Company Summary

| PMEX Review Summary | |

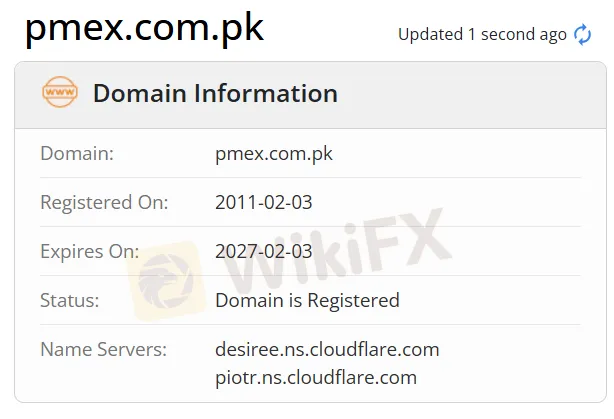

| Founded | 2011 |

| Registered Country/Region | Pakistan |

| Regulation | No regulation |

| Market Instruments | Metals, Energy, Agriculture products |

| Demo Account | ❌ |

| Trading Platform | MT5 |

| Minimum Deposit | / |

| Customer Support | Ccontact form, Whatsapp |

| Tel: +92–21–35155-022 | |

| Email: info@pmex.com.pk | |

| Address: The Hive, 3rd Floor, National Aerospace Science and Technology Park (NASTP), Main Shahra-e-Faisal, Karachi, Pakistan. | |

| Social media: Facebook, X, Instagram, LinkedIn, YouTube | |

PMEX Information

PMEX is an unregulated service provider of premier brokerage and financial services, which was founded in Pakistan in 2011. It offers Metals, Energy, and Agriculture products trading.

Pros and Cons

| Pros | Cons |

| Long operation time | Lack of regulation |

| Various contact channels | No demo accounts |

| Various trading products | No MT4 platform |

| MT5 platform | Lack of transparency |

Is PMEX Legit?

No. PMEX currently has no valid regulations. Please be aware of the risk!

What Can I Trade on PMEX?

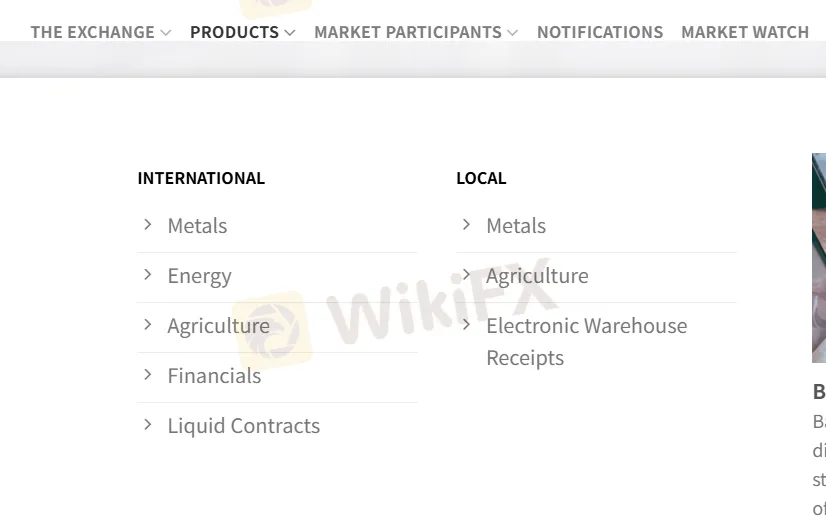

| Trading Instruments | Supported |

| Metals | ✔️ |

| Energy | ✔️ |

| Agriculture products | ✔️ |

| Forex | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

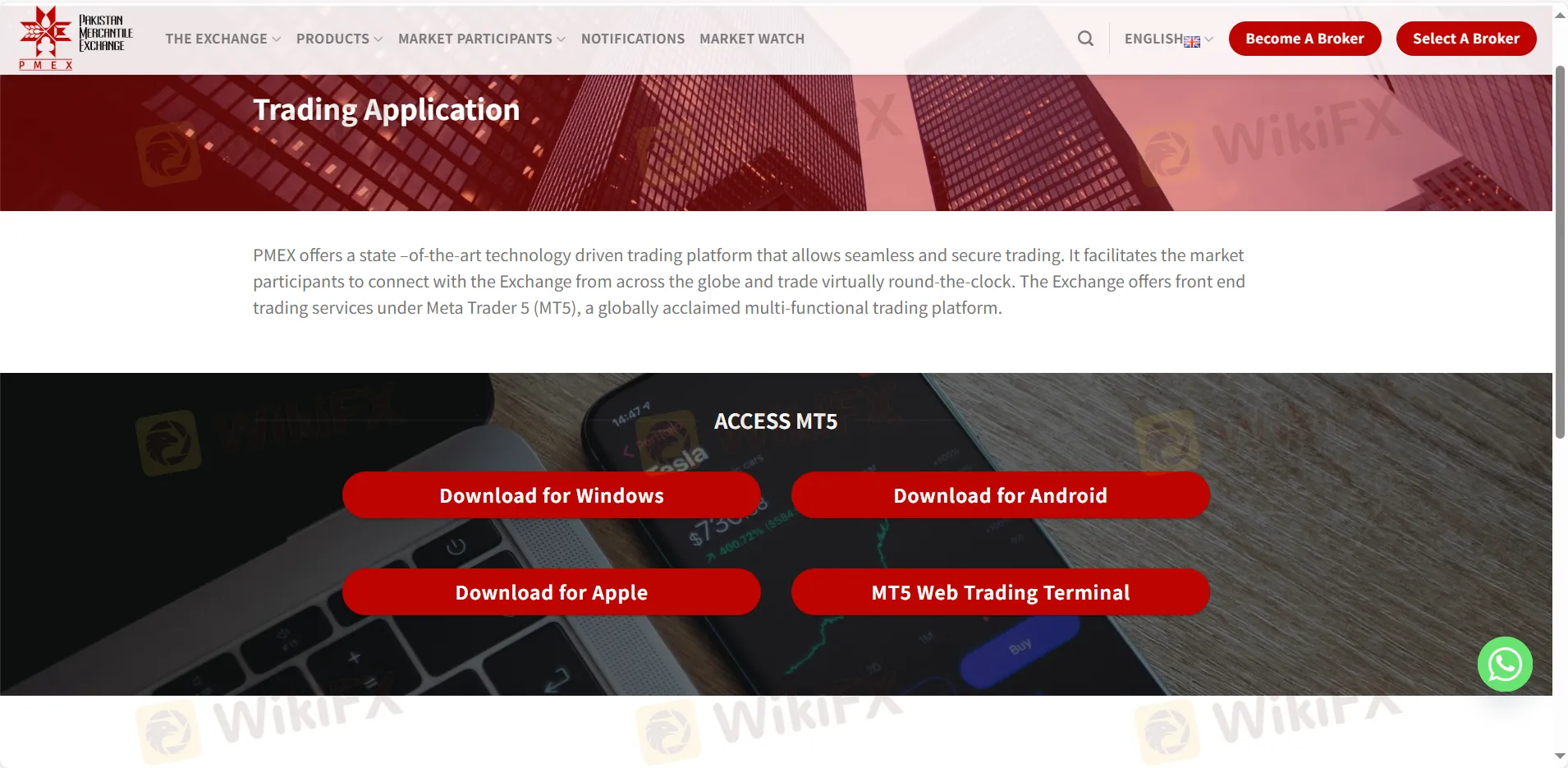

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Mobile, PC, web | Experienced traders |

| MT4 | ❌ | / | Beginners |