Company Summary

Note: Atlass's official website: http://www.atlassportfolios.com is currently inaccessible normally.

| Atlass Review Summary | |

| Founded | 2018 |

| Registered Country/Region | Nigeria |

| Regulation | No Regulation |

| Service | Stock Broking, Reconciliation, Verification & Collection of Outstanding Benefit, Investment Advisors, Investment Analysis, Portfolio Managers |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | CitiTrader |

| Minimum Deposit | / |

| Customer Support | Phone: +2347025005058 |

| Email: info@atlassportfolios.com | |

| Address: 80, Norman Williams Street, Off Awolowo Road, Ikoyi, Lagos | |

Founded in 2018, Atlass is an unregulated financial firm based in Nigeria. It claims to offer Stock Broking, Reconciliation, Verification & Collection of Outstanding Benefit, Investment Advisors, Investment Analysis, and Portfolio Managers.

Pros and Cons

| Pros | Cons |

| / | Non-functional Website |

| Lack of transparency | |

| No regulation | |

| Limited info on trading fees | |

| No demo accounts |

Is Atlass Legit?

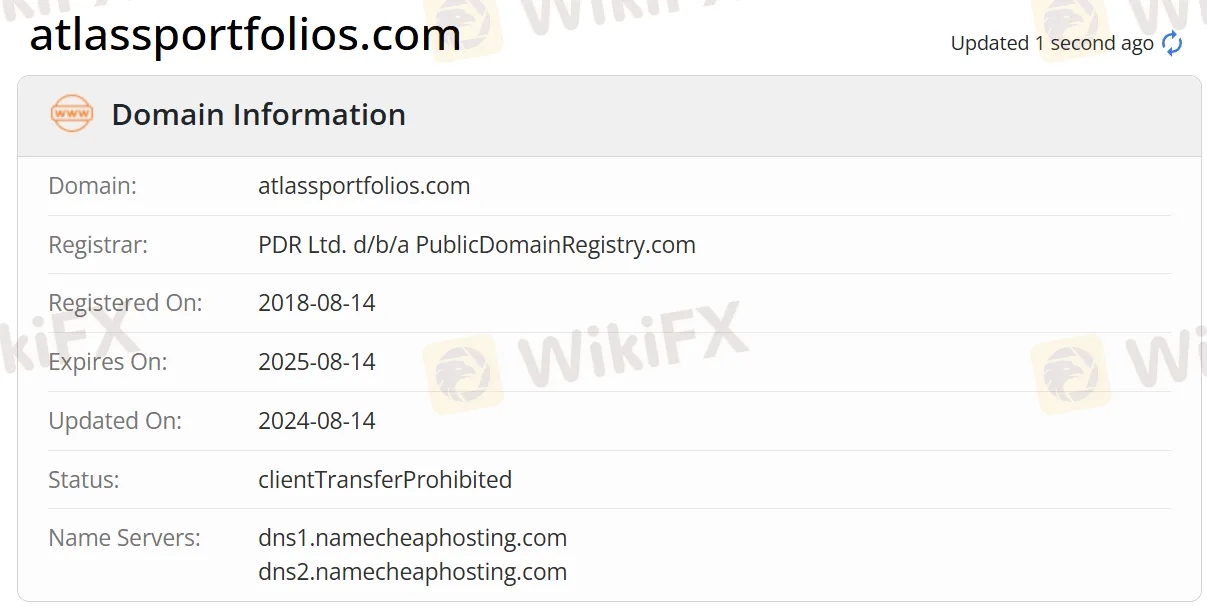

At present, Atlass lacks valid regulation. Its domain was registered on Aug 14, 2018, and the current status is “client Transfer Prohibited”. We suggest you look for regulated brokers.

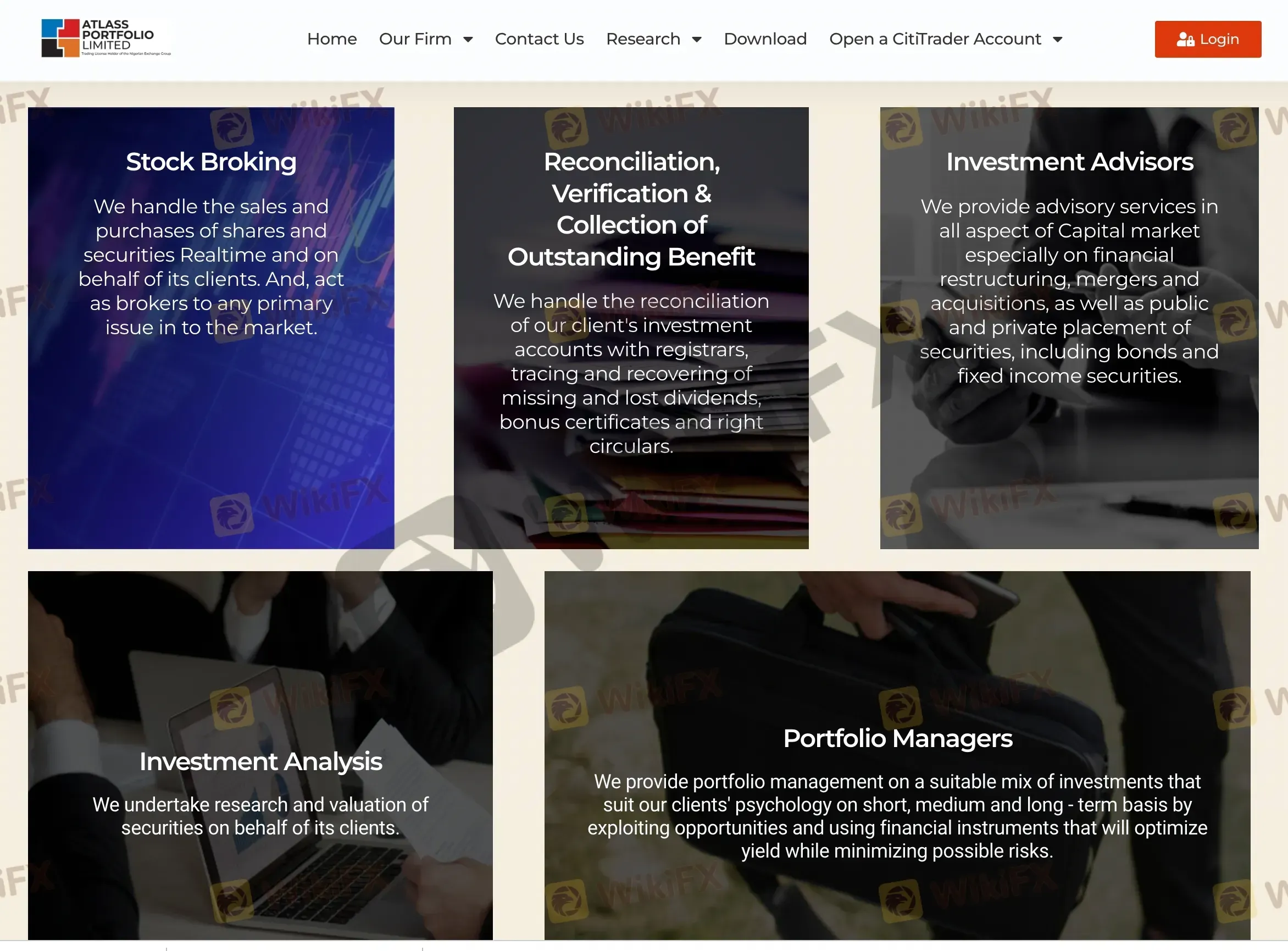

Service

Atlass provides services such as Stock Broking, Reconciliation, Verification & Collection of Outstanding Benefit, Investment Advisors, Investment Analysis, and Portfolio Managers.

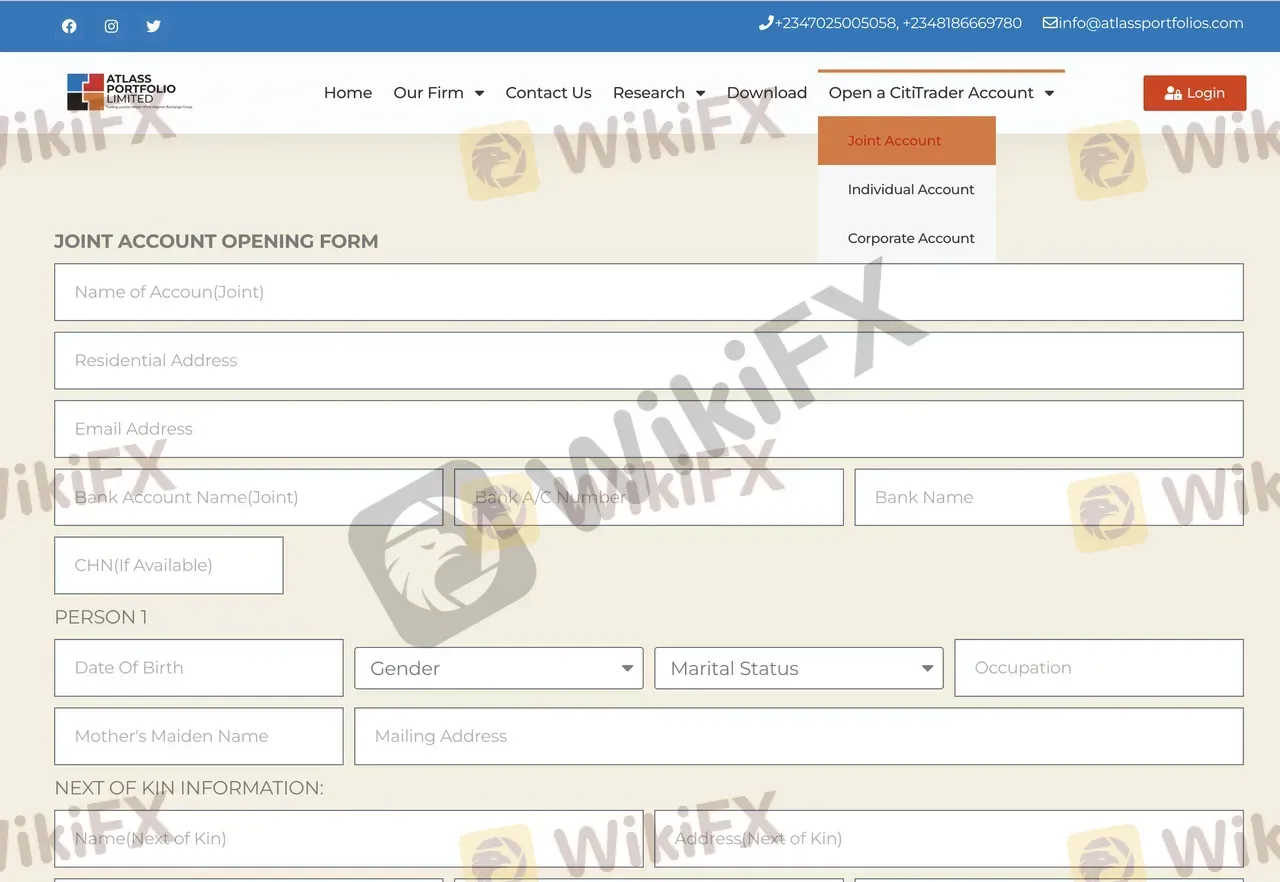

Account Type

Atlass offers Joint Accounts, Individual Accounts, and Corporate Accounts.

Trading Platform

Atlass provides CitiTrader as its trading platform.