EU Is Said to Lean Against a Merger of Italy Broadband Networks

Abstract:The European Union‘s antitrust arm would likely oppose Italy’s plan to create a single national broadband network controlled by former monopoly Telecom Italia SpA, according to people familiar with the matter.

The European Union‘s antitrust arm would likely oppose Italy’s plan to create a single national broadband network controlled by former monopoly Telecom Italia SpA, according to people familiar with the matter.

EU competition officials led by Margrethe Vestager are concerned that a proposed combination of Telecom Italias landline network and its smaller, state-backed rival Open Fiber SpA would create a monopoly, reversing two decades of deregulation, said the people, who asked not to be identified as the deliberations are private.

Telecom Italia Chief Executive Officer Luigi Gubitosi has been pushing for an Open Fiber deal for months, and has made it clear the company won‘t cede control of the network once it becomes Italy’s single provider of wholesale fixed-line broadband access.

It plans to design a full set of corporate governance remedies to guarantee the rights of minority shareholders, according to another person familiar with the matter.

Telecom Italia Takes First Step in Contes Single-Network Plan

However, EU officials are wary of a wholesale-only carrier being controlled by the countrys biggest communication service provider, the people said. It is common for companies to discuss their tie-up plans informally with antitrust officials before any official notification.

A representative for Telecom Italia declined to comment. The European Commission said in an emailed statement that it “is following the developments closely,” and declined further comment.

The EU‘s view will matter as it could potentially block a deal if it’s ever formally agreed, even though both companies are based in Italy and the bloc weighs in mostly on cross-border tie-ups. The EU has frequently refused to allow national authorities to review telecom deals even when they are within a single country.

The idea of unifying the country‘s landline infrastructure has strong government backing. Prime Minister Giuseppe Conte has made fixing Italy’s slow broadband speeds a top priority as part of a wider push to give the state a deeper role in the economy.

{18}

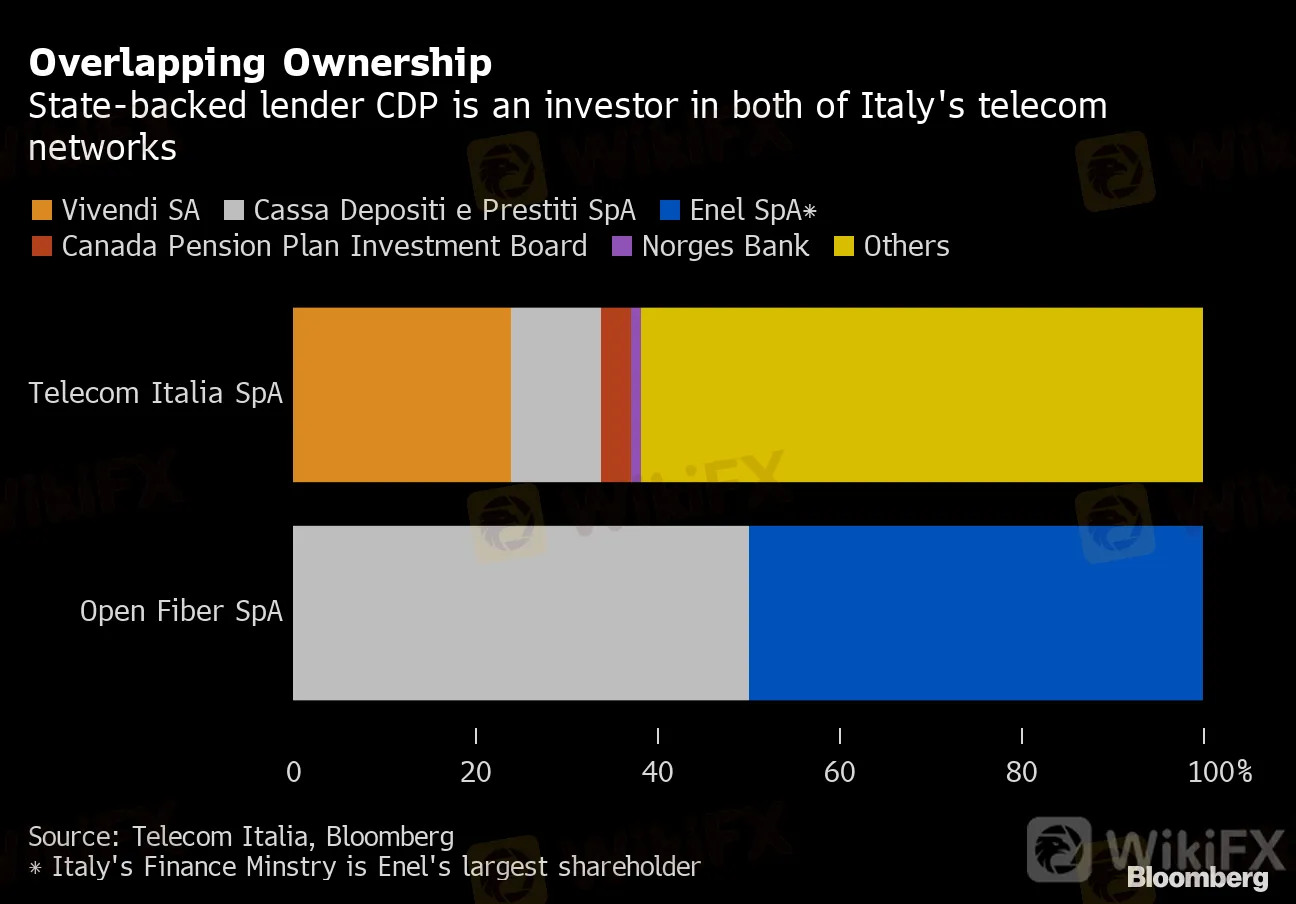

Overlapping Ownership

{18}

State-backed lender CDP is an investor in both of Italy's telecom networks

{21}

Source: Telecom Italia, Bloomberg

{21}{22}

* Italy's Finance Minstry is Enel's largest shareholder

{22}

The plan is moving ahead after months of deliberations between the government, Telecom Italia and state investment vehicle Cassa Depositi e Prestiti SpA -- a major shareholder in Telecom Italia that also owns half of Open Fiber.

Telecom Italia has already begun a process to separate its fixed-line infrastructure to raise much-needed cash. The debt-lumbered business has been shrinking in the face of tough competition and a lackluster Italian economy.

Last month, it agreed to sell a 37.5% stake in a new unit that will own the landline cables running from streets to homes and businesses -- the so-called secondary network -- to investment firm KKR & Co. for 1.8 billion euros ($2.1 billion).

{27}

The new company, FiberCop, will have an initial enterprise value of 7.7 billion euros. Telecom Italia sent a preliminary notification to the EU of its FiberCop plan earlier this month, according to one person familiar with the matter. EU officials see this first step as less problematic than a subsequent Open Fiber merger, the people said.

{27}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Start Winning Now! Here's How You Build a Winning Trading System

BaFin Warns Against Unlicensed FX Brokers in April

PH SEC to Set Cryptocurrency Rules in 2024

Exploring Swing Trading vs Scalping: A Strategy Comparison

Oppenheimer & Co. Fined $500K for Supervision Lapses

Man Arrested for Rs 68L Fraud Using Bogus Trading App

Robinhood to Fight SEC Over Crypto Business in Court

Scope Markets Boosts UAE Offer with 23 New Dubai Stocks CFDs

ON FOREX WINDOW, $1.7 BILLION WAS EXCHANGED IN A SINGLE WEEK.

Japan's FSA Alerts on Rising in Investment Cold Call Frauds

Currency Calculator