简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ACY Securities Review: A "Boss-Level" Barrier to Your Withdrawals?

Abstract:Our investigation into ACY Securities reveals alarming patterns of arbitrary profit deductions and abnormal price spikes triggering forced liquidations. While holding Australian licenses, the broker faces unauthorized warnings from European regulators and severe complaints regarding access restrictions and withheld funds.

By WikiFX Special Investigator

The promise of a regulated ACY Securities broker account is security and transparency. However, recent user reports paint a disturbing picture of a platform where profits can be erased by executive fiat and market prices seem to detach from reality. If you are considering this broker, read this ACY Securities review before you deposit a single cent.

The Trader's Nightmare: “The Boss Says No”

Our investigation begins with a visceral complaint from April 2025. A trader, trusting the platform's decade-long history, executed profitable trades only to face a sudden blockade.

According to the user, ACY Securities invalidated their profits, alleging “arbitrage” violations. The justification? The company claimed the user's orders coincided with a separate account in Japan. When the user demanded proof of this connection, none was provided. Instead, they were reportedly told that the “boss” had decided they were colluding, offering only to return the principal.

Even more chilling is the coercion described: the user alleges they were told to deposit more funds, or the broker would “hide the backend account”—essentially a threat to block ACY Securities login access and erase their digital footprint.

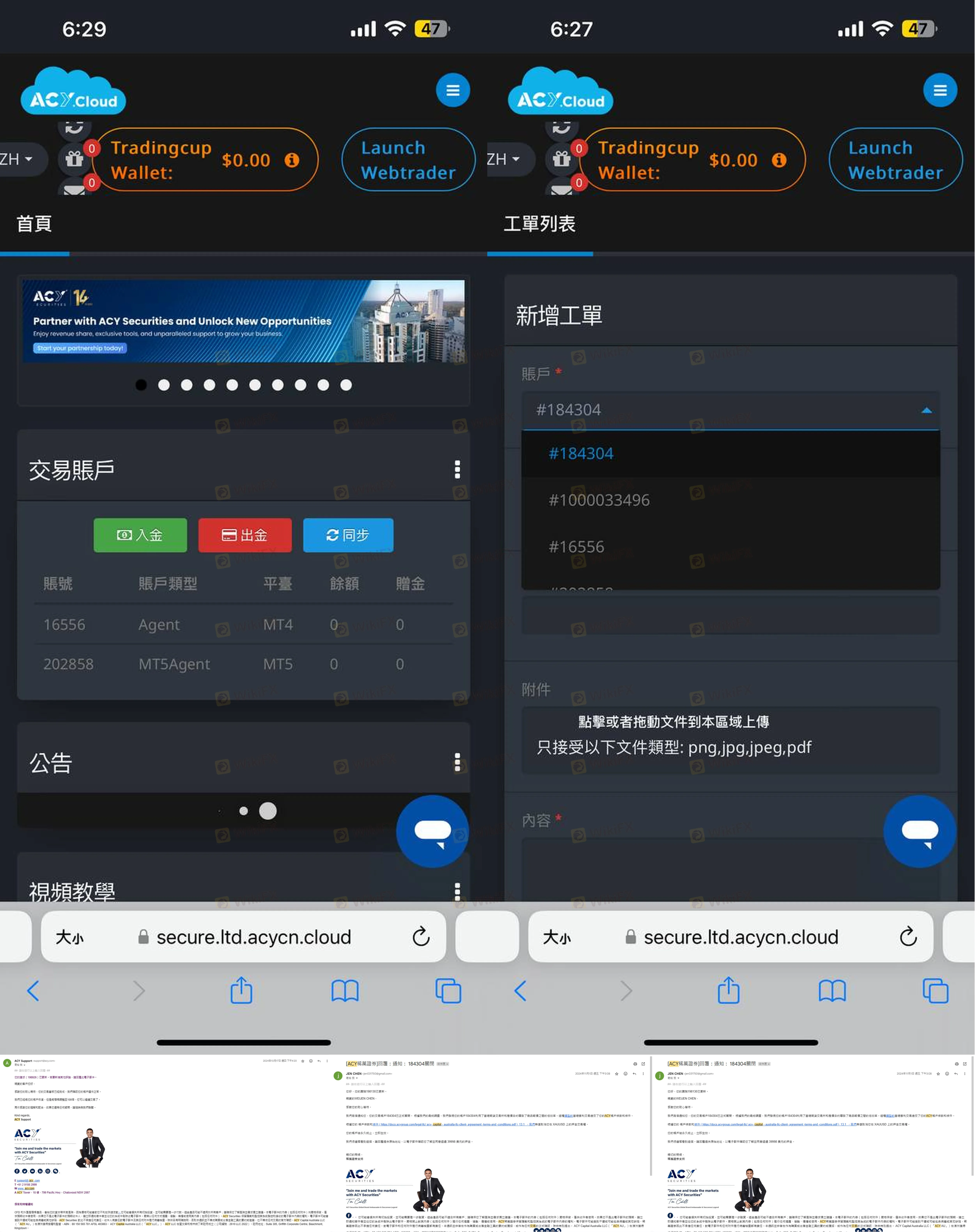

Evidence: User report alleging arbitrary profit deductions and threats to hide account access.

ACY Securities Regulation: The Compliance Gap

While the user struggle is emotional, the regulatory reality provides the facts. Does the ACY Securities regulation framework actually protect you? We audited their licenses against global warnings.

Regulatory Reality Audit

| Regulator | Country | License Type | REAL STATUS |

|---|---|---|---|

| ASIC | Australia | MM (Market Maker) | Regulated |

| FSCA | South Africa | Financial Service Provider | Regulated |

| CNMV | Spain | N/A | Warning: Unauthorized Activity |

| AMF | France | N/A | Blacklisted: Unauthorized |

| SCM | Malaysia | N/A | Warning: Unauthorized Capital Market Activity |

Our Investigation Reveals:

While ACY Securities holds valid licenses with ASIC and FSCA, they are simultaneously flagged by major European and Asian watchdogs. The CNMV (Spain) explicitly warned in 2024 that the broker is “not authorized to provide investment services.” The AMF (France) has placed them on a blacklist. This geographical dissonance is a massive red flag—a safe broker does not typically operate illegally in major jurisdictions.

Deep Dive: How the Capital Disappears

Beyond regulatory warnings, our analysis of ACY Securities Forex trading conditions exposes specific methods used to erode client funds.

1. The “Retroactive” Fee Trap

In September 2024, an Australian client reported a shocking deduction at the point of withdrawal. The broker allegedly claimed a calculation error on “inventory fees” (swap fees) represented an $8,000 shortfall. The user was told to pay back this massive sum—retroactively applied—before withdrawing. A regulated audit trail should prevent such “miscalculations,” yet here it was used to withhold funds.

2. The Abnormal Price Spike

In January 2024, a user in Japan reported a devastating event. During a specific timeframe, ACY Securities quoted Gold (XAU/USD) prices between 2185 and 2195, while the global market average was below 2150. This artificial price spike caused an immediate forced liquidation (margin call), wiping out approximately $8,940. When prices effectively differ from the real market, the ACY Securities broker environment ceases to be a marketplace and becomes a trap.

Evidence: Chart data showing abnormal pricing anomaly leading to forced liquidation.

3. The “Login” Leverage

Access denial is a recurring theme. Multiple complaints from early 2024 describe support tickets being deleted without reply. The threat mentioned in Case 1—to “hide” the account if new deposits aren't made—suggests that ACY Securities login protocols can be weaponized to silence dissent and prevent users from gathering evidence of their balances.

Key Red Flags

- Global Blacklists: Officially warned against by CNMV, SCM, and placed on the AMF blacklist.

- Arbitrary Deductions: Reports of retroactive fee charges ($8,000+) and voided profits based on unproven “collusion.”

- Market Manipulation: Documented allegations of off-market price spikes (Gold) triggering stop-outs.

- Support & Access Issues: Users report deleted support tickets and threats to disable account transparency.

The Verdict

Is ACY Securities safe? Despite holding an ASIC license, the operational behavior reported by users—retroactive fee demands, unproven accusations of arbitrage, and price anomalies—mirrors the tactics of unregulated entities. The warnings from French and Spanish regulators serve as a critical alert.

We strongly advise global traders to exercise extreme caution. If a platform can leverage your ACY Securities login access as a bargaining chip to demand more deposits, your capital is already in danger.

Stay vigilant. Choose transparency.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Currency Calculator