Company Summary

| FXBTG Review Summary | |

| Founded | 2008 |

| Registered Country/Region | New Zealand |

| Regulation | FMA |

| Market Instruments | Forex, metals, cryptocurrencies, stocks, commodities, and futures |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 1.1 pips(VIP Account) |

| Trading Platform | MT4, FXBTG APP |

| Min Deposit | $100 |

| Customer Support | Tel: +6011 7037 4764(Global), +64 9 889 5809 (New Zealand) |

| Email: cs@fxbtg-bank.com | |

| WeChat: FXBTG_service | |

| WhatsApp: +601170374764 | |

FXBTG Financial Group is an online broker with 18 years of experience, offering trading in cryptocurrency CFDs, currencies, indices, energy, precious metals, and stocks. It provides low commissions and tight spreads across diverse platforms including mobile (Android/iOS) and desktop.

Pros and Cons

| Pros | Cons |

| A wide range of products | MT5 Not Available |

| Demo accounts available | |

| Diverse account types | |

| Flexible leverage ratios | |

| MT4 platform Provided |

Is FXBTG Legit?

FXBTG is registered with New Zealand's Financial Markets Authority (FMA) under license number 9429030613140 as a general financial services provider. This basic business registration confirms legal operation but does not represent full regulatory oversight for all financial activities.

What Can I Trade on FXBTG?

On FXBTG, you can trade with forex, metals, cryptocurrencies, stocks, commodities, and futures.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Futures | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Options | ❌ |

| ETFs | ❌ |

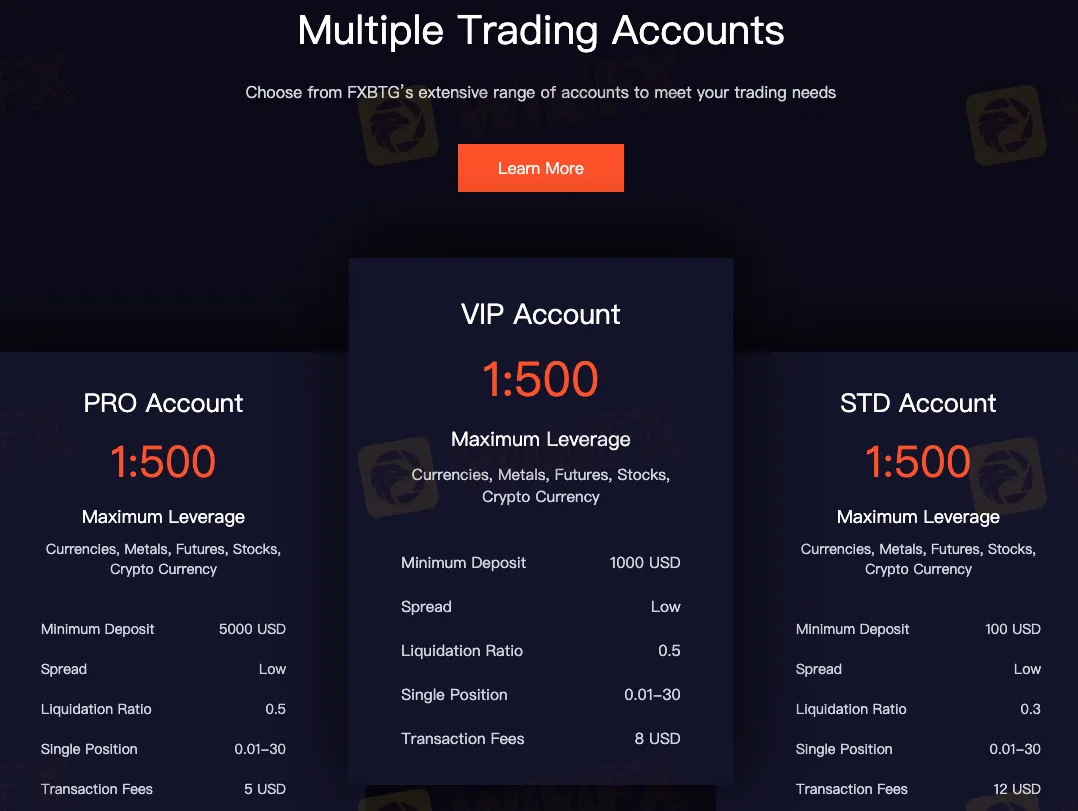

Account Types

| Feature | PRO Account | VIP Account | STD Account |

| Maximum Leverage | 1:500 | 1:500 | 1:500 |

| Tradable Assets | Currencies, Metals, Futures, Stocks, Cryptocurrency | Same as PRO | Same as PRO |

| Minimum Deposit | $5,000 USD | $1,000 USD | $100 USD |

| Spread Type | Low | Low | Low |

| Liquidation Ratio | 50% (0.5) | 50% (0.5) | 30% (0.3) |

| Position Size | 0.01-30 lots | 0.01-30 lots | 0.01-30 lots |

| Commission | $5 USD per trade | $8 USD per trade | $12 USD per trade |

Leverage

FXBTG offers flexible leverage up to 1:500, but please note that higher leverage may amplify both profits and losses.

| Account Type | Maximum Leverage |

| Standard Account | 1:500 |

| VIP Account | 1:500 |

| PRO Account | 1:500 |

Spreads

FXBTG claims to offer spreads as low as 0.2 pips.

| Account Type | Average EUR/USD Spread (in pips) |

| Standard Account | 1.3 |

| VIP Account | 1.1 |

| PRO Account | 0.2 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| FXBTG App | ✔ | PC, mobile | / |

| MT4 | ✔ | Windows, iOS, MAC, Android | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

FXBTG offers convenient and diversified deposit/withdrawal options through multiple payment channels, including: CLICKPAY, PayTrust88, PAY, BipiPAY, Tether (USDT), Huobi, and Binance. These integrated solutions provide transfers with reliable accessibility for global traders.

1739363738

Taiwan

This is a clone one

Exposure

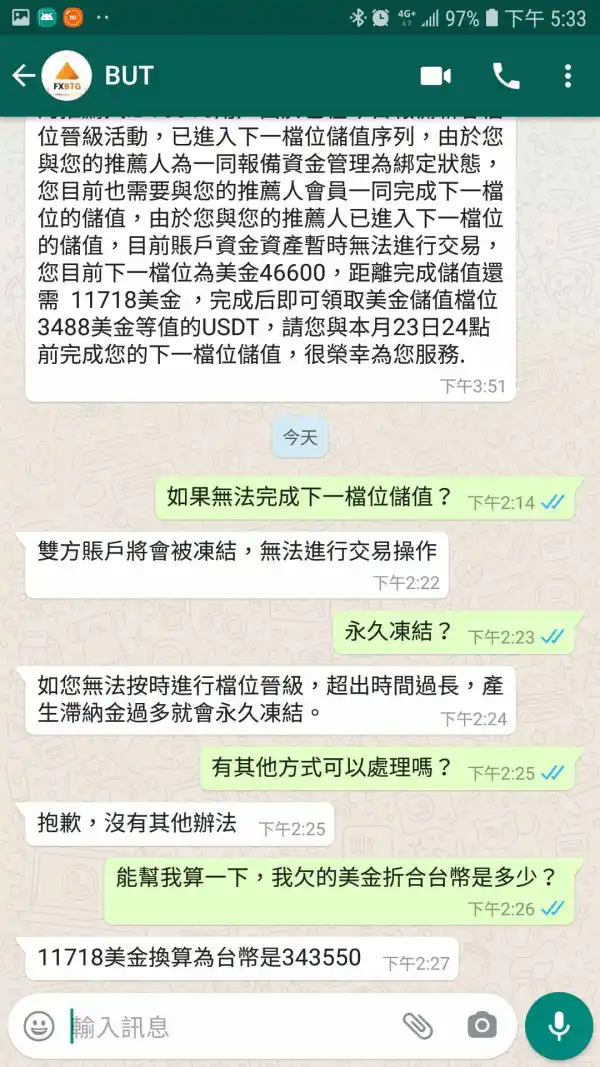

FX3584789522

Taiwan

Invest here with my friend. And we bound the fund management. The customer service called on the afternoone of February 16, 2021 and told that our accounts were forzen and asked for deposit to unfreeze them, otherewise, the accounts would be frozen forever. I hope the relevant department can help us solve the problem and recover the hard-earned money for us.

Exposure

Juciee

Nigeria

FXBTG seems to be well-regulated and they offer a few different trading platforms to choose from. It's good to see a broker that prioritizes compliance and gives traders options when it comes to their trading environment.

Neutral

Chen Miyagi

Singapore

Margin requirements are fair and transparent.👍👍👍

Positive

FX1496850438

Japan

I'm pretty happy with the low spreads and the variety of stuff I can trade. Setting up was a breeze, but getting a hold of their support team can be a bit of a drag sometimes. All in all, not a bad option if you're into trading different markets.

Neutral