Company Summary

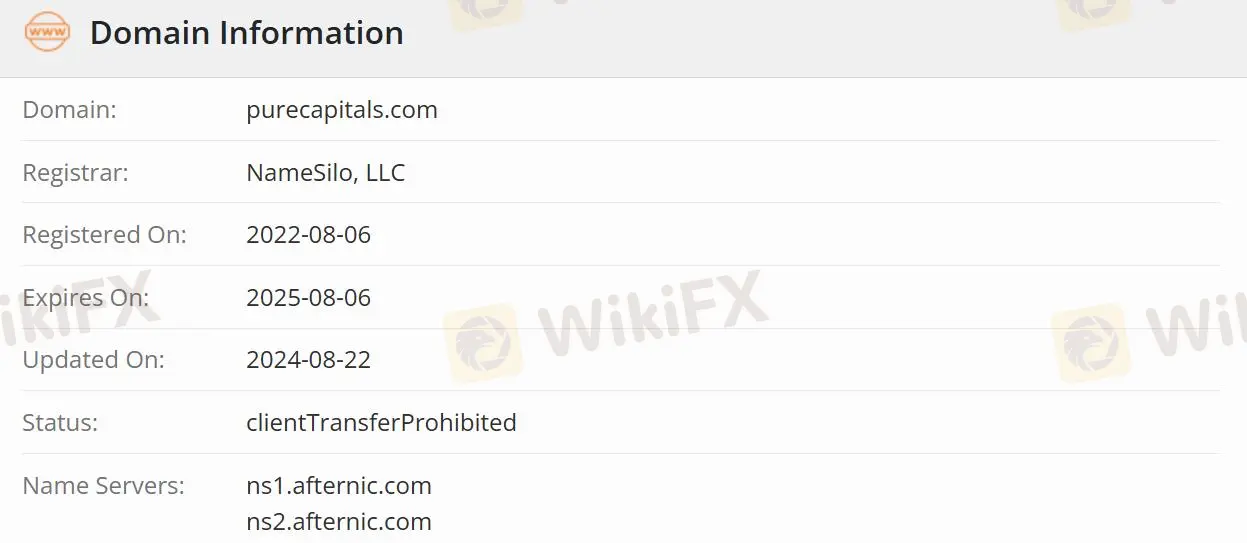

Note: PURECAPITALS's official website: https://purecapitals.com/ is currently inaccessible normally.

PURECAPITALS Information

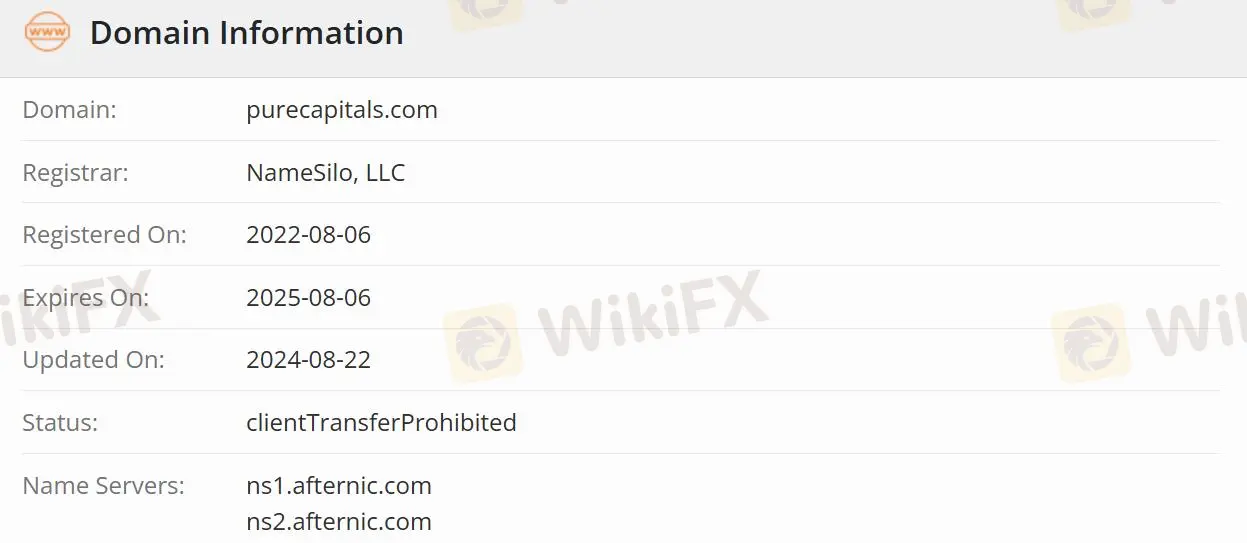

PURECAPITALS is an unregulated brokerage company registered in the United States. The company provides 4 major investment plans with a minimum fee of $100 including welcome-pack, starter, open-minds, and extra. While the broker's official website has been closed, so traders cannot obtain more security information.

Note: PURECAPITALS's official website: https://purecapitals.com/ is currently inaccessible normally.

PURECAPITALS Information

PURECAPITALS is an unregulated brokerage company registered in the United States. The company provides 4 major investment plans with a minimum fee of $100 including welcome-pack, starter, open-minds, and extra. While the broker's official website has been closed, so traders cannot obtain more security information.

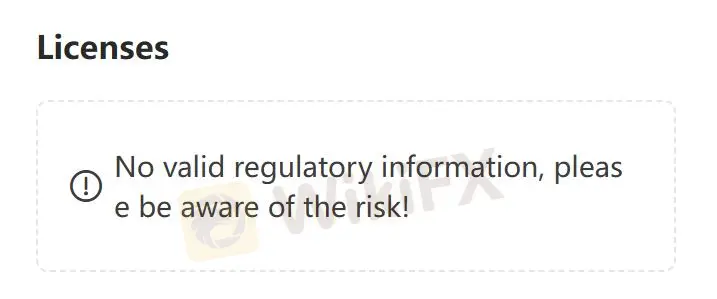

Is PURECAPITALS Legit?

PURECAPITALS is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with PURECAPITALS.

Downsides of PURECAPITALS

- Unavailable Website

Because of the inaccessible PURECAPITALS's official website, traders raise concerns about its reliability and accessibility.

- Lack of Transparency

Since PURECAPITALS does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

PURECAPITALS is not regulated, which increases the possibility of fraud.

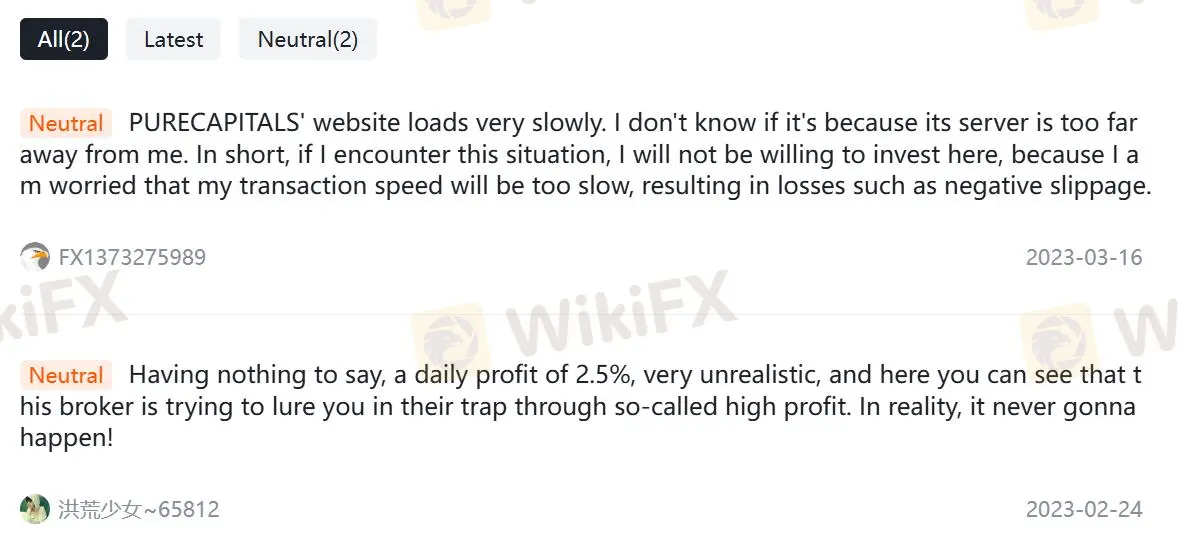

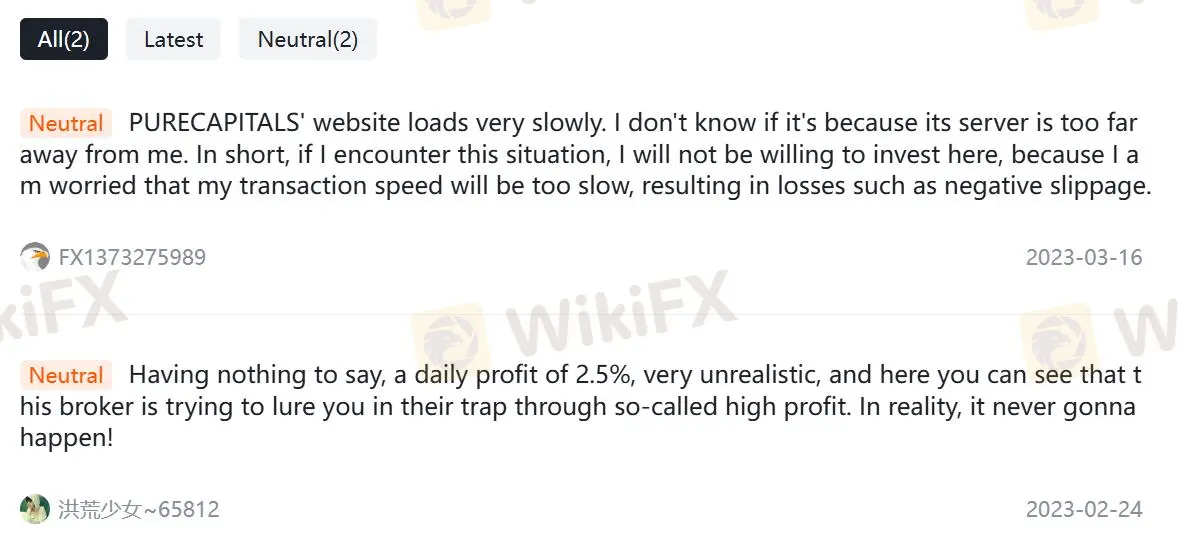

Negative PURECAPITALS Reviews on WikiFX

On WikiFX, traders must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

Currently, there are two pieces of PURECAPITALS neutral, expressing concerns about the brokers. You may visit: https://www.wikifx.com/en/comments/detail/Co202303167961297188.html https://www.wikifx.com/en/comments/detail/Co202302244711597395.html.

Conclusion

PURECAPITALS Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Is PURECAPITALS Legit?

PURECAPITALS is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with PURECAPITALS.

Downsides of PURECAPITALS

- Unavailable Website

Because of the inaccessible PURECAPITALS's official website, traders raise concerns about its reliability and accessibility.

- Lack of Transparency

Since PURECAPITALS does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

PURECAPITALS is not regulated, which increases the possibility of fraud.

Negative PURECAPITALS Reviews on WikiFX

On WikiFX, traders must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

Currently, there are two pieces of PURECAPITALS neutral, expressing concerns about the brokers. You may visit: https://www.wikifx.com/en/comments/detail/Co202303167961297188.html https://www.wikifx.com/en/comments/detail/Co202302244711597395.html.

Conclusion

PURECAPITALS Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.