Company Summary

| Opofinance Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (Offshore Regulated), ASIC (Exceeded) |

| Market Instruments | Forex, metals, commodities, stocks, indices, cryptocurrencies |

| Demo Account | / |

| Leverage | Up to 1:2000 |

| Spread | From 1.8 pips (Standard account) |

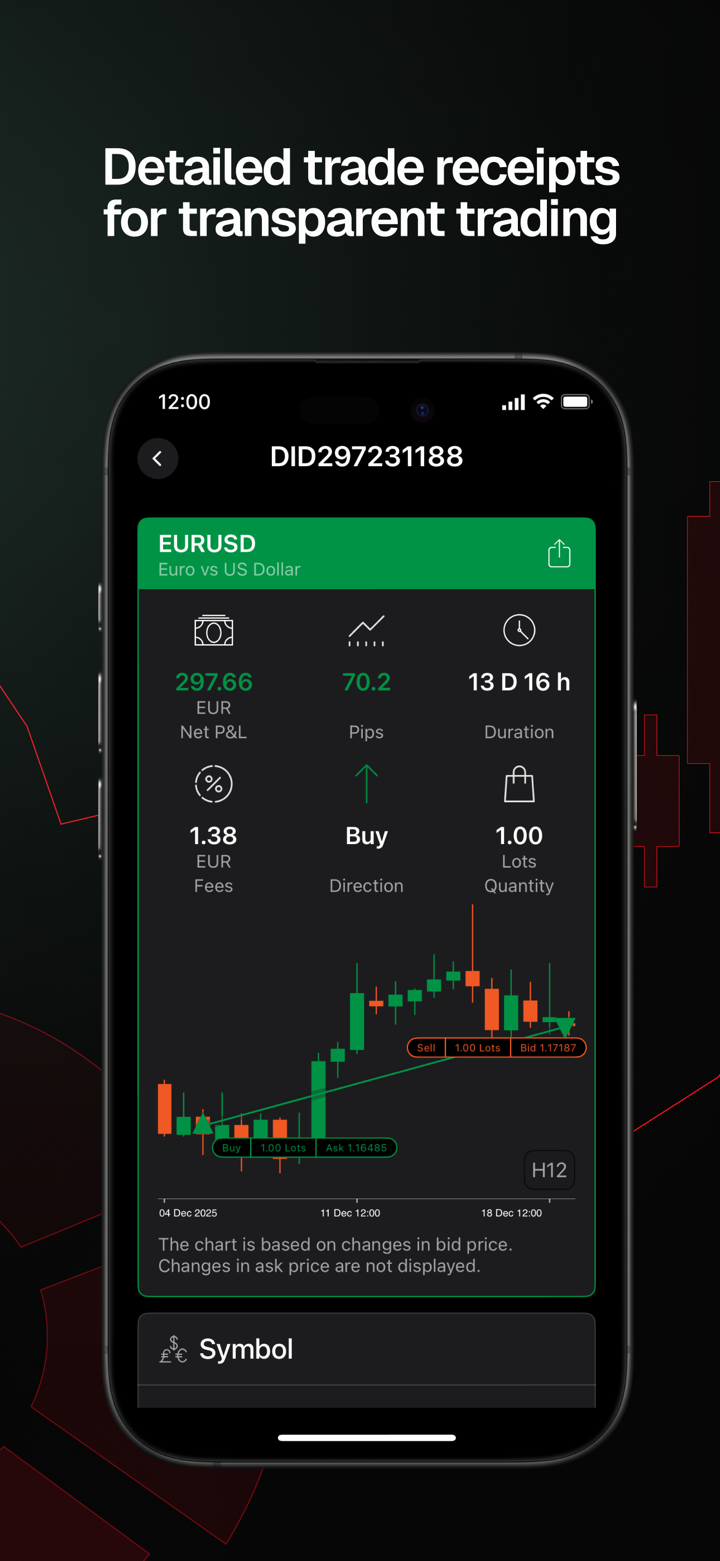

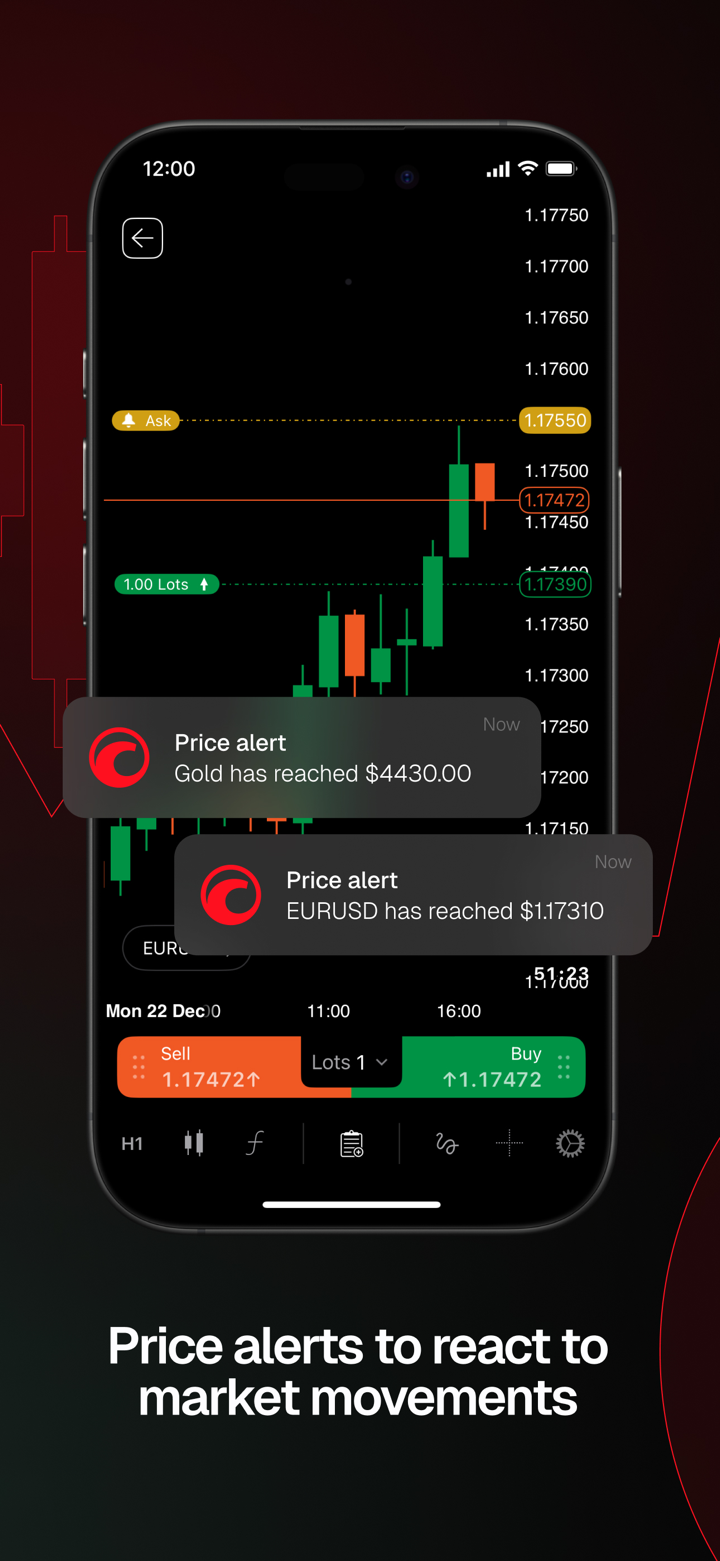

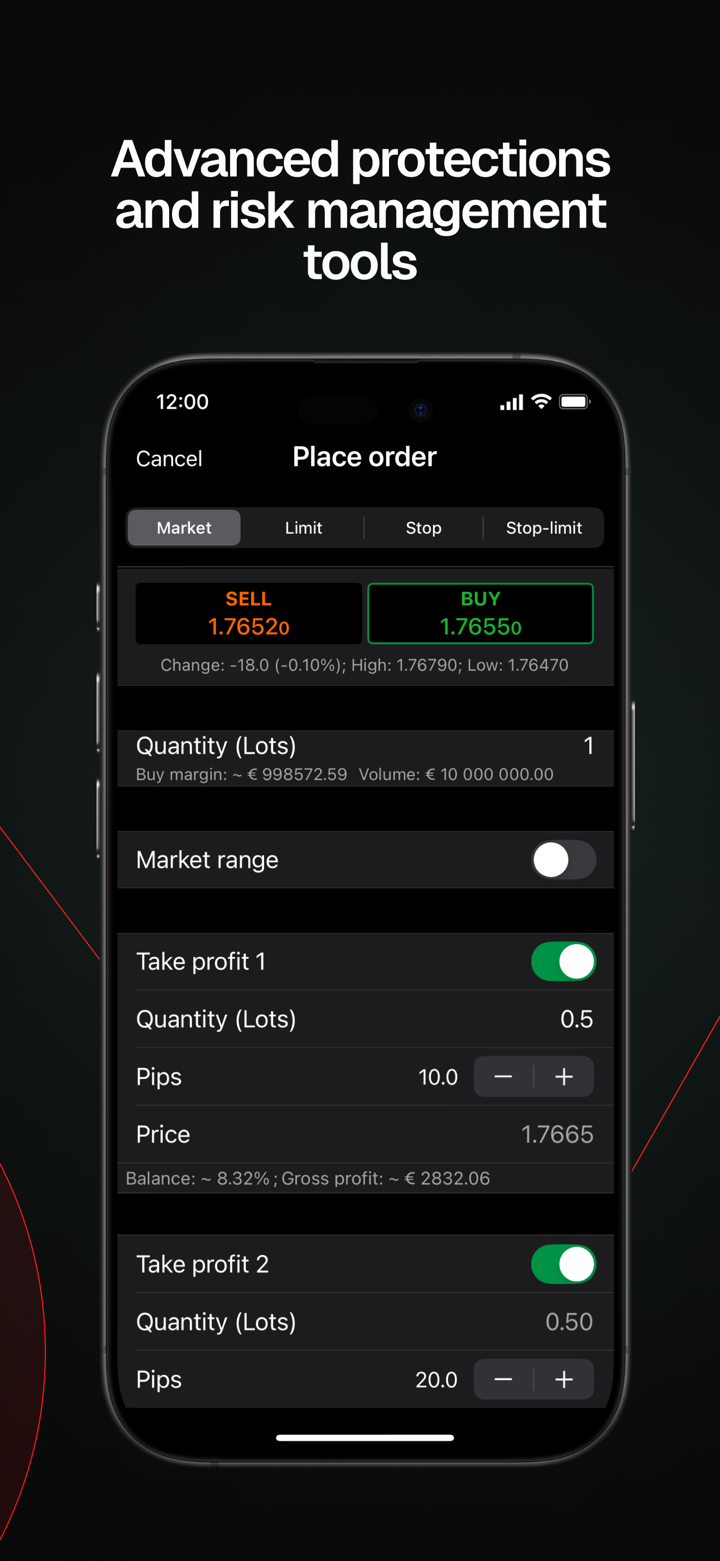

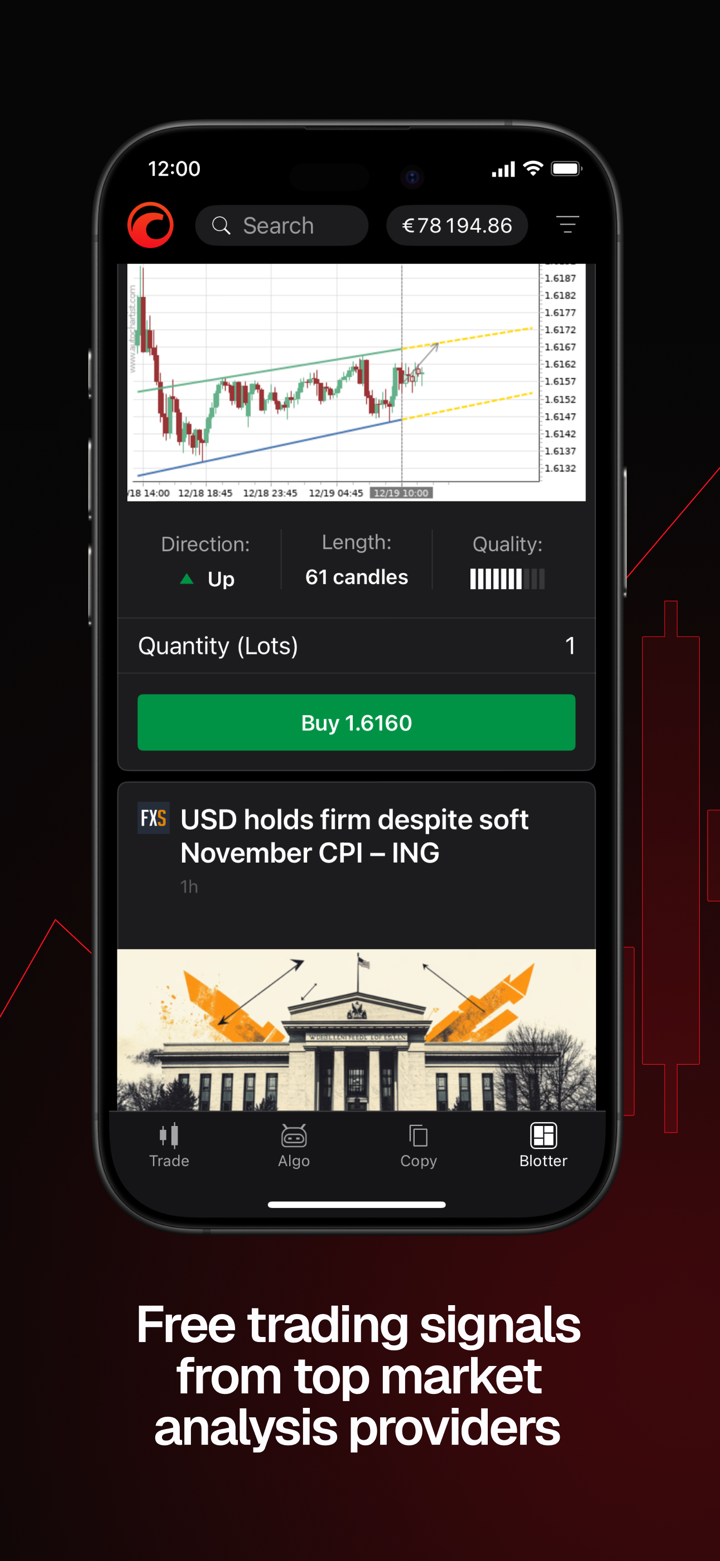

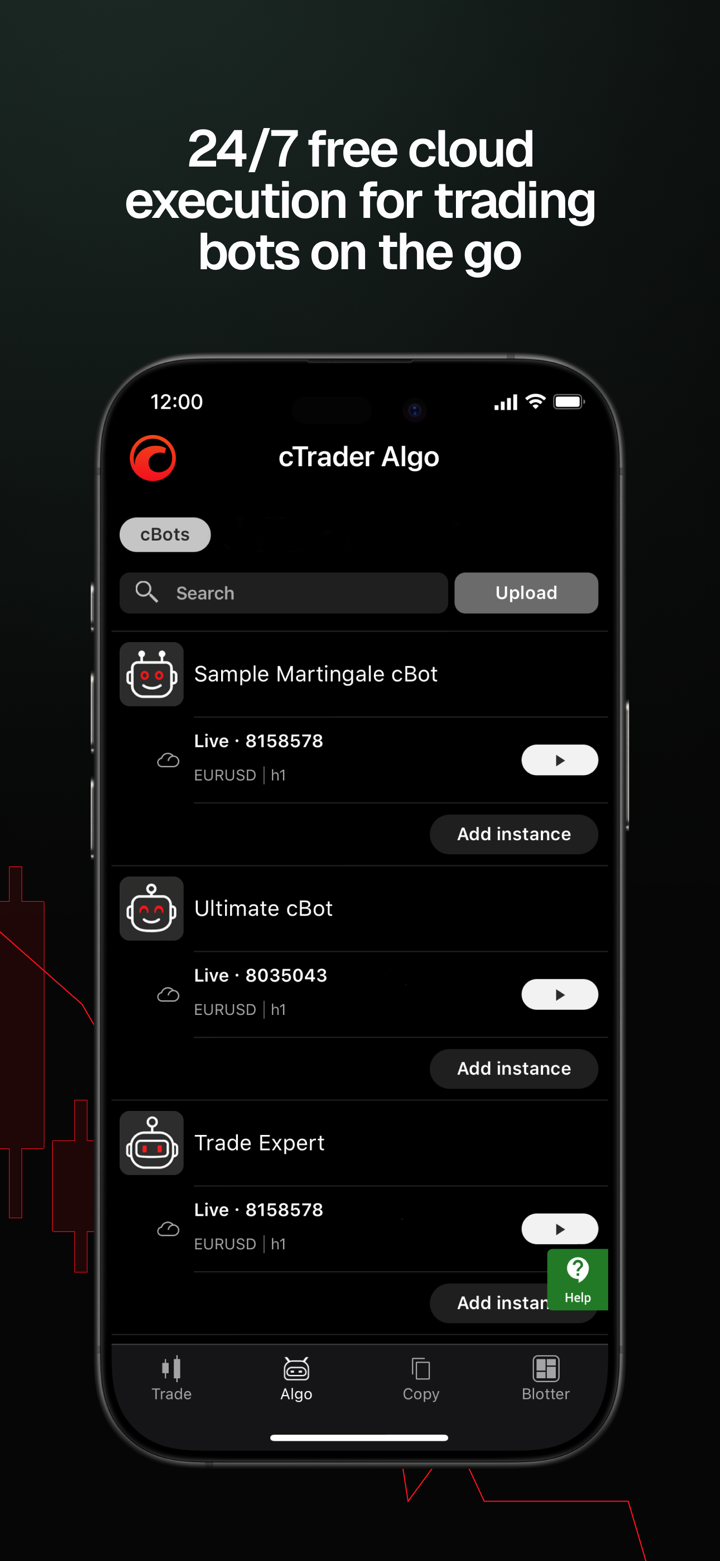

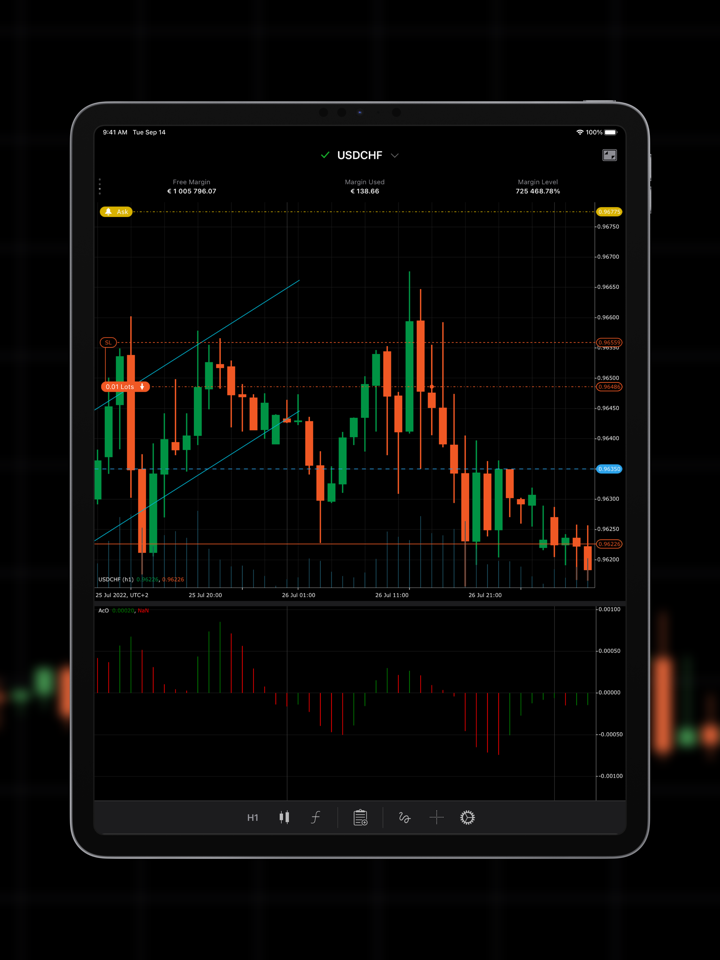

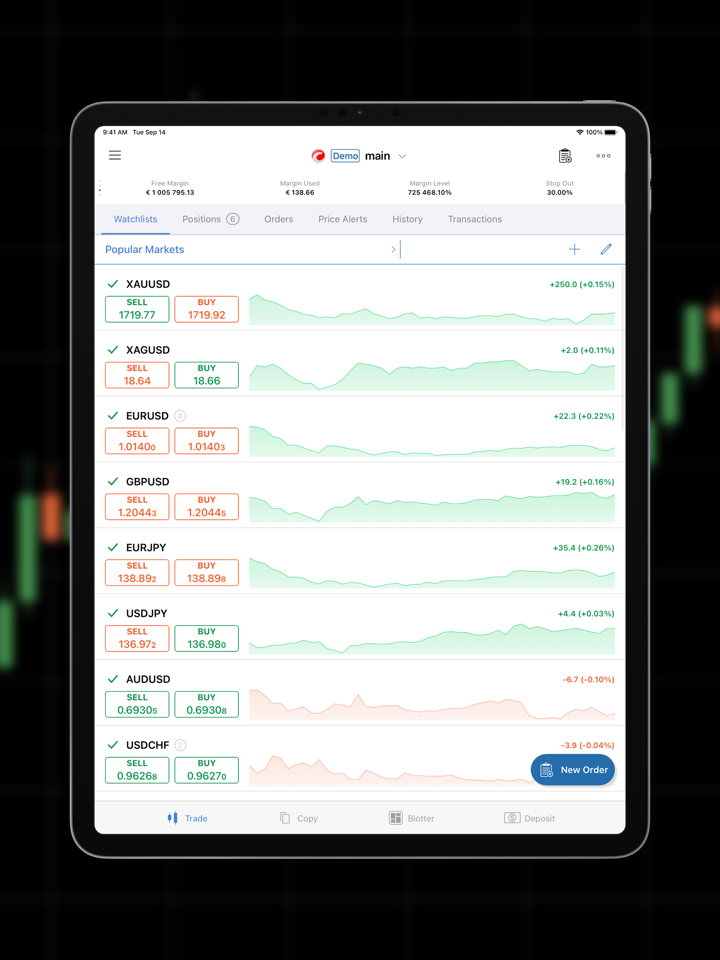

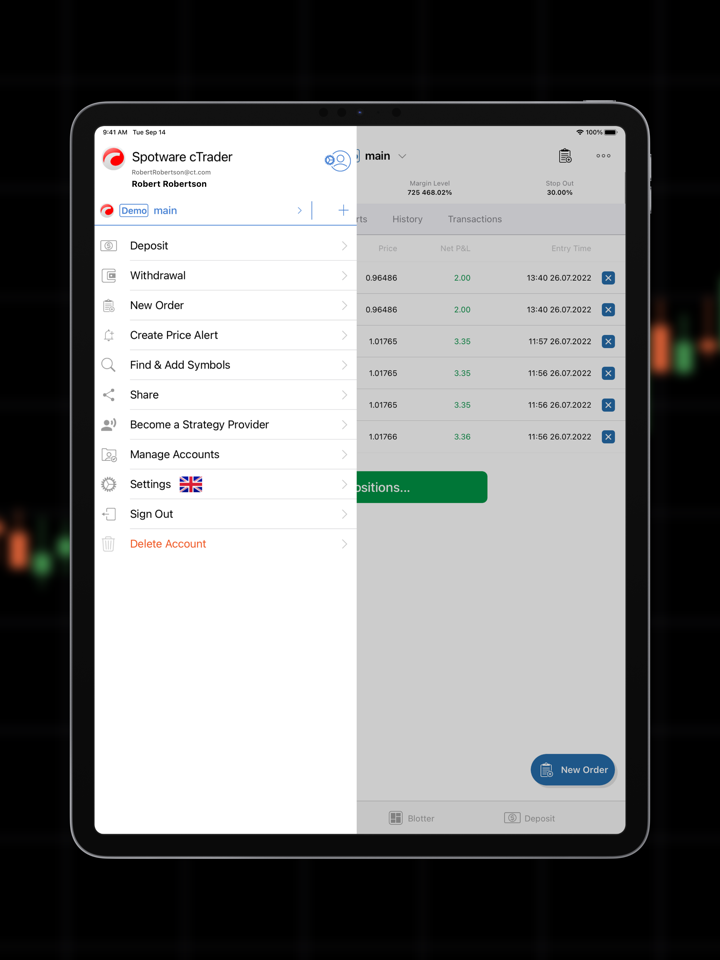

| Trading Platform | OpoTrade, MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

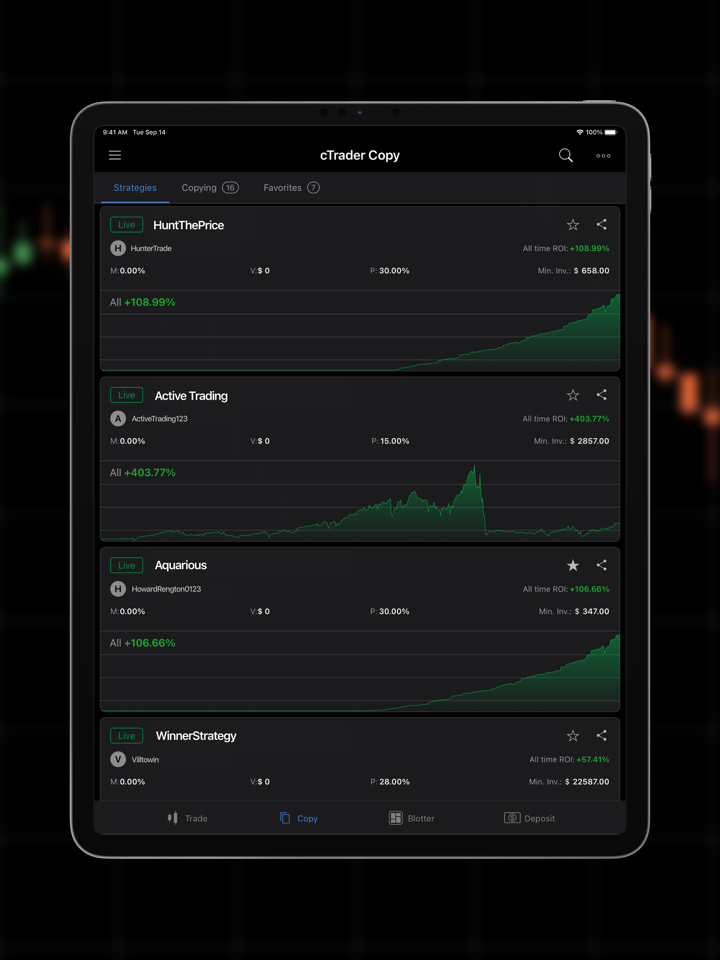

| Social Trading | ✅ |

| Minimum Deposit | $1 |

| Customer Support | Live chat |

| Phone: +447312763042 | |

| Email: support@opofinance.com | |

Opofinance Information

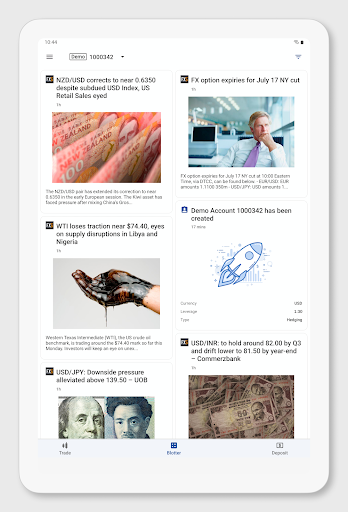

Opofinance was started in 2022 and is based in Seychelles. It is regulated by the Seychelles FSA under an offshore FX license. It has more than 350 trading tools from across the world, works with a number of platforms like MT4, MT5, cTrader, and OpoTrade, and has accounts for both new and experienced traders.

Pros and Cons

| Pros | Cons |

| Wide selection of platforms and account types | No clear mention of demo or Islamic accounts |

| Social trading | Offshore regulation |

| Low minimum deposit starting from $1 | Withdrawal fees apply on some payment methods |

Is Opofinance Legit?

| Licensed Entity | Regulated by | Regulatory Authority | License Type | License No. | Current Status |

| Opo Group Ltd | Seychelles | Seychelles Financial Services Authority (FSA) | Retail Forex License | SD124 | Offshore Regulated |

| Opo Finance Pty Ltd | Australia | Australia Securities & Investments Commission (ASIC) | Investment Advisory License | 402043 | Exceeded |

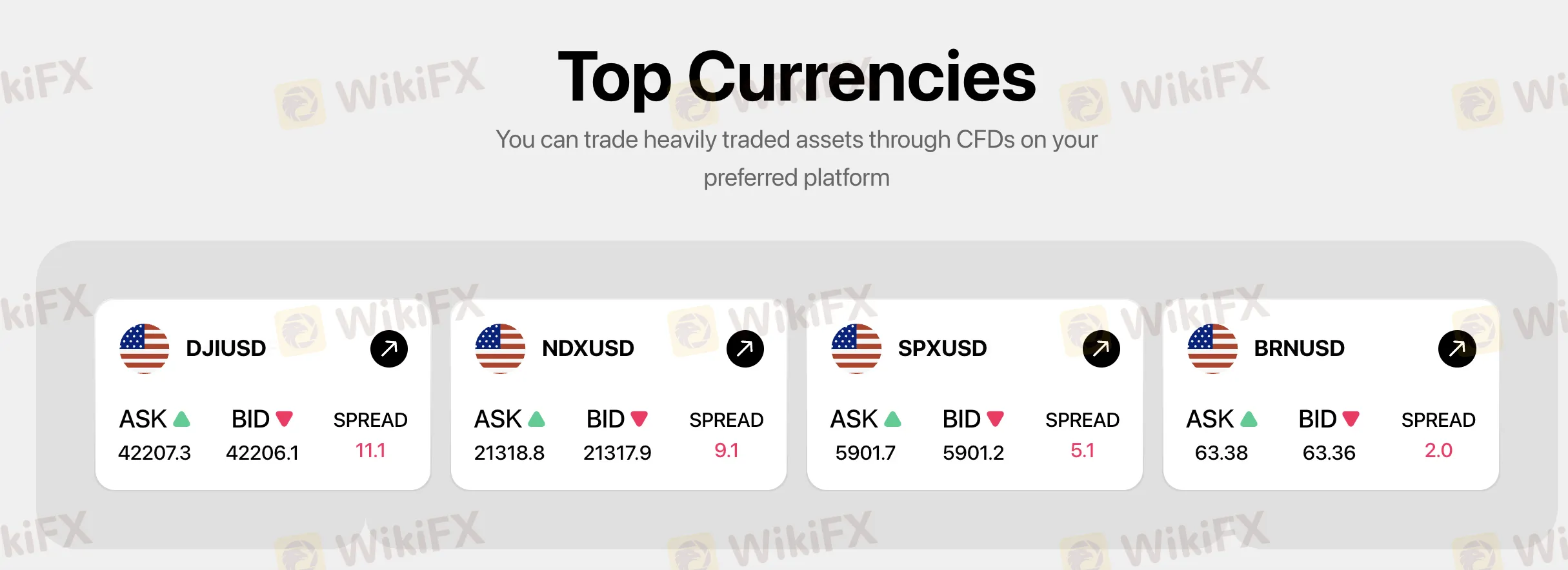

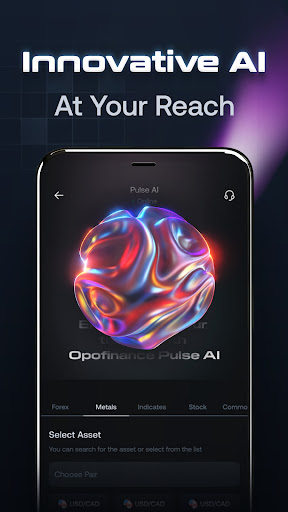

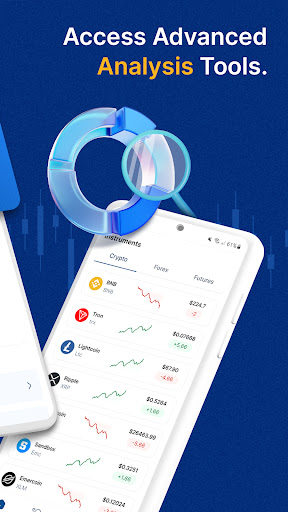

What Can I Trade on Opofinance?

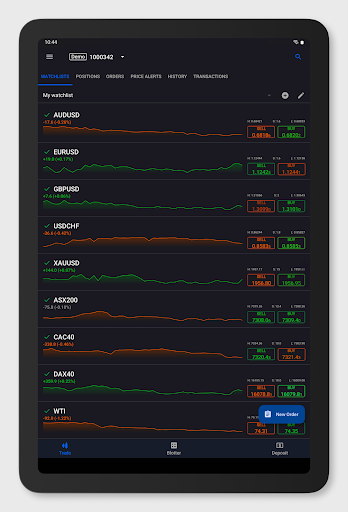

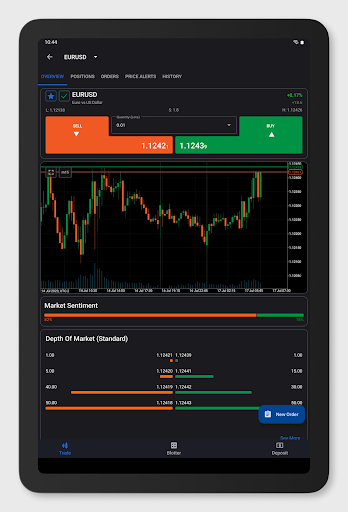

Opofinance offers access to over 350 trading instruments, including forex, metals, commodities, stocks, indices, and cryptocurrencies, providing a wide range of global market opportunities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✘ |

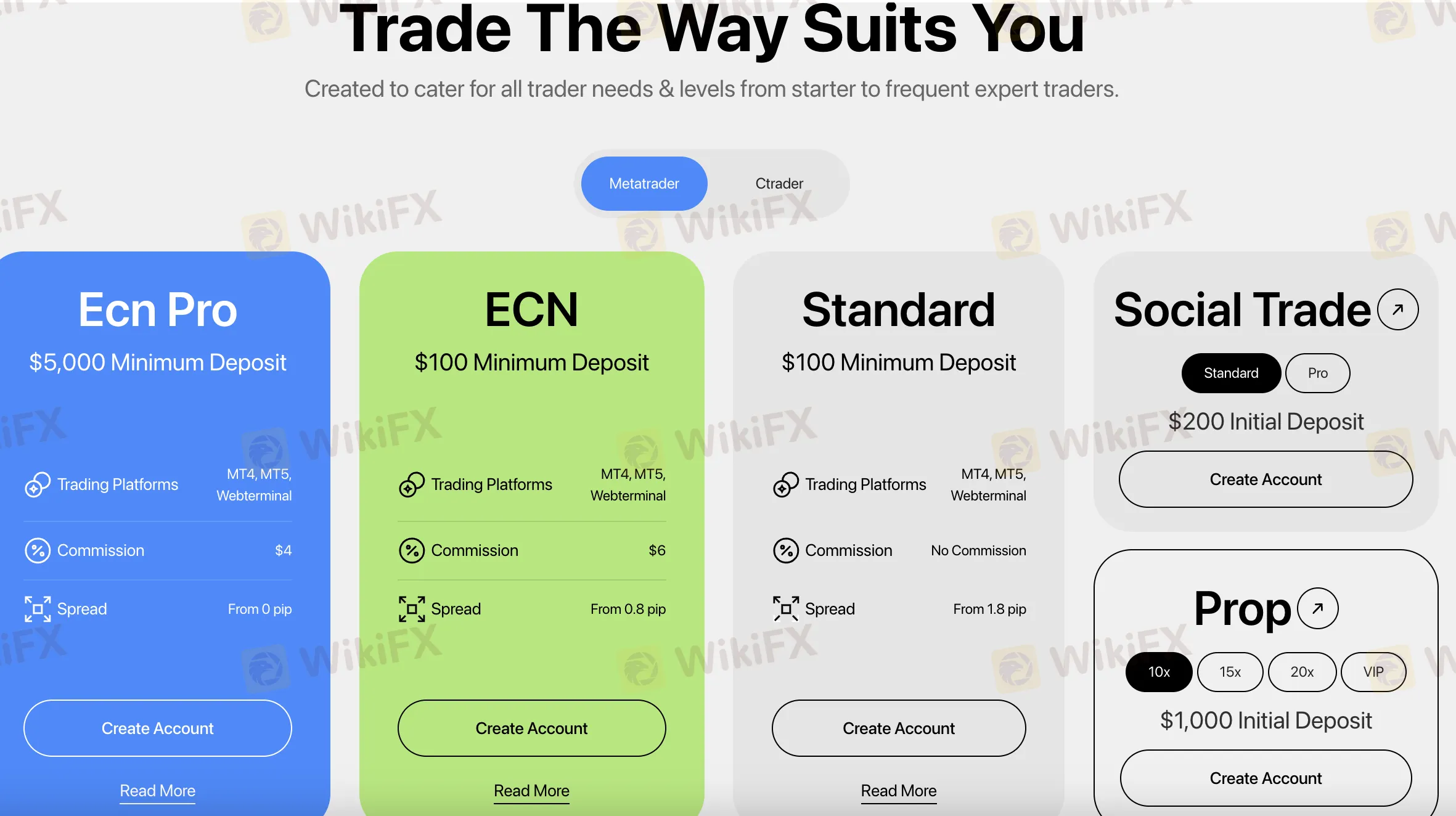

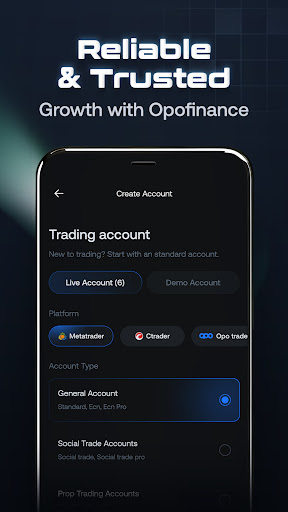

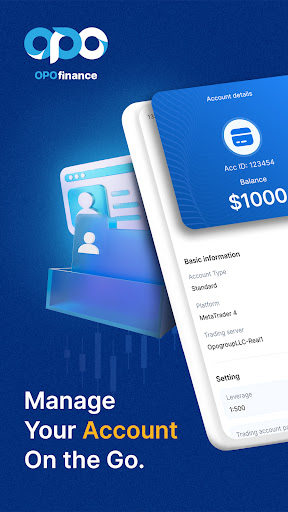

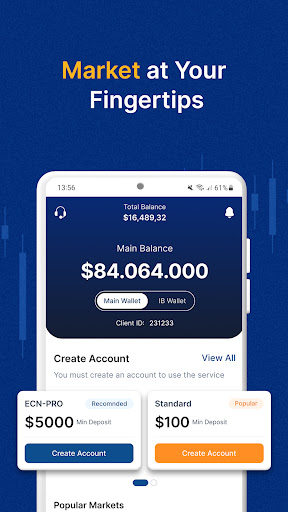

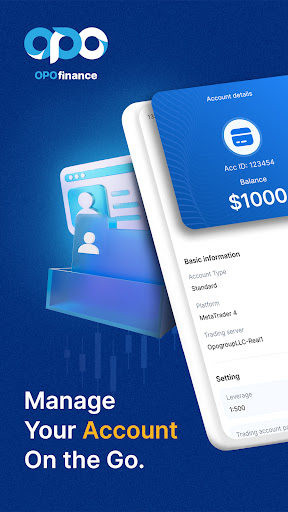

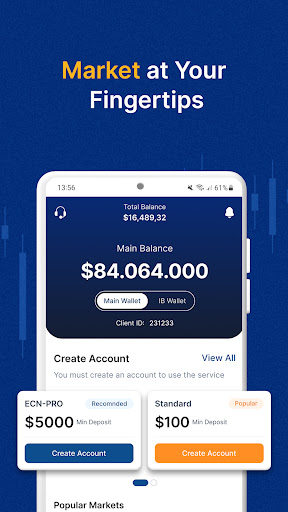

Account Type

Opofinance offers a wide range of live account types across MetaTrader, cTrader, and Optotrade platforms, designed to suit beginners, experienced traders, social traders, prop traders, and VIP clients. There is no mention of demo or Islamic (swap-free) accounts.

| Trading Platform | Account Type | Minimum Deposit | Maximum leverage | Spread | Commission | Suitable for |

| MetaTrader | Standard | $100 | 1:2000 | From 1.8 pips | 0 | Beginners, casual traders |

| ECN | From 0.8 pips | $6 | Active, experienced traders | |||

| ECN Pro | $5,000 | From 0.0 pips | $4 | Professional, high-volume traders | ||

| Social Trade | $200 | 1:500 | From 1.5 pips | 0 | Social traders, copy traders | |

| Prop | $1,000 | From 0.8 pips | $6 | Prop traders, funded accounts | ||

| Black | $100,000 | From near 0 pips | 0 | VIP, institutional clients | ||

| cTrader | ECN | $200 | - | From 1 pip | $6 | Active, experienced traders |

| ECN Plus | $5,000 | - | From 0.0 pips | $4 | Professional, high-volume traders | |

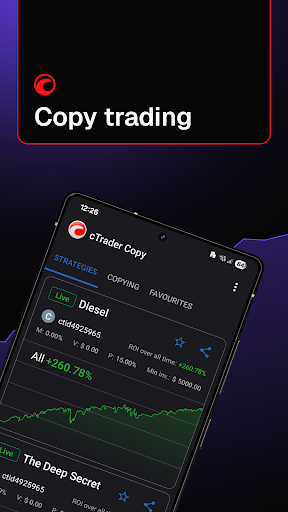

| Copy | $200 | - | From 2.2 pips | 0 | Social traders, copy traders | |

| Optotrade | Standard | $100 | 1:2000 | From 1.8 pips | Beginners, casual traders | |

| ECN | From 0.8 pips | $6 | Active, experienced traders | |||

| ECN Pro | $5,000 | From 0.0 pips | $4 | Professional, high-volume traders |

Leverage

Depending on the type of account, Opofinance offers leverage of up to 1:2000. This lets traders handle big holdings with only a modest amount of money. However, excessive leverage can also increase the chance of big losses, even as it can also boost the possible gains.

Opofinance Fees

In general, Opofinance's fees are in line with what other companies in the same field charge. Their ECN and ECN Pro accounts have spreads as low as 0 pips, however they charge commissions of $4 to $6. Their Standard account has bigger spreads but no commission.

| Account Type | Spread | Commission |

| Standard | From 1.8 pips | 0 |

| ECN | From 0.8 pips | $6 per lot |

| ECN Pro | From 0.0 pips | $4 per lot |

| Social Trade | From 1.5 pips | 0 |

| Prop | From 0.8 pips | $6 per lot |

| Black | Raw (near 0 pips) | 0 |

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | Varies: USDT $3–6, Advcash 2%, others |

| Inactivity Fee | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| OpoTrade | ✔ | Web, Desktop, Mobile | All trader levels |

| MetaTrader 4 (MT4) | ✔ | Windows, macOS, iOS, Android | Beginners |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, iOS, Android | Experienced traders |

| cTrader | ✔ | Web, Desktop, iOS, Android | Professional traders |

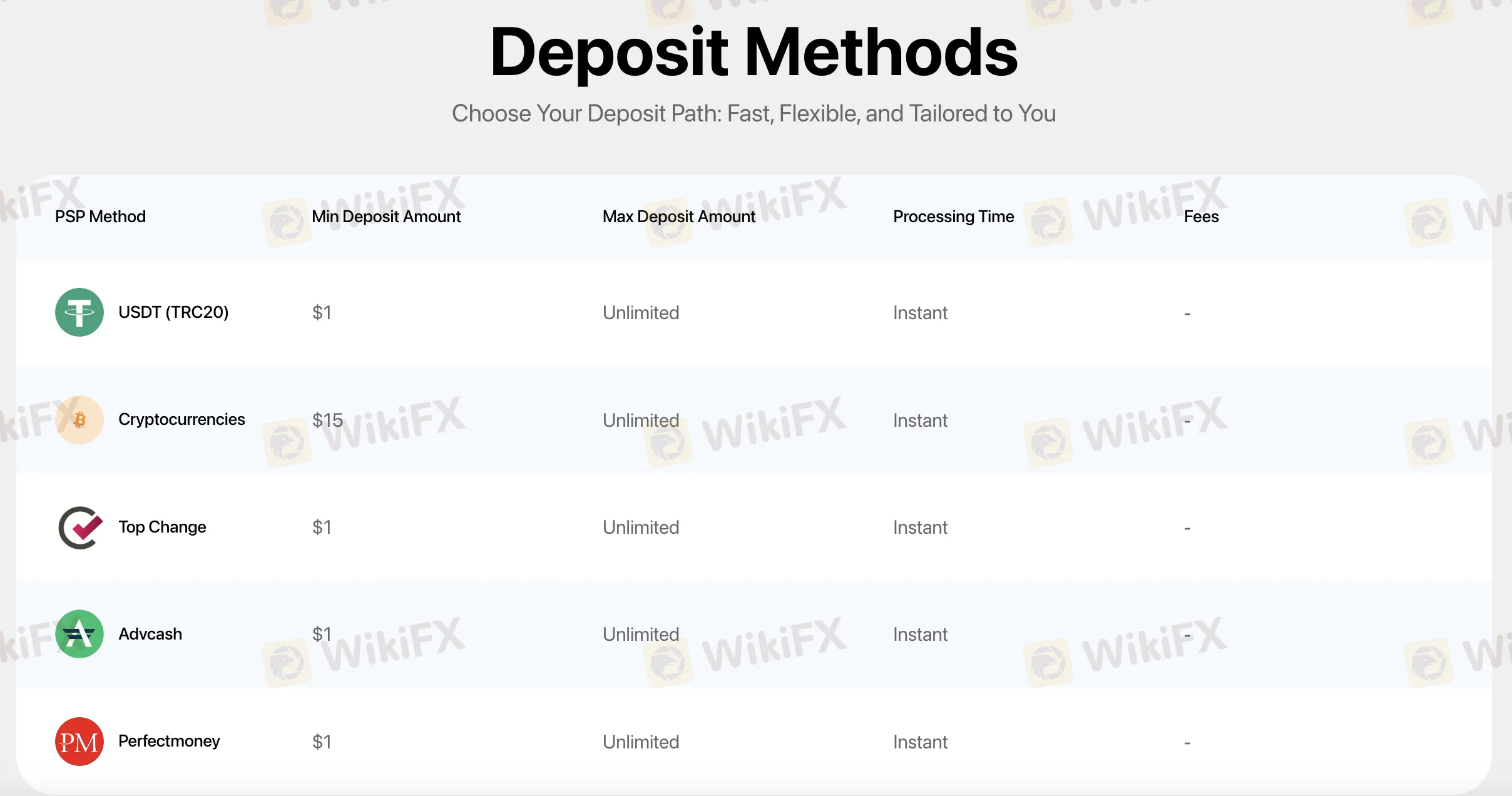

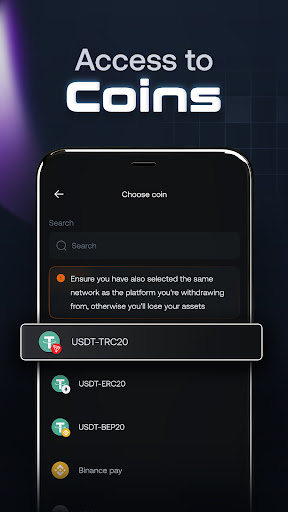

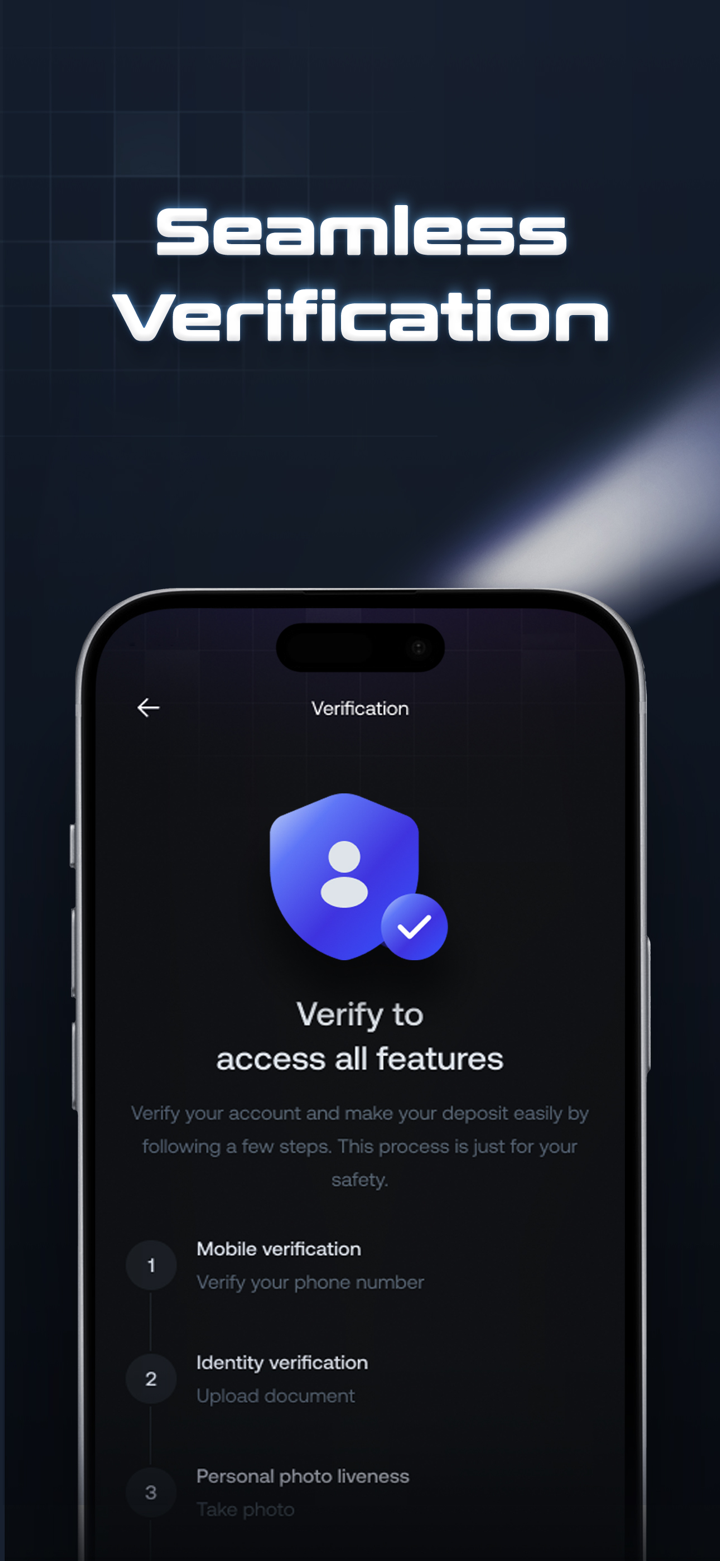

Deposit and Withdrawal

There are no hidden fees for deposits with Opofinance, and there are no deposit fees. The minimum deposit is as low as $1, depending on how you do it. You need to verify your account before you can make a withdrawal, and it happens swiftly. However, some methods charge minor fixed fees or fees based on a percentage.

Deposit Options

| Deposit Method | Minimum Deposit | Deposit Fees | Deposit Time |

| USDT (TRC20) | $1 | 0 | Instant |

| Cryptocurrencies | $15 | ||

| Top Change | $1 | ||

| Advcash | |||

| Perfectmoney |

Withdrawal Options

| Withdrawal Method | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| USDT (TRC20) | $15 | $3–6 | 24 hours |

| Cryptocurrencies | $10 | ||

| Advcash | $1 | 2% | |

| Perfectmoney | 0 |

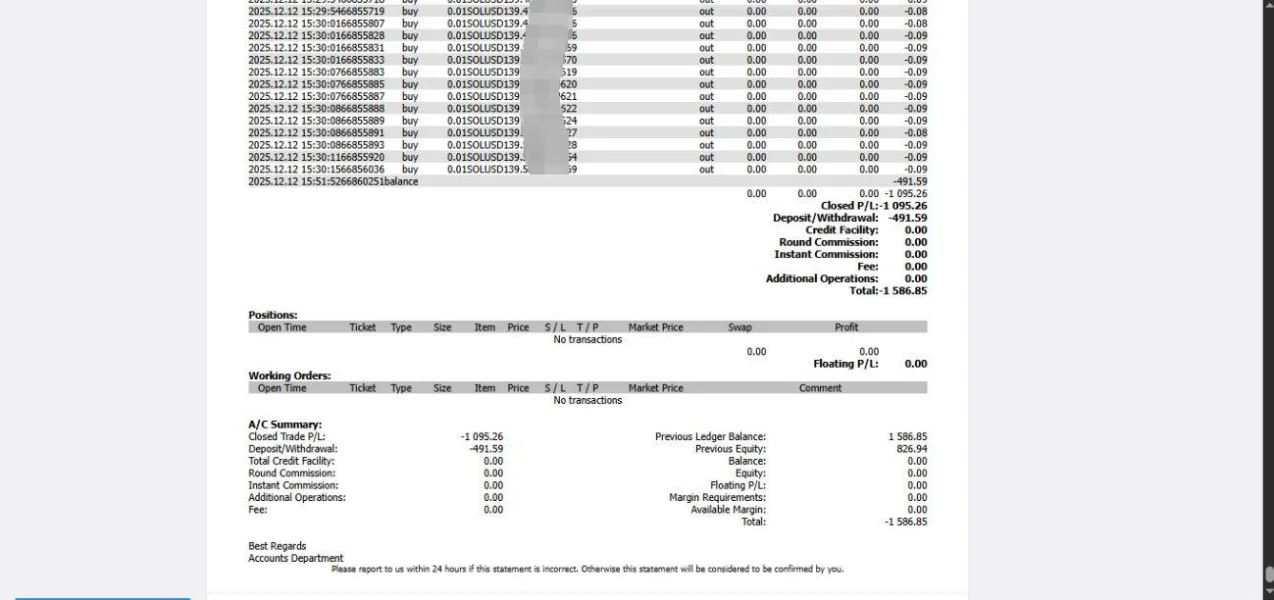

FX1093903482

Netherlands

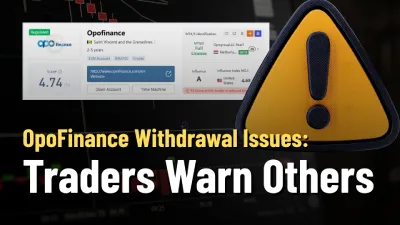

I think OPO FINANCE is a scam. All their services were good until I was losing money, but when I was making a profit with a bot, they closed my trades at a loss and gave me a loss of about $2,300 under the pretext of preventing infrastructure damage, even though I did nothing illegal to the best of my knowledge that they had the right to close my positions at a loss. Then when I asked them the reason many times, they did not provide any explanation from email or support, and then they completely deleted all my accounts and user account. Be very careful, friends.

Exposure

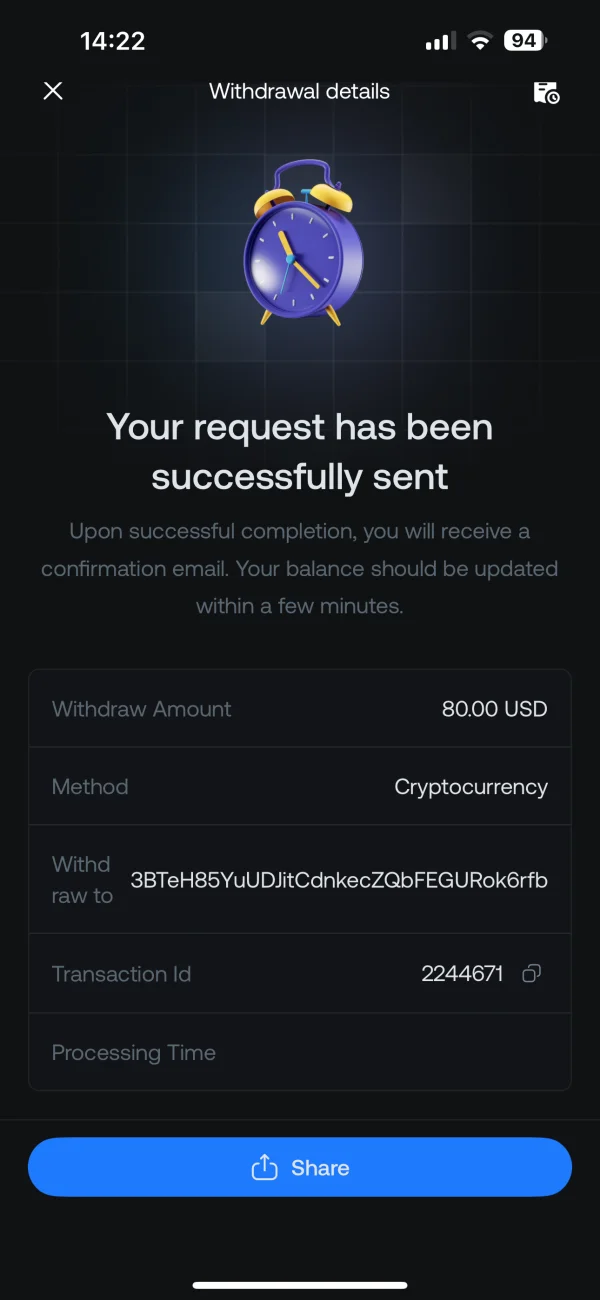

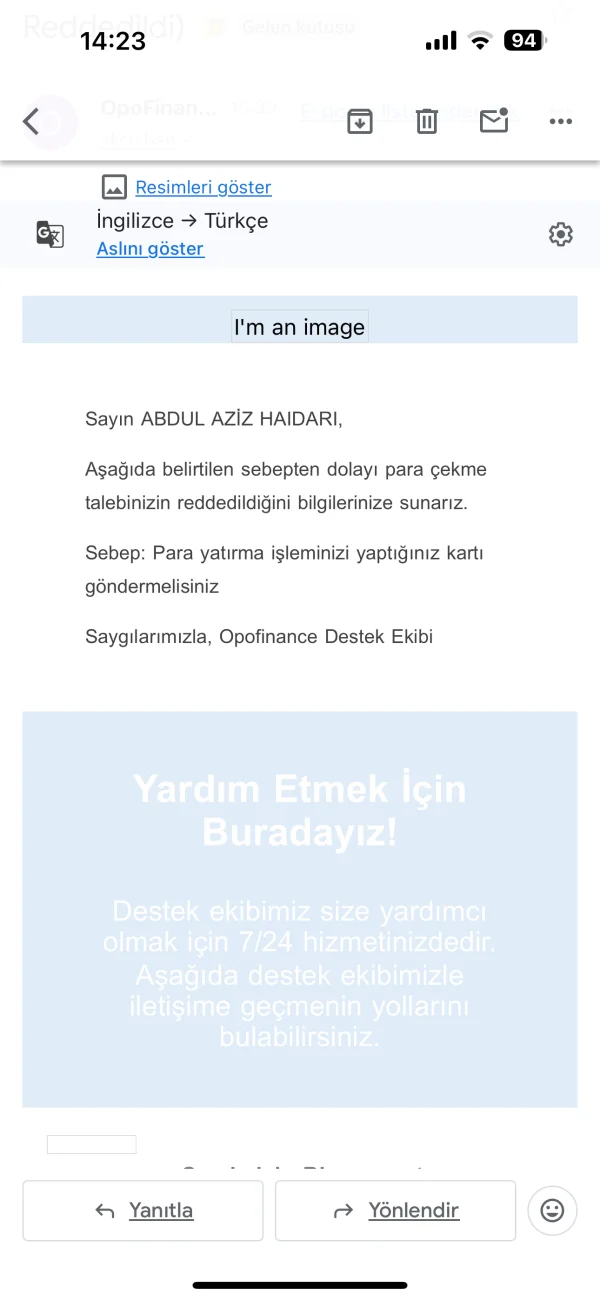

FX3952367275

Turkey

Warning: Do NOT Use This Broker! I am writing this to warn everyone — never use this broker. I deposited my money, and now I can’t withdraw it. Every time I try, they come up with excuses and delays. It feels like a scam. They are just finding ways to keep your money and avoid giving it back. This broker is completely untrustworthy. They are dishonest, manipulative, and offer no real support when you face issues. I’ve been hurt by this and I don’t want anyone else to go through the same pain. Once they take your money, they act like it’s theirs. This is the worst broker I’ve ever dealt with. Stay away from them — don’t let them steal your money like they did mine. Be smart. Protect yourself. Use a broker that is regulated, transparent, and trusted — not this one.

Exposure

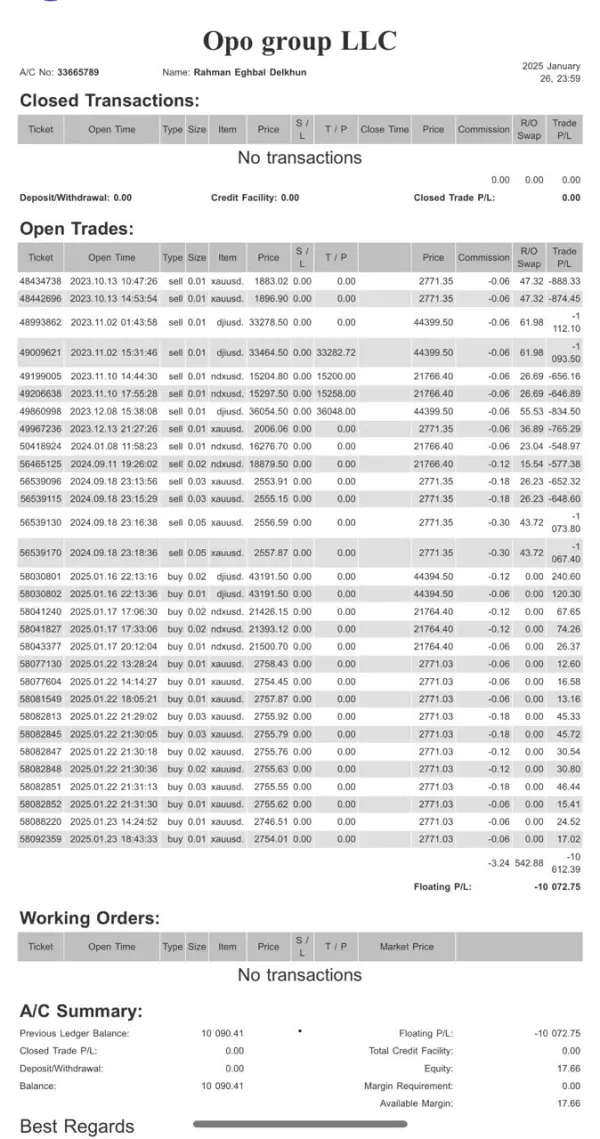

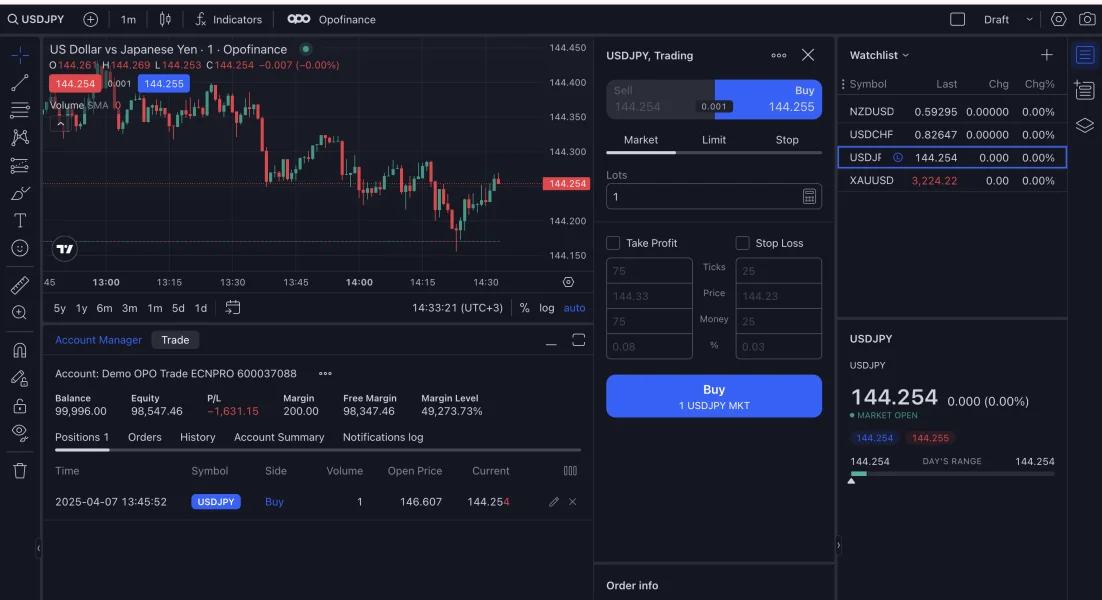

Rahman3741

India

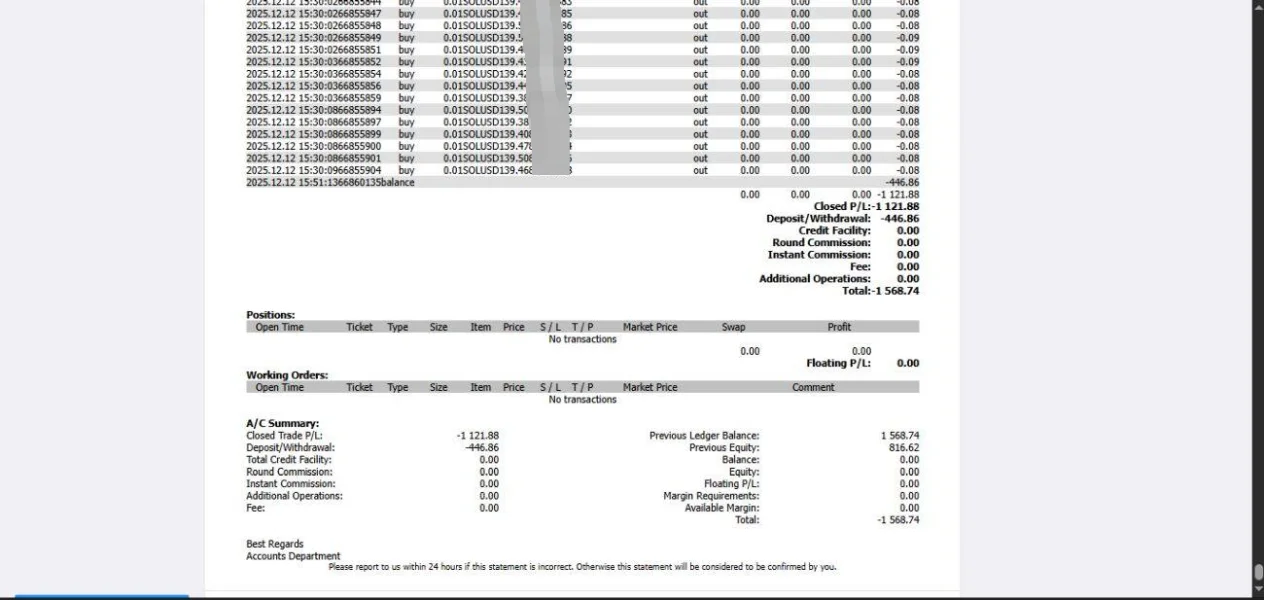

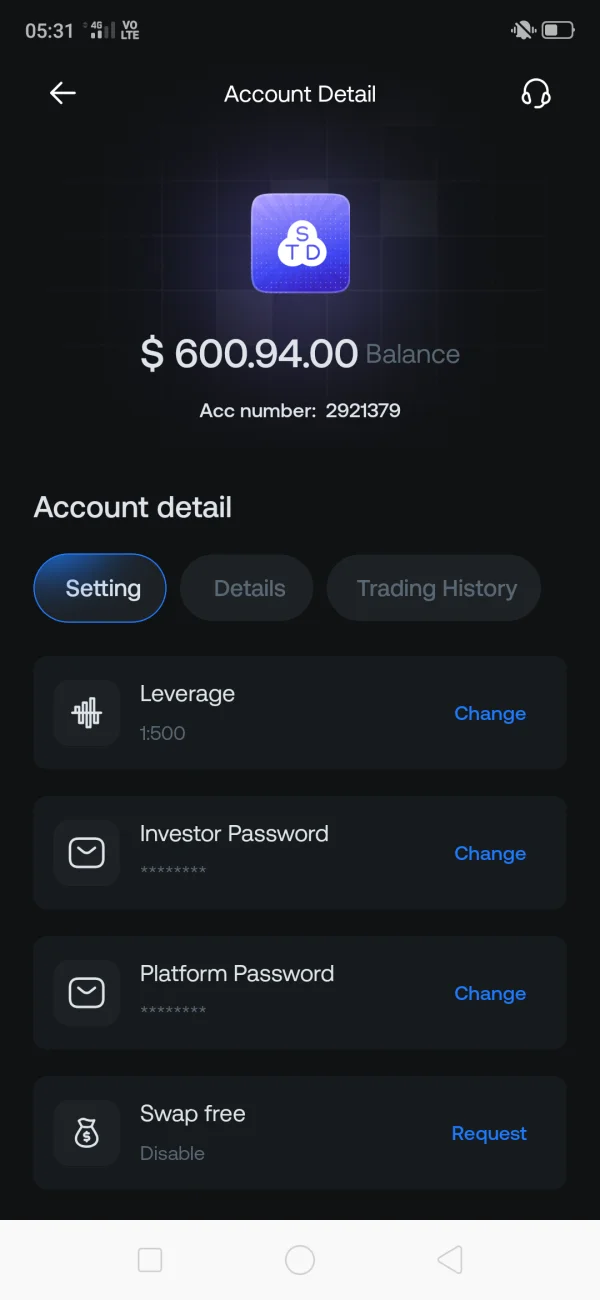

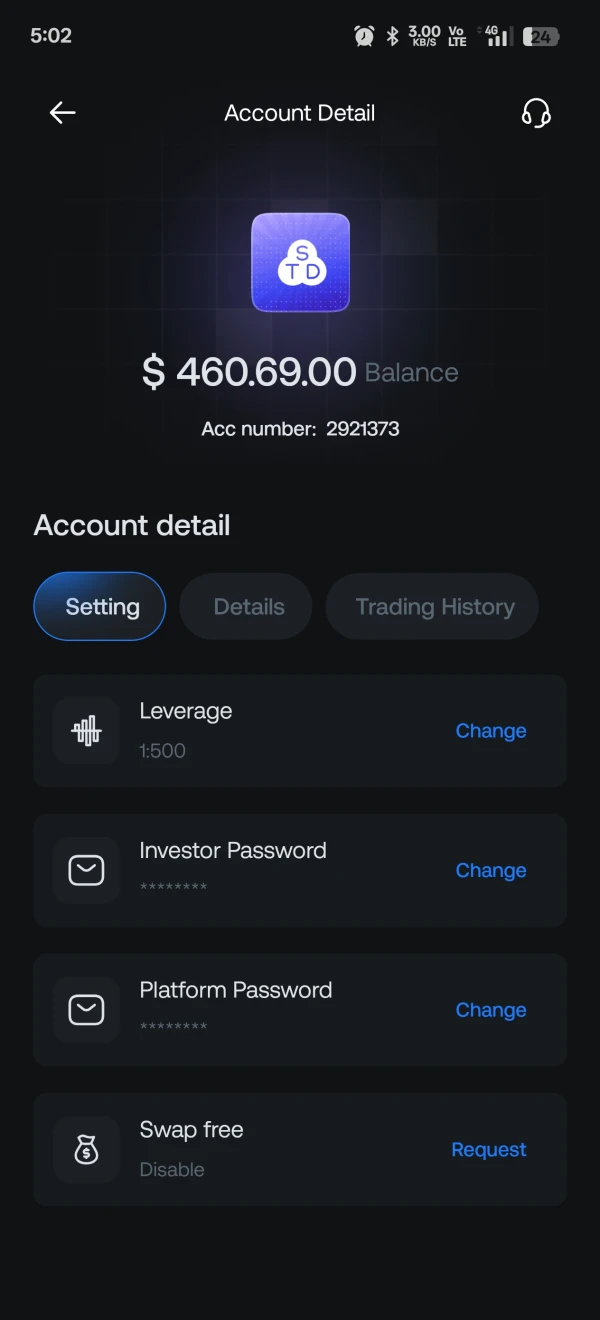

Hello, be careful with your capital in Opo Finance. This broker is a B-book and they make profits by call margin traders. No one is responsible for their problems. This company misleads traders with incorrect daily reports. They open trades themselves and withdraw money whenever they want. They can manually control and limit withdrawals. This is part of the problems that I experienced. They do not have a specific office and no user can complain. This is my ID number in Apo In this image, even though all my trades were hedges and according to the image, I had no negative swaps, my equity was deducted every day. I contacted the support, account manager, and support, but no one knew the reason, and in the end, the broker Call margin my acc

Exposure

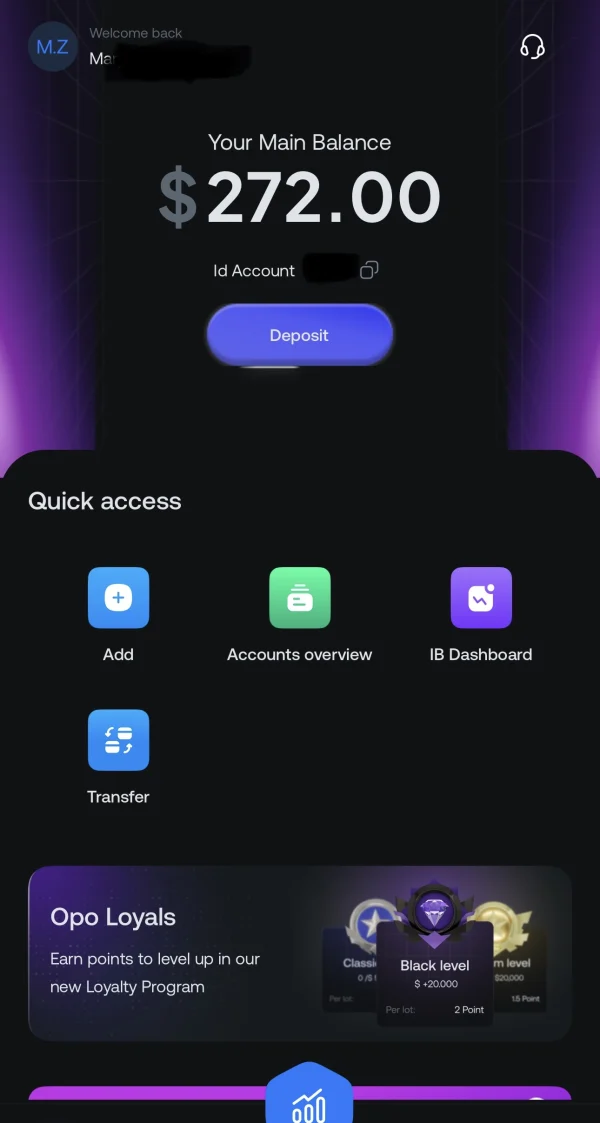

Maria za

Netherlands

I’ve had a great experience working with Spered. Their platform is user-friendly, the support team is always available, and deposits and withdrawals are fast and reliable. As someone active in the forex market, Spered has been one of my best choices.

Positive

FX2859746190

Turkey

The withdrawal took less than an hour. Surprisingly, the spreads do not get wider even during news time. The Opopotrade section is so helpful. I saw some comments, but I had the opposite experience 😏. For me, it was good and trustworthy.

Positive

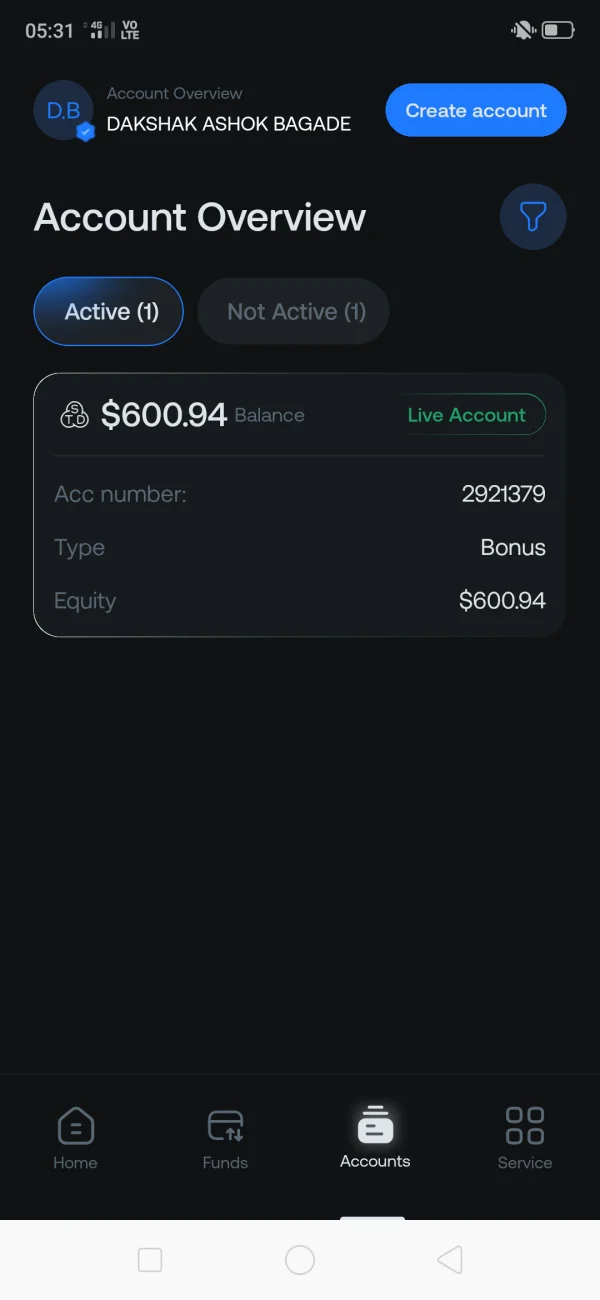

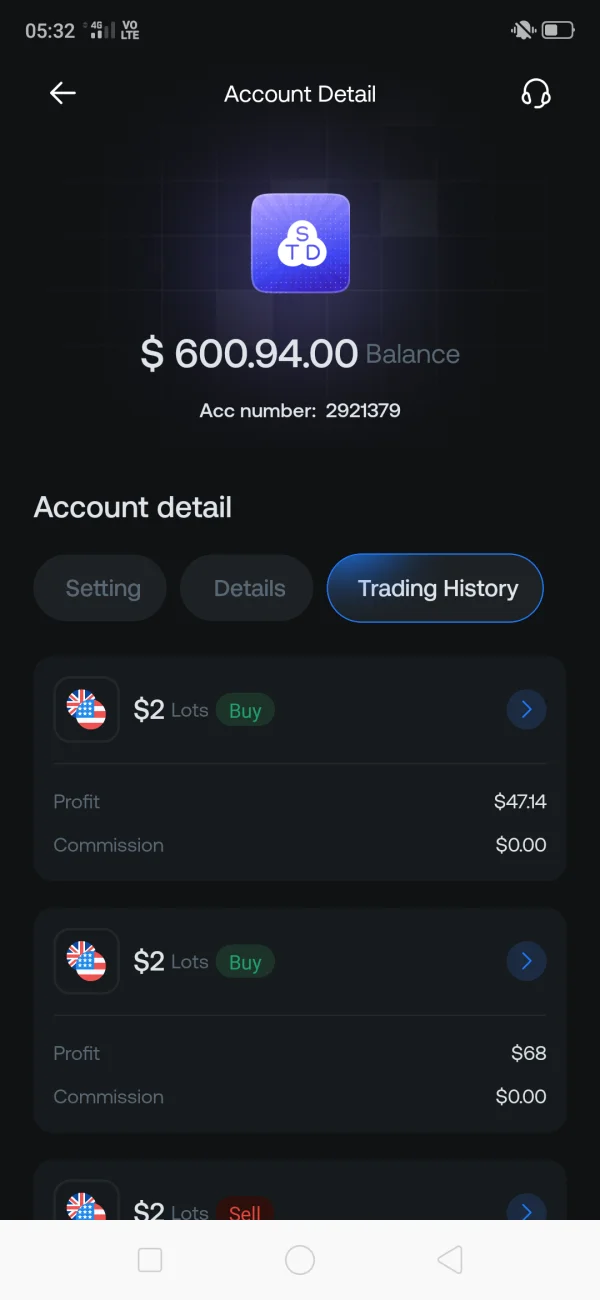

Dakshak

India

I strongly advise against using this platform. Despite completing the required 25 lots on their $100 no-deposit bonus over three weeks ago, my withdrawal request remains unprocessed. Their customer support provides no clear answers, repeatedly stating that my account is under review without offering a timeline or resolution. This lack of transparency and accountability is deeply concerning and suggests the platform is not trustworthy. My experience has been frustrating, with unmet promises and poor communication. If you value your time and resources, I recommend avoiding this platform and seeking a more reliable and reputable service provider instead.

Exposure

UnknownParticle

India

Do not waste your valuable time. This platform appears to be fraudulent. It has been over two weeks since I completed 25 lots on their $100 no-deposit bonus (NDB), yet they have failed to process my withdrawal request. Their customer support is unresponsive and unhelpful, repeatedly stating that my account is under review.

Exposure

1233294

Nigeria

It has really stepped up my trading with the Opo Social Trade feature. Copying trades from experienced traders has given me insights and boosted my confidence. It's great to learn from the pros and even mirror their success directly in my account. If you're looking to leverage expert strategies, Opofinance is worth checking out!

Positive

james46643

Hong Kong

The first liquidation, they said it was a normal situation. The second profit, they said no, the single to be deleted. The same time period my friend and I traded together, he slipped a loss, it did not return, and did not say that it is a violation. The platform is unscrupulous.

Exposure

MOHAMMED Qali

Turkey

The problem of withdrawing profits under the pretext of using a fraud company robot. Please pay attention

Exposure

MOHAMMED Qali

Turkey

I won a high amount I requested a withdrawal They don't accept my request and my account is closed

Exposure

Visal

Singapore

Overall, based on the information available, Opofinance appears to be a reputable and reliable online trading platform that provides a range of tools and resources to help traders succeed. As such, I would give Opofinance a five-star rating.

Positive

黎明不懂沙皮狗的忧伤

Philippines

Yes, I love this platform! $100 is enough for me to open a standard account, and I have a wide range of trading assets. Zero-commission trading environment is more suitable for me, only spreads calculated. Opofinance’s customer support is also responsive, always available to help you. An excellent broker. I’ve ready opened an account two days ago, so far so good.

Positive

乗聿夆

United States

Very pleasant trading experience! There are no commissions, the spread is very low, and the product range is very wide! I made a lot of money from copy trading! Great broker!

Positive