Company Summary

| Akatsuki Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Investment Trust, Stock, Bond |

| Demo Account | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Contact Form |

| Tel: 0120-753-960 | |

| Address: 17-10 Koamicho, Nihonbashi, Chuo-ku, Tokyo 103-0016 Nihonbashi Koamicho Square Building 5th floor | |

Akatsuki Information

Akatsuki is a Japan-based broker founded in 1997, regulated by FSA. It offers services in Investment Trust, Stock, and Bond.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited trading information |

| Physical office proved | Various fees charged |

| Long operational history |

Is Akatsuki Legit?

Akatsuki is regulated by Financial Services Agency (FSA) in Japan. Please be aware of the risk!

| Regulatory Status | Regulated By | Licensed Institution | License Type | License Number |

| Regulated | Financial Services Agency (FSA) | あかつき証券株式会社 | Retail Forex License | 関東財務局長(金商)第67号 |

WikiFX Field Survey

WikiFX field survey team visited Akatsuki's address is Japan, and we found its office on site, which means the company operates with an physical office.

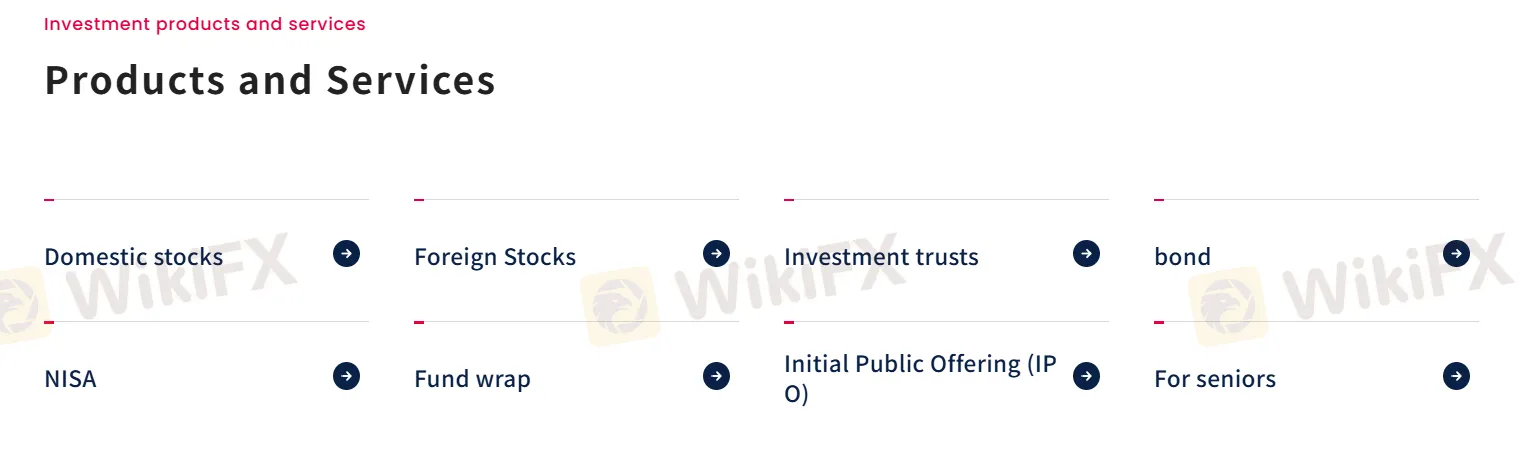

What Can I Trade on Akatsuki?

| Tradable Instruments | Supported |

| Bonds | ✔ |

| Stocks | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Futures | ❌ |

Akatsuki Fees

| Services Type | Basic Fee |

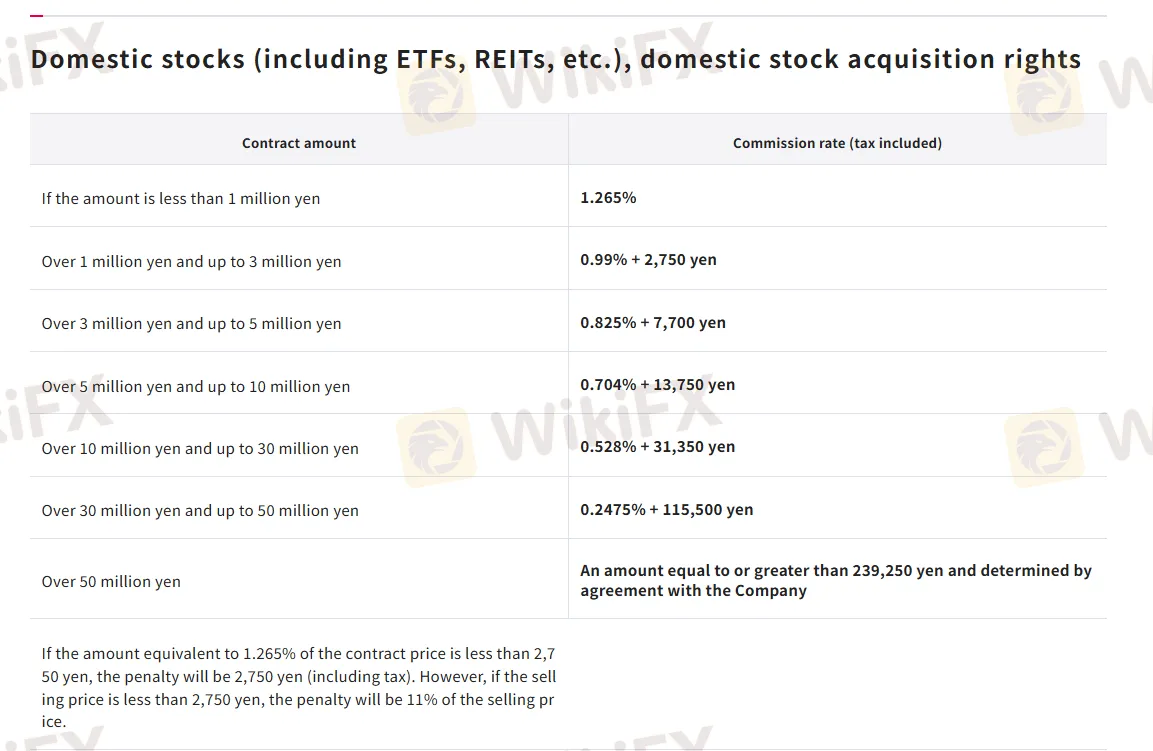

| Domestic Stocks Commission Rate | 0.2475% - 1.265% |

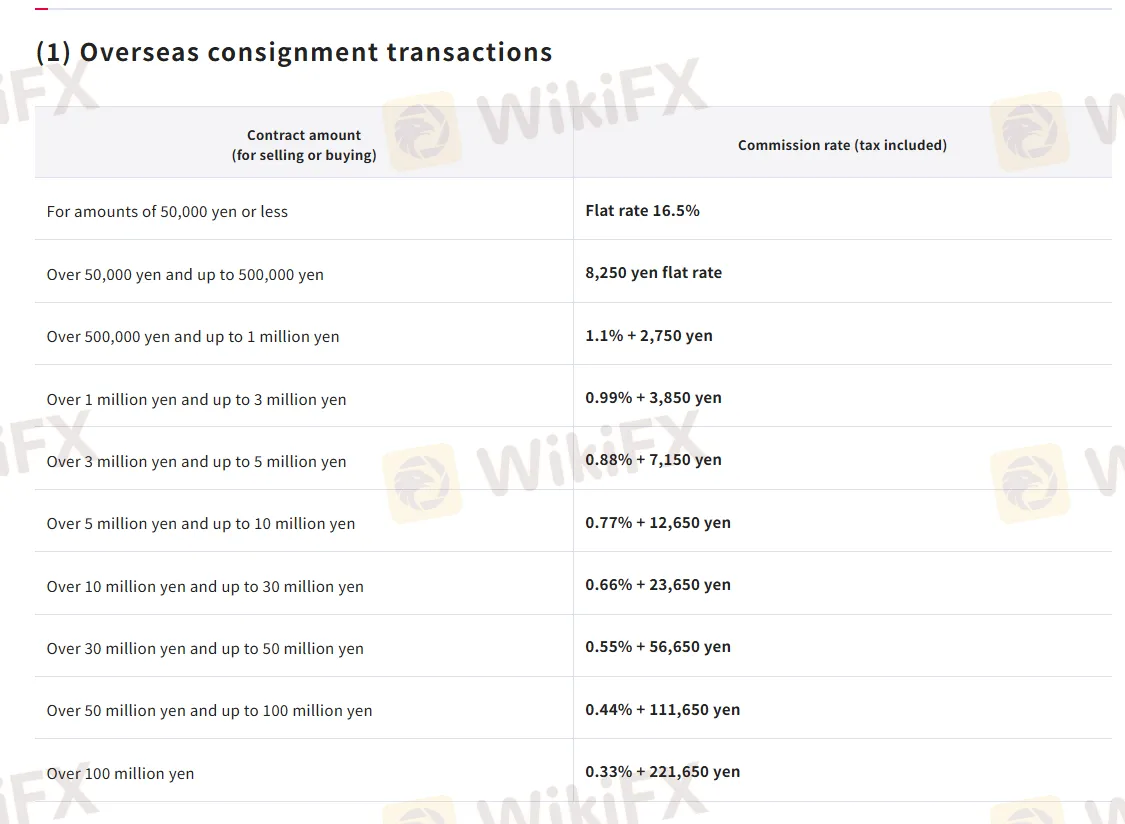

| Foreign Stocks Commission Rate | 0.33% - 16.5% |

| Domestic over-the-counter Transactions | 2.5% |

| Entering and Exiting | 1,100 yen |

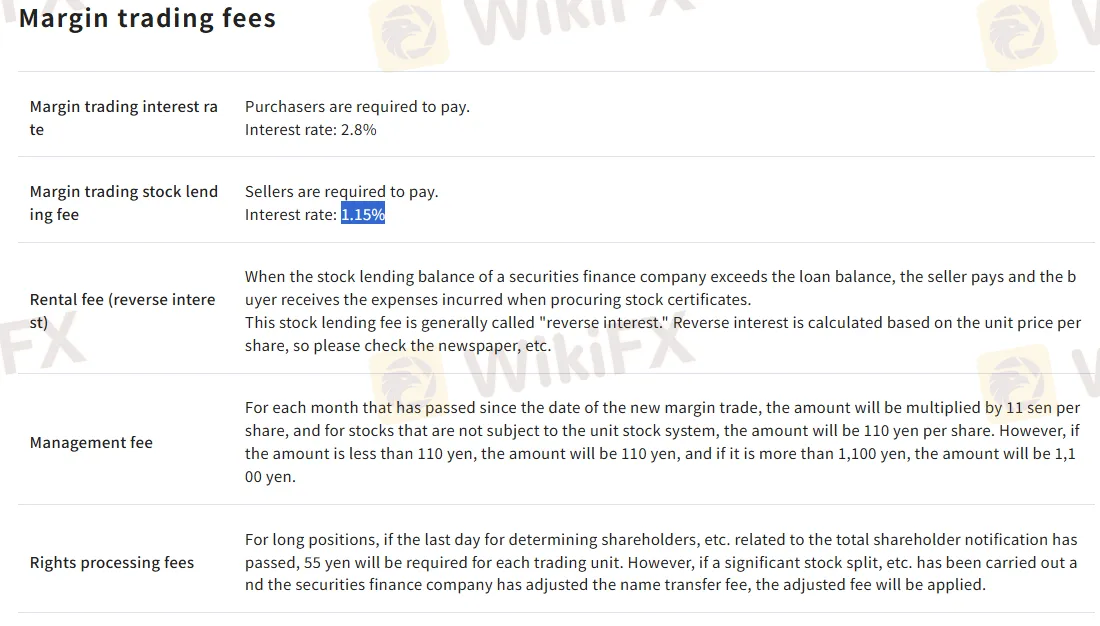

| Margin Trading Fees | 1.15% - 2.8% |