Company Summary

| TradeWill Review Summary | |

| Founded | 2024 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | FSA (Offshore regulated), ASIC |

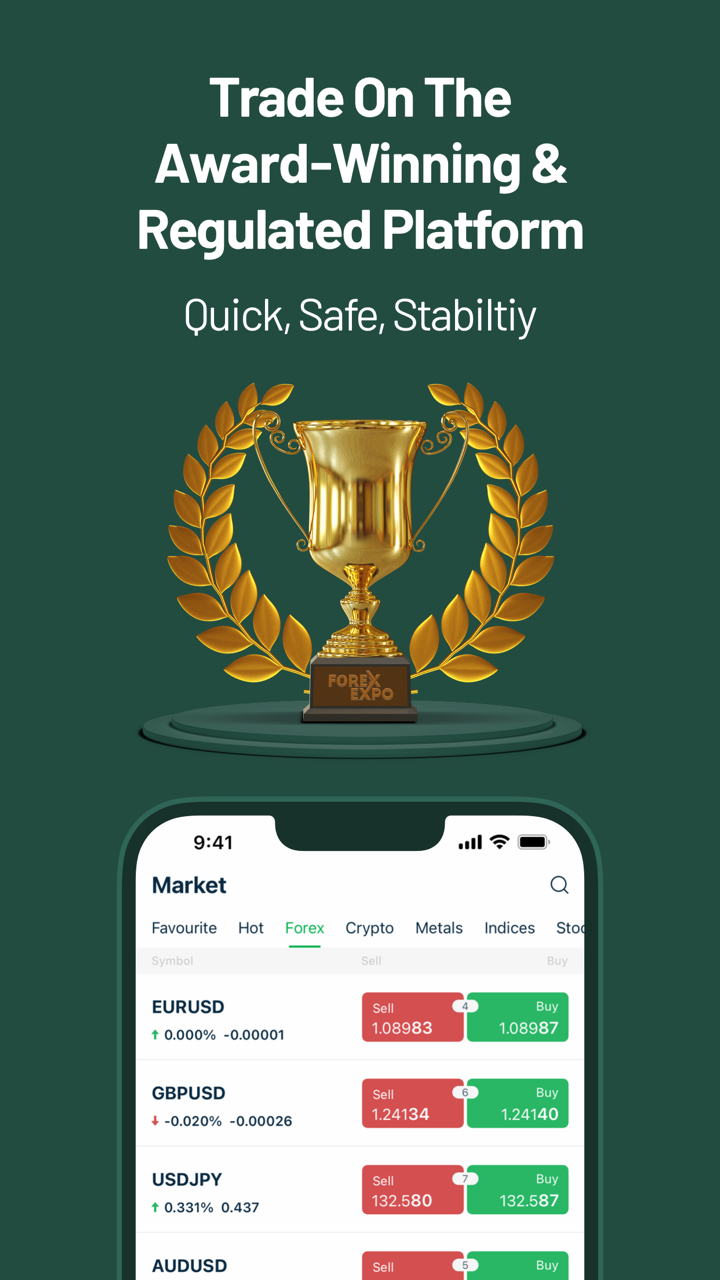

| Market Instruments | Forex, Metals, Indices, and Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| EUR/USD Spread | Floating around 0 pips |

| Trading Platform | Trade W, MT4 |

| Minimum Deposit | $3 |

| Customer Support | 24/7 Live Chat |

| Tel: +248 4224249 | |

| Email: support@trade-will.com | |

TradeWill Information

TradeWill, regulated by both the FSA and ASIC, is an online trading platform that offers trading in forex, metals, indices, and stocks on platforms like MT4 and their own Trade W platform. They provide leverage up to 1:500 and have a low minimum deposit of $3 for the Trade W account, though deposit and withdrawal fees are not mentioned.

Pros and Cons

| Pros | Cons |

|

|

|

|

| |

| |

|

Is TradeWill Legit?

TradeWill is officially licensed and offshore regulated by theSeychelles Financial Services Authority (FSA) in Seychelles under license number SD111.

The platform also has an Appointed Representative (AR) license regulated by the Australian Securities and Investments Commission (ASIC) in Australia with a license number of 001292696.

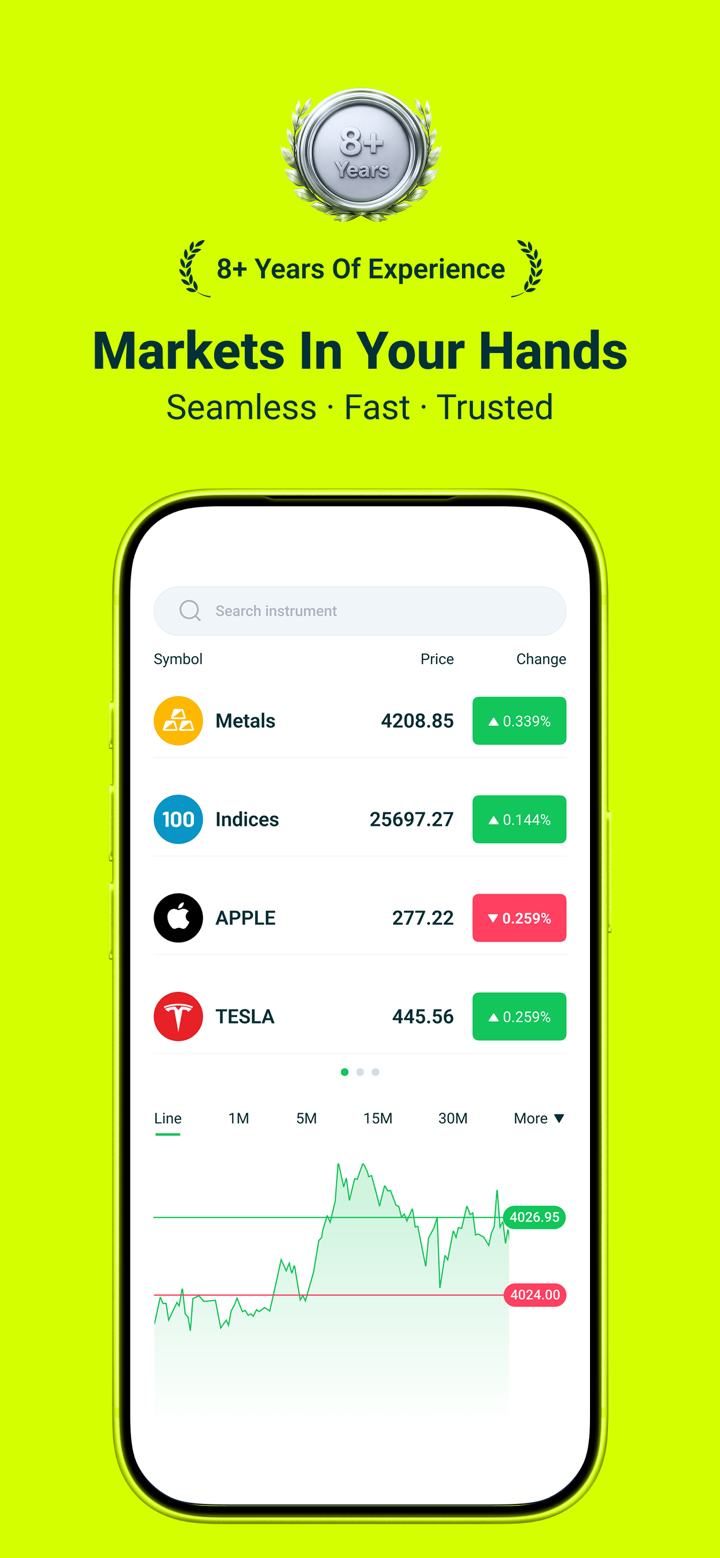

What Can I Trade on TradeWill?

TradeWill offers many financial instruments, mainly including forex, metals, indices, and stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

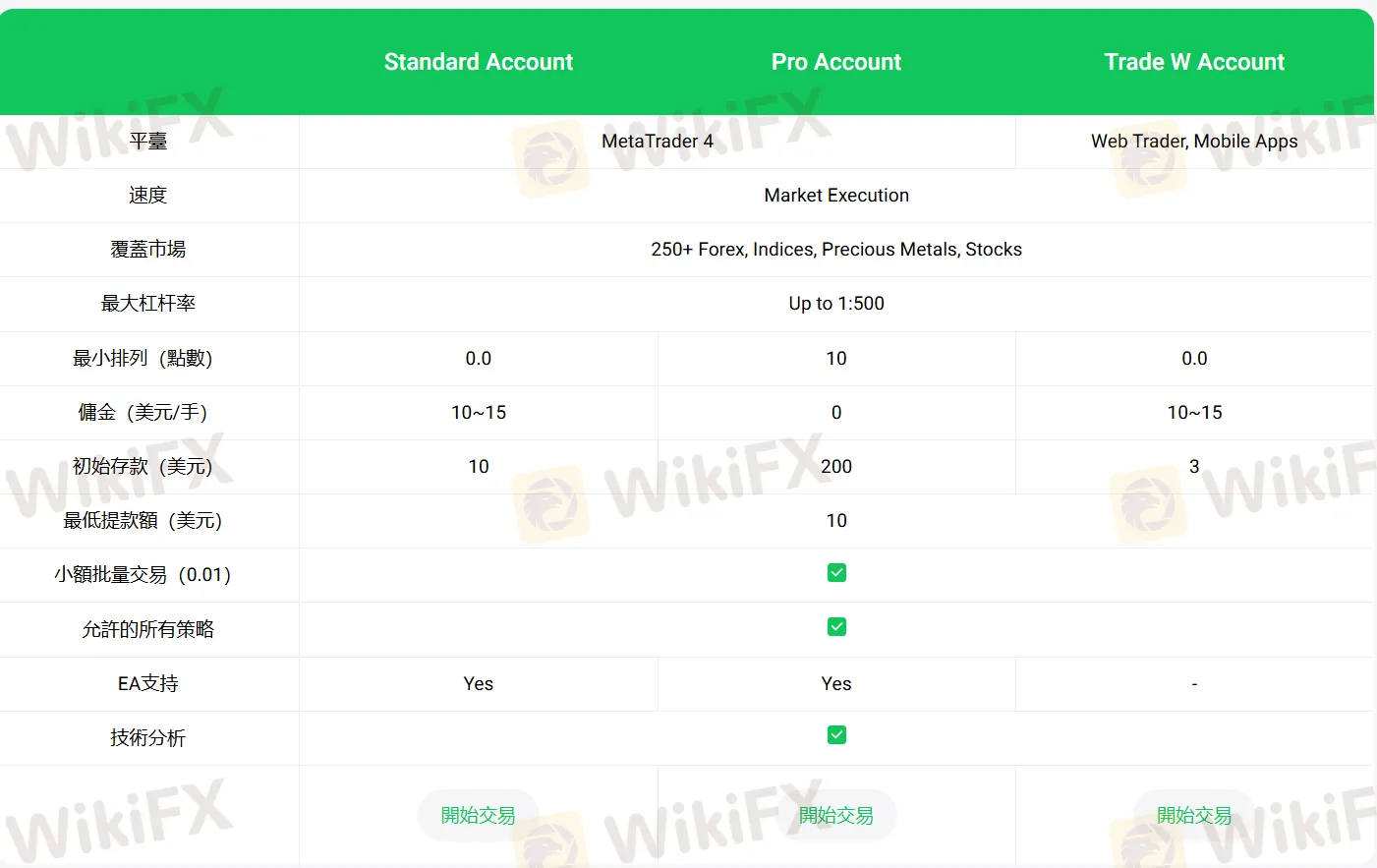

Account Type

| Account Type | Standard Account | Pro Account | Trade W Account |

| Platform | MetaTrader 4 | MetaTrader 4 | Web Trader, Mobile Apps |

| Execution | Market Execution | ||

| Markets | 250+ Forex, Indices, Precious Metals, Stocks | ||

| Minimum Deposit | 10 USD | 200 USD | 3 USD |

| Minimum Withdrawal | 10 USD | ||

| Leverage | Up to 1:500 | ||

| Spread | from 0 pips | from 10 pips | from 0 pips |

| Commission | 10~15 USD/lot | ❌ | 10~15 USD/lot |

| Minimum Lot Size | 0.01 | ||

| All Strategies Allowed | ✔ | ||

| EA Support | ✔ | - | |

| Technical Analysis | ✔ | ||

Leverage

TradeWill offers leverage up to 1:500 for its trading accounts. Note that high leverage can amplify not only profits but also losses.

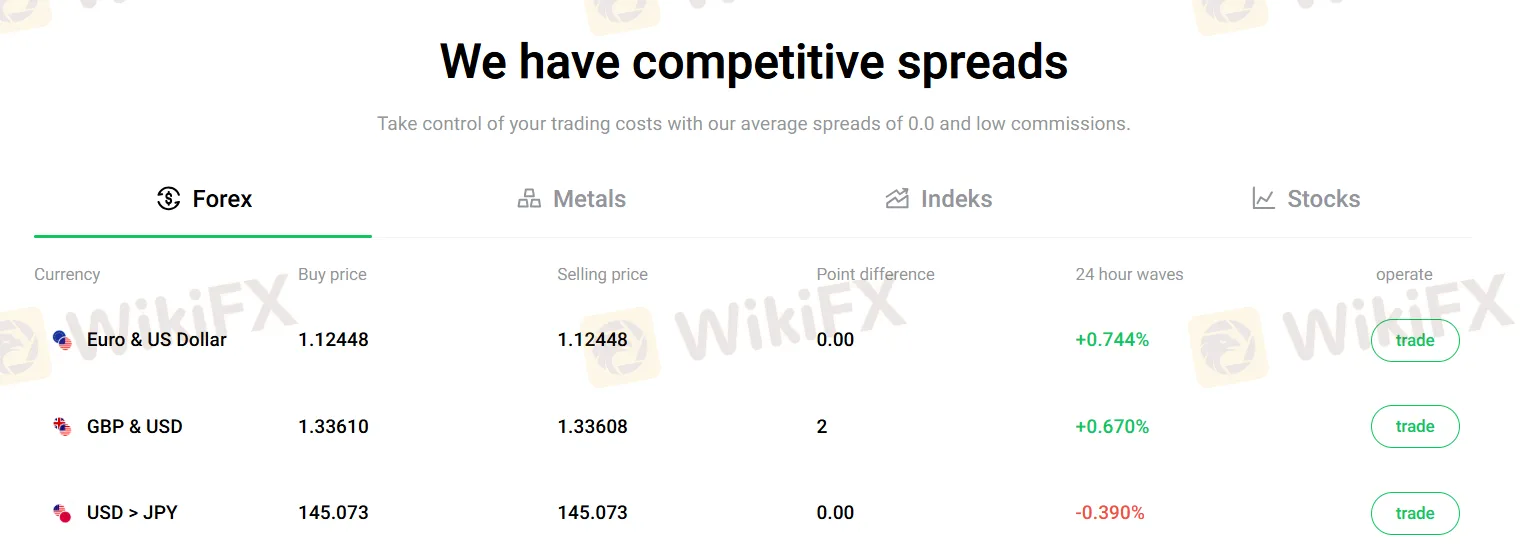

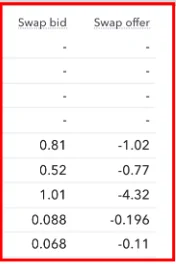

TradeWill Fees

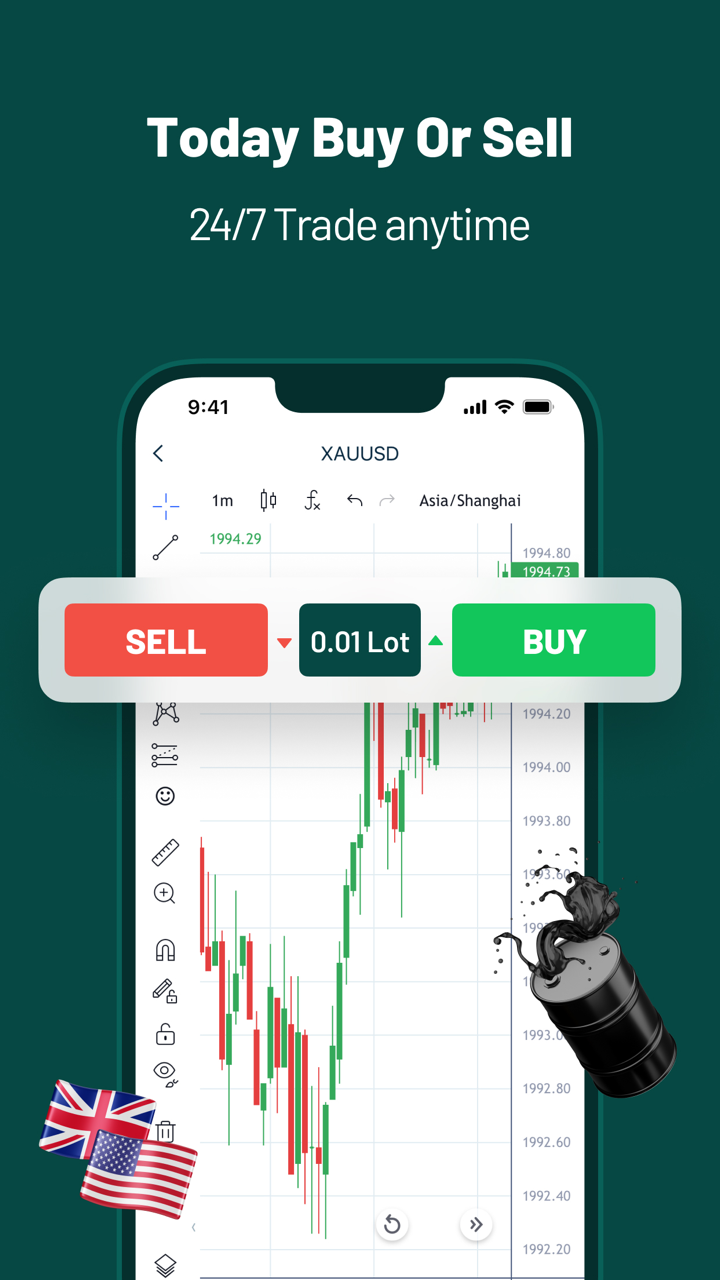

TradeWill offers spreads starting from 0 pips on both its Standard and Trade W accounts, while the Pro account has a minimum spread of 10 pips. Commission structures also vary, with the Standard and Trade W accounts charging $10-$15 per lot, and the Pro account offering zero commission.

| Account Type | Standard Account | Pro Account | Trade W Account |

| Spread | from 0 pips | from 10 pips | from 0 pips |

| Commission | 10~15 USD/lot | ❌ | 10~15 USD/lot |

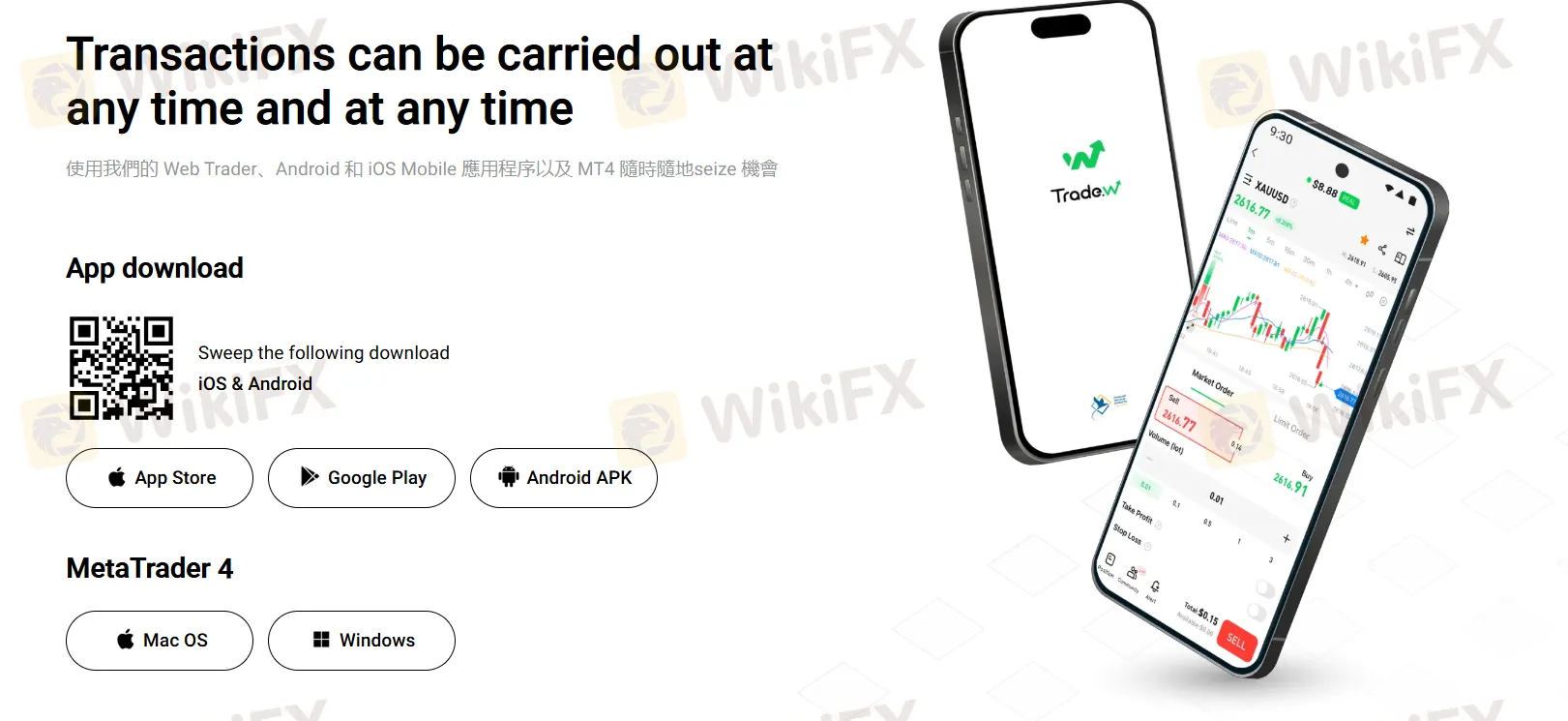

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Trade W | ✔ | iOS, Android, Desktop, Web | / |

| MetaTrader 4 | ✔ | MacOS, Windows | Beginners |

| MetaTrader 5 | ❌ | / | Experienced traders |

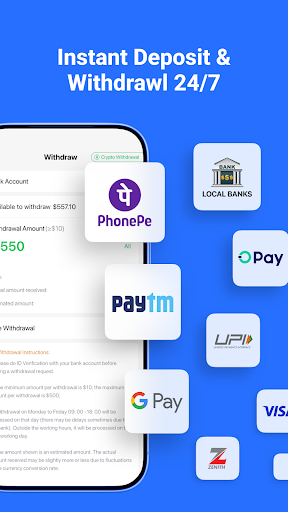

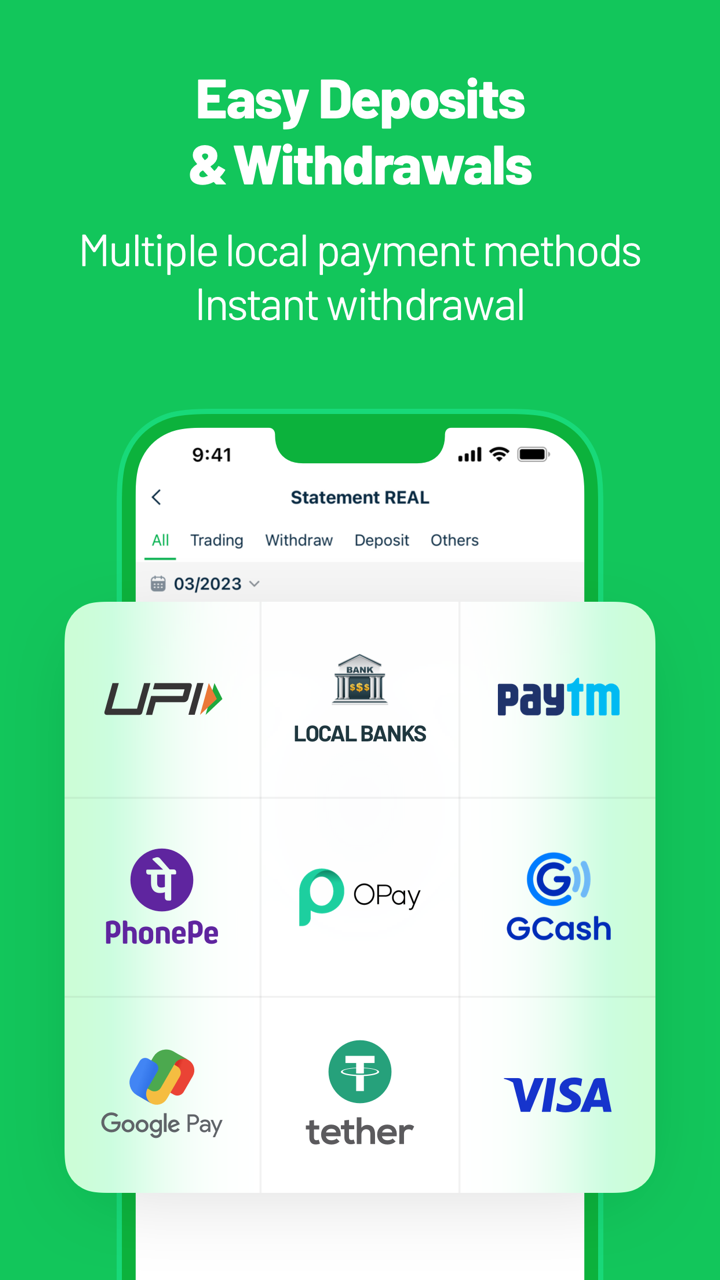

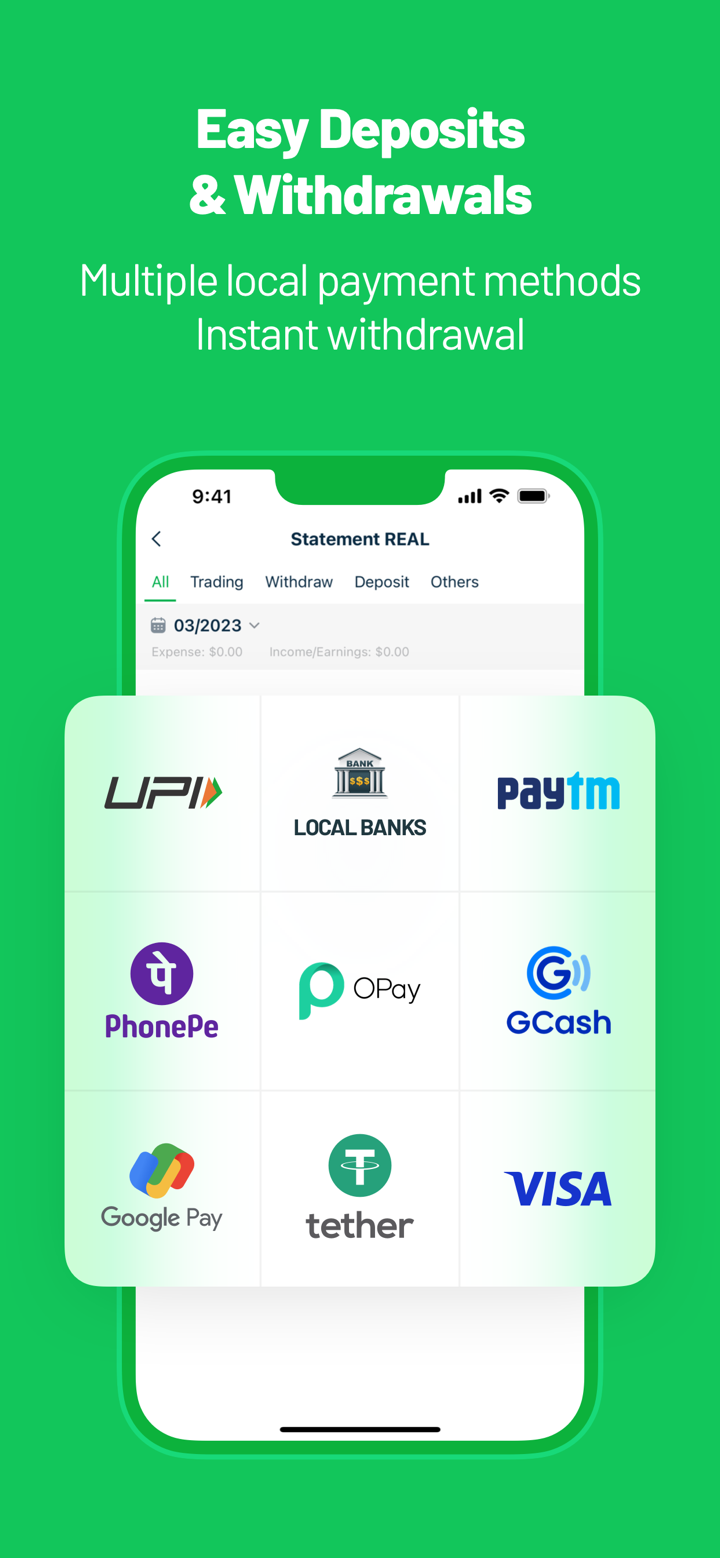

Deposit and Withdrawal

TradeWill has varying minimum deposits: $10 for the Standard Account, $200 for the Pro Account, and $3 for the Trade W Account. The minimum withdrawal amount is $10. The fees for deposit and withdrawal are not mentioned.

| Account Type | Standard Account | Pro Account | Trade W Account |

| Minimum Deposit | 10 USD | 200 USD | 3 USD |

| Minimum Withdrawal | 10 USD | ||

Denn

Malaysia

I've been using Trade W for a few weeks and its been great. The interface is clean, trades are smooth, and deposits/withdrawals are fast. Easy to navigate even if you're new to trading.They even have free demo and beginer tutorial for new users. Highly recommended! 👏

Positive

Wind5719

Malaysia

I would like to highlight this platform with their online web platform. It was easy to use and i can easily understand which button is for buy and sell. They did a great job on their interface.

Positive

doudu

Australia

I've used TradeWill for a few months. The app is user-friendly and the interface is smooth. Deposits and withdrawals are quick and hassle-free. It's a reliable app, great for trading across various markets.

Positive

FX1669530399

United States

TradeWill is the only broker that I have seen true zero spread. There are many brokers that claims zero spread but in reality they are lying. Exness is a good choice for scalpers, specially those who think to zero spread but only comission.

Positive

FX1520052774

Nigeria

Ever waited for a slow train that never arrived? That's how it felt with TradeWill. While I waited for my orders to go through, the market moved on, and not in my favor.

Neutral

FX1519339867

Malaysia

During my trades involving the EUR/USD pair, I often observed the spreads to be as low as 0.5 - 1 pips. This made a significant difference to my potential profits. In terms of withdrawal speed, TradeWill seriously impressed me. Money withdrawal was as quick as making instant noodles, with my funds reaching me in record time, usually within 24 hours of my request.

Neutral