Company Summary

| CENTRAL TANSHI GROUP Review Summary | |

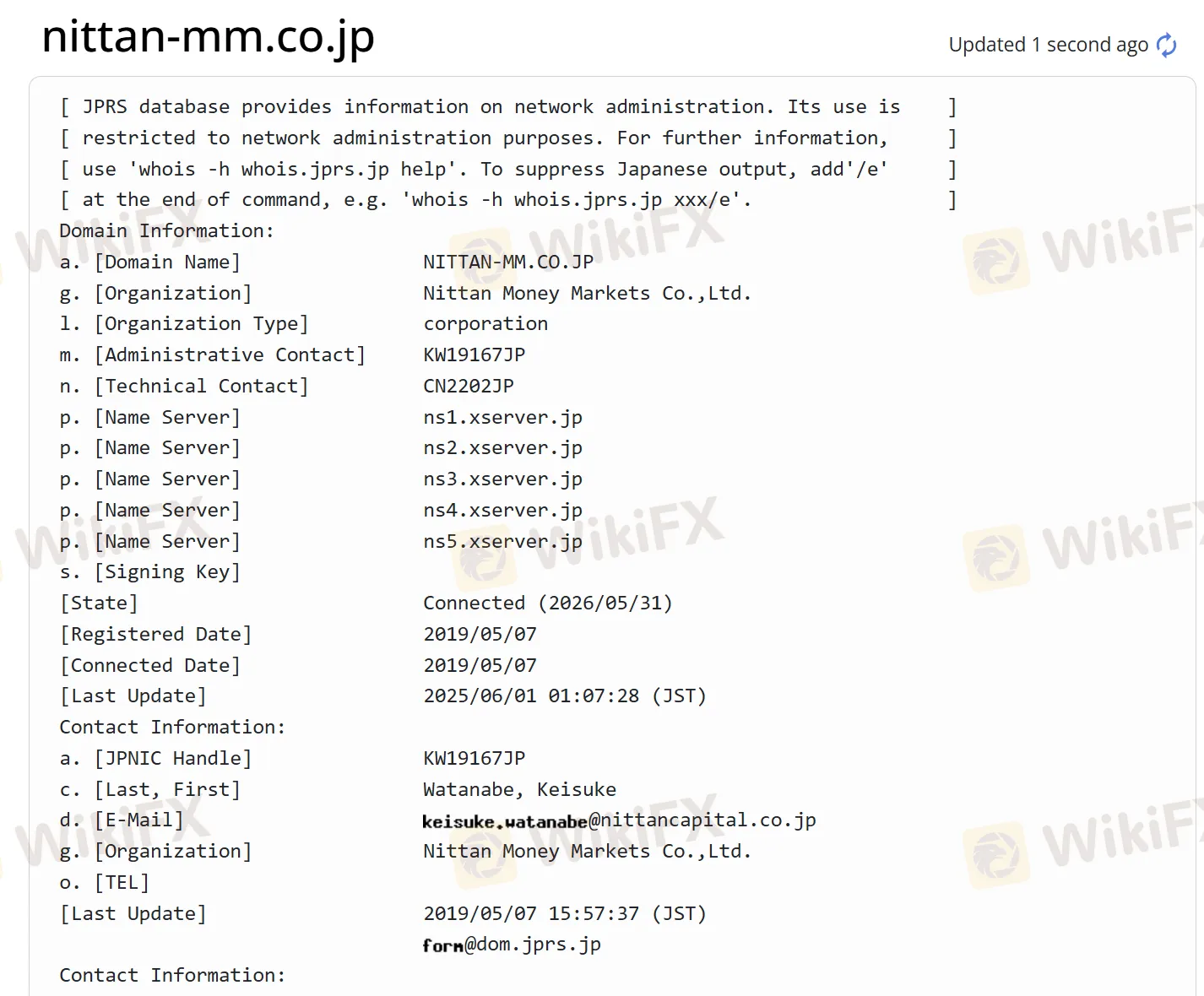

| Founded | 2019 |

| Registered Country/Region | Japan |

| Regulation | No regulation |

| Market Instrument | Forex |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Tel: 03-3271-8455 | |

| Address: 〒103-0021 3-3-14 Nihonbashi Honjocho, Chuo-ku, Tokyo | |

CENTRAL TANSHI GROUP Information

CENTRAL TANSHI GROUP is an unregulated service provider of premier brokerage and financial services, which was founded in Japan in 2019. It specializes in forex trading.

Pros and Cons

| Pros | Cons |

| / | Lack of regulation |

| Limited trading products | |

| No demo accounts | |

| Unclear fee structure | |

| No MT4/MT5 platform | |

| No info on deposit and withdrawal |

Is CENTRAL TANSHI GROUP Legit?

No. CENTRAL TANSHI GROUP currently has no valid regulations. Please be aware of the risk!

What Can I Trade on CENTRAL TANSHI GROUP?

| Trading Products | Supported |

| Forex | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |