Abstract:When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Introduction: The Main Question

When traders search for “Is ZarVista Safe or Scam,” they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

The Main Findings at a Quick Look

For traders who need a fast check, the key findings about ZarVista's risk level are worrying. The information, collected from legal authorities and lots of user feedback, shows an operation that needs extreme caution. Here's a summary of the most important points:

This overview gives a clear, fact-based look at ZarVista's operations and reputation. The mix of a very low trust score and serious user claims creates a worrying picture that any potential investor must consider seriously. The following sections will look at each of these points in more detail.

Breaking Down Legal Protection

A broker's legal license is the main protection for a trader's money. However, not all licenses are the same. Understanding the difference between top-level and offshore regulation is important when checking the real safety of your investment with a broker like ZarVista.

ZarVista's Official Licenses

According to public records, ZarVista operates under licenses from two offshore locations:

· Mauritius: Zarvista Capital Markets (MU) Ltd is regulated by the Financial Services Commission (FSC) of Mauritius, holding a Securities Trading License with number GB23202450.

· Comoros: The broker is also registered in Comoros and regulated by the Mwali International Services Authority (MISA).

While these are technically licenses, their location is very important. Both Mauritius and the Comoros are considered offshore financial centers, which have very different standards compared to regulators in major financial centers.

Why Offshore Regulation is Dangerous

Offshore regulation presents a big risk to traders. These locations often attract brokers with easy registration requirements, low capital rules, and a clear lack of strict oversight. For the average trader, this means several real dangers.

There is very limited investor protection. Unlike top-level regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), offshore bodies rarely offer compensation programs. If an offshore-regulated broker goes bankrupt or does fraudulent activity, traders have almost no chance of getting their capital back. Also, the lack of strict oversight means that practices, such as price manipulation or unfair trade execution, are more likely to go unchecked. The legal options for a wronged trader are almost non-existent, as pursuing a case across international borders against a company in a lenient location is often too complex and expensive.

Check a Broker's License

A broker's claims should never be taken without proof. Before investing, it's critical to check the brokers legal status using an independent platform. For a complete and up-to-date breakdown of ZarVista's licenses and the related risks, you can review its detailed profile on WikiFX. This step provides an unbiased, third-party check, which is essential for proper research.

Users' Own Words

While legal status provides a framework for risk, the most convincing evidence of a broker's character comes directly from its users. An analysis of ZarVista Complaints reveals a disturbing pattern of serious issues that go far beyond typical trading problems. We have organized the most common and severe complaints to provide a clear overview of the risks reported by other traders.

Serious Withdrawal Problems

A repeating theme among user complaints is the extreme difficulty in accessing funds. The process often follows a predictable and frustrating pattern. Users report that initial, small withdrawal requests may be processed, but larger requests are systematically blocked.

The excuses provided are often vague, such as “declined by the bank,” putting the responsibility on the user to solve a non-existent issue with their own bank. In more severe cases, the situation gets worse. A user from Nigeria, identified as `crypback@hotmail`, reported that after experiencing withdrawal problems, they were completely locked out of the broker's website, receiving an error message that prevented access.

This tactic effectively cuts off the user from their account and any record of their funds, turning a withdrawal issue into a complete loss of access.

Claims of Fund Theft

The most serious category of complaints involves direct accusations of fund theft and account manipulation by the broker itself. These are not minor disputes but claims of significant financial losses due to deliberate actions.

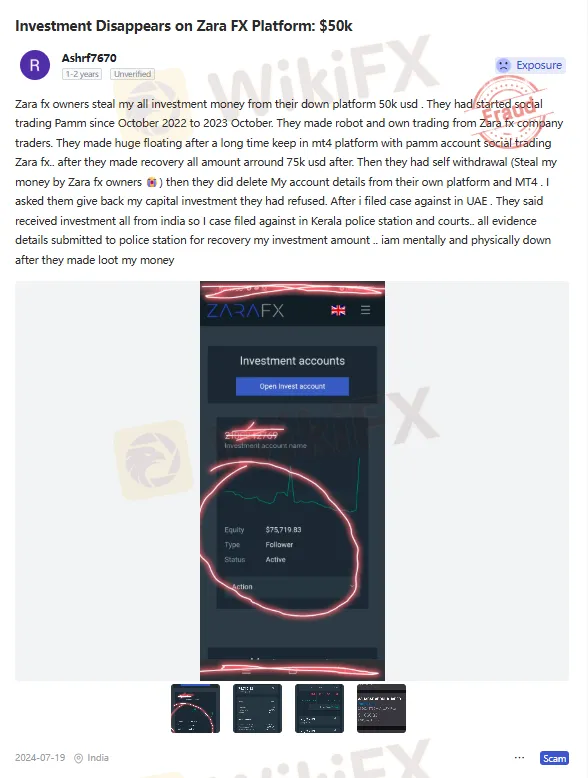

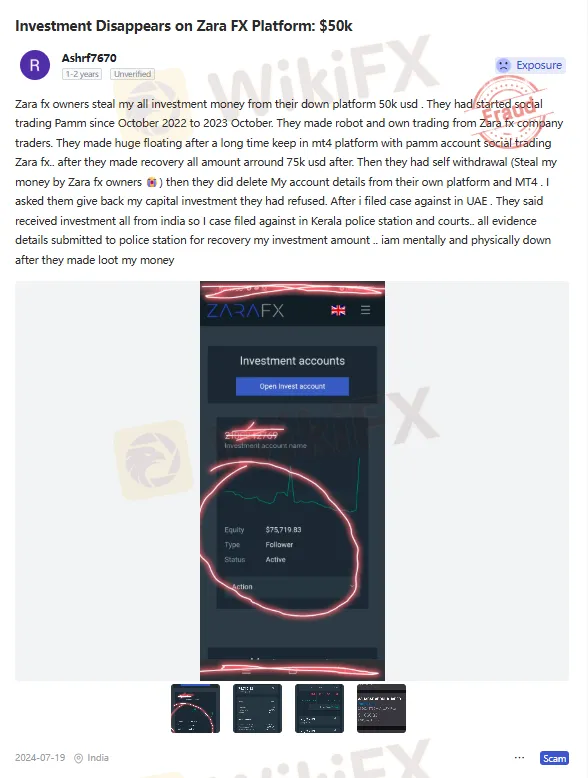

One of the most detailed and alarming reports comes from user `Ashrf7670` in India. This user claims that the owners of Zara FX (ZarVista's previous name) stole over $50,000 from their investment. The user claims that the broker ran a social trading PAMM account, intentionally created huge floating losses, and then, after a supposed recovery, the owners withdrew the recovered funds for themselves. To hide this, the broker allegedly deleted the user's account details from both the MT5 platform and their own client portal. The user states they have filed a police case in India, showing how serious the situation is.

Another user, `FX5311292362`, reported that profits earned through legitimate manual trading were rejected for withdrawal without any evidence or valid reason, pointing to potential manipulation of trading outcomes.

Social & Copy Trading Problems

ZarVista promotes social and copy trading services (PAMM/MAM) as a key feature. However, complaints suggest these services may be a way for exploitation. The report from user `Ashrf7670` specifically details a scenario where the copy trading is allegedly managed directly by the ZarVista team.

This creates a massive conflict of interest. If the broker is both the platform provider and the manager of a copy trading strategy, it can manipulate trades to its own benefit. The user's claim that the team creates large floating losses and then withdraws recovered funds for themselves, rather than returning them to investors, is a serious accusation. For traders attracted to the promise of passive income through copy trading, this represents an extreme and hidden risk.

Looking at Counter-Arguments

To provide a balanced analysis, it is important to acknowledge that not all feedback for ZarVista is negative. Some users have reported positive experiences, which often serve as the initial attraction for new clients. However, a critical examination of this feedback is necessary to place it in the proper context.

What Some Users Like

A review of positive and neutral feedback highlights a few repeating points that users appreciate. These generally relate to the platform's front-end features and trading conditions:

· Platform Features: Users mention the customizable charts and numerous indicators available on the MT5 platform.

· Trading Conditions: Some traders have noted low spreads and fast platform speed, which are attractive features, especially during volatile market conditions.

· Customer Support: At least one user reported a quick resolution to a trade execution issue, with support resolving the problem in under 10 minutes.

· Promotions: The offer of a $300 trading bonus is cited as an encouraging incentive for new depositors.

A Critical Look at Reviews

While these positive points seem appealing, they must be weighed against the overwhelming evidence of fund security issues. Even neutral reviews often contain warnings. For example, user `Yuri2` from the United States confirms that “Low spreads is true,” but immediately follows up with, “but when withdrawing, you may come across a couple of declined withdrawals.” This seemingly neutral comment validates the core problem highlighted in the most severe complaints.

Furthermore, promotional offers like a trading bonus are a very common marketing tactic used by high-risk and offshore brokers. They are designed to encourage initial deposits by creating the illusion of free capital. The real test of a broker is not the ease of depositing funds or the appeal of a bonus, but the ability to withdraw profits and capital without obstruction. The pattern of feedback suggests that while some users may have a positive initial experience with the platform's usability, these benefits are heavily overshadowed by the systematic, high-stakes problems related to accessing funds.

The Split Experience

The user experience with ZarVista is clearly split. To see the full, unfiltered range of feedback, from positive to severe exposure reports, prospective users should examine all the reviews aggregated on the ZarVista page on WikiFX. This allows for a comprehensive view that marketing materials will never provide.

Deeper Operating Warning Signs

Beyond user reviews and legal concerns, an investigation into ZarVista's operating structure reveals further warning signs. These are verifiable facts that undermine the broker's claims of being a legitimate, global operation and point to a significant lack of transparency and credibility.

Warning Sign #1: Fake Offices

A reputable international broker maintains verifiable physical offices to manage its operations. ZarVista's claims made here do not hold up to scrutiny. Independent on-site survey teams dispatched by WikiFX to investigate the broker's claimed addresses in Canada and Cyprus came back with the same result: “No Office Found.”

The significance of this cannot be overstated. The absence of a physical presence at a listed business address is a massive blow to a company's credibility. It suggests that the broker may not be the substantial entity it presents itself as, but rather a virtual operation with no tangible accountability. For a trader, this means there is no physical location to turn to and no real-world entity to hold responsible if issues arise.

Warning Sign #2: The Name Change

ZarVista was previously known as Zara FX. While companies rebrand for various legitimate reasons, a name change in the face of numerous complaints and a deteriorating reputation can be a strategic maneuver. This tactic is sometimes used by high-risk entities to escape negative search results and a poor public image. By changing its name in September 2024, the company may have been attempting to distance itself from the volume of complaints and negative press associated with the “Zara FX” brand, effectively trying to start with a clean slate without addressing the underlying issues.

Warning Sign #3: Terrible Trust Score

Quantitative scoring models provide an objective measure of a broker's overall health. ZarVista's score on the WikiFX platform is a stark 2.07 out of 10. This exceptionally low score is not arbitrary; the platform explicitly states the reason for the downgrade: “The WikiFX Score of this broker is reduced because of too many complaints!”

These operational warning signs are often hidden from a broker's own website. This is why using an investigative tool is essential. For instance, the 'No Office Found' survey is a critical piece of research you can only find by checking the broker's profile on a verification platform, such as WikiFX, before opening an account.

Conclusion: The Final Decision

After a thorough analysis of ZarVista's legal standing, user reputation, and operational integrity, the evidence points to an unavoidable conclusion. The broker shows an extremely high-risk profile that should be a major concern for any potential investor.

The combination of weak offshore regulation, which offers no meaningful investor protection, and a significant volume of severe ZarVista Complaints creates a dangerous environment for client funds. The accusations are not minor; they include systematic withdrawal obstruction, account manipulation, and outright claims of fund theft. These are further compounded by major operational warning signs, such as the lack of verifiable physical offices and a name change that coincides with a poor reputation.

Based on this overwhelming body of evidence, we must advise extreme caution. While we stop short of a legal declaration of “scam,” the patterns of behavior reported by users and the lack of legal accountability align strongly with characteristics commonly associated with fraudulent financial operations.

Our final advice is simple: prioritize the security of your capital above all else. Avoid brokers with weak offshore regulation, a history of user complaints, and a lack of operational transparency. Always conduct thorough research. We strongly recommend using a comprehensive broker verification tool like WikiFX to check a broker's legal status, user reviews, and operational history before making any financial commitment.