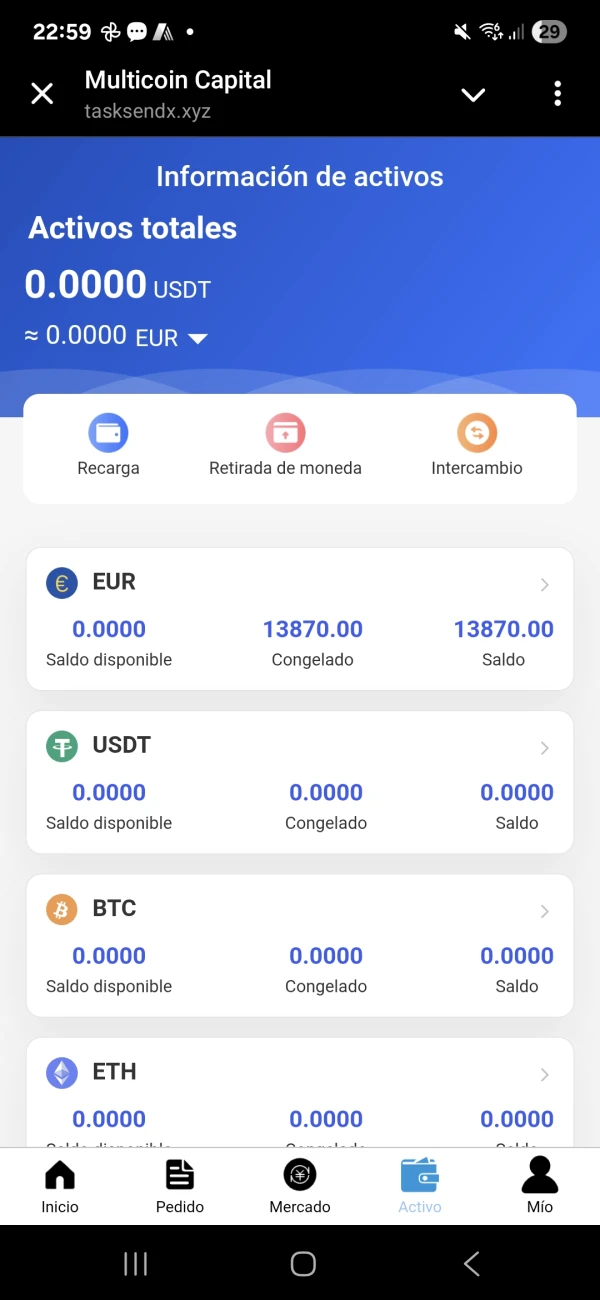

They have blocked my money and are not providing a code to be able to withdraw it. They tell me I have to put in more money to recover all the capital and they don't offer any solution other than that.

Exposure

Ramón 9135

Costa Rica

Unable to withdraw my money, they have blocked my account with something like 8000 dollars and they won't let me withdraw anything. It's incredible that these people with the score they have, I can't trade, I can't do anything, I have everything blocked, I don't know what these people are going to do with my money, and this has been going on for months, and no one does anything for me. I suggest someone steps up and addresses my issue.

Exposure

Ramón 9135

Costa Rica

Well, they have earned $8000 from me and have put a lock on it, saying that I have to pay the Swap separately, I don't know why. They have not wanted to give me the money or communicate with me. Only one person communicates with me to charge me $1500 to release the account and then they will give me the money. I don't understand why I have to pay if the Swap is automatically released. They are charging me and getting upset because I don't deposit the $1500. I want someone to take action on this issue to see if I can get my money. It has been several months of this and they have not solved anything. Thank you to whoever listens and reads this, please help me.

Exposure