Euro Braces for ECB and Draghi, US Dollar Eyes CPI Data

Abstract:Global traders will be in for a turbulent day as the ECB prepares to announce its rate decision which may inspire market-wide volatility. This may be amplified by US CPI data.

US Dollar, ECB, Euro – TALKING POINTS

Markets brace for ECB rate decision: will Draghi cool or amplify rate cut bets?

US CPI data may enlarge excessive easing bets if report falls short of forecasts

Fed has reiterated it is using a data-dependent approach. Will markets learn?

Learn how to use political-risk analysis in your trading strategy!

Markets will have a perilous day as the ECB prepares to announce its much-awaited rate decision and whether it will reintroduce unorthodox easing measures. Soon-to-be replaced central bank President Mario Draghi will be holding his last press briefing as head of the European Central Bank. Will he be able to meet the markets lofty expectations and tell them he will do “whatever it takes”, or will he crush easing bets and send traders flailing?

ECB and Draghi: Whatever it Takes, or Just Simply Whatever?

Eurozone inflation has been under pressure amid regional geopolitical shocks against the backdrop of a slowing global economy plagued by the US-China trade war. These factors have pressured price growth and prompted the ECB to shift from considering raising rates to now not only cutting but also possibly reintroducing its quantitative easing program after just having weaned markets off of it in December.

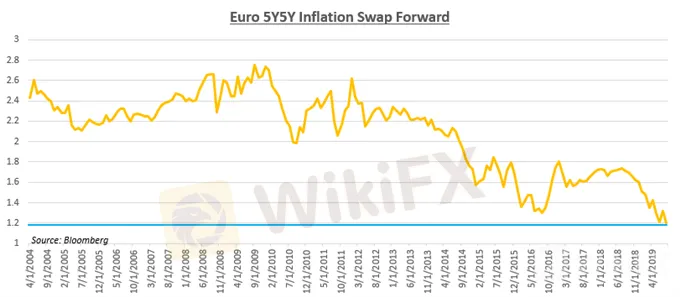

Looking at a monthly chart, the 5Y5Y Euro inflation forward swap is currently at its lowest level ever, hovering at around 1.206. Inflationary prospects are clearly not looking good and deteriorating fundamentals are not inspiring capital inflow into the Euro. German bunds are hovering in negative territory, and the global market for negative-yielding bonds continues to swell beyond $14 trillion as traders anticipate rate cuts ahead.

US CPI Data: Underwhelming Reading May Bloat Unrealistic Easing Expectations

Markets will be closely watching the publication of US CPI data, likely with built-in hopes that the report will underwhelm and provide even more impetus for the Fed to implement accommodative monetary policy. It might also then amplify the market‘s swollen rate cut bets, potentially setting equity markets up for failure when the Fed fails to meet the market’s aggressive expectations.

Such has been the pattern for most of 2019, most notably was during the July FOMC meeting where despite delivering a 25 basis-point cut, the US Dollar rose at the expense of equities. Chairman Jerome Powell cooled market expectations by reiterating his position that the Fed is data-dependent and will adjust policy in accordance to the prevailing economic circumstances that fall under the purview of its mandate.

Chart of the Day: European Inflation is not Looking Too Hot

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

U.S. stock indexes retreated from their record-high levels. The Dow Jones Industrial Average dropped 274 points (-0.71%) to 38,380, the S&P 500 fell 15 points (-0.32%) to 4,942, the Nasdaq 100 was down 29 points (-0.17%) to 17,613.

Nvidia (NVDA) gained 4.79% to $693.32, marking a third consecutive record close. Goldman Sachs raised its price target on the stock to $800. Tesla (TSLA) fell 3.65% to $181.06, the lowest close since May 2023. ON Semiconductor (ON) jumped 9.54% as fourth-quarter results exceeded market expectations.

US Dollar Soars on Higher Yields and Bank of England No-Go. Where to for USD?

US Dollar, Bank of England, Treasuries, OPEC+, Crude Oil, Japan - Talking Points

Euro Overview

Euro Jumps to 1-Month High as ECB's Lagarde Fails to Calm Rate Hike Bets.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CFI Collaborates with TradingView for Enhanced Trading Experience

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator